Prowealth SMSF Setup Forms

Prowealth SMSF Setup Forms

Prowealth SMSF Setup Forms

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

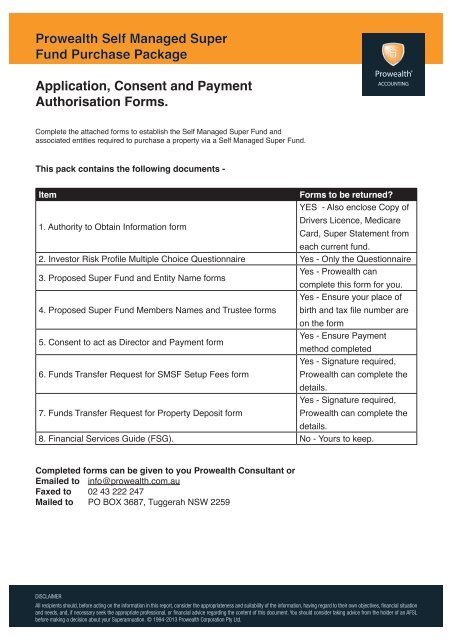

<strong>Prowealth</strong> Self Managed Super<br />

Fund Purchase Package<br />

Application, Consent and Payment<br />

Authorisation <strong>Forms</strong>.<br />

Complete the attached forms to establish the Self Managed Super Fund and<br />

associated entities required to purchase a property via a Self Managed Super Fund.<br />

This pack contains the following documents -<br />

Item<br />

<br />

<br />

3. Proposed Super Fund and Entity Name forms<br />

4. Proposed Super Fund Members Names and Trustee forms<br />

5. Consent to act as Director and Payment form<br />

6. Funds Transfer Request for <strong>SMSF</strong> <strong>Setup</strong> Fees form<br />

7. Funds Transfer Request for Property Deposit form<br />

<br />

<strong>Forms</strong> to be returned?<br />

YES - Also enclose Copy of<br />

Drivers Licence, Medicare<br />

Card, Super Statement from<br />

each current fund.<br />

<br />

Yes - <strong>Prowealth</strong> can<br />

complete this form for you.<br />

Yes - Ensure your place of<br />

<br />

on the form<br />

Yes - Ensure Payment<br />

method completed<br />

Yes - Signature required,<br />

<strong>Prowealth</strong> can complete the<br />

details.<br />

Yes - Signature required,<br />

<strong>Prowealth</strong> can complete the<br />

details.<br />

No - Yours to keep.<br />

Completed forms can be given to you <strong>Prowealth</strong> Consultant or<br />

Emailed to info@prowealth.com.au<br />

Faxed to 02 43 222 247<br />

Mailed to PO BOX 3687, Tuggerah NSW 2259<br />

DISCLAIMER<br />

All recipients should, before acting on the information in this report, consider the appropriateness and suitability of the information, having regard to their own objectives, financial situation<br />

and needs, and, if necessary seek the appropriate professional, or financial advice regarding the content of this document. You should consider taking advice from the holder of an AFSL<br />

before making a decision about your Superannuation. © 1994-2013 <strong>Prowealth</strong> Corporation Pty Ltd.

Authority To Obtain Information<br />

Date / /<br />

To whom it may concern,<br />

<br />

<br />

On presentation of this authorization, please provide <strong>Prowealth</strong> Financial Planning with full access<br />

to my records and information so that they can advise me appropriately.<br />

Print Full Name<br />

Signature<br />

Date of Birth / /<br />

Print Full Name<br />

Signature<br />

Date of Birth / /<br />

Residential Address<br />

Advisor Name<br />

Print Full Name<br />

Signed / /<br />

My advisor can be contacted directly on 1800 13 22 64.<br />

<strong>Prowealth</strong> Investments and Hunter Valley Real Estate are trading names of the <strong>Prowealth</strong> Corporation Pty Ltd ABN 20 126 015 594, Real Estate License No. 1624276. <strong>Prowealth</strong> Money Pty Ltd, ABN 98 125 416 971, Australian Credit<br />

License No. 378618. <strong>Prowealth</strong> Accounting is a trading name of <strong>Prowealth</strong> Accounting Services ABN 66 157 963 481 and is a registered Tax Agent No. 28067002, Liability limited by a scheme approved under Professional Standards<br />

Legislation. <strong>Prowealth</strong> Financial Planning Pty Ltd, ABN 32 143 548 994, Corporate Representative No. 420456 is an authorised representative of Podone Pty Ltd, ABN27 160 419 134, Australian Financial Services Licence No. 429718. The<br />

word ‘<strong>Prowealth</strong>’ and the ‘<strong>Prowealth</strong> Shield Logo’s are registered trademarks used with permission of IP Central Pty Ltd.

UNDERSTANDING INVESTOR RISK PROFILES<br />

Understanding your tolerance to risk will help us to ensure we recommend investments that<br />

<br />

Please be aware that this questionnaire and the outcome does not replace the discussion<br />

you have with your Financial Planner about your tolerance to risk, and the ability to meet<br />

your needs and objectives.<br />

<br />

is necessary to enable us to make appropriate recommendations and will be used solely<br />

for that purpose. We accept no liability for any advice given on the basis of inaccurate or<br />

incomplete information.<br />

Guidelines for Client<br />

<br />

<br />

expected.<br />

<br />

investment return, the higher the risk you are likely to be taking. Low expected investment returns generally mean that<br />

<br />

addition to this, you also need to consider the time frame that you wish to invest your money for. This is referred to as your<br />

<br />

<br />

Different people are comfortable with different levels of risk. Some people are very comfortable taking high risks, in return<br />

<br />

to high levels of risk.<br />

Do i complete the questionnaire or does my Financial Planner complete it for me?<br />

To ensure we accurately capture your attitude to risk and volatility it is required that you complete the questionnaire yourself.<br />

<br />

Possible Investor Outcomes<br />

Secure<br />

This portfolio is suitable for investors who seek to preserve<br />

and protect their entire capital base and prefer only a small<br />

exposure to risk. The probability of a negative return in any<br />

one year is 0% and the recommended investment horizon is<br />

approximately 12 months.<br />

Generally Defensive 100% / Growth 0% mix.<br />

Defensive<br />

This portfolio is suitable for defensive investors who seek<br />

moderate returns and do not wish to take on more than a<br />

low level of risk as capital protection is a major concern.<br />

Historically, the probability of a lower than expected return,<br />

in any one year is 4% and the recommended investment<br />

horizon is 1 to 3 years.<br />

Generally Defensive 80% / Growth 20% mix.<br />

Conservative<br />

This portfolio is suitable for investors who wish to establish<br />

<br />

<br />

moderate level of volatility (positive and negative movement)<br />

in the overall capital value of investments. Historically the<br />

probability of a lower than expected return, in any one year<br />

is 11% and the recommended investment horizon is 3-4<br />

years.<br />

Generally Defensive 60% / Growth 40% mix.<br />

Balanced<br />

<br />

portfolio and can accept some level of volatility in the value<br />

<br />

takers. Historically, the probability of a negative return in any<br />

one year is 16% and the recommended investment horizon<br />

is 4-5 years.<br />

Generally Defensive 40% / Growth 60% mix.<br />

Growth<br />

This portfolio is suitable for investors who seek to invest<br />

in a broad spread of quality investments, predominantly in<br />

growth assets, to achieve higher growth and can accept<br />

higher levels of investment risks. Historically, the probability<br />

of a negative return in any one year is 18% and the<br />

recommended investment horizon is 5-7 years.<br />

Generally Defensive 20% / Growth 80% mix.<br />

High Growth<br />

This portfolio is suitable for investors who seek to invest<br />

exclusively in growth assets due to their growth potential<br />

and can accept a very high level of volatility in the value<br />

of investments. Historically, the probability of a negative<br />

return in any one year is 20% and the recommended<br />

investment time-frame is over 7 years.<br />

Generally Defensive 0% / Growth 100% mix.

Name<br />

Signature<br />

Date<br />

Circle the most appropriate answer<br />

1. How long is the period of your investment?<br />

Less than 1 year [ 0 ]<br />

1-2 years [ 1 ]<br />

2-4 years [ 2 ]<br />

4-7 years [ 3 ]<br />

7- 10 years [ 4 ]<br />

More than 10 years [ 5 ]<br />

2. Generally speaking, given the proposed term of your<br />

investment, how would you describe your willingness to<br />

<br />

higher returns?<br />

Not at all [ 0]<br />

Low [ 3 ]<br />

Moderate [ 7 ]<br />

High [ 12 ]<br />

Very High [ 15 ]<br />

3. <br />

<br />

Not at all [ 0 ]<br />

I have some comfort [ 3 ]<br />

I’m comfortable [ 6 ]<br />

I’m very comfortable [ 10 ]<br />

4. How much income do you expect to receive from other<br />

sources during the investment period?<br />

None [ 0 ]<br />

A little [ 2 ]<br />

A reasonable amount [ 5 ]<br />

Enough to live on [ 7 ]<br />

More than enough [ 10 ]<br />

5. Generally speaking, and considering the proposed term of<br />

your investment, which of the following statements best<br />

summarises your objective?<br />

Preservation of capital [ 0 ]<br />

Consistent income with security of capital [ 2 ]<br />

Steady income and some capital growth, with the associated<br />

limited volatility<br />

[ 4 ]<br />

A balance of income and capital growth, with some volatility [ 6 ]<br />

Capital growth is more important than income [ 8 ]<br />

Capital growth only, with the associated greater volatility [ 10 ]<br />

6. Investment markets can go up or down in value. At<br />

what point would you feel uncomfortable about your<br />

investment?<br />

Any fall in value [ 0 ]<br />

A fall of 5% [ 3 ]<br />

A fall of 10% [ 6 ]<br />

A fall of 20% [ 12 ]<br />

A fall of more than 25% [ 15 ]<br />

7. Assuming you were invested for the longer term and the<br />

value of your investments fell by 25% in value, would<br />

you:<br />

Move your investments to cash immediately? [ 0 ]<br />

Consider moving to cash within 3 months [ 3 ]<br />

Consider moving half your investments to cash within 6<br />

months?<br />

[ 6 ]<br />

Stay invested but have some concern? [ 10 ]<br />

Stay invested and not be concerned? [ 15 ]<br />

8. How important to you is it that the value of your<br />

<br />

Not important – I would rather protect the value of my<br />

investment<br />

Slightly important – but I’m not prepared to take unnecessary<br />

risks<br />

Fairly important – I know that I will need to take some risks<br />

<br />

Very important – my priority is for these funds to grow<br />

<br />

8. 9. How would you describe your understanding of the<br />

investment markets?<br />

I have very little understanding or interest.<br />

I understand it is a good idea to invest in general<br />

I have enough experience to understand that markets<br />

<br />

I am an experienced investor in some asset classes.<br />

I am experienced and knowledgeable about all asset classes.<br />

Investor Type Results<br />

Total Score =<br />

[ 0 ]<br />

[ 3 ]<br />

[ 7 ]<br />

[ 10 ]<br />

[ 0 ]<br />

[ 4 ]<br />

[ 6 ]<br />

[ 8 ]<br />

[ 10 ]<br />

Score<br />

Secure < 15<br />

Defensive 16 - 29<br />

Conservative 30 - 49<br />

Balanced 50 - 69<br />

Growth 70 - 85<br />

High Growth > 85

Name<br />

Signature<br />

Date<br />

Circle the most appropriate answer<br />

1. How long is the period of your investment?<br />

Less than 1 year [ 0 ]<br />

1-2 years [ 1 ]<br />

2-4 years [ 2 ]<br />

4-7 years [ 3 ]<br />

7- 10 years [ 4 ]<br />

More than 10 years [ 5 ]<br />

2. Generally speaking, given the proposed term of your<br />

investment, how would you describe your willingness to<br />

<br />

higher returns?<br />

Not at all [ 0]<br />

Low [ 3 ]<br />

Moderate [ 7 ]<br />

High [ 12 ]<br />

Very High [ 15 ]<br />

3. <br />

<br />

Not at all [ 0 ]<br />

I have some comfort [ 3 ]<br />

I’m comfortable [ 6 ]<br />

I’m very comfortable [ 10 ]<br />

4. How much income do you expect to receive from other<br />

sources during the investment period?<br />

None [ 0 ]<br />

A little [ 2 ]<br />

A reasonable amount [ 5 ]<br />

Enough to live on [ 7 ]<br />

More than enough [ 10 ]<br />

5. Generally speaking, and considering the proposed term of<br />

your investment, which of the following statements best<br />

summarises your objective?<br />

Preservation of capital [ 0 ]<br />

Consistent income with security of capital [ 2 ]<br />

Steady income and some capital growth, with the associated<br />

limited volatility<br />

[ 4 ]<br />

A balance of income and capital growth, with some volatility [ 6 ]<br />

Capital growth is more important than income [ 8 ]<br />

Capital growth only, with the associated greater volatility [ 10 ]<br />

6. Investment markets can go up or down in value. At<br />

what point would you feel uncomfortable about your<br />

investment?<br />

Any fall in value [ 0 ]<br />

A fall of 5% [ 3 ]<br />

A fall of 10% [ 6 ]<br />

A fall of 20% [ 12 ]<br />

A fall of more than 25% [ 15 ]<br />

7. Assuming you were invested for the longer term and the<br />

value of your investments fell by 25% in value, would<br />

you:<br />

Move your investments to cash immediately? [ 0 ]<br />

Consider moving to cash within 3 months [ 3 ]<br />

Consider moving half your investments to cash within 6<br />

months?<br />

[ 6 ]<br />

Stay invested but have some concern? [ 10 ]<br />

Stay invested and not be concerned? [ 15 ]<br />

8. How important to you is it that the value of your<br />

<br />

Not important – I would rather protect the value of my<br />

investment<br />

Slightly important – but I’m not prepared to take unnecessary<br />

risks<br />

Fairly important – I know that I will need to take some risks<br />

<br />

Very important – my priority is for these funds to grow<br />

<br />

8. 9. How would you describe your understanding of the<br />

investment markets?<br />

I have very little understanding or interest.<br />

I understand it is a good idea to invest in general<br />

I have enough experience to understand that markets<br />

<br />

I am an experienced investor in some asset classes.<br />

I am experienced and knowledgeable about all asset classes.<br />

Investor Type Results<br />

Total Score =<br />

[ 0 ]<br />

[ 3 ]<br />

[ 7 ]<br />

[ 10 ]<br />

[ 0 ]<br />

[ 4 ]<br />

[ 6 ]<br />

[ 8 ]<br />

[ 10 ]<br />

Score<br />

Secure < 15<br />

Defensive 16 - 29<br />

Conservative 30 - 49<br />

Balanced 50 - 69<br />

Growth 70 - 85<br />

High Growth > 85

Proposed Super Fund Details<br />

Q1 - Super Fund Name<br />

Unless you specify otherwise, <strong>Prowealth</strong> will name your Self Managed Super Fund.<br />

Complete the box below ONLY if you want to choose a name for your fund.<br />

Super Fund Name (We recommend you leave blank and <strong>Prowealth</strong> will name the entity to avoid error or duplication)<br />

Standard naming method example - If names are John and Lisa Smith, then it would look like - The Smith Self Managed Super Fund.<br />

Self Managed Super Fund<br />

Q 2 - Corporate Trustee of Super Fund Name<br />

Unless you specify otherwise, <strong>Prowealth</strong> will name the Corporate Trustee of your Super Fund.<br />

<br />

<br />

Corporate Trustee Name (We recommend you leave blank and <strong>Prowealth</strong> will name the entity to avoid error or duplication)<br />

Standard naming method example - If names are John and Lisa Smith, then it would look like - J and L Smith 1 Pty Ltd.<br />

Pty Ltd<br />

Q 3 - Corporate Trustee of Bare Trust Name<br />

Unless you specify otherwise, <strong>Prowealth</strong> will name the Corporate Trustee of your Bare Trust.<br />

<br />

<br />

Corporate Trustee Name (We recommend you leave blank and <strong>Prowealth</strong> will name the entity to avoid error or duplication)<br />

Standard naming method example - If names are John and Lisa Smith then it would look like - J and L Smith 2 Pty Ltd.<br />

Pty Ltd<br />

Q 4 - Property Address<br />

The property address must be noted below as it is written into the Bare Trust. <strong>Prowealth</strong> can complete this for you.<br />

<br />

Address of Property (We recommend you leave blank for <strong>Prowealth</strong> to complete the correct legal address)<br />

Suburb State Postcode<br />

Continued over...

Q 5 - Super Fund Members and Directors of Corporate Trustee<br />

Super Fund Member and Director of Corporate Trustee<br />

Member Name, Middle and Surname<br />

Member - Tax File Number<br />

Member - Place of Birth<br />

Date of Birth<br />

/ /<br />

(circle)<br />

Male/Female<br />

Member - Address<br />

Member - Suburb Member - State Member - Postcode<br />

Member - Postal Address (only if different from above)<br />

Member - Home Phone Member - Mobile Member - Work Phone<br />

Member - Email Address<br />

Member - Occupation<br />

Q 6 - Additional Super Fund Members and Directors of Corporate Trustee<br />

Member Name, Middle and Surname<br />

Member - Tax File Number<br />

Member - Place of Birth<br />

Date of Birth<br />

/ /<br />

(circle)<br />

Male/Female<br />

Member - Address<br />

Leave blank if same as member 1<br />

Member - Suburb Member - State Member - Postcode<br />

Member - Postal Address (only if different from above)<br />

Member - Home Phone Member - Mobile Member - Work Phone<br />

Member - Email Address<br />

Member - Occupation<br />

Attach additional pages if more than 2 members/trustees.<br />

Continued over...

Q 7 - Consent to Establish and Payment<br />

<strong>SMSF</strong> Property Purchase Package - $4,499 including GST<br />

Establishment of Self Managed Super Fund + Corporate Trustee<br />

Establishment of Corporate Trustee and Bare Trust<br />

Establishment/Documentation of installment warrant arrangement (where necessary).<br />

<br />

<br />

An initial deposit of $1,000 is required in order to establish your Self Managed Super Fund and Trustee Companies.<br />

You pay this by direct deposit or credit card from your personal funds.<br />

Once your Super fund has been established and funds are available, the full amount of $4,499 will be transferred from<br />

your new Super fund to <strong>Prowealth</strong> Accounting and your initial $1,000 payment will be refunded to you personally.<br />

To pay your initial $1,000 via direct deposit -<br />

Account Name<br />

<strong>Prowealth</strong> Accounting Services Pty Ltd<br />

Account BSB 062544 Reference Your Surname<br />

Account Number 10685540 Bank Commonwealth Bank<br />

Or complete your details below to pay your initial $1,000 via credit card if you choose this option -<br />

Card Number<br />

____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____ ____<br />

Name on Card<br />

I/we :<br />

Expiry Date /<br />

Card Security No.<br />

Last 3 digits from rear of card ____ ____ ____<br />

Circle Type <br />

<br />

<br />

and have directed <strong>Prowealth</strong> to establish the entities listed on this application form;<br />

<br />

before making a decision whether or not to transfer any fund balances from my existing Super to the new Self Managed<br />

Fund and before making any contributions to this new fund;<br />

<br />

<br />

<br />

<br />

prior to the establishment the entities listed on this application form.<br />

Signatures of all members / directors are required for processing. Attach copy of page if more than two.<br />

Name Signed Date<br />

/ /<br />

Name Signed Date<br />

/ /

Funds Transfer Request and Payment<br />

Authorisation for <strong>SMSF</strong> <strong>Setup</strong> Fees<br />

Date / /<br />

Attention -<br />

Macquarie Bank Limited<br />

Cash Management Account<br />

PO Box 192,<br />

Australia Square<br />

Sydney NSW 1215<br />

Fax No: 1800 550 140<br />

Cash Management Account Number -<br />

Account Name -<br />

To whom it may concern,<br />

Please transfer the amount of<br />

$4,499 (Four thousand, four hundred and ninty nine dollars only) being for<br />

<strong>SMSF</strong> and Trustee Establishment and general advice from <strong>Prowealth</strong> Accounting Services.<br />

from our Cash Management Account listed above to the following bank account -<br />

Account Name<br />

<strong>Prowealth</strong> Accounting Services Pty Ltd<br />

Account BSB 012633<br />

Account Number 207 241 936<br />

Bank<br />

ANZ<br />

Reference No <strong>SMSF</strong> <strong>Setup</strong> fees - (your surname)<br />

Kind Regards,<br />

Company Name<br />

Address<br />

Name Date / /<br />

Signed<br />

Director<br />

Name Date / /<br />

Signed<br />

Director

Funds Transfer Request and Payment<br />

Authorisation of Property Deposit.<br />

Date / /<br />

Attention -<br />

Macquarie Bank Limited<br />

Cash Management Account<br />

PO Box 192,<br />

Australia Square<br />

Sydney NSW 1215<br />

Fax No: 1800 550 140<br />

Cash Management Account Number -<br />

Account Name -<br />

To whom it may concern,<br />

Please transfer the amount of $_____________________________<br />

_______________________________________________________________________(in words)<br />

representing our/my purchase deposit from our Cash Management Account listed above to the<br />

following bank account -<br />

Account Name<br />

<br />

Account BSB 012 633<br />

Account Number 207 240 589<br />

Bank<br />

ANZ<br />

Reference (your Lot No. or Surname)<br />

Kind Regards,<br />

Company Name<br />

Address<br />

Name Date / /<br />

Signed<br />

Director<br />

Name Date / /<br />

Signed<br />

Director