Complete 2008 Annual Report - Federal Reserve Bank of Philadelphia

Complete 2008 Annual Report - Federal Reserve Bank of Philadelphia

Complete 2008 Annual Report - Federal Reserve Bank of Philadelphia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Principles <strong>of</strong> Sound Central <strong>Bank</strong>ing<br />

by Charles I. Plosser<br />

By any measure, <strong>2008</strong> was an extraordinary<br />

year. The economic turmoil that began<br />

in housing two years ago swelled into a<br />

financial tsunami, which roiled the economy over<br />

the course <strong>of</strong> the year. That turmoil has not been<br />

confined to the U.S. Slowing economic growth<br />

and the deepening credit crisis have affected the<br />

global economy and prompted historic actions by<br />

policymakers in the U.S. and around the world.<br />

The crisis has led to fundamental changes in the<br />

financial landscape, prompting debates about the<br />

central bank’s roles and responsibilities and the<br />

appropriate approach to conducting policy.<br />

In this year’s annual report essay, I want to focus<br />

attention on some <strong>of</strong> the principles that I believe<br />

make for sound and effective central banking.<br />

Relying on sound principles to guide policymaking<br />

is always useful. But it is particularly important<br />

and helpful in times <strong>of</strong> crisis, when the temptation<br />

is to abandon all guiding principles and simply<br />

react to the daily challenges based on what seems<br />

expedient at the time. I believe that adhering to<br />

these principles can enhance the effectiveness <strong>of</strong><br />

monetary policy in these challenging times and<br />

can provide insights into how the central bank can<br />

promote greater financial stability.<br />

One <strong>of</strong> the most significant developments in economic<br />

theory during the last quarter <strong>of</strong> the 20th<br />

century was the recognition <strong>of</strong> the importance <strong>of</strong><br />

expectations in understanding economic behavior.<br />

Expectations about the future play an important<br />

role in the economic decisions <strong>of</strong> both households<br />

and businesses. This is particularly evident in<br />

financial markets, where expectations about the<br />

future play a role not only in investment decisions<br />

but also in the valuation <strong>of</strong> securities. Of course,<br />

the public’s expectations about future actions by<br />

policymakers are also important. Will Congress<br />

raise or lower taxes in the future? Will the <strong>Federal</strong><br />

<strong>Reserve</strong> ensure that inflation remains low and stable?<br />

Expectations about these future policy actions<br />

influence the decisions by households and firms<br />

today. Moreover, actions taken by policymakers<br />

today help inform the public about the likelihood<br />

<strong>of</strong> future policy actions. Thus, policymakers must<br />

make decisions with the understanding that those<br />

decisions may affect the public’s expectations<br />

about future decisions — which, in turn, will affect<br />

the choices market participants make today.<br />

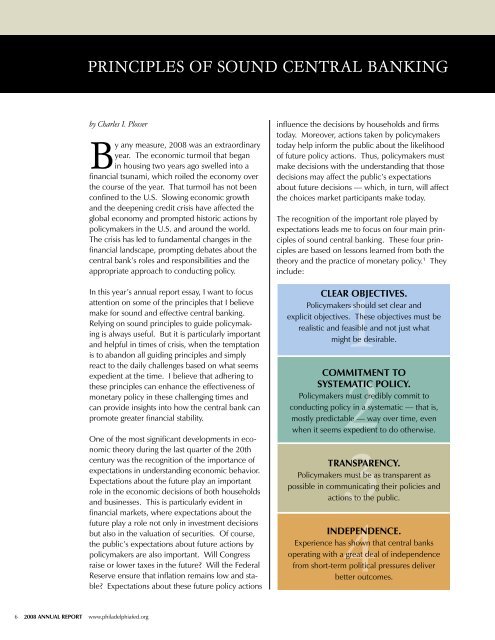

The recognition <strong>of</strong> the important role played by<br />

expectations leads me to focus on four main principles<br />

<strong>of</strong> sound central banking. These four principles<br />

are based on lessons learned from both the<br />

theory and the practice <strong>of</strong> monetary policy. 1 They<br />

include:<br />

Clear Objectives.<br />

1<br />

Policymakers should set clear and<br />

explicit objectives. These objectives must be<br />

realistic and feasible and not just what<br />

might be desirable.<br />

2<br />

3<br />

4<br />

Commitment to<br />

Systematic Policy.<br />

Policymakers must credibly commit to<br />

conducting policy in a systematic — that is,<br />

mostly predictable — way over time, even<br />

when it seems expedient to do otherwise.<br />

Transparency.<br />

Policymakers must be as transparent as<br />

possible in communicating their policies and<br />

actions to the public.<br />

Independence.<br />

Experience has shown that central banks<br />

operating with a great deal <strong>of</strong> independence<br />

from short-term political pressures deliver<br />

better outcomes.<br />

6 <strong>2008</strong> <strong>Annual</strong> <strong>Report</strong> www.philadelphiafed.org