Annual Balance Sheet as of 31 December 2010 - Sparkasse Leipzig

Annual Balance Sheet as of 31 December 2010 - Sparkasse Leipzig

Annual Balance Sheet as of 31 December 2010 - Sparkasse Leipzig

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

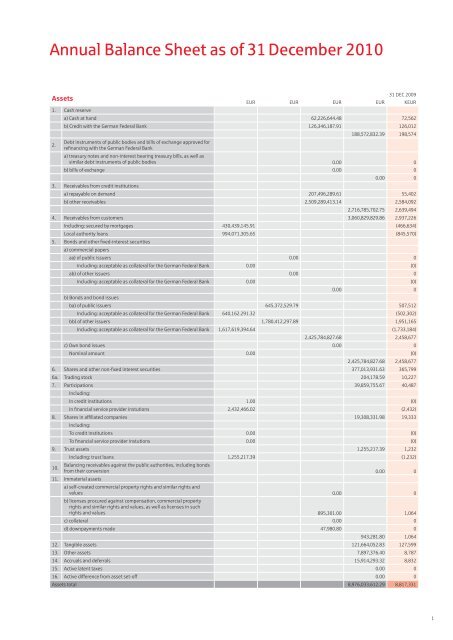

<strong>Annual</strong> <strong>Balance</strong> <strong>Sheet</strong> <strong>as</strong> <strong>of</strong> <strong>31</strong> <strong>December</strong> <strong>2010</strong><br />

Assets<br />

EUR EUR EUR EUR<br />

<strong>31</strong> DEC 2009<br />

1. C<strong>as</strong>h reserve<br />

a) C<strong>as</strong>h at hand 62,226,644.48 72,562<br />

b) Credit with the German Federal Bank 126,346,187.91 126,012<br />

188,572,832.39 198,574<br />

2.<br />

Debt instruments <strong>of</strong> public bodies and bills <strong>of</strong> exchange approved for<br />

refinancing with the German Federal Bank<br />

a) tre<strong>as</strong>ury notes and non-interest bearing tre<strong>as</strong>ury bills, <strong>as</strong> well <strong>as</strong><br />

similar debt instruments <strong>of</strong> public bodies 0.00 0<br />

b) bills <strong>of</strong> exchange 0.00 0<br />

0.00 0<br />

3. Receivables from credit institutions<br />

a) repayable on demand 207,496,289.61 55,402<br />

b) other receivables 2,509,289,413.14 2,584,092<br />

2,716,785,702.75 2,639,494<br />

4. Receivables from customers 3,060,829,829.86 2,937,226<br />

Including: secured by mortgages 430,439,145.91 (466,634)<br />

Local authority loans 994,071,305.65 (845,570)<br />

5. Bonds and other fixed-interest securities<br />

a) commercial papers<br />

aa) <strong>of</strong> public issuers 0.00 0<br />

Including: acceptable <strong>as</strong> collateral for the German Federal Bank 0.00 (0)<br />

ab) <strong>of</strong> other issuers 0.00 0<br />

Including: acceptable <strong>as</strong> collateral for the German Federal Bank 0.00 (0)<br />

0.00 0<br />

b) Bonds and bond issues<br />

ba) <strong>of</strong> public issuers 645,372,529.79 507,512<br />

Including: acceptable <strong>as</strong> collateral for the German Federal Bank 640,162.291.32 (502,302)<br />

bb) <strong>of</strong> other issuers 1,780,412,297.89 1,951,165<br />

Including: acceptable <strong>as</strong> collateral for the German Federal Bank 1,617,619,394.64 (1,733,184)<br />

2,425,784,827.68 2,458,677<br />

c) Own bond issues 0.00 0<br />

Nominal amount 0.00 (0)<br />

2,425,784,827.68 2,458,677<br />

6. Shares and other non-fixed interest securities 377,013,9<strong>31</strong>.63 365,799<br />

6a. Trading stock 204,178.59 10,227<br />

7. Participations 39,859,755.67 40,487<br />

Including:<br />

In credit institutions 1.00 (0)<br />

In financial service provider instutions 2,432,466.02 (2,432)<br />

8. Shares in affiliated companies 19,308,3<strong>31</strong>.98 19,333<br />

Including:<br />

To credit institutions 0.00 (0)<br />

To financial service provider instutions 0.00 (0)<br />

9. Trust <strong>as</strong>sets 1,255,217.39 1,232<br />

Including: trust loans 1,255,217.39 (1,232)<br />

10.<br />

Balancing receivables against the public authorities, including bonds<br />

from their conversion 0.00 0<br />

11. Immaterial <strong>as</strong>sets<br />

a) self-created commercial property rights and similar rights and<br />

values 0.00 0<br />

b) licenses procured against compensation, commercial property<br />

rights and similar rights and values, <strong>as</strong> well <strong>as</strong> licenses in such<br />

rights and values 895,301.00 1,064<br />

c) collateral 0.00 0<br />

d) downpayments made 47,980.80 0<br />

943,281.80 1,064<br />

12. Tangible <strong>as</strong>sets 121,664,052.83 127,599<br />

13. Other <strong>as</strong>sets 7,897,376.40 8,787<br />

14. Accruals and deferrals 15,914,293.32 8,832<br />

15. Active latent taxes 0.00 0<br />

16. Active difference from <strong>as</strong>set set-<strong>of</strong>f 0.00 0<br />

Assets total 8,976,033,612.29 8,817,3<strong>31</strong><br />

KEUR<br />

1

Liabilities<br />

EUR EUR EUR EUR<br />

<strong>31</strong> DEC 2009<br />

1. Liabilities towards credit institutions<br />

a) payable on demand 46,994,625.79 18,972<br />

b) with agreed term or termination period 1,741,128,016.06 1,705,052<br />

1,788,122,641.85 1,724,024<br />

2. Liabilities towards customers<br />

a) savings deposits<br />

aa) with an agreed termination period <strong>of</strong> three months 3,080,596,960.88 3,118,447<br />

ab) with an agreed termination period in excess <strong>of</strong> three months 377,812,707.74 304,675<br />

3,458,409,668.62 3,423,122<br />

b) other liabilities<br />

ba) payable on demand 2,742,283,582.56 2,509,906<br />

bb) with agreed term or termination period 372,272,807.60 557,288<br />

3,114,556,390.16 3,067,194<br />

6,572,966,058.78 6,490,<strong>31</strong>6<br />

3. Securitised liabilities<br />

a) issued bonds 30,633,041.82 47,956<br />

b) other securities liabilities 0.00 0<br />

30,633,041.82 47,956<br />

Including:<br />

Commercial papers 0.00 (0)<br />

Own acceptances and promissory notes in circulation 0.00 (0)<br />

3a. Trade stock 0.00 0<br />

4. Trust liabilities 1,255,217.39 1,232<br />

Including: trust loans 1,255,217.39 (1,232)<br />

5. Other liabilities 10,502,363.73 9,519<br />

6. Accruals and deferrals 7,297,8<strong>31</strong>.73 8,170<br />

6a. Deferred tax liabilities 0.00 0<br />

7. Provisions<br />

a) Provisions for pensions and similar obligations 22,175,483.27 22,244<br />

b) Tax provisions 15,388,146.24 12,429<br />

c) Other provisions 40,747,956.69 49,685<br />

78,<strong>31</strong>1,586.20 84,358<br />

8. Special item with provision share 0.00 0<br />

9. Subordinate liabilities 190,084,515.04 181,127<br />

10. Capital with participating rights 0.00 1,534<br />

Including: due before the end <strong>of</strong> two years 0.00 (1,534)<br />

11. Funds for general bank risks 50,000,000.00 35,000<br />

Including: special items according to § 340e para. 4 HGB 0.00 (0)<br />

12. Equity<br />

a) subscribed equity 0.00 23<br />

b) capital reserve 0.00 0<br />

c) pr<strong>of</strong>it reserve<br />

ca) safety reserve 234,071,451.12 225,009<br />

cb) other reserve 0.00 0<br />

234,071,451.12 225,009<br />

d) net pr<strong>of</strong>it 12,788,904.63 9,063<br />

246,860,355.75 234,095<br />

Liabilities total 8,976,033,612.29 8,817,3<strong>31</strong><br />

1. Contingent liabilities<br />

a) Contingent liabilities from p<strong>as</strong>sed-on settled bills <strong>of</strong> exchange 0.00 0<br />

b) Liabilities from guarantees and warranty contracts 86,<strong>31</strong>8,972.10 104,449<br />

A report on another contingent liability that cannot be quantified is<br />

included in the Annex<br />

c) Liability from provision <strong>of</strong> collateral for third-party liabilities 6,933,920.00 0<br />

93,252,892.10 104,449<br />

2. Other liabilities<br />

a) repurch<strong>as</strong>e obligations from repurch<strong>as</strong>e transactions 0.00 0<br />

b) placement and <strong>as</strong>sumption obligations 0.00 0<br />

c) irrevocable credit promises 67,872,709.11 68,193<br />

67,872,709.11 68,193<br />

KEUR<br />

2