audit reports

audit reports

audit reports

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

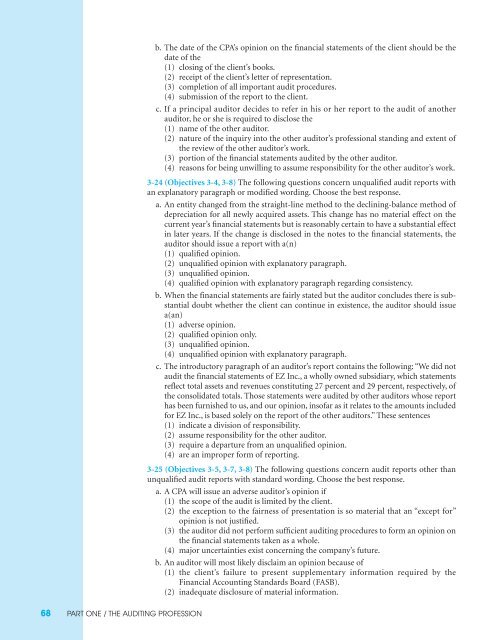

. The date of the CPA’s opinion on the financial statements of the client should be the<br />

date of the<br />

(1) closing of the client’s books.<br />

(2) receipt of the client’s letter of representation.<br />

(3) completion of all important <strong>audit</strong> procedures.<br />

(4) submission of the report to the client.<br />

c. If a principal <strong>audit</strong>or decides to refer in his or her report to the <strong>audit</strong> of another<br />

<strong>audit</strong>or, he or she is required to disclose the<br />

(1) name of the other <strong>audit</strong>or.<br />

(2) nature of the inquiry into the other <strong>audit</strong>or’s professional standing and extent of<br />

the review of the other <strong>audit</strong>or’s work.<br />

(3) portion of the financial statements <strong>audit</strong>ed by the other <strong>audit</strong>or.<br />

(4) reasons for being unwilling to assume responsibility for the other <strong>audit</strong>or’s work.<br />

3-24 (Objectives 3-4, 3-8) The following questions concern unqualified <strong>audit</strong> <strong>reports</strong> with<br />

an explanatory paragraph or modified wording. Choose the best response.<br />

a. An entity changed from the straight-line method to the declining-balance method of<br />

depreciation for all newly acquired assets. This change has no material effect on the<br />

current year’s financial statements but is reasonably certain to have a substantial effect<br />

in later years. If the change is disclosed in the notes to the financial statements, the<br />

<strong>audit</strong>or should issue a report with a(n)<br />

(1) qualified opinion.<br />

(2) unqualified opinion with explanatory paragraph.<br />

(3) unqualified opinion.<br />

(4) qualified opinion with explanatory paragraph regarding consistency.<br />

b. When the financial statements are fairly stated but the <strong>audit</strong>or concludes there is sub -<br />

stan tial doubt whether the client can continue in existence, the <strong>audit</strong>or should issue<br />

a(an)<br />

(1) adverse opinion.<br />

(2) qualified opinion only.<br />

(3) unqualified opinion.<br />

(4) unqualified opinion with explanatory paragraph.<br />

c. The introductory paragraph of an <strong>audit</strong>or’s report contains the following: “We did not<br />

<strong>audit</strong> the financial statements of EZ Inc., a wholly owned subsidiary, which statements<br />

reflect total assets and revenues constituting 27 percent and 29 percent, respectively, of<br />

the consolidated totals. Those statements were <strong>audit</strong>ed by other <strong>audit</strong>ors whose report<br />

has been furnished to us, and our opinion, insofar as it relates to the amounts included<br />

for EZ Inc., is based solely on the report of the other <strong>audit</strong>ors.” These sentences<br />

(1) indicate a division of responsibility.<br />

(2) assume responsibility for the other <strong>audit</strong>or.<br />

(3) require a departure from an unqualified opinion.<br />

(4) are an improper form of reporting.<br />

3-25 (Objectives 3-5, 3-7, 3-8) The following questions concern <strong>audit</strong> <strong>reports</strong> other than<br />

unqualified <strong>audit</strong> <strong>reports</strong> with standard wording. Choose the best response.<br />

a. A CPA will issue an adverse <strong>audit</strong>or’s opinion if<br />

(1) the scope of the <strong>audit</strong> is limited by the client.<br />

(2) the exception to the fairness of presentation is so material that an “except for”<br />

opinion is not justified.<br />

(3) the <strong>audit</strong>or did not perform sufficient <strong>audit</strong>ing procedures to form an opinion on<br />

the financial statements taken as a whole.<br />

(4) major uncertainties exist concerning the company’s future.<br />

b. An <strong>audit</strong>or will most likely disclaim an opinion because of<br />

(1) the client’s failure to present supplementary information required by the<br />

Financial Accounting Standards Board (FASB).<br />

(2) inadequate disclosure of material information.<br />

68 PART ONE / THE AUDITING PROFESSION