CICA Commodity Tax Symposium - CICA Conferences & Courses ...

CICA Commodity Tax Symposium - CICA Conferences & Courses ...

CICA Commodity Tax Symposium - CICA Conferences & Courses ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

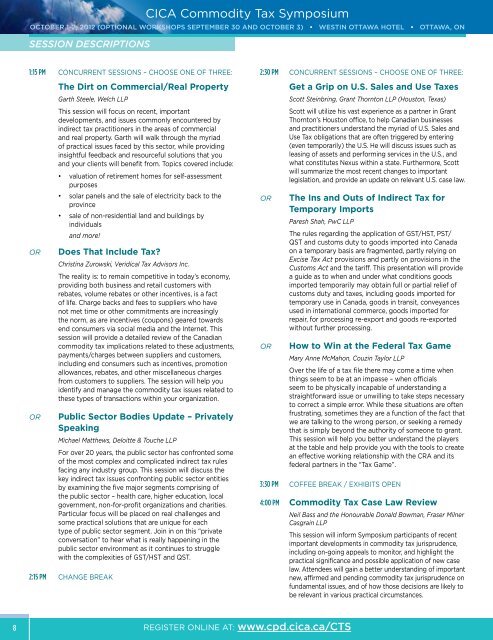

Session Descriptions<br />

<strong>CICA</strong> <strong>Commodity</strong> <strong>Tax</strong> <strong>Symposium</strong><br />

OCTOBER 1-2, 2012 (Optional Workshops September 30 and October 3) • WESTIN OTTAWA HOTEL • OTTAWA, ON<br />

1:15 pm CONCURRENT SESSIONS – CHOOSE ONE OF three:<br />

OR<br />

OR<br />

The Dirt on Commercial/Real Property<br />

Garth Steele, Welch LLP<br />

This session will focus on recent, important<br />

developments, and issues commonly encountered by<br />

indirect tax practitioners in the areas of commercial<br />

and real property. Garth will walk through the myriad<br />

of practical issues faced by this sector, while providing<br />

insightful feedback and resourceful solutions that you<br />

and your clients will benefit from. Topics covered include:<br />

• valuation of retirement homes for self-assessment<br />

purposes<br />

• solar panels and the sale of electricity back to the<br />

province<br />

• sale of non-residential land and buildings by<br />

individuals<br />

and more!<br />

Does That Include <strong>Tax</strong>?<br />

Christina Zurowski, Veridical <strong>Tax</strong> Advisors Inc.<br />

The reality is: to remain competitive in today’s economy,<br />

providing both business and retail customers with<br />

rebates, volume rebates or other incentives, is a fact<br />

of life. Charge backs and fees to suppliers who have<br />

not met time or other commitments are increasingly<br />

the norm, as are incentives (coupons) geared towards<br />

end consumers via social media and the Internet. This<br />

session will provide a detailed review of the Canadian<br />

commodity tax implications related to these adjustments,<br />

payments/charges between suppliers and customers,<br />

including end consumers such as incentives, promotion<br />

allowances, rebates, and other miscellaneous charges<br />

from customers to suppliers. The session will help you<br />

identify and manage the commodity tax issues related to<br />

these types of transactions within your organization.<br />

Public Sector Bodies Update – Privately<br />

Speaking<br />

Michael Matthews, Deloitte & Touche LLP<br />

For over 20 years, the public sector has confronted some<br />

of the most complex and complicated indirect tax rules<br />

facing any industry group. This session will discuss the<br />

key indirect tax issues confronting public sector entities<br />

by examining the five major segments comprising of<br />

the public sector – health care, higher education, local<br />

government, non-for-profit organizations and charities.<br />

Particular focus will be placed on real challenges and<br />

some practical solutions that are unique for each<br />

type of public sector segment. Join in on this “private<br />

conversation” to hear what is really happening in the<br />

public sector environment as it continues to struggle<br />

with the complexities of GST/HST and QST.<br />

2:15 pm Change Break<br />

2:30 pm Concurrent Sessions – Choose one of three:<br />

OR<br />

OR<br />

Get a Grip on U.S. Sales and Use <strong>Tax</strong>es<br />

Scott Steinbring, Grant Thornton LLP (Houston, Texas)<br />

Scott will utilize his vast experience as a partner in Grant<br />

Thornton’s Houston office, to help Canadian businesses<br />

and practitioners understand the myriad of U.S. Sales and<br />

Use <strong>Tax</strong> obligations that are often triggered by entering<br />

(even temporarily) the U.S. He will discuss issues such as<br />

leasing of assets and performing services in the U.S., and<br />

what constitutes Nexus within a state. Furthermore, Scott<br />

will summarize the most recent changes to important<br />

legislation, and provide an update on relevant U.S. case law.<br />

The Ins and Outs of Indirect <strong>Tax</strong> for<br />

Temporary Imports<br />

Paresh Shah, PwC LLP<br />

The rules regarding the application of GST/HST, PST/<br />

QST and customs duty to goods imported into Canada<br />

on a temporary basis are fragmented, partly relying on<br />

Excise <strong>Tax</strong> Act provisions and partly on provisions in the<br />

Customs Act and the tariff. This presentation will provide<br />

a guide as to when and under what conditions goods<br />

imported temporarily may obtain full or partial relief of<br />

customs duty and taxes, including goods imported for<br />

temporary use in Canada, goods in transit, conveyances<br />

used in international commerce, goods imported for<br />

repair, for processing re-export and goods re-exported<br />

without further processing.<br />

How to Win at the Federal <strong>Tax</strong> Game<br />

Mary Anne McMahon, Couzin Taylor LLP<br />

Over the life of a tax file there may come a time when<br />

things seem to be at an impasse – when officials<br />

seem to be physically incapable of understanding a<br />

straightforward issue or unwilling to take steps necessary<br />

to correct a simple error. While these situations are often<br />

frustrating, sometimes they are a function of the fact that<br />

we are talking to the wrong person, or seeking a remedy<br />

that is simply beyond the authority of someone to grant.<br />

This session will help you better understand the players<br />

at the table and help provide you with the tools to create<br />

an effective working relationship with the CRA and its<br />

federal partners in the “<strong>Tax</strong> Game”.<br />

3:30 Pm Coffee BREAK / ExhibitS OPEN<br />

4:00 pm <strong>Commodity</strong> <strong>Tax</strong> Case Law Review<br />

Neil Bass and the Honourable Donald Bowman, Fraser Milner<br />

Casgrain LLP<br />

This session will inform <strong>Symposium</strong> participants of recent<br />

important developments in commodity tax jurisprudence,<br />

including on-going appeals to monitor, and highlight the<br />

practical significance and possible application of new case<br />

law. Attendees will gain a better understanding of important<br />

new, affirmed and pending commodity tax jurisprudence on<br />

fundamental issues, and of how those decisions are likely to<br />

be relevant in various practical circumstances.<br />

8<br />

Register online at: www.cpd.cica.ca/CTS