Alumni Connecti N - St. Vincent-St. Mary High School

Alumni Connecti N - St. Vincent-St. Mary High School

Alumni Connecti N - St. Vincent-St. Mary High School

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Development News<br />

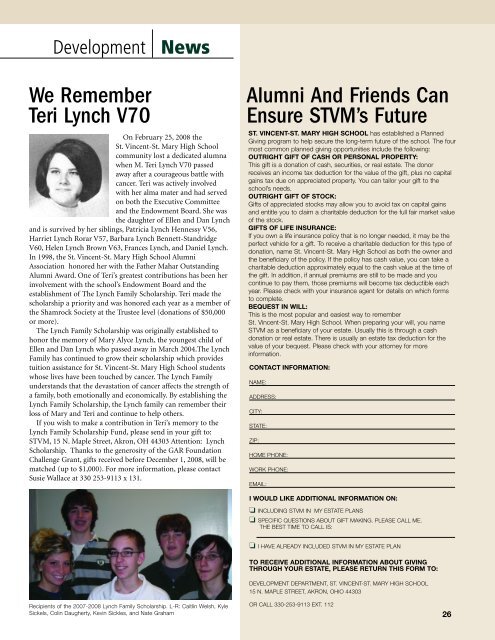

We Remember<br />

Teri Lynch V70<br />

On February 25, 2008 the<br />

<strong>St</strong>. <strong>Vincent</strong>-<strong>St</strong>. <strong>Mary</strong> <strong>High</strong> <strong>School</strong><br />

community lost a dedicated alumna<br />

when M. Teri Lynch V70 passed<br />

away after a courageous battle with<br />

cancer. Teri was actively involved<br />

with her alma mater and had served<br />

on both the Executive Committee<br />

and the Endowment Board. She was<br />

the daughter of Ellen and Dan Lynch<br />

and is survived by her siblings, Patricia Lynch Hennessy V56,<br />

Harriet Lynch Rorar V57, Barbara Lynch Bennett-<strong>St</strong>andridge<br />

V60, Helen Lynch Brown V63, Frances Lynch, and Daniel Lynch.<br />

In 1998, the <strong>St</strong>. <strong>Vincent</strong>-<strong>St</strong>. <strong>Mary</strong> <strong>High</strong> <strong>School</strong> <strong>Alumni</strong><br />

Association honored her with the Father Mahar Outstanding<br />

<strong>Alumni</strong> Award. One of Teri’s greatest contributions has been her<br />

involvement with the school’s Endowment Board and the<br />

establishment of The Lynch Family Scholarship. Teri made the<br />

scholarship a priority and was honored each year as a member of<br />

the Shamrock Society at the Trustee level (donations of $50,000<br />

or more).<br />

The Lynch Family Scholarship was originally established to<br />

honor the memory of <strong>Mary</strong> Alyce Lynch, the youngest child of<br />

Ellen and Dan Lynch who passed away in March 2004.The Lynch<br />

Family has continued to grow their scholarship which provides<br />

tuition assistance for <strong>St</strong>. <strong>Vincent</strong>-<strong>St</strong>. <strong>Mary</strong> <strong>High</strong> <strong>School</strong> students<br />

whose lives have been touched by cancer. The Lynch Family<br />

understands that the devastation of cancer affects the strength of<br />

a family, both emotionally and economically. By establishing the<br />

Lynch Family Scholarship, the Lynch family can remember their<br />

loss of <strong>Mary</strong> and Teri and continue to help others.<br />

If you wish to make a contribution in Teri’s memory to the<br />

Lynch Family Scholarship Fund, please send in your gift to:<br />

STVM, 15 N. Maple <strong>St</strong>reet, Akron, OH 44303 Attention: Lynch<br />

Scholarship. Thanks to the generosity of the GAR Foundation<br />

Challenge Grant, gifts received before December 1, 2008, will be<br />

matched (up to $1,000). For more information, please contact<br />

Susie Wallace at 330 253-9113 x 131.<br />

<strong>Alumni</strong> And Friends Can<br />

Ensure STVM’s Future<br />

ST. VINCENT-ST. MARY HIGH SCHOOL has established a Planned<br />

Giving program to help secure the long-term future of the school. The four<br />

most common planned giving opportunities include the following:<br />

OUTRIGHT GIFT OF CASH OR PERSONAL PROPERTY:<br />

This gift is a donation of cash, securities, or real estate. The donor<br />

receives an income tax deduction for the value of the gift, plus no capital<br />

gains tax due on appreciated property. You can tailor your gift to the<br />

school’s needs.<br />

OUTRIGHT GIFT OF STOCK:<br />

Gifts of appreciated stocks may allow you to avoid tax on capital gains<br />

and entitle you to claim a charitable deduction for the full fair market value<br />

of the stock.<br />

GIFTS OF LIFE INSURANCE:<br />

If you own a life insurance policy that is no longer needed, it may be the<br />

perfect vehicle for a gift. To receive a charitable deduction for this type of<br />

donation, name <strong>St</strong>. <strong>Vincent</strong>-<strong>St</strong>. <strong>Mary</strong> <strong>High</strong> <strong>School</strong> as both the owner and<br />

the beneficiary of the policy. If the policy has cash value, you can take a<br />

charitable deduction approximately equal to the cash value at the time of<br />

the gift. In addition, if annual premiums are still to be made and you<br />

continue to pay them, those premiums will become tax deductible each<br />

year. Please check with your insurance agent for details on which forms<br />

to complete.<br />

BEQUEST IN WILL:<br />

This is the most popular and easiest way to remember<br />

<strong>St</strong>. <strong>Vincent</strong>-<strong>St</strong>. <strong>Mary</strong> <strong>High</strong> <strong>School</strong>. When preparing your will, you name<br />

STVM as a beneficiary of your estate. Usually this is through a cash<br />

donation or real estate. There is usually an estate tax deduction for the<br />

value of your bequest. Please check with your attorney for more<br />

information.<br />

CONTACT INFORMATION:<br />

NAME:<br />

ADDRESS:<br />

CITY:<br />

STATE:<br />

ZIP:<br />

HOME PHONE:<br />

WORK PHONE:<br />

EMAIL:<br />

I WOULD LIKE ADDITIONAL INFORMATION ON:<br />

❏ INCLUDING STVM IN MY ESTATE PLANS<br />

❏ SPECIFIC QUESTIONS ABOUT GIFT MAKING. PLEASE CALL ME.<br />

THE BEST TIME TO CALL IS:<br />

❏ I HAVE ALREADY INCLUDED STVM IN MY ESTATE PLAN<br />

TO RECEIVE ADDITIONAL INFORMATION ABOUT GIVING<br />

THROUGH YOUR ESTATE, PLEASE RETURN THIS FORM TO:<br />

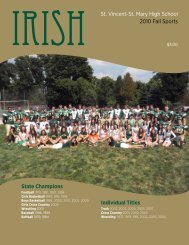

Recipients of the 2007-2008 Lynch Family Scholarship. L-R: Caitlin Welsh, Kyle<br />

Sickels, Colin Daugherty, Kevin Sickles, and Nate Graham<br />

DEVELOPMENT DEPARTMENT, ST. VINCENT-ST. MARY HIGH SCHOOL<br />

15 N. MAPLE STREET, AKRON, OHIO 44303<br />

OR CALL 330-253-9113 EXT. 112<br />

26