Self Managed Super fund Tax Return Checklist - Prowealth

Self Managed Super fund Tax Return Checklist - Prowealth

Self Managed Super fund Tax Return Checklist - Prowealth

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

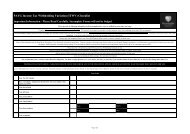

Enter the names and details of the <strong>fund</strong> members below.<br />

Member Name <strong>Tax</strong> File No. Date of Birth<br />

#Non-Concessional<br />

(After <strong>Tax</strong>) Contributions<br />

between 1 July 2011 and<br />

30 June 2012.<br />

*9% Employer, Salary<br />

Sacrifice and <strong>Self</strong><br />

Employed Contributions<br />

(Pre- <strong>Tax</strong>) between 1 July<br />

2011 and 30 June 2012.<br />

*You may need to refer to your Group Certificate or Payment Summaries to establish the amount paid into your <strong>fund</strong>. You could also check the SMSF’s bank<br />

statement for contributions. *Non-concessional contributions are voluntary contributions made to the Fund where you have not claimed a tax deduction.