2001 Qantas Financial Report

2001 Qantas Financial Report

2001 Qantas Financial Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the FINANCIAL STATEMENTS<br />

FOR THE YEAR ENDED 30 JUNE <strong>2001</strong><br />

(c)<br />

CHANGE IN ACCOUNTING POLICY (continued)<br />

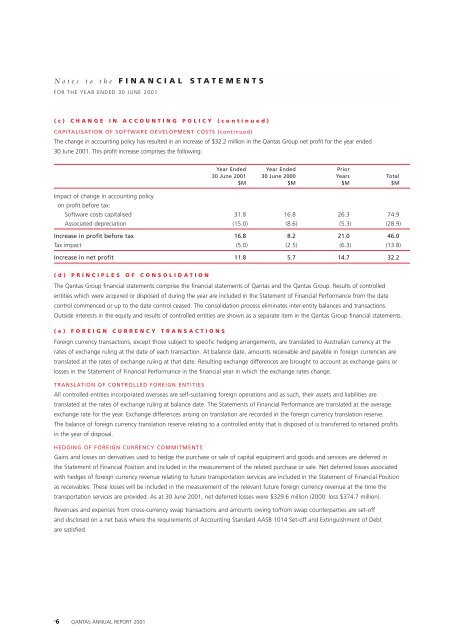

CAPITALISATION OF SOFTWARE DEVELOPMENT COSTS (continued)<br />

The change in accounting policy has resulted in an increase of $32.2 million in the <strong>Qantas</strong> Group net profit for the year ended<br />

30 June <strong>2001</strong>. This profit increase comprises the following:<br />

Year Ended Year Ended Prior<br />

30 June <strong>2001</strong> 30 June 2000 Years Total<br />

$M $M $M $M<br />

Impact of change in accounting policy<br />

on profit before tax:<br />

Software costs capitalised 31.8 16.8 26.3 74.9<br />

Associated depreciation (15.0) (8.6) (5.3) (28.9)<br />

Increase in profit before tax 16.8 8.2 21.0 46.0<br />

Tax impact (5.0) (2.5) (6.3) (13.8)<br />

Increase in net profit 11.8 5.7 14.7 32.2<br />

(d) PRINCIPLES OF CONSOLIDATION<br />

The <strong>Qantas</strong> Group financial statements comprise the financial statements of <strong>Qantas</strong> and the <strong>Qantas</strong> Group. Results of controlled<br />

entities which were acquired or disposed of during the year are included in the Statement of <strong>Financial</strong> Performance from the date<br />

control commenced or up to the date control ceased. The consolidation process eliminates inter-entity balances and transactions.<br />

Outside interests in the equity and results of controlled entities are shown as a separate item in the <strong>Qantas</strong> Group financial statements.<br />

(e) FOREIGN CURRENCY TRANSACTIONS<br />

Foreign currency transactions, except those subject to specific hedging arrangements, are translated to Australian currency at the<br />

rates of exchange ruling at the date of each transaction. At balance date, amounts receivable and payable in foreign currencies are<br />

translated at the rates of exchange ruling at that date. Resulting exchange differences are brought to account as exchange gains or<br />

losses in the Statement of <strong>Financial</strong> Performance in the financial year in which the exchange rates change.<br />

TRANSLATION OF CONTROLLED FOREIGN ENTITIES<br />

All controlled entities incorporated overseas are self-sustaining foreign operations and as such, their assets and liabilities are<br />

translated at the rates of exchange ruling at balance date. The Statements of <strong>Financial</strong> Performance are translated at the average<br />

exchange rate for the year. Exchange differences arising on translation are recorded in the foreign currency translation reserve.<br />

The balance of foreign currency translation reserve relating to a controlled entity that is disposed of is transferred to retained profits<br />

in the year of disposal.<br />

HEDGING OF FOREIGN CURRENCY COMMITMENTS<br />

Gains and losses on derivatives used to hedge the purchase or sale of capital equipment and goods and services are deferred in<br />

the Statement of <strong>Financial</strong> Position and included in the measurement of the related purchase or sale. Net deferred losses associated<br />

with hedges of foreign currency revenue relating to future transportation services are included in the Statement of <strong>Financial</strong> Position<br />

as receivables. These losses will be included in the measurement of the relevant future foreign currency revenue at the time the<br />

transportation services are provided. As at 30 June <strong>2001</strong>, net deferred losses were $329.6 million (2000: loss $374.7 million).<br />

Revenues and expenses from cross-currency swap transactions and amounts owing to/from swap counterparties are set-off<br />

and disclosed on a net basis where the requirements of Accounting Standard AASB 1014 Set-off and Extinguishment of Debt<br />

are satisfied.<br />

p<br />

6 QANTAS ANNUAL REPORT <strong>2001</strong>