Fall 2009 - Presbyterian Homes & Services

Fall 2009 - Presbyterian Homes & Services

Fall 2009 - Presbyterian Homes & Services

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Giving and Receiving<br />

through a Charitable Gift Annuity<br />

After a successful career helping<br />

employers with employee pensions and<br />

profit-sharing, Hugh Madson knows a wise<br />

charitable gift option when he sees one.<br />

<br />

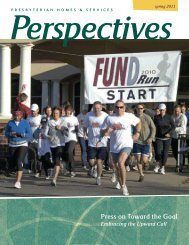

Hugh and Marilyn<br />

Madson<br />

That’s why he and his wife, Marilyn, agreed<br />

to arrange a Charitable Gift Annuity (CGA),<br />

transferring financial assets to <strong>Presbyterian</strong><br />

<strong>Homes</strong> Foundation (PHF) in exchange for a<br />

guaranteed, fixed income for life.<br />

Hugh and Marilyn are life-long St. Croix<br />

Valley residents who lived in Lake Elmo,<br />

Minnesota for nearly 50 years. They moved<br />

to the Brownstones at Boutwells Landing<br />

in 2004, and credit Steve Preus, PHF<br />

Executive Director, for their involvement<br />

in the planning of and fundraising for the<br />

Boutwells Landing care center. “We have<br />

been very impressed with the management<br />

of <strong>Presbyterian</strong> <strong>Homes</strong> & <strong>Services</strong> (PHS)<br />

and the Foundation,” said Hugh.<br />

Years before he was ready to retire from<br />

Aetna Life Insurance Company, Hugh held<br />

countless conversations with employees<br />

and employers as they considered<br />

what pension options would best suit<br />

their goals. So when Hugh and Marilyn<br />

considered their own retirement plans, the<br />

concept of a CGA was not new to them.<br />

The choice was appealing. “With the way<br />

the economy is developing along with our<br />

personal planning, we thought this was a<br />

good time to take advantage of (a CGA)<br />

to give to an organization we believe in,”<br />

said Hugh. The advantage is that while<br />

supporting PHS, a CGA also offers them<br />

a valuable stream of income for their lives.<br />

Their CGA is a simple contractual<br />

agreement between the Madsons and<br />

<strong>Presbyterian</strong> <strong>Homes</strong> Foundation. Their gift<br />

effectively advances the mission of PHS,<br />

while they receive fixed payments each<br />

year for life, a portion of which is tax-free.<br />

Their annual payment is guaranteed - no<br />

matter what happens to interest rates or<br />

to the stock market. Hugh explains. “It fits<br />

well into our overall planning.”<br />

Hugh and Marilyn’s plans fulfill their<br />

philanthropic as well as financial goals.<br />

“A CGA provides us with the opportunity<br />

to make a charitable gift and receive a<br />

reasonable income” said Hugh. After their<br />

lifetime, the remaining amount of their<br />

gift will be used to support PHS. “Over<br />

the years we have given to charitable<br />

organizations that provide excellent service<br />

to others. We believe PHS does just that.”<br />

To find out if a CGA meets your personal,<br />

financial, and philanthropic goals,<br />

contact <strong>Presbyterian</strong> <strong>Homes</strong> Foundation.<br />

A representative will answer any<br />

questions and provide a confidential,<br />

no-obligation calculation of your PHF<br />

Charitable Gift Annuity.<br />

24<br />

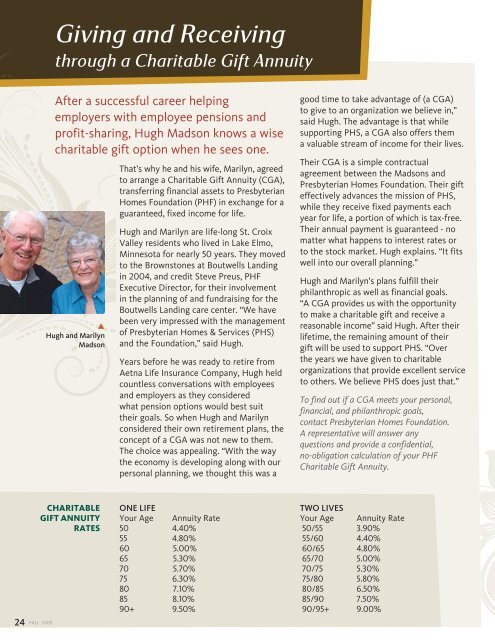

CHARITABLE<br />

GIFT ANNUITY<br />

RATES<br />

FALL <strong>2009</strong><br />

ONE LIFE<br />

Your Age Annuity Rate<br />

50 4.40%<br />

55 4.80%<br />

60 5.00%<br />

65 5.30%<br />

70 5.70%<br />

75 6.30%<br />

80 7.10%<br />

85 8.10%<br />

90+ 9.50%<br />

TWO LIVES<br />

Your Age Annuity Rate<br />

50/55 3.90%<br />

55/60 4.40%<br />

60/65 4.80%<br />

65/70 5.00%<br />

70/75 5.30%<br />

75/80 5.80%<br />

80/85 6.50%<br />

85/90 7.50%<br />

90/95+ 9.00%