Robeco Act.Quant Emerging Markets Eq. I EUR - Robeco.com

Robeco Act.Quant Emerging Markets Eq. I EUR - Robeco.com

Robeco Act.Quant Emerging Markets Eq. I EUR - Robeco.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Factsheet Figures as of 31/10/2012<br />

<strong>Robeco</strong> <strong>Act</strong>.<strong>Quant</strong> <strong>Emerging</strong> <strong>Markets</strong> <strong>Eq</strong>. I <strong>EUR</strong><br />

<strong>Robeco</strong> <strong>Act</strong>ive <strong>Quant</strong> <strong>Emerging</strong> <strong>Markets</strong> <strong>Eq</strong>uities invests in stocks of <strong>com</strong>panies in emerging economies throughout the world, such as Korea, Taiwan, Poland and Brazil. These economies can<br />

show rapid growth, so the risks can be greater than those in developed countries. The fund uses a quantitative stock-selection model and aims to benefit from the systematic behavioral mistakes<br />

of investors. This model ranks stocks according to valuation and sentiment. Highly ranked stocks are overweighted against the benchmark, whereas low-ranked stocks are underweighted.<br />

Performance<br />

1 m<br />

3 m<br />

Ytd<br />

1 year<br />

2 years*<br />

3 years*<br />

Start*<br />

*Annualized<br />

Fund<br />

-0.93%<br />

-0.33%<br />

11.52%<br />

11.63%<br />

3.52%<br />

12.00%<br />

6.27%<br />

Calendar Year Performances<br />

Fund<br />

2011<br />

-13.54%<br />

2010<br />

31.53%<br />

2009<br />

93.69%<br />

Rel.<br />

0.35%<br />

-0.08%<br />

0.98%<br />

1.89%<br />

3.06%<br />

3.87%<br />

-<br />

Rel.<br />

3.08%<br />

5.73%<br />

21.73%<br />

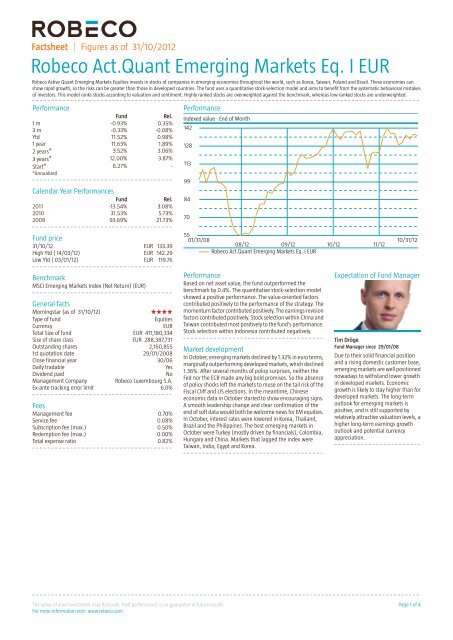

Performance<br />

Indexed value - End of Month<br />

142<br />

128<br />

113<br />

99<br />

84<br />

70<br />

Fund price<br />

31/10/12<br />

High Ytd ( 14/03/12)<br />

Low Ytd ( 03/01/12)<br />

<strong>EUR</strong><br />

<strong>EUR</strong><br />

<strong>EUR</strong><br />

133.39<br />

142.29<br />

119.76<br />

55<br />

01/31/08<br />

08/12 09/12 10/12 11/12<br />

<strong>Robeco</strong> <strong>Act</strong>.<strong>Quant</strong> <strong>Emerging</strong> <strong>Markets</strong> <strong>Eq</strong>. I <strong>EUR</strong><br />

10/31/12<br />

Benchmark<br />

Performance<br />

Expectation of Fund Manager<br />

MSCI <strong>Emerging</strong> <strong>Markets</strong> Index (Net Return) (<strong>EUR</strong>)<br />

Based on net asset value, the fund outperformed the<br />

benchmark by 0.4%. The quantitative stock-selection model<br />

showed a positive performance. The value-oriented factors<br />

General facts<br />

Morningstar (as of 31/10/12)<br />

contributed positively to the performance of the strategy. The<br />

momentum factor contributed positively. The earnings-revision<br />

Type of fund<br />

<strong>Eq</strong>uities factors contributed positively. Stock selection within China and<br />

Currency<br />

<strong>EUR</strong> Taiwan contributed most positively to the fund's performance.<br />

Total Size of fund<br />

<strong>EUR</strong> 411,180,334 Stock selection within Indonesia contributed negatively.<br />

Size of share class<br />

<strong>EUR</strong> 288,387,731<br />

Tim Dröge<br />

Outstanding shares 2,160,855<br />

Fund Manager since 29/01/08<br />

Market development<br />

1st quotation date<br />

29/01/2008<br />

In October, emerging markets declined by 1.32% in euro terms, Due to their solid financial position<br />

Close financial year<br />

30/06<br />

marginally outperforming developed markets, which declined and a rising domestic customer base,<br />

Daily tradable<br />

Yes<br />

1.36%. After several months of policy surprises, neither the emerging markets are well positioned<br />

Dividend paid<br />

No<br />

Fed nor the ECB made any big bold promises. So the absence nowadays to withstand lower growth<br />

Management Company<br />

<strong>Robeco</strong> Luxembourg S.A.<br />

of policy shocks left the markets to muse on the tail risk of the in developed markets. Economic<br />

Ex-ante tracking error limit<br />

6.0%<br />

Fiscal Cliff and US elections. In the meantime, Chinese<br />

growth is likely to stay higher than for<br />

economic data in October started to show encouraging signs. developed markets. The long-term<br />

Fees<br />

A smooth leadership change and clear confirmation of the outlook for emerging markets is<br />

end of soft data would both be wel<strong>com</strong>e news for EM equities. positive, and is still supported by<br />

Management fee<br />

0.70%<br />

In October, interest rates were lowered in Korea, Thailand, relatively attractive valuation levels, a<br />

Service fee<br />

0.08%<br />

Brazil and the Philippines. The best emerging markets in higher long-term earnings growth<br />

Subscription fee (max.)<br />

0.50%<br />

outlook and potential currency<br />

Redemption fee (max.)<br />

0.00% October were Turkey (mostly driven by financials), Colombia,<br />

Hungary and China. <strong>Markets</strong> that lagged the index were appreciation.<br />

Total expense ratio<br />

0.82%<br />

Taiwan, India, Egypt and Korea.<br />

The value of your investment may fluctuate. Past performance is no guarantee of future results.<br />

For more information visit: www.robeco.<strong>com</strong><br />

Page 1 of 4

<strong>Robeco</strong> <strong>Act</strong>.<strong>Quant</strong> <strong>Emerging</strong> <strong>Markets</strong> <strong>Eq</strong>. I <strong>EUR</strong><br />

Factsheet Figures as of 31/10/2012<br />

Top 10 largest positions<br />

Top 10 largest positions<br />

The top ten positions are primarily the result of the fact that Holdings<br />

Sector<br />

%<br />

these <strong>com</strong>panies have a large weight in the benchmark. Samsung Electronics<br />

Information Technology 4.12<br />

China Construction Bank-H<br />

Financials 1.79<br />

Gazprom/ADR<br />

Energy 1.78<br />

Taiwan Semiconductor Manufacturing Company<br />

Information Technology 1.58<br />

Vale SA ADR<br />

Materials 1.49<br />

China Mobile Ltd<br />

Tele<strong>com</strong>munication Services 1.45<br />

Hyundai Motor<br />

Consumer Discretionary 1.40<br />

Bank Of China Ltd - H<br />

Financials 1.36<br />

Industrial & Commercial Bank of China Lt<br />

Financials 1.36<br />

Petroleo Brasileiro SA ADR PRF<br />

Energy 1.36<br />

Total<br />

17.69<br />

Legal status<br />

Statistics<br />

Legal status<br />

Investment <strong>com</strong>pany with<br />

3 years<br />

variable capital incorporated Tracking error ex-post (%)<br />

3.27<br />

under Luxembourg law (SICAV) Information ratio<br />

1.18<br />

Issue structure Open-end Sharpe ratio<br />

0.77<br />

UCITS IV Yes Alpha (%)<br />

3.00<br />

Umbrella fund This fund is a subfund of <strong>Robeco</strong> Beta<br />

1.08<br />

Capital Growth Funds, SICAV Standard deviation<br />

17.01<br />

Share class I Excess return (%)<br />

3.87<br />

-<br />

Registered in Austria, Finland, France, Max. monthly gain (%)<br />

11.28<br />

Germany, Ireland, Italy, Max. monthly loss (%)<br />

-10.31<br />

Luxembourg, Netherlands,<br />

Norway, Singapore, Spain,<br />

Switzerland, United Kingdom<br />

Turnover rate 30/06/2011<br />

124.00<br />

Currency policy<br />

Hit ratio<br />

Currency risk is not hedged.<br />

3 years<br />

Months outperformance<br />

20<br />

Risk management<br />

Hit ratio (%)<br />

55.6<br />

Months Bull market<br />

21<br />

Risk management is fully integrated into the investment Months outperformance Bull<br />

14<br />

process to ensure that positions always meet predefined Hit ratio Bull (%)<br />

66.7<br />

guidelines.<br />

Months Bear market<br />

15<br />

Months outperformance Bear<br />

6<br />

Dividend policy<br />

The fund does not distribute dividend. The fund retains any<br />

in<strong>com</strong>e that is earned and so its entire performance is reflected<br />

in its share price.<br />

Hit ratio Bear (%)<br />

40.0<br />

Fund codes<br />

ISIN<br />

Reuters<br />

Bloomberg<br />

WKN<br />

Valoren<br />

LU0329356306<br />

LP65104278<br />

RCEMEIE LX<br />

A0NDKK<br />

3527523<br />

The value of your investment may fluctuate. Past performance is no guarantee of future results.<br />

For more information visit: www.robeco.<strong>com</strong><br />

Page 2 of 4

<strong>Robeco</strong> <strong>Act</strong>.<strong>Quant</strong> <strong>Emerging</strong> <strong>Markets</strong> <strong>Eq</strong>. I <strong>EUR</strong><br />

Factsheet Figures as of 31/10/2012<br />

Sector spread<br />

The fund's sector allocation is the result of the bottom-up<br />

stock-selection strategy.<br />

Sector spread + deviation benchmark<br />

Financials 27.2 % 1.7 %<br />

Information Technology 13.8 % 0.2 %<br />

Energy 13.0 % 0.0 %<br />

Materials 9.3 % -2.6 %<br />

Industrials 8.1 % 1.7 %<br />

Consumer Discretionary 7.0 % -1.0 %<br />

Tele<strong>com</strong>munication Services 6.9 % -1.1 %<br />

Utilities 6.4 % 2.8 %<br />

Consumer Staples 5.4 % -3.2 %<br />

Other 2.2 % 2.1 %<br />

Liquidity 0.4 % 0.4 %<br />

Health Care 0.3 % -1.0 %<br />

Regional spread<br />

The fund's regional allocation is the result of the bottom-up<br />

stock-selection strategy.<br />

Regional spread + deviation benchmark<br />

Far East 58.3 % -2.3 %<br />

America 18.1 % -3.4 %<br />

Europe 12.5 % 2.6 %<br />

Africa 7.7 % -0.4 %<br />

Other Countries 3.0 % 3.1 %<br />

Liquidity 0.4 % 0.4 %<br />

Currency spread<br />

The fund's currency allocation is the result of the bottom-up<br />

stock-selection strategy. The seemingly high position in USD<br />

originates from the investment in ADRs / GDRs which are<br />

quoted in USD.<br />

Currency spread + deviation benchmark<br />

US Dollar 21.5 % 19.8 %<br />

Hong Kong Dollar 19.2 % 0.8 %<br />

Korean Won 14.1 % -1.1 %<br />

New Taiwan Dollar 9.1 % -1.4 %<br />

South African Rand 6.9 % -0.7 %<br />

Brazilian Real 6.3 % -6.2 %<br />

Indian Rupee 4.6 % -2.2 %<br />

Thai Baht 4.5 % 2.3 %<br />

Other 4.2 % -13.7 %<br />

Malaysian Ringgit 4.0 % 0.2 %<br />

Turkish Lira 3.3 % 1.4 %<br />

Zloty 1.9 % 0.4 %<br />

Liquidity 0.4 % 0.4 %<br />

The value of your investment may fluctuate. Past performance is no guarantee of future results.<br />

For more information visit: www.robeco.<strong>com</strong><br />

Page 3 of 4

<strong>Robeco</strong> <strong>Act</strong>.<strong>Quant</strong> <strong>Emerging</strong> <strong>Markets</strong> <strong>Eq</strong>. I <strong>EUR</strong><br />

Factsheet Figures as of 31/10/2012<br />

Investment policy<br />

The quantitative model that is used for <strong>Robeco</strong> <strong>Act</strong>ive <strong>Quant</strong> <strong>Emerging</strong> <strong>Markets</strong> <strong>Eq</strong>uities is based on a <strong>Robeco</strong> stock-selection<br />

model which is a performance driver for two successful institutional <strong>Robeco</strong> funds. This model ranks stocks according to value,<br />

price momentum and earnings revisions. The <strong>Act</strong>ive <strong>Quant</strong> <strong>Emerging</strong> <strong>Markets</strong> <strong>Eq</strong>uities strategy makes optimal use of the<br />

model’s forecasting power, as it takes advantage of both its positive and negative views on stocks. High-ranked stocks are<br />

used to determine overweight positions, whereas low-ranked stocks are underweight. The size and number of positions provide<br />

a better level of diversification than a fundamentally managed long-only portfolio. This creates an optimized risk-return profile.<br />

Fund Manager's CV<br />

Mr. Tim Dröge is a Senior Portfolio Manager with <strong>Robeco</strong> and a member of the <strong>Quant</strong>itative <strong>Eq</strong>uities team since 2006. He<br />

started his career in the investment industry in 1999 with <strong>Robeco</strong> as Account Manager institutional clients. In 2001 he became<br />

Portfolio Manager Balanced Investments. Tim holds a Master's degree in Business Economics from Erasmus University<br />

Rotterdam.<br />

Fiscal product treatment<br />

The fund is established in Luxembourg and is subject to the Luxembourg tax laws and regulations. The fund is not liable to<br />

pay any corporation, in<strong>com</strong>e, dividend or capital gains tax in Luxembourg. The fund is subject to an annual subscription tax<br />

('tax d'abonnement') in Luxembourg, which amounts to 0.01% of the net asset value of the fund. This tax is included in the<br />

net asset value of the fund. The fund can in principle use the Luxembourg treaty network to partially recover any withholding<br />

tax on its in<strong>com</strong>e.<br />

Fiscal treatment of investor<br />

Investors who are not subject to (exempt from) Dutch corporate-in<strong>com</strong>e tax (e.g. pension funds) are not taxed on the achieved<br />

result. Investors who are subject to Dutch corporate-in<strong>com</strong>e tax can be taxed for the result achieved on their investment in<br />

the fund. Dutch bodies that are subject to corporate-in<strong>com</strong>e tax are obligated to declare interest and dividend in<strong>com</strong>e, as<br />

well as capital gains in their tax return. Investors residing outside the Netherlands are subject to their respective national tax<br />

regime applying to foreign investment funds. We advise individual investors to consult their financial or tax adviser about the<br />

tax consequences of an investment in this fund in their specific circumstances before deciding to invest in the fund.<br />

Morningstar<br />

Morningstar proprietary ratings on funds registered for sale in Europe reflect historical risk-adjusted performance. The ratings<br />

are subject to change every month. The calculation for the Morningstar ratings on funds registered for sale in Europe is<br />

motivated by the expected utility theory. The top 10% of the funds in a category receive five stars, the next 22.5% receive four<br />

stars, the next 35% receive three stars, the next 22.5% receive two stars and the bottom 10% receive one star. The fund was<br />

rated exclusively against funds registered for sale in Europe. All copyrights relating to the Morningstar Rating are held by<br />

Morningstar. For more information on Morningstar, please refer to www.morningstar.<strong>com</strong><br />

Disclaimer<br />

The information in this publication is derived from sources considered to be reliable. <strong>Robeco</strong> assumes no responsibility for the<br />

accuracy and <strong>com</strong>pleteness of the facts, opinions and expectations it contains, or their consequences. While we have taken<br />

every possible care in selecting the information in this publication, we accept no responsibility for any damage resulting from<br />

incorrect or in<strong>com</strong>plete data. This publication is subject to change without prior notice. The value of your investments may<br />

fluctuate, and past performance is no guarantee of future results. The performance figures are based on end-of-month<br />

transaction prices and are calculated on the basis of total returns with reinvestment of dividend. The prices used for the<br />

performance figures of the Luxembourg-based funds are the end-of-month transaction prices up to 4 August 2010. From 4<br />

August 2010, the transaction prices will be those of the first business day of the month. The investment-management result<br />

before deduction of management fees and/or performance fees is based on the performance figures relative to the benchmark.<br />

Fund returns include reinvestment of dividend and are based on the net asset values and exchange rates at the time the<br />

benchmark valuation was performed. Investors may lose all or part of their initial investment. If the currency in which the past<br />

performance is displayed differs from the currency of the country in which you reside, then you should be aware that due to<br />

exchange rate fluctuations the performance shown may increase or decrease if converted into your local currency. A full list<br />

of risks and disclosures can be found in the fund's prospectus. Please read the prospectus carefully before investing. This is<br />

available from <strong>Robeco</strong> offices or from www.robeco.<strong>com</strong>. The total expense ratio referred to in this publication is taken from<br />

the fund's latest (semi)annual report and calculated on the basis of data from the closing date of the last calendar year. All<br />

sources (unless indicated): <strong>Robeco</strong>.<br />

The value of your investment may fluctuate. Past performance is no guarantee of future results.<br />

For more information visit: www.robeco.<strong>com</strong><br />

Page 4 of 4