LOCAL GOVERNMENT BORROWING - ppiaf

LOCAL GOVERNMENT BORROWING - ppiaf

LOCAL GOVERNMENT BORROWING - ppiaf

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

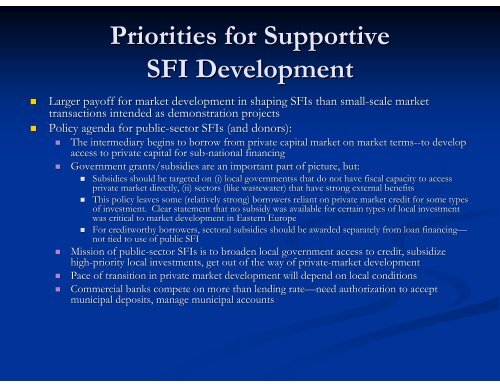

Priorities for Supportive<br />

SFI Development<br />

• Larger payoff for market development in shaping SFIs than small-scale scale market<br />

transactions intended as demonstration projects<br />

• Policy agenda for public-sector<br />

SFIs (and donors):<br />

• The intermediary begins to borrow from private capital market on market terms--<br />

--to develop<br />

access to private capital for sub-national financing<br />

• Government grants/subsidies are an important part of picture, but:<br />

• Subsidies should be targeted on (i) local governmentss that do not have fiscal capacity to access<br />

private market directly, (ii) sectors (like wastewater) that have e strong external benefits<br />

• This policy leaves some (relatively strong) borrowers reliant on private market credit for some types<br />

of investment. Clear statement that no subsidy was available for r certain types of local investment<br />

was critical to market development in Eastern Europe<br />

• For creditworthy borrowers, sectoral subsidies should be awarded separately from loan financing—<br />

not tied to use of public SFI<br />

• Mission of public-sector<br />

SFIs is to broaden local government access to credit, subsidize<br />

high-priority local investments, get out of the way of private-market development<br />

• Pace of transition in private market development will depend on local conditions<br />

• Commercial banks compete on more than lending rate—need authorization to accept<br />

municipal deposits, manage municipal accounts