You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FOODNEWS THAILAND January, <strong>2006</strong><br />

Canned<br />

fruits<br />

Sweetness,<br />

weakness<br />

Sugar and labour issues<br />

have been putting Thai<br />

processors under pressure,<br />

but with supply and sales<br />

rising, optimism is returning<br />

to the industry.<br />

BY RICHARD SIMPSON<br />

SUGAR is proving to be an extremely<br />

trying issue for Thai pineapple canners<br />

as fears of a shortage in the country, which<br />

is the world’s third largest exporter of the<br />

product, has left the canned industry with<br />

a distinctly sour taste in its mouth.<br />

Overall costs have gone up substantially<br />

over the past year, as they have in general for<br />

canned foods, with fuel, labour and tin-plate<br />

all increasing in price.<br />

The Thai government is closely monitoring<br />

the production cost of sugar at present<br />

before deciding whether to remove it from<br />

the list of price-controlled goods, to prevent<br />

a shortage to the domestic market.<br />

Pineapple canners in particular will have<br />

been alarmed by recent calls by the Thai<br />

Sugar Miller Corporation, one of the country’s<br />

biggest sugar companies, to float sugar<br />

prices and regulate the amount canners take.<br />

“Supply might be tight if the government<br />

cannot fix loopholes on sugar smuggling and<br />

the amount bought by major sugar consumers<br />

such as canned fruit producers,” said<br />

Thai Sugar Miller president Vibul Panitvong,<br />

quoted in the Business Times.<br />

A shortage of skilled labour has also been<br />

an issue for processors, and came to a head<br />

back in November 2005 when canners struggled<br />

to catch up on a backlog of orders, due<br />

partly to the delay in the start of the packing<br />

period.<br />

Factories were only running at about 80%<br />

of their capacity, due to the lack of labour but<br />

in the end canners were able to push on and<br />

ensure enough fruit was available coming<br />

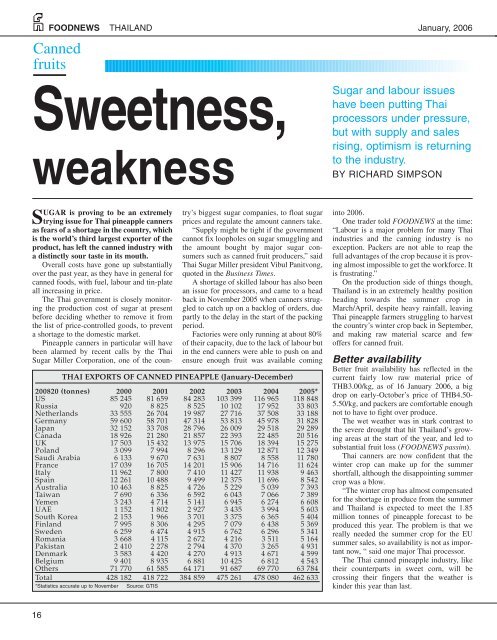

THAI EXPORTS OF CANNED PINEAPPLE (January-December)<br />

200820 (tonnes) 2000 2001 2002 2003 2004 2005*<br />

US 85 245 81 659 84 283 103 399 116 965 118 848<br />

Russia 920 8 825 8 525 10 102 17 952 33 803<br />

Netherlands 33 555 26 704 19 987 27 716 37 508 33 188<br />

Germany 59 600 58 701 47 314 53 813 45 978 31 828<br />

Japan 32 152 33 708 28 796 26 009 29 518 29 289<br />

Canada 18 926 21 280 21 857 22 393 22 485 20 516<br />

UK 17 503 15 432 13 975 15 706 18 394 15 275<br />

Poland 3 099 7 994 8 296 13 129 12 871 12 349<br />

Saudi Arabia 6 133 9 670 7 631 8 807 8 558 11 780<br />

France 17 039 16 705 14 201 15 906 14 716 11 624<br />

Italy 11 962 7 800 7 410 11 427 11 938 9 463<br />

Spain 12 261 10 488 9 499 12 375 11 696 8 542<br />

Australia 10 463 8 825 4 726 5 229 5 039 7 393<br />

Taiwan 7 690 6 336 6 592 6 043 7 066 7 389<br />

Yemen 3 243 4 714 5 141 6 945 6 274 6 608<br />

UAE 1 152 1 802 2 927 3 435 3 994 5 603<br />

South Korea 2 153 1 966 3 701 3 375 6 365 5 404<br />

Finland 7 995 8 306 4 295 7 079 6 438 5 369<br />

Sweden 6 259 6 474 4 915 6 762 6 296 5 341<br />

Romania 3 668 4 115 2 672 4 216 3 511 5 164<br />

Pakistan 2 410 2 278 2 794 4 370 3 265 4 931<br />

Denmark 3 583 4 420 4 270 4 913 4 671 4 599<br />

Belgium 9 401 8 935 6 881 10 425 6 812 4 543<br />

Others 71 770 61 585 64 171 91 687 69 770 63 784<br />

Total 428 182 418 722 384 859 475 261 478 080 462 633<br />

*Statistics accurate up to November Source: GTIS<br />

into <strong>2006</strong>.<br />

One trader told FOODNEWS at the time:<br />

“Labour is a major problem for many Thai<br />

industries and the canning industry is no<br />

exception. Packers are not able to reap the<br />

full advantages of the crop because it is proving<br />

almost impossible to get the workforce. It<br />

is frustrating.”<br />

On the production side of things though,<br />

<strong>Thailand</strong> is in an extremely healthy position<br />

heading towards the summer crop in<br />

March/April, despite heavy rainfall, leaving<br />

Thai pineapple farmers struggling to harvest<br />

the country’s winter crop back in September,<br />

and making raw material scarce and few<br />

offers for canned fruit.<br />

Better availability<br />

Better fruit availability has reflected in the<br />

current fairly low raw material price of<br />

THB3.00/kg, as of 16 January <strong>2006</strong>, a big<br />

drop on early-October’s price of THB4.50-<br />

5.50/kg, and packers are comfortable enough<br />

not to have to fight over produce.<br />

The wet weather was in stark contrast to<br />

the severe drought that hit <strong>Thailand</strong>’s growing<br />

areas at the start of the year, and led to<br />

substantial fruit loss (FOODNEWS passim).<br />

Thai canners are now confident that the<br />

winter crop can make up for the summer<br />

shortfall, although the disappointing summer<br />

crop was a blow.<br />

“The winter crop has almost compensated<br />

for the shortage in produce from the summer<br />

and <strong>Thailand</strong> is expected to meet the 1.85<br />

million tonnes of pineapple forecast to be<br />

produced this year. The problem is that we<br />

really needed the summer crop for the EU<br />

summer sales, so availability is not as important<br />

now, “ said one major Thai processor.<br />

The Thai canned pineapple industry, like<br />

their counterparts in sweet corn, will be<br />

crossing their fingers that the weather is<br />

kinder this year than last.<br />

16