affordable housing development models - City of Port Phillip

affordable housing development models - City of Port Phillip

affordable housing development models - City of Port Phillip

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

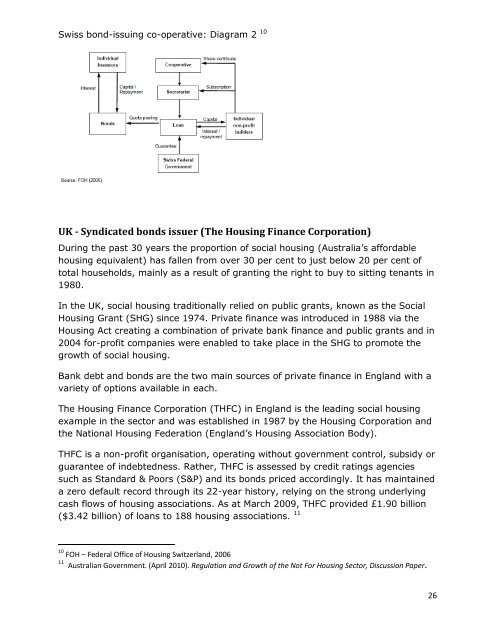

Swiss bond-issuing co-operative: Diagram 2 10<br />

UK - Syndicated bonds issuer (The Housing Finance Corporation)<br />

During the past 30 years the proportion <strong>of</strong> social <strong>housing</strong> (Australia‘s <strong>affordable</strong><br />

<strong>housing</strong> equivalent) has fallen from over 30 per cent to just below 20 per cent <strong>of</strong><br />

total households, mainly as a result <strong>of</strong> granting the right to buy to sitting tenants in<br />

1980.<br />

In the UK, social <strong>housing</strong> traditionally relied on public grants, known as the Social<br />

Housing Grant (SHG) since 1974. Private finance was introduced in 1988 via the<br />

Housing Act creating a combination <strong>of</strong> private bank finance and public grants and in<br />

2004 for-pr<strong>of</strong>it companies were enabled to take place in the SHG to promote the<br />

growth <strong>of</strong> social <strong>housing</strong>.<br />

Bank debt and bonds are the two main sources <strong>of</strong> private finance in England with a<br />

variety <strong>of</strong> options available in each.<br />

The Housing Finance Corporation (THFC) in England is the leading social <strong>housing</strong><br />

example in the sector and was established in 1987 by the Housing Corporation and<br />

the National Housing Federation (England‘s Housing Association Body).<br />

THFC is a non-pr<strong>of</strong>it organisation, operating without government control, subsidy or<br />

guarantee <strong>of</strong> indebtedness. Rather, THFC is assessed by credit ratings agencies<br />

such as Standard & Poors (S&P) and its bonds priced accordingly. It has maintained<br />

a zero default record through its 22-year history, relying on the strong underlying<br />

cash flows <strong>of</strong> <strong>housing</strong> associations. As at March 2009, THFC provided £1.90 billion<br />

($3.42 billion) <strong>of</strong> loans to 188 <strong>housing</strong> associations. 11<br />

10 FOH – Federal Office <strong>of</strong> Housing Switzerland, 2006<br />

11 Australian Government. (April 2010). Regulation and Growth <strong>of</strong> the Not For Housing Sector, Discussion Paper.<br />

26