UAE, Saudi Arabia & Oman - Rasmala Investment Bank

UAE, Saudi Arabia & Oman - Rasmala Investment Bank

UAE, Saudi Arabia & Oman - Rasmala Investment Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

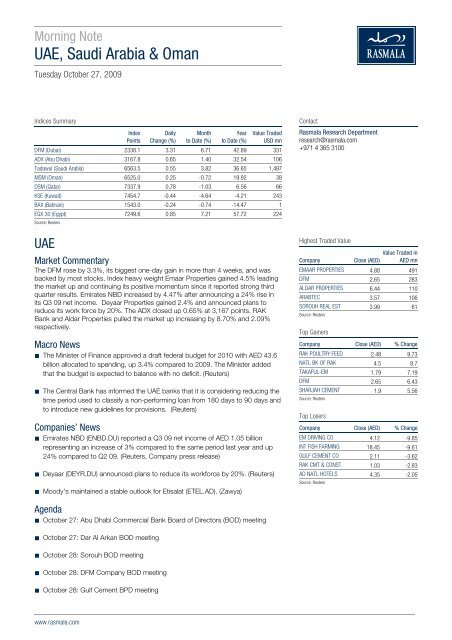

Morning Note<br />

<strong>UAE</strong>, <strong>Saudi</strong> <strong>Arabia</strong> & <strong>Oman</strong><br />

Tuesday October 27, 2009<br />

Indices Summary<br />

Index<br />

Points<br />

Daily<br />

Change (%)<br />

Month<br />

to Date (%)<br />

Year<br />

to Date (%)<br />

Value Traded<br />

USD mn<br />

DFM (Dubai) 2338.1 3.31 6.71 42.89 331<br />

ADX (Abu Dhabi) 3167.8 0.65 1.40 32.54 106<br />

Tadawul (<strong>Saudi</strong> <strong>Arabia</strong>) 6563.5 0.55 3.82 36.65 1,487<br />

MSM (<strong>Oman</strong>) 6525.0 0.25 -0.72 19.92 38<br />

DSM (Qatar) 7337.9 0.78 -1.03 6.56 66<br />

KSE (Kuwait) 7454.7 -0.44 -4.64 -4.21 243<br />

BAX (Bahrain) 1543.0 -0.24 -0.74 -14.47 1<br />

EGX 30 (Egypt) 7249.6 0.85 7.21 57.72 224<br />

Source: Reuters<br />

<strong>UAE</strong><br />

Market Commentary<br />

The DFM rose by 3.3%, its biggest one-day gain in more than 4 weeks, and was<br />

backed by most stocks. Index heavy weight Emaar Properties gained 4.5% leading<br />

the market up and continuing its positive momentum since it reported strong third<br />

quarter results. Emirates NBD increased by 4.47% after announcing a 24% rise in<br />

its Q3 09 net income. Deyaar Properties gained 2.4% and announced plans to<br />

reduce its work force by 20%. The ADX closed up 0.65% at 3,167 points. RAK<br />

<strong>Bank</strong> and Aldar Properties pulled the market up increasing by 8.70% and 2.09%<br />

respectively.<br />

Macro News<br />

• The Minister of Finance approved a draft federal budget for 2010 with AED 43.6<br />

billion allocated to spending, up 3.4% compared to 2009. The Minister added<br />

that the budget is expected to balance with no deficit. (Reuters)<br />

• The Central <strong>Bank</strong> has informed the <strong>UAE</strong> banks that it is considering reducing the<br />

time period used to classify a non-performing loan from 180 days to 90 days and<br />

to introduce new guidelines for provisions. (Reuters)<br />

Companies’ News<br />

• Emirates NBD (ENBD.DU) reported a Q3 09 net income of AED 1.05 billion<br />

representing an increase of 3% compared to the same period last year and up<br />

24% compared to Q2 09. (Reuters, Company press release)<br />

• Deyaar (DEYR.DU) announced plans to reduce its workforce by 20%. (Reuters)<br />

• Moody's maintained a stable outlook for Etisalat (ETEL.AD). (Zawya)<br />

Contact<br />

<strong>Rasmala</strong> Research Department<br />

research@rasmala.com<br />

+971 4 365 3100<br />

Highest Traded Value<br />

Value Traded in<br />

Company<br />

Close (AED) AED mn<br />

EMAAR PROPERTIES 4.88 491<br />

DFM 2.65 283<br />

ALDAR PROPERTIES 6.44 110<br />

ARABTEC 3.57 106<br />

SOROUH REAL EST 3.99 61<br />

Source: Reuters<br />

Top Gainers<br />

Company Close (AED) % Change<br />

RAK POULTRY FEED 2.48 9.73<br />

NATL BK OF RAK 4.5 8.7<br />

TAKAFUL-EM 1.79 7.19<br />

DFM 2.65 6.43<br />

SHARJAH CEMENT 1.9 5.56<br />

Source: Reuters<br />

Top Losers<br />

Company Close (AED) % Change<br />

EM DRIVING CO 4.12 -9.85<br />

INT FISH FARMING 18.45 -9.61<br />

GULF CEMENT CO 2.11 -3.62<br />

RAK CMT & CONST 1.03 -2.83<br />

AD NATL HOTELS 4.35 -2.05<br />

Source: Reuters<br />

Agenda<br />

• October 27: Abu Dhabi Commercial <strong>Bank</strong> Board of Directors (BOD) meeting<br />

• October 27: Dar Al Arkan BOD meeting<br />

• October 28: Sorouh BOD meeting<br />

• October 28: DFM Company BOD meeting<br />

• October 28: Gulf Cement BPD meeting<br />

www.rasmala.com

Morning Note: <strong>UAE</strong>, <strong>Saudi</strong> <strong>Arabia</strong> & <strong>Oman</strong><br />

Tuesday October 27, 2009<br />

• October 29: Commercial <strong>Bank</strong> International BOD meeting<br />

• October 29: Fujairah Cement BOD meeting<br />

• October 29: Mashreq <strong>Bank</strong> BOD meeting<br />

• November 2: Ajman <strong>Bank</strong> BOD meeting<br />

www.rasmala.com 2

Morning Note: <strong>UAE</strong>, <strong>Saudi</strong> <strong>Arabia</strong> & <strong>Oman</strong><br />

Tuesday October 27, 2009<br />

<strong>Saudi</strong> <strong>Arabia</strong><br />

Market Commentary<br />

The market closed up for the second time this week rising by 0.55% to 6,653.5<br />

points. SABIC led the market as it gained 0.89%. The banking sector, for the<br />

second day, followed the market trend with Riyad <strong>Bank</strong>, SABB and Al Rajhi <strong>Bank</strong><br />

increasing by 1.37%, 1.94% and 0.32% respectively.<br />

Companies’ News<br />

• Mobily (7020.SE) granted Ericsson a contract worth SAR 600 million in order to<br />

enhance Mobily's 3.5G network. (Tadawul)<br />

• Jarir Marketing Company (4190.SE) plans to increase its number of retail outlets.<br />

It currently has 26 outlets and aims to expand to 40-45 by the end of 2013. The<br />

company is targeting sales of SAR 4 billion in 2012, up from SAR 2.52 billion in<br />

2008. (Reuters)<br />

• Moody's maintained its positive outlook for <strong>Saudi</strong> Telecom Company (7010.SE).<br />

(Zawya)<br />

• <strong>Saudi</strong> <strong>Arabia</strong> Mining Company's (Ma'aden) (1211.SE) phosphate and fertilizers<br />

plant, which is a joint venture with SABIC (2010.SE), will commence operations in<br />

October 2010. (Zawya)<br />

• <strong>Saudi</strong> Electricity Company (5110.SE) plans to spend USD 20 billion to add more<br />

than 10,000 megawatts (MW) of generation capacity through six independent<br />

power producer projects. (Reuters)<br />

Highest Traded Value<br />

Value Traded in<br />

Company<br />

Close (SAR) SAR mn<br />

ALINMA 14.05 721<br />

SAUDI KAYAN 19.60 260<br />

SAUDI FISHERIES 58.75 237<br />

SA BASIC IND 84.75 221<br />

NATL AGR MKTING 41.00 190<br />

Source: Reuters<br />

Top Gainers<br />

Company Close (SAR) % Change<br />

WEQAYA 44.00 10.0<br />

FOOD PRODUCTS 22.70 9.9<br />

AL BAHA 20.75 9.8<br />

SABB TAKAFUL 41.80 6.9<br />

ZAMIL IND INV 60.50 5.7<br />

Source: Reuters<br />

Top Losers<br />

Company Close (SAR) % Change<br />

WALAA INS 33 -3.8<br />

TRADE UNION 33.7 -2.9<br />

NATL AGR MKTING 41 -2.4<br />

UCA 35.2 -2.2<br />

AICC 31.5 -2.2<br />

Source: Reuters<br />

Agenda<br />

• October 28: <strong>Saudi</strong> Industrial Development AGM.<br />

• October 31: Mobily AGM<br />

• November 1: Filling and Packing Materials Manufacturing Company AGM<br />

• November 9: <strong>Saudi</strong> Cement Company AGM<br />

• November 10: Jarir Marketing Company cash dividend of SAR 1.7 per share. Exdividend<br />

date on 04/11/09.<br />

• November 11: <strong>Saudi</strong> Telecom Company cash dividends of SAR 0.75 per share.<br />

Ex-dividend date 29/10/09<br />

• November 16: Qassim Cement Company EAGM<br />

• November 17: Qassim Cement Company, bonus shares ex-dividend date<br />

www.rasmala.com 3

Morning Note: <strong>UAE</strong>, <strong>Saudi</strong> <strong>Arabia</strong> & <strong>Oman</strong><br />

Tuesday October 27, 2009<br />

<strong>Oman</strong><br />

Market Commentary<br />

The market gained 0.25%, closing at 6,525 points. <strong>Oman</strong> International <strong>Bank</strong> fell by<br />

5.23% after announcing that its nine month net profit fell by 27%. On the other<br />

hand, Raysut Cement gained 1.27% reversing its losses from previous sessions.<br />

Renaissance Services grew by 1.40% after announcing that its subsidiary Topaz<br />

Energy and Marine Ltd won a contract in Turkmenistan.<br />

Companies’ News<br />

• <strong>Oman</strong> International <strong>Bank</strong> (OIB.OM) reported a nine month 2009 net profit of OMR<br />

15.5 million representing a decrease of 27% compared to the same period last<br />

year. The results imply a Q3 09 net income of OMR 3.72 million down 37%<br />

compared to the same period last year and down 32% from Q2 09. (Reuters)<br />

Corporate Actions<br />

• Dhofar Power (DHP.OM) announced the distribution of interim cash dividends of<br />

OMR 0.80 per share. The record date is 10/11/09. (MSM)<br />

• Dhofar Insurance Company (DIPP.OM) sold its shares in <strong>Bank</strong> Dhofar (BDOF.OM)<br />

amounting to 7.34 million shares, at a share price of OMR 0.62. (MSM)<br />

Highest Traded Value<br />

Value Traded in<br />

Company<br />

Close (OMR) OMR mn<br />

BANK DHOFAR 0.60 4.6<br />

AL JAZEIRA SVC 0.37 1.2<br />

AL ANWAR HOLDING 0.32 1.1<br />

OMINVEST 0.51 0.7<br />

OMANTEL 1.35 0.7<br />

Source: Reuters<br />

Top Gainers<br />

Company Close (OMR) % Change<br />

DHOFAR INSURANCE 0.33 7.3<br />

FINANCIAL SERV 0.19 7.0<br />

OMAN CHLORINE 0.38 6.2<br />

NAT ALUMINIUM PR 0.60 5.5<br />

NATL FINANCE 0.16 4.6<br />

Source: Reuters<br />

Top Losers<br />

Company Close (OMR) % Change<br />

OMAN INTERNL BK 0.292 -5.2<br />

OMAN CHEM IND CO 0.08 -1.2<br />

GALFAR ENG 0.69 -1.1<br />

BANK DHOFAR 0.6 -0.5<br />

Source: Reuters<br />

www.rasmala.com 4

Research Contact<br />

research@rasmala.com<br />

+971 4 365 3100<br />

MENA Sales Contact<br />

menasales@rasmala.com<br />

+971 4 424 2770<br />

Disclaimer<br />

The information provided herein is for informational purposes only and is not intended as an offer or<br />

solicitation with respect to the purchase or sale of any security, nor a recommendation to participate in any<br />

particular trading strategy.<br />

<strong>Rasmala</strong> has conducted extensive research to arrive at the fair value estimates for the company or<br />

companies mentioned in this report. Although the information in this report has been obtained from<br />

sources that <strong>Rasmala</strong> believes to be reliable, we do not guarantee its accuracy, and such information may<br />

be condensed or incomplete.<br />

Readers should understand that financial projections, fair value estimates and statements regarding future<br />

prospects may not be realized. All opinions and estimates included in this report constitute our judgment<br />

as of this date and are subject to change without notice.<br />

This research report does not constitute, nor shall it be deemed, an offer to sell or the solicitation of an offer<br />

to buy, any security, and has been prepared for informational purposes only. While reasonable care has<br />

been taken to ensure that the information contained herein is correct and not misleading, no representation<br />

is made as to the accuracy or completeness of this research report and, as a result, no reliance should be<br />

placed on it and no liability is accepted for any direct, consequential or other loss arising from any use of<br />

this research report or its contents.<br />

<strong>Rasmala</strong> does and seeks to do business with companies covered in its research reports. As a result,<br />

investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this<br />

report. Investors should consider this report as only a single factor in making their investment decision.<br />

www.rasmala.com