Iscor circular on LNM offer - ArcelorMittal South Africa

Iscor circular on LNM offer - ArcelorMittal South Africa

Iscor circular on LNM offer - ArcelorMittal South Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

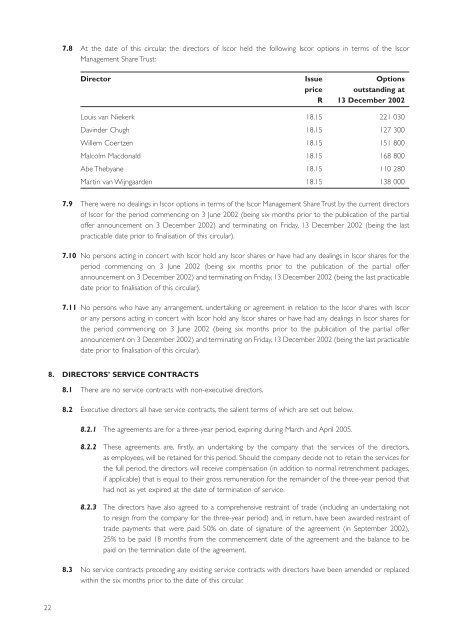

7.8 At the date of this <str<strong>on</strong>g>circular</str<strong>on</strong>g>, the directors of <str<strong>on</strong>g>Iscor</str<strong>on</strong>g> held the following <str<strong>on</strong>g>Iscor</str<strong>on</strong>g> opti<strong>on</strong>s in terms of the <str<strong>on</strong>g>Iscor</str<strong>on</strong>g><br />

Management Share Trust:<br />

Director Issue Opti<strong>on</strong>s<br />

price outstanding at<br />

R 13 December 2002<br />

Louis van Niekerk 18.15 221 030<br />

Davinder Chugh 18.15 127 300<br />

Willem Coertzen 18.15 151 800<br />

Malcolm Macd<strong>on</strong>ald 18.15 168 800<br />

Abe Thebyane 18.15 110 280<br />

Martin van Wijngaarden 18.15 138 000<br />

7.9 There were no dealings in <str<strong>on</strong>g>Iscor</str<strong>on</strong>g> opti<strong>on</strong>s in terms of the <str<strong>on</strong>g>Iscor</str<strong>on</strong>g> Management Share Trust by the current directors<br />

of <str<strong>on</strong>g>Iscor</str<strong>on</strong>g> for the period commencing <strong>on</strong> 3 June 2002 (being six m<strong>on</strong>ths prior to the publicati<strong>on</strong> of the partial<br />

<strong>offer</strong> announcement <strong>on</strong> 3 December 2002) and terminating <strong>on</strong> Friday, 13 December 2002 (being the last<br />

practicable date prior to finalisati<strong>on</strong> of this <str<strong>on</strong>g>circular</str<strong>on</strong>g>).<br />

7.10 No pers<strong>on</strong>s acting in c<strong>on</strong>cert with <str<strong>on</strong>g>Iscor</str<strong>on</strong>g> hold any <str<strong>on</strong>g>Iscor</str<strong>on</strong>g> shares or have had any dealings in <str<strong>on</strong>g>Iscor</str<strong>on</strong>g> shares for the<br />

period commencing <strong>on</strong> 3 June 2002 (being six m<strong>on</strong>ths prior to the publicati<strong>on</strong> of the partial <strong>offer</strong><br />

announcement <strong>on</strong> 3 December 2002) and terminating <strong>on</strong> Friday, 13 December 2002 (being the last practicable<br />

date prior to finalisati<strong>on</strong> of this <str<strong>on</strong>g>circular</str<strong>on</strong>g>).<br />

7.11 No pers<strong>on</strong>s who have any arrangement, undertaking or agreement in relati<strong>on</strong> to the <str<strong>on</strong>g>Iscor</str<strong>on</strong>g> shares with <str<strong>on</strong>g>Iscor</str<strong>on</strong>g><br />

or any pers<strong>on</strong>s acting in c<strong>on</strong>cert with <str<strong>on</strong>g>Iscor</str<strong>on</strong>g> hold any <str<strong>on</strong>g>Iscor</str<strong>on</strong>g> shares or have had any dealings in <str<strong>on</strong>g>Iscor</str<strong>on</strong>g> shares for<br />

the period commencing <strong>on</strong> 3 June 2002 (being six m<strong>on</strong>ths prior to the publicati<strong>on</strong> of the partial <strong>offer</strong><br />

announcement <strong>on</strong> 3 December 2002) and terminating <strong>on</strong> Friday, 13 December 2002 (being the last practicable<br />

date prior to finalisati<strong>on</strong> of this <str<strong>on</strong>g>circular</str<strong>on</strong>g>).<br />

8. DIRECTORS’ SERVICE CONTRACTS<br />

8.1 There are no service c<strong>on</strong>tracts with n<strong>on</strong>-executive directors.<br />

8.2 Executive directors all have service c<strong>on</strong>tracts, the salient terms of which are set out below.<br />

8.2.1 The agreements are for a three-year period, expiring during March and April 2005.<br />

8.2.2 These agreements are, firstly, an undertaking by the company that the services of the directors,<br />

as employees, will be retained for this period. Should the company decide not to retain the services for<br />

the full period, the directors will receive compensati<strong>on</strong> (in additi<strong>on</strong> to normal retrenchment packages,<br />

if applicable) that is equal to their gross remunerati<strong>on</strong> for the remainder of the three-year period that<br />

had not as yet expired at the date of terminati<strong>on</strong> of service.<br />

8.2.3 The directors have also agreed to a comprehensive restraint of trade (including an undertaking not<br />

to resign from the company for the three-year period) and, in return, have been awarded restraint of<br />

trade payments that were paid 50% <strong>on</strong> date of signature of the agreement (in September 2002),<br />

25% to be paid 18 m<strong>on</strong>ths from the commencement date of the agreement and the balance to be<br />

paid <strong>on</strong> the terminati<strong>on</strong> date of the agreement.<br />

8.3 No service c<strong>on</strong>tracts preceding any existing service c<strong>on</strong>tracts with directors have been amended or replaced<br />

within the six m<strong>on</strong>ths prior to the date of this <str<strong>on</strong>g>circular</str<strong>on</strong>g>.<br />

22