management report - PORR AG

management report - PORR AG

management report - PORR AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

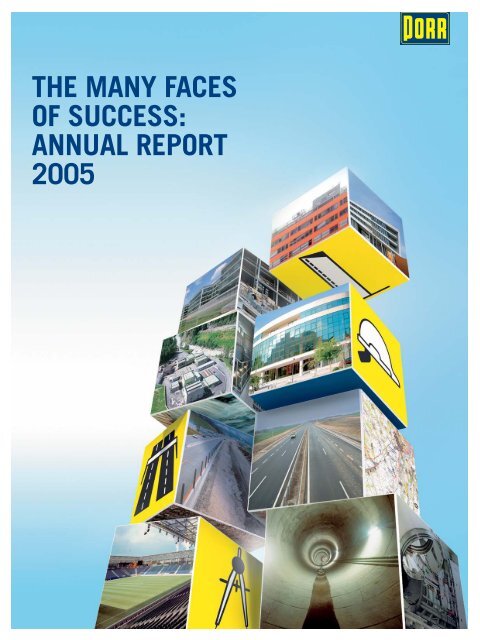

THE MANY FACES<br />

OF SUCCESS:<br />

ANNUAL REPORT<br />

2005

_ Production output up 21.8% to<br />

record level of approx. €2.3 billion<br />

_ Foreign share of production<br />

output raised by 2.5 percentage<br />

points to 31.2%<br />

_ EBT improves by one third to<br />

€32.4 million<br />

_ Return on Capital Employed<br />

increases from 7.2% to 9.9%<br />

_ Equity ratio expanded from<br />

15.3% to 16.4% despite higher<br />

balance sheet total

KEY DATA<br />

Values in million € 2005 Change 2004 2003<br />

<strong>PORR</strong> GROUP<br />

Gross revenues 1,828.2 19.2% 1,533.1 1,478.8<br />

Production output 2,258.0 21.8% 1,854.1 1,927.2<br />

Of which domestic 1,553.5 17.6% 1,321.4 1,345.8<br />

Of which foreign 704.5 32.3% 532.7 581.4<br />

Foreign share of total production output (in %) 31.2 2.5 PP 28.7 30.2<br />

Order receipts 2,219.8 11.3% 1,994.8 1,945.4<br />

Orders on hand at year end 1,465.3 - 2.5% 1,503.4 1,362.7<br />

Average number of employees 10,241 8.9% 9,406 9,527<br />

Equity capital (including profits due to minorities) 251.0 13.2% 221.8 228.8<br />

Investments 66.7 - 53.2% 142.6 109.6<br />

Cashflow (from operating activities) 64.2 62.5% 39.5 82.6<br />

Balance sheet total 1,527.6 5.4% 1,449.8 1,697.9<br />

EBIT 49.3 12.3% 43.9 47.5<br />

EBIT margin (in %) 2.7 - 0.2 PP 2.9 3.2<br />

EBT 32.4 33.3% 24.3 23.3<br />

ROCE (in %) 9.9 2.7 PP 7.2 5.4<br />

ROE (in %) 12.8 1.2 PP 11.6 10.0<br />

Consolidated profits 25.2 22.9% 20.5 14.8<br />

<strong>PORR</strong> <strong>AG</strong><br />

Price/earnings ratio (at end of year)<br />

Ordinary share 10.0 9.9% 9.1 12.8<br />

Preference share 9.0 20.0% 7.5 8.6<br />

Earnings per share (in €) 12.4 21.6% 10.2 7.4<br />

Dividend per share*,** 1.7 0.0% 1.7 1.7<br />

Payout ratio (as % of annual profit) 14.0 - 18.1% 17.1 23.7<br />

Market capitalisation (at end of year)<br />

Ordinary share 166.4 33.3% 124.8 126.1<br />

Preference share 72.2 48.0% 48.8 40.6<br />

* Value for 2005 to be proposed at the annual shareholders’ meeting on 29 th June 2006<br />

** Ordinary and preference shares

OUTPUT DISTRIBUTION BY SEGMENT<br />

IN MILLION €<br />

2,500<br />

REGIONAL OUTPUT DISTRIBUTION<br />

IN MILLION €<br />

2,500<br />

DISTRIBUTION OF PRODUCTION OUTPUT<br />

2005 BY SEGMENT<br />

IN MILLION €<br />

2,250<br />

2,000<br />

1,750<br />

107.7<br />

692.8<br />

711.3<br />

787.3<br />

2,250<br />

2,000<br />

1,750<br />

581.4<br />

532.7<br />

704.5<br />

S 3 787.3<br />

S 1 880.9<br />

1,500<br />

1,250<br />

1,000<br />

420.5<br />

465.0<br />

589.7<br />

1,500<br />

1,250<br />

1,000<br />

1,345.8<br />

1,321.4<br />

1.553.5<br />

750<br />

500<br />

706.2<br />

677.8<br />

880.9<br />

750<br />

500<br />

S 2 589.7<br />

250<br />

250<br />

0<br />

2003 2004 2005<br />

Civil Engineering / PTU Group<br />

Building Construction / PPH Group<br />

Road Construction / T-A Group<br />

Real Estate / UBM Group*<br />

0<br />

2003 2004 2005<br />

Domestic<br />

Foreign<br />

S 1 CIVIL ENGINEERING / PTU GROUP<br />

S 2 BUILDING CONSTRUCTION /<br />

PPH GROUP<br />

S 3 ROAD CONSTRUCTION / T-A GROUP<br />

* The Real estate/UBM Group segment has not<br />

been managed since the deconsolidation of<br />

the UBM Group in 2004.<br />

DEVELOPMENT OF<br />

KEY PROFITABILITY DATA<br />

IN %<br />

FOREIGN SHARE<br />

OF PRODUCTION OUTPUT<br />

IN %<br />

DIVIDEND AND EARNINGS PER SHARE<br />

IN €<br />

14<br />

12<br />

10<br />

10.0<br />

11.6<br />

12.8<br />

9.9<br />

35<br />

30<br />

25<br />

30.2<br />

28.7<br />

31.2<br />

14<br />

12<br />

10<br />

10.2<br />

12.4<br />

8<br />

6<br />

7.2<br />

20<br />

15<br />

8<br />

6<br />

7.4<br />

4<br />

2<br />

0<br />

3.2<br />

2.9 2.7<br />

5.4<br />

2003 2004 2005<br />

10<br />

5<br />

0<br />

2003 2004 2005<br />

4<br />

2<br />

0<br />

1.7<br />

1.7<br />

1.7<br />

2003 2004 2005<br />

EBIT margin<br />

ROE<br />

ROCE<br />

Earnings per share<br />

Dividend per share (ordinary and<br />

preference shares, value for 2005<br />

to be proposed at the annual shareholders’<br />

meeting on 29 th June 2006

CONTENTS<br />

Letter to the shareholders 12<br />

Information on the <strong>management</strong> 15<br />

Supervisory board 17<br />

Overview of the <strong>PORR</strong> Group 18<br />

Corporate strategy 22<br />

Highlights and milestones 28<br />

Group structure 30<br />

BUSINESS AREAS OF THE <strong>PORR</strong> GROUP<br />

Porr Technobau und Umwelt <strong>AG</strong> 32<br />

Porr Projekt und Hochbau <strong>AG</strong> 38<br />

TEER<strong>AG</strong>-ASD<strong>AG</strong> <strong>AG</strong> 44<br />

Porr Solutions<br />

Immobilien und Infrastrukturprojekte GmbH 49<br />

<strong>PORR</strong> on the stock exchange 54<br />

Employees 58<br />

Research and development 60<br />

MAN<strong>AG</strong>EMENT REPORT<br />

General economic environment 63<br />

Development of output 68<br />

Earnings situation 73<br />

Financial position 75<br />

<strong>PORR</strong> <strong>AG</strong> 77<br />

Risk <strong>management</strong> 78<br />

Forecast <strong>report</strong> 80<br />

SEGMENT REPORTS<br />

Civil Engineering / PTU Group 82<br />

Building Construction / PPH Group 84<br />

Road Construction / T-A Group 86<br />

CONSOLIDATED ACCOUNTS OF <strong>PORR</strong> <strong>AG</strong> 2005 90<br />

ANNUAL FINANCIAL STATEMENTS OF <strong>PORR</strong> <strong>AG</strong> 2005 130<br />

Glossary 136

WHICHEVER WAY<br />

YOU LOOK AT IT,<br />

<strong>PORR</strong> CONSTRUCTION<br />

HAS NO LIMITS.<br />

In an ever-changing world, you have to evolve to<br />

seize opportunities and generate growth. Over<br />

the decades, <strong>PORR</strong> has developed from a purely<br />

construction company into a multi-utility corporate<br />

group with many successful facets. The company<br />

units PPH, PTU, T-A and PS are now consolidated<br />

within the organisation of <strong>PORR</strong>.<br />

These days, business areas like financing, project<br />

development, infrastructure projects, real estate<br />

<strong>management</strong> and environmental technology are<br />

every bit as indispensable to our service portfolio<br />

as building construction. This comprehensive<br />

value chain enables us to maximise potential<br />

in diverse sectors and regions and open up new<br />

perspectives for the future. When you look at it<br />

from this angle, you will see there’s more to discover<br />

in <strong>PORR</strong> than ever before: we stand for<br />

construction unlimited.

THE SPORTING FACE OF <strong>PORR</strong>.<br />

THE 2008 EUROPEAN<br />

CHAMPIONSHIPS<br />

ALREADY HAS A WINNER.<br />

A SPECIALIST IN EVERY SENSE: Before you can claim to offer something special, you must<br />

have a perfect command of specialist areas. That’s because more and more construction<br />

projects for specific purposes demand specialist expertise, from planning to completion,<br />

facility <strong>management</strong> and utilisation. With our knack for implementing such a diversity of<br />

projects, we are a true specialist for every situation – and our experience and efficiency<br />

make us extremely competitive.<br />

The contract to upgrade the stadiums at Klagenfurt, Innsbruck and Salzburg provides an<br />

example of what we mean. Salzburg stadium is a multi-functional arena that needs to<br />

perform a number of functions: apart from the European football championships in 2008,<br />

it will also host rock concerts and motocross events. <strong>PORR</strong> triumphed in the bidding<br />

process partly because of its business proposal, and partly because of its ability to handle<br />

special constructional and technical requirements such as the covered stand, the<br />

artificial turf and the floodlighting. The 18,000-seater stadium opened in March 2003;<br />

by the time of the 2008 football tournament, further expansion will enable it to accommodate<br />

30,000 spectators.

THE FLEXIBLE FACE OF <strong>PORR</strong>.

WE BUILD STRUCTURES<br />

THAT HOUSE THE FUTURE.<br />

ACCELERATING DIVERSITY: Our wide-ranging service portfolio is<br />

extending the value chain; we are also making projects happen<br />

much faster thanks to the smooth coordination of all areas of<br />

the company. Given the networking of proficiency and expertise<br />

across the group, no challenge is too complex.<br />

The highly demanding Vienna Business & Science Park building<br />

construction project – conceived as a research and development<br />

centre – presented us with numerous technological and<br />

constructional obstacles to overcome. For example, the steel<br />

hall had to be built as a Faraday cage; powerful impedance<br />

coils needed to be housed in an 18-metre high wooden hall.<br />

Thanks to some faultless project development and planning,<br />

the general contractorship and the building construction of<br />

<strong>PORR</strong>, the halls – covering a total surface area of 13,000m 2 –<br />

were constructed in just 14 months. The specific needs of the<br />

client were met, to the letter and on schedule.

THE MOBILE FACE OF <strong>PORR</strong>.<br />

WHEN IT COMES TO RENOVATION, WE’RE ON THE RIGHT ROAD.<br />

FAST TRACK TO THE FUTURE: As a full-service supplier in the sectors of road construction, canal building and environmental<br />

protection as well as the field of sealing works, TEER<strong>AG</strong>-ASD<strong>AG</strong> <strong>AG</strong> ranks as a highly productive building block in the<br />

<strong>PORR</strong> Group alongside the areas of building construction and civil engineering. Given the rising requirement for maintenance<br />

and renovation and the urgent need to upgrade the motorway network in central and eastern Europe, this is a road that leads<br />

to massive business potential in the years ahead.<br />

In connection with the large-scale renovation of the A1 Westautobahn motorway, a 13.4km section of road surface was upgraded;<br />

19 bridges within this building section were also overhauled, with seven new ones being built. Five water pollution prevention<br />

systems were installed, and 23,000 metres of drainage pipelines were laid. Maintaining the flow of traffic throughout the<br />

construction period was a particular challenge; this was achieved by setting up diversion routes at certain points.

THE STYLISH FACE OF <strong>PORR</strong>.<br />

WE INVEST IN PLACES<br />

THAT ARE GOING PLACES.<br />

We also believe in the build-it-yourself approach. The development<br />

and marketing of real estate is a logical and lucrative<br />

step for a construction company – not least because this is a<br />

way to exploit fresh potential for expansion, particularly in<br />

booming markets. After all, who better to build a property<br />

than the company that planned it?<br />

Working with a local partner company, <strong>PORR</strong> SOLUTIONS has<br />

resurrected a jewel of yesteryear: the Villa Neretva in Mostar.<br />

A new section has also expanded the usage possibilities of the<br />

building: providing a total area of 3,950m 2 , luxury apartments,<br />

office space and catering premises are ready to be marketed.<br />

Doubly satisfying is the fact that the Villa Neretva stands as a<br />

symbol of the regeneration of Bosnia and Herzegovina.

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

LETTER TO THE SHAREHOLDERS<br />

DEAR SHAREHOLDERS AND<br />

VALUED BUSINESS PARTNERS OF <strong>PORR</strong>,<br />

Development for our markets was highly encouraging in 2005, with the substantial public<br />

investment backlog steadily converting into concrete demand.<br />

Growth rates on the construction market in Austria are outpacing average levels; in Germany,<br />

where staffing levels halved following the short-lived post-reunification boom, the first signs of<br />

recovery are emerging; building production is running at over 5% p.a. in the new EU member<br />

states. The EU accession candidates are also raising their levels of public and private investment.<br />

In central Europe, a region in which we are active, growth is likely to remain above average<br />

on balance for the next 10 to 15 years.<br />

From a strategic and structural viewpoint, the <strong>PORR</strong> Group is ready to meet these exciting<br />

challenges. We are continually expanding our presence on these expanding markets. Thanks<br />

to an organisational structure adapted to the needs of the market, an effective cost and risk<br />

<strong>management</strong> system and a policy of selective acquisition, we will be in a position to raise our<br />

profitability.<br />

Our Group structure and organisational framework have also been enhanced as planned. Various<br />

elements have been permanently tightened or simplified with a view to improving results and<br />

cost monitoring; we have also invested significantly in grouping the operations centres of all<br />

subsidiaries within the Vienna district. This will facilitate and raise efficiency in terms of material<br />

planning, device <strong>management</strong> and logistics.<br />

Demand is set to rise in the area of infrastructure. Power plant construction is certain to undergo<br />

a renaissance in the years ahead, and private investors will be putting their money into offices<br />

and industrial plant. This means that we will have the opportunity to optimise our construction<br />

capacity whilst bringing to bear our 137 years of experience in project development. In both<br />

the public and private sectors, investors prefer to rent properties rather than act as owner; we<br />

will be well placed increasingly to play the role of investor, as we have always done on occasion<br />

in the past.<br />

12

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

LEFT TO RIGHT: WEBER, MAYER, HESOUN, PÖCHHACKER<br />

13

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

During 2005, we established the preconditions for this by enhancing our financial structure.<br />

Efforts continue to improve our equity ratio still further.<br />

Allgemeine Baugesellschaft – A. Porr <strong>AG</strong> issued two bonds in the first half of 2005. In April,<br />

an Asset Linked Porr Security (ALPS) bond was issued as a private placement with institutional<br />

investors at a nominal value of €72 million; the quoted corporate bond with a volume of<br />

€100 million was issued in June. This enabled us to shift a large part of the Group’s bank<br />

liabilities from the short-term to the long-term area and thereby guarantee financial backing for<br />

our long-term corporate strategy. At the end of 2005, the level of short-term bank liabilities<br />

(€187.4 million) was 55% below the previous year’s value.<br />

On the basis of the positive earnings situation, the equity ratio of the Group also improved<br />

from 15.3% to 16.4%. The <strong>PORR</strong> Group belongs to the top division of industrial construction<br />

companies with an EBIT margin of 2.7%.<br />

As of 31 st March 2006, our order balance stood at €1.93 billion. Our proficient and motivated<br />

industrial and salaried employees are working to high capacity at home and abroad in pursuit of<br />

their primary aim of customer satisfaction. We would like to thank our customers, many of whom<br />

are long-established, for their positive cooperation and their trust.<br />

We would also like to thank our shareholders. We will do everything in our power to repay their<br />

commitment by delivering outstanding performance in a challenging sector.<br />

Finally, we would like to express our appreciation of the highly cooperative relationship with the<br />

employee representatives, who consistently support our corporate objectives in a constructive<br />

manner.<br />

Director General<br />

Horst Pöchhacker<br />

Chairman of the Board of Management<br />

Deputy Director General<br />

Wolfgang Hesoun<br />

Vice Chairman of the Board of Management<br />

Helmut Mayer<br />

Member of the Board of Management<br />

Peter Weber<br />

Member of the Board of Management<br />

14

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

INFORMATION ON THE MAN<strong>AG</strong>EMENT<br />

CHIEF EXECUTIVE OFFICER HORST PÖCHHACKER<br />

Born 1938, married with two children; studied at the Vienna University of Technology, second<br />

state examination 1962, joined <strong>PORR</strong> <strong>AG</strong> as an engineer in the same year, general power of<br />

attorney granted in 1975, appointed to Executive Board in 1976, Chairman of the Executive<br />

Board of <strong>PORR</strong> <strong>AG</strong> since 1982.<br />

Responsible for the departments of Strategy, Organisation, Human Resources, Public Relations<br />

and Auditing.<br />

Additional functions: Chairman of the Supervisory Board of Porr Projekt und Hochbau <strong>AG</strong>, Porr<br />

Technobau und Umwelt <strong>AG</strong> and Wibeba-Holding GmbH, Deputy Chairman of the Supervisory<br />

Board of UBM Realitätenentwicklung <strong>AG</strong> and TEER<strong>AG</strong>-ASD<strong>AG</strong> <strong>AG</strong>.<br />

President of the Federation of Austrian Industrial Building Contractors (Vereinigung Industrieller<br />

Bauunternehmungen Österreichs) since 1992, appointed member of the Executive Board of<br />

the Federation of Austrian Industry (Vereinigung der Österreichischen Industrie) in 1996,<br />

member of the Supervisory Board of Österreichische Industrieholding <strong>AG</strong> (ÖI<strong>AG</strong>) from 1986 to<br />

1996, Deputy Chairman of the Supervisory Board of ÖI<strong>AG</strong> from 1996 to 2000.<br />

DEPUTY CHIEF EXECUTIVE OFFICER WOLFGANG HESOUN<br />

Born 1960, married with one child; graduated from the Höhere Technische Lehranstalt für Feinwerktechnik,<br />

Mödling, in 1981, active in various power stations in Germany as commissioning<br />

engineer for the Siemens group from 1982 to 1987, joined <strong>PORR</strong> <strong>AG</strong> as technical employee in<br />

1988, joint power of attorney granted in 1993, member of the Executive Board of Porr Umwelttechnik<br />

<strong>AG</strong> from 1995 to 1999 (also Chairman of the Executive Board), member of the Executive<br />

Board of the restructured Porr Technobau und Umwelt <strong>AG</strong> (following the merger of Porr Umwelttechnik<br />

<strong>AG</strong> and Porr Technobau <strong>AG</strong>), appointed to Executive Board of <strong>PORR</strong> <strong>AG</strong> in March 2003.<br />

Nominated Deputy Executive Board Chairman of <strong>PORR</strong> <strong>AG</strong> in December 2004.<br />

Responsible for the departments of Project Development (Civil Engineering and Building Construction),<br />

Project Financing, Technology Management, Quality Management and Equipment<br />

and the business areas Porr Technobau und Umwelt <strong>AG</strong>, Porr Projekt und Hochbau <strong>AG</strong> and<br />

Porr Solutions Immobilien- und Infrastrukturprojekte GmbH.<br />

Additional functions: Deputy Chairman of the Supervisory Board of Porr Technobau und Umwelt<br />

<strong>AG</strong> and Porr Projekt und Hochbau <strong>AG</strong>, member of the Executive Board of the Federation of<br />

Austrian Industry in Vienna.<br />

15

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

MEMBER OF THE BOARD OF MAN<strong>AG</strong>EMENT HELMUT MAYER, CFO<br />

Born 1953, married; graduated from the Academy of Commerce (Handelsakademie) in 1972,<br />

certified as company accountant and cost accountant in 1979, accountant at Loba-Chemie<br />

of Vienna from 1973 to 1974, joined TEER<strong>AG</strong>-ASD<strong>AG</strong> <strong>AG</strong> in 1974 as staff member in the<br />

accounting department, appointed head of commercial department in 1983, appointed head of<br />

finance and accounting in 1988, joint power of attorney granted in 1989, appointed to the<br />

Executive Board of TEER<strong>AG</strong>-ASD<strong>AG</strong> <strong>AG</strong> in 1996, member of the Executive Board of <strong>PORR</strong> <strong>AG</strong><br />

since March 2003.<br />

Responsible for the departments of Financial Management and Capital Market, Accounting, IT,<br />

Insurance and Purchasing.<br />

Additional functions: Deputy Chairman of the Supervisory Board of Porr Aktiengesellschaft,<br />

Munich, Chairman of the Supervisory Board of Prazské silnicí a vodohospodárské stavby a.s.,<br />

Prague, member of the Wirtschaftsparlament corporate assembly, Deputy Chairman of the<br />

industrial section of the Austrian Federal Economic Chamber.<br />

MEMBER OF THE BOARD OF MAN<strong>AG</strong>EMENT PETER WEBER<br />

Born 1949, married with two children; completed doctorate in chemistry in 1975, supplementary<br />

Master of Science degree (Industrial Management) at the Polytechnic Institute of New York from<br />

1976 to 1977, joined CA-BV in 1977 in the investments/industry area, executive assistant with<br />

project <strong>management</strong> responsibility for large-scale projects at Semperit <strong>AG</strong> from 1978 to 1982,<br />

head of industrial paints and assistant to the Chairman of the Executive Board at Stolllack from<br />

1982 to 1987, responsible for investment <strong>management</strong> at Länderbank from 1987 to 1991; following<br />

the merger of Länderbank with Zentralsparkasse to form Bank Austria, head of investment<br />

<strong>management</strong> for the overall group and Managing Director of Bank-Austria Handelsholding GmbH,<br />

moved to real estate in 1995, Chairman of the Management Board of Immobilien Holding GmbH<br />

until start of 2003, appointed member of the Executive Board of <strong>PORR</strong> <strong>AG</strong> in March 2003.<br />

Responsible for the departments of Group Structure and Information Management, Real Estate<br />

Portfolio, Resources, Controlling and Law and the business area UBM Realitätenentwicklung <strong>AG</strong>.<br />

Additional functions: Member of the Supervisory Board of UBM Realitätenentwicklung <strong>AG</strong>, Deputy<br />

Chairman of the Supervisory Board of Wibeba-Holding GmbH.<br />

16

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

SUPERVISORY BOARD<br />

MEMBERS OF THE SUPERVISORY BOARD<br />

President Klaus Ortner*, Vienna, Chairman<br />

Director Karl Schmutzer*, Winzendorf, Deputy Chairman<br />

Georg Riedl*, Vienna, Deputy Chairman<br />

Günther W. Havranek*, Perchtoldsdorf<br />

Executive Director Martin Krajcsir*, Vienna<br />

Director Walter Lederer*, Vienna<br />

Heinz Mückstein*, Bad Vöslau<br />

Karl Samstag*, Mödling<br />

* The Supervisory Board of the company was re-elected at the 124 th ordinary shareholders’ meeting held on 24 th June 2004<br />

for the duration of the period up to the end of the annual shareholders’ meeting that passes resolutions on fiscal year 2008.<br />

Members delegated by works council<br />

Peter Grandits, Vienna<br />

Walter Huber, Wiesen<br />

Johann Karner, Mönchhof<br />

Walter Jenny, Vienna (from 1.9.2005)<br />

Albert Stranzl, Vienna (to 31.8.2005)<br />

17

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

OVERVIEW OF THE <strong>PORR</strong> GROUP<br />

ALLGEMEINE BAUGESELLSCHAFT –<br />

A. <strong>PORR</strong> AKTIENGESELLSCHAFT<br />

WIBEBA HOLDING GMBH<br />

100%<br />

41.27%<br />

UBM REALITÄTENENTWICKLUNG<br />

AKTIENGESELLSCHAFT<br />

100% 52%<br />

100%<br />

52.49%<br />

24% 24%<br />

<strong>PORR</strong> TECHNOBAU UND UMWELT<br />

AKTIENGESELLSCHAFT<br />

<strong>PORR</strong> SOLUTIONS IMMOBILIEN- UND<br />

INFRASTRUKTURPROJEKTE GMBH<br />

<strong>PORR</strong> PROJEKT UND HOCHBAU<br />

AKTIENGESELLSCHAFT<br />

TEER<strong>AG</strong>-ASD<strong>AG</strong><br />

AKTIENGESELLSCHAFT<br />

* *<br />

WIBEBA HOCHBAU GMBH & CO. NFG. KG<br />

WIENER BETRIEBS- UND BAU-<br />

GESELLSCHAFT M.B.H. & CO. NFG. KG<br />

Correct as of February 2006<br />

* Industrial <strong>management</strong><br />

THE RIGHT CORPORATE STRUCTURE FOR THE MARKET<br />

The organisational alignment of the <strong>PORR</strong> Group is continually adapting to changing market<br />

conditions and the needs of our customers. The various company areas are coordinated through<br />

the holding company, Allgemeine Baugesellschaft – A. Porr Aktiengesellschaft.<br />

The founding of the two national sector-specific subsidiaries Porr Technobau und Umwelt <strong>AG</strong> (in<br />

1989) and Porr Projekt und Hochbau <strong>AG</strong> (in 1994) laid the foundation for the current structure<br />

of the <strong>PORR</strong> Group. Amalgamating domestic and foreign activities for a particular sector makes it<br />

possible to respond quickly and effectively to demand levels on a particular market. An alignment<br />

along sectoral lines also supports the attainment of high expertise: know-how is developed as a<br />

package rather than in parallel across several regions. The coordination of cross-sector subsidiary<br />

activity was further optimised by the establishment of Porr GmbH in 2004.<br />

The long-held Group tradition of real estate development was revived in 1992 through UBM,<br />

which until that point had only been responsible for administrative functions. In order to improve<br />

the structure of the consolidated balance sheet, the share in UBM was reduced to below 50% in<br />

2004, and this corporate area was subsequently deconsolidated. Despite this, the productive<br />

partnership between <strong>PORR</strong> and UBM will continue as before to the benefit of both parties.<br />

18

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

“I can only compare the<br />

current demand situation in our<br />

sector to that which existed after<br />

the second world war”<br />

DIRECTOR GENERAL HORST PÖCHHACKER ON THE OVERALL POTENTIAL<br />

IN THE CONSTRUCTION INDUSTRY AND HOW <strong>PORR</strong> CAN BENEFIT.<br />

Some years ago, the members of the<br />

European Union agreed a growth and<br />

stability pact, which later metamorphosed<br />

into merely a stability pact because of the<br />

reluctance of the public sector to invest.<br />

This was the start of a downward spiral<br />

which also discouraged companies from<br />

investing. The result of that trend is the<br />

massive investment backlog that we see<br />

today. In western Europe, it is mainly infrastructure<br />

and energy projects that urgently<br />

require completion; in the east of Europe,<br />

there is demand in virtually all sectors.<br />

Taking account of the usual regional and<br />

sector-specific fluctuations, I calculate<br />

that overall demand levels will remain high<br />

for the next 10 to 15 years. I can only<br />

compare the magnitude of the current<br />

demand situation to that which existed<br />

after the second world war.<br />

The <strong>PORR</strong> Group is ideally placed to maximise<br />

this market potential. In additional to<br />

our traditional field of construction, we<br />

have successfully positioned ourselves in<br />

recent years as an expert partner for complex<br />

projects, operator models and franchise<br />

models. This is where I perceive the main<br />

potential of <strong>PORR</strong> for the future. We have<br />

already carried out critical preparatory<br />

work in this regard by establishing <strong>PORR</strong><br />

SOLUTIONS, which has provided the focal<br />

point for project development expertise<br />

across the Group. At the same time, of<br />

course, we remain active as a conventional<br />

construction company. By extending the<br />

value chain to include elements requiring<br />

high levels of know-how, we are setting<br />

ourselves apart from the competition whilst<br />

raising our profitability. It is therefore<br />

important to secure this know-how along<br />

with a differentiated system of risk <strong>management</strong>.<br />

The <strong>PORR</strong> Group has demonstrated<br />

a strong ability to cope with such<br />

challenges on many occasions in the past.<br />

We were, for example, one of the first<br />

organisations to identify the opportunities<br />

offered by the emerging economies of<br />

eastern Europe; today, this region is a firm<br />

part of our extended home market. Our<br />

corporate structures are also tracking the<br />

rapid development trends that characterise<br />

our markets and our customers. With our<br />

robust sectoral structure, the <strong>PORR</strong> Group<br />

today ranks as a flexible and versatile<br />

corporate group – one that pursues a<br />

consistent and considered path of expansion,<br />

and one that is quick to pinpoint<br />

and utilise the indicators and opportunities<br />

of the day.<br />

19

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

In 2000, <strong>PORR</strong> considerably expanded its production volume in road construction by gaining a<br />

shareholding in TEER<strong>AG</strong>-ASD<strong>AG</strong> <strong>AG</strong>. This participation since been expanded to around 52.5%,<br />

giving <strong>PORR</strong> the industrial <strong>management</strong> of the company.<br />

During fiscal year 2005, the integration of WIBEBA (acquired late in 2004) was completed. This<br />

company’s operational units have been gradually merged into the corresponding areas of the<br />

<strong>PORR</strong> Group.<br />

The <strong>PORR</strong> Group established a new and nationally active project development company known<br />

as Porr Solutions Immobilien- und Infrastrukturprojekte GmbH (PS) during the first half of 2005.<br />

Two companies which had been involved in project development for many years – Porr Immoprojekt<br />

GmbH and Porr Infrastruktur GmbH – were amalgamated to form this wholly-owned<br />

subsidiary, thereby merging their respective areas of expertise. The areas PT&S (26% shareholding<br />

of PS specialising in construction, planning and project <strong>management</strong>) and FMA (50% shareholding<br />

of PT&S specialising in total facility <strong>management</strong>) have also been assigned to project<br />

development.<br />

INTERNATIONAL PRESENCE<br />

The <strong>PORR</strong> Group has always operated well beyond the<br />

domestic borders of Austria. The countries of central, eastern<br />

and southern Europe are currently gaining in significance on<br />

account of their above-average rates of growth. The <strong>PORR</strong><br />

Group has been represented in Hungary, the Czech Republic,<br />

Slovakia and Poland for many years.<br />

During fiscal year 2005, inroads were made into the markets<br />

of the constituent states of the former Yugoslavia, with<br />

subsidiaries established in Zagreb, Belgrade, Sarajevo and<br />

Banja Luka. Projects have also been successfully realised in<br />

Slovenia, Croatia, Lithuania, Romania and Bulgaria. Italy<br />

and Ukraine are currently under assessment.<br />

FR<br />

20

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

COUNTRIES IN WHICH <strong>PORR</strong> IS REPRESENTED<br />

COUNTRIES CURRENTLY UNDER ASSESSMENT BY <strong>PORR</strong><br />

AT<br />

BA<br />

BG<br />

CH<br />

CZ<br />

DE<br />

FR<br />

HU<br />

Austria<br />

Bosnia and Herzegovina<br />

Bulgaria<br />

Switzerland<br />

Czech Republic<br />

Germany<br />

France<br />

Hungary<br />

HR<br />

LT<br />

PL<br />

RO<br />

SCG<br />

SL<br />

SK<br />

Croatia<br />

Lithuania<br />

Poland<br />

Romania<br />

Serbia and Montenegro<br />

Slovenia<br />

Slovakia<br />

IT<br />

UA<br />

Italy<br />

Ukraine<br />

Vienna head office<br />

Main subsidiaries<br />

LT<br />

PL<br />

DE<br />

CZ<br />

UA<br />

CH<br />

AT<br />

SK<br />

HU<br />

SI<br />

HR<br />

RO<br />

IT<br />

BA<br />

SCG<br />

BG<br />

21

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

CORPORATE STRATEGY<br />

OVERVIEW OF STRATEGIC PRIORITIES<br />

_ Place quality of production output before quantity<br />

_ Place long-term corporate governance ahead of short-term increases in earnings<br />

_ Develop the highest level of expertise<br />

_ Reduce simple construction business in favour of a greater share in complex<br />

projects that fewer competitors are able to realise<br />

_ Raise involvement in projects delivering a yield over many years in order<br />

to ensure a basic level of revenue in times of low demand<br />

_ Expand market presence to level out fluctuations in demand and ensure<br />

utilisation of specialist expertise<br />

_ Focus exclusively on European markets<br />

MARKET FOCUS<br />

The corporate structures of the <strong>PORR</strong> Group<br />

are specifically designed to reflect the<br />

requirements and conditions on our various<br />

geographical markets and sectors. The four<br />

company areas enable us to pool our knowhow<br />

and proficiency in the sectors of building<br />

construction, civil engineering, road construction<br />

and project development. Porr GmbH<br />

was set up to coordinate cross-sector subsidiary<br />

business; the Group’s project development<br />

expertise is concentrated in <strong>PORR</strong><br />

SOLUTIONS (founded in 2005), in which the<br />

subsidiaries PPH and PTU hold shares.<br />

SERVICE PORTFOLIO<br />

The <strong>PORR</strong> Group has successfully positioned itself as a multi-utility group covering every need of<br />

the modern-day construction industry. In addition to the traditional field of building construction,<br />

the project development area (which includes stock maintenance, property development, planning<br />

and facility <strong>management</strong>) is becoming increasingly important. The seamless networking of<br />

subsidiaries organised according to sector enables us to implement complex projects from a single<br />

source. As a result, <strong>PORR</strong> is increasingly fulfilling the role of reliable partner in operator and<br />

franchise projects, more and more of which are being launched in response to brisk investment<br />

activity in the infrastructure/energy area at a time when public budgets are limited.<br />

CORPORATE MAN<strong>AG</strong>EMENT<br />

As a strategic holding company, <strong>PORR</strong> <strong>AG</strong> is responsible for overall control of the subsidiaries.<br />

Agreement is reached with the <strong>management</strong> committees of the ancillary companies at regular<br />

coordination meetings. Members of the <strong>PORR</strong> <strong>AG</strong> executive board are also represented on the<br />

supervisory committees of the subsidiaries and majority holdings. To facilitate fast decisionmaking,<br />

the executive boards and managing directors of the respective companies take responsibility<br />

for operational corporate <strong>management</strong>; their decisions are informed by general Group<br />

guidelines.<br />

22

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

“We want to grow in terms<br />

of quality, not quantity”<br />

DEPUTY DIRECTOR GENERAL WOLFGANG HESOUN ON THE SELECTIVE<br />

EXPANSION POLICY AND THE HIGH-POTENTIAL BUSINESS AREAS OF <strong>PORR</strong>.<br />

Alongside the German-speaking region,<br />

which we define as our core market, the<br />

<strong>PORR</strong> Group has established a highly<br />

successful presence in central, eastern and<br />

southern Europe. In 2005, projects were<br />

launched and branch offices were founded<br />

in the constituent states of the former<br />

Yugoslavia for the first time. Although we<br />

are at a very early stage in Romania,<br />

Bulgaria and Ukraine, we are convinced of<br />

the long-term potential of these markets.<br />

However, our efforts to expand are not<br />

driven by a simple desire to grow in terms<br />

of size. We want to expand by selectively<br />

developing projects that allow us to apply<br />

our expertise in as many diverse – and,<br />

above all, profitable – ways as possible. This<br />

policy will require us to take stock of our<br />

situation at certain intervals and accept that<br />

periods of consolidation will be necessary.<br />

The huge potential of our existing markets<br />

means that we won’t need to experiment in<br />

exotic regions; we can already count on<br />

expansion during the years ahead. I believe<br />

there is a massive backlog in the infrastructure<br />

and energy area, even if the realisation<br />

of projects in these areas will vary<br />

from region to region. For example, in<br />

western Europe, where energy supply<br />

companies are in a position to make their<br />

own investments, we can continue to position<br />

ourselves as an expert partner for<br />

implementation. It is a different situation<br />

in the east and southeast of Europe, where<br />

there is simply a lack of funds. In this<br />

region, it is up to us to seize the opportunities<br />

and present ourselves as a reliable<br />

project manager. Needless to say, financial<br />

and planning aspects become critical given<br />

the long-term nature of such projects.<br />

On the other hand, from the viewpoint of<br />

long-term corporate <strong>management</strong>, an<br />

extended timeframe ensures long-term<br />

revenue, which can compensate for any<br />

fluctuations in the overall orders situation.<br />

On many past occasions, we have demonstrated<br />

beyond doubt that <strong>PORR</strong> possesses<br />

the expertise needed to run operator<br />

models and franchise models. To give just<br />

one example, we are currently realising a<br />

section of around 59km on the M6 motorway<br />

between Budapest and Dunaùjvaros in<br />

the form of a public-private partnership<br />

project.<br />

23

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

“We are doing everything possible to<br />

enhance our financing structure”<br />

EXECUTIVE DIRECTOR HELMUT MAYER ON THE<br />

ONGOING EFFORTS OF THE <strong>PORR</strong> GROUP TO IMPROVE THE BALANCE SHEET<br />

AND FINANCING STRUCTURES.<br />

Until fairly recently, it was easy for a<br />

construction group of our size and reputation<br />

to secure financing for projects and<br />

proposals with relatively favourable, shortterm<br />

borrowed funds. Now that the lending<br />

policy of the banks has changed in the<br />

wake of the Basel II agreement, the organisation<br />

and maturity profile of our financing<br />

structure has become increasingly important.<br />

With the instrument of raising capital<br />

no longer available, our first step was to<br />

deconsolidate UBM Realitätenentwicklung<br />

<strong>AG</strong>; by reducing our share to below 50%,<br />

we were able to cut the consolidated<br />

financial liabilities of the <strong>PORR</strong> Group<br />

significantly. The simultaneous reduction<br />

in bank liabilities that we accomplished<br />

through our own efforts – which included<br />

reassessing the real estate portfolio –<br />

improved the equity ratio, including minority<br />

shares, from 13.5% to the current level<br />

of 16.4% over the last two years.<br />

The next step was to issue two bonds: a<br />

structured bond followed in June 2005 by<br />

a corporate bond. These measures enabled<br />

us to optimise and amend our financing<br />

sources at a fundamental level whilst<br />

preparing the ground for further capital<br />

measures.<br />

Another strategic priority was to improve<br />

our profitability. At an operational level, we<br />

pursued this aim with a policy of selective<br />

order acquisition. Internally, we needed to<br />

bring about greater efficiency and resource<br />

planning. New software solutions have<br />

resulted in significant successes in the<br />

accounting and IT areas; the establishment<br />

of the Group Treasury has optimised<br />

the raising and application of financial<br />

resources.<br />

We are also proud of our successes in the<br />

field of personnel. In 2005, following years<br />

of preparatory work and intensive dialogue<br />

with employee representatives, we finalised<br />

a collective agreement between the <strong>management</strong><br />

and the works council. This<br />

agreement not only bridges traditional<br />

disparities, but also defines the first uniform<br />

remuneration and social model for<br />

all employees of the <strong>PORR</strong> Group. The<br />

pension fund model that it creates accords<br />

with the Group strategy of sustainable<br />

development.<br />

24

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

“We need sound structures to<br />

achieve successful growth”<br />

EXECUTIVE DIRECTOR PETER WEBER ON<br />

EXPANSION PRECONDITIONS, INTEGRATION AND<br />

CONTROLLING MEASURES.<br />

The <strong>PORR</strong> Group is pursuing a strategy of<br />

measured expansion; we cannot grow faster<br />

than our own structures will allow, and nor<br />

would we wish to. We are highly cautious<br />

when it comes to developing new markets;<br />

we become familiar with these markets<br />

step by step, carrying out specific projects<br />

and keeping the associated risks manageable<br />

at all times. Only when we are sufficiently<br />

familiar with a market do we set up<br />

our own permanent structures and introduce<br />

a comprehensive marketing plan. As<br />

our sphere of action grows, personnel and<br />

resource <strong>management</strong> becomes critical. We<br />

cannot hope to complete projects successfully<br />

unless we have secured access to the<br />

necessary qualified personnel and a supply<br />

of raw materials – things that we cannot<br />

take for granted in some eastern European<br />

countries. During the year under review, we<br />

tightened the organisation of our resource<br />

<strong>management</strong> across the Group, and we are<br />

currently developing a strategy for widening<br />

these business areas.<br />

Owing to the geographical and sectoral<br />

expansion of our operating network, our<br />

operational <strong>report</strong>ing and control system<br />

is gaining in importance. During the <strong>report</strong>ing<br />

year, we implemented a value-based<br />

risk <strong>management</strong> system with a view to<br />

counteracting adverse developments as<br />

early as possible. Cost accounting, budgeting<br />

and financial accounting data is entered<br />

into a complex model, which utilises a<br />

sophisticated key data catalogue to provide<br />

an excellent early warning system. This is<br />

integrated into a standardised <strong>report</strong>ing<br />

system, which produces a monthly assessment<br />

of the company’s situation.<br />

Another key strategic focus of 2005 was<br />

the integration of WIBEBA, which was<br />

acquired at the end of 2004. The main<br />

areas have now been merged into the<br />

relevant areas of <strong>PORR</strong>, and the operational<br />

units have been relocated to their<br />

respective positions in the <strong>PORR</strong> Group.<br />

Subject to temporary provisions, the<br />

new collective agreement between the<br />

<strong>management</strong> and works council of the<br />

<strong>PORR</strong> Group will apply to all staff members<br />

of WIBEBA. The new standard service<br />

regulations came into force across the<br />

group following years of preparatory work.<br />

25

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

RISK MAN<strong>AG</strong>EMENT ACROSS THE GROUP<br />

A group-wide risk <strong>management</strong> system – ideally matched to the specific needs of the <strong>PORR</strong><br />

Group – was implemented in fiscal year 2005. Based on a value-oriented model, cost accounting,<br />

budgeting and financial accounting data is entered into a key data catalogue which acts as<br />

an early warning system. A specialist team known as Operational Controlling supports the various<br />

business areas; the same team is responsible for developing controlling know-how in the operational<br />

areas. Controlling tasks and measures for the construction sites and business areas are<br />

defined in a comprehensive set of guidelines; compliance with and performance of these is<br />

monitored within the framework of formalised advisory council <strong>report</strong>s and coordination meetings.<br />

The measures are backed up by a standardised <strong>report</strong>ing system, which produces a monthly<br />

assessment of the company’s situation based on business-related data and notes and enables<br />

adverse developments to be forestalled at an early stage.<br />

GEOGRAPHICAL EXPANSION<br />

The <strong>PORR</strong> Group has operated on the flourishing markets of central, eastern and southern<br />

Europe for decades. We generally move into new markets by carrying out small-scale projects at<br />

first; in this way we familiarise ourselves with local conditions and requirements whilst keeping<br />

risk to a minimum. Permanent company structures are only established when the general level of<br />

market potential justifies a longer-term commitment. The <strong>PORR</strong> Group is not currently considering<br />

a move into underdeveloped markets in Europe or markets outside of Europe. The only exceptions<br />

to this rule are low-risk deliveries and services in collaboration with our global partners.<br />

ACQUISITION POLICY<br />

The expansion strategy of the <strong>PORR</strong> Group does not involve raising production output at any<br />

cost. Corporate acquisitions are only made where these offer better-than-average opportunities<br />

for growth and yield; in other words, to buy in additional expertise, open up new sectoral or<br />

geographical markets or boost activity in specific business areas. Projects of this kind are carried<br />

out by the holding company itself or in close cooperation with the holding company; risk <strong>management</strong><br />

is applied.<br />

In order to avoid the duplication of activities and deploy available resources as effectively as<br />

possible, contract and project acquisition is coordinated internally. Regional and national<br />

company units must act in full agreement and cooperation.<br />

26

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

UTILISING MARKET DEVELOPMENTS<br />

Allowing for the usual variations in different regions and sectors, years of insufficient investment<br />

have ensured that levels of demand on our central and eastern European markets will remain<br />

generally satisfactory for the next few years. The demand that exists in all sectors in the new and<br />

prospective EU member states will add to the infrastructure and energy-related backlog in the<br />

15 old member states. Given that there are no indications of any long-term change in the restrictive<br />

budgetary policies of public authorities, alternative sources of finance such as public-private<br />

partnerships and franchise models are becoming more important. We have already acquired the<br />

necessary know-how in relation to these financing models (and a contract awards process that is<br />

becoming ever more complicated) through <strong>PORR</strong> SOLUTIONS and the centrally managed finance<br />

department of the <strong>PORR</strong> Group.<br />

OPTIMISING THE FINANCE STRUCTURE<br />

Now that the lending policy of the banks has changed in the wake of the Basel II agreement,<br />

conditions for the external financing of projects have become less favourable owing to the poor<br />

equity capitalisation of the <strong>PORR</strong> Group. For this reason, a realignment of financing structures<br />

and sources has been a strategic priority of recent years. One milestone in this objective was the<br />

deconsolidation of UBM, whose balance sheet structure had been notable for high liabilities in<br />

connection with project development business. Our balance sheet structure and maturity profile<br />

were further enhanced during fiscal year 2005 by means of project sales and the issue of bonds.<br />

Compared to the previous year, payables to banks were cut by €211 million in 2005. The equity<br />

ratio (including minority shares) of the <strong>PORR</strong> Group rose from 15.3% to 16.4% by the end of<br />

2005. Recent capital procurement measures should improve the financing structure still further.<br />

These initiatives will also ensure that we can react flexibly (and, more importantly, quickly) to<br />

acquisition opportunities that may arise.<br />

27

HIGHLIGHTS OF 2005<br />

JAN FEB MAR APR MAY JUN<br />

PPH contracted to build<br />

Zagreb Tower in Croatia<br />

Acquisition of<br />

WIBEBA completed<br />

Contract concluded to build Euro<br />

2008 stadium at Klagenfurt;<br />

structured bond issued at nominal<br />

value of €72 million<br />

Final phase of residential development<br />

at Monte Laa commences<br />

(construction sites 10, 11.1 and 11.2)<br />

Corporate bond issued at<br />

nominal value of €100 million;<br />

Porr Solutions Immobilien- und<br />

Infrastrukturprojekte GmbH<br />

formed through merger of Porr<br />

Solutions Immobilien GmbH,<br />

Porr Infrastruktur GmbH and<br />

Porr Immoprojekt GmbH to<br />

maximise market focus<br />

Annual financial statements for 2004<br />

approved; consolidated profits up<br />

38.5% on previous year<br />

MILESTONES IN THE COMPANY HISTORY<br />

1869 1912 1927 1946 1955 1958 1971 1979<br />

Majority shareholding<br />

acquired in what is<br />

now UBM Realitätenentwicklung<br />

<strong>AG</strong><br />

<strong>PORR</strong> comes under control<br />

of military authorities in the<br />

Russian-occupied zone;<br />

receiving company is formed<br />

in the western zones<br />

<strong>PORR</strong> East and <strong>PORR</strong> West<br />

merge as occupying forces<br />

withdraw<br />

Group turnover exceeds one billion<br />

Foundation of<br />

Allgemeine Österreichische<br />

Austrian schillings for first time<br />

Allgemeine<br />

Baugesellschaft merges with<br />

Österreichische<br />

A. Porr Betonbauunternehmung GmbH<br />

Baugesellschaft;<br />

(founded 1908); changes to<br />

Vienna State Opera<br />

UNO City completed under<br />

quoted on Vienna<br />

Allgemeine Baugesellschaft –<br />

opens, having been<br />

<strong>management</strong> of <strong>PORR</strong>;<br />

Stock Exchange<br />

A. Porr <strong>AG</strong>, which remains the<br />

reconstructed by<br />

start of activities in eastern<br />

on 8 th April<br />

company’s official name<br />

<strong>PORR</strong><br />

Europe

JUN JUL AUG OCT NOV DEC<br />

Annual shareholders’<br />

meeting at company<br />

headquarters<br />

Contract won for first project<br />

in Romania (Hella Timisoara)<br />

Final section of<br />

Lötschberg base<br />

tunnel handed over<br />

<strong>PORR</strong> ordinary shares hit yearly high<br />

after rising 40%<br />

140%<br />

Work resumes on additional<br />

130%<br />

sections of Chodov Business<br />

Technology Park in Prague<br />

120%<br />

110%<br />

Million €<br />

2,500<br />

Output hits record level of<br />

€2.3 billion<br />

100%<br />

01<br />

2005<br />

02 03 04 05 06 07 08<br />

2,000<br />

1,500<br />

1,000<br />

581.4<br />

1,345.8<br />

532.7<br />

1,321.4<br />

704.5<br />

1,553.5<br />

500<br />

0<br />

2003 2004 2005<br />

Domestic<br />

Foreign<br />

1987 1990 1992 2000 2001 2002 2004 2005<br />

Turnover at<br />

5 billion schillings<br />

Turnover at<br />

10 billion schillings<br />

Majority holding acquired<br />

in TEER<strong>AG</strong>-ASD<strong>AG</strong> <strong>AG</strong>;<br />

Majority holding acquired in<br />

UBM Realitätenentwicklung <strong>AG</strong><br />

Acquisition of Wiener Betriebs- und<br />

industrial <strong>management</strong><br />

Turnover at<br />

Baugesellschaft m.b.H. (WIBEBA)<br />

assumed<br />

20 billion schillings<br />

Share in Radmer Bau <strong>AG</strong><br />

München acquired (now<br />

Corporate bond and structured bond<br />

issued to optimise financing structures<br />

Porr Deutschland GmbH);<br />

commencement of activities<br />

in Switzerland<br />

Foreign share of total<br />

turnover exceeds 25%<br />

for first time<br />

Production output exceeds €2 billion;<br />

geographical presence in 15 countries

<strong>PORR</strong> GROUP STRUCTURE<br />

THE FOUR STRATEGIC CORPORATE AREAS OF<br />

ALLGEMEINE BAUGESELLSCHAFT – A. <strong>PORR</strong> AKTIENGESELLSCHAFT<br />

TEER<strong>AG</strong>-ASD<strong>AG</strong> <strong>AG</strong><br />

<strong>PORR</strong> SOLUTIONS IMMOBILIEN- UND<br />

INFRASTRUKTURPROJEKTE GMBH<br />

AUSTRIAN SUBSIDIARIES VIENNA, STYRIA, CARINTHIA, KREMS,<br />

UPPER AUSTRIA, SALZBURG, BURGENLAND, TYROL<br />

ALLGEMEINE STRASSENBAU GMBH<br />

SUBSIDIARIES IN ALL FEDERAL STATES<br />

BAUGESELLSCHAFT MBH ERHARD MÖRTL<br />

HANS BÖCHHEIMER HOCH- UND TIEFBAU GMBH<br />

<strong>AG</strong>ES-BAU ASPHALT GMBH<br />

GESELLSCHAFT FÜR BAUWESEN GMBH<br />

BOSCH BAUGESELLSCHAFT MBH<br />

ASPHALTUNTERNEHMUNG DIPL. ING. O. SMEREKER & CO GMBH<br />

ASPHALTUNTERNEHMUNG RAIMUND GUCKLER<br />

BAUUNTERNEHMUNG GMBH<br />

TECHNISCHES BÜRO SEPP STEHRER BAUSTOFF-GROSSHANDEL GMBH<br />

EUPHALT-HANDELSGESELLSCHAFT MBH<br />

EISENSCHUTZGESELLSCHAFT MBH<br />

ING. OTTO RICHTER & CO STRASSENMARKIERUNGEN GMBH<br />

IAT GMBH<br />

ASPHALT-UNTERNEHMUNG CARL GÜNTHER GMBH<br />

WIENER BETRIEBS- UND BAUGESELLSCHAFT MBH & CO NFG KG*<br />

PRAZSKÉ SILNICNÍ A VODOHOSPODÁRSKÉ STAVBY A.S., PR<strong>AG</strong>UE<br />

TEER<strong>AG</strong>-ASD<strong>AG</strong> POLSKA SP. Z O.O., WARSAW<br />

TEER<strong>AG</strong>-ASD<strong>AG</strong> KFT., MOSONM<strong>AG</strong>YARÓVÁR<br />

ASD<strong>AG</strong> KAVISCBÁNYA ÉS ÉPITÖ KFT., JÁNOSSOMORJA<br />

<strong>PORR</strong> TECHNICS & SERVICES GMBH & CO KG<br />

FMA GEBÄUDEMAN<strong>AG</strong>EMENT GMBH<br />

KÄRNTNER RESTMÜLLVERWERTUNGS GMBH<br />

LTE LOGISTIK- UND TRANSPORT-GMBH<br />

GREENPOWER ANL<strong>AG</strong>ENERRICHTUNGS- UND BETRIEBS- GMBH<br />

AQUA PLUS WASSERVERSORGUNGS- UND<br />

ABWASSERENTSORGUNGS GMBH<br />

M-PARKING ERRICHTUNGS-, BETRIEBS- UND SERVICE GMBH<br />

ECRA EMISSION CERTIFICATE REGISTRY GMBH<br />

“HOSPITALS” PROJEKTENTWICKLUNGS GMBH<br />

ARIWA ABWASSERREINIGUNG IM WALDVIERTEL GMBH<br />

<strong>PORR</strong> SOLUTIONS IMMOBILIEN- UND INFRASTRUKTURPROJEKTE<br />

GMBH, BERLIN<br />

<strong>PORR</strong> SOLUTIONS SP. Z O.O., WARSAW<br />

<strong>PORR</strong> SOLUTIONS S.R.L., BUCHAREST<br />

<strong>PORR</strong> SOLUTIONS D.O.O., Z<strong>AG</strong>REB<br />

M6 DUNA AUTÓPÁLYA KONCESSZIÓS RT., BUDAPEST<br />

<strong>PORR</strong> INFRA BULGARIA E.O.O.D., SOFIA<br />

LTE LOGISTIK A TRANSPORT SLOVAKIA S.R.0., PRESSBURG<br />

AQUA PLUS CZ VODOHODPODARSKA S.R.O., BRNO<br />

AQUASYSTEMS GOSPODARJENJE Z VODAMI D.O.O., MARBURG<br />

FAB QUICKBORN GMBH & CO & KG, HAMBURG<br />

GUNIMPERM-BAUVEG SA, BELLINZONA<br />

BAUVEG-WINKLER D.O.O., Z<strong>AG</strong>REB<br />

Domestic<br />

Foreign<br />

* Industrial <strong>management</strong>

<strong>PORR</strong> TECHNOBAU UND UMWELT <strong>AG</strong><br />

<strong>PORR</strong> PROJEKT UND HOCHBAU <strong>AG</strong><br />

RAILWAY CONSTRUCTION<br />

FOUNDATIONS<br />

CIVIL ENGINEERING PROJECTS<br />

VIENNA SUBSIDIARY<br />

<strong>PORR</strong> GMBH SUBSIDIARIES IN LOWER AND UPPER AUSTRIA,<br />

SALZBURG, CARINTHIA, TYROL, STYRIA<br />

<strong>PORR</strong> TUNNELBAU GMBH<br />

<strong>PORR</strong> UMWELTTECHNIK GMBH<br />

<strong>PORR</strong> SOLUTIONS IMMOBILIEN- UND INFRASTRUKTURPROJEKTE GMBH<br />

VORSPANN-TECHNIK GMBH & CO KG<br />

SCHOTTER- UND BETONWERK KARL SCHWARZL BETRIEBSGMBH<br />

<strong>PORR</strong> DEUTSCHLAND GMBH SUBSIDIARIES IN MUNICH, BERLIN,<br />

HAMBURG, THURINGIA/SAXONY<br />

<strong>PORR</strong> TECHNOBAU UND UMWELT GMBH, MUNICH<br />

BETZOLD ROHRBAU GMBH & CO KG, NUREMBERG<br />

<strong>PORR</strong> SUISSE <strong>AG</strong>, ALTDORF<br />

<strong>PORR</strong> (BUDAPEST) ÉPÍTÉSI KFT.<br />

<strong>PORR</strong> TECHNOBUD POLSKA SP. Z O.O., WROCLAW<br />

<strong>PORR</strong> D.O.O., MARBURG<br />

GP <strong>PORR</strong> D.O.O., BELGRADE<br />

<strong>PORR</strong> CONSTRUCT S.R.L., BUCHAREST<br />

<strong>PORR</strong> HRVATSKA D.O.O, Z<strong>AG</strong>REB<br />

<strong>PORR</strong> BULGARIA E.O.O.D., SOFIA<br />

<strong>PORR</strong> D.O.O., SARAJEVO<br />

<strong>PORR</strong> D.O.O., BANJA LUKA<br />

TOV “<strong>PORR</strong> UKRAINA”, KIEV<br />

TOV “<strong>PORR</strong> INTERGAL-BUD”, KIEV<br />

<strong>PORR</strong> (MONTENEGRO) D.O.O., PODGORICA<br />

REGIONAL BUILDING CONSTRUCTION, VIENNA<br />

NATIONAL BUILDING CONSTRUCTION<br />

REVITALISATION, VIENNA SUBSIDIARY<br />

<strong>PORR</strong> GMBH SUBSIDIARIES IN LOWER AND UPPER AUSTRIA,<br />

SALZBURG, CARINTHIA, TYROL, STYRIA<br />

WIBEBA HOCHBAU GMBH & CO NFG KG*<br />

O.M. MEISSL & CO BAU GMBH<br />

ING. RADL-BAU GMBH*<br />

<strong>PORR</strong> TECHNICS & SERVICES GMBH & CO KG<br />

<strong>PORR</strong> SOLUTIONS IMMOBILIEN- UND INFRASTRUKTURPROJEKTE GMBH<br />

ALU-SOMMER GMBH*<br />

<strong>PORR</strong> DEUTSCHLAND GMBH SUBSIDIARIES IN MUNICH, BERLIN,<br />

HAMBURG, THURINGIA/SAXONY<br />

EMIL MAYR HOCH- UND TIEFBAU GMBH, ETTRINGEN, WERTACH<br />

<strong>PORR</strong> (ČESKO) A.S., PR<strong>AG</strong>UE<br />

<strong>PORR</strong> (SLOVENSKO) A.S., PRESSBURG<br />

<strong>PORR</strong> (POLSKA) S.A., WARSAW<br />

MODZELEWSKI & RODEK SP. Z O.O., WARSAW<br />

STAL-SERVICE SP. Z O.O., WARSAW<br />

<strong>PORR</strong> CONSTRUCT S.R.L., BUCHAREST<br />

<strong>PORR</strong> HRVATSKA D.O.O., Z<strong>AG</strong>REB<br />

<strong>PORR</strong> (HUNGÁRIA) M<strong>AG</strong>ASÉPÍTÉSI KFT., BUDAPEST<br />

GP <strong>PORR</strong> D.O.O., BELGRADE<br />

<strong>PORR</strong> D.O.O., SARAJEVO<br />

<strong>PORR</strong> D.O.O. BANJA LUKA<br />

TOV “<strong>PORR</strong> UKRAINA”, KIEV<br />

TOV “<strong>PORR</strong> INTERGAL-BUD”, KIEV<br />

<strong>PORR</strong> (MONTENEGRO) D.O.O., PODGORICA

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

<strong>PORR</strong> TECHNOBAU<br />

UND UMWELT <strong>AG</strong> (PTU)<br />

STEPHAN GILLICH<br />

EXECUTIVE BOARD<br />

CHAIRMAN<br />

JOHANNES DOTTER<br />

EXECUTIVE BOARD<br />

MEMBER<br />

ALFRED JAHN<br />

EXECUTIVE BOARD<br />

MEMBER<br />

ALFRED SEBL-LITZLBAUER<br />

EXECUTIVE BOARD<br />

MEMBER<br />

HEINZ GSCHNITZER<br />

EXECUTIVE BOARD<br />

MEMBER<br />

(TO 28.3.2006)<br />

SPECIALIST IN CIVIL<br />

ENGINEERING AND<br />

ENVIRONMENTAL TECHNOLOGY<br />

COMPANY PROFILE<br />

Porr Technobau und Umwelt <strong>AG</strong> (PTU) is responsible for the civil engineering activities of the<br />

<strong>PORR</strong> Group in the fields of engineering construction, environmental technology and resource<br />

<strong>management</strong>; it also manages operator and franchise models for those sectors. The close<br />

cooperation between national departments and regional cross-sector subsidiaries ensures that<br />

our specialist know-how and regional presence are retained and expanded. This is our basis for<br />

business success, along with our highly qualified staff and the standards of quality we maintain.<br />

Specialist departments provide expertise predominantly in the sectors of foundations, tunnel<br />

construction, power plant construction, railway construction, bridge construction, environmental<br />

technology and prestressing technology. Both at home and abroad, we are offering more and<br />

more operator and franchise models in the areas of road construction and waste disposal and in<br />

connection with various industrial plant projects. Our rock, gravel and landfill resources guarantee<br />

long-term market opportunities and reduce our dependence on external sources of raw materials.<br />

STRONG AT HOME<br />

AND ABROAD<br />

32<br />

SERVICE PORTFOLIO<br />

Engineering construction<br />

Civil engineering services are delivered nationally through the Civil Engineering Projects<br />

department, regionally (in Austria) through the Vienna office and Porr GmbH and internationally<br />

through the respective PTU companies abroad.<br />

The Civil Engineering Projects department operates in the fields of underground railway construction,<br />

motorway and expressway construction, bridge construction, energy engineering and power plant<br />

construction. In November 2005, the Bindermichl project unit on the A7 “Mühlkreis” motorway<br />

was handed over on schedule. Much of the construction work on project unit U 2/5 (Stadion) in<br />

connection with the Vienna underground railway project has been completed; contracts for the units<br />

U 2/6 (Donaumarina) and U2/10(Aspernstrasse) were secured in December 2005 following a lengthy<br />

awards procedure. Our Vienna office performs the full range of engineering construction and civil<br />

engineering tasks at regional and municipal level in Vienna and its environs. Its remit includes<br />

everything from bridges, car parks and industrial plant to sewer pipes and district heating pipelines.

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

KEY DATA, PTU GROUP 2005 CHANGE 2004 2003<br />

Turnover in million € 880.9 + 30.0% 677.8 706.2<br />

Foreign share of turnover 38.6% + 4.4 PP 34.2% 36.1%<br />

Orders on hand at year end<br />

in million € 663.8 - 8.6% 726.5 574.7<br />

Average number of employees 3,562 + 3.9% 3,428 3,509<br />

Railway construction<br />

The railway construction area fulfils contracts for rail-related constructions such as railway<br />

bridges, underpasses and stations as well as substructure works and track construction work. The<br />

“reinforced track” system developed by <strong>PORR</strong> in collaboration with Austrian Federal Railways<br />

continues to constitute a technologically significant specialist area. The focus of activity in 2005<br />

was on the four-track extension of the Westbahn line around the Linz–St. Pölten–Tullnerfeld<br />

areas. Wide-ranging construction work is also in progress in connection with the expansion and<br />

redevelopment of the underground rail station at Schwechat airport. Another major sales generator<br />

in 2005 was the “track construction for Bosnia” project involving the Bradina–Konjic and<br />

Josavka–Banja Luka lines. The “Jedrinje tunnel” contract has already been secured for 2006.<br />

FAST-TRACK TECHNOLOGY<br />

Specialist civil engineering<br />

The Foundations department delivers specialist civil engineering services such as bored piles,<br />

diaphragm walls, insulation walls, drilling and injection tasks and pile driving work. Through the<br />

PTU branch offices, contracts are also gained beyond the borders of Austria; the company is<br />

particularly active in Hungary. In future, we plan to develop the Hungarian market by establishing<br />

a separate foundations department within Porr Budapest Kft. In Sri Lanka, the bulk of the work<br />

on the pile foundations of Waagner Biró bridges was successfully concluded as a one-off project.<br />

SUCCESS IN BOTH<br />

AUSTRIA AND HUNGARY<br />

Tunnel construction<br />

The tunnel construction sector is now benefiting from significant growth impetus in Austria. Investment<br />

in the expansion of the rail and road network – and further investment on the part of energy<br />

suppliers – will ensure a steady stream of contracts over the coming years. Porr Tunnelbau GmbH is<br />

ideally placed to meet these challenges. In 2005, technically complex tunnel driving work involving<br />

artificial icing technology and injection engineering continued in Vienna on the underground railway<br />

U 2/1 project unit (Schottenring). Tunnel driving for the Wiental main sewer was brought to a highly<br />

successful conclusion in April; proceeding at 36 metres per day, we achieved a world first in tunnel<br />

driving with a large EPB shield. Two tunnelling machines were constructed for the “Wienerwald<br />

tunnel” project; these were put into operation in autumn 2005. The Lötschberg base tunnel project<br />

linked to the MaTrans joint venture, also neared completion in 2005.<br />

TUNNEL DRIVING<br />

AT RECORD LEVEL<br />

NASENBACHTAL, GERMANY<br />

WIENERWALD TUNNEL, AUSTRIA<br />

M6 MOTORWAY, HUNGARY<br />

33

THE HIDDEN FACE OF <strong>PORR</strong>.

SOME OF OUR TECHNICAL<br />

MASTERPIECES NEVER SEE THE<br />

LIGHT OF DAY.<br />

GROWING IN EVERY DIRECTION MEANS HEADING UNDERGROUND:<br />

<strong>PORR</strong> can also point to a long company tradition in the field of<br />

tunnel construction. For 137 years, we have been gaining the<br />

kind of invaluable experiences that make us such an innovative<br />

company today. No wonder our technical solutions are in such<br />

high demand.<br />

Built by <strong>PORR</strong> TUNNELBAU, the Wiental main sewer relief channel<br />

is a masterpiece of classical engineering, running for 2.6 kilometres<br />

at a depth of 30 metres below the heart of Vienna. For tunnel<br />

driving, we used a shield tunnel boring machine with an impressive<br />

diameter of 8.60 metres: a mere number to some, but an ideal<br />

solution at the cutting edge of technology to our customers.

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />

EXTENDING THE VALUE<br />

CHAIN WITH ENVIRONMENTAL<br />

EXPERTISE<br />

SECURING THE SUPPLY<br />

OF RAW MATERIALS<br />

Environmental technology<br />

Within the framework of the Budgetbegleitgesetz legislation of 2003 (a series of legal measures<br />

aimed at supporting the labour market opportunities of older employees), an amendment was<br />

passed to the Contaminated Sites Clean-up Act. This introduced an increase in charges for contaminated<br />

sites and the liability to pay charges on incinerated waste. On the basis of the associated<br />

budgetary surplus of the federal government, we are working on the assumption that subsidies for<br />

hazardous site remediation will remain available. The strategy of Porr Umwelttechnik GmbH is to<br />

establish the longest possible value chain. For this reason, whilst developing resources for treating<br />

inorganic waste in particular, the company continues to pursue and acquire complex restoration<br />

projects. These include the restoration of the TEER<strong>AG</strong>-ASD<strong>AG</strong> Simmering site and the restoration<br />

of the Angeler pit in the Neustadt area of Vienna, which commenced in January 2006.<br />

Resources<br />

Thanks to Schotter- und Betonwerk Karl Schwarzl Betriebsgesellschaft m.b.H., a wholly-owned<br />

subsidiary of <strong>PORR</strong> under the industrial <strong>management</strong> of PTU, we can remain largely independent<br />

of external rock and concrete resources. Operating five quarries and three gravel pits in Austria, four<br />

gravel pits in Germany and a total of 15 concrete manufacturing plants in Austria, Hungary and<br />

Croatia, Schwarzl is a key player in this field. A major exploration for raw materials began in southeastern<br />

Europe in 2005 to ensure we are ready for the large-scale building projects of the future.<br />

<strong>PORR</strong> GMBH FOCUSES<br />

MARKET PRESENCE<br />

GEOGRAPHICAL PRESENCE<br />

Austria<br />

Porr GmbH – through which branch offices are managed in Lower Austria, Upper Austria,<br />

Salzburg, Tyrol, Styria and Carinthia – positioned itself effectively in 2005, its first year of<br />

business. Under the joint <strong>management</strong> of PTU and PPH, Porr GmbH functions as a cross-sector<br />

company in the fields of regional building construction and civil engineering. The company also<br />

performs a certain level of intensive construction-related project development. The contract to<br />

build the stadium in Klagenfurt – which attracted widespread media coverage – was secured in<br />

mid-2005. This led to follow-up orders for stadium redevelopments in Innsbruck and Salzburg.<br />

At the end of 2005, Vorspanntechnik GmbH & Co KG (VT) joined the new franchise company<br />

BBR-VT International <strong>AG</strong>. In addition to its globally recognised brands, BBR provides a licensee<br />

WIENTAL MAIN SEWER RELIEF CHANNEL<br />

36<br />

Z<strong>AG</strong>REB TOWER OFFICE BUILDING, Z<strong>AG</strong>REB<br />

BRIXLEGG TUNNEL, TYROL

COMMENT ORGANS STRATEGY BUSINESS AREAS STOCK EXCHANGE EMPLOYEES R&D MAN<strong>AG</strong>EMENT REPORT SEGMENTS CONSOLIDATED ACCOUNTS INVESTMENTS SUPERVISORY BOARD REPORT <strong>AG</strong> ACCOUNTS GLOSSARY<br />