Probate, Estate Planning & Trust Section - South Carolina Bar ...

Probate, Estate Planning & Trust Section - South Carolina Bar ...

Probate, Estate Planning & Trust Section - South Carolina Bar ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

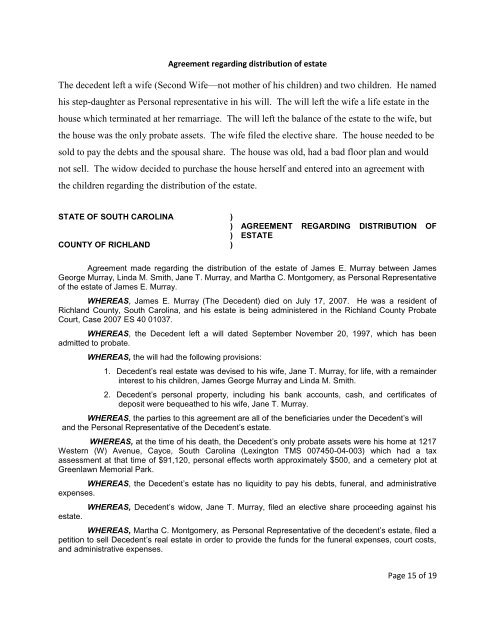

Agreement regarding distribution of estate<br />

The decedent left a wife (Second Wife—not mother of his children) and two children. He named<br />

his step-daughter as Personal representative in his will. The will left the wife a life estate in the<br />

house which terminated at her remarriage. The will left the balance of the estate to the wife, but<br />

the house was the only probate assets. The wife filed the elective share. The house needed to be<br />

sold to pay the debts and the spousal share. The house was old, had a bad floor plan and would<br />

not sell. The widow decided to purchase the house herself and entered into an agreement with<br />

the children regarding the distribution of the estate.<br />

STATE OF SOUTH CAROLINA )<br />

)<br />

)<br />

COUNTY OF RICHLAND )<br />

AGREEMENT REGARDING DISTRIBUTION OF<br />

ESTATE<br />

Agreement made regarding the distribution of the estate of James E. Murray between James<br />

George Murray, Linda M. Smith, Jane T. Murray, and Martha C. Montgomery, as Personal Representative<br />

of the estate of James E. Murray.<br />

WHEREAS, James E. Murray (The Decedent) died on July 17, 2007. He was a resident of<br />

Richland County, <strong>South</strong> <strong>Carolina</strong>, and his estate is being administered in the Richland County <strong>Probate</strong><br />

Court, Case 2007 ES 40 01037.<br />

WHEREAS, the Decedent left a will dated September November 20, 1997, which has been<br />

admitted to probate.<br />

WHEREAS, the will had the following provisions:<br />

1. Decedent’s real estate was devised to his wife, Jane T. Murray, for life, with a remainder<br />

interest to his children, James George Murray and Linda M. Smith.<br />

2. Decedent’s personal property, including his bank accounts, cash, and certificates of<br />

deposit were bequeathed to his wife, Jane T. Murray.<br />

WHEREAS, the parties to this agreement are all of the beneficiaries under the Decedent’s will<br />

and the Personal Representative of the Decedent’s estate.<br />

WHEREAS, at the time of his death, the Decedent’s only probate assets were his home at 1217<br />

Western (W) Avenue, Cayce, <strong>South</strong> <strong>Carolina</strong> (Lexington TMS 007450-04-003) which had a tax<br />

assessment at that time of $91,120, personal effects worth approximately $500, and a cemetery plot at<br />

Greenlawn Memorial Park.<br />

WHEREAS, the Decedent’s estate has no liquidity to pay his debts, funeral, and administrative<br />

expenses.<br />

estate.<br />

WHEREAS, Decedent’s widow, Jane T. Murray, filed an elective share proceeding against his<br />

WHEREAS, Martha C. Montgomery, as Personal Representative of the decedent’s estate, filed a<br />

petition to sell Decedent’s real estate in order to provide the funds for the funeral expenses, court costs,<br />

and administrative expenses.<br />

Page 15 of 19