Prevent theft - it starts with you - Queensland Police Service ...

Prevent theft - it starts with you - Queensland Police Service ...

Prevent theft - it starts with you - Queensland Police Service ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

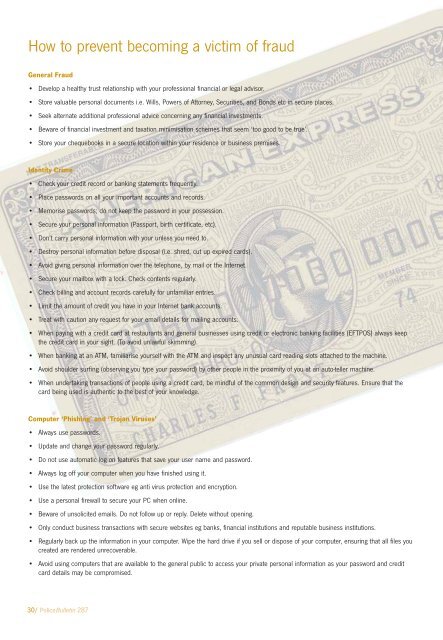

How to prevent becoming a victim of fraud<br />

General Fraud<br />

• Develop a healthy trust relationship w<strong>it</strong>h <strong>you</strong>r professional financial or legal advisor.<br />

• Store valuable personal documents i.e. Wills, Powers of Attorney, Secur<strong>it</strong>ies, and Bonds etc in secure places.<br />

• Seek alternate add<strong>it</strong>ional professional advice concerning any financial investments.<br />

• Beware of financial investment and taxation minimisation schemes that seem ‘too good to be true’.<br />

• Store <strong>you</strong>r chequebooks in a secure location w<strong>it</strong>hin <strong>you</strong>r residence or business premises.<br />

Ident<strong>it</strong>y Crime<br />

• Check <strong>you</strong>r cred<strong>it</strong> record or banking statements frequently.<br />

• Place passwords on all <strong>you</strong>r important accounts and records.<br />

• Memorise passwords; do not keep the password in <strong>you</strong>r possession.<br />

• Secure <strong>you</strong>r personal information (Passport, birth certificate, etc).<br />

• Don’t carry personal information w<strong>it</strong>h <strong>you</strong>r unless <strong>you</strong> need to.<br />

• Destroy personal information before disposal (i.e. shred, cut up expired cards).<br />

• Avoid giving personal information over the telephone, by mail or the Internet.<br />

• Secure <strong>you</strong>r mailbox w<strong>it</strong>h a lock. Check contents regularly.<br />

• Check billing and account records carefully for unfamiliar entries.<br />

• Lim<strong>it</strong> the amount of cred<strong>it</strong> <strong>you</strong> have in <strong>you</strong>r Internet bank accounts.<br />

• Treat w<strong>it</strong>h caution any request for <strong>you</strong>r email details for mailing accounts.<br />

• When paying w<strong>it</strong>h a cred<strong>it</strong> card at restaurants and general businesses using cred<strong>it</strong> or electronic banking facil<strong>it</strong>ies (EFTPOS) always keep<br />

the cred<strong>it</strong> card in <strong>you</strong>r sight. (To avoid unlawful skimming).<br />

• When banking at an ATM, familiarise <strong>you</strong>rself w<strong>it</strong>h the ATM and inspect any unusual card reading slots attached to the machine.<br />

• Avoid shoulder surfing (observing <strong>you</strong> type <strong>you</strong>r password) by other people in the proxim<strong>it</strong>y of <strong>you</strong> at an auto-teller machine.<br />

• When undertaking transactions of people using a cred<strong>it</strong> card, be mindful of the common design and secur<strong>it</strong>y features. Ensure that the<br />

card being used is authentic to the best of <strong>you</strong>r knowledge.<br />

Computer ‘Phishing’ and ‘Trojan Viruses’<br />

• Always use passwords.<br />

• Update and change <strong>you</strong>r password regularly.<br />

• Do not use automatic log on features that save <strong>you</strong>r user name and password.<br />

• Always log off <strong>you</strong>r computer when <strong>you</strong> have finished using <strong>it</strong>.<br />

• Use the latest protection software eg anti virus protection and encryption.<br />

• Use a personal firewall to secure <strong>you</strong>r PC when online.<br />

• Beware of unsolic<strong>it</strong>ed emails. Do not follow up or reply. Delete w<strong>it</strong>hout opening.<br />

• Only conduct business transactions w<strong>it</strong>h secure webs<strong>it</strong>es eg banks, financial inst<strong>it</strong>utions and reputable business inst<strong>it</strong>utions.<br />

• Regularly back up the information in <strong>you</strong>r computer. Wipe the hard drive if <strong>you</strong> sell or dispose of <strong>you</strong>r computer, ensuring that all files <strong>you</strong><br />

created are rendered unrecoverable.<br />

• Avoid using computers that are available to the general public to access <strong>you</strong>r private personal information as <strong>you</strong>r password and cred<strong>it</strong><br />

card details may be compromised.<br />

30/ <strong>Police</strong>Bulletin 287