Russell Investments Survey on Alternative Investing

Russell Investments Survey on Alternative Investing

Russell Investments Survey on Alternative Investing

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

RUSSELL RESEARCH<br />

THE 2007-2008<br />

<str<strong>on</strong>g>Russell</str<strong>on</strong>g> <str<strong>on</strong>g>Investments</str<strong>on</strong>g><br />

<str<strong>on</strong>g>Survey</str<strong>on</strong>g> <strong>on</strong> <strong>Alternative</strong> <strong>Investing</strong><br />

A SURVEY OF ORGANIZATIONS IN<br />

NORTH AMERICA, EUROPE, AUSTRALIA, AND JAPAN<br />

EXECUTIVE SUMMARY OF KEY FINDINGS

This material is for your private informati<strong>on</strong>, and we are not soliciting any acti<strong>on</strong> based up<strong>on</strong> it. Nothing c<strong>on</strong>tained in this material is intended to<br />

c<strong>on</strong>stitute legal, tax, securities, or investment advice, or an opini<strong>on</strong> regarding the appropriateness of any investment, nor a solicitati<strong>on</strong> of any type.<br />

The general informati<strong>on</strong> c<strong>on</strong>tained in this publicati<strong>on</strong> should not be acted up<strong>on</strong> without obtaining specific legal, tax, and investment advice from a<br />

licensed professi<strong>on</strong>al.<br />

The material is based up<strong>on</strong> informati<strong>on</strong> that we c<strong>on</strong>sider reliable, but we do not represent that it is accurate or complete, and it should not be<br />

relied up<strong>on</strong> as such. In particular, we have not undertaken any independent review of the informati<strong>on</strong>, including expected future returns, reported by<br />

resp<strong>on</strong>dents. Opini<strong>on</strong>s expressed are current opini<strong>on</strong>s as of the date appearing <strong>on</strong> this material <strong>on</strong>ly. We do not undertake to update the informati<strong>on</strong><br />

discussed in this material. We may be in a positi<strong>on</strong> to benefit, as an investor, manager, advisor or other service provider, from increased interest in<br />

investments of the type described in this report.<br />

Informati<strong>on</strong> c<strong>on</strong>tained in this report includes informati<strong>on</strong> developed by and/or supplied under license by <str<strong>on</strong>g>Russell</str<strong>on</strong>g> Investment Group. In particular, the<br />

methodology and data in this survey are the exclusive property of <str<strong>on</strong>g>Russell</str<strong>on</strong>g> Investment Group and any use without the prior express written permissi<strong>on</strong> of<br />

<str<strong>on</strong>g>Russell</str<strong>on</strong>g> Investment Group is strictly prohibited. Data from 2003 and earlier referenced in this report drawn from previous surveys c<strong>on</strong>ducted jointly with<br />

Goldman Sachs Internati<strong>on</strong>al.

Introducti<strong>on</strong><br />

As interest in alternative investments has grown, and as such investments have become more<br />

mainstream, the phrase “alternative investments” itself is beginning to sound like a c<strong>on</strong>tradicti<strong>on</strong> in<br />

terms. What were <strong>on</strong>ce c<strong>on</strong>sidered fringe investments are now deemed essential comp<strong>on</strong>ents of many<br />

instituti<strong>on</strong>al investors’ portfolios.<br />

<str<strong>on</strong>g>Russell</str<strong>on</strong>g> Investment Group began studying alternative investments back in 1992, to fill a void in the<br />

useful informati<strong>on</strong> available about private equity investment practices. Our survey has now become<br />

an indispensable tool for many investors, who look forward to receiving it biennially. With 15 years of<br />

accumulated data, <str<strong>on</strong>g>Russell</str<strong>on</strong>g> is able to offer insights and perspectives not available elsewhere.<br />

About the survey<br />

• For the eighth editi<strong>on</strong> of the <str<strong>on</strong>g>Russell</str<strong>on</strong>g> <str<strong>on</strong>g>Survey</str<strong>on</strong>g> <strong>on</strong> <strong>Alternative</strong> <strong>Investing</strong>, we asked pensi<strong>on</strong> funds,<br />

endowments and foundati<strong>on</strong>s about their use of private equity, hedge funds and real estate.<br />

• In all, 326 large organizati<strong>on</strong>s resp<strong>on</strong>sible for managing tax-exempt assets resp<strong>on</strong>ded, representing<br />

Australia, Europe, Japan and North America.<br />

• The survey asked in-depth questi<strong>on</strong>s designed to extract useful informati<strong>on</strong> and insights.<br />

On page 3, subject matter experts from <str<strong>on</strong>g>Russell</str<strong>on</strong>g>’s <strong>Alternative</strong> <str<strong>on</strong>g>Investments</str<strong>on</strong>g> practice highlight the key<br />

findings of the report. The executive summary that follows provides more detail <strong>on</strong> the various and<br />

numerous alternatives across the regi<strong>on</strong>s.<br />

Thanks to the resp<strong>on</strong>dents<br />

<str<strong>on</strong>g>Russell</str<strong>on</strong>g> gratefully acknowledges the valuable input we received from those who resp<strong>on</strong>ded to this<br />

editi<strong>on</strong> of the survey. In a world where there is competiti<strong>on</strong> for every moment’s attenti<strong>on</strong>, we<br />

appreciate that so many took the time to make this report possible. We intend to c<strong>on</strong>tinue providing a<br />

report that holds value for you and your organizati<strong>on</strong>. Toward that end, we welcome your comments<br />

and any suggesti<strong>on</strong>s for further refinement of this research.<br />

Yours sincerely,<br />

J<strong>on</strong> Bailie, Managing Director<br />

<strong>Alternative</strong> <str<strong>on</strong>g>Investments</str<strong>on</strong>g><br />

ALTERNATIVE INVESTING SURVEY 1

Methodology<br />

A total of 326 surveys of instituti<strong>on</strong>al investors were completed by ph<strong>on</strong>e, mail, e-mail and Internet during the first<br />

half of 2007 and represented organizati<strong>on</strong>s that utilize at least <strong>on</strong>e form of alternative investment. The resp<strong>on</strong>dents<br />

were selected from a broad-based, global list of instituti<strong>on</strong>s that manage tax-exempt assets, and those interviewed<br />

were qualified to represent the investment activities, decisi<strong>on</strong>s and views of their organizati<strong>on</strong>s. The list included<br />

large instituti<strong>on</strong>s located in the United States, Canada, Britain, C<strong>on</strong>tinental Europe, Australia and Japan. <str<strong>on</strong>g>Russell</str<strong>on</strong>g><br />

Investment Group was assisted in the research by Riverside Associates, Inc.—The Markets Group.<br />

Note that since the topic of alternative investments includes a c<strong>on</strong>siderable subjective comp<strong>on</strong>ent and the<br />

sample sizes are typically small (or in some cases limited), the results of this survey, or others like it, should not<br />

be c<strong>on</strong>sidered projectable to a larger populati<strong>on</strong>. Changes observed between two surveys may be affected by<br />

differences in the compositi<strong>on</strong> of the samples, such as the mix of types of organizati<strong>on</strong>s, or by changes in the<br />

investment behavior of <strong>on</strong>e or two very large instituti<strong>on</strong>s. The reader is advised to take a qualitative approach to<br />

the data, with a focus <strong>on</strong> the l<strong>on</strong>g-term trends and implicati<strong>on</strong>s that are suggested.<br />

The total sample was divided into smaller segments for reporting <strong>on</strong> the basis of geography and major types of<br />

alternative investments (i.e., private equity, hedge funds, real estate and “other”). The complete sample was asked<br />

about types of “other” investments, whereas for the other three categories, private equity, hedge funds, and real<br />

estate categories <strong>on</strong>ly those who indicated using investments in each area were asked the detail questi<strong>on</strong>s for each<br />

type of investment. In this study, sub-groups that represent less than three resp<strong>on</strong>dents are not reported graphically,<br />

and a footnote is used when <strong>on</strong>ly three to five resp<strong>on</strong>dents are represented.<br />

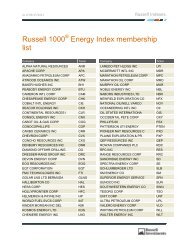

Recent Sample Sizes (i.e., completed interviews) by Geography and Type<br />

2001 2003 2005 2007<br />

North America<br />

Private Equity 112 116 100 95<br />

Hedge Funds 30 39 47 54<br />

Real Estate N/A 93 96 102<br />

Other N/A 166 176 167<br />

Europe<br />

Private Equity 51 41 41 37<br />

Hedge Funds 14 15 23 20<br />

Real Estate N/A 47 43 49<br />

Other N/A 71 65 69<br />

2001 2003 2005 2007<br />

Australia<br />

Private Equity 21 27 16 11<br />

Hedge Funds 1 7 7 10<br />

Real Estate N/A 28 19 17<br />

Other N/A 39 22 18<br />

Japan<br />

Private Equity 3 6 9 14<br />

Hedge Funds 13 20 38 51<br />

Real Estate N/A N/A 14 28<br />

Other N/A N/A 64 72<br />

Note: Real Estate and Other were included starting in 2003 (in 2005 in Japan).<br />

2 RUSSELL INVESTMENT GROUP

Overview<br />

Private Equity: Allocati<strong>on</strong>s expected to increase in all regi<strong>on</strong>s<br />

Private equity remains a popular alternative investment, with strategic allocati<strong>on</strong>s up in Europe, Australia and<br />

Japan, and down slightly in North America. However, all locati<strong>on</strong>s forecast allocati<strong>on</strong>s to increase through 2009.<br />

Investors may have come to the c<strong>on</strong>clusi<strong>on</strong> that the best and biggest Leveraged Buyouts (LBOs) have already<br />

occurred, as they forecast more growth in popularity for venture capital and sec<strong>on</strong>daries over the next three years.<br />

Mean return expectati<strong>on</strong>s worldwide with the excepti<strong>on</strong> of Japanese resp<strong>on</strong>dents’ expectati<strong>on</strong>s for 2007 and 2008,<br />

remain in double digits with North American and European resp<strong>on</strong>dents expressing the greatest optimism.<br />

Jay Pierrep<strong>on</strong>t<br />

Managing Partner<br />

Panthe<strong>on</strong> Ventures—<str<strong>on</strong>g>Russell</str<strong>on</strong>g> Investment Group<br />

Hedge Funds: Allocati<strong>on</strong>s expected to increase in nearly all regi<strong>on</strong>s<br />

Worldwide, hedge funds have matured as an investment tool for diversifying portfolios and reducing risk. Asked<br />

to project their usage of hedge funds over the next three years, investors predict that strategic allocati<strong>on</strong>s will<br />

increase in nearly all global markets. Of the various hedge fund structures, funds of funds appears to be the most<br />

popular method of accessing this investment strategy. As more and more players enter the hedge fund marketplace,<br />

investors are increasingly turning to c<strong>on</strong>sultants to help them select hedge fund providers. C<strong>on</strong>sultant use rose by 25<br />

percentage points in North America, 32 in Australia, and 20 in Japan, while remaining stable in Europe.<br />

Victor Leverett<br />

Director—Hedge Funds<br />

<str<strong>on</strong>g>Russell</str<strong>on</strong>g> Investment Group<br />

Real Estate: Use as investment strategy increasing worldwide<br />

Real estate c<strong>on</strong>tinues to play an integral role in instituti<strong>on</strong>al portfolios. The percent of resp<strong>on</strong>dents utilizing real<br />

estate as an investment strategy increased over 2005, especially in Japan, which posted a 77% increase over<br />

2005. Strategic allocati<strong>on</strong>s to real estate remain relatively high, with slight declines in Europe and Australia. The<br />

c<strong>on</strong>sensus is for increased allocati<strong>on</strong>s worldwide through 2009. Investors are increasingly interested in global<br />

investments with growing allocati<strong>on</strong>s to n<strong>on</strong>-domestic markets.<br />

Karl Smith<br />

Director—Real Estate<br />

<str<strong>on</strong>g>Russell</str<strong>on</strong>g> Investment Group<br />

ALTERNATIVE INVESTING SURVEY 3

Executive Summary<br />

Summary of Regi<strong>on</strong>al Findings<br />

North America<br />

»»<br />

»»<br />

»»<br />

Private equity and real estate are top alternatives choices of North American resp<strong>on</strong>dents<br />

Resp<strong>on</strong>dents’ commitments to hedge funds jump $15 billi<strong>on</strong> from 2005 level<br />

Resp<strong>on</strong>dents expect strategic allocati<strong>on</strong>s to increase in all categories<br />

• Am<strong>on</strong>g the three alternative investment categories, private equity and real estate are the most widely used<br />

by resp<strong>on</strong>dents (57% and 61% of North American survey resp<strong>on</strong>dents, respectively), with hedge funds less<br />

widely used (32%) but growing in popularity.<br />

• The total commitment by North American survey resp<strong>on</strong>dents to private equity is $132 billi<strong>on</strong>, down<br />

slightly from $137 billi<strong>on</strong> in 2005; to real estate, $68 billi<strong>on</strong>, down from $81 billi<strong>on</strong> in 2005; and to<br />

hedge funds, $40 billi<strong>on</strong>, a significant increase over the $25 billi<strong>on</strong> in 2005.<br />

• In all three categories, North American resp<strong>on</strong>dents expect allocati<strong>on</strong>s to increase in the next two years.<br />

For example, the current mean strategic allocati<strong>on</strong> to hedge funds of 7.5% of total fund assets is forecast<br />

to rise to 8.9%. The allocati<strong>on</strong>s to private equity and real estate (6.5% and 6.7% respectively) are also<br />

forecast to rise (to 7.0% and 7.3% respectively).<br />

• Return expectati<strong>on</strong>s over a 1–3 year horiz<strong>on</strong> are highest for private equity, with an average expected<br />

return of 13.2%, while real estate and hedge funds are expected to return <strong>on</strong> average 9.8% and 9.2%,<br />

respectively.<br />

• Private equity and real estate—traditi<strong>on</strong>ally categories regarded as domestic in nature—are both showing<br />

signs of evolving into global investment opportunities. According to survey resp<strong>on</strong>dents, 27% of private<br />

equity allocati<strong>on</strong>s now go to global mandates (the corresp<strong>on</strong>ding figure was 8% in 2005), and 48% of<br />

resp<strong>on</strong>dents indicate that they expect to invest in a global real estate mandate in the next three years.<br />

4 RUSSELL INVESTMENT GROUP

North 14 America*<br />

% of Total Fund Assets<br />

12<br />

Exhibit 1: Mean Strategic Allocati<strong>on</strong> to <strong>Alternative</strong> <str<strong>on</strong>g>Investments</str<strong>on</strong>g><br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

7.5 7.5 7.0 7.0<br />

6.5<br />

Private Equity<br />

2.5<br />

8.9<br />

7.1 7.7 7.5<br />

Hedge Funds<br />

7.1 6.7 6.7<br />

7.3<br />

Real Estate**<br />

2001 2003 2005 2007 2009 Forecast<br />

Exhibit 2: Mean Expected Return of <strong>Alternative</strong> <str<strong>on</strong>g>Investments</str<strong>on</strong>g><br />

16<br />

14<br />

% Expected Return<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

13.0 13.2 13.1 13.4 9.2 9.2 9.2<br />

10.2<br />

9.0<br />

9.6 9.5<br />

8.2<br />

Private Equity Hedge Funds Real Estate<br />

3-Yr Expected Return Made in 2005<br />

2007 2008 2009<br />

Note: In the 2007 survey, resp<strong>on</strong>dents<br />

were asked their 1-year expected return<br />

for 2007, 2008 and 2009, respectively.<br />

Exhibit 3: <strong>Alternative</strong> <str<strong>on</strong>g>Investments</str<strong>on</strong>g> Used as Percent of Resp<strong>on</strong>dents<br />

100<br />

% of Resp<strong>on</strong>dents<br />

80<br />

60<br />

40<br />

20<br />

64<br />

70<br />

57 57<br />

17<br />

23<br />

27<br />

32<br />

56 55<br />

61<br />

* All data based <strong>on</strong> survey resp<strong>on</strong>ses,<br />

in North America n=167<br />

0<br />

Private Equity Hedge Funds Real Estate**<br />

2001 2003 2005 2007<br />

** 2003 was the first year for which<br />

informati<strong>on</strong> <strong>on</strong> use of real estate was<br />

collected.<br />

ALTERNATIVE INVESTING SURVEY 5

Executive Summary<br />

Summary of Regi<strong>on</strong>al Findings<br />

Europe<br />

»»<br />

Funds of funds grow in popularity for private equity and hedge funds am<strong>on</strong>g European resp<strong>on</strong>dents<br />

»» Demand am<strong>on</strong>g resp<strong>on</strong>dents increasing for global real estate investments<br />

»» Resp<strong>on</strong>dents expect strategic allocati<strong>on</strong>s to increase in all categories<br />

• Funds of funds are increasingly being used by European resp<strong>on</strong>dents to access private equity and hedge fund<br />

investments.<br />

• European resp<strong>on</strong>dents expect to increase their strategic allocati<strong>on</strong>s to alternatives over the next two years. For<br />

example, the current mean strategic allocati<strong>on</strong> to private equity of 4.6% is forecast to rise to 5.5%. Allocati<strong>on</strong>s<br />

to hedge funds and real estate are forecast to rise from 7.4% to 8.4% and from 8.9% to 9.7%, respectively.<br />

• While most real estate portfolios of European resp<strong>on</strong>dents are still heavily invested in Western Europe, demand<br />

for global investments is increasing.<br />

• Although private equity commitments to other regi<strong>on</strong>s around the world are <strong>on</strong> the increase, <strong>on</strong>e in five<br />

resp<strong>on</strong>dents limits private equity exposure to Europe, while two out of three resp<strong>on</strong>dents have little or no<br />

exposure to Asia.<br />

• Nearly <strong>on</strong>e in three European resp<strong>on</strong>dents maintains direct real estate investments. Those who do, hold all, or<br />

nearly all, their real estate assets in direct investments. However, allocati<strong>on</strong>s to listed real estate securities and<br />

funds c<strong>on</strong>tinue to increase, as more resp<strong>on</strong>dents gain exposure via indirect vehicles.<br />

• European resp<strong>on</strong>dents are either using or c<strong>on</strong>sidering other forms of alternative investing. Am<strong>on</strong>g strategies<br />

reported as currently in use, currency overlay, absolute return and infrastructure were menti<strong>on</strong>ed most<br />

frequently. The most frequently menti<strong>on</strong>ed strategies under c<strong>on</strong>siderati<strong>on</strong> are Currency Overlay, Tactical Asset<br />

Allocati<strong>on</strong> Overlay, Portable Alpha and Infrastructure.<br />

• The majority of European resp<strong>on</strong>dents do not have even <strong>on</strong>e full-time employee dedicated to alternatives. Those<br />

that do are most likely to employ some<strong>on</strong>e to focus primarily <strong>on</strong> real estate.<br />

6 RUSSELL INVESTMENT GROUP

Europe* 14<br />

% of Total Fund Assets<br />

12<br />

Exhibit 4: Mean Strategic Allocati<strong>on</strong> to <strong>Alternative</strong> <str<strong>on</strong>g>Investments</str<strong>on</strong>g><br />

9.8<br />

10<br />

9.7<br />

8.9<br />

8.4<br />

8.3<br />

8<br />

7.4<br />

6<br />

5.5<br />

5.3<br />

4 3.6 4.0 4.5 4.6<br />

3.6<br />

2<br />

1.7<br />

0<br />

Private Equity Hedge Funds Real Estate**<br />

2001 2003 2005 2007 2009 Forecast<br />

Exhibit 5: Mean Expected Return of <strong>Alternative</strong> <str<strong>on</strong>g>Investments</str<strong>on</strong>g><br />

16<br />

14<br />

% Expected Return<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

10.2<br />

12.8 13.1 13.1 7.4<br />

Private Equity<br />

8.6 8.7 8.6<br />

8.5<br />

7.6 7.6 7.7<br />

Hedge Funds<br />

3-Yr Expected Return Made in 2005<br />

2007 2008 2009<br />

Real Estate<br />

Note: In the 2007 survey, resp<strong>on</strong>dents<br />

were asked their 1-year expected return<br />

for 2007, 2008 and 2009, respectively.<br />

Exhibit 6: <strong>Alternative</strong> <str<strong>on</strong>g>Investments</str<strong>on</strong>g> Used as Percent of Resp<strong>on</strong>dents<br />

100<br />

% of Resp<strong>on</strong>dents<br />

80<br />

60<br />

40<br />

20<br />

55<br />

58<br />

63<br />

54<br />

15<br />

21<br />

35<br />

29<br />

66 66<br />

71<br />

* All data based <strong>on</strong> survey resp<strong>on</strong>ses,<br />

for Europe n=69<br />

0<br />

Private Equity Hedge Funds Real Estate**<br />

2001 2003 2005 2007<br />

** 2003 was the first year for which<br />

informati<strong>on</strong> <strong>on</strong> use of real estate was<br />

collected.<br />

ALTERNATIVE INVESTING SURVEY 7

Executive Summary<br />

Summary of Regi<strong>on</strong>al Findings<br />

australia<br />

»»<br />

»»<br />

»»<br />

Use of real estate investment strategy by Australian resp<strong>on</strong>dents is widespread<br />

Return expectati<strong>on</strong>s am<strong>on</strong>g resp<strong>on</strong>dents highest for private equity<br />

Resp<strong>on</strong>dents expect private equity and real estate strategic allocati<strong>on</strong>s to increase<br />

• Am<strong>on</strong>g the three alternative investment categories, real estate was the most widely used (94%), with private<br />

equity and hedge funds less widely used (61% and 56% respectively) by Australian resp<strong>on</strong>dents.<br />

• Mean return expectati<strong>on</strong>s over a 1–3 year horiz<strong>on</strong> are highest for private equity, with an average expected<br />

return of 11.1%, while resp<strong>on</strong>dents expect real estate and hedge funds to return <strong>on</strong> average 9.8% and<br />

9.4%, respectively.<br />

• Australian resp<strong>on</strong>dents expect to increase their strategic asset allocati<strong>on</strong>s to two alternatives categories over<br />

the next two years. The current mean strategic allocati<strong>on</strong> as a percent of total fund assets to private equity<br />

of 6.3% is forecast to rise to 7.6%, and the allocati<strong>on</strong> to real estate of 9.6% is forecast to rise to 10.5%.<br />

• Real estate—traditi<strong>on</strong>ally a category regarded as domestic in nature—is evolving into a global<br />

investment opportunity for Australian resp<strong>on</strong>dents. 18% of real estate allocati<strong>on</strong>s are now to Global and<br />

Other (the corresp<strong>on</strong>ding figure was less than 2% in 2005). 55% of resp<strong>on</strong>dents indicate that they expect<br />

to invest in a global real estate mandate in the next three years, with North America and Asia Pacific<br />

Developed also cited as favored regi<strong>on</strong>s.<br />

• Funds of Funds are becoming a preferred investment structure for private equity and hedge funds. The<br />

reported use of funds of funds as a percent of private equity commitments by Australian resp<strong>on</strong>dents has<br />

risen significantly from 29% in 2005 to 47% in 2007 and for hedge funds as a percent of hedge fund<br />

commitments—from 38% in 2005 to 87% in 2007.<br />

• A number of Australian resp<strong>on</strong>dents are using, or c<strong>on</strong>sidering, other forms of alternative investing. The<br />

most prevalent strategies currently reported in use are Infrastructure and Currency Overlay. The most<br />

frequently menti<strong>on</strong>ed strategies under c<strong>on</strong>siderati<strong>on</strong> are Portable Alpha, Active and Passive Commodities,<br />

and Collateralized Debt Obligati<strong>on</strong>s, and Tactical Asset Allocati<strong>on</strong>.<br />

8 RUSSELL INVESTMENT GROUP

australia*<br />

14<br />

Exhibit 7: Mean Strategic Allocati<strong>on</strong> to <strong>Alternative</strong> <str<strong>on</strong>g>Investments</str<strong>on</strong>g><br />

12<br />

10<br />

11.5<br />

10.4 10.5<br />

9.6<br />

% of Total Fund Assets<br />

8<br />

6<br />

4<br />

2<br />

0<br />

6.5<br />

7.6<br />

6.3<br />

5.0 4.7<br />

Private Equity<br />

4.3<br />

6.2<br />

4.1 4.1<br />

Hedge Funds<br />

Real Estate**<br />

2001 2003 2005 2007 2009 Forecast<br />

Exhibit 8: Mean Expected Return of <strong>Alternative</strong> <str<strong>on</strong>g>Investments</str<strong>on</strong>g><br />

16<br />

% Expected Return<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

12.4<br />

11.0 11.0 11.4 9.8<br />

10.2<br />

9.4 9.4 9.4<br />

9.5 9.6<br />

8.8<br />

Private Equity Hedge Funds Real Estate<br />

3-Yr Expected Return Made in 2005<br />

2007 2008 2009<br />

Note: In the 2007 survey, resp<strong>on</strong>dents<br />

were asked their 1-year expected return<br />

for 2007, 2008 and 2009, respectively.<br />

Exhibit 9: <strong>Alternative</strong> <str<strong>on</strong>g>Investments</str<strong>on</strong>g> Used as Percent of Resp<strong>on</strong>dents<br />

% of Resp<strong>on</strong>dents<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

94<br />

86<br />

73<br />

72<br />

69<br />

64<br />

61<br />

56<br />

32<br />

18<br />

3<br />

Private Equity Hedge Funds Real Estate**<br />

2001 2003 2005 2007<br />

* All data based <strong>on</strong> survey resp<strong>on</strong>ses,<br />

for Australia n=18<br />

** 2003 was the first year for which<br />

informati<strong>on</strong> <strong>on</strong> use of real estate was<br />

collected.<br />

ALTERNATIVE INVESTING SURVEY 9

Executive Summary<br />

Summary of Regi<strong>on</strong>al Findings<br />

jApan<br />

»»<br />

»»<br />

»»<br />

Hedge fund use c<strong>on</strong>tinues to be str<strong>on</strong>g am<strong>on</strong>g Japanese resp<strong>on</strong>dents<br />

Use of real estate investment strategy by resp<strong>on</strong>dents up 77% from 2005<br />

Resp<strong>on</strong>dents expect to increase strategic allocati<strong>on</strong>s in real estate<br />

• Am<strong>on</strong>g the three alternative investment categories, hedge funds are the most widely used, as was the case<br />

in the previous survey. The percentage of resp<strong>on</strong>dents investing in hedge funds increased from 59% in<br />

2005 to 71% in 2007 though the rate of growth appears to be slowing. The mean strategic allocati<strong>on</strong> to<br />

hedge funds also increased, from 8.1% to 9.3%. The total commitment reported was ¥967 billi<strong>on</strong> in 2007.<br />

• The ratio of Japanese resp<strong>on</strong>dents who invest in real estate has increased significantly, from 22% in 2005<br />

to 39% in 2007. The total commitment of ¥322.5 billi<strong>on</strong> reported by resp<strong>on</strong>dents in 2007 is nearly triple<br />

the ¥112 billi<strong>on</strong> reported in 2005. However, both figures are low relative to other regi<strong>on</strong>s.<br />

• According to resp<strong>on</strong>dents the mean strategic allocati<strong>on</strong> to real estate in 2007 was 4.7%, an increase of 1.3<br />

percentage points from 2005 (3.4%). Nearly three out of ten resp<strong>on</strong>dents plan to increase their strategic<br />

allocati<strong>on</strong>s to real estate over the next three years.<br />

• Resp<strong>on</strong>dents commit the highest percentage of their real estate commitments to Public Real Estate<br />

Securities (45%) and Core Commingled Funds (30%). The majority of resp<strong>on</strong>dents’ real estate portfolios is<br />

geographically c<strong>on</strong>centrated in the developed area of the Asia Pacific sector, although some are indicating<br />

an interest in other regi<strong>on</strong>s around the world.<br />

• The percentage of resp<strong>on</strong>dents who invest in private equity is relatively low at 19%, and the growth since<br />

2005 as a share of total fund assets (0.9 percentage points) is slightly below that of hedge funds and real<br />

estate, 1.2 and 1.3 percentage points, respectively. Total commitment to private equity am<strong>on</strong>g Japanese<br />

resp<strong>on</strong>dents in 2007 was ¥207.4 billi<strong>on</strong>, up more than 100% from 2005. The mean allocati<strong>on</strong> to private<br />

equity has grown steadily since 2003 to reach 3.3% in 2007.<br />

• Resp<strong>on</strong>dents c<strong>on</strong>tinue to buy into the established North American private equities market—38% of their<br />

allocati<strong>on</strong> is to this regi<strong>on</strong>. Regarding investment type, 63% of the capital commitment goes to leveraged<br />

buyouts.<br />

• Resp<strong>on</strong>dents expect a mean 4.6% annual return for hedge funds through 2009, in line with 2005<br />

projecti<strong>on</strong>s. Given that the short term rate in Japan is a little less than 1.0%, the implied return expectati<strong>on</strong><br />

of resp<strong>on</strong>dents is around 3.6 percentage points over Yen LIBOR.<br />

10 RUSSELL INVESTMENT GROUP

jApan*<br />

14<br />

Exhibit 12 10: Mean Strategic Allocati<strong>on</strong> to <strong>Alternative</strong> <str<strong>on</strong>g>Investments</str<strong>on</strong>g><br />

% of Total Fund Assets<br />

10<br />

8<br />

6<br />

4<br />

2<br />

4.2<br />

3.3<br />

1.8 2.4<br />

9.3 9.9<br />

8.1<br />

7.1<br />

5.7<br />

4.5<br />

4.7<br />

3.4<br />

0<br />

Private Equity Hedge Funds Real Estate**<br />

2001 2003 2005 2007 2009 Forecast<br />

Exhibit 11: Mean Expected Return of <strong>Alternative</strong> <str<strong>on</strong>g>Investments</str<strong>on</strong>g><br />

16<br />

14<br />

13.8<br />

% Expected Return<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

11.2<br />

9.5<br />

7.9<br />

7.3 7.4 7.5<br />

4.7 4.5 4.6 4.6 4.8<br />

Private Equity Hedge Funds Real Estate<br />

3-Yr Expected Return Made in 2005<br />

2007 2008 2009<br />

Note: In the 2007 survey, resp<strong>on</strong>dents<br />

were asked their 1-year expected return<br />

for 2007, 2008 and 2009, respectively.<br />

Exhibit 12: <strong>Alternative</strong> <str<strong>on</strong>g>Investments</str<strong>on</strong>g> Used as Percent of Resp<strong>on</strong>dents<br />

100<br />

% of Resp<strong>on</strong>dents<br />

80<br />

60<br />

40<br />

20<br />

0<br />

71<br />

59<br />

41<br />

39<br />

30<br />

19<br />

22<br />

12<br />

14<br />

7<br />

Private Equity Hedge Funds Real Estate**<br />

2001 2003 2005 2007<br />

* All data based <strong>on</strong> survey resp<strong>on</strong>ses,<br />

for Japan n=72<br />

** 2005 was the first year for which<br />

informati<strong>on</strong> <strong>on</strong> use of real estate was<br />

collected.<br />

ALTERNATIVE INVESTING SURVEY 11

This executive summary sets out the main points of the 2007-2008 <str<strong>on</strong>g>Russell</str<strong>on</strong>g> <str<strong>on</strong>g>Survey</str<strong>on</strong>g> <strong>on</strong> <strong>Alternative</strong> <strong>Investing</strong>. Copies of<br />

the full survey can be requested by including name, title, organizati<strong>on</strong>, and country of domicile by email request to<br />

altsurvey@russell.com.<br />

12 RUSSELL INVESTMENT GROUP

Copyright © <str<strong>on</strong>g>Russell</str<strong>on</strong>g> Investment Group 2007. All rights reserved. This material is proprietary and may not be reproduced, transferred, or distributed in<br />

any form without prior written permissi<strong>on</strong> from <str<strong>on</strong>g>Russell</str<strong>on</strong>g> Investment Group. It is delivered <strong>on</strong> an “as is” basis without warranty.<br />

<str<strong>on</strong>g>Russell</str<strong>on</strong>g> Investment Group is a Washingt<strong>on</strong>, USA corporati<strong>on</strong>, which operates through subsidiaries worldwide, including <str<strong>on</strong>g>Russell</str<strong>on</strong>g> <str<strong>on</strong>g>Investments</str<strong>on</strong>g> and is a<br />

subsidiary of The Northwestern Mutual Life Insurance Company.<br />

The <str<strong>on</strong>g>Russell</str<strong>on</strong>g> logo is a trademark and service mark of <str<strong>on</strong>g>Russell</str<strong>on</strong>g> Investment Group.<br />

First used: December 2007<br />

USIMSLRC2894

Copyright © <str<strong>on</strong>g>Russell</str<strong>on</strong>g> Investment Group 2007. All rights reserved. 26-36-002 (1 12/07)