2010 FERC Form 1 - Pacific Gas and Electric Company

2010 FERC Form 1 - Pacific Gas and Electric Company

2010 FERC Form 1 - Pacific Gas and Electric Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2010</strong><br />

ANNUAL REPORT<br />

of<br />

<strong>Pacific</strong> <strong>Gas</strong> <strong>and</strong> <strong>Electric</strong> <strong>Company</strong><br />

77 Beale Street<br />

P.O. Box 770000, B7C<br />

San Francisco, CA 94177<br />

to the<br />

Public Utilities Commission<br />

of the<br />

State of California<br />

For the Year Ended December 31, <strong>2010</strong><br />

Volume No. 1 (<strong>Form</strong> 1)

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report Is:<br />

Date of Report<br />

(1) X An Original<br />

(Mo, Da, Yr)<br />

(2) A Resubmission<br />

04/08/2011<br />

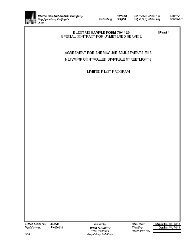

LIST OF SCHEDULES (<strong>Electric</strong> Utility)<br />

Year/Period of Report<br />

End of <strong>2010</strong>/Q4<br />

Enter in column (c) the terms "none," "not applicable," or "NA," as appropriate, where no information or amounts have been reported for<br />

certain pages. Omit pages where the respondents are "none," "not applicable," or "NA".<br />

Line<br />

No.<br />

Title of Schedule<br />

(a)<br />

Reference<br />

Page No.<br />

(b)<br />

Remarks<br />

(c)<br />

1<br />

General Information<br />

101<br />

2<br />

Control Over Respondent<br />

102<br />

3<br />

Corporations Controlled by Respondent<br />

103<br />

4<br />

Officers<br />

104<br />

5<br />

Directors<br />

105<br />

6<br />

Information on <strong>Form</strong>ula Rates<br />

106(a)(b)<br />

7<br />

Important Changes During the Year<br />

108-109<br />

8<br />

Comparative Balance Sheet<br />

110-113<br />

9<br />

Statement of Income for the Year<br />

114-117<br />

10<br />

Statement of Retained Earnings for the Year<br />

118-119<br />

11<br />

Statement of Cash Flows<br />

120-121<br />

12<br />

Notes to Financial Statements<br />

122-123<br />

13<br />

Statement of Accum Comp Income, Comp Income, <strong>and</strong> Hedging Activities<br />

122(a)(b)<br />

14<br />

Summary of Utility Plant & Accumulated Provisions for Dep, Amort & Dep<br />

200-201<br />

15<br />

Nuclear Fuel Materials<br />

202-203<br />

16<br />

<strong>Electric</strong> Plant in Service<br />

204-207<br />

17<br />

<strong>Electric</strong> Plant Leased to Others<br />

213<br />

NONE<br />

18<br />

<strong>Electric</strong> Plant Held for Future Use<br />

214<br />

NONE<br />

19<br />

Construction Work in Progress-<strong>Electric</strong><br />

216<br />

20<br />

Accumulated Provision for Depreciation of <strong>Electric</strong> Utility Plant<br />

219<br />

21<br />

Investment of Subsidiary Companies<br />

224-225<br />

22<br />

Materials <strong>and</strong> Supplies<br />

227<br />

23<br />

Allowances<br />

228(ab)-229(ab)<br />

24<br />

Extraordinary Property Losses<br />

230<br />

NONE<br />

25<br />

Unrecovered Plant <strong>and</strong> Regulatory Study Costs<br />

230<br />

NONE<br />

26<br />

Transmission Service <strong>and</strong> Generation Interconnection Study Costs<br />

231<br />

27<br />

Other Regulatory Assets<br />

232<br />

28<br />

Miscellaneous Deferred Debits<br />

233<br />

29<br />

Accumulated Deferred Income Taxes<br />

234<br />

30<br />

Capital Stock<br />

250-251<br />

31<br />

Other Paid-in Capital<br />

253<br />

32<br />

Capital Stock Expense<br />

254<br />

33<br />

Long-Term Debt<br />

256-257<br />

34<br />

Reconciliation of Reported Net Income with Taxable Inc for Fed Inc Tax<br />

261<br />

35<br />

Taxes Accrued, Prepaid <strong>and</strong> Charged During the Year<br />

262-263<br />

36<br />

Accumulated Deferred Investment Tax Credits<br />

266-267<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-96) Page 2

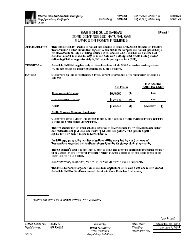

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report Is:<br />

Date of Report<br />

(1) X An Original<br />

(Mo, Da, Yr)<br />

(2) A Resubmission<br />

04/08/2011<br />

LIST OF SCHEDULES (<strong>Electric</strong> Utility) (continued)<br />

Year/Period of Report<br />

End of <strong>2010</strong>/Q4<br />

Enter in column (c) the terms "none," "not applicable," or "NA," as appropriate, where no information or amounts have been reported for<br />

certain pages. Omit pages where the respondents are "none," "not applicable," or "NA".<br />

Line<br />

No.<br />

Title of Schedule<br />

(a)<br />

Reference<br />

Page No.<br />

(b)<br />

Remarks<br />

(c)<br />

37<br />

Other Deferred Credits<br />

269<br />

38<br />

Accumulated Deferred Income Taxes-Accelerated Amortization Property<br />

272-273<br />

39<br />

Accumulated Deferred Income Taxes-Other Property<br />

274-275<br />

40<br />

Accumulated Deferred Income Taxes-Other<br />

276-277<br />

41<br />

Other Regulatory Liabilities<br />

278<br />

42<br />

<strong>Electric</strong> Operating Revenues<br />

300-301<br />

43<br />

Sales of <strong>Electric</strong>ity by Rate Schedules<br />

304<br />

44<br />

Sales for Resale<br />

310-311<br />

45<br />

<strong>Electric</strong> Operation <strong>and</strong> Maintenance Expenses<br />

320-323<br />

46<br />

Purchased Power<br />

326-327<br />

47<br />

Transmission of <strong>Electric</strong>ity for Others<br />

328-330<br />

48<br />

Transmission of <strong>Electric</strong>ity by ISO/RTOs<br />

331<br />

NOT APPLICABLE<br />

49<br />

Transmission of <strong>Electric</strong>ity by Others<br />

332<br />

50<br />

Miscellaneous General Expenses-<strong>Electric</strong><br />

335<br />

51<br />

Depreciation <strong>and</strong> Amortization of <strong>Electric</strong> Plant<br />

336-337<br />

52<br />

Regulatory Commission Expenses<br />

350-351<br />

53<br />

Research, Development <strong>and</strong> Demonstration Activities<br />

352-353<br />

NONE<br />

54<br />

Distribution of Salaries <strong>and</strong> Wages<br />

354-355<br />

55<br />

Common Utility Plant <strong>and</strong> Expenses<br />

356<br />

56<br />

Amounts included in ISO/RTO Settlement Statements<br />

397<br />

57<br />

Purchase <strong>and</strong> Sale of Ancillary Services<br />

398<br />

58<br />

Monthly Transmission System Peak Load<br />

400<br />

59<br />

Monthly ISO/RTO Transmission System Peak Load<br />

400a<br />

NOT APPLICABLE<br />

60<br />

<strong>Electric</strong> Energy Account<br />

401<br />

61<br />

Monthly Peaks <strong>and</strong> Output<br />

401<br />

62<br />

Steam <strong>Electric</strong> Generating Plant Statistics<br />

402-403<br />

63<br />

Hydroelectric Generating Plant Statistics<br />

406-407<br />

64<br />

Pumped Storage Generating Plant Statistics<br />

408-409<br />

65<br />

Generating Plant Statistics Pages<br />

410-411<br />

66<br />

Transmission Line Statistics Pages<br />

422-423<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-96) Page 3

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report Is:<br />

Date of Report<br />

(1) X An Original<br />

(Mo, Da, Yr)<br />

(2) A Resubmission<br />

04/08/2011<br />

LIST OF SCHEDULES (<strong>Electric</strong> Utility) (continued)<br />

Year/Period of Report<br />

End of <strong>2010</strong>/Q4<br />

Enter in column (c) the terms "none," "not applicable," or "NA," as appropriate, where no information or amounts have been reported for<br />

certain pages. Omit pages where the respondents are "none," "not applicable," or "NA".<br />

Line<br />

No.<br />

Title of Schedule<br />

(a)<br />

Reference<br />

Page No.<br />

(b)<br />

Remarks<br />

(c)<br />

67<br />

Transmission Lines Added During the Year<br />

424-425<br />

68<br />

Substations<br />

426-427<br />

69<br />

Transactions with Associated (Affiliated) Companies<br />

429<br />

70<br />

Footnote Data<br />

450<br />

Stockholders' Reports Check appropriate box:<br />

X Two copies will be submitted<br />

No annual report to stockholders is prepared<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-96) Page 4

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report Is:<br />

(1) X An Original<br />

(2) A Resubmission<br />

Date of Report<br />

(Mo, Da, Yr)<br />

04/08/2011<br />

Year/Period of Report<br />

End of<br />

<strong>2010</strong>/Q4<br />

Dinyar Mistry, Vice President <strong>and</strong> Controller<br />

77 Beale Street, B7A<br />

San Francisco, California 94105<br />

GENERAL INFORMATION<br />

1. Provide name <strong>and</strong> title of officer having custody of the general corporate books of account <strong>and</strong> address of<br />

office where the general corporate books are kept, <strong>and</strong> address of office where any other corporate books of account<br />

are kept, if different from that where the general corporate books are kept.<br />

2. Provide the name of the State under the laws of which respondent is incorporated, <strong>and</strong> date of incorporation.<br />

If incorporated under a special law, give reference to such law. If not incorporated, state that fact <strong>and</strong> give the type<br />

of organization <strong>and</strong> the date organized.<br />

California - October 10, 1905<br />

3. If at any time during the year the property of respondent was held by a receiver or trustee, give (a) name of<br />

receiver or trustee, (b) date such receiver or trustee took possession, (c) the authority by which the receivership or<br />

trusteeship was created, <strong>and</strong> (d) date when possession by receiver or trustee ceased.<br />

Not Applicable.<br />

4. State the classes or utility <strong>and</strong> other services furnished by respondent during the year in each State in which<br />

the respondent operated.<br />

<strong>Electric</strong>ity <strong>and</strong> natural gas distribution, electricity generation, procurement, <strong>and</strong> transmission, <strong>and</strong><br />

natural gas procurement, transportation, <strong>and</strong> storage.<br />

State of California only.<br />

5. Have you engaged as the principal accountant to audit your financial statements an accountant who is not<br />

the principal accountant for your previous year's certified financial statements?<br />

(1) Yes...Enter the date when such independent accountant was initially engaged:<br />

(2) X No<br />

<strong>FERC</strong> FORM No.1 (ED. 12-87) PAGE 101

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report Is:<br />

(1) X An Original<br />

(2) A Resubmission<br />

Date of Report<br />

(Mo, Da, Yr)<br />

04/08/2011<br />

Year/Period of Report<br />

End of<br />

<strong>2010</strong>/Q4<br />

CONTROL OVER RESPONDENT<br />

1. If any corporation, business trust, or similar organization or a combination of such organizations jointly held<br />

control over the repondent at the end of the year, state name of controlling corporation or organization, manner in<br />

which control was held, <strong>and</strong> extent of control. If control was in a holding company organization, show the chain<br />

of ownership or control to the main parent company or organization. If control was held by a trustee(s), state<br />

name of trustee(s), name of beneficiary or beneficiearies for whom trust was maintained, <strong>and</strong> purpose of the trust.<br />

Effective January 1, 1997, PG&E Corporation became the holding company of <strong>Pacific</strong> <strong>Gas</strong> <strong>and</strong> <strong>Electric</strong> <strong>Company</strong>.<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-96)<br />

Page 102

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report Is:<br />

Date of Report<br />

(1) X An Original<br />

(Mo, Da, Yr)<br />

(2) A Resubmission<br />

04/08/2011<br />

CORPORATIONS CONTROLLED BY RESPONDENT<br />

Year/Period of Report<br />

End of <strong>2010</strong>/Q4<br />

1. Report below the names of all corporations, business trusts, <strong>and</strong> similar organizations, controlled directly or indirectly by respondent<br />

at any time during the year. If control ceased prior to end of year, give particulars (details) in a footnote.<br />

2. If control was by other means than a direct holding of voting rights, state in a footnote the manner in which control was held, naming<br />

any intermediaries involved.<br />

3. If control was held jointly with one or more other interests, state the fact in a footnote <strong>and</strong> name the other interests.<br />

Definitions<br />

1. See the Uniform System of Accounts for a definition of control.<br />

2. Direct control is that which is exercised without interposition of an intermediary.<br />

3. Indirect control is that which is exercised by the interposition of an intermediary which exercises direct control.<br />

4. Joint control is that in which neither interest can effectively control or direct action without the consent of the other, as where the<br />

voting control is equally divided between two holders, or each party holds a veto power over the other. Joint control may exist by<br />

mutual agreement or underst<strong>and</strong>ing between two or more parties who together have control within the meaning of the definition of<br />

control in the Uniform System of Accounts, regardless of the relative voting rights of each party.<br />

Line<br />

No.<br />

Name of <strong>Company</strong> Controlled Kind of Business Percent Voting<br />

Stock Owned<br />

(a)<br />

(b)<br />

(c)<br />

1 Calaska Energy <strong>Company</strong><br />

2<br />

3<br />

4<br />

5<br />

6 Eureka Energy <strong>Company</strong><br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13 Midway Power, LLC<br />

14<br />

15<br />

16<br />

17<br />

18 Natural <strong>Gas</strong> Corporation of California (NGC)<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24 NGC Production <strong>Company</strong><br />

25 (The Utility has an indirect interest in<br />

26 NGC Production <strong>Company</strong> by virtue of its<br />

27 sole ownership of NGC.)<br />

<strong>Form</strong>erly the Utility's 100<br />

representative in the<br />

Alaska Highway<br />

Pipeline Project.<br />

<strong>Form</strong>erly managed 100<br />

the Utility's Utah coal<br />

venture. Currently holds<br />

part of the Marre Ranch<br />

property in San Luis<br />

Obispo County.<br />

<strong>Form</strong>ed to be the ownership 100<br />

entity for real estate <strong>and</strong><br />

licenses for a suspended<br />

development project.<br />

Entity used to amortize 100<br />

remaining <strong>Gas</strong><br />

Exploration <strong>and</strong><br />

Development Account<br />

assets.<br />

A wholly owned subsidiary<br />

of NGC engaged in<br />

financing capital<br />

requirements of NGC.<br />

Footnote<br />

Ref.<br />

(d)<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-96) Page 103

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report Is:<br />

Date of Report<br />

(1) X An Original<br />

(Mo, Da, Yr)<br />

(2) A Resubmission<br />

04/08/2011<br />

CORPORATIONS CONTROLLED BY RESPONDENT<br />

Year/Period of Report<br />

End of <strong>2010</strong>/Q4<br />

1. Report below the names of all corporations, business trusts, <strong>and</strong> similar organizations, controlled directly or indirectly by respondent<br />

at any time during the year. If control ceased prior to end of year, give particulars (details) in a footnote.<br />

2. If control was by other means than a direct holding of voting rights, state in a footnote the manner in which control was held, naming<br />

any intermediaries involved.<br />

3. If control was held jointly with one or more other interests, state the fact in a footnote <strong>and</strong> name the other interests.<br />

Definitions<br />

1. See the Uniform System of Accounts for a definition of control.<br />

2. Direct control is that which is exercised without interposition of an intermediary.<br />

3. Indirect control is that which is exercised by the interposition of an intermediary which exercises direct control.<br />

4. Joint control is that in which neither interest can effectively control or direct action without the consent of the other, as where the<br />

voting control is equally divided between two holders, or each party holds a veto power over the other. Joint control may exist by<br />

mutual agreement or underst<strong>and</strong>ing between two or more parties who together have control within the meaning of the definition of<br />

control in the Uniform System of Accounts, regardless of the relative voting rights of each party.<br />

Line<br />

No.<br />

1<br />

Name of <strong>Company</strong> Controlled Kind of Business Percent Voting<br />

Stock Owned<br />

(a)<br />

(b)<br />

(c)<br />

2 Newco Energy Corporation<br />

3<br />

4<br />

5<br />

6<br />

7 <strong>Pacific</strong> California <strong>Gas</strong> System, Inc.<br />

8<br />

9<br />

10<br />

11 <strong>Pacific</strong> Conservation Services <strong>Company</strong><br />

12<br />

13<br />

14<br />

15<br />

16<br />

17 <strong>Pacific</strong> Energy Fuels <strong>Company</strong><br />

18<br />

19<br />

20<br />

21<br />

22 <strong>Pacific</strong> <strong>Gas</strong> Properties <strong>Company</strong><br />

23<br />

24<br />

25<br />

26<br />

27<br />

<strong>Form</strong>ed to facilitate 100<br />

implementation of the<br />

Utility's original proposed<br />

plan of reorganization.<br />

<strong>Form</strong>ed to hold the 100<br />

intrastate gas pipeline<br />

operations.<br />

<strong>Form</strong>erly engaged in the 100<br />

borrowing <strong>and</strong> lending<br />

operations required<br />

to fund the Utility's<br />

conservation loan programs.<br />

<strong>Form</strong>ed to own <strong>and</strong> 100<br />

finance the nuclear fuel<br />

inventory previously owned<br />

by <strong>Pacific</strong> Energy Trust.<br />

<strong>Form</strong>ed to hold Alaska 100<br />

<strong>and</strong> California property<br />

interests, previously<br />

intended for LNG projects,<br />

for sale or development.<br />

Footnote<br />

Ref.<br />

(d)<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-96) Page 103.1

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report Is:<br />

Date of Report<br />

(1) X An Original<br />

(Mo, Da, Yr)<br />

(2) A Resubmission<br />

04/08/2011<br />

CORPORATIONS CONTROLLED BY RESPONDENT<br />

Year/Period of Report<br />

End of <strong>2010</strong>/Q4<br />

1. Report below the names of all corporations, business trusts, <strong>and</strong> similar organizations, controlled directly or indirectly by respondent<br />

at any time during the year. If control ceased prior to end of year, give particulars (details) in a footnote.<br />

2. If control was by other means than a direct holding of voting rights, state in a footnote the manner in which control was held, naming<br />

any intermediaries involved.<br />

3. If control was held jointly with one or more other interests, state the fact in a footnote <strong>and</strong> name the other interests.<br />

Definitions<br />

1. See the Uniform System of Accounts for a definition of control.<br />

2. Direct control is that which is exercised without interposition of an intermediary.<br />

3. Indirect control is that which is exercised by the interposition of an intermediary which exercises direct control.<br />

4. Joint control is that in which neither interest can effectively control or direct action without the consent of the other, as where the<br />

voting control is equally divided between two holders, or each party holds a veto power over the other. Joint control may exist by<br />

mutual agreement or underst<strong>and</strong>ing between two or more parties who together have control within the meaning of the definition of<br />

control in the Uniform System of Accounts, regardless of the relative voting rights of each party.<br />

Line<br />

No.<br />

1 PG&E CalHydro, LLC<br />

2<br />

3<br />

4<br />

5<br />

6<br />

Name of <strong>Company</strong> Controlled Kind of Business Percent Voting<br />

Stock Owned<br />

(a)<br />

(b)<br />

(c)<br />

7 PG&E Energy Recovery Funding LLC<br />

8<br />

9<br />

10<br />

11 St<strong>and</strong>ard <strong>Pacific</strong> <strong>Gas</strong> Line Incorporated<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18 PG&E Real Estate, LLC<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

<strong>Form</strong>ed for the purpose of 100<br />

owning <strong>and</strong> operating a<br />

system of hydroelectric<br />

facilities <strong>and</strong> related<br />

watershed.<br />

<strong>Form</strong>ed to retain ownership 100<br />

of recovery property <strong>and</strong><br />

to issue securities.<br />

Engaged in the transportation 85.71<br />

of natural gas in California.<br />

The Utility owns an 85.71%<br />

interest <strong>and</strong> Chevron Pipe<br />

Line <strong>Company</strong> owns the<br />

remaining 14.29% interest.<br />

A wholly-owned subsidiary of 100<br />

<strong>Pacific</strong> <strong>Gas</strong> <strong>and</strong> <strong>Electric</strong><br />

<strong>Company</strong>, formed to conduct<br />

real estate transactions,<br />

most likely related to<br />

purchase of property rights<br />

of San Bruno incident<br />

Footnote<br />

Ref.<br />

(d)<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-96) Page 103.2

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

Line<br />

No.<br />

This Report Is:<br />

(1) X An Original<br />

(2) A Resubmission<br />

OFFICERS<br />

Date of Report<br />

(Mo, Da, Yr)<br />

04/08/2011<br />

Year/Period of Report<br />

End of <strong>2010</strong>/Q4<br />

1. Report below the name, title <strong>and</strong> salary for each executive officer whose salary is $50,000 or more. An "executive officer" of a<br />

respondent includes its president, secretary, treasurer, <strong>and</strong> vice president in charge of a principal business unit, division or function<br />

(such as sales, administration or finance), <strong>and</strong> any other person who performs similar policy making functions.<br />

2. If a change was made during the year in the incumbent of any position, show name <strong>and</strong> total remuneration of the previous<br />

incumbent, <strong>and</strong> the date the change in incumbency was made.<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

36<br />

37<br />

38<br />

39<br />

40<br />

41<br />

42<br />

43<br />

44<br />

Title Name of Officer Salary<br />

for Year<br />

(a)<br />

(b)<br />

(c)<br />

President Christopher P. Johns<br />

672,500<br />

Senior VP <strong>and</strong> Chief Operating Officer John S. Keenan<br />

616,250<br />

Senior VP, Financial Services Kent M. Harvey<br />

537,500<br />

Senior VP, Energy Supply <strong>and</strong> Chief Nuclear Offcer John T. Conway<br />

486,667<br />

Senior VP, Human Resources John R. Simon<br />

366,972<br />

Senior VP <strong>and</strong> Chief Information Officer Patricia M. Lawicki<br />

360,559<br />

Senior VP, Engineering <strong>and</strong> Operations Edward A. Salas<br />

348,823<br />

Senior VP, Energy Delivery Geisha J. Williams<br />

345,485<br />

Senior VP, Corporate Affairs Greg S. Pruett<br />

336,667<br />

Senior VP, Regulatory Relations Thomas E. Bottorff<br />

334,031<br />

Senior VP <strong>and</strong> Chief Customer Officer Helen A. Burt<br />

320,253<br />

Senior VP, Shared Services <strong>and</strong> Chief Procurement Officer Desmond Bell<br />

317,369<br />

Senior VP, Energy Procurement Fong Wan<br />

316,725<br />

VP <strong>and</strong> Controller Dinyar B.Mistry<br />

315,208<br />

VP, Finance <strong>and</strong> CFO Sara A.Cherry<br />

262,258<br />

VP <strong>and</strong> Controller Stephen J. Cairns<br />

309,000<br />

VP, Finance <strong>and</strong> CFO Barbara L. Barcon<br />

52,620<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-96) Page 104

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report is:<br />

(1) X An Original<br />

(2) A Resubmission<br />

Date of Report<br />

(Mo, Da, Yr)<br />

04/08/2011<br />

Year/Period of Report<br />

<strong>2010</strong>/Q4<br />

FOOTNOTE DATA<br />

Schedule Page: 104 Line No.: 14 Column: a<br />

(1) Mr. Mistry became VP <strong>and</strong> Controller on March 8, <strong>2010</strong>.<br />

Schedule Page: 104 Line No.: 15 Column: a<br />

Ms. Cherry became VP, Finance <strong>and</strong> CFO on March 1, <strong>2010</strong>.<br />

Schedule Page: 104 Line No.: 16 Column: a<br />

Mr. Cairns served as VP <strong>and</strong> Controller through March 7, <strong>2010</strong>.<br />

Schedule Page: 104 Line No.: 17 Column: a<br />

Ms. Barcon served as VP, Finance <strong>and</strong> CFO through March 1, <strong>2010</strong>.<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-87) Page 450.1

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report Is:<br />

(1) X An Original<br />

(2) A Resubmission<br />

DIRECTORS<br />

Date of Report<br />

(Mo, Da, Yr)<br />

04/08/2011<br />

Year/Period of Report<br />

End of <strong>2010</strong>/Q4<br />

1. Report below the information called for concerning each director of the respondent who held office at any time during the year. Include in column (a), abbreviated<br />

titles of the directors who are officers of the respondent.<br />

2. Designate members of the Executive Committee by a triple asterisk <strong>and</strong> the Chairman of the Executive Committee by a double asterisk.<br />

Line<br />

No.<br />

Name (<strong>and</strong> Title) of Director<br />

(a)<br />

Principal Business Address<br />

(b)<br />

1 David R. Andrews, Esq. ***<br />

c/o PG&E Corporation<br />

2<br />

One Market, Spear Tower, Suite 2400<br />

3<br />

4<br />

5 Lewis Chew<br />

San Francisco, CA 94105<br />

c/o National Semiconductor Corporation<br />

6<br />

2900 Semiconductor Drive, Mail Stop G3-155<br />

7<br />

8<br />

9 C. Lee Cox ***<br />

Santa Clara, CA 95051<br />

c/o PG&E Corporation<br />

10 Non-Executive Chairman of the Board<br />

One Market, Spear Tower, Suite 2400<br />

11<br />

12<br />

13 Peter A. Darbee **<br />

San Francisco, CA 94105<br />

c/o PG&E Corporation<br />

14<br />

One Market, Spear Tower, Suite 2400<br />

15<br />

16<br />

17 Maryellen C. Herringer ***<br />

San Francisco, CA 94105<br />

c/o PG&E Corporation<br />

18<br />

One Market, Spear Tower, Suite 2400<br />

19<br />

20<br />

21 Roger H. Kimmel<br />

San Francisco, CA 94105<br />

c/o Rothschild Inc.<br />

22<br />

1251 Avenue of the Americas<br />

23<br />

24<br />

25 Richard A. Meserve<br />

New York, NY 10020<br />

c/o Carnegie Institution of Washington<br />

26<br />

1530 P Street, NW<br />

27<br />

28<br />

29 Forrest E. Miller<br />

Washington, DC 20005<br />

c/o AT&T Inc.<br />

30<br />

208 S. Akard Street, Suite 3701<br />

31<br />

32<br />

33 Rosendo G. Parra<br />

Dallas, TX 75202<br />

c/o Daylight Partners<br />

34<br />

3725 Hunterwood Point<br />

35<br />

36<br />

37 Barbara L. Rambo ***<br />

Austin, TX 78746<br />

c/o PG&E Corporation<br />

38<br />

One Market, Spear Tower, Suite 2400<br />

39<br />

40<br />

41 Barry Lawson Williams ***<br />

San Francisco, CA 94105<br />

c/o Williams <strong>Pacific</strong> Ventures, Inc.<br />

42<br />

4 Embarcadero Center, Suite 3700<br />

43<br />

44<br />

45 Christopher P Johns ***<br />

San Francisco, CA 94111<br />

c/o <strong>Pacific</strong> <strong>Gas</strong> <strong>and</strong> <strong>Electric</strong> <strong>Company</strong><br />

46<br />

77 Beale Street, 32nd Floor<br />

47<br />

48<br />

San Francisco, CA 94105<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-95) Page 105

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report is:<br />

(1) X An Original<br />

(2) A Resubmission<br />

Date of Report<br />

(Mo, Da, Yr)<br />

04/08/2011<br />

Year/Period of Report<br />

<strong>2010</strong>/Q4<br />

FOOTNOTE DATA<br />

Schedule Page: 105 Line No.: 45 Column: a<br />

Christopher P. Johns was elected as President of the Utility on August 1, 2009 <strong>and</strong> as a<br />

director of the Utility on February 17, <strong>2010</strong>.<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-87) Page 450.1

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report Is:<br />

Date of Report<br />

(1) X An Original<br />

(Mo, Da, Yr)<br />

(2) A Resubmission<br />

04/08/2011<br />

INFORMATION ON FORMULA RATES<br />

<strong>FERC</strong> Rate Schedule/Tariff Number <strong>FERC</strong> Proceeding<br />

Year/Period of Report<br />

End of <strong>2010</strong>/Q4<br />

Does the respondent have formula rates?<br />

Line<br />

No.<br />

<strong>FERC</strong> Rate Schedule or Tariff Number<br />

<strong>FERC</strong> Proceeding<br />

Yes<br />

X No<br />

1. Please list the Commission accepted formula rates including <strong>FERC</strong> Rate Schedule or Tariff Number <strong>and</strong> <strong>FERC</strong> proceeding (i.e. Docket No)<br />

accepting the rate(s) or changes in the accepted rate.<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

36<br />

37<br />

38<br />

39<br />

40<br />

41<br />

NOT APPLICABLE<br />

<strong>FERC</strong> FORM NO. 1 (NEW. 12-08) Page 106

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report Is:<br />

Date of Report<br />

(1) X An Original<br />

(Mo, Da, Yr)<br />

(2) A Resubmission<br />

04/08/2011<br />

INFORMATION ON FORMULA RATES<br />

<strong>FERC</strong> Rate Schedule/Tariff Number <strong>FERC</strong> Proceeding<br />

Year/Period of Report<br />

End of <strong>2010</strong>/Q4<br />

Does the respondent file with the Commission annual (or more frequent)<br />

filings containing the inputs to the formula rate(s)?<br />

2. If yes, provide a listing of such filings as contained on the Commission's eLibrary website<br />

X<br />

Yes<br />

No<br />

Line<br />

No.<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

36<br />

37<br />

38<br />

39<br />

40<br />

41<br />

42<br />

43<br />

44<br />

45<br />

46<br />

Accession No.<br />

Document Date<br />

\ Filed Date<br />

Docket No.<br />

NOT APPLICABLE<br />

Description<br />

<strong>Form</strong>ula Rate <strong>FERC</strong> Rate<br />

Schedule Number or<br />

Tariff Number<br />

<strong>FERC</strong> FORM NO. 1 (NEW. 12-08)<br />

Page 106a

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report Is:<br />

(1) X An Original<br />

(2) A Resubmission<br />

INFORMATION ON FORMULA RATES<br />

<strong>Form</strong>ula Rate Variances<br />

Date of Report<br />

(Mo, Da, Yr)<br />

04/08/2011<br />

Year/Period of Report<br />

End of <strong>2010</strong>/Q4<br />

1. If a respondent does not submit such filings then indicate in a footnote to the applicable <strong>Form</strong> 1 schedule where formula rate inputs differ from<br />

amounts reported in the <strong>Form</strong> 1.<br />

2. The footnote should provide a narrative description explaining how the "rate" (or billing) was derived if different from the reported amount in the<br />

<strong>Form</strong> 1.<br />

3. The footnote should explain amounts excluded from the ratebase or where labor or other allocation factors, operating expenses, or other items<br />

impacting formula rate inputs differ from amounts reported in <strong>Form</strong> 1 schedule amounts.<br />

4. Where the Commission has provided guidance on formula rate inputs, the specific proceeding should be noted in the footnote.<br />

Line<br />

No. Page No(s). Schedule Column Line No<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

36<br />

37<br />

38<br />

39<br />

40<br />

41<br />

42<br />

43<br />

44<br />

NOT APPLICABLE<br />

<strong>FERC</strong> FORM NO. 1 (NEW. 12-08)<br />

Page 106b

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This<br />

(1)<br />

Report<br />

X<br />

Is:<br />

An Original<br />

(2) A Resubmission<br />

Date of Report<br />

04/08/2011<br />

Year/Period of Report<br />

End of <strong>2010</strong>/Q4<br />

IMPORTANT CHANGES DURING THE QUARTER/YEAR<br />

Give particulars (details) concerning the matters indicated below. Make the statements explicit <strong>and</strong> precise, <strong>and</strong> number them in<br />

accordance with the inquiries. Each inquiry should be answered. Enter "none," "not applicable," or "NA" where applicable. If<br />

information which answers an inquiry is given elsewhere in the report, make a reference to the schedule in which it appears.<br />

1. Changes in <strong>and</strong> important additions to franchise rights: Describe the actual consideration given therefore <strong>and</strong> state from whom the<br />

franchise rights were acquired. If acquired without the payment of consideration, state that fact.<br />

2. Acquisition of ownership in other companies by reorganization, merger, or consolidation with other companies: Give names of<br />

companies involved, particulars concerning the transactions, name of the Commission authorizing the transaction, <strong>and</strong> reference to<br />

Commission authorization.<br />

3. Purchase or sale of an operating unit or system: Give a brief description of the property, <strong>and</strong> of the transactions relating thereto,<br />

<strong>and</strong> reference to Commission authorization, if any was required. Give date journal entries called for by the Uniform System of Accounts<br />

were submitted to the Commission.<br />

4. Important leaseholds (other than leaseholds for natural gas l<strong>and</strong>s) that have been acquired or given, assigned or surrendered: Give<br />

effective dates, lengths of terms, names of parties, rents, <strong>and</strong> other condition. State name of Commission authorizing lease <strong>and</strong> give<br />

reference to such authorization.<br />

5. Important extension or reduction of transmission or distribution system: State territory added or relinquished <strong>and</strong> date operations<br />

began or ceased <strong>and</strong> give reference to Commission authorization, if any was required. State also the approximate number of<br />

customers added or lost <strong>and</strong> approximate annual revenues of each class of service. Each natural gas company must also state major<br />

new continuing sources of gas made available to it from purchases, development, purchase contract or otherwise, giving location <strong>and</strong><br />

approximate total gas volumes available, period of contracts, <strong>and</strong> other parties to any such arrangements, etc.<br />

6. Obligations incurred as a result of issuance of securities or assumption of liabilities or guarantees including issuance of short-term<br />

debt <strong>and</strong> commercial paper having a maturity of one year or less. Give reference to <strong>FERC</strong> or State Commission authorization, as<br />

appropriate, <strong>and</strong> the amount of obligation or guarantee.<br />

7. Changes in articles of incorporation or amendments to charter: Explain the nature <strong>and</strong> purpose of such changes or amendments.<br />

8. State the estimated annual effect <strong>and</strong> nature of any important wage scale changes during the year.<br />

9. State briefly the status of any materially important legal proceedings pending at the end of the year, <strong>and</strong> the results of any such<br />

proceedings culminated during the year.<br />

10. Describe briefly any materially important transactions of the respondent not disclosed elsewhere in this report in which an officer,<br />

director, security holder reported on Page 106, voting trustee, associated company or known associate of any of these persons was a<br />

party or in which any such person had a material interest.<br />

11. (Reserved.)<br />

12. If the important changes during the year relating to the respondent company appearing in the annual report to stockholders are<br />

applicable in every respect <strong>and</strong> furnish the data required by Instructions 1 to 11 above, such notes may be included on this page.<br />

13. Describe fully any changes in officers, directors, major security holders <strong>and</strong> voting powers of the respondent that may have<br />

occurred during the reporting period.<br />

14. In the event that the respondent participates in a cash management program(s) <strong>and</strong> its proprietary capital ratio is less than 30<br />

percent please describe the significant events or transactions causing the proprietary capital ratio to be less than 30 percent, <strong>and</strong> the<br />

extent to which the respondent has amounts loaned or money advanced to its parent, subsidiary, or affiliated companies through a<br />

cash management program(s). Additionally, please describe plans, if any to regain at least a 30 percent proprietary ratio.<br />

PAGE 108 INTENTIONALLY LEFT BLANK<br />

SEE PAGE 109 FOR REQUIRED INFORMATION.<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-96) Page 108

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report is:<br />

(1) X An Original<br />

(2) A Resubmission<br />

Date of Report<br />

(Mo, Da, Yr)<br />

04/08/2011<br />

Year/Period of Report<br />

<strong>2010</strong>/Q4<br />

IMPORTANT CHANGES DURING THE QUARTER/YEAR (Continued)<br />

1. Changes in <strong>and</strong> important additions to franchise rights:<br />

On February 23, <strong>2010</strong>, the City of San Jose adopted amendments to <strong>Pacific</strong> <strong>Gas</strong> <strong>and</strong><br />

<strong>Electric</strong> <strong>Company</strong>’s (the "Utility") gas <strong>and</strong> electric franchise agreements which<br />

provide for an increase in the franchise fee by three-tenths of one percent (0.3%).<br />

The increase in the franchise fee is collected as a surcharge to customers within the<br />

City of San Jose. The California Public Utilities Commission (“CPUC”) approved the<br />

franchise fee surcharge effective May 5, <strong>2010</strong>.<br />

On May 28, <strong>2010</strong>, the City of Fresno ("City") adopted a new gas franchise for the<br />

Utility, under Ordinance No. <strong>2010</strong>-16, replacing the existing gas franchise that<br />

expired in June, <strong>2010</strong>. The new gas franchise went into effect June 27, <strong>2010</strong> <strong>and</strong> is<br />

for a 50 year term. Under the new franchise, the City receives a total franchise fee<br />

of two (2) percent, of which one (1) percent is collected as a surcharge to customers<br />

within the City. The CPUC approved the franchise fee surcharge on September 16,<br />

<strong>2010</strong>, with an effective date of August 16, <strong>2010</strong>.<br />

2. Acquisition of ownership in other companies by reorganization, merger, or<br />

consolidation with other companies:<br />

None.<br />

3. Purchase or sale of an operating unit or system:<br />

Sale:<br />

Transaction Date Sale To: Equipment Type Location Amount 1<br />

Nov. 11. <strong>2010</strong> TPUD-Hyampom ETP Operating Trinity 761,002<br />

System<br />

County<br />

4. Important leaseholds that have been acquired or given, assigned or surrendered:<br />

Effective<br />

Location Lessor/Lessee Lease Term<br />

Date<br />

(St., City)<br />

Type<br />

Term<br />

Commencement<br />

Date<br />

Annual<br />

Rent<br />

5/3/10 1/1/09 345<br />

Sacramento<br />

St, Auburn<br />

9/30/10 1/1/11 118 S 3rd<br />

Street, King<br />

City<br />

10/15/10 10/15/10 1070 Airport<br />

Blvd, Santa<br />

Rosa<br />

11/1/10 12/1/10 900 Cherry<br />

Ave., 3rd<br />

Floor, San<br />

Bruno<br />

11/8/10 1/5/11 850 Stillwater<br />

Road, West<br />

Sacramento<br />

Twentieth<br />

District<br />

Agricultural<br />

Association<br />

JIM APPLING<br />

Laier <strong>and</strong><br />

Kantock<br />

SFO Business<br />

Centers, Inc.<br />

HARSCH<br />

INVESTMENT<br />

CORP.<br />

Lease<br />

Renewal<br />

Lease<br />

Renewal<br />

Lease<br />

Expansion<br />

(580 sq.<br />

ft.)<br />

36<br />

months<br />

36<br />

months<br />

36<br />

months<br />

New Lease 18<br />

months<br />

Lease<br />

Renewal<br />

12<br />

months<br />

$10,164<br />

$21,967.32<br />

$12,000<br />

$222,240<br />

$1,328,811.<br />

60<br />

11/15/10 12/1/<strong>2010</strong> 2700 Ygnacio,<br />

Suite 210,<br />

Walnut Creek<br />

<strong>Pacific</strong> 2700<br />

Ygnacio<br />

Corporation<br />

New Lease 18<br />

months<br />

$113,011.20<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-96) Page 109.1

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report is:<br />

(1) X An Original<br />

(2) A Resubmission<br />

Date of Report<br />

(Mo, Da, Yr)<br />

04/08/2011<br />

Year/Period of Report<br />

<strong>2010</strong>/Q4<br />

IMPORTANT CHANGES DURING THE QUARTER/YEAR (Continued)<br />

12/8/10 1/1/11 410 N Main<br />

St, Fort<br />

Bragg<br />

12/10/10 12/15/10 125 Venture<br />

Dr, San Luis<br />

Obispo<br />

12/20/10 3/1/10 375 Fifth St,<br />

Hollister<br />

12/31/10 1/1/08 2570<br />

Cloverdale<br />

Ave., Suites<br />

19 & 20,<br />

Concord<br />

MS CORDELIA<br />

SHAMPANIER<br />

Vachell Lane<br />

Properties<br />

City of<br />

Hollister<br />

THE SCHMIDT<br />

FAMILY TRUST<br />

Lease<br />

Renewal<br />

36<br />

months<br />

New Lease 3<br />

months<br />

New Vacant<br />

L<strong>and</strong> Lease<br />

Lease<br />

Surrender/<br />

Lease<br />

Expiration<br />

120<br />

months<br />

36<br />

months<br />

$11,423.16<br />

$90,000<br />

$3,984<br />

$28,644.36<br />

5. Important extension or reduction of transmission or distribution system:<br />

<strong>Electric</strong>:<br />

On July 16, <strong>2010</strong>, the Gill Ranch <strong>Gas</strong> Storage 115 kV Load Interconnection Project<br />

became operational. Located in Madera, California, PG&E constructed a 10-mile long<br />

overhead tap line from the Dairyl<strong>and</strong>-Mendota 115 kV circuit to the customer-owned<br />

Gill Ranch Substation. Completion of this project enables the Gill Ranch customer to<br />

obtain transmission service from PG&E’s electric grid.<br />

On August 1, <strong>2010</strong>, the Oakl<strong>and</strong> Station C-X No. 3 115 kV Underground Cable Project was<br />

energized for service. This project, located in Alameda County, installed a single<br />

3.7 miles underground cable between Oakl<strong>and</strong> C <strong>and</strong> Oakl<strong>and</strong> X Substations. This<br />

project increases the area transmission capacity, thereby ensures reliable<br />

transmission service for electric customers in North Oakl<strong>and</strong> area.<br />

On August 27, <strong>2010</strong>, PG&E took ownership of the Carberry Switching Substation that was<br />

energized on June 22, <strong>2010</strong>. Located in Shasta County near Burney, California, the<br />

new 230 kV switching station was constructed to interconnect the Hatchet Ridge Wind<br />

Farm with PG&E’s electric grid. The wind farm is owned by a third-party developer,<br />

<strong>and</strong> it has a total output of approximately 100 MW. The new switching station is<br />

equipped with protection, control, <strong>and</strong> communication equipment enabling the existing<br />

230 kV Pit No. 3 to Round Mountain circuit to loop into the station for electric<br />

power delivery.<br />

On November 23, <strong>2010</strong>, the TransBay Cable Project interconnected with PG&E’s electric<br />

grid. This third-party-owned project installed a high-voltage direct-current cable<br />

<strong>and</strong> associated onshore facilities into PG&E’s grid. The 53-mile submarine cable<br />

improves electric transmission reliability to San Francisco by providing 400 MW of<br />

electric power transfer capability from Pittsburg Substation in Contra Costa County,<br />

to Potrero Substation in San Francisco County, California.<br />

On December 1, <strong>2010</strong>, the 7th St<strong>and</strong>ard Substation located in Kern County was released<br />

to Operations. New transmission <strong>and</strong> distribution facilities, including control <strong>and</strong><br />

protection equipment, were installed to provide additional capacity to reliably serve<br />

electric customers in Northwest Bakersfield <strong>and</strong> the surrounding area in Kern County,<br />

California.<br />

On December 22, <strong>2010</strong>, the PG&E-owned Colusa Generating Station interconnected to the<br />

Delevan Switching Substation for commercial operation. Located near Maxwell in<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-96) Page 109.2

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report is:<br />

(1) X An Original<br />

(2) A Resubmission<br />

Date of Report<br />

(Mo, Da, Yr)<br />

04/08/2011<br />

Year/Period of Report<br />

<strong>2010</strong>/Q4<br />

IMPORTANT CHANGES DURING THE QUARTER/YEAR (Continued)<br />

Colusa County, California, the switching Station was energized on February 3, <strong>2010</strong>.<br />

The switching station has protection, control, <strong>and</strong> communication equipment that<br />

enables power output from the 660 MW generation station be delivered to the<br />

transmission corridor between Cottonwood <strong>and</strong> Vaca Dixon Substations.<br />

6. Obligations incurred as a result of issuance of securities or assumption of liabilities<br />

or guarantees including issuance of short-term debt <strong>and</strong> commercial paper having maturity<br />

of one year or less. Give reference to <strong>FERC</strong> or State Commission authorization, as<br />

appropriate, <strong>and</strong> the amount of obligation or guarantee:<br />

a) Financings:<br />

At December 31, <strong>2010</strong>, the Utility had $10.15 billion of unsecured senior notes<br />

outst<strong>and</strong>ing with various interest rates <strong>and</strong> maturity dates, including the<br />

following issuances made during <strong>2010</strong>.<br />

On April 1, <strong>2010</strong>, the Utility issued $250 million of 30-year unsecured Senior<br />

Notes. The issuance was a re-opening of the 5.80% 30-year Senior Notes issued in<br />

March 2007. In a bond re-opening, all of the terms of the new issue are<br />

identical to that of the original issue including coupon, interest payment dates,<br />

maturity date, etc. The Senior Notes were authorized by the California Public<br />

Utilities Commission (“CPUC”) Decision No. 08-10-013.<br />

On September 15, <strong>2010</strong>, the Utility issued $550 million of unsecured Senior Notes<br />

due October 1, 2020 at a coupon of 3.50%. The Senior Notes were authorized by<br />

the CPUC Decision No. 08-10-013.<br />

On October 12, <strong>2010</strong>, the Utility issued $250 principal amount of Floating Rate<br />

Senior Notes due October 11, 2011. The Senior Notes were authorized by CPUC<br />

Decision No. 04-10-037 as modified by Decision Nos. 05-04-023, 06-11-006 <strong>and</strong><br />

09-05-002.<br />

On November 18, <strong>2010</strong>, the Utility issued $250 million of 10-year unsecured Senior<br />

Notes <strong>and</strong> $250 million 30-year unsecured Senior Notes. Issuances were<br />

re-openings of the 3.50% 10-year Senior Notes <strong>and</strong> the 5.40% 30-year Senior Notes<br />

issued in September 15, <strong>2010</strong> <strong>and</strong> November 18, 2009, respectively. The Senior<br />

Notes were authorized by the CPUC Decision No. 08-10-013.<br />

On April 8, <strong>2010</strong>, the California Infrastructure <strong>and</strong> Economic Development Bank<br />

(I-Bank), issued $50 million of tax-exempt pollution control bond series <strong>2010</strong> E<br />

at a yield of 2.25%, due on November 1, 2026 with a 2-year m<strong>and</strong>atory put. The<br />

proceeds were loaned to the Utility to repurchase pollution control bonds series<br />

2005 E. The pollution control bonds were authorized by the CPUC Decision No.<br />

08-10-013.<br />

Refer to Note 4, Debt, of the Notes to Financial Statements on page 123 of the<br />

<strong>FERC</strong> <strong>Form</strong> 3-Q.<br />

b) Bank Credit Facilities:<br />

On June 8, <strong>2010</strong>, the Utility entered into a $750 million revolving credit<br />

facility agreement. This credit facility will expire on February 26, 2012 <strong>and</strong><br />

does not support the letters of credit program. At December 31, <strong>2010</strong>, the<br />

Utility had nothing outst<strong>and</strong>ing under this revolving credit facility.<br />

At December 31, <strong>2010</strong>, the Utility had $329 million of letters of credit<br />

outst<strong>and</strong>ing under the Utility’s $1.94 billion revolving credit facility.<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-96) Page 109.3

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report is:<br />

(1) X An Original<br />

(2) A Resubmission<br />

Date of Report<br />

(Mo, Da, Yr)<br />

04/08/2011<br />

Year/Period of Report<br />

<strong>2010</strong>/Q4<br />

IMPORTANT CHANGES DURING THE QUARTER/YEAR (Continued)<br />

The revolving credit facility also provides liquidity support for commercial<br />

paper offerings. At December 31, <strong>2010</strong>, the Utility had $603 million of<br />

commercial paper outst<strong>and</strong>ing. The short-term borrowings are authorized by CPUC<br />

Decision No. 04-10-037 as modified by Decision Nos. 05-04-023, 06-11-006 <strong>and</strong><br />

09-05-002.<br />

Refer to Note 4, Debt, of the Notes to Financial Statements on page 123 of the<br />

<strong>FERC</strong> <strong>Form</strong> 3-Q.<br />

c) Surety Bonds <strong>and</strong> Financial Guarantees Backed by Insurance:<br />

From October 1, <strong>2010</strong> through December 31, <strong>2010</strong>, $865,000 in surety bonds was<br />

authorized by CPUC Decision No. 08-10-013. At December 31, <strong>2010</strong>, there was<br />

$11,959,000 in long-term surety bond obligations outst<strong>and</strong>ing.<br />

d) Capital Support:<br />

CCPUC Decision No. 91-12-057 (as modified by Decision No. 99-04-068) authorized<br />

the Utility to provide capital support to regulated <strong>and</strong> unregulated subsidiaries.<br />

At December 31, <strong>2010</strong>, the Utility has no outst<strong>and</strong>ing future capital commitments<br />

to unregulated subsidiaries <strong>and</strong> affiliates.<br />

e) Preferred repayments: None<br />

7. Changes in articles of incorporation or amendments to charter. Explain the nature<br />

<strong>and</strong> purpose of such changes or amendments:<br />

None.<br />

8. State the estimated annual effect <strong>and</strong> nature of any important wage scale changes<br />

during the period:<br />

As provided for in labor agreements with the International Brotherhood of <strong>Electric</strong>al<br />

Workers (“IBEW”), Local 1245, representing a majority of the Utility’s employees in<br />

physical <strong>and</strong> clerical classifications; the Engineers <strong>and</strong> Scientists of California<br />

(“ESC”), representing certain Utility employees in the technical <strong>and</strong> engineering<br />

classifications; <strong>and</strong>, the Service Employees International Union (“SEIU”),<br />

representing certain Utility security officers at Diablo Canyon Nuclear Power Plant,<br />

the following general wage increases were granted effective January 1, <strong>2010</strong>:<br />

IBEW Physical <strong>and</strong> Clerical classifications 3.75%<br />

ESC classifications 3.75%<br />

SEIU classifications 4.50%<br />

The full annual cost of the above general wage increases is approximately $40.3<br />

million.<br />

9. State briefly the status of any materially important legal proceedings pending at the<br />

end of the period <strong>and</strong> the results of any such proceedings culminated during the<br />

period:<br />

Refer to Note 15 of the Notes to Financial Statements on page 123, which discusses<br />

materially important pending legal matters.<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-96) Page 109.4

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report is:<br />

(1) X An Original<br />

(2) A Resubmission<br />

Date of Report<br />

(Mo, Da, Yr)<br />

04/08/2011<br />

Year/Period of Report<br />

<strong>2010</strong>/Q4<br />

IMPORTANT CHANGES DURING THE QUARTER/YEAR (Continued)<br />

Further, refer to Part I, Item 3 in PG&E Corporation's <strong>and</strong> the Utility’s combined<br />

Annual Report on <strong>Form</strong> 10-K for the year ended December 31, <strong>2010</strong>, which describes<br />

certain legal proceedings pursuant to Item 103 of Regulation S-K of the Securities<br />

Exchange Act of 1934, as amended. Four copies of the <strong>Form</strong> 10—K report are filed in<br />

accordance with Instruction III(b) of Instructions For Filing the <strong>FERC</strong> <strong>Form</strong> No. 1.<br />

10. Describe briefly any material important transactions of the respondent not disclosed<br />

elsewhere in this report in which an officer, director, security holder reported in<br />

the last Annual Report <strong>FERC</strong> <strong>Form</strong> 1, 1-F, 2 or 2-A, voting trustee, associated company<br />

or known associate of any of these persons was a party or in which such person had a<br />

material interest:<br />

Refer to the PG&E Corporation <strong>and</strong> <strong>Pacific</strong> <strong>Gas</strong> <strong>and</strong> <strong>Electric</strong> <strong>Company</strong> Joint Proxy<br />

Statement dated March 30, 2011 which describes certain related person transactions<br />

pursuant to Item 7 of Schedule 14A under the Securities Exchange Act of 1934, as<br />

amended <strong>and</strong> to Note 14 of the Notes to Financial Statements on page 123 of the <strong>FERC</strong><br />

<strong>Form</strong> 1, which describes certain material related party agreements <strong>and</strong> transactions.<br />

A copy of the proxy statement is attached.<br />

11. Reserved<br />

12. If the important changes during the year relating to the respondent company appearing<br />

in the annual report to stockholders are applicable in every respect <strong>and</strong> furnish the<br />

data required by instructions to 1 to 11 above, such notes may be included on this<br />

page.<br />

Four copies of PG&E Corporation’s <strong>and</strong> <strong>Pacific</strong> <strong>Gas</strong> <strong>and</strong> <strong>Electric</strong> <strong>Company</strong>’s combined<br />

Annual Report on <strong>Form</strong> 10-K for the year ended December 31, <strong>2010</strong>, <strong>and</strong> four copies of<br />

PG&E Corporation <strong>and</strong> <strong>Pacific</strong> <strong>Gas</strong> <strong>and</strong> <strong>Electric</strong> <strong>Company</strong>’s joint <strong>2010</strong> Annual Report To<br />

Shareholders have been filed in accordance with Instruction III(b) of the<br />

Instructions for Filing the <strong>FERC</strong> <strong>Form</strong> No. 1.<br />

13. Describe fully any changes in officers, directors, major security holders <strong>and</strong> voting<br />

powers of the respondent that may have occurred during the reporting period:<br />

Directors<br />

The following individual was elected as a director of the Utility:<br />

• Christopher P. Johns<br />

Officers<br />

The following individuals were elected as officers of the Utility:<br />

• Sara A. Cherry, Vice President, Finance <strong>and</strong> Chief Financial Officer<br />

• Anil K. Suri, Vice President <strong>and</strong> Chief Risk <strong>and</strong> Audit Officer<br />

• M. Kirk Johnson, Vice President, <strong>Gas</strong> Engineering <strong>and</strong> Operations<br />

• Janet C. Loduca, Vice President, Corporate Relations<br />

The following officers’ titles changed:<br />

• Stephen J. Cairns, Vice President, Internal Audit <strong>and</strong> Compliance (formerly Vice<br />

President <strong>and</strong> Controller)<br />

• William D. Hayes, Vice President, <strong>Gas</strong> Maintenance <strong>and</strong> Construction (formerly Vice<br />

President, Maintenance <strong>and</strong> Construction)<br />

• Dinyar B. Mistry, Vice President <strong>and</strong> Controller (formerly Vice President <strong>and</strong> Chief<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-96) Page 109.5

Name of Respondent<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

This Report is:<br />

(1) X An Original<br />

(2) A Resubmission<br />

Date of Report<br />

(Mo, Da, Yr)<br />

04/08/2011<br />

Year/Period of Report<br />

<strong>2010</strong>/Q4<br />

IMPORTANT CHANGES DURING THE QUARTER/YEAR (Continued)<br />

Risk <strong>and</strong> Audit Officer)<br />

• Mark S. Johnson, Vice President, <strong>Electric</strong> Transmission, Planning <strong>and</strong> Engineering<br />

(formerly Vice President, <strong>Electric</strong> Operations <strong>and</strong> Engineering)<br />

• R<strong>and</strong>al S. Livingston, Vice President, <strong>Gas</strong> Transmission Programs (formerly Vice<br />

President, Power Generation)<br />

• Placido J. Martinez, Vice President, <strong>Electric</strong> Distribution, Planning <strong>and</strong><br />

Engineering (formerly Vice President, Engineering)<br />

• Gregory K. Kiraly, Vice President, SmartMeter Operations (formerly Vice President,<br />

<strong>Electric</strong> Maintenance <strong>and</strong> Construction)<br />

The following individual is no longer an officer of the Utility:<br />

• Barbara L. Barcon, Vice President, Finance <strong>and</strong> Chief Financial Officer<br />

Major Security Holders<br />

Changes to the major holders of the Utility’s First Preferred Stock are as follows:<br />

• Cede & Co., P.O. Box 20, Bowling Green Station, New York, NY 10004-9998, increased<br />

its share ownership from 9,113,478 shares as of September 30, <strong>2010</strong> to 9,142,905<br />

shares as of December 31, <strong>2010</strong> (approximately 89% of the total preferred shares<br />

outst<strong>and</strong>ing).<br />

• John R Vaughn & Shirley M Vaughn TR UA Oct 18 93 John & Shirley Vaughn Living<br />

Trust, Box 1125, Grovel<strong>and</strong>, CA 95321-1125 are major shareholders with 12,000<br />

shares of preferred stock.<br />

• Elena E. Skidmore, 2826 N. Ridge Rd Lot 24, Perry, OH 44081-9524, is no longer a<br />

major shareholder.<br />

Dividend Payments<br />

Refer to Note 6, Common Stock, of the Notes to Financial Statements on page 123 of<br />

the <strong>FERC</strong> <strong>Form</strong> 1.<br />

14. If respondent participates in a cash management program, describe the significant<br />

events or transactions causing the proprietary capital to be less than 30 percent,<br />

<strong>and</strong> the extent to which respondent has amounts loaned or money advanced to its<br />

parent, subsidiary, or affiliated companies. Also, describe any plans to regain at<br />

least a 30 percent proprietary ratio:<br />

Not applicable.<br />

<strong>FERC</strong> FORM NO. 1 (ED. 12-96) Page 109.6

Name of Respondent<br />

This Report Is:<br />

Date of Report Year/Period of Report<br />

(1) X An Original<br />

(Mo, Da, Yr)<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

(2) A Resubmission<br />

04/08/2011 End of <strong>2010</strong>/Q4<br />

COMPARATIVE BALANCE SHEET (ASSETS AND OTHER DEBITS)<br />

Line<br />

No.<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

36<br />

37<br />

38<br />

39<br />

40<br />

41<br />

42<br />

43<br />

44<br />

45<br />

46<br />

47<br />

48<br />

49<br />

50<br />

51<br />

52<br />

Title of Account<br />

(a)<br />

UTILITY PLANT<br />

Utility Plant (101-106, 114)<br />

Construction Work in Progress (107)<br />

TOTAL Utility Plant (Enter Total of lines 2 <strong>and</strong> 3)<br />

(Less) Accum. Prov. for Depr. Amort. Depl. (108, 110, 111, 115)<br />

Net Utility Plant (Enter Total of line 4 less 5)<br />

Nuclear Fuel in Process of Ref., Conv.,Enrich., <strong>and</strong> Fab. (120.1)<br />

Nuclear Fuel Materials <strong>and</strong> Assemblies-Stock Account (120.2)<br />

Nuclear Fuel Assemblies in Reactor (120.3)<br />

Spent Nuclear Fuel (120.4)<br />

Nuclear Fuel Under Capital Leases (120.6)<br />

(Less) Accum. Prov. for Amort. of Nucl. Fuel Assemblies (120.5)<br />

Net Nuclear Fuel (Enter Total of lines 7-11 less 12)<br />

Net Utility Plant (Enter Total of lines 6 <strong>and</strong> 13)<br />

Utility Plant Adjustments (116)<br />

<strong>Gas</strong> Stored Underground - Noncurrent (117)<br />

OTHER PROPERTY AND INVESTMENTS<br />

Nonutility Property (121)<br />

(Less) Accum. Prov. for Depr. <strong>and</strong> Amort. (122)<br />

Investments in Associated Companies (123)<br />

Investment in Subsidiary Companies (123.1)<br />

(For Cost of Account 123.1, See Footnote Page 224, line 42)<br />

Noncurrent Portion of Allowances<br />

Other Investments (124)<br />

Sinking Funds (125)<br />

Depreciation Fund (126)<br />

Amortization Fund - Federal (127)<br />

Other Special Funds (128)<br />

Special Funds (Non Major Only) (129)<br />

Long-Term Portion of Derivative Assets (175)<br />

Long-Term Portion of Derivative Assets – Hedges (176)<br />

TOTAL Other Property <strong>and</strong> Investments (Lines 18-21 <strong>and</strong> 23-31)<br />

CURRENT AND ACCRUED ASSETS<br />

Cash <strong>and</strong> Working Funds (Non-major Only) (130)<br />

Cash (131)<br />

Special Deposits (132-134)<br />

Working Fund (135)<br />

Temporary Cash Investments (136)<br />

Notes Receivable (141)<br />

Customer Accounts Receivable (142)<br />

Other Accounts Receivable (143)<br />

(Less) Accum. Prov. for Uncollectible Acct.-Credit (144)<br />

Notes Receivable from Associated Companies (145)<br />

Accounts Receivable from Assoc. Companies (146)<br />

Fuel Stock (151)<br />

Fuel Stock Expenses Undistributed (152)<br />

Residuals (Elec) <strong>and</strong> Extracted Products (153)<br />

Plant Materials <strong>and</strong> Operating Supplies (154)<br />

Merch<strong>and</strong>ise (155)<br />

Other Materials <strong>and</strong> Supplies (156)<br />

Nuclear Materials Held for Sale (157)<br />

Allowances (158.1 <strong>and</strong> 158.2)<br />

Ref.<br />

Page No.<br />

(b)<br />

200-201<br />

200-201<br />

200-201<br />

202-203<br />

202-203<br />

224-225<br />

228-229<br />

227<br />

227<br />

227<br />

227<br />

227<br />

227<br />

202-203/227<br />

228-229<br />

Current Year<br />

End of Quarter/Year<br />

Balance<br />

(c)<br />

Prior Year<br />

End Balance<br />

12/31<br />

(d)<br />

51,551,661,569 47,904,159,113<br />

1,377,023,361 1,880,810,974<br />

52,928,684,930 49,784,970,087<br />

25,060,388,172 24,183,592,649<br />

27,868,296,758 25,601,377,438<br />

281,347,356 213,404,552<br />

0 0<br />

301,814,427 282,637,283<br />

1,570,143,594 1,499,757,195<br />

0 0<br />

1,697,958,450 1,612,579,237<br />

455,346,927 383,219,793<br />

28,323,643,685 25,984,597,231<br />

0 0<br />

55,601,557 54,824,273<br />

24,587,641 25,011,186<br />

0 0<br />

0 0<br />

115,151,066 133,708,094<br />

0 0<br />

3,488,597 3,602,527<br />

0 0<br />

0 0<br />

0 0<br />

2,009,045,545 1,899,001,318<br />

0 0<br />

67,059,253 59,405,376<br />

1,390,062 4,767,170<br />

2,220,722,164 2,125,495,671<br />

0 0<br />

44,435,787 49,676,271<br />

524,476,356 594,263,154<br />

126,030 144,255<br />

3,800,000 281,238,152<br />

0 0<br />

1,118,498,245 1,057,146,098<br />

1,358,186,666 1,370,842,175<br />

80,956,900 67,653,038<br />

0 0<br />

105,193,991 40,082,030<br />

1,143,343 403,420<br />

0 0<br />

0 0<br />

205,202,946 199,534,201<br />

0 0<br />

0 0<br />

0 0<br />

0 0<br />

<strong>FERC</strong> FORM NO. 1 (REV. 12-03) Page 110

Name of Respondent<br />

This Report Is:<br />

Date of Report Year/Period of Report<br />

(1) X An Original<br />

(Mo, Da, Yr)<br />

PACIFIC GAS AND ELECTRIC COMPANY<br />

(2) A Resubmission<br />

04/08/2011 End of <strong>2010</strong>/Q4<br />

COMPARATIVE BALANCE SHEET (ASSETS AND OTHER DEBITS) (Continued)<br />

Line<br />

No.<br />

53<br />

54<br />

55<br />

56<br />

57<br />

58<br />

59<br />

60<br />

61<br />

62<br />

63<br />

64<br />

65<br />

66<br />

67<br />

68<br />

69<br />

70<br />

71<br />

72<br />

73<br />

74<br />

75<br />

76<br />

77<br />

78<br />

79<br />

80<br />

81<br />

82<br />

83<br />

84<br />

85<br />

Title of Account<br />

(a)<br />

(Less) Noncurrent Portion of Allowances<br />

Stores Expense Undistributed (163)<br />

<strong>Gas</strong> Stored Underground - Current (164.1)<br />

Liquefied Natural <strong>Gas</strong> Stored <strong>and</strong> Held for Processing (164.2-164.3)<br />

Prepayments (165)<br />

Advances for <strong>Gas</strong> (166-167)<br />

Interest <strong>and</strong> Dividends Receivable (171)<br />

Rents Receivable (172)<br />

Accrued Utility Revenues (173)<br />

Miscellaneous Current <strong>and</strong> Accrued Assets (174)<br />

Derivative Instrument Assets (175)<br />

(Less) Long-Term Portion of Derivative Instrument Assets (175)<br />

Derivative Instrument Assets - Hedges (176)<br />

(Less) Long-Term Portion of Derivative Instrument Assets - Hedges (176<br />

Total Current <strong>and</strong> Accrued Assets (Lines 34 through 66)<br />

DEFERRED DEBITS<br />

Unamortized Debt Expenses (181)<br />

Extraordinary Property Losses (182.1)<br />

Unrecovered Plant <strong>and</strong> Regulatory Study Costs (182.2)<br />

Other Regulatory Assets (182.3)<br />

Prelim. Survey <strong>and</strong> Investigation Charges (<strong>Electric</strong>) (183)<br />

Preliminary Natural <strong>Gas</strong> Survey <strong>and</strong> Investigation Charges 183.1)<br />

Other Preliminary Survey <strong>and</strong> Investigation Charges (183.2)<br />

Clearing Accounts (184)<br />

Temporary Facilities (185)<br />

Miscellaneous Deferred Debits (186)<br />

Def. Losses from Disposition of Utility Plt. (187)<br />

Research, Devel. <strong>and</strong> Demonstration Expend. (188)<br />

Unamortized Loss on Reaquired Debt (189)<br />

Accumulated Deferred Income Taxes (190)<br />

Unrecovered Purchased <strong>Gas</strong> Costs (191)<br />

Total Deferred Debits (lines 69 through 83)<br />

TOTAL ASSETS (lines 14-16, 32, 67, <strong>and</strong> 84)<br />

Ref.<br />

Page No.<br />

(b)<br />

227<br />

230a<br />

230b<br />

232<br />

233<br />

352-353<br />

234<br />

Current Year<br />

End of Quarter/Year<br />

Balance<br />

(c)<br />

Prior Year<br />

End Balance<br />

12/31<br />

(d)<br />

0 0<br />

0 0<br />

151,139,525 113,638,846<br />

0 0<br />

70,557,735 71,115,771<br />

0 0<br />

1,779 27,166<br />

0 0<br />

649,179,020 671,230,961<br />

446,253,293 201,593,062<br />

109,356,761 133,371,719<br />

67,059,253 59,405,376<br />

2,032,074 6,988,870<br />

1,390,062 4,767,170<br />

4,640,177,336 4,659,470,567<br />

82,785,690 77,037,490<br />

0 0<br />

0 0<br />

6,898,245,621 6,500,673,291<br />

0 0<br />

0 0<br />

0 0<br />

-42,884 0<br />

0 0<br />