complimentary eBook - Pre Foreclosure Data

complimentary eBook - Pre Foreclosure Data

complimentary eBook - Pre Foreclosure Data

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Marketing to Distressed Homeowners<br />

A <strong>complimentary</strong> ebook by Homestead <strong>Data</strong><br />

It’s been said that knowledge is power. Armed with early, accurate<br />

pre-foreclosure data, you can be the first to advise distressed<br />

homeowners on their options and turn them into motivated sellers.<br />

Yet it’s the application of that knowledge which is even more powerful.<br />

This <strong>eBook</strong> discusses how to market your services to homeowners that<br />

need your help in this turbulent real estate market.<br />

www.preforeclosuredata.net | 1-866-490-3459

Communicating and Getting Through To<br />

Distressed Homeowners<br />

Homeowners that are falling behind on their mortgage payment are<br />

oftentimes emotionally frozen, or at least in slow motion. Whether due to a<br />

loss of employment, a divorce, illness or other calamitous event, they are<br />

going through a tumultuous time and adept real estate agents and investors<br />

that can help them through this difficult period will undoubtedly be<br />

successful. The challenge for the real estate professional is to instill calm and<br />

help those homeowners overcome the emotional roller coaster of<br />

embarrassment, shame and panic. Yet while distressed homeowners are<br />

eager for options and hope, a great number of them are leery of a stranger<br />

and potentially, a vulture looking to swoop down and profit from their misery.<br />

Remember, the entire media has been telling them for three years that if<br />

someone offers their services to stave foreclosure, it is probably a scam.<br />

All too often, we’ve seen marketing campaigns that talk<br />

bumpkins about the agent’s credentials. The reality is,<br />

distressed homeowners don’t care about you, your<br />

credentials, or even your expertise. These are fine, but<br />

they will not immediately earn the trust of homeowners<br />

falling behind on their payments. Rather than appealing to<br />

the homeowner’s intellect, it’s important to impact the<br />

homeowner on an emotional level. Word-renowned sales<br />

trainer Zig Ziglar explains, “People buy on their emotions<br />

and then justify it with logic”. Sure, if you’ve saved 28<br />

borrowers from foreclosure last month, that’s great. If<br />

you’re a member of the Better Business Bureau, that’s a<br />

sign that you are reputable. You might have specialized<br />

training or a designation in working with distressed<br />

properties which adds credibility. Yet these are all<br />

intellectual features that will not galvanize homeowners<br />

into action. They may come back to your credentials later,<br />

but it’s emotions that are the gateway for those<br />

mortgagors to make a decision to work with you. While<br />

features are the language of intellect, benefits are the<br />

language of emotion.<br />

“People buy on emotions and then<br />

justify it with logic.”<br />

– Zig Ziglar<br />

What would be a better way to sell diamonds?<br />

“This ring features a 1.4 carat, pear-shaped cut white<br />

diamond with a Sl1 clarity grade and an H color rating”.<br />

Unless you are gemologist, this ad is gibberish. Here is what<br />

might sell diamonds better:<br />

“Imagine that special evening when you gently slip this on<br />

your finger and stare intensely into their eyes. She peers at<br />

this symbol of your devotion, the promise of your future<br />

together, and tears begin to glisten. An adoring smile<br />

spreads across her face, and at that moment your love is<br />

sealed forever”.<br />

While distressed homeowners aren’t concerned initially<br />

with your breadth of expertise, training or track record – all<br />

of which are features – they are more receptive to<br />

emotional benefits that help them solve their problem,<br />

make their lives better and most of all, how will you make<br />

them feel good. Some examples of these emotional benefits<br />

might be:<br />

Move on to build better memories… Get a good night’s<br />

sleep for the first time in six months… Relieve the<br />

uncertainty… Let go of the loads of bricks on your<br />

shoulders… Keep your children in their school… Stop the<br />

harassing phone calls…. Help your family… Return to your<br />

normal, day to day affairs, and so on.

Working with distressed homeowners requires a whole<br />

new mindset different than traditional sales. Your goal<br />

should not be to sell, but to solve problems with real<br />

estate loans.<br />

I do not sell, but I can solve problems, says Ken Lawson,<br />

JD, the owner of the Lawson Group Mediation Services. In<br />

the minds of distressed homeowners, they have nowhere<br />

to turn because their stereotypical thinking limits the<br />

possibilities that you as a real estate professional provide.<br />

They expect a lawyer to want them to file bankruptcy.<br />

They expect an investor to rip them off. They expect an<br />

agent to sell their home. In order to overcome this<br />

stereotype, Ken Lawson, an attorney, advertises “Debt<br />

relief without bankruptcy.” If you are an agent perusing<br />

more short sale listings, why not offer a workshop on<br />

applying for a loan modification?<br />

Many successful subscribers to our data “lead in” with a<br />

loan modification for free. While this flies against the<br />

mindset of traditional sales, it is effective in building<br />

rapport with homeowners hanging by a thread because<br />

you are dispelling the stereotype of an opportunistic<br />

REALTOR that is out for a commission. A staggering<br />

amount of distressed mortgagors will not qualify for the<br />

modification. For these disqualified borrowers, it is natural<br />

to turn to the agent that started the conversation with a<br />

loan modification. Having established the trust and<br />

rapport with those homeowners by advising them of all of<br />

their options from day one, the homeowner can lean on<br />

you for advice on other options, including a short sale.<br />

Mortgagors that have attempted a loan mod on their own<br />

are especially appreciative of the REALTOR’s offer to<br />

advise them on applying for a loan modification. Having<br />

experienced the frustration of getting nine different<br />

answers from their bank, getting lost in paperwork and<br />

gaining ire from all of the other complexities and pitfalls of<br />

negotiating with the bank, your message is a welcome<br />

relief.<br />

Enter the revamped guidelines of the HARP 2.0 program,<br />

and the option of modification becomes more appealing<br />

to the homeowner. An effective strategy is to educate<br />

those borrowers on the new guidelines to the program<br />

and offer to explore their eligibility.<br />

It is this solution based, client centric approach that is<br />

attributed to the success of Rick Geha, a partner in Keller<br />

Williams Benchmark Properties that leads his team to<br />

record-breaking sales. When talking in a YouTube video<br />

about working with distressed homeowners, he says,<br />

“When your whole life is spent making sure… clients are<br />

well taken care of… that your reaching out to them, say<br />

‘what can I do for you’, without regard to whether they<br />

buy or sell real estate from you, your whole life will open<br />

up, and people be throwing leads at you”.<br />

With such a high inventory of distressed properties, the<br />

real estate industry is changing, and it is incumbent for<br />

real estate professionals to change with it. The traditional<br />

message of “pick up the phone and call to list your home<br />

with me because I sell so many houses” is increasingly<br />

ineffective at best or at worst, falling on deaf ears.<br />

The quintessential point to grasp from 40,000 feet is that<br />

it is best to position yourself in this turbulent market as a<br />

compassionate real estate professional that offers ethical<br />

solutions to problematic loans, including a variety of tools<br />

including but not limited to a short sale.<br />

“To move people emotionally frozen in action<br />

requires you, the agent, to stop selling and help<br />

them solve a problem. They must see that you are<br />

not after only the listing, but that you have a variety<br />

of tools in your toolbox to help them.”<br />

– Ken Lawson, Esq.

The Call To Action and<br />

Two-Step Marketing –<br />

Telling Distressed<br />

Homeowners What To<br />

Do NEXT.<br />

Ironically, while the call to action is often overlooked, it is<br />

arguably the most important component to your<br />

marketing. Why? Once you’ve piqued the curiosity of the<br />

homeowner, they have to be told what to do NEXT. You<br />

want them to respond, period.<br />

As mentioned in the previous section, many troubled<br />

homeowners are on an emotional roller coaster of shame,<br />

embarrassment and panic. Many of them will not<br />

immediately warm up to a stranger. Your initial “touch<br />

point” can grab the homeowner by their eyeballs, but<br />

unless they take action, your time, energy and money<br />

spent getting in front of them will be for naught.<br />

Ideally, you want the homeowner to pick up the phone,<br />

and so at first thought, you might craft the call to action<br />

“Call for a confidential consultation”. This will lose the<br />

homeowners that are gun shy and not ready to reach out<br />

to you yet. Those leery homeowners that would not<br />

otherwise call you may be motivated to download a free<br />

report, watch a video, or listen to an anonymous hot line<br />

where they can listen to a pre-recorded message on what<br />

some of their options are.<br />

In order to nurture distressed homeowner leads to<br />

fruition, a two-pronged approach should be<br />

employed:<br />

1. Generate a lead by offering something of<br />

value, such as a free report, in exchange<br />

for something in return, such as the<br />

homeowner’s e-mail address.<br />

2. Provide the requested information and<br />

then follow up.<br />

Distressed homeowners need to take baby steps and be<br />

guided along in an incubation process that nurtures the<br />

lead until they are ready to use your services. While a<br />

great number of distressed homeowners are not ready to<br />

part with their homes just yet, they can be warmed along<br />

until they trust you enough and the timing is right to list<br />

their home.<br />

What’s so great about this two-step process? It’s<br />

much easier to spark an interest in learning about<br />

alternatives to foreclosure (a lead) than it is to get<br />

a homeowner to sign on the dotted line. You are<br />

not asking them to sell their home with you – not<br />

yet anyway. In this fashion, you can warm the lead<br />

along and continue your dialog with those<br />

borrowers that first contact began.

A non-threatening way for troubled homeowners to respond is to send them to a<br />

landing page where they can download a gift-wrapped report that contains relevant<br />

information. Some possible report topics might include:<br />

« Five mistakes you should never make if you fall behind on your mortgage payment<br />

« Now that your loan modification has been disapproved, now what?<br />

« Checklist of what steps to take if you receive a certified letter from your lender<br />

« How to stop annoying collection calls using the Fair Debt Collection Practices Act<br />

« Short Sale versus <strong>Foreclosure</strong>- The Consequences<br />

In the homeowner’s mind, they are not saying, “I want to sell my house with this<br />

agent”… they are merely thinking, “Geez, I better get that report because I don’t want<br />

to make those five mistakes!”<br />

Some Words of Caution<br />

You don’t want to overwhelm homeowners with too many calls to action. There’s an old direct marketing axiom that<br />

states too many choices paralyzes your prospect into complete non-action. Studies in supermarkets have shown that if<br />

the shopper is presented with too many varieties they are less likely to make a purchase. Distressed homeowners are no<br />

different.<br />

As a real estate expert, you have a wealth of information to provide distressed homeowners, but you should resist the<br />

temptation to ask the homeowner to access too much information. If you ask them to choose too much, you guarantee<br />

either they will do nothing, or avail all of your resources and close themselves without consulting you. Remember, you<br />

are the real estate expert, not them.<br />

Also, calls to action should be specific. For example, “visit my website for more information” is vague. What will they find<br />

at your destination, and once on your website, what should they do? Here are examples of calls to action with more<br />

specificity:<br />

• If you owe more on your home than what it’s worth, visit my website to download my free <strong>eBook</strong> on how to get<br />

fair market value for your home.<br />

• Visit my website to watch a video with the answers to commonly asked questions on what a short sale is.<br />

• Visit my website to get a free report on the five things you should never do if you miss a mortgage payment.<br />

• To learn if you qualify for the revamped Home Affordable Refinance Program, download my free report with a<br />

checklist of the new guidelines.

Sending Homeowners to a Landing Page<br />

The purpose of your initial marketing message<br />

should not be to close the homeowner. For<br />

example, a post card by itself normally won’t lead to<br />

a listing. What it can do is serve as a “teaser” by<br />

piquing the curiosity of the distressed borrower and<br />

send them elsewhere for more information, where<br />

the dialogue can be continued. A landing page is an<br />

excellent next step for the homeowner to learn<br />

more after you’ve gotten their attention.<br />

Unlike your initial advertisement – it’s randomly<br />

received by the homeowner and they didn’t ask for<br />

it – a landing page is a destination that the<br />

homeowner got to proactively. Think of a golf<br />

course – a landing page is the putting green that<br />

you drive the ball (prospect) to. Once on the green,<br />

the goal is to get the ball in the hole. Likewise, the<br />

goal of the copy and design of your landing page is<br />

incite the distressed homeowner into taking a<br />

desired course of action.<br />

You wouldn’t ask someone to solve an algebra equation in order to view the content they came for on your website. Nor<br />

should you ask a distressed homeowner to find the page that is relevant to them. A typical agent’s site is busy, with a lot of<br />

links to information that speak to entirely different audiences. For example, your site might have a section geared towards<br />

home buyers, while another section is devoted to homeowners selling their home, and there may be other links sprinkled<br />

about the benefits to moving to your community, tips on moving, etc. If you have a section on helping homeowners stave<br />

foreclosure, rather than sending a distressed homeowner to your home page where they have to work to find the page<br />

relevant to foreclosure help, you should have a separate domain that takes them right to the information they want. For<br />

example, if your main page is bobsellsrealestate.com, you should have a URL dedicated to helping distressed homeowners,<br />

such as BobCares.com, Denver<strong>Foreclosure</strong>Help.com, BobStops<strong>Foreclosure</strong>.com, and so forth.<br />

It is critical to capture the contact information of your web visitors using clickable<br />

engagement points that asks the user to take action. By obtaining the contact details of<br />

your web visitors, you can follow up and continue a conversation with the distressed<br />

borrower through e-mail or over the phone using a “drip” campaign. In other words, a<br />

homeowner that volunteers their e-mail address is a “lead” that can be converted in a<br />

sequence of a pre-written set of e-mails sent to them over time. It’s the first rule of<br />

negotiation – “I’ll give you X if you give me Y in return”. If you have rich content to<br />

provide those homeowners that are falling behind or owe more on their home than it is<br />

worth, don’t give it away without the quid pro quo of the homeowner’s information, at<br />

minimal, the homeowner’s name and e-mail address.<br />

In agriculture, drip<br />

irrigation is the process<br />

of watering plants or<br />

crops using small<br />

amounts of water over<br />

long periods of time.<br />

Using the same principle,<br />

you can send timely,<br />

relevant e-mail messages<br />

to distressed<br />

homeowners that have a<br />

demonstrated need for<br />

your services.

Caution should be exercised, however, when asking a distressed homeowner<br />

for too much information. People don’t like volunteering too much information about<br />

them and if they are prompted for too much information, they are likely to hit the back<br />

button.<br />

We’ve seen some forms that ask the homeowner to fill out the property address,<br />

percentage of equity, source of income, how many days late they are, how much they<br />

owe on other bills, how many loans the homeowner has on their loans, and other details.<br />

Besides being overly prying, who has the time to fill all of that information out?<br />

It’s also a good practice to tell the homeowner that their information is confidential and<br />

perhaps even include a link to a privacy policy for extra assurance.<br />

It’s important to stay focused in your calls to action – too many of them and the visitor feels overwhelmed. Distressed<br />

homeowners need to take baby steps, and by limiting the number of choices they have once on your landing page, you reduce<br />

the amount of mental effort. For this reason, in our view, it is better to offer a singular report or a small number of reports,<br />

than to provide a cornucopia. All of your content can be great and empowering, but the homeowner should be guided along<br />

step by step. Do you have multiple calls to action? To indicate the relative importance of a call to action with respect to other<br />

actions, you can vary their sizes. The size of an element relative to its surrounding elements indicates its importance; the larger<br />

the element is, the more important it is. For example, maybe you want the homeowner to download an <strong>eBook</strong>, but you also<br />

want them to view testimonials of other homeowners that you have helped avoid foreclosure, as well as subscribe to your<br />

blog. Which call to action is more important? If downloading the <strong>eBook</strong> is a more important step that you want your visitor to<br />

take, make it more prominent. It’s not just the position or size of your call to action that matters. It’s also the space around it.<br />

The more space around a call to action, the more attention is drawn to it. If your call to action is cluttered with surrounding<br />

content, it will be lost in the overall noise of the page.<br />

Here are some sample elements we’ve come across that attempt to galvanize the homeowner into action:

When designing reports, consider that most newspapers and<br />

magazines are written at the 8 th grade level. Some of the<br />

more popular fare, such as People and US Weekly, are written<br />

more towards the 6 th grade level.<br />

You might be an expert on the housing market and have a huge vocabulary of<br />

foreclosure terms, but your audience is the distressed homeowner. You are not<br />

writing to a real estate economist. We’ve seen many reports that provided excellent<br />

information, but reads more like a college textbook.<br />

Does your report speak to the BENEFITS?<br />

One final tip we have when generating content is to ask yourself, “Does this information help distressed homeowners<br />

solve their problem, make their lives better, and most importantly, help them feel better?” Some content, in our view,<br />

doesn’t past that test. For example, many reports center around the credit consequences of a foreclosure versus a short<br />

sale. This might be a consideration for some people, but how vital is it? Most of the homeowners in our credit bureau<br />

database have low FICO scores. If their credit score is already marred, they simply don’t care that much about what the<br />

credit consequences of a foreclosure are. If their credit is atrocious, a less adverse mark on their credit by doing a short<br />

sale just isn’t much of an incentive. Sure, a homeowner may be denied a job with secret government clearance, but how<br />

many distressed homeowners are actively seeking jobs with Top Secret clearance? The task is to provide relevant content<br />

that helps them visualize the future and provide them with something that they desire more than the fear of the present.<br />

Using Online Video to Make a Connection<br />

In today’s online culture of instant gratification and information on demand, it is easier to press<br />

“Play” and watch something, than it is to read. Consider YouTube, a mass medium where over 35<br />

hours of video is uploaded every minute. It’s “always on” and you can watch just about anything<br />

imaginable on demand, it’s free, and you can watch it anywhere. In today’s fragmented media,<br />

younger home buyers and sellers aren’t flipping through the newspaper or watching television,<br />

they are zipping through cyberspace and congregating on YouTube, where you as the agent can<br />

communicate with them on their own turf.<br />

Unless you have a piano-playing cat or a sneezing baby panda, it’s unlikely<br />

that your video will go viral. But nothing can establish trust, empathy and<br />

rapport between you and the struggling mortgagor that visits your site, than<br />

a video. In the course of a 2 to 3 minute video, the homeowner can<br />

experience your voice, hear your tone, and develop a connection in a<br />

“fireside chat”. You have the ability to introduce yourself as someone that<br />

cares, someone that is a real person and one that is likeable. In order to<br />

agree to work with you, the homeowner has to like you and trust you, and a<br />

video is the perfect media to create this personal feel. Have you yourself<br />

experienced tough times? Mention this in the video. An agent in Oklahoma,<br />

for example, experienced tremendous hardship when the drilling industry<br />

was wiped out in the 80’s, and she capitalizes on this opportunity to relate<br />

her personal story and tell those distressed homeowners that she<br />

understands their difficulty because she was in the same boat.

10 Tips on Producing and Editing Video for Your<br />

Landing Page to Distressed Homeowners<br />

1. Your camera doesn’t have to be expensive.<br />

Cheap is fine. As an agent, you likely have a<br />

camera that can produce video. If not, chances<br />

are you know a kid that can lend you their<br />

camera.<br />

2. Get an external microphone jack. Sound is<br />

absolutely critical in an online video, and the<br />

internal microphones on cameras are normally<br />

poor. You can greatly improve sound quality by<br />

investing in an inexpensive external<br />

microphone jack for as little as $20 at Best Buy.<br />

3. Avoid windows. Windows look great on the<br />

late night airwaves with a sprawling<br />

background of LA with fake tinted windows and a zillion lights, but not so good for the layperson.<br />

4. Stay away from barren rooms or tiled floors. You want to avoid any echo.<br />

5. Short is sweet. We recommend a video length of no more than three minutes, otherwise you risk losing your audience.<br />

Studies from eyeviewdigital.com, a technology solutions provider to advertisers and ad agencies, show that the<br />

attention of your viewers will significantly atrophy as your video goes on.<br />

6. Get a tripod. Positioning your camera can be cumbersome. By getting an inexpensive tripod, you can place your<br />

camera seamlessly in the right place and hold it steady, without calling on other people to hold the camera for you.<br />

7. Import, edit and save your video using free software. If you have Windows, you probably have Movie Maker already<br />

installed on your computer or if you are a Mac person, IMovie.<br />

8. Camera shy? You can use screen recording which marries your voice to your web navigation. Cam Studio is an open<br />

source program you can use to capture what is on your computer screen and convert it to video. You can also record<br />

audio using an inexpensive set of headsets and add background music using Audacity, a free, cross platform software<br />

for recording and editing sounds.<br />

9. Don’t get bogged down in file formats. Videos can come in .wmv, .mov, .mp4, Flash and other formats, but you can<br />

upload to sites like YouTube, MetaCafe, Blip.TV and other video hosting sites that will convert your video file for you.<br />

You can then embed these videos into your website.<br />

10. State and amplify your call to action in the video. What do you want the homeowner to do NEXT? The distressed<br />

homeowner may find your video informative and leave your site. To retain your visitors, spell out in specific detail<br />

what steps you want the homeowner to take next. A video can be a great mechanism to fill out a form that is placed in<br />

close proximity. For example, you can say in your video, “Type in your e-mail address on the form above (and point to<br />

it) to discover how you can…” (complete the sentence)

Using Direct Mail<br />

Direct mail is a tried and true method to<br />

generate new business. During an age where a<br />

lot of marketers are zipping Tweets across<br />

cyberspace and pulling in fans for Facebook,<br />

direct mail can seem decidedly old school. Yet<br />

direct mail should not be dismissed as too<br />

pricey or passé, and can be combined with<br />

online marketing to create synergy. It also<br />

creates a more personal touch and is a snap to<br />

measure.<br />

Postcard Advertising<br />

When reaching out to distressed homeowners, postcards<br />

have been a popular vehicle. After receiving two of our<br />

lists, Andy Waldo, a Certified Distressed Property Expert in<br />

Winchester, Virginia, landed 10 listings by sending<br />

postcards. Countless others have had success with<br />

postcard marketing because they are cheap to print,<br />

cheap to mail, and they don’t have to be opened – they<br />

stare homeowners in the face. Yet there are some<br />

potential pitfalls when using this “tiny billboard”.<br />

Postcards should not be meant to close the<br />

homeowner. You can’t fit much information on a<br />

postcard. Your objective with a postcard, then, should not<br />

be to get the homeowner to commit to working with you,<br />

but to drive them to other outlets where they can obtain<br />

more information, such as a landing page. Your postcard<br />

can be a “teaser” that prods the distressed homeowner to<br />

learn more and continue the dialog that the postcard<br />

started.<br />

Repetition is key. If you send one postcard, one<br />

time, to one list, hopefully it will generate a response.<br />

But it is repetitive mailings over time that creates big,<br />

predictable results.<br />

Instead of a logo of your real estate company,<br />

how about a map to your office? In our view, a<br />

logo isn’t as important as a brick and mortar<br />

address. People want to see a real place and this is<br />

especially true for distressed homeowners that feel<br />

vulnerable. Having a real place for the homeowner<br />

to see and visit will go a long way to establishing<br />

credibility.<br />

Postcards should speak about benefits. In many<br />

postcards we have seen, the limited canvas space was<br />

squandered with large portraits of the agent and a list of<br />

their credentials. As discussed earlier, the only question<br />

the homeowner has is “What’s in it for me?” The<br />

homeowner is compelled to respond if you focus on<br />

emotional benefits. Here’s a postcard that does a good job<br />

mentioning tangible benefits.

Sending Letters<br />

We’re often asked what is better to mail to a homeowner falling behind on their mortgage payment, a postcard or letter?<br />

Our experience has shown that there is no silver bullet that is a clear winner in terms of a marketing vehicle. The biggest<br />

determinant of success is the number of “touch points” you make with the homeowner, using multiple vehicles and<br />

channels. Having said that, we believe that when sending letters, it will take less mailings to achieve an impact, relative to<br />

postcards. In other words, two to three letters will create as much results as sending four to five postcards. The reason is<br />

the intimate nature of a letter. In today’s fast-paced society, no one seems to take the time anymore to write a letter. It<br />

strikes of personal correspondence that is hard to ignore.<br />

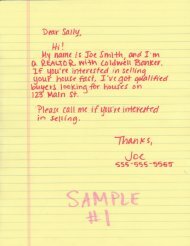

Yellow Letters<br />

A hybrid of the traditional sales letter is the “Yellow Letter”, a handwritten, usually<br />

brief message written on yellow rule paper. Its magic lies in its personal touch, look<br />

and feel. Since the homeowner sees that you took the time to handwrite the letter,<br />

the Yellow Letter smashes through the clutter and commands their attention. It’s as<br />

if receiving a wedding invitation or a birthday card from Uncle Tom. The drawback<br />

to the Yellow Letter is the amount of time required to individually write each piece.<br />

While there are computer programs you can use to simulate hand writing the best<br />

results come from authentic human handwriting. If you don’t want to get Carpel<br />

Tunnel, you can rely on our staff to do the handwriting for you.<br />

« You can view PDF samples of Yellow Letter here.<br />

The Envelope<br />

Studies show that recipients spend split seconds deciding whether to open your envelope.<br />

Regardless of how many time and work you invested in creating your mail piece, you can<br />

go from hero to goat in these mere seconds. Let’s face it – we all judge a book by its<br />

cover, and distressed homeowners will judge your direct mail by the envelope. Getting<br />

your envelope opened is half the battle, and today’s savvy consumer will often zone out<br />

anything that looks commercial. Want to guarantee that your mail piece is opened? Hand<br />

addressing your envelope will ensure that your message is read.<br />

As discussed in the first section of this <strong>eBook</strong>, distressed homeowners may have a<br />

preconceived stereotype of what you as a REALTOR does, and for this reason, consider<br />

eliminating your company logo and even your company name in the return address. By<br />

including only your name in the return address, it strikes of personal correspondence.<br />

A Word About Postage<br />

Postage is expensive and keeps rising. Since everyone wants to save coins nowadays, a postage<br />

meter can be tempting to shave marketing expenses, yet first class postage gets the highest open<br />

rate. Live stamps typically more than pay for themselves because it looks non-commercial. While<br />

first class postage creates the impact of personal correspondence, consider using unique, attentiongrabbing<br />

stamps with animal, seasonal, or holiday themes on it.

Think inside the box.<br />

Also referred to as “lumpy mail”, dimensional mail is mail that takes on any form<br />

other than your typical flat piece of mail. Although it can come in many shapes<br />

and sizes, all dimensional mail has one thing in common – it is practically<br />

guaranteed to be opened like a little kid opening presents underneath a<br />

Christmas tree. People love opening up packages and almost always pay<br />

attention to what’s inside.<br />

While dimensional mail costs more to produce and mail, the return on<br />

investment is superior. A real estate investor in Corpus Christi, Texas sends a<br />

fortune cookie to distressed homeowners on our list. The recipients open the<br />

fortune cookie and are greeted with a slip that says, “What’s in your home’s<br />

future? Save your home, call me”. This innovative campaign yields a double digit<br />

response. How clever is that?<br />

Snap Pack Mailers<br />

The easiest way to picture a snap pack mailer is an IRS refund check in the mail. The pressure sealed snap pack mailers is<br />

perforated on three sides for easy and official opening and is designed to look important. The recipient tears the perforated<br />

strips off the side and bottom of the mail piece in order to open it and see your message.<br />

Because of its official looking, urgent, time sensitive format design, snap pack mailers have an extremely high open rate.<br />

The snap pack mailer is familiar to the mortgage industry that promotes government sponsored refinance initiatives. Enter<br />

the new guidelines of HARP 2.0 and the listing agent can harness the official look of the snap pack mailer to grab<br />

homeowners by their eyeballs and start a conversation about their eligibility to lock in historically low rates under the<br />

revamped Obama guidelines. In terms of a lead capture system, it is easier to “hook” distressed homeowners on learning<br />

about their eligibility for the HARP 2.0 program, than asking them to list their home. When the homeowner doesn’t meet<br />

the requirements, you can now educate them on the other options at their disposal.

Knocking On The Doors Of Distressed<br />

Homeowners<br />

How many ads can pull a football fanatic out of<br />

his chair, during an exciting football game, to<br />

see or hear your advertisement? The answer is<br />

none. Delivering your message of hope and<br />

solutions in person to a captive audience at the<br />

doorstep can make the most indelible<br />

impression.<br />

Here is some sample verbiage we’ve come across that has worked well for other agents when door knocking:<br />

KNOCK KNOCK. “Hi, Mr. Smith… my name is Bob, I’m a local real estate/short sale expert, I provide ethical,<br />

compassionate solutions to problems with real estate loans and I’m visiting the neighbors this evening… I<br />

hope I’m not interrupting dinner, I just want to get a couple of these in your hands and get out of your<br />

hair…. (hand them a card, flyer or other collateral with a link to your free resource).<br />

This is a book I put together and I’m not sure if this applies to you or not, Mr, Smith, but I’m sure you<br />

know someone here in Maricopa County that is having a hard time making their mortgage payment or<br />

owes more on their house than what it’s worth, and if you give this to them, they’ll thank you, I know<br />

they will. It’s not about me, I wish they would call me, but they’ll thank you for this. This book will show<br />

them how to avoid foreclosure, it’s got all the tools they need, resources to pull it off. Maybe they want to<br />

sell their house for free – short sale – deed in lieu of foreclosure, maybe they just want the bank to<br />

foreclose, maybe they’ve been trying to modify that loan for six months now and it’s just not going<br />

anywhere. This book will talk about that, too, and what to expect. So can I leave you with a couple of these<br />

and you can download it and get a free copy and you can send it to whoever you might know, maybe a coworker,<br />

someone at the gym, family member, friend, that is upside down on their primary residence – or<br />

investment property – it doesn’t really matter, this book will help them out, it will show them the way out,<br />

well, out of the woods. I appreciate your time, have a fantastic evening”.<br />

The key component to this is “I’m not sure if this applies to you or not, but I’m sure you know someone”… this<br />

verbiage disarms the homeowner because you are not singling them out. If you are using our list, you never want to<br />

profess that you have inside knowledge that they are falling behind on their mortgage payment – it will be the<br />

quickest way to get thrown off the porch.

Some Pointers When Canvasing In Person<br />

Have a Script <strong>Pre</strong>pared<br />

When you are face-to-face with a distressed<br />

homeowner, your goal is to make an<br />

emotional connection. In theater, all actors are<br />

scripted because they are trying to build<br />

emotional excitement with the audience. In<br />

the same way, you should have a script<br />

prepared instead of “winging it.” Whether it’s<br />

our example or another script, you should<br />

know what you are going to say before you say<br />

it. You have a small window of opportunity to<br />

introduce yourself as someone that genuinely<br />

cares about their plight. Many agents and<br />

investors mistakenly blurt the first words out<br />

of their mouth and never recover.<br />

Ask To Come Inside<br />

Many novices think that the deal is going to be<br />

made right on the front porch. If the<br />

homeowner is receptive to learning more, try<br />

to face them on the turn they feel most<br />

comfortable in – their kitchen table.<br />

Nobody Home? Leave Behind an Overnight<br />

Mail Package<br />

Obviously, the homeowner will not always be at their<br />

residence when you visit, but rather than squander the<br />

opportunity by moving on to the next house, drop off an<br />

Express envelope with your material. Some people insert a<br />

door hanger, but door hangers look commercial. Many<br />

homeowners will not even bother to read what is on the<br />

door hanger and just assume it is from Dominos Pizza.<br />

Not Up To Door Knocking? Hire someone else<br />

to do it.<br />

Let’s face it – it takes a special kind of person to knock on<br />

doors, and not everyone is cut out for it. Still others that are<br />

not averse to knocking on doors say that they are simply too<br />

busy to go up and down the street. If this sounds like you,<br />

you can still harness the power of door knocking by paying<br />

someone else to perform this task.<br />

Modesty is Important – No Bling<br />

Image isn’t everything… unless you want to<br />

succeed. If you pull up to the homeowner’s<br />

address in a fancy car with a suit and<br />

expensive jewelry, you look like an opportunist<br />

that stands to profit from the homeowner’s<br />

misery. Conservatism is key.<br />

Look Non-Threatening<br />

First impressions are key. When the<br />

homeowner looks out to see who is knocking<br />

on their door, you better look nonthreatening.<br />

Keep your hands in plain view and<br />

stay a sufficient distance from the entrance. If<br />

you hear the homeowner coming to the door,<br />

perhaps back up and turn sideways, as if to<br />

leave. This will convey that you are not a<br />

threat.

The Marketing Secret Every Child Knows<br />

“Don’t expect results after one<br />

call, mailing or door knock. The<br />

foreclosure process can take<br />

months, and many distressed<br />

homeowners will refuse to face<br />

the reality of their situation<br />

until their time has run out.<br />

As with any effective outreach<br />

campaign, follow the “Rule of<br />

7” which states that the<br />

majority of prospects need to<br />

be contacted a minimum of<br />

seven times before they notice<br />

your message. Distressed<br />

homeowners, who are often in<br />

denial of their situation, may<br />

require even more touches.<br />

Stick with it; persistence is<br />

key”…<br />

Article from the February Issue<br />

of the Distressed Property<br />

Newsletter<br />

You probably tell your clients Location, Location, Location. We<br />

tell our clients Repetition, Repetition, Repetition.<br />

If you are a parent, you know how hard it is to refuse repeated requests for an ice<br />

cream or a desperately wanted toy. If you are not a parent, you probably<br />

remember asking, even begging for a toy, a treat, or permission to stay up past<br />

your bedtime, until your parents finally gave in.<br />

Distressed homeowners are similar.<br />

They need to be asked repeatedly, too.<br />

The reality is marketing has never meant<br />

to be and will never be a one-time shot.<br />

It’s a well-established marketing axiom<br />

that any communication is most<br />

effective when it is repeatedly brought<br />

in front of your target audience. It may<br />

take multiple “touches” to create the<br />

trust and rapport necessary for<br />

homeowners to give in. Familiarity<br />

builds credibility, which in turn builds<br />

trust.<br />

This rule of repetition is even more important when contacting homeowners that<br />

are late on their mortgage payment. In ordinary mailings, the intended recipient<br />

may have been away, lost or misplaced the mail piece, been distracted with more<br />

pressing tasks, or a myriad of other possibilities. When mailing to financially<br />

distressed homeowners, these homeowners are oftentimes facing major life<br />

events such as a divorce, loss of a job, and other tumultuous circumstances that<br />

compete with your message for their attention.<br />

We're often asked what the best marketing vehicle is to generate a response. Is it a<br />

post card, a phone call, a letter, a knock on the door, or is it best to drive them to a<br />

website? The answer is all of the above. There is no silver bullet. Rather, it is<br />

constant exposure to your service that is the biggest determinant of success.<br />

Consider the marketing of Publishers Clearing House. Here is a company who sells<br />

magazines with great flare… “Win 10 million dollars in the Publishers Clearing<br />

House Sweepstakes!” You’d think everyone would jump at the chance to win all<br />

that money and get their magazine of choice, right? Of course not – we all know<br />

it’s not that easy. They get people to buy its magazines through an absolutely<br />

incredible marketing campaign. The center point of that campaign is repetitive<br />

mailings over an extended period of time.<br />

Follow this principle and you will have a smile on your face just like the child with a<br />

belly full of ice cream that they convinced mom or dad to buy.

The Mailbox versus the Inbox – the ultimate boxing match, right?<br />

Actually, smart marketers know that it’s not about choosing one corner. Rather, you can<br />

integrate both mail and the Internet into your media mix to create synergy. One plus<br />

one isn’t two, it’s four.<br />

For instance, your postcard can drive distressed homeowner’s to a landing page where they can enter their e-mail<br />

address in order to access a video or free report. Rick Lemmons, an agent in Ohio, understood the marriage between<br />

direct mail and the Internet when he sent a letter to distressed homeowners. It’s a surprising fact – a staggering 4 out of<br />

5 people read the P.S. of a letter first, because it’s viewed as a more intimate message. In his P.S, he invited the reader<br />

to watch a YouTube video that had an interview format that defined some key foreclosure terms. « Watch the video<br />

here. Upon last check, this video generated over $800,000 in new listings.<br />

Provide Something Extra<br />

A free gas card or gift card may be the extra incentive<br />

necessary to unfreeze homeowners into action and get some<br />

face to face time. There’s something magical about the word<br />

“FREE”. Let’s say your mail piece drives a homeowner to your<br />

web site, where they enter their e-mail address to download a<br />

free report. You can then e-mail the homeowner with<br />

additional information and inform the homeowner they will<br />

get a free $50 gas card by coming in to your office for a 20-<br />

minute consultation to figure out the best option legally<br />

available for their situation.<br />

Times are tough, especially so for a delinquent homeowner. For this reason, a free gas card or other promotional item can<br />

be the extra prod it takes to get in front of borrowers that need your help. This type of promotional marketing strategy is<br />

commonplace with other products and services, but rare in the distressed property industry. You can provide the best<br />

solution for the homeowner and with a gas card, you put your money where your mouth is.<br />

Put an Expiration Date on Your Offer<br />

We've all received pieces of mail that want us to do<br />

something. And they're typically covered with act now,<br />

supplies are limited, this is a limited time offer, this offer<br />

expires soon, this is a once in a lifetime opportunity, and so<br />

on. Why do people still do this? Everyone knows that the<br />

limited time offer is probably twenty years. The answer is<br />

because it works. In the above example of offering a free<br />

gas card in exchange for a face to face meeting, you can<br />

create urgency by telling the homeowner they have to act<br />

by Friday in order to get the gift.

Directing Distressed Homeowners to a Hotline<br />

Many delinquent homeowners are cautious and would prefer the<br />

anonymity of listening to a recording that presents your message of<br />

hope and solutions.<br />

One way to overcome a distressed homeowner’s inaction and lack of trust is to send them to a pre-recorded hotline<br />

that makes an introduction and provides an overview of what some of the homeowner’s options are. Many<br />

homeowners that are otherwise hesitant to call you, would call a hotline to hear a recorded message. This is a nonthreatening<br />

call to action – there is little perceived risk on the part of the homeowner. A hotline also provides the<br />

opportunity to add a human element – the homeowner gets to hear your voice and tone. You can enable your hotline<br />

to be patched through to a live person. If the homeowner is comfortable with the message and/or messenger, they can<br />

dial 1 to start a conversation.<br />

There are many affordable technology providers such as Voice Nation that can set up your hotline. We recommend<br />

keeping your message relatively short, perhaps two to three minutes long so as to not lose the listener’s attention. The<br />

goal with your hotline should not overwhelm the homeowner with too much information, close the homeowner, or<br />

provide every detail on what their options are. At this stage, the objective should be to start a “heart to heart”<br />

conversation with the listener that establishes trust and rapport with a calm voice of reasoning and empathy.<br />

“I started mailing to the pre-foreclosure list in 2004. The most effective mail pieces for generating immediate business have<br />

always been the toll-free Recorded Messages. I find that a six-piece sequence over 3-4 weeks to around 400 homeowners gets the<br />

phone ringing immediately, averaging a couple calls per day for 2-3 weeks”<br />

- Ross Kilburn, Seattle Short Sales, Inc.<br />

“Sellers in distress are looking for solutions, but are very cautious as there is so much info/mis-info going around. By providing<br />

low risk, low or no exposure information to these folks gives them the ability to anonymously shop for a solution provider who<br />

they feel comfortable with. Whether it be websites, recorded messages or chat – no matter. The more media types, the larger<br />

your potential audience. Once size doesn’t fit all ” - Steve Mallires, Real Choices Realty<br />

The added benefit to using a pre-recorded hotline is that the phone numbers of incoming calls can be logged so if the<br />

listener does not eventually take action, you can call them back to follow-up.

Tracking Your Results<br />

The reality is there are myriad variables that influence the success of your campaign to distressed homeowners. Your<br />

headline, your copy, your call to action, the frequency of contact, even the day of the week and colors are just some of<br />

the factors that play a role. Our advice is to TEST, TEST TEST again to see what works – and what doesn’t work.<br />

For example, let’s say you want to know which a more compelling<br />

report is. You can send 1,000 postcards that are identical except for<br />

the free report offered.<br />

You send 500 postcards to delinquent homeowners which prompt<br />

them to download a report on “The five mistakes you can’t afford to<br />

make if you fall behind on your mortgage payments”. You sent 500<br />

postcards to another set of homeowners which asks them to<br />

download a free report “Are you eligible for the Home Affordable<br />

Refinance Act under the new Obama guidelines?”<br />

You can clearly discern which report is more alluring. If 13 people download your report on the mistakes they<br />

shouldn’t make and 7 people download your report on the HARP program, you can say that the first report generated<br />

nearly a 50% better response and thus, promote that report more heavily.<br />

When conducting this A/B or “bucket” testing, it’s important to keep other things equal besides the specific element<br />

you want to test. For instance, if you are testing the report offered, the two different report s should be on landing<br />

pages with the same design. If they are on pages with unlike designs, you can’t conclude that more people<br />

downloaded “Report A” because it was more interesting than “Report B”. Perhaps Report A was placed higher on the<br />

page, with big bolded text and/or arrows that prominently directed attention to download the report, whereas Report<br />

B was placed lower in the page with less attention-getting callouts around it.<br />

Conversely, let’s say you want to test the design of your landing page, you would keep the report constant – you offer<br />

the same report but with different page designs. In this case, you can determine which is the more compelling design<br />

because more people downloaded your report on “Page A” than they did on “Page B”.<br />

If you are not tracking your marketing to distressed<br />

homeowners, you are not marketing. The results of your<br />

marketing should not be left to chance. Rather, it should<br />

be a deliberate, calculated and methodic approach of<br />

testing what works, and what doesn’t work.<br />

Significant improvements can be seen through<br />

testing elements like copy text, layouts, images<br />

and colors. However, not all elements produce<br />

the same improvements, and by looking at the<br />

results from different tests, it is possible to<br />

identify those elements that consistently tend to<br />

produce the greatest improvements.

The Most Important Component of Your Marketing Is The List.<br />

At Homestead <strong>Data</strong>, we provide early, accurate and exclusive pre-foreclosure data for real estate professionals. In the short<br />

sale business, nothing increases profits more than being the first. Unlike the vast majority of other pre-foreclosure sources that<br />

compile their information through public records, our “soft” credit data is not yet public information, as illustrated in this time<br />

chart:<br />

For expert consultation, fast counts and custom quotes, call us at 1-866-490-3459, or visit www.preforeclosuredata.net.<br />

Did you find this <strong>eBook</strong> informative? Stay in touch to subscribe to updated<br />

blog posts, articles, videos and insight into the distressed property industry.<br />

Subscribe via E-mail<br />

Follow us on Twitter @shortsaledata