Audit Exemption for Small Companies - Accounting and - ACRA

Audit Exemption for Small Companies - Accounting and - ACRA

Audit Exemption for Small Companies - Accounting and - ACRA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

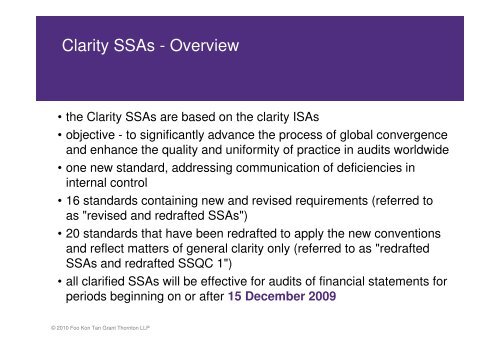

Clarity SSAs - Overview<br />

• the Clarity SSAs are based on the clarity ISAs<br />

• objective - to significantly advance the process of global convergence<br />

<strong>and</strong> enhance the quality <strong>and</strong> uni<strong>for</strong>mity of practice in audits worldwide<br />

• one new st<strong>and</strong>ard, addressing communication of deficiencies in<br />

internal control<br />

• 16 st<strong>and</strong>ards containing new <strong>and</strong> revised requirements (referred to<br />

as "revised <strong>and</strong> redrafted SSAs")<br />

• 20 st<strong>and</strong>ards that have been redrafted to apply the new conventions<br />

<strong>and</strong> reflect matters of general clarity only (referred to as "redrafted<br />

SSAs <strong>and</strong> redrafted SSQC 1")<br />

• all clarified SSAs will be effective <strong>for</strong> audits of financial statements <strong>for</strong><br />

periods beginning on or after 15 December 2009<br />

© 2010 Foo Kon Tan Grant Thornton LLP