Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2<br />

FOODNEWS THAILAND January, <strong>2006</strong>

FOODNEWS THAILAND January, <strong>2006</strong><br />

Thai<br />

focus<br />

Hungry?<br />

Yes, Siam!<br />

If you travel along any major boulevard<br />

in Europe where restaurants are found,<br />

there will be a good chance that one of<br />

them will house Thai cuisine. The last 10<br />

years have seen a huge increase in the<br />

number of Thai restaurants. Even local<br />

pubs in Britain serve Thai food.<br />

Bordering Cambodia, Myanmar, Laos<br />

and Malaysia, <strong>Thailand</strong> has 3 220 kilometres<br />

of coastline and possesses an ideal topography<br />

and climate for food growing. Blessed<br />

with large expanses of fertile land and ideal<br />

growing conditions <strong>Thailand</strong> enjoys the status<br />

of being agriculturally self-sufficient,<br />

being the only net exporter of food in Asia<br />

and eighth biggest exporter (in terms of revenue)<br />

of food in the world. It is the world’s<br />

largest exporter of canned pineapple, secondlargest<br />

seafood exporter and the world’s foremost<br />

tapioca and rice exporter.<br />

<strong>Thailand</strong> has 66 million inhabitants, GDP<br />

growth of 4.8% and its exports goods and<br />

services fuel the economy (exports accounted<br />

for 66.3% of GDP in 2001 compared with<br />

23% in 1984). The agricultural sector has<br />

long been the country’s backbone, generating<br />

food and income for Thai people. Before<br />

the manufacturing industry began to play a<br />

leading role in the Thai economy in the late<br />

1970s, the agricultural sector generated<br />

almost 100% of the country’s export income.<br />

Thai agricultural production constitutes<br />

Company<br />

Page No<br />

Champaca Co., Ltd. 17<br />

Doi Kham <strong>Food</strong> Products Co., Ltd. 2<br />

Exotic <strong>Food</strong> 7<br />

<strong>Food</strong> and Drinks Public Company Limited 5<br />

Hiwa Rotterdam Port Cold Stores 9<br />

Itohwen & Co., Ltd. 19<br />

JFC Enterprise Co., Ltd. 19<br />

Malinee <strong>Food</strong> Products Co., Ltd. 9<br />

Prunesco 15<br />

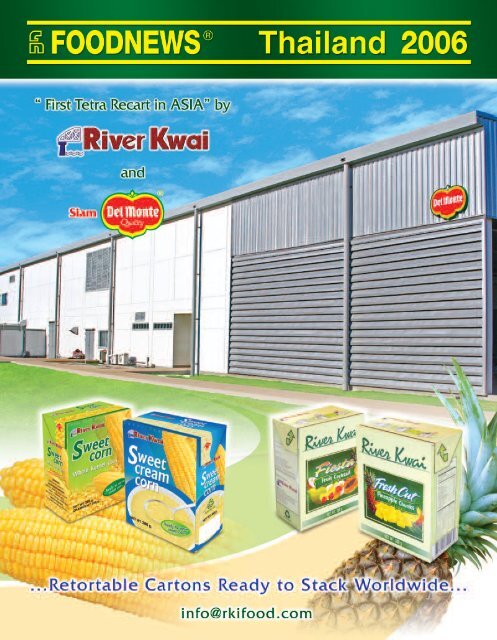

River Kwai International <strong>Food</strong> <strong>Industry</strong> Co., Ltd. 1<br />

Advertisers’ Index<br />

14.12% of the country’s total exports (in<br />

value terms) and provides employment to<br />

some 20 million people. Conversely though,<br />

as the level of its food exports grows, its contribution<br />

to the gross domestic product<br />

declines due to the rapid expansion of other<br />

sectors of the economy. The food industry<br />

will continue to play a crucial role in the<br />

Thai economy because it consumes very little<br />

foreign capital and contributes greatly to<br />

foreign earnings.<br />

Productivity has increased as has public<br />

and private investment enabling the expansion<br />

of trade in Thai produce in global markets.<br />

It also showed its importance to the<br />

economy as a whole in its response to the<br />

1997 financial and economic crises. Exports<br />

of rice, shrimp, poultry and corn all significantly<br />

increased following the crisis.<br />

The sector’s dynamism and importance<br />

have prompted a high level of government<br />

interest and participation. The Thai government<br />

has responded swiftly over the past few<br />

years to issues related to food safety and the<br />

need to diversify. <strong>Thailand</strong> is ripe for agrobusiness<br />

investment. The combination of<br />

quality, popular and safe raw materials, the<br />

long history and experience found in<br />

<strong>Thailand</strong> and the ability of the food sector to<br />

respond to global trends and needs point to<br />

the fact that this is a country deserving of the<br />

global food community’s attention.<br />

Sea Value Co., Ltd. 12 & 13<br />

Shaanxi Haisheng Fresh Fruit Juice Co., Ltd. 7<br />

Siam Fruit Canning (1988) Co., LTD. 15<br />

Stutzer & Co. AG Switzerland 19<br />

Surapon <strong>Food</strong>s Public Company Limited 9<br />

Thai Bonanza International Co. Ltd. 17<br />

Trisun (Israel) Ltd. 7<br />

Tuna and Fishes Limited 17<br />

Tuna <strong>2006</strong> 2<br />

Viriyah <strong>Food</strong> Processing Co., Ltd. 15<br />

Xiamen Kingstar Imp & Exp Co., Ltd. 9<br />

Editor: Neil Murray<br />

Chief Reporter: Kath Miller<br />

Specialist Reporters:<br />

Eugenie Bryan<br />

Richard Simpson<br />

Robert Songer<br />

Advertisement Manager:<br />

Vicky Drinkwater<br />

Advertisement Assistant: Helen Davies<br />

Market Prices: Matthew Pendered<br />

Managing Director: Michael Hobbs<br />

Contents<br />

■ Set the juice loose: <strong>Thailand</strong>’s<br />

main contribution to the world’s<br />

portfolio of fruit juices is pineapple,<br />

of which it is the globe’s leading<br />

producer. However, processors are<br />

finding it difficult to obtain the<br />

prices they want ..............................6<br />

■ The big fish in the sea: canned<br />

tuna prices rise and fall according<br />

to the quantity of the catch, but<br />

there seems to be no slowing in<br />

global demand................................14<br />

■ Sweetness weakness: the soaring<br />

price of sugar (and other key<br />

inputs) is proving a headache for<br />

canned fruit producers .................16<br />

■ The seeds of doubt: Exports of<br />

Thai canned sweet corn rose again<br />

in 2005, and are now almost four<br />

times higher than they were at the<br />

start of the decade, but poor weather<br />

has hurt production..................22<br />

FOODNEWS<br />

80 Calverley Road, Tunbridge Wells,<br />

Kent TN1 2UN, UK.<br />

Phone: +44 (0) 207 017 7495<br />

Fax: +44 (0) 207 017 7592<br />

E-mail: fneditorial@agra-net.com<br />

www.agra-net.com<br />

© FOODNEWS <strong>2006</strong>. All rights reserved. No<br />

part of this publication may be reproduced or<br />

transmitted in any form or by any means without<br />

the written permission of the publisher. Registered<br />

Trade Mark: FOODNEWS ® . Informa<br />

Group plc.<br />

Advertising in FOODNEWS and <strong>Food</strong>news supplements is<br />

accepted on condition that the advertiser will indemnify the<br />

company from any claims or actions arising from the appearance<br />

of an advertisement. Printed by Fleet Litho (Kent) Ltd.<br />

Supplement to FOODNEWS®<br />

This report was written and researched by Global Business Reports.<br />

For further information please contact info@gbreports.com<br />

3

FOODNEWS THAILAND January, <strong>2006</strong><br />

Thai<br />

focus<br />

The past 20 years have seen rapid changes<br />

and growth in the Thai food industry, especially<br />

in the processed, value added and finished<br />

sectors. The 1997-1998 Asian financial<br />

crisis presented setbacks for those producers<br />

who relied on imports and the domestic market.<br />

However, this period also presented a<br />

good opportunity for those with low foreign<br />

debt, high exports and foreign currency<br />

inflows. While their wage bill and local costs<br />

dropped, their foreign income provided them<br />

with healthier than usual margins. With the<br />

focus placed on food safety and standards,<br />

coupled with <strong>Thailand</strong>’s abundance of raw<br />

materials from local producers (<strong>Thailand</strong>,<br />

being the region’s only net exporter, enjoys<br />

the capability to produce more than it can<br />

consume) and government initiatives such<br />

as, ‘Kitchen of the World’ the future looks<br />

very good for <strong>Thailand</strong>’s food processors.<br />

At the same time there is also a need for<br />

<strong>Thailand</strong>’s food processors to import certain<br />

food ingredients that are unavailable domestically.<br />

The value of these imports in 2000<br />

was estimated at around US$1.5 billion<br />

(Agri-culture and Agri-food Canada<br />

http://atn-riae.agr.ca/asean/e3021.htm).<br />

<strong>Thailand</strong> itself is one of the leading food<br />

processing nations of the world, with over<br />

10 000 food manufacturing companies. Of<br />

these, 96% are SMEs (small and mediumsized<br />

enterprises) who (in the past) were<br />

geared to serving the domestic market. With<br />

annual exports totalling around US$10 billion,<br />

<strong>Thailand</strong>’s world share of the global<br />

food trade (as estimated by FAO – <strong>Food</strong> and<br />

Agriculture Organisation in 1998) was<br />

around 0.2%, which at the turn of the century<br />

was estimated at US$5.5 trillion.<br />

<strong>Thailand</strong>’s share in world food export had,<br />

by 2001, risen (according to The National<br />

<strong>Food</strong> Institute) to 2.28%.<br />

<strong>Thailand</strong> itself is still home to some<br />

colossal firms including Boonrawd Trading,<br />

the Charoen Pokphand (CP) Group, Thai<br />

Union and Bangkok Produce, to name a few.<br />

However, the sales revenues of these companies<br />

compared to some of their global colleagues<br />

still remain as yet modest. For<br />

instance, in 1999 the profits of Nestlé<br />

amounted to 97 times that of the most profitable<br />

Thai food company.<br />

The major markets for Thai food exports<br />

are Japan and the ASEAN countries, closely<br />

followed by the US and EU. The Middle East<br />

and Africa also constitute 10% of the export<br />

markets for the Thai producers. There are<br />

myriad reasons for this, from tariffs and<br />

duties to GSP status and anti-dumping measures<br />

in various sectors.<br />

In terms of the export structure of<br />

<strong>Thailand</strong>’s food industry in recent years, the<br />

export statistics, commodity by commodity,<br />

show that fisheries are a crucial component<br />

of Thai food exports.<br />

<strong>Thailand</strong>’s advantages<br />

It would seem an extremely pertinent<br />

question to ask ‘Why is <strong>Thailand</strong> the only net<br />

<strong>Food</strong> exporter in Asia?’ Many of its south<br />

east Asian neighbours enjoy the same climate<br />

that makes <strong>Thailand</strong>’s claim to be the<br />

‘food basket of Asia’ possible. All the rice<br />

paddies in south east Asia are well suited to<br />

the regions annual monsoons, not just those<br />

in <strong>Thailand</strong>. One is able to grow the same<br />

variety and multitude of tropical treats in,<br />

say, Vietnam as one can in <strong>Thailand</strong>. The<br />

answer is multi faceted and complex but can<br />

be answered nonetheless.<br />

Regional competition between all the<br />

Asian and, more specifically, south east<br />

Asian countries has always been fierce and<br />

has a long and colourful history.<br />

In terms of the food industry these tensions<br />

and a sense of regional competition are<br />

still keenly apparent. In terms of rice production,<br />

Asia is responsible for nearly 90% of<br />

global output and consumption, 50% of<br />

imports and 72% of exports. In shrimp production<br />

both Indonesia and Vietnam are in<br />

the top six global producers along with<br />

<strong>Thailand</strong>.<br />

Importance of food safety<br />

But there exist several factors that allow<br />

<strong>Thailand</strong>, as opposed its neighbours, to<br />

maintain its current exalted position in the<br />

global food market. But also present are possible<br />

indicators of why this may not continue<br />

to be the case forever.<br />

Steven Chia-Apar of Seafresh, one of the<br />

leading groups in the Thai <strong>Food</strong> industry<br />

explains: “One obvious advantage possessed<br />

by Thai food companies over their Asian<br />

counterparts is that of food safety”. This<br />

statement, by one of the leading figures of<br />

the Thai <strong>Food</strong> industry, highlights the one<br />

obvious advantage possessed by Thai food<br />

companies over their Asian counterparts:<br />

food safety.<br />

The government’s emphasis on food safety<br />

is illustrated by the measures put in place<br />

in 2003 and by making 2004 ‘<strong>Food</strong> Safety<br />

Year’. Strategies involved the reduction of<br />

chemical use and promotion of hygienic conditions<br />

and looking at the improvement of<br />

soil quality. The government’s food and drug<br />

administration has since 2003 enforced the<br />

law on good manufacturing practice or GMP.<br />

In effect <strong>Thailand</strong> has utilised the principles<br />

of GMP to raise the manufacturing standards<br />

to international levels.<br />

This is not a uniquely government-led initiative<br />

though. The private sector has realised<br />

the importance of reaching internationally<br />

recognised safety standards to make them<br />

attractive to overseas investors and multinational<br />

companies and, as a rule, today the<br />

vast majority of Thai food processing companies<br />

are in compliance with the host of<br />

international standards, for example HACCP,<br />

BRC, the ISO, essentially, the ones needed to<br />

export across the globe.<br />

The seafood sector illustrates the attention<br />

and focus brought upon food safety standards.<br />

The code of conduct for food safety in<br />

the shrimp sector was drawn up as long ago<br />

as 1999 by five organisations: the department<br />

of Fisheries, the Thai Frozen <strong>Food</strong>s<br />

Association, the Thai <strong>Food</strong> Processors association<br />

and the Aquaculture business club.<br />

The rules and regulations that concerned<br />

shrimp health management, waste management<br />

and the application of drugs and chemicals<br />

were enforced and confirm the importance<br />

of international sanitary and phytosanitary<br />

(SPS) standards.<br />

That <strong>Thailand</strong> is the world’s largest<br />

exporter of canned tuna, and competes well<br />

in the US market with a 60% share, indicates<br />

not only efficient production, but also a high<br />

quality safety standard.<br />

This emphasis on food safety increased<br />

after 2000 when Egypt placed a ban on<br />

canned Tuna imports from <strong>Thailand</strong> due to<br />

the presence of genetically modified soybean<br />

4

FOODNEWS THAILAND January, <strong>2006</strong><br />

Thai<br />

focus<br />

oil in the cans. Thai companies showed their<br />

flexibility by substituting sunflower oil for<br />

the offending GM oil.<br />

It costs roughly US$10 000 for a firm to<br />

obtain the ISO900 safety certificate, yet,<br />

within three years of its creation over 70% of<br />

firms in <strong>Thailand</strong> had obtained it.<br />

Thai tuna canning companies realised<br />

that by attaining high quality standards, they<br />

can differentiate themselves and their products<br />

from their competitors and overcome<br />

any cost disadvantage that may exist due to<br />

tariff barriers. As with the rice industry, it is<br />

also an admission that consumers are willing<br />

to pay slightly higher prices for safer and<br />

higher quality products.<br />

However, there exists another school of<br />

thought that suggests that the government’s<br />

focus on the food industry has more to do<br />

with clever marketing, as seen with the<br />

‘Kitchen of the World’ scheme, than any<br />

massive focus on improving food safety. Soh<br />

Chee Yong of Ice-Cremo says. “I am glad<br />

that the government has taken such an active<br />

role in promoting Thai food around the<br />

globe”. And whether one agrees with him<br />

that their role is mainly that of a good marketing<br />

agent or not, what is clear is that the<br />

major comparative advantage <strong>Thailand</strong><br />

holds over its regional rivals is that its government<br />

is playing such an active role.<br />

A comparison with Vietnam illustrates<br />

this advantage. Overall the Vietnamese food<br />

industry is blighted by a lack of up-to-date<br />

processing equipment, which in turn is holding<br />

back progress.<br />

Although in recent years the Vietnamese<br />

government has increased the attention it<br />

pays to its expanding food industry, it still<br />

needs to reduce risks to food safety and to<br />

improve quality to help the industry compete<br />

on the world market. And this reality places<br />

it a good few years behind <strong>Thailand</strong>.<br />

The comparison favours <strong>Thailand</strong>, but<br />

this advantage may not last forever. This<br />

shows why, at present, <strong>Thailand</strong> is the preeminent<br />

force in the Asian food sector.<br />

continued on page 8<br />

5

FOODNEWS THAILAND January, <strong>2006</strong><br />

Fruit<br />

juices<br />

Set the juice<br />

Pineapple<br />

loose<br />

juice – traditionally<br />

the most expensive of<br />

the mainstream juices –<br />

has seen prices take a<br />

knock of late, and <strong>Thailand</strong><br />

has been feeling the pinch.<br />

BY NEIL MURRAY<br />

It must be a frustrating time for pineapple<br />

farmers and processors in <strong>Thailand</strong><br />

right now. What has always been the most<br />

expensive ‘mainstream’ fruit juice is now<br />

around the same price as apple juice concentrate<br />

(AJC) thanks to startling rises in<br />

the price of other juices.<br />

In late summer/early autumn last year,<br />

pineapple concentrate prices were edging<br />

upwards. Elsewhere, prices of frozen concentrated<br />

orange juice (FCOJ) and AJC were<br />

heading for the stratosphere. At the time of<br />

writing, these two juices cost around<br />

US$1 700/tonne and US$1 000/tonne<br />

respectively, while pineapple is around<br />

US$1 050/ tonne, all prices c&f Europe.<br />

The problem is that demand in the EU<br />

appears weak at the moment. German interest<br />

in pineapple juice is waning because of<br />

the decline in sales of multi-fruit drinks in<br />

the country. The Spanish, traditionally the<br />

largest drinkers of pineapple juice, also seem<br />

to be losing their taste for the product:<br />

Spanish imports of pineapple concentrate for<br />

the first three quarters of 2005 (the most<br />

recent data available) show a fall in imports<br />

of 19% to 13 340 tonnes from 26485 tonnes<br />

in January-September 2004.<br />

“They are trying hard to keep the market<br />

at a certain level, but there is no strong<br />

demand, so they are struggling,” said a<br />

European trader recently, a viewpoint that<br />

was corroborated by another buyer of<br />

pineapple juice, who added: “The Thais are<br />

eyeing the rest of the fruit juice market and<br />

are trying to get some upwards price movement,<br />

but it’s not happening.”<br />

Looking at the figures in the table opposite<br />

would seem to contradict this. According<br />

to the latest trade data, Thai exports of<br />

pineapple concentrate have risen steeply this<br />

year, to the point where exports for January-<br />

November 2005 are more than 20 000 tonnes<br />

ahead of exports for the whole of 2004.<br />

However, in October and November 2005<br />

sales fell quite sharply, compared with the<br />

same months last year, confirming that the<br />

downturn has been relatively recent.<br />

In addition, there has been a definite<br />

swing towards not from concentrate (NFC)<br />

juice, and <strong>Thailand</strong> is finding it hard to supply<br />

EU (especially Spanish) demand.<br />

“The European market has been quite<br />

slow,” said one trader in Germany recently.<br />

“The Spanish market, the biggest, was stable<br />

for many years but now I hear that NFC is<br />

increasing and this is taking share from the<br />

Thais. Costa Rice, for example, is becoming<br />

more important in NFC pineapple juice.”<br />

To a degree, this is true. In 2002, <strong>Thailand</strong><br />

accounted for nearly half of all Spanish<br />

imports of NFC, then running at about 4 300<br />

tonnes annually. By 2004, the market had<br />

grown spectacularly to just under 9 000<br />

tonnes, but <strong>Thailand</strong>’s share fell to about<br />

21%. <strong>Thailand</strong> has regained some market<br />

share so far this year, but is unlikely to<br />

account for more than 40% of a full-year<br />

NFC market estimated by FOODNEWS to be<br />

about 10 000 tonnes.<br />

Indonesia has gained market share. There<br />

is little difference in pricing between<br />

Indonesian and Thai product, so the reason<br />

for this is unclear, but Indonesia now has<br />

about 10% of the Spanish NFC market.<br />

The biggest supplier to the Spanish market,<br />

however, remains the Netherlands and it<br />

is possible that a lot of this juice is Thai.<br />

Competition between newly established<br />

processors may also keep Thai prices low.<br />

THAILAND EXPORTS OF PINEAPPLE JUICE CONCENTRATE<br />

200949 (tonnes) 2000 2001 2002 2003 2004 *2005<br />

Netherlands 53 708 46 016 40 434 50 789 34 473 38 653<br />

US 24 067 25 529 23 034 23 550 16 106 20 911<br />

Spain 13 023 9 935 6 248 8 874 5 704 9 728<br />

Japan 1 515 2 401 2 177 3 196 3 877 6 290<br />

Italy n/a 1 691 2 270 5 393 5 033 6 055<br />

UK n/a 675 331 854 914 2 017<br />

Canada 1 673 1 916 2 458 1 608 1 136 1 810<br />

Russia n/a 344 1 580 1 443 1 430 1 784<br />

Israel 2 487 1 414 3 026 2 250 2 749 1 452<br />

Belgium n/a 308 177 93 21 1 021<br />

South Korea 528 924 1 010 997 1 020 729<br />

Australia 2 262 2 662 3 193 3 573 1 000 662<br />

Saudi Arabia n/a 437 252 305 – 595<br />

Chile 638 1 138 959 641 – 501<br />

France 1 270 603 119 59 3 845 443<br />

Lebanon 713 614 1 589 1 353 – 403<br />

Puerto Rico 1 420 316 94 95 – 336<br />

Taiwan n/a 262 388 213 – 266<br />

Germany 1 017 1 121 132 282 6 197 215<br />

Finland n/a 820 378 467 865 189<br />

Singapore n/a 94 123 128 129 122<br />

Hong Kong n/a 95 55 110 – 81<br />

Mexico n/a – – 353 – 0<br />

Others 10 694 5 996 5 834 5 725 2081 6 399<br />

Total 115 015 105 311 95 861 112 351 81 599 100 662<br />

*January-November Source: Department of Business Economics, Department of Customs, GTIS<br />

6

FOODNEWS THAILAND January, <strong>2006</strong><br />

FOODNEWS Online Buyers Guide offers buyers a quick and easy way to<br />

search for companies by product, country or company name<br />

www.fnbuyersguide.com<br />

7

FOODNEWS THAILAND January, <strong>2006</strong><br />

Thai<br />

focus<br />

continued from page 5<br />

If proof were needed that <strong>Thailand</strong> is<br />

refusing to rest on its laurels, look no further<br />

than some of the organisations that reflect<br />

on, advise and control the industry. They are<br />

evidence of planning and strategy, and given<br />

that they have cut their teeth on years of trouble<br />

with economic restrictions, regulations,<br />

safety issues, and viruses they have evolved<br />

into some of the most dynamic organisations<br />

across the board. The National <strong>Food</strong><br />

Institute, the Kitchen of the World and the<br />

Thai Frozen <strong>Food</strong>s Association are three of<br />

the most energetic. The former covers the<br />

industry as a whole, and the latter has<br />

evolved from covering one of the most significant<br />

Thai exports – seafood, to covering a<br />

range of frozen products. Run by Panithan<br />

Vajaranant and Poj Aramwattananont respectively,<br />

they are evidence that an industry of<br />

this size and of this potential needs structure<br />

and planning to realize its potential.<br />

National <strong>Food</strong> Institute – Interview<br />

with Panithan Vajaranant:<br />

What were the reasons behind the establishment<br />

of the NFI?<br />

Actually it started as a private sector initiative<br />

around nine years ago. Many of the<br />

bigger companies involved in production and<br />

export were having difficulties with regula-<br />

Surapon Vongvadhanaroj of Surapon <strong>Food</strong>s<br />

tions. Some felt that the government arm was<br />

too slow to work with them in terms of action<br />

and reaction. Subsequently, some of the bigger<br />

players proposed to the government that<br />

we needed an organisation that would help<br />

watch over the food industry. The biggest<br />

challenge and the priority back then was the<br />

safety system. That was nine years ago. If we<br />

were to be serious about the success of our<br />

food industry, we were going to need someone<br />

to look into these issues full-time.<br />

How important is food safety to <strong>Thailand</strong>’s<br />

food industry?<br />

It is quite clear that if <strong>Thailand</strong> wants to<br />

be competitive then we have to put food safety<br />

first. We started initially with the export<br />

segment. Somebody asked, “Well what about<br />

the domestic?” But we realized that we could<br />

not do everything at the same time. So we<br />

began with the export. We can proudly say<br />

we are the only organization who has been<br />

sticking with this role since the beginning.<br />

How would you define your role?<br />

We have four missions. The first one is<br />

food safety, the second one is research and<br />

development, the third one is information<br />

and information systems and the fourth one<br />

is business development. If you look at these<br />

four missions, they present a huge task. I<br />

think I can say that this government is the<br />

first government that has tried to put this<br />

strategy into action, tried to make it happen.<br />

A lot is down to deputy prime minister<br />

Somkid. He is also very involved with the<br />

NFI and how we can achieve our objectives.<br />

The key will be in the planning and the<br />

strategy. We have a strategy. With regards to<br />

food safety, even though we began with<br />

exports, we have since moved onto domestic<br />

issues. An initiative in 2002 with the Public<br />

Health Ministry set about helping food producers<br />

obtain their GMP. There is no reason<br />

that the standards for food consumed in<br />

<strong>Thailand</strong> should be any less than those outside<br />

of <strong>Thailand</strong>.<br />

This is something that our prime minister<br />

is very keen on: every chance he has he<br />

emphasises that food safety is the priority<br />

and it needs to be applied domestically as<br />

well as internationally. Thai people deserve<br />

the same standards as everyone else.<br />

How successful have these initiatives been?<br />

“<br />

Of course, bird flu was a very painful and worrying time for<br />

us all, but it has given us an opportunity to make a lot of<br />

changes.The farmers’ attitude has been one of humility.<br />

”<br />

Panithan Vajaranant, Executive Director of the<br />

National <strong>Food</strong> Institute<br />

That was two years ago, and I would say<br />

that now the government, including the NFI,<br />

has the commitment to bring the standard up<br />

to the international level. You can see for<br />

yourself the food stalls in the street: which<br />

ones do you trust?<br />

How are today’s challenges being overcome?<br />

Well, last year for instance, bird flu hit<br />

<strong>Thailand</strong>. But on the bright side, I suppose<br />

you could say there was a degree of good<br />

timing for the country. The government<br />

began to use a lot of advertising and campaigns<br />

to try and change the attitudes of people,<br />

not only the people in the street, but also<br />

the people in the farms.<br />

Of course this was a very painful and<br />

worrying time for us all, but it has given us<br />

an opportunity to carry out a lot of changes.<br />

The attitude of the farmers has been one of<br />

humility, to the extent that they are now asking,<br />

“What can we do? How can we<br />

improve? Just let us know”. This attitude is<br />

totally different from before, where we were<br />

asking if not begging them to do this or that.<br />

At what point in the food chain does the<br />

responsibility of the NFI lie?<br />

It really is across the board, from farming<br />

to the point of sale, but our true focus has to<br />

lie in the middle of the chain. The processing,<br />

that is where we operate and is where<br />

our priorities lie.<br />

We are expanding to cover the beginning<br />

of the supply chain, we believe in the market<br />

and we are striving to understand what we<br />

need to do in order to fill any gaps. We are<br />

very pro-active.<br />

To be competitive now, you need to be<br />

very assertive.<br />

continued on page 10<br />

8

January, <strong>2006</strong><br />

With more than 10 years professional<br />

knowledge in the food industry and the<br />

updated E-commerce technology, we<br />

promise that we can create a powerful<br />

platform for food trading, provide a diverse<br />

portfolio of processing food products, and<br />

offer an efficient service to our overseas<br />

clients. Our overseas clients trust in our<br />

excellent and professional handling skills.<br />

AVAILABLE PRODUCTS ARE:<br />

• Canned Vegetables • Canned Fruits<br />

• Frozen Vegetables • Frozen Fruits<br />

• Freeze-Dried Fruits • Fresh Fruits<br />

• Freeze-Dried Vegetables<br />

• Juice Concentrates<br />

9

FOODNEWS THAILAND January, <strong>2006</strong><br />

Thai<br />

focus<br />

continued from page 8<br />

To those looking to do business in or with<br />

<strong>Thailand</strong>, I would say that <strong>Thailand</strong> is very<br />

easy compared to the rest of the world. Thai<br />

people are very open-minded. The way we<br />

do business is very different to the west; even<br />

within Asia it is different. I would say<br />

<strong>Thailand</strong> is very understanding and easy to<br />

understand. We try to understand people and<br />

everyone who is doing business with us. We<br />

have learnt a lot about people’s requirements<br />

(in and from this industry) and we are<br />

focused on providing the world with the best<br />

products. We want to be assertive without<br />

being aggressive.<br />

Interview with Poj Aramwattananont,<br />

President of the Thai Frozen <strong>Food</strong><br />

Association and frozen seafood guru.<br />

Could you explain the evolution of the<br />

TFFA?<br />

The Thai Frozen <strong>Food</strong>s Association is a<br />

private non-profit organization. We were<br />

founded in 1968. The Association began life<br />

as the Thai Marine Association. In 1983 we<br />

evolved into the “Thai fishery and Frozen<br />

Products Association” reflecting the fact that<br />

we also covered the frozen products industry.<br />

The current name however was adopted 11<br />

years later. The Thai Frozen <strong>Food</strong>s<br />

Poj Aramwattananont, president of the Thai<br />

Frozen <strong>Food</strong>s Association and industry guru<br />

10<br />

In Season <strong>Food</strong>s: High technology and skill in <strong>Thailand</strong><br />

Association reflects our blanketing of frozen<br />

products and it also extends the<br />

Association’s supervision from just marine<br />

products to cover other food types too.<br />

Specifically what are the aims of TFFA?<br />

The objectives of TFFA are based around<br />

the promotion of entrepreneurship of all<br />

frozen foods in <strong>Thailand</strong>. This includes<br />

informing and supporting our members<br />

through any business hurdles that may be<br />

placed in their paths. This also includes<br />

mediation, conflict resolution and information<br />

transfer between two or more of our<br />

members. We aim to promote both in qualitative<br />

and quantitative terms the fishery and<br />

agriculture industries, in response to domestic<br />

and international demand. We compile,<br />

collate and share our data to produce statistics,<br />

which benefit our members. And of<br />

course we cooperate and collaborate with the<br />

government and its relevant departments<br />

whilst retaining a neutral stance, politically.<br />

What activities are undertaken to assure<br />

these objectives are met?<br />

The TFFA has set up 3 sub-committees;<br />

take the Export Problems Solving<br />

Committee, for instance. It was established<br />

11 years ago to deal with the problems<br />

exporters were facing at that time. Back then,<br />

there were continuing rejections coming<br />

from some major markets. These problems<br />

intensified to the point that there was a total<br />

ban on imports into Italy several times. We<br />

firmly believe that prevention is better than a<br />

“<br />

The higher tariff made it very difficult for Thai shrimp to<br />

stay competitive in the EU and US markets. In the first quarter,Thai<br />

shrimp exports to the US were down by 43%.<br />

”<br />

cure. This is why we meet every two months<br />

to share information, news and problems<br />

among representatives. We conduct seminars<br />

that allow us to share our views, which can<br />

assist the whole industry. There is a good<br />

feeling of camaraderie among us all.<br />

The Data and Information Committee<br />

was established in 1993. The TFFA advises<br />

its members about the prices of fishery products<br />

etc.<br />

The NASEG Committee or North<br />

America Shrimp Exporters Group was born<br />

out of a club of several TFFA members<br />

called The Shrimp Club. Upon seeing the<br />

necessity of unity in negotiation they formed,<br />

‘The North America Shrimp Exporters<br />

Group’ or NASEG”. NASEG negotiates the<br />

cost with freightliners enabling its members<br />

to achieve lower costs than non-members.<br />

NASEG has over 90 members.<br />

Regarding Anti-Dumping measures?<br />

With the higher tariff, it became very difficult<br />

for Thai shrimp to stay competitive in<br />

the EU and US markets. In the first quarter<br />

Thai shrimp imports to the US have been<br />

pulled down by 43% year on year and overall<br />

Thai shrimp exports have fallen by 36%.<br />

A lot depended on the US ruling.<br />

With regards to GSP, a lower GSP would<br />

provide good export opportunities for<br />

<strong>Thailand</strong>’s shrimp in the European markets.<br />

You, yourself clearly have faith in the industry<br />

with your recent US$20 million investment<br />

in the new facility and Sea Value?<br />

Sea Value was formed in March 2004 as a<br />

holding company for two of the leading Tuna<br />

processors, namely Unicord PLC and ISA<br />

Value.<br />

Unicord itself has over 20 years of history;<br />

it was founded in 1978 as Unicord

FOODNEWS THAILAND January, <strong>2006</strong><br />

Thai<br />

focus<br />

Investment and changed to Unicord in 1984.<br />

Unicord produces mainly canned food,<br />

pouch packs and frozen products, Human<br />

food, pet food and value added food respectively.<br />

ISA Value also has many years of experience<br />

and is today producing 500 tonnes of<br />

tuna under strict quality guidelines.<br />

With the experience of the people<br />

involved in this project and the technology<br />

involved, this will become one of the largest,<br />

most advanced tuna operations in the world.<br />

Kitchen of the World<br />

<strong>Thailand</strong>’s abundance of food products and<br />

climate ranges, combined with the reputation<br />

of <strong>Thailand</strong> as a net exporter of foods, has<br />

meant that the promotion of <strong>Thailand</strong> as a<br />

business partner and of Thai products overseas<br />

has been essential. With this aim in<br />

mind, the Department of Agriculture, under<br />

the Ministry of Agriculture and Cooperatives<br />

spent 2003 outlining methods by which the<br />

export or fruit and vegetables as well as the<br />

processing of food could be made healthier<br />

and safer. Particular efforts were made in the<br />

reduction of chemical usage and the development<br />

of soil quality.<br />

This aim was merely one method of the<br />

multi-pronged assault on the world food<br />

markets made by the government. Yet perhaps<br />

one of the most ambitious tactics is the<br />

Kitchen of the World campaign.<br />

The Kitchen of the World is essentially<br />

aimed at increasing the number of Thai<br />

restaurants overseas. The reasons behind this<br />

are that first, <strong>Thailand</strong>’s place on the food<br />

map will be reinforced. The consumption of<br />

Thai food will increase awareness of<br />

<strong>Thailand</strong> as a food processing nation and<br />

would ideally encourage business to and<br />

from <strong>Thailand</strong>. An increased number of<br />

restaurants will provide a distribution network<br />

for <strong>Thailand</strong>’s food processors to be<br />

able to sell their products overseas. Finally,<br />

any interest in Thai cuisine will surely<br />

increase interest in the finished Thai-style<br />

products that are being manufactured in<br />

increasing quantities in <strong>Thailand</strong>.<br />

As several members of the Kitchen of the<br />

World and NFI team believe, “We think that<br />

food is one of our crowns. We want to export<br />

to the world, we have a unique product, and<br />

Thai food is already very popular across the<br />

world. This is our niche, if we can promote<br />

Thai food it means that we can increase the<br />

number of Thai restaurants overseas which<br />

means that we can increase exports of products,<br />

specifically ready to eat and ready to<br />

cook. Moreover, we can also export personnel,<br />

Thai chefs for instance.”<br />

“The Kitchen of the World initiative<br />

began in 2003. It was an initiative of Prime<br />

Minister Thaksin himself. He realised that<br />

Thai cuisine is very popular, and has a great<br />

potential for export, and so he managed to<br />

get funding for this project.<br />

“He is explicit when it comes to expressing<br />

<strong>Thailand</strong>’s skill as a food producer and<br />

exporter. We are the top exporters of many<br />

products, pineapple for instance. In terms of<br />

the technology, the know-how and the experience<br />

we truly excel.”<br />

For <strong>Thailand</strong> to truly thrive as Kitchen of<br />

the World, it will take more than premium<br />

finished products, or an abundance of exotic<br />

raw materials. The kind of challenges that<br />

<strong>Thailand</strong> is up against include meeting<br />

hygiene standards, non-tariff barriers, raw<br />

material shortages in certain sectors and epidemics<br />

such as the aforementioned AI.<br />

From the thoroughness of the National<br />

<strong>Food</strong> Institute to the camaraderie and ambition<br />

of the Thai Frozen <strong>Food</strong>s Association<br />

and its President, along with hopes within<br />

the poultry industry, it would appear that the<br />

future is bright for <strong>Thailand</strong>, its exporters<br />

and its consumers. One remaining anxiety is<br />

the fact that, although in the last decade or<br />

so, revenue gained from the export of<br />

processed materials has doubled, the farmers<br />

of <strong>Thailand</strong> still seem to be living in relative<br />

poverty. The focus on manufacturing needs<br />

to be shared with the farmers, as it is crucial<br />

that <strong>Thailand</strong> and its food industry realize<br />

that without raw materials, there is no processing.<br />

Where from here?<br />

For all the praise due to the Thai food industry<br />

and its government’s keen participation in<br />

it, it remains clear that with the development<br />

of the Chinese and Vietnamese food industries,<br />

the Thais cannot rest on their laurels<br />

and further developments need to be made.<br />

But resting on their laurels does not seem to<br />

be on the menu. The presence of innovative<br />

companies, favourable global trends and the<br />

development of existing recipes indicate that<br />

the industry is doing its utmost to remain the<br />

‘food basket of Asia’.<br />

<strong>Thailand</strong> is famed for being the world’s<br />

leading exporter of a host of products, rice<br />

and canned pineapple to name but two. Yet it<br />

is also home to several little known but innovative<br />

companies that illustrate the breadth<br />

Vilai Kiatsrichart, president of the Thai <strong>Food</strong><br />

Processors Association<br />

of products the country has to offer and the<br />

ability of the industry to use its plentiful supply<br />

of quality raw materials to create something<br />

new and exciting. Developments like<br />

this hint at a positive future for Thai companies<br />

in the arena of ‘niche’ food products.<br />

One such company is In-Season <strong>Food</strong>s. It<br />

has taken one of <strong>Thailand</strong>’s most abundant<br />

and popular raw materials, tropical fruits<br />

such as pineapples, lychees and mangos, and<br />

treated them in a way that ensures all the<br />

goodness and taste remains whether it is<br />

eaten two days after being picked or two<br />

weeks.<br />

Its innovative methods ensure that<br />

Europeans are not denied the same luxury as<br />

Asians in eating truly delectable fresh fruit.<br />

Once picked, the fruits are taken to In-<br />

Season <strong>Food</strong>’s state of the art factory and on<br />

the same day they are cryogenically frozen<br />

using liquid nitrogen to produce individually<br />

quick frozen (IFQ) fruit. The company is the<br />

only one of its kind in Asia and already in its<br />

short life has created much excitement and<br />

disbelief over the quality of the product.<br />

“Due to the nature of the project and idea<br />

only a ‘back of the envelope’ type of feasibility<br />

was possible. However the concept was<br />

developed on strong business principles”<br />

said Asraf Fancy, who owns and runs the<br />

company with his son Ali Fancy.<br />

The company is indeed built on strong<br />

business principles but also two other important<br />

ingredients – innovation and vision.<br />

continued on page 20<br />

11

FOODNEWS THAILAND January, <strong>2006</strong><br />

Canned<br />

fish<br />

The big fish<br />

Tuna<br />

in the sea<br />

catches have been<br />

erratic over the last year,<br />

but with exports up and a<br />

free trade agreement with<br />

the US in the works, there<br />

is no sign of sales slowing.<br />

BY RICHARD SIMPSON<br />

THE Hollywood screenwriter William<br />

Goldman once famously remarked<br />

that in the film industry “no-one knows<br />

anything really”, but this maxim could<br />

almost as easily be applied to the tuna<br />

business, with catch levels and fish prices<br />

proving almost impossible to predict.<br />

The last two year’s have seen both dramatic<br />

fluctuations in price for raw fish and in<br />

tuna supply, with last year’s tsunami casting<br />

a distinctly dark shadow despite only peripherally<br />

affecting the industry.<br />

Prices for raw material hit an all time high<br />

in September 2004 of US$1 180/tonne in<br />

Bangkok, heart of the tuna business, but<br />

2005 saw prices vary from US$700/tonne<br />

(towards the beginning and end of the year)<br />

to as much as US$1 030/tonne in August. On<br />

the whole, prices for the year averaged out at<br />

around US$900/tonne, an awkward price for<br />

processors to deal with as one told FOOD-<br />

NEWS back in 2005: “At around<br />

US$900/tonne it is very expensive for us<br />

buyers, especially when we look back at the<br />

prices we have had before of around<br />

US$600/tonne. However, we are all conscious<br />

of the fact prices could so easily go up<br />

and then we really feel the squeeze.”<br />

One of the major issues for the Thai tuna<br />

industry in <strong>2006</strong> will be the ongoing negotiations<br />

between the US and <strong>Thailand</strong> aimed at<br />

finalising a bilateral free trade agreement.<br />

Discussions between the two countries began<br />

back in January 2004 and are still on schedule<br />

to be completed by June <strong>2006</strong>.<br />

THAI EXPORTS OF CANNED TUNA (January-December)<br />

160414 (tonnes) 2000 2001 2002 2003 2004 2005*<br />

US 70 564 71 497 73 634 108 085 98 472 103 591<br />

Australia 19 283 20 015 23 683 28 606 29 850 29 333<br />

Japan 21 586 19 788 23 496 24 114 28 910 26 251<br />

Canada 23 711 24 089 25 523 25 303 25 381 25 873<br />

Egypt 27 419 29 687 21 216 23 001 19 300 22 789<br />

Libya 1 258 1 698 9 540 14 233 18 290 22 743<br />

Germany 4 275 10 373 10 406 9 661 6 061 15 462<br />

UK 13 460 17 196 17 248 18 123 13 174 15 432<br />

Saudi Arabia 6 118 12 433 12 408 11 834 15 347 13 795<br />

Israel 4 876 7 286 7 635 10 255 7 779 8 256<br />

Argentina 7 448 9 330 378 6 643 8 941 7 537<br />

Switzerland 3 093 3 192 2 965 6 296 5 070 5 880<br />

South Africa 2 447 2 886 2 759 4 925 5 268 5 833<br />

Others 60 190 69 120 89 378 104 641 95 675 111 775<br />

Total 265 728 298 590 320 269 395 720 377 518 414 541<br />

*2005 exports are up until until the end of November<br />

Source: GTIS<br />

Tuna talks<br />

At five-day talks in the northern Thai city of<br />

Chiang Mai in early January 2005, Prime<br />

Minister Thaksin Shinawatra, said in an<br />

address to local and foreign business leaders,<br />

“On the Thai-US FTA, if we don’t trade with<br />

the US, we will lose. Right now, our greatest<br />

surplus with any country is with the US. We<br />

will be at a huge disadvantage to others if we<br />

lose our access to the US market, as other<br />

countries will pursue their own deals. We<br />

need to move now, before we have no more<br />

room to move.”<br />

A report by the <strong>Thailand</strong> Development<br />

and Research Institute, a Bangkok-based<br />

think-tank, estimates that, in respect to agriculture,<br />

the US and <strong>Thailand</strong> would both<br />

enjoy big economic gains from an FTA.<br />

According to their analysis, agricultural<br />

exports to the US would increase by 5-22%,<br />

while US exports would also increase by 4-<br />

67%. The gains for <strong>Thailand</strong>’s agricultural<br />

sector would result in a 2.3% increase in<br />

gross domestic product, says to the report.<br />

The US has agreed to end tariffs on 74%<br />

of all Thai imports totalling US$1.28 billion<br />

(THB51 billion) immediately after the FTA’s<br />

implementation, increasing to 85% and<br />

US$1.46 billion in five years. The items covered<br />

will reach 97% in 10 years totalling<br />

US$1.60 billion and will include canned tuna<br />

and processed fruit.“If the US comes with a<br />

lower duty for Thai tuna with no strings<br />

attached, it will certainly help,” said one<br />

major Thai trader.<br />

“But as usual with these things, strings<br />

are always attached somewhere. What we<br />

really need is for EU to drop their duties so<br />

<strong>Thailand</strong> is not at any disadvantage and<br />

everybody is on a level playing field, and this<br />

applies not only to tuna but also to canned<br />

pineapple and canned sweet corn.”<br />

Nevertheless, Thai exports of canned tuna<br />

are at their highest levels in history, hitting<br />

414 540 tonnes by the end of December<br />

2005, compared with full year sales of<br />

377 520 tonnes in 2004 and 395 720 tonnes<br />

in 2003 respectively.<br />

The US has once again boosted its intake<br />

of Thai tuna to over 100 000 tonnes, after a<br />

slight sales slump in 2004.<br />

The subject of mercury in canned fish,<br />

has sporadically reared its head in the US<br />

through media reports, but this scare seems<br />

to have had little effect on the country’s tuna<br />

needs. With one month to go in 2005, Thai<br />

exports look set to surpass the 430 000<br />

tonnes mark, even though December is usually<br />

a fairly quiet period, being a a holiday<br />

period for countries.<br />

14

FOODNEWS THAILAND January, <strong>2006</strong><br />

15

FOODNEWS THAILAND January, <strong>2006</strong><br />

Canned<br />

fruits<br />

Sweetness,<br />

weakness<br />

Sugar and labour issues<br />

have been putting Thai<br />

processors under pressure,<br />

but with supply and sales<br />

rising, optimism is returning<br />

to the industry.<br />

BY RICHARD SIMPSON<br />

SUGAR is proving to be an extremely<br />

trying issue for Thai pineapple canners<br />

as fears of a shortage in the country, which<br />

is the world’s third largest exporter of the<br />

product, has left the canned industry with<br />

a distinctly sour taste in its mouth.<br />

Overall costs have gone up substantially<br />

over the past year, as they have in general for<br />

canned foods, with fuel, labour and tin-plate<br />

all increasing in price.<br />

The Thai government is closely monitoring<br />

the production cost of sugar at present<br />

before deciding whether to remove it from<br />

the list of price-controlled goods, to prevent<br />

a shortage to the domestic market.<br />

Pineapple canners in particular will have<br />

been alarmed by recent calls by the Thai<br />

Sugar Miller Corporation, one of the country’s<br />

biggest sugar companies, to float sugar<br />

prices and regulate the amount canners take.<br />

“Supply might be tight if the government<br />

cannot fix loopholes on sugar smuggling and<br />

the amount bought by major sugar consumers<br />

such as canned fruit producers,” said<br />

Thai Sugar Miller president Vibul Panitvong,<br />

quoted in the Business Times.<br />

A shortage of skilled labour has also been<br />

an issue for processors, and came to a head<br />

back in November 2005 when canners struggled<br />

to catch up on a backlog of orders, due<br />

partly to the delay in the start of the packing<br />

period.<br />

Factories were only running at about 80%<br />

of their capacity, due to the lack of labour but<br />

in the end canners were able to push on and<br />

ensure enough fruit was available coming<br />

THAI EXPORTS OF CANNED PINEAPPLE (January-December)<br />

200820 (tonnes) 2000 2001 2002 2003 2004 2005*<br />

US 85 245 81 659 84 283 103 399 116 965 118 848<br />

Russia 920 8 825 8 525 10 102 17 952 33 803<br />

Netherlands 33 555 26 704 19 987 27 716 37 508 33 188<br />

Germany 59 600 58 701 47 314 53 813 45 978 31 828<br />

Japan 32 152 33 708 28 796 26 009 29 518 29 289<br />

Canada 18 926 21 280 21 857 22 393 22 485 20 516<br />

UK 17 503 15 432 13 975 15 706 18 394 15 275<br />

Poland 3 099 7 994 8 296 13 129 12 871 12 349<br />

Saudi Arabia 6 133 9 670 7 631 8 807 8 558 11 780<br />

France 17 039 16 705 14 201 15 906 14 716 11 624<br />

Italy 11 962 7 800 7 410 11 427 11 938 9 463<br />

Spain 12 261 10 488 9 499 12 375 11 696 8 542<br />

Australia 10 463 8 825 4 726 5 229 5 039 7 393<br />

Taiwan 7 690 6 336 6 592 6 043 7 066 7 389<br />

Yemen 3 243 4 714 5 141 6 945 6 274 6 608<br />

UAE 1 152 1 802 2 927 3 435 3 994 5 603<br />

South Korea 2 153 1 966 3 701 3 375 6 365 5 404<br />

Finland 7 995 8 306 4 295 7 079 6 438 5 369<br />

Sweden 6 259 6 474 4 915 6 762 6 296 5 341<br />

Romania 3 668 4 115 2 672 4 216 3 511 5 164<br />

Pakistan 2 410 2 278 2 794 4 370 3 265 4 931<br />

Denmark 3 583 4 420 4 270 4 913 4 671 4 599<br />

Belgium 9 401 8 935 6 881 10 425 6 812 4 543<br />

Others 71 770 61 585 64 171 91 687 69 770 63 784<br />

Total 428 182 418 722 384 859 475 261 478 080 462 633<br />

*Statistics accurate up to November Source: GTIS<br />

into <strong>2006</strong>.<br />

One trader told FOODNEWS at the time:<br />

“Labour is a major problem for many Thai<br />

industries and the canning industry is no<br />

exception. Packers are not able to reap the<br />

full advantages of the crop because it is proving<br />

almost impossible to get the workforce. It<br />

is frustrating.”<br />

On the production side of things though,<br />

<strong>Thailand</strong> is in an extremely healthy position<br />

heading towards the summer crop in<br />

March/April, despite heavy rainfall, leaving<br />

Thai pineapple farmers struggling to harvest<br />

the country’s winter crop back in September,<br />

and making raw material scarce and few<br />

offers for canned fruit.<br />

Better availability<br />

Better fruit availability has reflected in the<br />

current fairly low raw material price of<br />

THB3.00/kg, as of 16 January <strong>2006</strong>, a big<br />

drop on early-October’s price of THB4.50-<br />

5.50/kg, and packers are comfortable enough<br />

not to have to fight over produce.<br />

The wet weather was in stark contrast to<br />

the severe drought that hit <strong>Thailand</strong>’s growing<br />

areas at the start of the year, and led to<br />

substantial fruit loss (FOODNEWS passim).<br />

Thai canners are now confident that the<br />

winter crop can make up for the summer<br />

shortfall, although the disappointing summer<br />

crop was a blow.<br />

“The winter crop has almost compensated<br />

for the shortage in produce from the summer<br />

and <strong>Thailand</strong> is expected to meet the 1.85<br />

million tonnes of pineapple forecast to be<br />

produced this year. The problem is that we<br />

really needed the summer crop for the EU<br />

summer sales, so availability is not as important<br />

now, “ said one major Thai processor.<br />

The Thai canned pineapple industry, like<br />

their counterparts in sweet corn, will be<br />

crossing their fingers that the weather is<br />

kinder this year than last.<br />

16

FOODNEWS THAILAND January, <strong>2006</strong><br />

<strong>2006</strong> Media Information<br />

NOW AVAILABLE<br />

If you have not got your copy contact Vicky on:<br />

+44 (0)20 7017 7494 fnadvertising@agra-net.com<br />

17

FOODNEWS THAILAND January, <strong>2006</strong><br />

ITOH<br />

ITOHWEN AND COMPANY, LIMITED<br />

We are the Producer and Exporter with our own facilities and equipment in China of the following:<br />

FROZEN PRODUCT:<br />

Boletus Edulis, Nameko, Pleurotus, Shiitake, Morel, Cantharellus Cibarius, Champignons, Suillus Granulatus, Black Fungus, Strawberry<br />

(whole/cube), Peach, Pear, Apricot, Blueberry, Blackberry, Blackcurrant, Lingonberry, Raspberry, Lychee, Asparagus, Garlic.<br />

BRINED PRODUCT:<br />

Boletus Edulis, Champignons, Nameko, Pleurotus, Shiitake, Cantharellus Cibarius, Suillus Granulatus, Armillaria Mellea, Strawmushroom,<br />

Terreum, Garlic.<br />

DRIED AND OTHER PRODUCT:<br />

Boletus Edulis, Champignons, Pleurotus, Shiitake, Morel, Cantharellus Cibarius, Black Fungus (black/black or black/white), Strawmushroom,<br />

Apple Dice, Apple Ring, Garlic, Safflower, Hibiscus Flower, Concentration of Apple/Pineapple/Passion Fruit.<br />

Head Office:<br />

Branch Office:<br />

Flat A, 16/F., Catic Plaza, 8 Causeway Road, Room 3202, Block C,<br />

Causeway Bay, Hong Kong<br />

Bao Hai Gao Ji Gong Yu, Guan Shang Bei Lu,<br />

E-mail: itohwen@netvigator.com<br />

Kunming, China<br />

Website: http://www.itohwen.com Tel: (86) 1370 8840558<br />

Tel: (852) 2770 7168 Fax: (852) 2782 5411 Fax: (86) 871 7154937<br />

MARKET REVIEWS <strong>2006</strong><br />

MARKET REVIEW<br />

PUBLISHED<br />

The Americas 31st March <strong>2006</strong><br />

NEW<br />

Poland 21st April <strong>2006</strong><br />

Asia/Vietnam 12th May <strong>2006</strong><br />

Processed Tomatoes 26th May <strong>2006</strong><br />

Juices & Frozen Fruit 16th June <strong>2006</strong><br />

World Juice Programme 7th July <strong>2006</strong><br />

NEW Colombia 28th July <strong>2006</strong><br />

Bilingual Review published<br />

NEW Russia in Russian and English 11th August <strong>2006</strong><br />

Turkey 25th August <strong>2006</strong><br />

Europe/SIAL 15th September <strong>2006</strong><br />

Juice Yearbook 13th October <strong>2006</strong><br />

Canned <strong>Food</strong>s 17th November <strong>2006</strong><br />

Soft Drinks 8th December <strong>2006</strong><br />

Review of <strong>2006</strong>/Editorial Listing 1st January 2007<br />

For more information, please contact Vicky or Helen on:<br />

Tel +44 (0) 20 7017 7494 or email fnadvertising@agra-net.com<br />

18

FOODNEWS THAILAND January, <strong>2006</strong><br />

FOODNEWS THAILAND <strong>2006</strong> Market Review<br />

is available to download online<br />

FREE OF CHARGE<br />

www.foodnews.co.uk/marketreviews<br />

For fast and easy finding, the Contents page is<br />

linked to the article. Also, some of our<br />

advertisers have requested a hyperlink to either<br />

their website or email to enable you to<br />

contact them directly - click on the<br />

advertisements to find out!<br />

Agents — Importers<br />

Canned/dehydrated<br />

frozen/freeze dried<br />

Fruits/vegetables<br />

mushrooms/seafood<br />

Edible nuts — rice<br />

dried fruits — spices<br />

Raw materials, ingredients,<br />

for food manufacturers<br />

P.O. Box 8050 Zurich, Switzerland<br />

Phone (01) 315 56 56, Fax (01) 315 56 00<br />

E-mail: info@stutzer.ch<br />

LOOKING FOR PRODUCTS?<br />

FOODNEWS Online Buyers Guide<br />

offers buyers a quick and easy way to<br />

search for companies by product, country or<br />

company name.<br />

The World Wide Web is now the fastest<br />

growing medium for promoting products<br />

and services to a global market. Take<br />

advantage of FOODNEWS excellent<br />

value Web Packages.<br />

For more information, please contact<br />

Vicky or Helen on email<br />

fnadvertising@agra-net.com<br />

or Tel: +44 (0) 20 7017 7494<br />

www.fnbuyersguide.com<br />

19

FOODNEWS THAILAND January, <strong>2006</strong><br />

Thai<br />

focus<br />

continued from page 11<br />

Another such company is Ice-Cremo. It<br />

has seen a gap in the ice cream market that it<br />

intends to fill using, like In-Season foods, the<br />

very thing that makes <strong>Thailand</strong> an attractive<br />

proposition for foreign investors in the first<br />

place – its abundance of quality raw materials.<br />

Realising that it could not compete in the<br />

global market by producing the well-known<br />

flavours we all love to eat, such as chocolate<br />

and vanilla, it hopes to create a name for<br />

itself by producing distinctive ‘Thai<br />

flavours’. Such weird and wonderful flavours<br />

as jackfruit and mangosteen may seem<br />

strange, but have already achieved success<br />

and once more illustrates the variety of products<br />

on offer in <strong>Thailand</strong>.<br />

Excellence can be found in every corner<br />

of this industry. The shelves of the <strong>Food</strong> and<br />

Drinks Company are filled with brands<br />

instantly recognisable in any number of<br />

European and American (not to mention<br />

Australian and Japanese) retailers. As Huai<br />

Hui Lee of <strong>Food</strong> and Drinks says, “People<br />

need to know exactly what we are capable of<br />

in <strong>Thailand</strong>. We can produce absolutely anything,<br />

to the specifics and standards of the<br />

customer”. She goes on to add, “We want to<br />

make every product delicious, and with a<br />

good quality, and it’s not only a mission for<br />

Kuang Pei San, with distinctive Smiling Fish logo<br />

me, but for any Thai company. We, here in<br />

<strong>Thailand</strong> are developing together so that the<br />

industry as a whole can proceed. In sales, yes<br />

we may compete. But when it comes to technology<br />

and know-how, everybody should<br />

help out so that we can continually increase<br />

the quality of the whole industry.”<br />

And success is not only the responsibility<br />

nor the luxury of the established older companies<br />

such as <strong>Food</strong> and Drinks. Even newcomers<br />

such as Viriyah have injected their<br />

own adrenalin into the industry. As producers<br />

of corn and awaiting its second birthday,<br />

Viriyah is more than a “new kid on the<br />

block”. Its managing director, Apichat<br />

Suttisiltum was adamant (as were his colleagues)<br />

that quality and safety were essential<br />

to success. However he differed over one<br />

issue.<br />

Whereas his colleagues in canning and<br />

vegetable production believed that the only<br />

hurdle in achieving higher quality was the<br />

quality of the raw material, Apichat was<br />

clear: “Of course a higher quality raw material<br />

will give a better quality of finished<br />

product, but we believe that skill in production,<br />

especially in our field is of similar<br />

importance. We have the processing knowhow<br />

and expertise, which allows us to take a<br />

product and ensure that it is processed to the<br />

very highest standards available. Of course,<br />

everyone needs to be using the best raw<br />

materials, but we can go one step further.”<br />

High technology<br />

High technology and know how are in abundance<br />

in <strong>Thailand</strong>, but the feeling across<br />

many of the processors is one of camaraderie.<br />

Doi Kham, for instance, is a company<br />

born out of the Royal Project, an initiative<br />

of the King himself, initially to help the<br />

farmers in the north. Today Doi Kham goes<br />

from strength to strength with a new line of<br />

tomato juices. Mrs Mayoree, the President,<br />

knows that a fair price and fair treatment of<br />

farmers will always be respected, not only<br />

within the industry but also by the consumer.<br />

Of greater importance though to the<br />

future of the Thai food exports is the<br />

favourable development concerning the huge<br />

income generator, shrimp. The last few years<br />

have been a gloomy period for Thai shrimp<br />

“<br />

People need to know exactly what we are capable of in<br />

<strong>Thailand</strong>. We can produce absolutely anything, to the specifics<br />

and standards of the customer, whatever it may be.<br />

”<br />

companies. Faced with export hurdles, not<br />

only in the EU but also the US, it has had to<br />

endure very difficult times in competing in<br />

these two high shrimp consumption markets.<br />

For years <strong>Thailand</strong> has urged the EU to reinstate<br />

tariff privileges for shrimp under its<br />

Generalised System of Preferences (GSP) to<br />

boost the competitive edge of Thai shrimp<br />

products. And success has been achieved.<br />

This year sees the return of the GSP meaning<br />

that the tariff on Thai frozen shrimp will be<br />

reduced to 4.2%, down from 12%, and 7%,<br />

down from 20%, for processed shrimp.<br />

Steven Chia-Apar still has good hopes for<br />

his industry: “There is clearly light at the end<br />

of this tunnel,” he says. That the future can<br />

be considered bright for Thai shrimp is further<br />

highlighted when set against the background<br />

of increasing exports of the previous<br />

two years. 2005 saw 430 000 tonnes of<br />

shrimp exported from <strong>Thailand</strong>. This was up<br />

from the 360 000 tonnes exported in 2004.<br />

Over the next three years it is hoped that the<br />

volume increases to 600 000 tonnes. With<br />

this favourable change in European attitudes,<br />

many Thai shrimp companies are focusing<br />

much of their attention on the European market.<br />

Anti-dumping measures<br />

Although the anti-dumping measures against<br />

Thai shrimp in the US remain, this in spite of<br />

US statements saying they would seriously<br />

look at removing them in the wake of 2004’s<br />

tsunami, the outlook is not as bleak as some<br />

may think. Last year saw exports of Thai<br />

shrimp to the US increased to 111 000<br />

tonnes, a surprising rise of 32.5%. During<br />

the same period China, which used to be the<br />

second major exporter to the US, has witnessed<br />

its exports decrease by 29 %. This<br />

combined with the fact that the Japanese<br />

market is opening up once more after the<br />

country’s decade long recession and Thai<br />

shrimp companies and by extension the<br />

whole food industry have every reason to be<br />

optimistic.<br />

One effect of the tariffs illustrates another<br />

trend seemingly being felt throughout the<br />

Thai food sector. When questioned about the<br />

consequences of the damaging EU and US<br />

tariffs Chia-Apar said that many smaller<br />

operators had gone out of business. This has<br />

had the effect of streamlining the industry.<br />

There now exist fewer players but these tend<br />

to be large in size and capable of exporting in<br />

greater volume. Therefore, increased competition<br />

on the global market is also replicated<br />

20

FOODNEWS THAILAND January, <strong>2006</strong><br />

Thai<br />

focus<br />

on a smaller scale within <strong>Thailand</strong>.<br />

<strong>Thailand</strong>’s fixation with Free Trade<br />

Agreements (FTA) has also contributed to<br />

the trend of smaller producers and exporters<br />

worrying about their future while the larger<br />

players have been able to take advantage and<br />

grow. For example, while big names such as<br />

the CP Group can benefit from zero tariff<br />

imports to China, this is not the case with all<br />

exporters. At the same time as the CP Group<br />

export revenue of fruits nearly doubled in<br />

2005 from THB100 million in 2004, due to<br />

FTA deals with China and Australia, smaller<br />

producers have not increased their share by<br />

nearly as much, due to the US$2 000 inspection<br />

cost per shipment that remains in place.<br />

Therefore, it is likely, although not certain,<br />

that the Thai <strong>Food</strong> sector will be dominated<br />

and driven by large companies such as<br />

the CP Group and Seafresh and not as used<br />

to be the case by the plethora of small to<br />

medium sized operations. If the smaller players<br />

are to gain footholds in foreign markets<br />

then they will need foreign partners more<br />

than ever.<br />

The presence of tariffs on food products is<br />

commonplace throughout the world, and<br />

with regard to <strong>Thailand</strong> are not limited to its<br />

shrimp industry. Its pineapples are also subject<br />

to anti-dumping measures in the US, and<br />

this has forced the pineapple processing<br />

industry to seek out other markets or find a<br />

US partner. This move, although hardly revolutionary,<br />

is a microcosm of the whole food<br />

processing industry in <strong>Thailand</strong>.<br />

Whilst always looking to extend its<br />

advantages in the large markets such as the<br />

US, EU and its Asian neighbours, many Thai<br />

companies are looking to the emerging food<br />

markets to export to. This is no different<br />

where canned pineapple companies are concerned.<br />

Russia is one of the fastest-growing<br />

markets for canned pineapple and Thai companies<br />

have been quick to latch onto this<br />

growth market. The first quarter of 2005 saw<br />

<strong>Thailand</strong> export 622 900, compared with just<br />

166 500 in 2003.<br />

The great advantage of Thai companies is<br />

their experience and acknowledged focus on<br />

safety, hence they are able to tap into new<br />

markets much more easily than their opponents.<br />

In being such huge exporters of many<br />

products, Thai companies are able to seek<br />

out these new growth markets quicker and<br />

better than their rivals. If the industry as a<br />

whole is to expand as the government<br />

intends, then one should expect to see further<br />

penetration into new growth markets such as<br />

Russia and China.<br />

Whilst we wait to see if the changes articulated<br />

above materialise across the board,<br />

one motor of change that is set to continue is<br />

the recent growth of ready-to-eat products<br />

and Thai sauce companies.<br />

The growth in popularity of Thai food<br />

around the globe will not necessarily lead to<br />

a growth in sales of, for example, Thai<br />

canned pineapple or Thai shrimp. The<br />

emerging emphasis within the industry on<br />

ready-to-eat Thai meals and Thai sauces is a<br />

tacit acknowledgement of this fact.<br />

Ready to eat Thai meals and Thai sauces<br />

are capable of riding the wave of popularity<br />

that exists concerning Thai cuisine. As<br />

Surapon Vongvadhanaroj of Surapon <strong>Food</strong>s<br />

knows all too well, “you cannot ignore the<br />

growing importance of ready to eat produce”.<br />

He is not alone in this view. Indeed, if one<br />

was to write a history on the vast majority of<br />

Thai sauce companies it would not amount to<br />

much. This is because so many of them have<br />

only recently been established. Jittaporn<br />

Jantarich of Exotic <strong>Food</strong>s, when studying in<br />

the US, really wanted a homemade Thai<br />

meal, but upon venturing to his local supermarket<br />

found he was not able to buy any<br />

authentic Thai sauces. Now several years<br />

later he is at the forefront of a burgeoning<br />

industry aiming to ensure that others in foreign<br />

supermarkets do not have the same<br />

struggle he experienced.<br />

Foreign palette adjustment<br />

Already the receptiveness of foreign palates<br />

to authentic Thai meals and sauces is being<br />

seen beyond the host of Thai restaurants.<br />

Exports to Europe are increasing year by<br />

year and this trend shows no sign of abating.<br />

Add to this the effect of ‘Thai Kitchen of the<br />

World’ and one can see why the Thai food<br />

processors association deemed it necessary<br />

to create a new grouping, that of ready to eat<br />

processors. This clearly illustrates that the<br />

future of Thai food is to be found in this new<br />

exciting sector.<br />

One other great change that needs to<br />

occur, and which ‘Thai Kitchen of the<br />

World’ is testament to, is that the industry as<br />

a whole needs to market itself much better.<br />

As Surapon Vongvadhanaroj said: “There<br />

was a time when Thai food companies would<br />

not market themselves at all; they would simply<br />

wait for buyers to find them.” This growing<br />

realisation, although government-led, has<br />

permeated down through the industry on two<br />

levels. Firstly, the keenness of Thai companies<br />