You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

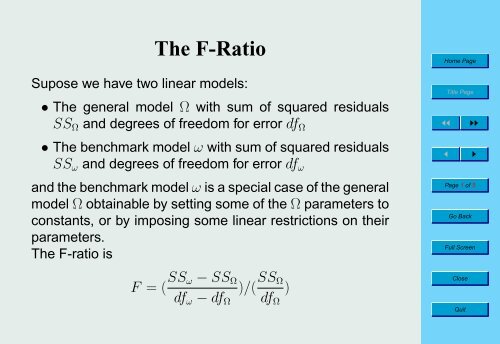

<strong>The</strong> F-<strong>Ratio</strong><br />

Supose we have two linear models:<br />

• <strong>The</strong> general model Ω with sum of squared residuals<br />

SS Ω and degrees of freedom for error df Ω<br />

• <strong>The</strong> benchmark model ω with sum of squared residuals<br />

SS ω and degrees of freedom for error df ω<br />

and the benchmark model ω is a special case of the general<br />

model Ω obtainable by setting some of the Ω parameters to<br />

constants, or by imposing some linear restrictions on their<br />

parameters.<br />

<strong>The</strong> F-ratio is<br />

Home Page<br />

Title Page<br />

◭◭ ◮◮<br />

◭ ◮<br />

Page 1 of 5<br />

Go Back<br />

Full Screen<br />

F = ( SS ω − SS Ω<br />

)/( SS Ω<br />

)<br />

df ω − df Ω df Ω<br />

Close<br />

Quit

Interpreting the F-ratio<br />

Home Page<br />

Title Page<br />

• <strong>The</strong> numerator of the F-ratio is the decrease in error<br />

sum of squares per degree of freedom spent by moving<br />

from the more specific and less powerful model ω to the<br />

more general and powerful model Ω.<br />

• <strong>The</strong> denominator of the F-ratio is the remaining error<br />

sum of squares per parameter left to spend to drive it to<br />

0.<br />

• Each ratio can be considered as a “return on investment”,<br />

degrees of freedom being invested, and decrease<br />

in error sum of squares being returned.<br />

◭◭ ◮◮<br />

◭ ◮<br />

Page 2 of 5<br />

Go Back<br />

Full Screen<br />

Close<br />

Quit

Home Page<br />

Title Page<br />

• We want to keep the move from the benchmark model<br />

ω to the general model Ω if its “return on investment” is<br />

large relative to what remains to be achieved.<br />

• We prefer the benchmark model ω if the “return on investment”<br />

ratio represented by F is near one.<br />

◭◭ ◮◮<br />

◭ ◮<br />

Page 3 of 5<br />

Go Back<br />

Full Screen<br />

Close<br />

Quit

F-ratio and the F-distribution<br />

<strong>The</strong> F-ratio has an F-distribution over repeated samples if,<br />

for any combination of independent variable values, the distribution<br />

of the residuals have<br />

• mean 0 (i. e. the benchmark model is correct)<br />

• standard deviation σ (i. e. is constant)<br />

• a normal distribution<br />

• and are independent of the residuals for any other set<br />

of independent variable values<br />

Home Page<br />

Title Page<br />

◭◭ ◮◮<br />

◭ ◮<br />

Page 4 of 5<br />

Go Back<br />

Full Screen<br />

Close<br />

Quit

Home Page<br />

• If the F-ratio turns out to be surprisingly large relative<br />

to tabled critical values, we should conclude that something<br />

is wrong with one or more of the above assumptions.<br />

• It may not necessarily be the benchmark model that is<br />

wrong.<br />

• Also, in accepting the general model Ω, we only take it<br />

as being better than the benchmark model ω, and not<br />

as necessarily the right model.<br />

Title Page<br />

◭◭ ◮◮<br />

◭ ◮<br />

Page 5 of 5<br />

Go Back<br />

Full Screen<br />

Close<br />

Quit