Agenda - City of Santa Monica

Agenda - City of Santa Monica

Agenda - City of Santa Monica

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

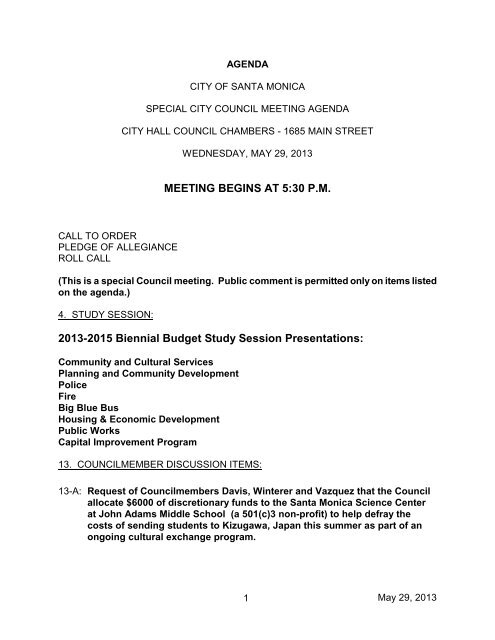

AGENDA<br />

CITY OF SANTA MONICA<br />

SPECIAL CITY COUNCIL MEETING AGENDA<br />

CITY HALL COUNCIL CHAMBERS - 1685 MAIN STREET<br />

WEDNESDAY, MAY 29, 2013<br />

MEETING BEGINS AT 5:30 P.M.<br />

CALL TO ORDER<br />

PLEDGE OF ALLEGIANCE<br />

ROLL CALL<br />

(This is a special Council meeting. Public comment is permitted only on items listed<br />

on the agenda.)<br />

4. STUDY SESSION:<br />

2013-2015 Biennial Budget Study Session Presentations:<br />

Community and Cultural Services<br />

Planning and Community Development<br />

Police<br />

Fire<br />

Big Blue Bus<br />

Housing & Economic Development<br />

Public Works<br />

Capital Improvement Program<br />

13. COUNCILMEMBER DISCUSSION ITEMS:<br />

13-A: Request <strong>of</strong> Councilmembers Davis, Winterer and Vazquez that the Council<br />

allocate $6000 <strong>of</strong> discretionary funds to the <strong>Santa</strong> <strong>Monica</strong> Science Center<br />

at John Adams Middle School (a 501(c)3 non-pr<strong>of</strong>it) to help defray the<br />

costs <strong>of</strong> sending students to Kizugawa, Japan this summer as part <strong>of</strong> an<br />

ongoing cultural exchange program.<br />

1<br />

May 29, 2013

13-B: Request <strong>of</strong> Councilmember Winterer that the Council authorize staff to<br />

return with an emergency ordinance amending SMMC Section 8.08.070(d))<br />

to allow a fourth extension <strong>of</strong> time for building permits for development<br />

projects that retain designated <strong>City</strong> Landmarks.<br />

ADJOURNMENT.<br />

Any documents produced by the <strong>City</strong> and distributed to a majority <strong>of</strong> the <strong>City</strong> Council<br />

regarding any item on this agenda will be made available at the <strong>City</strong> Clerk's Counter<br />

located at <strong>City</strong> Hall, 1685 Main Street, <strong>Santa</strong> <strong>Monica</strong>, and at the <strong>City</strong>’s public libraries<br />

during normal business hours. Documents are also available at<br />

http://www.smgov.net/departments/clerk/agendas.aspx.<br />

For a free subscription to <strong>City</strong> Council <strong>Agenda</strong>s sign up at http://www01.smgov.net/win<br />

or call the <strong>City</strong> Clerk’s Office at (310) 458-8211.<br />

Any member <strong>of</strong> the public unable to attend a meeting but wishing to comment on an<br />

item(s) listed on the agenda may submit written comments prior to the meeting by<br />

mailing them to: <strong>City</strong> Clerk, 1685 Main Street, <strong>Santa</strong> <strong>Monica</strong>, CA 90401. Comments<br />

may also be e-mailed to: clerk@smgov.net<br />

Si desea comunicarse con alguien en español, llame a nuestra <strong>of</strong>icina al (310) 458-8211 y<br />

pida hablar con Esterlina Lugo.<br />

<strong>City</strong> Hall and the Council Chamber is wheelchair accessible. If you require any special<br />

disability related accommodations (i.e. sign language interpreting, access to an<br />

amplified sound system, etc.), please contact the <strong>City</strong> Clerk’s Office at (310) 458-8211<br />

or TDD: (310) 917-6626 at least 3 days prior to the scheduled meeting. This agenda is<br />

available in alternate format upon request by calling the <strong>City</strong> Clerk’s Office.<br />

Parking is available in front <strong>of</strong> <strong>City</strong> Hall and on Olympic Drive and in the Civic Center<br />

Parking Structure (validation free).<br />

2<br />

May 29, 2013

<strong>City</strong> Council Report<br />

To:<br />

From:<br />

Subject:<br />

<strong>City</strong> Council Meeting: May 28, 2013<br />

<strong>Agenda</strong> Item: 4-A<br />

Mayor and <strong>City</strong> Council<br />

Gigi Decavalles-Hughes, Director <strong>of</strong> Finance<br />

Financial Status Update and Proposed FY 2013-15 Biennial Budget<br />

Recommended Actions<br />

Staff recommends that the <strong>City</strong> Council:<br />

1) Receive the FY 2013-14 through FY 2017-18 Financial Status Update;<br />

2) Receive <strong>City</strong> departments’ presentations on the Proposed FY 2013-15 Biennial<br />

Budget;<br />

3) Review and provide direction to staff on the Proposed FY 2013-15 Biennial<br />

Budget (Attachment A);<br />

4) Review and provide direction to staff on Decision Packages (Attachment C);<br />

5) Review and provide direction to staff on the Fee Study Report (Attachment D);<br />

and<br />

6) Direct staff to proceed with setting the FY 2013-15 Budget Adoption hearing on<br />

June 25, 2013.<br />

Executive Summary<br />

This report presents the <strong>City</strong> <strong>of</strong> <strong>Santa</strong> <strong>Monica</strong>’s Proposed FY 2013-15 Biennial Budget<br />

and Capital Improvement Program Budget for FY 2013-14, as well as the May 2013<br />

Financial Status Update for the General Fund for Fiscal Years 2013-14 through<br />

2017-18. The financial status update includes the numbers set forth in the Proposed<br />

Budget as well as new information received since the Five Year Financial Forecast was<br />

presented to Council on January 22, 2013.<br />

In January, staff projected a potential General Fund structural deficit beginning in<br />

FY 2013-14 in the worst case, and in FY 2014-15 in the best case. At the time, Council<br />

directed staff to implement strategies to develop a balanced FY 2013-15 Biennial<br />

Budget that would avert such deficits.<br />

The Proposed FY 2013-15 Biennial Budget is balanced and maintains core municipal<br />

services. Responding to Council direction, <strong>City</strong> staff identified expenditure savings and<br />

cost recovery proposals resulting from a comprehensive fee study when developing<br />

1

their department budgets. The Proposed Biennial Budget is $520.9 million in<br />

FY 2013-14 and $527.7 million in FY 2014-15.<br />

The May 2013 Financial Status Update shows positive balances in the first two years.<br />

However, structural deficits starting at $3.9 million begin in FY 2015-16 due to projected<br />

extraordinary increases in the <strong>City</strong>’s pension contributions, and increase to $9.2 million<br />

in FY 2017-18. Applying best and worst scenarios to the forecast results in varying<br />

degrees <strong>of</strong> deficits over the latter three and four years <strong>of</strong> the forecast, respectively.<br />

Changes in other funds since the January 2013 forecast are resulting in healthier fund<br />

balances.<br />

Background<br />

On January 22, 2013, <strong>City</strong> Council reviewed and commented on the FY 2013-14<br />

through FY 2017-18 Five-Year Financial Forecast. The Forecast included a range <strong>of</strong><br />

scenarios noting best to worst cases. In the best case, the General Fund would have a<br />

budget shortfall <strong>of</strong> $9 million in FY 2014-15, increasing to approximately $15 million in<br />

FY 2017-18. Under the worst case scenario, State takeaways related to Redevelopment<br />

dissolution and higher expenditures related to labor costs resulted in a deficit <strong>of</strong><br />

$4 million beginning in FY 2013-14, increasing to almost $29 million in FY 2017-18. To<br />

achieve fiscal sustainability despite the pressures <strong>of</strong> rising costs and the threat <strong>of</strong><br />

redevelopment claw backs, Council directed staff to implement various budget<br />

strategies in the development <strong>of</strong> the Proposed FY 2013-15 Biennial Budget. These<br />

budget strategies include controlling total compensation costs through negotiations with<br />

bargaining units; achieving efficiencies and increasing cost recovery to lower the<br />

General Fund net expenditure baseline by 5%; and maintaining the <strong>City</strong>’s healthy<br />

reserves.<br />

Discussion<br />

Economic Update<br />

The national economy is recovering slowly. After annual growth <strong>of</strong> 2% in the last three<br />

years, many experts are projecting growth approaching 3% annually in 2014 and 2015.<br />

Unemployment, while slowly improving, at 7.5%, is still not expected to drop below 7%<br />

until possibly 2015, based on recent economic forecasts. The housing market is<br />

2

ebounding and home prices and sales are anticipated to continue to grow over the next<br />

two years.<br />

Like the national economy, the State economy is expected to show modest<br />

improvement over the next few years. Unemployment continues to fall, housing sales<br />

and median prices have been strong, and the commercial real estate market is also<br />

showing signs <strong>of</strong> recovery, with lower vacancy rates and higher asking rents. The<br />

Governor’s May Revision to the proposed FY 2013-14 budget is balanced due to<br />

spending reductions and new revenues from Proposition 30. The May Revision also<br />

increased FY 2012-13 revenue estimates by $2.8 billion, reflecting increased income<br />

tax revenues, due partially to the recovering economy and to wealthy individuals taking<br />

capital gains before higher tax rates kicked in for 2013. However, revenue estimates for<br />

FY 2013-14 were revised downward by $1.3 billion (1.3%), reflecting lowered personal<br />

income growth estimates, primarily due to the uncertain global economy and the end <strong>of</strong><br />

the payroll tax holiday.<br />

<strong>Santa</strong> <strong>Monica</strong>’s diversified tax base and geographic locations has led to a typical strong<br />

recovery from the most recent economic downturn. The <strong>City</strong>’s economically driven tax<br />

sources have recovered significantly to reach or exceed their pre-recession levels. This<br />

strong recovery will moderate in the future as the <strong>City</strong> transitions out <strong>of</strong> its recovery<br />

period.<br />

Property values in the <strong>City</strong> remain the third highest in Los Angeles County and are<br />

expected to continue to increase about 3% annually. Sales tax receipts, which declined<br />

for two consecutive years due to the economy and the temporary closure and remodel<br />

<strong>of</strong> <strong>Santa</strong> <strong>Monica</strong> Place, have also turned around and, like property taxes, are projected<br />

to show modest growth in the near future. Tourism continues to exhibit strength, but<br />

growth is expected to moderate to about 3.5% per year after three consecutive years <strong>of</strong><br />

near double digit gains coming out <strong>of</strong> the recession. Business license taxes are also<br />

expected to grow slowly, following the general course <strong>of</strong> the local economy, while Utility<br />

3

Users Tax revenues projected to remain flat.<br />

General Fund Financial Status Update<br />

The financial status update includes updated revenue projections and the most recent<br />

information related to growth rates for both revenues and expenditures. Operating<br />

expenditures are anticipated to increase at an average rate <strong>of</strong> 3.7% over the five years<br />

<strong>of</strong> the financial update, while revenues are anticipated to increase at an average rate <strong>of</strong><br />

2.4%. The primary reason for the difference is a 4% average annual increase in total<br />

staff compensation (salaries and benefits), which represents 72% <strong>of</strong> the General Fund<br />

operating budget. The high rate <strong>of</strong> expenditure growth is due primarily to new<br />

developments in PERS contribution rates that will start in FY 2015-16. Non-salary<br />

expenditures increase at the rate <strong>of</strong> the consumer price index, which is 2.0% in<br />

FY 2013-14, increasing to 2.5% for the remainder <strong>of</strong> the forecast period.<br />

Scenarios<br />

The financial status update includes three scenarios.<br />

• The probable scenario reflects the Proposed Budget assumptions as well as<br />

increases in retirement and healthcare. Also incorporated in the probable<br />

scenario are known impacts from the dissolution <strong>of</strong> redevelopment.<br />

• The best case scenario reflects slightly higher revenues than are projected in the<br />

Proposed Budget.<br />

• The worst case scenario reflects the effects <strong>of</strong> additional State takeaways <strong>of</strong><br />

former redevelopment assets and loss <strong>of</strong> additional revenues.<br />

The factors noted in the scenarios are explained in more detail below.<br />

4

Proposed FY 2013-15 Biennial Budget<br />

The proposed two-year budget, presented as Attachment A, is balanced and maintains<br />

core municipal services; addresses continuing and emerging community needs; sets<br />

forth a reduced budget baseline; funds high priority capital projects and maintenance;<br />

and promotes sustainability, livability, education, human capital, economic development,<br />

mobility, and fiscal stability. New revenues anticipated from the fee study and the<br />

decision packages are included in the proposed budget. The overall Proposed Budget<br />

for the <strong>City</strong> <strong>of</strong> <strong>Santa</strong> <strong>Monica</strong> is $520.9 million in FY 2013-14 and $527.7 million in<br />

FY 2014-15.<br />

The largest component <strong>of</strong> the budget is the General Fund. Much <strong>of</strong> the budget<br />

balancing work has centered on the General Fund, where most municipal services are<br />

funded. The proposed General Fund budget is $306.1 million in FY 2013-14 and<br />

$311.3 million in FY 2014-15.<br />

Retirement Costs<br />

In Spring 2013, CalPERS staff announced a number <strong>of</strong> upcoming adjustments to the<br />

PERS actuarial methodology used to determine retirement contribution rates paid by<br />

employers and employees beginning in FY 2015-16. These adjustments include a<br />

change in the amortization methodology, updated mortality assumptions, and a lowering<br />

<strong>of</strong> the portfolio’s 7.5% discount rate to 7.25%.<br />

In April 2013, the CalPERS Board approved the amortization change, and it is likely that<br />

the Board will approve the mortality and discount rate changes in the next year. Early<br />

estimates indicate as much as 50% increases in contribution rates over five years. This<br />

is an unprecedented increase that has the ability to cripple municipalities that have<br />

already suffered severe losses due to the recession and the dissolution <strong>of</strong><br />

redevelopment.<br />

5

In <strong>Santa</strong> <strong>Monica</strong>, staff estimates a $5.8 million annual increase to the General Fund<br />

contribution rate in FY 2015-16, that will ultimately reach an $18.1 million annual<br />

contribution in FY 2019-20. <strong>City</strong>wide, the contribution increase begins at $7.4 million<br />

and reaches $22.7 million in FY 2019-20. Discussions and analysis on this change are<br />

in the early stages and therefore estimates are subject to change. However, staff will<br />

be forced to look at General Fund priorities over the next two years to find ways to<br />

absorb these costs.<br />

Healthcare Costs<br />

January 1, 2014 marks the full implementation <strong>of</strong> the Patient Protection and Affordable<br />

Care Act (PPACA). At this point, the <strong>City</strong>’s health insurance consultants have advised<br />

that new taxes will be levied on employers (the <strong>City</strong>) and health insurance companies.<br />

These taxes, the latter <strong>of</strong> which will be passed on to the <strong>City</strong>, are anticipated to total at<br />

least $1 million annually. These costs were not included in the January 2013 forecast<br />

but have been incorporated in the Proposed Budget. Alongside these new costs will be<br />

the continued escalation <strong>of</strong> healthcare premiums, which are anticipated to increase by<br />

at least 14% per year over the next two years. In addition, current healthcare premiums<br />

are subject to change pending new agreements with insurers.<br />

Redevelopment<br />

The General Fund has absorbed approximately $2 million in costs previously funded by<br />

Redevelopment. This is due to the State’s disallowance <strong>of</strong> redevelopment loan and<br />

note repayments to the General Fund, including debt service payments on the Civic<br />

Center Parking Structure, as well as senior housing voucher costs and compliance<br />

monitoring <strong>of</strong> affordability covenants for housing. These costs were included in the<br />

January Forecast. In addition to the operating costs are ongoing impacts related to<br />

potential State clawbacks <strong>of</strong> former redevelopment assets and revenues, which are<br />

shown in the worst case scenario.<br />

6

Probable Scenario (as budgeted)<br />

FIVE YEAR PROJECTIONS<br />

General Fund Operating and Capital Budget FY 2013-14 FY 2014-15 FY 2015-16 FY 2016-17 FY 2017-18<br />

REVENUES* $ 303.6 $ 312.4 $ 321.0 $ 328.7 $ 337.2<br />

EXPENDITURES<br />

Operating** $ (283.7) $ (292.4) $ (306.6) $ (316.8) $ (328.2)<br />

Capital $ (22.2) $ (18.2) $ (18.2) $ (18.2) $ (18.2)<br />

USE OF CAPITAL RESERVES $ 10.9 $ - $ - $ - $ -<br />

NET REVENUES OVER EXPENDITURES $ 8.6 $ 1.8 $ (3.9) $ (6.4) $ (9.2)<br />

* Does not include $2.4 million in annual restricted revenues.<br />

** Includes 15 percent contingency.<br />

Staff estimates that the first two years <strong>of</strong> the forecast will yield a positive fund balance,<br />

which will strengthen the <strong>City</strong>’s reserves. This is due in large part to the cost<br />

efficiencies and enhanced cost recovery efforts that the <strong>City</strong> has incorporated into the<br />

Proposed Budget per Council direction.<br />

However, the third year <strong>of</strong> the forecast, FY 2015-16, shows a potential budget shortfall<br />

<strong>of</strong> $3.9 million due to increased retirement costs, increasing to $9.2 million in<br />

FY 2017-18. The worst case shows a potential deficit <strong>of</strong> approximately $2.2 million as<br />

early as FY 2014-15, increasing to $13.2 million in FY 2017-18, depending upon the<br />

outcome <strong>of</strong> disputes between the <strong>City</strong> and the State regarding former redevelopment<br />

assets. A best case scenario, where revenues could increase slightly, shows the<br />

7

FY 2015-16 deficit decreasing to $0.7 million, increasing to $5.8 million in FY 2017-18.<br />

Expenditure Reductions and Cost Recovery & Compliance Proposals – General Fund<br />

As part <strong>of</strong> the budget development process, <strong>City</strong> departments were asked to find ways<br />

to <strong>of</strong>fset their current budgets by 5%. By focusing on core services, departments<br />

identified expenditure savings <strong>of</strong> $5.5 million in FY 2013-14, increasing to $6.2 million in<br />

FY 2014-15. Enhanced cost recovery efforts are anticipated to yield $4 million in<br />

FY 2013-14, increasing to $5.6 million in FY 2014-15. A portion <strong>of</strong> the cost recovery<br />

increases were identified in the fee study, discussed below. Finally, $3 million in<br />

FY 2014-15 projects previously included in the CIP plan were rescheduled to reflect<br />

updated project timing. In combination, these changes achieve the 5% target in<br />

FY 2014-15.<br />

To achieve expenditure savings, staff first reduced operating budgets to eliminate<br />

recurrent savings. Staff also established more efficient staffing structures by eliminating<br />

positions that are vacant and reducing overtime budgets. Streamlining operations and<br />

new methods <strong>of</strong> providing services also resulted in savings.<br />

To ensure that <strong>City</strong> staff are able to provide the highest level <strong>of</strong> services to the public,<br />

community members must contribute their fair share, be it through taxes, fees or<br />

permits, for services ranging from the general to those providing individualized benefits<br />

that are fee-supported. In the next year, Finance staff will be strengthening the<br />

compliance, audit and collections program to ensure taxes and fees owed to the <strong>City</strong><br />

are identified and collected.<br />

Several departments have identified new areas where cost recovery is warranted, such<br />

as park trainer fees, filming fees from interim use <strong>of</strong> the Civic Auditorium, and new nonresident<br />

Library access fees. By leveraging <strong>City</strong> resources more effectively, such as<br />

auctioning used computer equipment and providing a new passport processing service,<br />

the <strong>City</strong> is also able to increase cost recovery.<br />

8

A number <strong>of</strong> return on investment programs are anticipated to increase revenues while<br />

also addressing key community needs. Additional parking meters and extended meter<br />

enforcement hours will increase turnover <strong>of</strong> on-street spaces and thereby make this<br />

limited resource available to more community members. Continued expansion <strong>of</strong> the<br />

<strong>City</strong>’s fiber optic network, <strong>City</strong>Net will increase revenues while also helping local<br />

businesses become stronger players in the global economy.<br />

<strong>City</strong> Departments’ Significant Expenditure Reductions and Cost Recovery Proposals are<br />

detailed in Attachment B.<br />

Other Funds<br />

Other major funds that are included in the Financial Status Update fall into two<br />

categories: 1) funds that operate with sufficient revenues to sustain necessary<br />

operation and capital needs, and 2) funds that have a structural deficit where ongoing<br />

revenues are not sufficient to cover ongoing expenditures.<br />

Self-Sustaining Enterprise Funds<br />

In the Proposed FY 2013-15 Biennial Budget, the Wastewater Fund forecast indicates<br />

there are adequate reserves for the next two years. The Big Blue Bus Fund is also<br />

showing a stable forecast as the department reduced overtime pay and materials and<br />

supplies budgets and increased cost recovery on contractual services.<br />

The Resource Recovery and Recycling Fund is anticipated to experience a structural<br />

deficit in FY 2014-15 unless a rate increase is implemented. Staff will complete a rate<br />

study upon the completion <strong>of</strong> the Zero Waste Master Plan and will return to Council in<br />

the second quarter for FY 2013-14 to present proposed rates.<br />

The Water Fund has sufficient revenue to cover current operations and a rate increase<br />

will not be necessary for FY 2013-14. A rate study will commence in FY 2013-14 after<br />

the Sustainable Water Master Plan is completed in order to include financial impacts<br />

identified in the Plan and ensure financial sustainability <strong>of</strong> the Fund.<br />

9

The Beach Fund will generate adequate revenues to sustain its operations throughout<br />

the next five years. The Proposed Biennial Budget shows the merging <strong>of</strong> the Beach<br />

House Fund into the Beach Fund for more efficient tracking.<br />

In the Airport Fund, a realignment <strong>of</strong> capital projects, streamlined expenditures and a<br />

greater focus on revenues, including updated landing fees approved by Council in<br />

April 2013, present a balanced fund picture going forward.<br />

Funds Requiring General Fund Subsidies<br />

The subsidies from the General Fund to the Cemetery and Pier Funds are anticipated to<br />

decrease by $400,000 in FY 2013-14 due to expenditure efficiencies, increased<br />

revenues and changes in capital project scheduling.<br />

The Housing Authority Fund will require General Fund subsidies <strong>of</strong> $120,000 and<br />

$290,000, respectively during each year <strong>of</strong> the biennial budget due to the loss <strong>of</strong><br />

Redevelopment funding and reduction in HUD funding.<br />

The Civic Auditorium will discontinue full operation on June 30, 2013. Council will be<br />

considering potential future uses <strong>of</strong> the facility in June 2013.<br />

Position Changes<br />

The <strong>City</strong>wide Proposed Budget includes a net increase <strong>of</strong> 6.1 Full Time Equivalent<br />

(FTE) positions in FY 2013-14. The General Fund includes a net increase <strong>of</strong> 0.5 FTE<br />

temporary position (decrease <strong>of</strong> 8.1 permanent FTE, <strong>of</strong>fset by increase <strong>of</strong> 8.6 temporary<br />

FTE). Non-General Funds include a net increase <strong>of</strong> 5.6 FTE temporary positions<br />

(decrease <strong>of</strong> 18.5 permanent FTE, <strong>of</strong>fset by increase <strong>of</strong> 24.1 temporary FTE). For<br />

FY 2014-15, the proposed budget includes a net increase <strong>of</strong> 1.6 FTE (increase <strong>of</strong> 0.5<br />

permanent FTE and 1.1 temporary FTE) in the General Fund. New positions are<br />

related to the opening <strong>of</strong> the Pico Library and Tongva Park (7.0 permanent FTE and 5.6<br />

temporary FTE), or are funded through overtime savings or increased revenues.<br />

10

Major Initiatives<br />

A number <strong>of</strong> initiatives that <strong>City</strong> staff will be supporting during the biennial budget period<br />

are reiterated throughout the proposed budget document, as they are among the<br />

highest priorities. These initiatives are noted in the <strong>City</strong> Manager’s Message, Emerging<br />

Themes as well as department goals and objectives.<br />

Decision Packages<br />

As part <strong>of</strong> the Proposed FY 2013-15 Biennial Budget, <strong>City</strong> staff has developed decision<br />

packages in four areas that require Council’s review and direction. These decision<br />

packages specify proposed projects, expected benefits, financial impact, as well as<br />

alternatives to the recommended policy decisions. The following decision packages are<br />

detailed in Attachment C:<br />

1) Records & Election Services – <strong>City</strong> Council <strong>Agenda</strong> Mailing Subscription and<br />

Election Filing and Translation Fees<br />

2) Finance – Adjust Preferential Parking Permit Rates<br />

3) Information Systems – Auctioning Decommissioned Computer Equipment<br />

4) Library – Charge Non-Residents for Library Cards and Charge for Library<br />

Internet Time<br />

<strong>City</strong>wide Fee Study<br />

Since 1988, Council has directed staff to periodically conduct studies to calculate the<br />

<strong>City</strong>’s cost <strong>of</strong> providing various services that benefit individual users <strong>of</strong> the service rather<br />

than members <strong>of</strong> the community, and to determine if the <strong>City</strong> is recovering an<br />

appropriate share <strong>of</strong> these costs through user fees. It is <strong>City</strong> policy to achieve full cost<br />

recovery for these services, with some exceptions. The Community & Cultural Services<br />

Department fees, which average 26% cost recovery, are based on a pricing policy that<br />

reflects Council priorities for community recreation and social services benefits. Animal<br />

Control fees are also less than cost covering as cities traditionally subsidize these<br />

11

services to encourage licensing spaying/neutering. Some other fees are recommended<br />

for less than full cost recovery due to previous Council direction or statutory limits.<br />

A recent study prepared by MGT <strong>of</strong> America analyzed the cost <strong>of</strong> services in the<br />

Planning and Community Development, Public Works, Police, Fire, Community and<br />

Cultural Services, and the Records and Election Services Departments. Zoning<br />

ordinance fees were not studied and will be presented to Council when the Zoning<br />

ordinance revisions are completed in FY 2013-14. This study was the most<br />

comprehensive fee study conducted in over 15 years as over 700 fees were studied.<br />

Based on the study, staff recommends creating 27 new user fees and one new penalty<br />

charge (16 <strong>of</strong> which are in the General Fund), increasing most fees to an appropriate<br />

level <strong>of</strong> cost recovery, reducing 71 fees, and eliminating 6 fees. Staff anticipates<br />

implementation <strong>of</strong> the fee study recommendations will result in approximately<br />

$1.45 million in additional annual revenue, $1.1 million <strong>of</strong> which is in the General Fund<br />

($0.9 million – user fees; $0.2 million – penalty charge).<br />

Attachment D (Fee Study Report) provides a summary <strong>of</strong> the results <strong>of</strong> the fee study, as<br />

well as the consultant’s report. Staff will return to Council with implementing ordinances<br />

and resolutions at the time <strong>of</strong> Budget Adoption.<br />

Capital Improvement Program (CIP) Budget<br />

Last year the <strong>City</strong> <strong>of</strong> <strong>Santa</strong> <strong>Monica</strong> developed its first biennial Capital Improvement<br />

Program (CIP) Budget. On June 12, 2012, Council approved and adopted funds for<br />

FY 2012-13 and approved funds for FY2013-14. This year, the CIP Committee was<br />

asked to consider a small number <strong>of</strong> new applications for FY 2013-14 as part <strong>of</strong> the CIP<br />

Exception Based Budgeting process. The loss <strong>of</strong> Redevelopment Funds, the possibility<br />

<strong>of</strong> additional Redevelopment Agency claw backs, and the escalating cost <strong>of</strong> total<br />

compensation have resulted in reduced commitments to capital spending. With no<br />

additional funding allocated to capital projects, only those projects that required<br />

immediate funding or that could be funded through return on investments (ROIs) or<br />

12

special revenue sources were considered. Additionally, staff reallocated funds from<br />

existing capital projects that could be postponed, terminated, or reduced in scope to<br />

fund immediate projects that have emerged as higher priorities.<br />

The CIP Committee’s recommendations placed an emphasis on safety. New projects<br />

include two critical public safety communication projects, traffic signal safety<br />

enhancements, emergency water distribution infrastructure, and water treatment<br />

technology testing. The <strong>City</strong>wide FY 2013-14 CIP Proposed Budget is $91.4 million.<br />

The General Fund portion is $22.2 million and is consistent with the FY 2013-14 budget<br />

approved by Council last year as part <strong>of</strong> the biennial CIP Budget process. The new<br />

projects recommended by the CIP Committee are described in more detail as follows:<br />

• The Portable Radios and Mobile Radios project would upgrade firmware,<br />

standardize the feature sets and add encryption capability on all radios used by<br />

the Fire Department to ensure that all Fire personnel can communicate with the<br />

<strong>Santa</strong> <strong>Monica</strong> Police Department in emergencies. The proposed funding is<br />

$213,000 and would be funded in the General Fund.<br />

• The Mobile Data Computer Replacement project would replace outdated and<br />

inadequate equipment on all fire apparatus to provide real time information to first<br />

responders, capture accurate response time data, and provide mapping and preincident<br />

plan information. The proposed funding is $360,000 and would be<br />

funded in the General Fund.<br />

• Funds deferred from Phase 5 <strong>of</strong> the ATMS project would be used to fund critical<br />

Traffic Signal Safety Enhancements. This project would construct a new traffic<br />

signal at Olympic Dr. and Avenida Mazatlan and identify and replace any aging<br />

concrete composite traffic signal poles. The proposed funding is $750,000 and<br />

would be funded in the General Fund.<br />

• The installation <strong>of</strong> 350 additional on-street single-space parking meters at various<br />

locations throughout the <strong>City</strong> is forecasted to generate over $500,000 annually in<br />

net revenue. The proposed funding is $323,000 and would be funded in the<br />

General Fund.<br />

• The proposed funding for the <strong>City</strong>TV Replacement Playback System is $130,000<br />

and is funded through rent savings. A minor tenant improvement that would<br />

create a new training facility in an existing unused space will be funded from<br />

$50,000 savings from deferred projects.<br />

13

• The Colorado Esplanade project is a multi-modal streetscape and circulation<br />

infrastructure project that fully integrates the downtown Light Rail station by<br />

providing optimal access for pedestrians, bicycles and vehicles in and around the<br />

station area. The proposed additional $710,000 in funding would be in the<br />

Water, Wastewater, and Special Revenue Source Funds, and added to the<br />

previously approved $9 million.<br />

• Community Development Block Grant (CDBG) will provide funds for the Park<br />

Restroom Renovations ($700,000), the Accessible Beach Walkway – South<br />

Beach Park Universally Accessible Playground ($154,000), alley renewal work<br />

($297,212), and Energy Upgrades to the Ken Edwards Center ($100,800).<br />

• The Big Blue Bus is purchasing 38 CNG 40 foot buses to replace the remaining<br />

diesel bus inventory. The proposed funding is $11 million and would be funded<br />

in the Big Blue Bus Fund.<br />

• The San Vicente Booster Station Standby Generator project requires an<br />

additional $1.85 million, for a project total <strong>of</strong> $3.85 million, to construct and install<br />

a new standby emergency generator to replace a diesel engine installed in the<br />

1930’s. This project is under design and provides the necessary infrastructure to<br />

ensure that water can be distributed in the case <strong>of</strong> catastrophic power failure.<br />

The new allocation would cover geotechnical and structural costs that are<br />

required as a result <strong>of</strong> the reconstruction <strong>of</strong> the vault. This project would be<br />

funded in the Water Fund.<br />

• The Water Treatment Technology Testing Pilot project would verify acceptability<br />

and suitability <strong>of</strong> an alternative membrane technology to increase water<br />

recoverability at the Arcadia and Olympic Water Treatment Plants. The Arcadia<br />

project budget would be $400,000 and funded in the Water Fund and the<br />

Olympic project budget would be $500,000 and utilizes remediation funds<br />

provided by the Gillette/Boeing settlement.<br />

While FY 2014-18 capital plan amounts are provided solely as a planning tool and<br />

projects are not guaranteed for funding, there are significant gaps between budget plan<br />

capital amounts and available funds beginning FY 2014-15. Although the <strong>City</strong> is<br />

considering issuing bonds for some projects, the CIP Committee will have to make<br />

decisions to both maintain the <strong>City</strong>’s infrastructure and proceed with new capital<br />

initiatives. As the <strong>City</strong>’s fund balance continues to decline, projects may be deferred,<br />

including the maintenance <strong>of</strong> infrastructure, to the extent that financial resources are<br />

available. Staff will continue to evaluate the deferral <strong>of</strong> maintenance to ensure that<br />

safety and the long term useful life <strong>of</strong> the assets are not compromised.<br />

14

Human Services Grants Program (HSGP) and Organizational Support Program (OSP)<br />

for <strong>Santa</strong> <strong>Monica</strong>’s Arts and Culture Non-Pr<strong>of</strong>its<br />

The <strong>City</strong> engages in a competitive process to allocate funds to non-pr<strong>of</strong>it organizations<br />

through the Human Services Grants Program (HSGP) and Cultural Arts Organizational<br />

Support Program (OSP). Funds are awarded to core agencies for a multi-year period<br />

and provide predictable resources for program operation and services to the<br />

community. On June 21, 2011, Council awarded two-year grants to 11 nonpr<strong>of</strong>it arts<br />

and cultural agencies through OSP and four-year grants to 24 human service<br />

organizations through HSGP. On January 22, 2013, Council renewed OSP grants for<br />

two years, which would align the program with the HSGP funding cycle, and postponed<br />

the next grant cycle to begin in FY 2015-16.<br />

FY 2013-14 represents the third year <strong>of</strong> the current four-year funding cycle. The<br />

Proposed FY 2013-15 Biennial Budget includes grant funding levels equivalent to<br />

FY 2012-13 funding levels to well performing agencies.<br />

Pursuant to the Council action on January 8, 2013, <strong>City</strong> staff issued a Request for<br />

Proposals (RFP) to serve disengaged youth ages 16 to 24 in <strong>Santa</strong> <strong>Monica</strong>. Funding<br />

recommendations to serve an unmet need among older (opportunity) youth will be<br />

presented to <strong>City</strong> Council on June 25, 2013.<br />

Next Steps<br />

Council will convene a public hearing on June 25, 2013 to consider, receive public<br />

comment, make revisions to, and adopt the first year and approve the second year <strong>of</strong><br />

the Biennial Budget.<br />

Members <strong>of</strong> the public can provide comments on the Proposed Budget by sending an<br />

email to council@smgov.net or by giving public testimony at the May 28 and May 29<br />

study sessions and Budget Adoption hearing on June 25, 2013.<br />

15

Financial Impacts & Budget Actions<br />

There is no immediate budget action necessary as a result <strong>of</strong> the recommended<br />

actions. Staff will return to Council on June 25, 2013 to recommend adoption <strong>of</strong> the first<br />

year and approval <strong>of</strong> the second year <strong>of</strong> the Proposed FY 2013-15 Biennial Budget.<br />

Prepared by: Susan Lai, Acting Budget Manager<br />

Approved:<br />

Forwarded to Council:<br />

Gigi Decavalles-Hughes<br />

Director <strong>of</strong> Finance<br />

Rod Gould<br />

<strong>City</strong> Manager<br />

Attachments:<br />

A: Proposed FY 2013-15 Biennial Budget<br />

B: <strong>City</strong> Departments’ Significant Expenditure Reductions and Cost Recovery<br />

Proposals<br />

C: Decision Packages<br />

D1: <strong>City</strong>wide Fee Study Summary<br />

D2: Fee Study Report<br />

16

<strong>City</strong> <strong>of</strong> <strong>Santa</strong> <strong>Monica</strong><br />

FY 2013-15 Proposed Biennial Budget<br />

<strong>City</strong> Council<br />

Pam O’Connor<br />

Mayor<br />

Terry O’Day<br />

Mayor Pro Tempore<br />

Gleam Davis<br />

Robert Holbrook<br />

Kevin McKeown<br />

Tony Vasquez<br />

Ted Winterer<br />

Executive Management<br />

Rod Gould<br />

Elaine Polachek<br />

Kathryn Vernez<br />

<strong>City</strong> Manager<br />

Assistant <strong>City</strong> Manager<br />

Deputy <strong>City</strong> Manager<br />

Budget Preparation<br />

FINANCE STAFF<br />

Gigi Decavalles-Hughes<br />

Director <strong>of</strong> Finance<br />

Susan Lai<br />

Acting Budget Manager<br />

David Carr<br />

Assistant <strong>City</strong> Treasurer<br />

Oscar Santiago<br />

Principal Budget Analyst<br />

Stephanie Lazicki<br />

Senior Budget Analyst<br />

Michael Towler<br />

Senior Administrative Analyst<br />

Carolyn Connolly<br />

Assistant Administrative Analyst<br />

Jennifer Young<br />

Executive Administrative Assistant<br />

Danielle Noble<br />

Matthew Mornick<br />

CITY MANAGER’S STAFF<br />

Assistant to the <strong>City</strong> Manager<br />

Principal Administrative Analyst

Table <strong>of</strong> Contents<br />

FY 2013-15 Proposed Biennial Budget

Table <strong>of</strong> Contents<br />

User Guide .................................................................................................................................................... i<br />

<strong>City</strong> Manager’s Message<br />

<strong>City</strong> Manager’s Message .......................................................................................................................... 1<br />

<strong>Santa</strong> <strong>Monica</strong> at a Glance<br />

<strong>Santa</strong> <strong>Monica</strong> at a Glance ..................................................................................................................... 11<br />

Budget Overview<br />

Overall Economic Conditions ................................................................................................................. 15<br />

<strong>City</strong>wide Budget Overview ..................................................................................................................... 18<br />

Major General Fund Tax Base Projections ............................................................................................ 23<br />

Emerging Themes ..................................................................................................................................... 25<br />

Fund Balances<br />

Fund Balances .......................................................................................................................................... 29<br />

Fund Balance Projections for FY 2013-14 and FY 2014-15 .................................................................. 32<br />

Revenues<br />

Revenue Summary by Category ........................................................................................................... 37<br />

Five-Year Revenue Summary .................................................................................................................. 39<br />

Revenue Analysis, General Fund ........................................................................................................... 46<br />

Revenue Analysis, Other Funds .............................................................................................................. 55<br />

Expenditures<br />

Expenditure Summary by Fund .............................................................................................................. 67<br />

Five-Year Expenditure Summary ............................................................................................................ 69<br />

Departmental Summaries<br />

<strong>City</strong> Council ............................................................................................................................................... 81<br />

<strong>City</strong> Manager ............................................................................................................................................ 85<br />

Records and Election Services (<strong>City</strong> Clerk) .......................................................................................... 97<br />

Finance .................................................................................................................................................... 105<br />

<strong>City</strong> Attorney ........................................................................................................................................... 115<br />

Human Resources ................................................................................................................................... 121<br />

Information Systems ............................................................................................................................... 127<br />

Planning and Community Development ........................................................................................... 135<br />

Police ........................................................................................................................................................ 147<br />

Fire ............................................................................................................................................................. 157<br />

Community and Cultural Services ....................................................................................................... 165<br />

Library ....................................................................................................................................................... 175<br />

Public Works............................................................................................................................................. 185<br />

Big Blue Bus .............................................................................................................................................. 201<br />

Housing and Economic Development ............................................................................................... 211<br />

Personnel and Staffing<br />

Organizational Chart ............................................................................................................................. 219<br />

Summary <strong>of</strong> Personnel by Fund ............................................................................................................ 220<br />

Personnel by Department and Division .............................................................................................. 225

Table <strong>of</strong> Contents<br />

Capital Improvement Program<br />

Program Summary .................................................................................................................................. 261<br />

FY 2013-14 Project Descriptions ............................................................................................... 264<br />

Project Detail ........................................................................................................................................... 267<br />

CIP Summary—Appropriations by Fund .............................................................................................. 268<br />

Appendix<br />

Budget Planning Process ....................................................................................................................... 275<br />

Budget Calendar and Budget Cycle .................................................................................................. 277<br />

Fiscal Policies ........................................................................................................................................... 279<br />

Financial Framework for Budgeting ..................................................................................................... 283<br />

Summary <strong>of</strong> Long-term Indebtedness ................................................................................... 286<br />

Debt Service Schedule ............................................................................................................. 287<br />

GANN Appropriations Limit ...................................................................................................... 289<br />

Youth Budget .......................................................................................................................................... 291<br />

Glossary .................................................................................................................................................... 293<br />

Acronyms ................................................................................................................................................. 305<br />

GFOA Award ........................................................................................................................................... 309<br />

Photo Credits: Photos courtesy <strong>of</strong> Kristen Beinke; Ed Burns; Robert Landau; Kirk M. Rogers; Nik Wheeler and <strong>City</strong> Staff.

User Guide<br />

Each May, the <strong>City</strong>’s Proposed Budget is available in executive summary format for presentation to <strong>City</strong><br />

Council and the public at public counters and online at www.smgov.net. Following adoption in June, the<br />

Adopted Budget is made available at the same sites. Also available with the Adopted Budget is a<br />

supplemental document detailing revenue and expenditure line item budgets for each department.<br />

The Budget Process<br />

In June 2011, the <strong>City</strong> Council adopted <strong>Santa</strong> <strong>Monica</strong>’s first Biennial Budget, covering fiscal years 2011-13. The<br />

new, longer-range budget planning tool has made the overall budget process more efficient. Staff continues<br />

to return to Council semi-annually to present financial status updates on the <strong>City</strong>’s general and other funds, to<br />

make adjustments at midyear and year-end, and to adopt an exception-based budget in the second year.<br />

The FY 2013-15 Biennial Budget includes the following budgeting and planning components:<br />

Expenditure Efficiencies and Updated Cost Recovery and Tax Compliance—The <strong>City</strong>’s five year forecast<br />

highlighted that rising compensation costs and the loss <strong>of</strong> revenue due to the dissolution <strong>of</strong> redevelopment<br />

are requiring the <strong>City</strong> to adjust its budget in order to achieve long range stability. To effect this change,<br />

Departments presented proposals for expenditure savings, increased cost recovery, a greater focus on tax<br />

compliance, and returns on investment along with their budget submissions. Recommended changes are<br />

included in this Proposed Budget.<br />

Expenditure control budgeting—Expenditure control budgeting is an approach that promotes sound fiscal<br />

management and <strong>of</strong>fers flexibility and resources to respond to emerging or changing needs. Year-end<br />

departmental savings will be split between the department (1/3) and the General Fund (2/3).<br />

Departments may use the funds for one-time needs, or bank the savings over multiple years. This practice,<br />

begun in <strong>Santa</strong> <strong>Monica</strong> in 2011, has produced increased savings in the great majority <strong>of</strong> the <strong>City</strong>’s<br />

departments.<br />

A streamlined budget document reduces duplicative information and improves readability. The line item<br />

detail is not provided with the Proposed Budget but will be available online with the Adopted Budget.<br />

Goals, objectives and service benchmarks are limited to the few items that best describe department<br />

core services.<br />

“Emerging Themes” identify the areas <strong>of</strong> special emphasis for the upcoming budget. Emerging themes<br />

are discussed later in this report.<br />

Proposed Budget<br />

The budget document provides background information relevant to the development <strong>of</strong> the annual budget<br />

along with a presentation <strong>of</strong> the actual budget information in proposed form. The budget sections include:<br />

<strong>City</strong> Manager’s Message<br />

This section transmits the budget document to <strong>City</strong> Council and the citizens <strong>of</strong> <strong>Santa</strong> <strong>Monica</strong> in a transmittal<br />

letter.<br />

<strong>Santa</strong> <strong>Monica</strong> at a Glance<br />

Included in the <strong>Santa</strong> <strong>Monica</strong> at a Glance section is an overview <strong>of</strong> <strong>Santa</strong> <strong>Monica</strong>, including history, general<br />

information, and demographics.<br />

i

User Guide<br />

Budget Overview<br />

The amount <strong>of</strong> funding recommended for programs and services is driven by available resources. Economic<br />

conditions at the national, state and local levels affect the level <strong>of</strong> revenue available to the <strong>City</strong> each year.<br />

This section identifies the existing economic conditions that influenced the development <strong>of</strong> the annual<br />

budget. The section includes summary charts for <strong>City</strong>wide budgeted revenues and expenditures, including<br />

an overview <strong>of</strong> retirement expenditures and employee contributions. The section also presents summary<br />

information regarding the major tax revenues and their impact on the General Fund revenue forecasting, and<br />

revenue analysis for each fund.<br />

Fund Balances<br />

This section includes a description <strong>of</strong> the funds and their fund balance projections for the two budget years.<br />

Revenues<br />

This section presents Revenue Analysis for all funds and a Five-Year Revenue Summary.<br />

Expenditure Summaries<br />

This section includes a description <strong>of</strong> the funds and their fund balance projections for the two budget years. It<br />

also presents a Five-Year Expenditure Summary, which covers two prior years, the current year, and two<br />

budget years. It is important to note that in some cases, total expenditures exceed revenues. With very few<br />

exceptions, this discrepancy is due to the timing <strong>of</strong> capital expenditures, which are funded from prior year<br />

revenues, and is not indicative <strong>of</strong> a structural operating deficit.<br />

Department Summaries<br />

This section presents a description <strong>of</strong> each department, its mission and the services provided by its divisions.<br />

The section also identifies the department goals, objectives, and benchmarks for the upcoming budget cycle.<br />

It also identifies the divisional expenditure budget and related positions and identifies any significant changes<br />

presented in the budget.<br />

Personnel & Staffing<br />

This section presents the <strong>City</strong>’s organization chart and displays positions by fund and department as proposed<br />

or adopted in the budget.<br />

Capital Improvement Program<br />

The annual Capital Improvement Program (CIP) budget is presented in this section, along with the proposed<br />

CIP plan for the next four years.<br />

Reference<br />

The reference section includes a description <strong>of</strong> the budget planning process and budget framework, budget<br />

calendar and budget cycle, fiscal policies, summary <strong>of</strong> long-term indebtedness, debt service schedule, GANN<br />

appropriations limit, the Youth Budget, a glossary <strong>of</strong> terms, and a listing <strong>of</strong> acronyms.<br />

ii

<strong>City</strong> Manager’s Message<br />

FY 2013-15 Proposed Biennial Budget

<strong>City</strong> Manager’s Message<br />

I am pleased to <strong>of</strong>fer a balanced and strategic two-year budget for the <strong>City</strong> <strong>of</strong> <strong>Santa</strong> <strong>Monica</strong>.<br />

After five years <strong>of</strong> turmoil in the housing and stock markets, accompanied by high unemployment, indications<br />

are that the economy is making a slow recovery. However, cities are still struggling to cope with great losses<br />

in property and sales tax income, as well as state and federal program funding. At the same time, they must<br />

shoulder the burden <strong>of</strong> steep increases in pension and health care costs. The elimination <strong>of</strong> redevelopment<br />

agencies (RDA) in California has wiped out a major source <strong>of</strong> revenue that cities relied upon to rehabilitate<br />

blighted areas and aging infrastructure, and to fund affordable housing. Cities have been forced to cut<br />

services, infrastructure maintenance, and staffing, and to draw down precious reserves to sustain core<br />

services and pay debts. A number <strong>of</strong> California cities were forced to declare bankruptcy in this environment.<br />

<strong>Santa</strong> <strong>Monica</strong> is very fortunate to have emerged from the economic downturn with renewed vigor and<br />

promise. Our location, and our enterprising and diverse commercial base, afford us the opportunity to<br />

weather economic downturns better than others, and to rebound earlier. However, <strong>Santa</strong> <strong>Monica</strong> shares the<br />

challenges <strong>of</strong> lost Redevelopment funding and rising healthcare and pension costs. These challenges require<br />

us to be frugal and regularly revisit our priorities in order to properly fund the wide range <strong>of</strong> services and<br />

projects that help define our community.<br />

This two-year budget proposal:<br />

Maintains core municipal services, despite the additional costs we will be required to shoulder due to the<br />

dissolution <strong>of</strong> redevelopment<br />

Addresses continuing and emerging community needs<br />

Sets forth a more sustainable, reduced budget baseline<br />

Funds high priority capital projects and maintenance<br />

Promotes sustainability, livability, education, human capital, economic development, mobility, and fiscal<br />

stability<br />

In recent years, forecasting has taken on a vital role in <strong>Santa</strong> <strong>Monica</strong>’s budget planning, prompting us to<br />

make budget mid-course adjustments to successfully meet challenges. Regular updates <strong>of</strong> our five year<br />

financial plan have highlighted the prospect <strong>of</strong> a structural deficit in the General Fund in the future due to<br />

expenditures increasing at a faster pace than revenues. Most recently, this has been exacerbated by the loss<br />

<strong>of</strong> redevelopment revenue and assets.<br />

During the previous biennial budget period, the <strong>City</strong> Council endorsed a multi-pronged strategy to address<br />

the projected deficits in the General Fund while maintaining services, staffing, and infrastructure. The strategy<br />

involved:<br />

Negotiated changes in employee compensation, including health care and retirement cost sharing, a<br />

second tier retirement plan, and elimination <strong>of</strong> performance bonuses<br />

Two significant paydowns <strong>of</strong> pension liabilities as well as continued discounted prepayment <strong>of</strong> annual<br />

pension costs<br />

Greater cost recovery through updated fees and charges for individual benefit services<br />

Strengthening <strong>of</strong> the <strong>City</strong>’s economic uncertainty and contingency reserves<br />

A zero-based budgeting approach for the <strong>City</strong>’s Capital Improvement Program (CIP)<br />

This combination <strong>of</strong> actions improved the <strong>City</strong>’s financial outlook, yet the loss <strong>of</strong> Redevelopment and the<br />

threat <strong>of</strong> State clawback <strong>of</strong> Redevelopment assets, as well as continuing increases in health care, pension,<br />

and workers’ compensation costs, have added new obstacles to achieving a balanced General Fund<br />

budget over the next five years. These concerns, as well as the lessons learned during the recent recession,<br />

point to the importance <strong>of</strong> maintaining healthy reserves to weather challenges ahead.<br />

1

<strong>City</strong> Manager’s Message<br />

In January 2013, as we began planning for the new biennial budget, Council directed staff to implement the<br />

following budget strategies:<br />

Limit the growth <strong>of</strong> total compensation costs<br />

Find efficiencies and increase cost recovery to lower the General Fund net expenditure baseline by 5%<br />

Maintain our healthy reserves<br />

Using these strategies, and barring any new shock losses, the current five-year forecast gives us a path<br />

towards increased stability. Future developments related to the disposition <strong>of</strong> former RDA assets and pension<br />

and healthcare costs will require revisiting the forecast and make further budget adjustments as necessary.<br />

The overall proposed budget for the <strong>City</strong> <strong>of</strong> <strong>Santa</strong> <strong>Monica</strong> is $520.9 million in FY 2013-14 and $527.7 million in<br />

FY 2014-15. The size <strong>of</strong> these budgets is indicative <strong>of</strong> the breadth, depth, and diversity <strong>of</strong> services, projects,<br />

and activities undertaken by the <strong>City</strong> <strong>of</strong> <strong>Santa</strong> <strong>Monica</strong> for public safety, quality <strong>of</strong> life, infrastructure<br />

maintenance, transportation and development-related services. In many ways, <strong>Santa</strong> <strong>Monica</strong> operates<br />

similarly to a small county despite its compact 8.3 square mile land area.<br />

The largest component <strong>of</strong> the budget is the General Fund. Much <strong>of</strong> the budget balancing work has<br />

centered on the General Fund where most municipal services are funded. The proposed General Fund<br />

budget is $306.1 million in FY 2013-14 and $311.3 million in FY 2014-15.<br />

Significant Budget Issues<br />

While we weigh a number <strong>of</strong> factors in developing the budget, the following items represent the greatest<br />

hurdles to a balanced budget.<br />

The dissolution <strong>of</strong> Redevelopment will result in an annual loss <strong>of</strong> at least $20 million in revenue to the <strong>City</strong>, with<br />

another $22 million up for renewed negotiation each year, in addition to threatening redevelopment assets.<br />

After the California Supreme Court upheld AB1x26, the legislation dissolving redevelopment agencies, the<br />

<strong>City</strong> Council elected to become the Successor Agency to the Redevelopment Agency <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Santa</strong><br />

<strong>Monica</strong> in order to satisfy obligations <strong>of</strong> the former agency. Legislation signed on June 27, 2012 (AB1484)<br />

sought to clarify the process that Successor Agencies would follow in the administration and gradual<br />

dissolution <strong>of</strong> the redevelopment program. However, the process has been inconsistent and unclear, and a<br />

great amount <strong>of</strong> time and effort has been spent by cities, counties, and the State to determine the validity <strong>of</strong><br />

each and every contractual obligation, and to release funds to pay down these obligations.<br />

Agencies are in the process <strong>of</strong> completing a series <strong>of</strong> audits administered on behalf <strong>of</strong> the State Department<br />

<strong>of</strong> Finance and the State Controller’s Office to determine disposition <strong>of</strong> agency assets. These assets are<br />

subject to clawback, with the added threat that those cities not complying with the clawback demands will<br />

have their sales and property taxes withheld.<br />

To date, more than 100 lawsuits have been filed against the State by cities and agencies protesting these<br />

terms; <strong>Santa</strong> <strong>Monica</strong> is among these complainants.<br />

While <strong>Santa</strong> <strong>Monica</strong> seeks recognition and agreement by the State <strong>of</strong> its redevelopment cash flow needed<br />

to pay debt service obligations, in addition to protecting the former assets <strong>of</strong> the Redevelopment Agency,<br />

our budgeting strategy is to anticipate the worst until we have confirmation that our funding streams and<br />

assets are safe.<br />

In the meantime, the known effects <strong>of</strong> the dissolution <strong>of</strong> redevelopment are many. Two major projects, the<br />

Civic Center Joint Use Program with the <strong>Santa</strong> <strong>Monica</strong>-Malibu Unified School District (SMMUSD) and the<br />

rehabilitation <strong>of</strong> the Civic Auditorium, were suspended. Without seismic retr<strong>of</strong>itting, the Civic Auditorium<br />

cannot continue to function, and so it is necessary to close the facility and eliminate 20 permanent positions<br />

2

<strong>City</strong> Manager’s Message<br />

as <strong>of</strong> July 1, 2013. While we have worked hard to place 18 staff in other positions, it is anticipated that as<br />

many as 13 employees (10 permanent and 3 as-needed) will not find an alternative placement within the<br />

<strong>City</strong>. Another 11 positions funded by redevelopment funds are also deleted as <strong>of</strong> July 1, 2013, requiring staff<br />

to transfer to funded vacant positions. While staff has attempted to transition all personnel whose positions<br />

are eliminated to other openings in the <strong>City</strong>, the <strong>City</strong> will not be able to accommodate all personnel from the<br />

Civic Auditorium.<br />

The State’s disallowance <strong>of</strong> redevelopment loan and note repayments to the General Fund, including debt<br />

service payments on the Civic Center Parking Structure, as well as senior housing voucher costs and<br />

compliance monitoring <strong>of</strong> affordability covenants for housing, will have a net impact <strong>of</strong> approximately<br />

$2 million on the General Fund. And finally, staff reprioritized its General Fund capital project programming to<br />

accommodate the funding <strong>of</strong> high impact projects that could no longer be funded with redevelopment<br />

funds, including the Pico Branch Library, the Early Childhood Education Center, and the Colorado Esplanade.<br />

It will be necessary for the <strong>City</strong> to seek financing for other critical projects, such as Fire Station I and the<br />

Corporation Yards, and to secure new funding streams to support the continuation <strong>of</strong> the affordable housing<br />

production program.<br />

Employee compensation<br />

Total compensation, which includes employee salaries, pension contributions, health care and workers’<br />

compensation costs, makes up 58% <strong>of</strong> the <strong>City</strong>’s overall budget, and 72% <strong>of</strong> the General Fund operating<br />

budget. The rising cost <strong>of</strong> healthcare, and the need to supplement CalPERS pension portfolios with higher<br />

contributions, drive our total compensation cost growth rate to a level that is approximately double our<br />

revenue growth rate. To accommodate healthcare, pension, and worker’s compensation increases, the cost<br />

<strong>of</strong> living adjustment (COLA) for employees must consider the total compensation package and not just<br />

salaries.<br />

Significant new healthcare costs and continued increases<br />

January 1, 2014 marks the full implementation <strong>of</strong> the Patient Protection and Affordable Care Act (PPACA).<br />

While this measure has the very necessary but difficult goal <strong>of</strong> bringing affordable healthcare to all<br />

Americans, the positive effects <strong>of</strong> lower health care costs are in the long term, and the short term brings<br />

higher costs related to program administration and funding. At this point, experts have advised us that our<br />

added citywide costs will be at least $1 million annually. Alongside these new costs will be the continued<br />

escalation <strong>of</strong> healthcare premiums, which are anticipated to increase by at least 14% per year over the next<br />

two years.<br />

Steep retirement rate increases in the future<br />

Pension plans have taken center stage during the years after the market downturn <strong>of</strong> 2008, as CalPERS<br />

investment portfolio returns fell to a level that left many overly generous plans underfunded. Here I should<br />

note that <strong>Santa</strong> <strong>Monica</strong> has historically exercised prudence in its plan <strong>of</strong>fering, and requires employee<br />

contributions to pay for benefit costs. The total cost <strong>of</strong> pension benefits, <strong>of</strong>fset by employee contributions, is<br />

detailed for your information on page 22 <strong>of</strong> this document.<br />

California took steps to stem the further growth <strong>of</strong> pension costs in 2012 with the passage <strong>of</strong> the Public<br />

Employee Pension Reform Act (PEPRA). Among the changes included in the measure is the requirement that<br />

employees entering the CalPERS system after December 31, 2012 will receive a smaller retirement benefit<br />

package. This will serve to lower pension costs in the long term, but is not anticipated to provide relief in the<br />

near future.<br />

In April 2013, the CalPERS Board approved adjustments related to the methodology used to amortize pension<br />

costs over time in order to fully fund the plan in 30 years. At the same time, CalPERS staff announced that<br />

3

<strong>City</strong> Manager’s Message<br />

additional adjustments would very likely be made to actuarial assumptions relating to mortality and the<br />

discount rate <strong>of</strong> the PERS portfolio. While this is a solid and prudent plan, the cost is high. Early estimates<br />

indicate as much as 50% increases in contribution rates over five years. These increases will not take effect<br />

until the next biennial budget period, in FY 2015-16, yet potential citywide annual increases reaching as much<br />

as $22 million in five years must be considered as we prepare this year’s budget.<br />

Continued increases in workers’ compensation costs<br />

Workers’ compensation costs are also increasing at a faster pace than revenues, growing up to 7.5% from<br />

year to year. Workers’ compensation is a difficult cost to control, as it is highly regulated at the state and<br />

federal level. Ironically, the State’s passage <strong>of</strong> the Workers’ Compensation Reform Act in 2012 served to<br />

increase the costs <strong>of</strong> certain benefits without the advantage <strong>of</strong> <strong>of</strong>fsetting savings. It is essential that we do<br />

everything in our power to limit employee absences and prevent new claims.<br />

On that score, we have a strong Return to Work program that places injured employees in modified duty jobs.<br />

Further, we regularly monitor the progress <strong>of</strong> all injured employees and evaluate injury trends to determine if<br />

training or process improvements can prevent future occurrences. The <strong>City</strong> recently implemented a<br />

strengthened pre-placement physical testing program and is making more wellness opportunities available to<br />

employees. These efforts, coupled with a commitment to create a safe work environment, represent best<br />

practices for managing workers’ compensation costs.<br />

Budget Strategy<br />

The <strong>City</strong>’s overall budget strategy centers on controlling total compensation costs through negotiations with<br />

bargaining units, a combination <strong>of</strong> ongoing expenditure decreases and cost recovery, and the commitment<br />

to maintain reserves into the future. Departments were asked to undertake a thoughtful review <strong>of</strong> their<br />

current operations and refocus attention and funding on core and priority programs. Departments were able<br />

to shift our reliance on General Fund revenues by 3.7% in FY 2013-14 and 5.0% in FY 2014-15. The following are<br />

some <strong>of</strong> the changes reflected in this budget document:<br />

Expenditure savings<br />

By focusing on core services, departments were able to identify expenditure savings totaling $5.5 million in<br />

FY 2013-14, increasing to $6.2 million in FY 2014-15. Human Services grant funding levels are recommended to<br />

remain constant given the economic conditions and reduced federal and State support for these services.<br />

Using FY 2013-14 amounts, changes include:<br />

$3.0 million in efficiencies. This includes an overall decrease <strong>of</strong> 8 permanent and as-needed General<br />

Fund FTE positions (without lay<strong>of</strong>fs) and approximately $1 million in reduced overtime. Also included are<br />

decreased costs resulting from streamlining contractual costs, more efficient use <strong>of</strong> supplies, restructured<br />

canine and mounted units in the Police Department, and more cost-effective methods <strong>of</strong> handling<br />

uniform costs. These reductions will have minimal impact on services.<br />

$1.5 million in reductions related to doing things differently. Reductions result from reorganization <strong>of</strong><br />

processes and priorities at the Cemetery and the Pier, which lower the subsidy from the General Fund to<br />

these funds by approximately $400,000, more restricted use <strong>of</strong> <strong>City</strong> vehicles, changes in emergency<br />

vehicle procurement practices, streamlining fleet maintenance operations and in-house construction<br />

management costs for capital projects, which together will provide almost $600,000 in savings, transferring<br />

selected parks maintenance tasks from contractors to existing staff, and changing the service model for<br />

Household Hazardous Waste disposal. These changes will also have minimal or no impact on services.<br />

$1.0 million in recurrent savings that have been available in past years for new initiatives or one-time<br />

projects.<br />

4

<strong>City</strong> Manager’s Message<br />

While there are no significant changes in capital improvement projects in FY 2013-14, the second year <strong>of</strong> the<br />

Biennial Budget forces a reduction <strong>of</strong> $3 million in FY 2014-15. While this change may not have a great impact<br />

initially due to updated project scheduling, continued contraction <strong>of</strong> our capital project program will result in<br />

deferral <strong>of</strong> maintenance over time. We expect to address this potential in FY 2014-15, when we have greater<br />

clarity over the effects <strong>of</strong> the redevelopment loss.<br />

Cost Recovery and Tax Compliance<br />

To ensure that we are able to provide the highest level <strong>of</strong> services to the public, we must make sure that<br />