ICB-AMCL Sonali Bank Limited First Mutual Fund---- Prospectus

ICB-AMCL Sonali Bank Limited First Mutual Fund---- Prospectus

ICB-AMCL Sonali Bank Limited First Mutual Fund---- Prospectus

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

If you have any queries about this document, you may consult Asset Manager.<br />

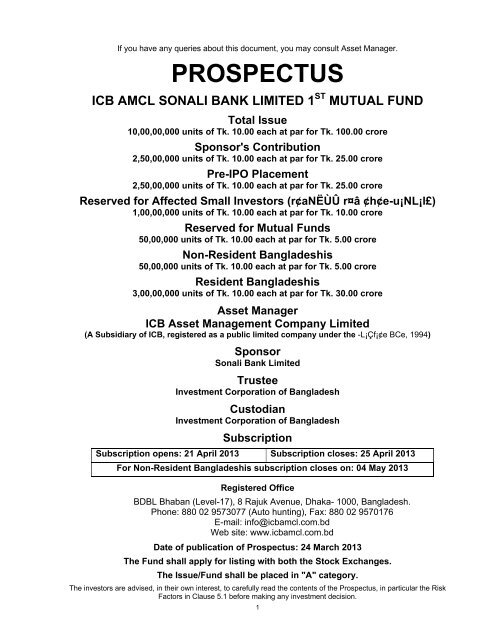

PROSPECTUS<br />

<strong>ICB</strong> <strong>AMCL</strong> SONALI BANK LIMITED 1 ST MUTUAL FUND<br />

Total Issue<br />

10,00,00,000 units of Tk. 10.00 each at par for Tk. 100.00 crore<br />

Sponsor's Contribution<br />

2,50,00,000 units of Tk. 10.00 each at par for Tk. 25.00 crore<br />

Pre-IPO Placement<br />

2,50,00,000 units of Tk. 10.00 each at par for Tk. 25.00 crore<br />

Reserved for Affected Small Investors (r¢aNËÙÛ r¤â ¢h¢e-u¡NL¡l£)<br />

1,00,00,000 units of Tk. 10.00 each at par for Tk. 10.00 crore<br />

Reserved for <strong>Mutual</strong> <strong>Fund</strong>s<br />

50,00,000 units of Tk. 10.00 each at par for Tk. 5.00 crore<br />

Non-Resident Bangladeshis<br />

50,00,000 units of Tk. 10.00 each at par for Tk. 5.00 crore<br />

Resident Bangladeshis<br />

3,00,00,000 units of Tk. 10.00 each at par for Tk. 30.00 crore<br />

Asset Manager<br />

<strong>ICB</strong> Asset Management Company <strong>Limited</strong><br />

(A Subsidiary of <strong>ICB</strong>, registered as a public limited company under the -L¡Çf¡¢e BCe, 1994)<br />

Sponsor<br />

<strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong><br />

Trustee<br />

Investment Corporation of Bangladesh<br />

Custodian<br />

Investment Corporation of Bangladesh<br />

Subscription<br />

Subscription opens: 21 April 2013 Subscription closes: 25 April 2013<br />

For Non-Resident Bangladeshis subscription closes on: 04 May 2013<br />

Registered Office<br />

BDBL Bhaban (Level-17), 8 Rajuk Avenue, Dhaka- 1000, Bangladesh.<br />

Phone: 880 02 9573077 (Auto hunting), Fax: 880 02 9570176<br />

E-mail: info@icbamcl.com.bd<br />

Web site: www.icbamcl.com.bd<br />

Date of publication of <strong>Prospectus</strong>: 24 March 2013<br />

The <strong>Fund</strong> shall apply for listing with both the Stock Exchanges.<br />

The Issue/<strong>Fund</strong> shall be placed in "A" category.<br />

The investors are advised, in their own interest, to carefully read the contents of the <strong>Prospectus</strong>, in particular the Risk<br />

Factors in Clause 5.1 before making any investment decision.<br />

1

FUND PROFILE<br />

Registered Office : <strong>ICB</strong> Asset Management Company <strong>Limited</strong><br />

BDBL Bhaban (Level-17)<br />

8 Rajuk Avenue<br />

Dhaka-1000.<br />

Sponsor : <strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong><br />

35-42, 44, Motijheel C/A<br />

Dhaka-1000.<br />

Trustee : Investment Corporation of Bangladesh<br />

BDBL Bhaban (Level 14-17)<br />

8 Rajuk Avenue<br />

Dhaka-1000.<br />

Custodian : Investment Corporation of Bangladesh<br />

BDBL Bhaban (Level 14-17)<br />

8 Rajuk Avenue<br />

Dhaka-1000.<br />

Asset Manager/ : <strong>ICB</strong> Asset Management Company <strong>Limited</strong><br />

<strong>Fund</strong> Manager<br />

BDBL Bhaban (Level-17)<br />

8 Rajuk Avenue<br />

Dhaka-1000.<br />

Auditor : Ahmed Mashuque & Co.<br />

62/1, Purana Paltan (Level-4)<br />

Dhaka-1000.<br />

<strong>Bank</strong>er : Bangladesh Commerce <strong>Bank</strong> <strong>Limited</strong><br />

Principal Branch<br />

Taranga Complex<br />

19 Rajuk Avenue, Motijheel C/A<br />

Dhaka-1000.<br />

2

Definition and Elaboration of the abbreviated words and definitions used in the <strong>Prospectus</strong><br />

¢h¢dj¡m¡ / Rules : ¢p¢LE¢l¢VS J H„-Q” L¢jne (¢jEQ¤Éu¡m g¡ä) ¢h¢dj¡m¡, 2001<br />

Act : h¡wm¡-cn ¢p¢LE¢l¢VS Hä H„-Q” L¢jne BCe, 1993<br />

Allotment : Letter of Allotment for units<br />

Asset Manager/AMC : The Asset Management Company (AMC) refers to "<strong>ICB</strong> Asset<br />

Management Company <strong>Limited</strong> (<strong>ICB</strong> <strong>AMCL</strong>)", a subsidiary of <strong>ICB</strong><br />

incorporated as a public limited company with the Registrar of Joint<br />

Stock Companies and Firms.<br />

BO A/C : Beneficial Owner Account or Depository Account<br />

BSEC : Bangladesh Securities and Exchange Commission<br />

CDBL : Central Depository Bangladesh <strong>Limited</strong><br />

CEO : The Chief Executive Officer of the Asset Management Company<br />

Certificate : Unit Certificate of the <strong>Fund</strong><br />

Commission : Bangladesh Securities and Exchange Commission<br />

Companies Act : -L¡Çf¡¢e BCe, 1994 (1994 p-el 18 ew BCe)<br />

CSE : Chittagong Stock Exchange <strong>Limited</strong><br />

DSE : Dhaka Stock Exchange <strong>Limited</strong><br />

EPS : Earning Per Share<br />

FC Account : Foreign Currency Account<br />

FI : Financial Institution<br />

Government : The Government of the People’s Republic of Bangladesh<br />

<strong>ICB</strong> : Investment Corporation of Bangladesh<br />

Issue : Public Issue<br />

NBFI : Non-<strong>Bank</strong>ing Financial Institution<br />

NBR : National Board of Revenue<br />

Net Assets : The excess of assets over liabilities of the <strong>Fund</strong>, computed in the<br />

manner specified hereunder<br />

Net Asset Value (NAV): Net Asset Value of the <strong>Fund</strong><br />

NRB : Non-Resident Bangladeshi (NRB) means Bangladeshi citizens<br />

staying abroad including all those who have dual citizenship<br />

(provided they have a valid Bangladeshi passport) or those, whose<br />

foreign passport bear a stamp from the concerned Bangladesh<br />

Embassy/High Commission to the effect that no visa is required to<br />

travel to Bangladesh.<br />

Offering Price : Price of the Securities of the <strong>Fund</strong> being offered<br />

<strong>Prospectus</strong> : The advertisements or other documents (approved by the BSEC),<br />

which contain the investment and all other information in respect of<br />

the <strong>Mutual</strong> <strong>Fund</strong>, as required by the ¢h¢dj¡m¡ and is circulated to<br />

invite the public to invest in the <strong>Mutual</strong> <strong>Fund</strong>.<br />

Reinvestment : Distribution of profit by issuing units as per most recent NAV of the<br />

<strong>Fund</strong>.<br />

RJSC : Registrar of Joint Stock Companies & Firms<br />

Securities : Units of the <strong>Fund</strong><br />

Sponsor : Sponsor of the <strong>Fund</strong> i.e. <strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong>, largest and leading<br />

state owned commercial <strong>Bank</strong> in Bangladesh.<br />

STD A/C : Short Term Deposit Account<br />

Subscription : Application Money<br />

The <strong>Fund</strong> : <strong>ICB</strong> <strong>AMCL</strong> <strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong> 1 st <strong>Mutual</strong> <strong>Fund</strong><br />

Unit : One undivided share in the <strong>Fund</strong><br />

3

HIGHLIGHTS<br />

01. Name <strong>ICB</strong> <strong>AMCL</strong> <strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong> 1 st <strong>Mutual</strong> <strong>Fund</strong><br />

02. Size of the <strong>Fund</strong><br />

Tk. 100.00 crore divided into 10,00,00,000 units at par value of<br />

Tk. 10.00 each.<br />

03. Face Value Tk. 10.00 (ten) per unit<br />

`<br />

04. Market Lot 500 (five hundred) units<br />

05. Nature Close-end <strong>Mutual</strong> <strong>Fund</strong> of 10 (ten) years tenure<br />

06. Objective<br />

The objective of the <strong>Fund</strong> is to provide attractive dividend to the unit<br />

holders by investing the proceeds in the Capital Market and Money<br />

Market.<br />

07. Target Group<br />

08. Dividend<br />

09. Mode of Distribution<br />

10. Transferability<br />

11. Encashment<br />

12. Tax Benefit<br />

13. Report & Accounts<br />

Individuals, institutions, Non-Resident Bangladeshis (NRB), <strong>Mutual</strong><br />

<strong>Fund</strong>s and collective investment schemes are eligible to apply for<br />

investment in the <strong>Fund</strong>.<br />

Minimum 70% income of the <strong>Fund</strong> will be distributed as cash dividend<br />

or reinvestment or both cash dividend and reinvestment at the end of<br />

each accounting year. The <strong>Fund</strong> shall create a dividend equalization<br />

reserve fund to ensure consistency in dividend.<br />

The dividend will be distributed within 45 (forty five) days from the date<br />

of declaration.<br />

Units are transferable. The transfer will be made by the CDBL under<br />

electronic settlement process.<br />

The <strong>Fund</strong> will be listed with DSE and CSE. So investment in this <strong>Fund</strong><br />

will easily be encashable.<br />

Income will be tax free up to certain level, which is permitted as per<br />

Finance Act.<br />

Investment in the <strong>Fund</strong> would qualify for investment tax credit under<br />

section 44(2) of the Income Tax Ordinance 1984.<br />

Every unit holder is entitled to receive Annual Report together with the<br />

yearly and half-yearly statements of accounts as and when published.<br />

RISK FACTORS<br />

01. The performance of the <strong>Fund</strong> is directly related with the macro economic situation particularly<br />

the capital market of Bangladesh.<br />

02. Since the capital market of Bangladesh is highly volatile, there is no assurance of achieving the<br />

stated objective of the <strong>Fund</strong>.<br />

03. Due to small number of listed securities in both the Stock Exchange(s), it may be difficult to<br />

invest the <strong>Fund</strong>’s assets in a widely diversified portfolio as and when required to do so.<br />

04. Stock market trend shows that prices of almost all the listed securities move in unpredictable<br />

direction, which may affect the value of the <strong>Fund</strong>. Moreover, there is no guarantee that the<br />

market price of unit of the <strong>Fund</strong> will fully reflect their underlying net asset values.<br />

05. If the companies wherein the <strong>Fund</strong> will be invested fail to pay expected dividend may affect the<br />

return of the <strong>Fund</strong>.<br />

06. For investing in Pre-IPO Placement securities i.e. in unlisted securities by the <strong>Fund</strong> may<br />

involve liquidity risk.<br />

07. Uncertainties like political and social instability may affect the value of the <strong>Fund</strong>’s assets.<br />

08. Adverse natural climatic condition may hamper the performance of the <strong>Fund</strong>.<br />

4

Chapter One<br />

: PRELIMINARY<br />

TABLE OF CONTENTS<br />

Particulars<br />

Publication of <strong>Prospectus</strong> for public offering<br />

Approval of the Bangladesh Securities and Exchange Commission<br />

Listing of <strong>Fund</strong><br />

Documents available for inspection<br />

Conditions of PUBLIC OFFER<br />

General Information<br />

Subscription<br />

Declarations<br />

Page<br />

No.<br />

7-16<br />

7<br />

7<br />

7<br />

7<br />

8<br />

14<br />

14<br />

14<br />

Chapter Two<br />

: BACKGROUND<br />

Formation of <strong>ICB</strong> <strong>AMCL</strong> <strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong> 1 st <strong>Mutual</strong> <strong>Fund</strong><br />

Present condition of the capital market regarding formation of a<br />

<strong>Mutual</strong> <strong>Fund</strong><br />

Advantages in investing in <strong>ICB</strong> <strong>AMCL</strong> <strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong> 1 st <strong>Mutual</strong><br />

<strong>Fund</strong><br />

17-19<br />

17<br />

18<br />

18<br />

Chapter Three : THE FUND<br />

The constitution of the <strong>Fund</strong><br />

Life of the <strong>Fund</strong><br />

Size, Face Value and Market Lot of the <strong>Fund</strong><br />

20<br />

20<br />

20<br />

20<br />

Chapter Four<br />

Chapter Five<br />

Chapter Six<br />

: INVESTMENT OBJECTIVES AND POLICIES<br />

Investment Objective<br />

Investment Policies<br />

Investment Restrictions<br />

Valuation Policy<br />

Investment Management<br />

Dividend Policy<br />

: RISK MANAGEMENT<br />

Risk Factors<br />

Expected Market Performance of the <strong>Fund</strong><br />

Who to invest and how much to invest<br />

: FORMATION, MANAGEMENT AND ADMINISTRATION<br />

Sponsor of the <strong>Fund</strong><br />

Trustee & Custodian of the <strong>Fund</strong><br />

Asset Manager of the <strong>Fund</strong><br />

Auditors<br />

21-24<br />

21<br />

21<br />

21<br />

22<br />

23<br />

23<br />

25-26<br />

25<br />

26<br />

26<br />

27-29<br />

27<br />

27<br />

28<br />

29<br />

5

Chapter Seven : FINANCIAL CHARGES<br />

Limitation of Expenses<br />

Fees and Expenses<br />

Issue and Formation Expenses<br />

Management Fee<br />

Trustee Fee<br />

Custodian Fee<br />

<strong>Fund</strong> Registration and Annual Fee<br />

CDBL Fee<br />

Listing Fee<br />

Audit Fee<br />

Chapter Eight : CAPITAL STRUCTURE, TAX STATUS AND RIGHTS OF UNIT<br />

HOLDERS<br />

Issue of Units<br />

Pre-IPO Placement<br />

Subscription from Sponsor<br />

Pre-IPO Investors<br />

Public Offer<br />

Tax exemption<br />

Rights of the Unit holders<br />

Beneficial Interest<br />

30-31<br />

30<br />

30<br />

30<br />

31<br />

31<br />

31<br />

31<br />

31<br />

31<br />

31<br />

32-33<br />

32<br />

32<br />

32<br />

32<br />

32<br />

33<br />

33<br />

33<br />

Chapter Nine<br />

: REDEMPTION / WINDING UP AND CONVERSION POLICY<br />

Procedure of Winding up<br />

Manner of Winding up and Redemption<br />

Effect of Winding up<br />

Conversion of the <strong>Fund</strong><br />

34<br />

34<br />

34<br />

34<br />

34<br />

Chapter Ten<br />

: CONDITIONS FOR PUBLIC OFFER, ALLOTMENT,<br />

SUBSCRIPTION AND REFUND OF UNITS<br />

Disclosure in respect of issuance of Security Demat Form<br />

Issue of Units<br />

Minimum Subscription for the issue<br />

Conditions of Allotment<br />

Application for Subscription<br />

Refund of Subscription Money<br />

Subscription by and Refund to Non-Resident Bangladeshi (NRB)<br />

Application Forms<br />

35-48<br />

35<br />

35<br />

35<br />

35<br />

37<br />

39<br />

40<br />

41<br />

6

CHAPTER -1<br />

PRELIMINARY<br />

1.1 Publication of <strong>Prospectus</strong> for public offering<br />

<strong>ICB</strong> Asset Management Company <strong>Limited</strong> has received Registration Certificate from the<br />

Bangladesh Securities and Exchange Commission (BSEC) under the h¡wm¡-cn ¢p¢LE¢l¢VS Hä<br />

H„-Q” L¢jne BCe, 1993 and the ¢p¢LE¢l¢VS J H„-Q” L¢jne (¢jEQ¤Éu¡m g¡ä) ¢h¢dj¡m¡, 2001 made<br />

there under and also received approval for issuing <strong>Prospectus</strong> for public offering. A complete copy<br />

of the <strong>Prospectus</strong> of the public offering is available for public inspection at the registered office of<br />

the <strong>Fund</strong>.<br />

1.2 Approval of the Bangladesh Securities and Exchange Commission (BSEC)<br />

“APPROVAL OF THE BANGLADESH SECURITIES AND EXCHANGE COMMISSION HAS BEEN<br />

OBTAINED TO THE ISSUE/OFFER OF THE FUND UNDER THE SECURITIES AND EXCHANGE<br />

ORDINANCE, 1969 AND THE ¢p¢LE¢l¢VS J H„-Q” L¢jne (¢jEQ¤Éu¡m g¡ä) ¢h¢dj¡m¡, 2001. IT<br />

MUST BE DISTINCTLY UNDERSTOOD THAT IN GIVING THIS APPROVAL THE COMMISSION<br />

DOES NOT TAKE ANY RESPONSIBILITY FOR THE FINANCIAL SOUNDNESS OF THE FUND,<br />

ANY OF ITS SCHEMES OR THE ISSUE PRICE OF ITS UNITS OR FOR THE CORRECTNESS<br />

OF ANY OF THE STATEMENTS MADE OR OPINION EXPRESSED WITH REGARD TO THEM.<br />

SUCH RESPONSIBILITY LIES WITH THE ASSET MANAGER, TRUSTEE, SPONSOR AND/OR<br />

CUSTODIAN.”<br />

1.3 Listing of <strong>Fund</strong><br />

Declaration about Listing of <strong>Fund</strong> with the Stock Exchange(s)<br />

“None of the Stock Exchange(s), if for any valid reason, grants listing within 75 (seventy five) days<br />

from the closure of subscription, any allotment in terms of this <strong>Prospectus</strong> shall be void and the<br />

Asset Management Company shall refund the subscription money within 15 (fifteen) days from the<br />

date of refusal for listing by the Stock Exchange(s), or from the date of expiry of the said 75<br />

(seventy five) days, as the case may be.<br />

In case of non-refund of the subscription money within the aforesaid 15 (fifteen) days, the Asset<br />

Management Company, in addition to the Sponsor and the Trustee, shall be collectively and<br />

severally liable for refund of the subscription money, with interest at the rate of 2% (two percent)<br />

per month above the bank rate, to the subscribers concerned.<br />

The Asset Management Company, in addition to the Sponsor and the Trustee shall ensure due<br />

compliance of the above mentioned conditions and shall submit compliance report thereon to the<br />

Commission within 7 (seven) days of expiry of the aforesaid 15 (fifteen) days time period allowed<br />

for refund of the subscription money.”<br />

1.4 Documents available for inspection<br />

(01) Copy of this <strong>Prospectus</strong> will be available at the Members of the Stock Exchanges, <strong>Bank</strong>er<br />

to the Issue and the registered office of the <strong>ICB</strong> Asset Management Company <strong>Limited</strong><br />

and also available at the website of Bangladesh Securities and Exchange Commission<br />

(www.secbd.org) and <strong>ICB</strong> Asset Management Company <strong>Limited</strong> (www.icbamcl.com.bd).<br />

7

(02) Copy of Trust Deed, Investment Management Agreement and the <strong>Prospectus</strong> may be<br />

inspected during the business hours at the head office of the Asset Management<br />

Company of the <strong>Fund</strong> during the period 10 (ten) days from the publication date of this<br />

<strong>Prospectus</strong>.<br />

1.5 CONDITIONS OF PUBLIC OFFER (PO)<br />

i) <strong>Fund</strong> size can be increased through Re-investment only as <strong>ICB</strong> <strong>AMCL</strong> SONALI BANK<br />

LIMITED 1 ST MUTUAL FUND is a close-end <strong>Mutual</strong> <strong>Fund</strong>.<br />

ii) The following further conditions are mentioned under Part – A, B, C and D namely:-<br />

PART-A<br />

(01) The <strong>Fund</strong> shall go for Public Offer (PO) for 5,00,00,000 (five crore) units of Tk. 10.00 (ten)<br />

each at par worth Tk. 50,00,00,000.00 (fifty crore) only following ¢p¢LE¢l¢VS J H„-Q” L¢jne<br />

(¢jEQ¤Éu¡m g¡ä) ¢h¢dj¡m¡, 2001, the Securities and Exchange Commission (Public Issue)<br />

Rules, 2006, the ¢Xf¢SV¢l BCe, 1999 and regulations issued there under.<br />

(02) The prospectus/abridged version of the prospectus as vetted by BSEC, shall be published<br />

in two widely circulated national daily newspapers (Bangla and English) within 10 (ten)<br />

days of receipt of the approval letter. Provided that information relating to publication of<br />

prospectus in the form of advertisement be published in two national daily newspapers<br />

(Bangla and English).<br />

(03) Sufficient copies of prospectus shall be made available by the Asset Management<br />

Company so that any person requesting a copy may receive one. A notice shall be placed<br />

on the front of the application form distributed in connection with the offering, informing that<br />

interested persons are entitled to a prospectus, if they so desire, and that copies of<br />

prospectus may be obtained from the Asset Management Company. The subscription<br />

application shall indicate in bold type that no sale of securities shall be made, nor shall any<br />

money be taken from any person, in connection with such sale until 25 (twenty five) days<br />

after the prospectus has been published.<br />

(04) The Asset Management Company shall ensure transmission of the prospectus and relevant<br />

application forms for NRBs through e-mail, simultaneously of publication of the prospectus,<br />

to the Bangladesh Embassies and Missions abroad, as mentioned in the prospectus, and<br />

shall also ensure sending of the printed prospectus and application forms to the said<br />

Embassies and Missions within 5 (five) working days of the publication date by express<br />

mail service (EMS) of the postal department. A compliance report shall be submitted in this<br />

respect to the BSEC by the Asset Management Company within 3 (three) working days<br />

from the date of said despatch of the prospectus & the forms.<br />

(05) The paper clipping of the published prospectus/abridged version of the prospectus and all<br />

other published documents/notices regarding the Scheme shall be submitted to the<br />

Commission within 24 (twenty four) hours of publication thereof.<br />

(06) The Asset Management Company shall submit 40 (forty) copies of the printed prospectus,<br />

along with a Diskette / Compact Disc (CD) prepared in “MS WORD” containing the<br />

prospectus and its abridged version, as vetted by BSEC, to the Bangladesh Securities and<br />

Exchange Commission for official record within 5 (five) working days from the date of<br />

publication of the prospectus in the newspaper.<br />

8

(07) The Asset Management Company shall maintain separate bank account(s) for collecting<br />

proceeds of the Public Offering and shall also open FC account(s) to deposit the application<br />

money of the Non-Resident Bangladeshis (NRBs) for Public Offer purpose, and shall<br />

incorporate full particulars of said FC account(s) in the prospectus. The Company shall<br />

open the above-mentioned accounts for Public Offer purpose and close these accounts<br />

after refund of over-subscription. NRB means Bangladeshi citizens staying abroad<br />

including all those who have dual citizenship (provided they have a valid<br />

Bangladeshi passport) or those, whose foreign passport bear a stamp from the<br />

concerned Bangladesh Embassy/High Commission to the effect that “no visa is<br />

required to travel to Bangladesh”.<br />

(08) Subscription shall start after 25 (twenty five) days from the date of publication of the<br />

prospectus for both NRBs and resident Bangladeshis. Subscription will remain open for<br />

5 (five) consecutive banking days.<br />

(09) Application shall be sent by the NRB applicants directly to the Asset Management Company<br />

within the closing date of the subscription so as to reach the same to the Asset<br />

Management Company by the closing date plus 9 (nine) days. Applications received by the<br />

Asset Management Company after the above-mentioned time period will not be considered<br />

for allotment purpose.<br />

(10) The Asset Management Company shall apply the spot buying rate (TT clean) in US$,<br />

UK Pound Sterling and Euro of <strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong> as prevailed on the date of opening of<br />

the subscription for the purpose of application of the NRBs.<br />

(11) A non-resident Bangladeshi shall apply either directly by enclosing a foreign demand<br />

draft drawn on a bank payable at Dhaka, or through a nominee by paying out of<br />

foreign currency deposit account maintained in Bangladesh or in Taka supported by<br />

foreign currency encashment certificate issued by the concerned bank, for the value<br />

of securities applied for through crossed bank cheque marking “Account Payee<br />

only”. Application shall be sent by the NRB applicants to the Asset Management<br />

Company within the closing date of the subscription so as to reach the same to the<br />

company by the closing date plus 9 (nine) days. Applications received by the<br />

company after the above time period will not be considered for allotment purpose.<br />

(12) The Asset Management Company shall ensure prompt collection/clearance of the foreign<br />

remittances of NRBs for allotment of units without any difficulty/complain.<br />

(13) The Asset Management Company shall provide BSEC with the preliminary status of the<br />

subscription within 5 (five) working days from closure of the subscription date, and also<br />

the list of valid and invalid applicants (i.e. final status of subscription) in electronic form in<br />

2 (two) CDs to the Commission within 3 (three) weeks after the closure of the subscription<br />

date including bank statement (original), branch-wise subscription statement. The final list<br />

of valid and invalid applicants shall be finalized after examining with the CDBL in respect of<br />

BO accounts and particulars thereof. The public offering shall stand cancelled and the<br />

application money shall be refunded immediately {but not later than 5 (five) weeks from the<br />

date of the subscription closure} if any of the following events occur:<br />

a) Upon closing of the subscription list it is found that the total number of<br />

valid applications is less than the minimum requirement as specified in<br />

the listing regulations of the Stock Exchange(s) concerned; or<br />

b) At least 50% (i.e. Tk. 50.00 crore) of the targeted amount (i.e. Tk. 100.00<br />

crore) under ¢h¢d 48 of the ¢p¢LE¢l¢VS J H„-Q” L¢jne (¢jEQ¤Éu¡m g¡ä)<br />

¢h¢dj¡m¡, 2001, is not subscribed.<br />

9

(14) Public Offer Distribution System<br />

a) Units of Tk. 5,00,00,000.00 (five crore) only of total public offering shall be<br />

reserved for Non-Resident Bangladeshi (NRB), Tk. 5,00,00,000.00 (five crore)<br />

only for <strong>Mutual</strong> <strong>Fund</strong>s and collective investment schemes registered with the<br />

Commission, Tk. 10,00,00,000.00 (ten crore) only for Affected Small Investors<br />

and the remaining units of Tk. 30,00,00,000.00 (thirty crore) only shall be<br />

opened for subscription by the general public;<br />

b) All securities/units stated in para (a) shall be offered for subscription and<br />

subsequent allotment by the Asset Management Company subject to any<br />

restriction which may be imposed from time to time by the Bangladesh<br />

Securities and Exchange Commission;<br />

c) In case of over subscription under any of the 4 (four) categories mentioned<br />

in para (a), the Asset Management Company shall conduct an open lottery of<br />

all the applications received under each category separately in accordance<br />

with the BSEC’s instructions;<br />

d) In case of under-subscription under any of the 3 (three) categories [i.e. Units<br />

of Tk. 5,00,00,000.00 (five crore) only for NRB and units of Tk.<br />

5,00,00,000.00 (five crore) only for <strong>Mutual</strong> <strong>Fund</strong>s and collective investment<br />

schemes and Tk. 10,00,00,000.00 (ten crore) only for Affected Small<br />

Investors] mentioned in para (a), the unsubscribed portion shall be added to<br />

the general public category [units of Tk. 30,00,00,000.00 (thirty crore) only]<br />

and, if after such addition, there is over subscription in the general public<br />

category, the Asset Management Company shall conduct an open lottery of all<br />

the applicants added together;<br />

e) The lottery as stated in para (c) and (d) shall be conducted in presence of the<br />

authorized representatives of the BSEC, Stock Exchange(s) concerned,<br />

Sponsor, Asset Management Company, Trustee and the applicants.<br />

(15) Upon completion of the period of subscription for securities the Issuer and the Asset<br />

Manager shall jointly provide the Commission and the Stock Exchange(s) with the<br />

preliminary status of the subscription within 5 (five) working days, in respect of the<br />

following matters, namely:-<br />

a) Total number of securities for which subscription has been received;<br />

b) Amount received from the subscription; and<br />

c) Amount of commission paid to the banker to the issue.<br />

(16) The Asset Management Company shall issue unit allotment letters to all successful<br />

applicant’s within 5 (five) weeks from the date of the subscription closing date. Within the<br />

same time, refund to the unsuccessful applicants shall be made in the currency in which the<br />

value of units was paid for by the applicants without any interest and refunded to the<br />

respective banks for onward deposit of the refund money into the applicant’s bank accounts<br />

provided in the respective application form for subscription.<br />

After completion of remittance of the Scheme to the respective applicant’s bank account,<br />

the Asset Manager shall disclose the information in the newspapers where the abridged<br />

version of prospectus has been published. In this regards a compliance report shall be<br />

submitted to the Commission within 7 (seven) days from the date of completion of the<br />

allotment of units and refund warrants (if applicable).<br />

10

(17) The applicant shall provide the same bank account number in the application form as<br />

it is in the Beneficiary Owners Account of the applicant. Otherwise the application<br />

will be considered invalid and the Commission will forfeit 15% (fifteen) of their<br />

subscription money too.<br />

(18) All the applicants shall first be treated as applied for one minimum market lot of 500 (five<br />

hundred) units worth Tk. 5,000.00 (five thousand) only. If, on this basis, there is over<br />

subscription, then lottery shall be held amongst the applicants allocating one identification<br />

number for each application, irrespective of the application money. In case of oversubscription<br />

under any of the categories mentioned hereinabove, the issuer and the Asset<br />

Manager shall jointly conduct an open lottery of all the applications received under each<br />

category separately in presence of the representatives from the BSEC, Stock Exchange(s),<br />

Sponsor, Trustee, Asset Manager and applicants, if there be any.<br />

(19) An applicant cannot submit more than two applications, one in his/her own name and<br />

another jointly with another person. In case an applicant makes more than two<br />

applications, all applications will be treated as invalid and will not be considered for<br />

allotment purpose. In addition, 15% (fifteen) of the application money will be forfeited<br />

by the Commission and the balance amount will be refunded to the applicant.<br />

(20) Lottery (if applicable) will be held within 4 (four) weeks from closure of the subscription<br />

date.<br />

(21) The Asset Management Company shall furnish the List of Allotees to the Commission and<br />

the Stock Exchange(s) simultaneously in which the units will be listed, within 24 (twenty<br />

four) hours of allotment.<br />

(22) Unit Certificates for 100% of the Sponsor’s contribution amounting to<br />

Tk. 25,00,00,000.00 (twenty five crore) only shall be subject to a lock-in period of<br />

1 (one) year from the date of listing in the Stock Exchange(s) and 1/10 th of the<br />

Sponsor’s contribution amounting to Tk. 2,50,00,000.00 (two crore fifty lac) only shall<br />

be subject to a lock-in period of full time of the <strong>Fund</strong>.<br />

(23) All Pre-IPO placement will be in 6 (six) months lock-in period from the date of listing of the<br />

<strong>Fund</strong>.<br />

(24) If the Asset Management Company fails to collect the minimum 50% of the targeted amount<br />

under ¢h¢d 48 of the ¢p¢LE¢l¢VS J H„-Q” L¢jne (¢jEQ¤Éu¡m g¡ä) ¢h¢dj¡m¡, 2001, it will<br />

refund the subscription money within 5 (five) weeks from the closure of subscription<br />

without any deduction. In case of failure, the Asset Management Company shall refund the<br />

same with interest @ 18% per annum from its own account within the next month.<br />

(25) In case of over subscription, the excess amount shall be refunded within 5 (five) weeks<br />

from the closure of subscription period, failing which the Asset Management Company will<br />

refund the same with an interest @ 18% per annum from its own account within the next<br />

month.<br />

(26) The Asset Management Company shall publish a notice through the newspaper to all<br />

successful applicants within 5 (five) weeks from the closing of subscription for collection of<br />

allotment letters.<br />

11

(27) The Asset Management Company shall apply for listing of the Scheme with Stock<br />

Exchange(s) within 7 (seven) working days of first publication of the prospectus.<br />

(28) Declaration about Listing of the Scheme with the Stock Exchange(s)<br />

“None of the Stock Exchange(s), if for any reason, grants listing within 75 (seventy five)<br />

days from the closure of subscription, any allotment in terms of this prospectus shall be void<br />

and the Asset Management Company shall refund the subscription money within<br />

15 (fifteen) days from the date of refusal for listing by the Stock Exchange(s), or from the<br />

date of expiry of the said 75 (seventy five) days, as the case may be.<br />

In case of non-refund of the subscription money within the aforesaid 15 (fifteen) days, the<br />

Asset Management Company, in addition to the Sponsor and Trustee, shall be collectively<br />

and severally liable for refund of the subscription money, with interest @ 2% per month<br />

above the bank rate, to the subscribers concerned.<br />

The Asset Management Company, in addition to the Sponsor and Trustee shall ensure due<br />

compliance of the above-mentioned conditions and shall submit compliance report thereon<br />

to the Commission within 7 (seven) days of expiry of the aforesaid 15 (fifteen) days time<br />

period allowed for refund of the subscription money.”<br />

(29) Letter informing allotment shall be issued within 5 (five) weeks from the closure of<br />

subscription.<br />

(30) The Scheme shall maintain escrow bank account for proceeds of public offering. The<br />

<strong>Fund</strong> collected through public offering shall not be utilized prior to the allotment and shall be<br />

affected through banking channel i.e., through account payee cheque, pay order, bank draft<br />

etc.<br />

(31) The Scheme shall not be involved in option trading, short selling or carry forward<br />

transactions.<br />

(32) The Annual Report or its abridged version of the Scheme shall be published within 45 (forty<br />

five) days of the closure of each accounting year of the Scheme.<br />

(33) An Annual Report and details of investment and savings of the Scheme shall be submitted<br />

to the Commission, Trustee and Custodian of the Schemes of the <strong>Fund</strong> within 90 (ninety)<br />

days from the closure of the accounts.<br />

(34) Half-yearly accounts/financial results of the Scheme shall be submitted to the Commission<br />

& the Stock Exchange(s) and published in at least one widely circulated Bangla national<br />

daily newspaper within 30 (thirty) days from end of the period.<br />

(35) Dividend shall be paid within 30 (thirty) working days of its declaration, and a report shall<br />

be submitted to BSEC, Trustee and Custodian within 7 (seven) days of dividend<br />

distribution.<br />

(36) Net Asset Value (NAV) of the Scheme shall be calculated and disclosed publicly as per<br />

¢h¢d 60 of the ¢p¢LE¢l¢VS J H„-Q” L¢jne (¢jEQ¤Éu¡m g¡ä) ¢h¢dj¡m¡, 2001.<br />

(37) BSEC may appoint auditors for special audit/investigation on the affairs of the Scheme, if it<br />

so desires.<br />

Part -B<br />

12

(01) The Asset Management Company (i.e. <strong>ICB</strong> Asset Management Company Ltd.) shall ensure<br />

that the prospectus/abridged version of the prospectus is published correctly and in strict<br />

conformity without any error/omission, as vetted by the Bangladesh Securities and<br />

Exchange Commission.<br />

(02) The Asset Management Company shall carefully examine and compare the published<br />

prospectus/abridged version of the prospectus on the date of publication with the<br />

prospectus, as vetted by BSEC. If any discrepancy/inconsistency is found, both the<br />

Sponsor and the Asset Management Company shall jointly publish a corrigendum<br />

immediately in the same newspapers concerned, simultaneously endorsing copies thereof<br />

to BSEC and the Stock Exchange(s) concerned, correcting the discrepancy/inconsistency<br />

as required under ‘Declaration’ provided with BSEC.<br />

(03) The Sponsor and the Asset Management Company shall immediately after publication of<br />

the prospectus jointly inform the Commission in writing that the published prospectus/<br />

abridged version of the prospectus is a verbatim copy of the prospectus vetted by the<br />

Commission.<br />

(04) The Sponsor and the Asset Management Company shall simultaneously submit to the<br />

Commission an attested copy of the application filed with the Stock Exchange(s) for listing<br />

of the securities.<br />

(05) The fund collected through public offering shall not be utilized prior to allotment and/or<br />

issuance of unit, as and when applicable, and that utilization of the said <strong>Fund</strong> shall be<br />

effected through banking channel, i.e. account payee cheque, pay order or bank draft etc.<br />

PART-C<br />

(01) All the above-imposed conditions shall be incorporated in the prospectus/abridged version<br />

immediately after the page of the table of contents where applicable, with a reference in the<br />

table of contents, prior to its publication.<br />

(02) The Commission may impose further conditions/restrictions etc. from time to time as and<br />

when considered necessary which shall also be binding upon the Sponsor, Asset<br />

Management Company, Trustee and Custodian.<br />

PART-D<br />

(01) As per provision of the ¢Xf¢SV¢l BCe, 1999 and regulations made there under, units shall<br />

only be issued in dematerialized condition. All transfer/transmission/splitting will take place<br />

in the Central Depository Bangladesh <strong>Limited</strong> (CDBL) system and any further issuance of<br />

units will be issued in dematerialized form only.<br />

An applicant (including NRB) shall not be able to apply for allotment of units without<br />

Beneficiary Owner account (BO account).<br />

(02) The Asset Management Company shall also ensure due compliance of all above-mentioned<br />

conditions.<br />

13

General Information<br />

(01) This <strong>Prospectus</strong> has been prepared by <strong>ICB</strong> <strong>AMCL</strong> based on the Trust Deed executed<br />

between the Trustee & the Sponsor of the <strong>Fund</strong>, which is approved by the Commission.<br />

The information contained herein is true and correct in all material aspects and that there<br />

are no other material facts, the omission of which would make any statement herein<br />

misleading.<br />

(02) No person is authorized to give any information to make any representation not contained in<br />

this <strong>Prospectus</strong> and if given or made, any such information or representation must not be<br />

relied upon as having been authorized by the <strong>ICB</strong> <strong>AMCL</strong>.<br />

(03) The issue as contemplated in this document is made in Bangladesh and is subject to the<br />

exclusive jurisdiction of the court of Bangladesh. Forwarding this <strong>Prospectus</strong> to any person<br />

residing outside Bangladesh in no way implies that the issue is made in accordance with<br />

the laws of that country or is subject to the jurisdiction of the laws of that country.<br />

1.6 Subscription<br />

Subscription to the <strong>ICB</strong> <strong>AMCL</strong> <strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong> 1 st <strong>Mutual</strong> <strong>Fund</strong> will remain open for 5 (five)<br />

consecutive banking days which will commence at the opening of banking business on<br />

21 April 2013 and will be closed at the end of the banking business on 25 April 2013.<br />

1.7 DECLARATIONS<br />

Declarations about the responsibility of the Sponsor<br />

The Sponsor, whose name appears in this <strong>Prospectus</strong>, accepts full responsibility for the<br />

authenticity and accuracy of the information contained in this <strong>Prospectus</strong> and other documents<br />

regarding the <strong>Fund</strong>. To the best of the knowledge and belief of the Sponsor, who has taken all<br />

reasonable care to ensure that all conditions and requirements concerning this public issue and all<br />

the information contained in this document, drawn up by virtue of the Trust Deed of the <strong>Fund</strong> by the<br />

entrusted AMC, have been met and there is no other information or documents the omission of<br />

which may make any information or statements therein misleading.<br />

The Sponsor also confirms that full and fair disclosures have been made in this <strong>Prospectus</strong> to<br />

enable the investors to make an informed decision for investment.<br />

Sd/-<br />

(Kaniz Fatema Choudhury)<br />

Deputy General Manager<br />

<strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong><br />

14

Declaration about the responsibility of the Asset Management Company<br />

This <strong>Prospectus</strong> has been prepared by us based on the Trust Deed, Investment Management<br />

Agreement, the Securities and Exchange Commission (Public Issue) Rules, 2006, the ¢p¢LE¢l¢VS<br />

J H„-Q” L¢jne (¢jEQ¤Éu¡m g¡ä) ¢h¢dj¡m¡, 2001, the ¢Xf¢SV¢l BCe, 1999 and other related<br />

agreement & examination of other documents as relevant for adequate disclosure of the <strong>Fund</strong>’s<br />

objectives and investment strategies to the investors. We also confirm that:<br />

(a)<br />

(b)<br />

(c)<br />

This <strong>Prospectus</strong> is in conformity with the documents, materials and papers related to<br />

the offer;<br />

All the legal requirements of the issue have been duly fulfilled; and<br />

The disclosures made are true, fair and adequate for investment decision.<br />

Investors should be aware that the value of investments in the <strong>Fund</strong> could be volatile and as such<br />

no guarantee can be made about the returns from the investments that the <strong>Fund</strong> will make. Like<br />

any other equity investment, only investors who are willing to accept a moderate amount of risk,<br />

should invest in the <strong>Fund</strong>. Investors are requested to pay careful attention to the “Risk Factors” as<br />

detailed in Chapter 5 and to take proper cognizance of the risks associated with any investment in<br />

the <strong>Fund</strong>.<br />

Sd/-<br />

(Md. Alauddin Khan)<br />

Chief Executive Officer<br />

<strong>ICB</strong> Asset Management Company Ltd.<br />

Declaration about the responsibility of the Trustee<br />

We, as Trustee of the <strong>ICB</strong> <strong>AMCL</strong> <strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong> 1 st <strong>Mutual</strong> <strong>Fund</strong>, accept the responsibility<br />

and confirm that we shall:<br />

(a) be the guardian of the <strong>Fund</strong>, held in trust for the benefit of the unit holders in<br />

accordance with the Rules & Trust Deed;<br />

(b)<br />

(c)<br />

always act in the interest of the unit holders;<br />

take all reasonable care to ensure that the <strong>Fund</strong> floated and managed by the Asset<br />

Management Company are in accordance with the Trust Deed and the Rules;<br />

(d) make such disclosure by the Asset Management Company to the investors as are<br />

essential in order to keep them informed about any information, which may have any<br />

bearing on their investments;<br />

(e) take such remedial steps as are necessary to rectify the situation where they have<br />

reason to believe that the conduct of business of the <strong>Fund</strong> is not in conformity with the<br />

relevant Rules.<br />

Sd/-<br />

(Md. Ayub Ali)<br />

Deputy General Manager<br />

Investment Corporation of Bangladesh<br />

15

Declaration about the responsibility of the Custodian<br />

We, as Custodian of the <strong>ICB</strong> <strong>AMCL</strong> <strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong> 1 st <strong>Mutual</strong> <strong>Fund</strong> accept the responsibility<br />

and confirm that we shall:<br />

(a)<br />

(b)<br />

keep all the securities in safe custody and shall provide the highest security for the<br />

assets of the <strong>Fund</strong>; and<br />

preserve necessary documents and record so as to ascertain movement of assets of<br />

the <strong>Fund</strong> as per Rules.<br />

Sd/-<br />

(Md. Ayub Ali)<br />

Deputy General Manager<br />

Investment Corporation of Bangladesh<br />

16

CHAPTER-2<br />

BACKGROUND<br />

2.1 Formation of <strong>ICB</strong> <strong>AMCL</strong> <strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong> 1 st <strong>Mutual</strong> <strong>Fund</strong><br />

<strong>Mutual</strong> <strong>Fund</strong>s are recent entrants in the field and are fast-emerging as a buffer between the gullible<br />

and vulnerable small and medium investors and treacherous capital market. Elsewhere in the<br />

world, <strong>Mutual</strong> <strong>Fund</strong>s have proved to be safe intermediately in capital and money market. Safety of<br />

funds, disposal of risks and a satisfactory yield are the hallmarks of <strong>Mutual</strong> <strong>Fund</strong>s. In Bangladesh<br />

<strong>ICB</strong> is the harbinger of <strong>Mutual</strong> <strong>Fund</strong>s. Out of the total 48 (forty eight) <strong>Mutual</strong> <strong>Fund</strong>s, <strong>ICB</strong> and its<br />

Subsidiary have so far floated 23 (twenty three) <strong>Mutual</strong> <strong>Fund</strong>s in the Market. Among these<br />

23 (twenty three) <strong>Mutual</strong> <strong>Fund</strong>s, the <strong>ICB</strong> <strong>AMCL</strong> has floated 14 (fourteen) <strong>Mutual</strong> <strong>Fund</strong>s of which<br />

are given bellow:<br />

Name of the Conventional <strong>Mutual</strong> <strong>Fund</strong>s Name of the Sponsor Nature<br />

<strong>ICB</strong> <strong>AMCL</strong> <strong>First</strong> <strong>Mutual</strong> <strong>Fund</strong> <strong>ICB</strong> Capital Management <strong>Limited</strong> Close-end<br />

Prime Finance <strong>First</strong> <strong>Mutual</strong> <strong>Fund</strong> Prime Finance and Investment <strong>Limited</strong> Close-end<br />

<strong>ICB</strong> <strong>AMCL</strong> Second <strong>Mutual</strong> <strong>Fund</strong> <strong>ICB</strong> Capital Management <strong>Limited</strong> Close-end<br />

<strong>ICB</strong> Employees Provident <strong>Mutual</strong> <strong>Fund</strong><br />

One: Scheme One<br />

<strong>ICB</strong> Employees Provident <strong>Fund</strong><br />

Close-end<br />

Prime <strong>Bank</strong> 1 st <strong>ICB</strong> <strong>AMCL</strong> <strong>Mutual</strong> <strong>Fund</strong> Prime <strong>Bank</strong> <strong>Limited</strong> Close-end<br />

Phoenix Finance 1 st <strong>Mutual</strong> <strong>Fund</strong> Phoenix Finance & Investment <strong>Limited</strong> Close-end<br />

<strong>ICB</strong> <strong>AMCL</strong> Unit <strong>Fund</strong> <strong>ICB</strong> Capital Management <strong>Limited</strong> Open-end<br />

Name of the Non-Conventional <strong>Mutual</strong> <strong>Fund</strong>s<br />

<strong>ICB</strong> <strong>AMCL</strong> Islamic <strong>Mutual</strong> <strong>Fund</strong> <strong>ICB</strong> Capital Management <strong>Limited</strong> Close-end<br />

<strong>ICB</strong> <strong>AMCL</strong> <strong>First</strong> NRB <strong>Mutual</strong> <strong>Fund</strong> <strong>ICB</strong> Capital Management <strong>Limited</strong> Close-end<br />

<strong>ICB</strong> <strong>AMCL</strong> Second NRB <strong>Mutual</strong> <strong>Fund</strong> <strong>ICB</strong> Capital Management <strong>Limited</strong> Close-end<br />

<strong>ICB</strong> <strong>AMCL</strong> Third NRB <strong>Mutual</strong> <strong>Fund</strong> <strong>ICB</strong> Capital Management <strong>Limited</strong> Close-end<br />

IFIL Islamic <strong>Mutual</strong> <strong>Fund</strong>-1 Islamic Finance & Investment <strong>Limited</strong> Close-end<br />

<strong>ICB</strong> <strong>AMCL</strong> Pension Holders' Unit <strong>Fund</strong> <strong>ICB</strong> Capital Management <strong>Limited</strong> Open-end<br />

Bangladesh <strong>Fund</strong><br />

Investment Corporation of Bangladesh<br />

<strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong><br />

Janata <strong>Bank</strong> <strong>Limited</strong><br />

Agrani <strong>Bank</strong> <strong>Limited</strong><br />

Rupali <strong>Bank</strong> <strong>Limited</strong><br />

Bangladesh Development <strong>Bank</strong> <strong>Limited</strong><br />

Sadharan Bima Corporation<br />

Jiban Bima Corporation<br />

Open-end<br />

<strong>Mutual</strong> <strong>Fund</strong>s contribution is bigger than other securities in developed countries. The contribution<br />

of the existing <strong>Mutual</strong> <strong>Fund</strong>s in terms of the local stock market capitalization is around 1%, which is<br />

more than 30% in many developed countries. Keeping in view the situation, <strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong> (a<br />

state owned Commercial <strong>Bank</strong>) comes forward with the proposal to act as Sponsor of a <strong>Mutual</strong><br />

<strong>Fund</strong> to fulfill the market demand.<br />

17

2.2 Present condition of the capital market regarding formation of a <strong>Mutual</strong> <strong>Fund</strong><br />

The capital market was surrounded by the downstream circle throughout the FY 2011-12. The<br />

stock market of Bangladesh passes with lot of potentiality, discussion and criticism during the year.<br />

All concerned bodies, including the Finance Ministry, NBR, Bangladesh <strong>Bank</strong>, BSEC, DSE and<br />

CSE, are working together for the development of the stock market of Bangladesh. For the<br />

development of the stock market, the Honorable Prime Minister of People’s Republic of<br />

Bangladesh ordered to take effective steps for the stabilization of the stock market after sitting with<br />

different bodies which clearly depicts the present government’s cordiality about the stock market.<br />

As on September 30, 2012, the total number of listed securities in DSE was 513 where 240 are<br />

companies, 41 <strong>Mutual</strong> <strong>Fund</strong>s, 8 debentures, 221 treasury bonds and 3 corporate bonds which<br />

issued capital was Tk. 94,195.3 crore and market capitalization was Tk. 2,52,064.5 crore. The<br />

DSE’s general price index was 4,544.41 points on September 30, 2012 which stood highest<br />

8,918.51 points on December 05, 2010. However, for implementing the demutualization process in<br />

order to establish more transparency and accountability in the activities of the DSE, a Committee<br />

was formed on February 02, 2011.<br />

As on September 30, 2012, the total number of securities in CSE was 253 which issued capital<br />

was Tk. 33,672.90 crore and market capitalization was Tk. 1,86,784.69 crore. The CSE’s selective<br />

categories index was 9,572.67 points on September 30, 2012 which stood highest 16,122.42<br />

points on December 05, 2010.<br />

Capital market related activities especially investment related information flow, value aided<br />

information services and other securities related activities may take place over the internet, which<br />

may be of immense value to various market participants. In this regard BSEC is working to frame<br />

rules/guidelines named “Securities Activities over the Internet” for introducing securities related<br />

activities in the internet. On the other hand, in order to popularize the government bond, to<br />

increase the depth of market and for development of the bond market, Finance Division-Ministry of<br />

Finance, Bangladesh <strong>Bank</strong>, BSEC and NBR are working together.<br />

By most measures the current listed closed-end <strong>Mutual</strong> <strong>Fund</strong>s in the market, which number<br />

approximately 41 in total, represent a very small percentage of the total domestic market<br />

capitalization; thus there exists greater scope for market growth in the <strong>Mutual</strong> <strong>Fund</strong> sector. In the<br />

present scenario <strong>Mutual</strong> <strong>Fund</strong> has emerged as the effective investment vehicle for those who like<br />

to rely on professional fund manager for investment management as it has been tested over time<br />

all around the world in both developed and emerging economies. The professional fund<br />

management, portfolio diversification, low cost but high quality investing, convenience, flexibility<br />

and liquidity are distinct features of a mutual fund that make it a very reliable market instrument for<br />

small investors. It is apparent that there is ample opportunity for growth of our nascent <strong>Mutual</strong> <strong>Fund</strong><br />

industry.<br />

It can be said that in course of time <strong>Mutual</strong> <strong>Fund</strong> will play a vital role in our capital market because<br />

of its inherent strength of being a professionally managed investment vehicle and the small<br />

individual investors will gradually go under the umbrella of professional fund managers like those in<br />

any other emerging market.<br />

2.3 Advantages in investing in <strong>ICB</strong> <strong>AMCL</strong> <strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong> 1 st <strong>Mutual</strong> <strong>Fund</strong><br />

Generally investment in <strong>Mutual</strong> <strong>Fund</strong>s enjoys the some advantages compared to investment made<br />

directly in other securities of the capital market. Investors of this <strong>Mutual</strong> <strong>Fund</strong> should be able to<br />

enjoy the following advantages:<br />

18

(01) Diversified portfolio to be developed for the <strong>Fund</strong> will help in lowering investment risk of<br />

the small investors.<br />

(02) Diversified portfolio of the <strong>Fund</strong> will help the small investor to access to the whole<br />

market, which is difficult at individual level.<br />

(03) By channelizing small investors saving both in local currency and foreign currency will<br />

add liquidity to the market.<br />

(04) As the <strong>Fund</strong> will be professionally managed, investors will be relieved from the<br />

emotional stress associated with day-to-day management of individual investment<br />

portfolio.<br />

(05) The <strong>Mutual</strong> <strong>Fund</strong> industry gives investors more and better information than any other<br />

investment industry.<br />

(06) Expertise in stock selection and timing is made available to investors by generating<br />

higher return to them.<br />

(07) The investors will be able to save a great deal in transaction/operating cost as he/she<br />

has access to a larger number of securities by purchasing a single unit of the <strong>Mutual</strong><br />

<strong>Fund</strong>.<br />

(08) <strong>Fund</strong> will apply for listing on stock exchanges to enable investors to enjoy liquidity of<br />

their investment as well as to realize appreciation available as a result improving market<br />

positions.<br />

(09) According to the rules of BSEC, the <strong>Mutual</strong> <strong>Fund</strong>s and collective investment schemes<br />

registered with the Commission enjoy a ten percent reserve quota in all Initial Public<br />

Offerings (IPOs). Therefore, investors in <strong>Mutual</strong> <strong>Fund</strong>s by default enjoy the benefit of<br />

acquiring lucrative stocks at the Primary Market.<br />

(10) Tax exemption is available for investors of <strong>Mutual</strong> <strong>Fund</strong>. Income from the <strong>Fund</strong> will be<br />

tax free up-to certain level, which is permitted as per Finance Act.<br />

(11) Investment in the <strong>Fund</strong> would qualify for investment tax credit under section 44(2) of the<br />

Income Tax Ordinance, 1984.<br />

(12) Management and operation of <strong>Mutual</strong> <strong>Fund</strong>s are subject to prudential guidelines. BSEC<br />

regularly monitors the performance of such funds. The laws governing <strong>Mutual</strong> <strong>Fund</strong>s<br />

require exhaustive disclosure to the regulator and general public. As a result, the<br />

investors will be able to know the performance of the <strong>Fund</strong> and accordingly they can be<br />

able to take convenient entry and exit options.<br />

19

CHAPTER-3<br />

THE FUND<br />

3.1 The constitution of the <strong>Fund</strong><br />

The <strong>ICB</strong> <strong>AMCL</strong> <strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong> 1 st <strong>Mutual</strong> <strong>Fund</strong> is constituted by a Trust Deed entered into<br />

between <strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong> and Investment Corporation of Bangladesh on September 06, 2010<br />

under the Trust Act, 1882 and Registration Act, 1908.<br />

The <strong>Fund</strong> has been registered by the BSEC on October 03, 2010 under the ¢p¢LE¢l¢VS J H„-Q”<br />

L¢jne (¢jEQ¤Éu¡m g¡ä) ¢h¢dj¡m¡, 2001. The <strong>Fund</strong> received consent for issuing <strong>Prospectus</strong> for<br />

public offer from BSEC on March 19, 2013.<br />

3.2 Life of the <strong>Fund</strong><br />

The <strong>Fund</strong> will be a close-end <strong>Mutual</strong> <strong>Fund</strong> of 10 (ten) years tenure, established with a view to<br />

broaden the base of investment and develop the capital market.<br />

The Trust Deed also provides the flexibility to the unit-holders to extend the tenure of the <strong>Fund</strong><br />

beyond the initial 10 years. Besides this, if three-fourth majority of the unit holders pass a<br />

resolution in favour of converting the <strong>Fund</strong> as an open-end <strong>Mutual</strong> <strong>Fund</strong> from close-end nature,<br />

then the <strong>Fund</strong> may be converted as an open-end <strong>Mutual</strong> <strong>Fund</strong> after being prior consent of the<br />

Commission.<br />

3.3 Size, Face Value and Market Lot of the <strong>Fund</strong><br />

(01) Total <strong>Fund</strong> is at 10,00,00,000 (ten crore) units of Tk. 10.00 (ten) each totaling<br />

Tk. 100,00,00,000.00 (one hundred crore) only.<br />

(02) The Sponsor’s portion of the <strong>Fund</strong> is 2,50,00,000 (two crore fifty lac) units of Tk. 10.00<br />

(ten) each totaling Tk. 25,00,00,000.00 (twenty five crore) only.<br />

(03) Size of the Pre-IPO Placement is 2,50,00,000 (two crore fifty lac) units of Tk. 10.00 (ten)<br />

each totaling Tk. 25,00,00,000.00 (twenty five crore) only.<br />

(04) Size of the Initial Public Offering (IPO) is 5,00,00,000 (five crore) units, each worth<br />

Tk. 10.00 (ten), totaling Tk. 50,00,00,000.00 (fifty core) only available as public offering<br />

to General Public, Affected Small Investors (r¢aNËÙÛ r¤â ¢h¢e-u¡NL¡l£), NRB, <strong>Mutual</strong><br />

<strong>Fund</strong>s and collective investment schemes.<br />

(05) The market lot will be constituted of 500 (five hundred) units.<br />

20

CHAPTER- 4<br />

INVESTMENT OBJECTIVES AND POLICIES<br />

4.1 Investment Objective<br />

The main objective of the <strong>Fund</strong> is to invest in the Capital and Money Market of the country and<br />

to provide attractive dividend to the investors.<br />

4.2 Investment Policies<br />

(01) The <strong>Fund</strong> shall invest subject to the ¢h¢dj¡m¡ and only in those securities, deposits and<br />

investments approved by the BSEC and/or the Bangladesh <strong>Bank</strong> and/or the Insurance<br />

Regulatory Authority (IRA) of Bangladesh or any other competent authority in this<br />

regards.<br />

(02) Not less than 60% of the total asset of the <strong>Fund</strong> shall be invested in capital market<br />

instruments out of which at least 50% shall be invested in listed securities or as<br />

determined by the Commission from time to time.<br />

(03) Not more than 15% of the total asset of the <strong>Fund</strong> shall be invested in pre-IPOs at one<br />

time or as determined by the Commission from time to time.<br />

(04) All money collected under the <strong>Fund</strong> shall be invested in en-cashable/transferable<br />

instruments, securities whether in money market or capital market or privately placed<br />

pre-IPO equity, preference shares, debentures or securitized debts.<br />

(05) The <strong>Fund</strong> shall get the securities purchased or transferred in the name of the <strong>Fund</strong>.<br />

(06) Only the Asset Management Company will make the investment decisions and place<br />

orders for securities to be purchased or sold for the <strong>Fund</strong>'s portfolio.<br />

(07) The Asset Management Company will choose broker(s) for the purchase and sale of<br />

securities for the <strong>Fund</strong>’s portfolio.<br />

(08) Settlement of transaction will take place as per the customs and practice of the Stock<br />

Exchange(s) in the country.<br />

4.3 Investment Restrictions<br />

In making investment decision the following restrictions should be taken into due consideration:<br />

(01) The <strong>Fund</strong> shall not invest more than 10% of its assets in any one particular company or<br />

as determined by the Commission from time to time.<br />

(02) The <strong>Fund</strong> shall not own more than 15% of any company’s paid-up capital at any point of<br />

time or as determined by the Commission from time to time.<br />

(03) The <strong>Fund</strong> shall not invest more than 20% of its total asset in shares, debentures or<br />

other securities of a single company or group or as determined by the Commission from<br />

time to time.<br />

21

(04) The <strong>Fund</strong> shall not invest more than 25% of its total asset in shares, debentures or<br />

other securities in any one industry or as determined by the Commission from time to<br />

time.<br />

(05) The <strong>Fund</strong> shall not invest in or lend to any Scheme under the same Asset Management<br />

Company unless authorized by the Commission.<br />

(06) The <strong>Fund</strong> shall not acquire any asset out of the Trust property, which involves the<br />

assumption of any liability that is unlimited or shall result in encumbrance of the Trust<br />

property in any way.<br />

(07) The <strong>Fund</strong> shall not provide term loan or advance to any entity unless authorized by the<br />

Commission.<br />

(08) The <strong>Fund</strong> shall not involve in option trading or short selling or carry forward transactions<br />

unless authorized by the Commission.<br />

(09) The <strong>Fund</strong> shall not buy its own units, other than under any approved buy-back or<br />

redemption plan.<br />

4.4 Valuation Policy<br />

The <strong>Fund</strong> intends to determine its NAV per unit on the last business day of each week by dividing<br />

the value of the net asset of the <strong>Fund</strong> (the value of total asset less total liabilities as per ¢h¢d 60 of<br />

the ¢p¢LE¢l¢VS J H„-Q” L¢jne (¢jEQ¤Éu¡m g¡ä) ¢h¢dj¡m¡, 2001 by the total number of units<br />

outstanding). As per ¢h¢d 58 of the ¢p¢LE¢l¢VS J H„-Q” L¢jne (¢jEQ¤Éu¡m g¡ä) ¢h¢dj¡m¡, 2001,<br />

valuation policy of investment of the <strong>Fund</strong> needs to be approved earlier by BSEC. Valuation<br />

criterion so far approved by the Commission in the Trust Deed is as follows:<br />

(01) For listed securities, the average quoted market price on the Stock Exchanges on the<br />

date of valuation shall form the basis of any calculation of Net Asset Value of such<br />

securities in the portfolio of the <strong>Fund</strong>.<br />

(02) For securitized debts, debentures, margin or fixed deposits, the accrued interest on<br />

such instruments on the date of valuation shall be taken into account in any calculation<br />

of Net Asset Value of such securities in the portfolio of the <strong>Fund</strong>.<br />

(03) The valuation of listed securities not traded within previous one month will be made<br />

based on their reasonable value by the Asset Management Company and approved by<br />

the Trustee and commented upon by the auditors in the Annual Report of the <strong>Fund</strong> but<br />

shall not be more than the intrinsic value of the securities.<br />

(04) The valuation of non-listed securities will be made by the Asset Management Company<br />

with their reasonable value and approved by the Trustee and commented upon by the<br />

Auditors in the Annual Report of the <strong>Fund</strong>.<br />

(05) Once non-listed securities are valued, the valued amount will be considered for purpose<br />

of valuing the <strong>Fund</strong>'s assets in any interval of time until the securities are further<br />

revalued by the Asset Management Company.<br />

(06) Asset Management Company and Trustee will value the non-listed securities at least<br />

once in every three months.<br />

22

(07) In case of deferred expenses, accrued expenses for the period will be taken into<br />

account for determining total liabilities.<br />

(08) Net Asset Value (NAV) calculation<br />

The <strong>Fund</strong> will use the following formula to derive NAV per unit:<br />

Total NAV = V A - L T<br />

NAV per unit = Total NAV / No. of units outstanding<br />

V A<br />

L T<br />

= Value of all securities in vault + Value of all securities placed in lien + Cash<br />

in hand and at bank + Value of all securities receivables + Receivables of<br />

proceeds of sale of investments + Dividend receivables net of tax +<br />

Interest receivables net of tax + Issue expenses amortized as on date +<br />

Printing, publication and stationery expenses amortized as on date.<br />

= Value of all securities payable + Payable against purchase of investments<br />

+ Payable as brokerage and custodial charges + Payable as Trustee fees<br />

+ All other payable related to printing, publication and stationery + Accrued<br />

deferred expenses with regard to management fee, annual fee, audit fee<br />

and safe keeping fee.<br />

4.5 Investment Management<br />

<strong>ICB</strong> <strong>AMCL</strong> shall conduct the day-to-day management of the <strong>Fund</strong>’s portfolio as the Asset<br />

Management Company subject to the provisions laid down in the ¢h¢dj¡m¡ and Trust Deed or any<br />

general directions given by the Trustee and/or by the Commission.<br />

However, <strong>ICB</strong> <strong>AMCL</strong> will have discretionary authority over the <strong>Fund</strong>’s portfolio about investment<br />

decision.<br />

4.6 Dividend Policy<br />

(01) The accounting year of the <strong>Fund</strong> shall be July 01 to June 30.<br />

(02) The <strong>Fund</strong> shall, as soon as may be, after the closing of the annual accounts, declare<br />

and distribute cash dividend or reinvestment or both cash dividend and reinvestment if<br />

any, to the unit holders in accordance with the ¢h¢dj¡m¡, an amount which shall not be<br />

less than 70% of the realized income during the year, or as determined by the<br />

Commission from time to time. The <strong>Fund</strong> shall create a Dividend Equalization Reserve<br />

by appropriation from the income of the <strong>Fund</strong>.<br />

(03) Before declaration of dividend, the Asset Management Company shall make a provision<br />

in consultation with the auditors if market value of investments goes below the<br />

acquisition cost and the method of calculation of this provision will be incorporated in<br />

the notes of accounts.<br />

(04) Surpluses arising simply from the valuation of investments shall not be available for<br />

dividend.<br />

23

(05) Dividend warrants will be dispatched within 45 (forty five) days from the declaration of<br />

such dividend.<br />

(06) Before record of ownership by the CDBL, a transferee shall not possess the right to any<br />

dividend declared by the <strong>Fund</strong>.<br />

(07) The Asset Management Company may open separate <strong>Bank</strong> Account for each dividend<br />

distribution out of the <strong>Fund</strong>. Notwithstanding any thing in the Trust Deed the beneficial<br />

ownership of the balances in the Accounts shall vest in the Unit Holders.<br />

24

CHAPTER-5<br />

RISK MANAGEMENT<br />

5.1 Risk Factors<br />

Investment in securities market always bears some risks. Investment in this <strong>Fund</strong> also involves<br />

certain risk factors. The investors should carefully consider the following risks in addition to other<br />

information contained in the <strong>Prospectus</strong> in evaluating the offer and also for taking a decision<br />

whether to invest or not:<br />

(01) The performance of the <strong>Fund</strong> is directly related with the macro economic situation<br />

particularly the capital market of Bangladesh.<br />

(02) Since the capital market of Bangladesh is highly volatile, there is no assurance of<br />

achieving the stated objective of the <strong>Fund</strong>.<br />

(03) Due to small number of listed securities in both the Stock Exchanges, it may be difficult<br />

to invest the <strong>Fund</strong>’s assets in a widely diversified portfolio as and when required to do<br />

so.<br />

(04) Due to a very thin secondary debenture market in Bangladesh, it would be difficult for<br />

the <strong>Fund</strong> Manager to swap between asset classes if and when required.<br />

(05) <strong>Limited</strong> money market instruments narrowed the opportunity of short term or temporary<br />

investments of the <strong>Fund</strong>.<br />

(06) Stock market trends show that price of almost all the listed securities move in<br />

unpredictable direction which may affect the value of the <strong>Fund</strong>. Moreover, there is no<br />

guarantee that the market price of units of the <strong>Fund</strong> will fully reflect their underlying net<br />

asset values.<br />

(07) If the companies fail to provide expected dividend, this may affect the return of the<br />

<strong>Fund</strong>.<br />

(08) For investing in Pre-Public Offer Placement securities i.e. in unlisted equity securities by<br />

the <strong>Fund</strong> may involve liquidity risk.<br />

(09) Uncertainties like political and social instability may affect the value of the <strong>Fund</strong>’s<br />

Assets.<br />

(10) Government policy and tax laws may change, affecting the return on investment in<br />

Units.<br />

(11) Adverse effect of the economic crisis of the international community on the Capital<br />

Market of Bangladesh may affect the performance of the <strong>Fund</strong>.<br />

(12) Adverse natural climatic condition may hamper the performance of the <strong>Fund</strong>.<br />

25

5.2 Expected Market Performance of the <strong>Fund</strong><br />

(01) As the capital market index is comparatively low now, the <strong>Fund</strong> should be able to<br />

construct portfolio at a relatively cheaper cost base.<br />

(02) It is expected that demand of the <strong>Fund</strong>’s units will always rule over supply.<br />

(03) Image of <strong>ICB</strong>, being the holding company of the <strong>ICB</strong> <strong>AMCL</strong> and the Trustee of the <strong>Fund</strong><br />

for successful marketing of 8 (eight) close-end and 1 (one) open-end <strong>Mutual</strong> <strong>Fund</strong> may<br />

motivate investors to invest in this <strong>Fund</strong> before enactment of the ¢p¢LE¢l¢VS J H„-Q”<br />

L¢jne (¢jEQ¤Éu¡m g¡ä) ¢h¢dj¡m¡, 2001.<br />

(04) Successful launching and subsequent satisfactory performance of 14 (fourteen) <strong>Mutual</strong><br />

<strong>Fund</strong>s managed by the <strong>ICB</strong> <strong>AMCL</strong> may attract the Investors to invest in this <strong>Fund</strong>.<br />

5.3 Who to invest and how much to invest<br />

Persons who do not have tolerance of bearing risk and know nothing about the functioning of the<br />

capital market need not apply for the units of the <strong>Fund</strong>. Considering other factors like the<br />

investment opportunities available in the market, return expectation, income level and consumption<br />

pattern, one may put a part of his/her total portfolio into the <strong>Fund</strong>.<br />

26

CHAPTER-6<br />

FORMATION, MANAGEMENT AND ADMINISTRATION<br />

6.1 Sponsor of the <strong>Fund</strong><br />

<strong>Sonali</strong> <strong>Bank</strong> emerged as the largest and leading nationalized commercial bank by proclamation of<br />

the <strong>Bank</strong>s' Nationalization Order 1972 (Presidential Order-26) liquidating the then National <strong>Bank</strong> of<br />

Pakistan, Premier <strong>Bank</strong> and <strong>Bank</strong> of Bhwalpur. As a fully state owned institution, the bank had<br />

been discharging its nation-building responsibilities by undertaking government entrusted different<br />

socio-economic schemes as well as money market activities of its own volition, covering all<br />

spheres of the economy. The <strong>Bank</strong> has been converted to a public limited company with 100%<br />

ownership of the government and started functioning as <strong>Sonali</strong> <strong>Bank</strong> <strong>Limited</strong> from November 15,<br />

2007 taking over all assets, liabilities and business of <strong>Sonali</strong> <strong>Bank</strong>. After corporatization, the<br />

management of the <strong>Bank</strong> has been given required autonomy to make the <strong>Bank</strong> competitive & to<br />