Economic Perspective - Jewish Community Federation

Economic Perspective - Jewish Community Federation

Economic Perspective - Jewish Community Federation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Economic</strong> <strong>Perspective</strong> for January 25, 2008: This Is Just The Beginning<br />

Tuesday’s surprise cut in the Federal funds rate in and of itself will<br />

have a negligible impact on financing for the property markets.<br />

The credit market environment won’t change until the yield curve<br />

steepens (yields on longer term securities become much higher<br />

than the rate on short-term paper) and steepens a lot. A low base<br />

lending rate in combination with a steep curve is always the way<br />

out of a market mess because it puts the necessary profit back into<br />

fi nancial institutions so that balance sheets can be stabilized and<br />

other financial institutions can be rescued. Once this reshuffling<br />

of capital is effectively complete, the credit markets can get back<br />

to the business of fi nancing economic expansion.<br />

The yield curve, however, is still fl at and that makes recovery<br />

problematic. Yield curves steepen when markets price to a recovery<br />

rather than recession. To get there, broad policy intervention<br />

must be seen as sufficient to keep the economic situation, severe<br />

as it is, from demanding a devastating outcome. Judging from<br />

how securities are still being priced, the consensus seems to be<br />

that policy has yet to get out in front of a deteriorating economic<br />

environment.<br />

A significant factor likely weighing down market sentiment is that<br />

the housing market cannot be particularly responsive to lower interest<br />

rates. Housing has always been one of the main mechanisms by<br />

which interest rate cuts stimulate the economy. This time around<br />

we have the huge excess inventory of unsold homes, the continuing<br />

lack of credit for marginal borrowers and the negative psychology<br />

for house prices. These types of debt/deflation cycles are tough to<br />

reverse and so we expect the housing market to show little nearterm<br />

response and at best will have a delayed response.<br />

To the point of shifting the confidence of market participants by its<br />

actions, the Fed has also been its own worst enemy. When the Fed<br />

comes in and cuts the funds rate in a surprise 75 basis point move,<br />

its new transparent communication style conveys a worried Fed<br />

rather than a pre-emptive one. When the central bank is worried,<br />

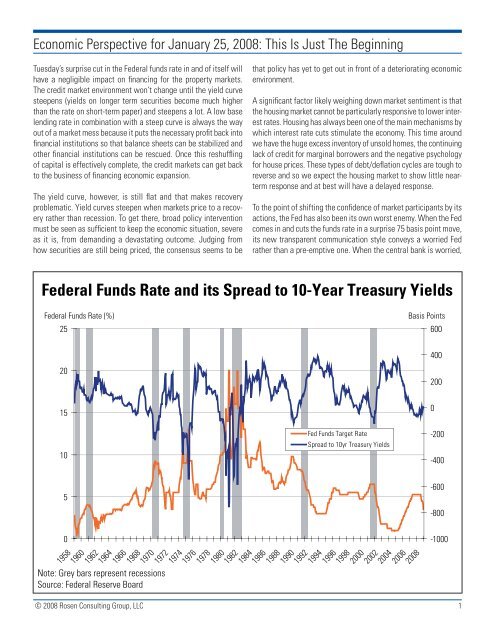

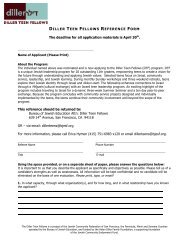

Federal Funds Rate and its Spread to 10-Year Treasury Yields<br />

Federal Funds Rate (%)<br />

25<br />

Basis Points<br />

600<br />

400<br />

20<br />

200<br />

15<br />

0<br />

10<br />

5<br />

0<br />

1958<br />

1960<br />

1962<br />

Note: Grey bars represent recessions<br />

Source: Federal Reserve Board<br />

Fed Funds Target Rate<br />

Spread to 10yr Treasury Yields<br />

1964<br />

1966<br />

1968<br />

1970<br />

1972<br />

1974<br />

1976<br />

1978<br />

1980<br />

1982<br />

1984<br />

1986<br />

1988<br />

1990<br />

1992<br />

1994<br />

1996<br />

1998<br />

2000<br />

2002<br />

2004<br />

2006<br />

2008<br />

© 2008 Rosen Consulting Group, LLC 1<br />

-200<br />

-400<br />

-600<br />

-800<br />

-1000

markets are frightened. At some point the central bank needs to<br />

convey that its policy actions ensure a positive outcome rather<br />

than that they are chasing the market to stop the fall. The Federal<br />

funds rate will eventually be low enough to raise confidence in a<br />

recovery and thus steepen the curve. Therefore we believe that<br />

barring an unforeseen sudden shift in market sentiment, the funds<br />

rate isn’t low enough.<br />

How the low base lending rate/steep yield curve works to restart<br />

the flow of credit is by first creating the sharply wider net interest<br />

margins necessary to restore profit levels at financial institutions.<br />

Financial institutions are leveraged operations and so the low<br />

rate/steep curve sharply lowers the cost of carrying their inventory.<br />

As bank balance sheets stabilize, investors eventually grow weary<br />

of being “punished” for holding cash and then recommit capital to<br />

the credit markets in order to earn compensatory returns. A less<br />

stringent credit environment begins to unfold. This is the first sign of<br />

a turn towards growth—an environment obviously more conducive<br />

to real estate transactions.<br />

The central bank has engineered a positive curve for every recovery<br />

since 1958. This is illustrated in the accompanying chart<br />

that compares the Federal funds rate to the spread between the<br />

10-year Treasury yield and the target funds rate. Today’s flat yield<br />

curve is in no way close to what is necessary to move the economy<br />

toward recovery.<br />

Bringing the fi nancial system to heel is, however, much more<br />

problematic. Banks serve a unique function in the economy. They<br />

function freely to chase profits, like any firm in any industry, but we<br />

cannot afford to let them fail because the broader economy is then<br />

starved of the credit necessary to grow. Whether banks will still be<br />

given the free upside and socialized protection to the downside, a<br />

balance that only serves to increase the risk taking, is the debate<br />

that will take center stage once the current mess is behind us. In<br />

the meantime, the Federal Reserve is chartered to keep the banking<br />

system afloat and credit flowing to the economy at large, and that<br />

is exactly what they are doing.<br />

In sum, the required first steps have been taken but the flat curve<br />

says that the market has yet to begin discounting a recovery in its<br />

valuations. Until sentiment shifts to expectations for an upturn,<br />

the credit necessary to finance economic expansion will not be<br />

forthcoming. For the property markets, now so directly reliant on the<br />

capital markets to insure an inflow of credit, until a steeper curve<br />

stabilizes the debt markets, the credit crunch continues.<br />

—Steven Blitz<br />

A hallmark of the current expansion has been its unprecedented<br />

reliance on cheap credit created by an intricate and overly complex<br />

global financial system—a system that in and of itself was also<br />

a source of economic growth. The systemic risk inherent in the<br />

market’s unprecedented complexity means that low rates and a<br />

steep curve will likely need to be in place for an extended period<br />

in order to give the market the time necessary to unwind positions,<br />

bail out participants and get balance sheets back in order. There<br />

is some thought that the Fed needs to hold the line and allow the<br />

free market to punish the excess and thus bring to heel what has<br />

been an obviously out-of-control capital market—lest it risk a<br />

resumption of cheap credit and the attendant inflation risk. The<br />

dollar plays into this policy prescription as well, because the debt<br />

fueled U.S. economy is doomed to implosion if foreign investors<br />

demand signifi cantly higher real returns for their capital.<br />

© 2008 Rosen Consulting Group, LLC 2