Robeco Act.Quant Emerging Markets Eq. I EUR - Robeco.com

Robeco Act.Quant Emerging Markets Eq. I EUR - Robeco.com

Robeco Act.Quant Emerging Markets Eq. I EUR - Robeco.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

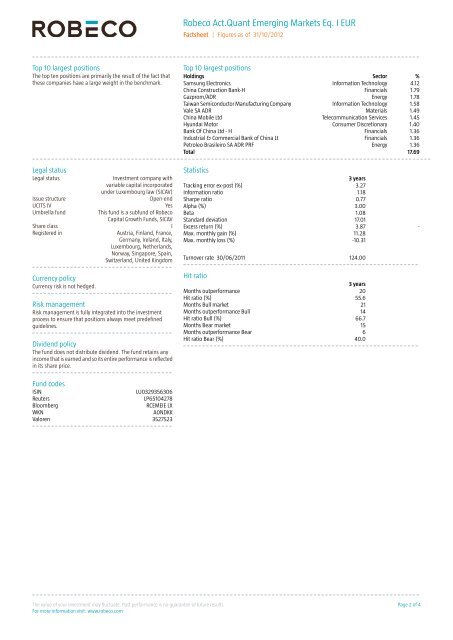

<strong>Robeco</strong> <strong>Act</strong>.<strong>Quant</strong> <strong>Emerging</strong> <strong>Markets</strong> <strong>Eq</strong>. I <strong>EUR</strong><br />

Factsheet Figures as of 31/10/2012<br />

Top 10 largest positions<br />

Top 10 largest positions<br />

The top ten positions are primarily the result of the fact that Holdings<br />

Sector<br />

%<br />

these <strong>com</strong>panies have a large weight in the benchmark. Samsung Electronics<br />

Information Technology 4.12<br />

China Construction Bank-H<br />

Financials 1.79<br />

Gazprom/ADR<br />

Energy 1.78<br />

Taiwan Semiconductor Manufacturing Company<br />

Information Technology 1.58<br />

Vale SA ADR<br />

Materials 1.49<br />

China Mobile Ltd<br />

Tele<strong>com</strong>munication Services 1.45<br />

Hyundai Motor<br />

Consumer Discretionary 1.40<br />

Bank Of China Ltd - H<br />

Financials 1.36<br />

Industrial & Commercial Bank of China Lt<br />

Financials 1.36<br />

Petroleo Brasileiro SA ADR PRF<br />

Energy 1.36<br />

Total<br />

17.69<br />

Legal status<br />

Statistics<br />

Legal status<br />

Investment <strong>com</strong>pany with<br />

3 years<br />

variable capital incorporated Tracking error ex-post (%)<br />

3.27<br />

under Luxembourg law (SICAV) Information ratio<br />

1.18<br />

Issue structure Open-end Sharpe ratio<br />

0.77<br />

UCITS IV Yes Alpha (%)<br />

3.00<br />

Umbrella fund This fund is a subfund of <strong>Robeco</strong> Beta<br />

1.08<br />

Capital Growth Funds, SICAV Standard deviation<br />

17.01<br />

Share class I Excess return (%)<br />

3.87<br />

-<br />

Registered in Austria, Finland, France, Max. monthly gain (%)<br />

11.28<br />

Germany, Ireland, Italy, Max. monthly loss (%)<br />

-10.31<br />

Luxembourg, Netherlands,<br />

Norway, Singapore, Spain,<br />

Switzerland, United Kingdom<br />

Turnover rate 30/06/2011<br />

124.00<br />

Currency policy<br />

Hit ratio<br />

Currency risk is not hedged.<br />

3 years<br />

Months outperformance<br />

20<br />

Risk management<br />

Hit ratio (%)<br />

55.6<br />

Months Bull market<br />

21<br />

Risk management is fully integrated into the investment Months outperformance Bull<br />

14<br />

process to ensure that positions always meet predefined Hit ratio Bull (%)<br />

66.7<br />

guidelines.<br />

Months Bear market<br />

15<br />

Months outperformance Bear<br />

6<br />

Dividend policy<br />

The fund does not distribute dividend. The fund retains any<br />

in<strong>com</strong>e that is earned and so its entire performance is reflected<br />

in its share price.<br />

Hit ratio Bear (%)<br />

40.0<br />

Fund codes<br />

ISIN<br />

Reuters<br />

Bloomberg<br />

WKN<br />

Valoren<br />

LU0329356306<br />

LP65104278<br />

RCEMEIE LX<br />

A0NDKK<br />

3527523<br />

The value of your investment may fluctuate. Past performance is no guarantee of future results.<br />

For more information visit: www.robeco.<strong>com</strong><br />

Page 2 of 4