Annual Report 2009 - Camposol

Annual Report 2009 - Camposol

Annual Report 2009 - Camposol

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

40<br />

camposol annual report <strong>2009</strong><br />

Overview<br />

Product &<br />

categories<br />

Management’s<br />

<strong>Report</strong><br />

Key Investment<br />

Considerations<br />

Corporate<br />

Governance<br />

Independent Auditors’ <strong>Report</strong><br />

and Audited Financial Statements<br />

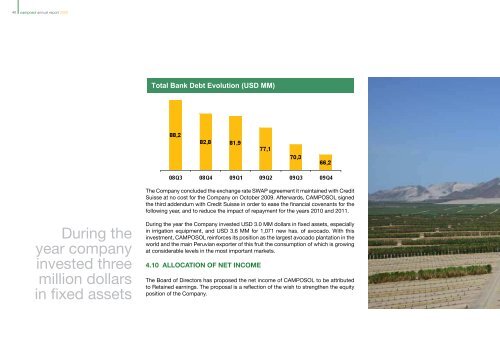

Total Bank Debt Evolution (USD MM)<br />

4.11 Shares and<br />

shareholders<br />

Investor Shares Percentage<br />

1 DYER – CORIAT HOLDING 8 571 000 28,73%<br />

Largest 20 Shareholders as of<br />

18 February, 2010.<br />

2 DEUTSCHE BANK AG LON PRIME BROKERAGE FULL 4 350 018 14,58%<br />

3 ANDEAN FISCHING L.L. 3 380 100 11,33%<br />

4 EUROCLEAR BANK S.A./ 25% CLIENTS 2 196 000 7,36%<br />

5 FONDO DE INVERSIóN A Y FORESTAL 1 908 750 6,40%<br />

6 CLEARSTREAM BANKING CID DEPT, FRANKFURT 1 829 400 6,13%<br />

7 SOUTH WINDS AS 1 753 000 5,88%<br />

8 PERU LAND FARMING LL 1 195 950 4,01%<br />

9 ORKLA ASA 750 000 2,51%<br />

10 BROWN BROTHERS HARRI S/A GENESIS EME OPP 404 000 1,35%<br />

The Company concluded the exchange rate SWAP agreement it maintained with Credit<br />

Suisse at no cost for the Company on October <strong>2009</strong>. Afterwards, CAMPOSOL signed<br />

the third addendum with Credit Suisse in order to ease the financial covenants for the<br />

following year, and to reduce the impact of repayment for the years 2010 and 2011.<br />

11 DEUTSCHE BANK AG LON 393 482 1,32%<br />

12 STOREBRAND LIVSFORSI P980, AKSJEFONDET 322 000 1,08%<br />

13 CREDIT SUISSE SECURI SPECIAL CUSTODY A/C 309 000 1,04%<br />

During the<br />

year company<br />

invested three<br />

million dollars<br />

in fixed assets<br />

During the year the Company invested USD 3.0 MM dollars in fixed assets, especially<br />

in irrigation equipment, and USD 3.6 MM for 1,071 new has. of avocado. With this<br />

investment, CAMPOSOL reinforces its position as the largest avocado plantation in the<br />

world and the main Peruvian exporter of this fruit the consumption of which is growing<br />

at considerable levels in the most important markets.<br />

4.10 Allocation of Net Income<br />

The Board of Directors has proposed the net income of CAMPOSOL to be attributed<br />

to Retained earnings. The proposal is a reflection of the wish to strengthen the equity<br />

position of the Company.<br />

14 JPMORGAN CHASE BANK NORDEA RE:NON-TREATY 234 500 0,79%<br />

15 VPF NORDEA AVKASTNIN C/O JPMORGAN EUROPE 193 900 0,65%<br />

16 DNB NOR SMB VPF 165 000 0,55%<br />

17 SABARO INVESTMENTS L JOHN CASELY 157 000 0,53%<br />

18 MP PENSJON 137 000 0,46%<br />

19 VPF NORDEA NORGE VER C/O JPMORGAN EUROPE 91 300 0,31%<br />

20 VITAL FORSIKRING ASA OMLØPSMIDLER 77 043 0,26%<br />

TOTAL TOP 20 28,418,443 95,27%<br />

OTHERS 1,415,377 4,73%<br />

TOTAL 29,833,820 100.00%<br />

41