You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

th<br />

9 <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2010</strong>-<strong>11</strong><br />

NATIONAL MULTI-COMMODITY EXCHANGE OF INDIA LIMITED

Trade with the Pioneer<br />

Sr. No. Index Page No.<br />

1 Our Vision & Mission 4<br />

2 Notice calling AGM 5<br />

3 Director’s Report 8<br />

4 Corporate Governance 16<br />

5 Discussion and Analysis 28<br />

6 Auditor’s Report 30<br />

7 Balance Sheet, PL Account and Schedules 36<br />

8 Event Photo 60<br />

1

NATIONAL MULTI-COMMODITY EXCHANGE<br />

CORPORATE INFORMATION<br />

Board of Directors<br />

Shri B. B. Pattanaik - Chairman<br />

Shri Shyamal Ghosh (IAS Retd.) - Independent Director<br />

Shri K, Rajendran Nair (IAS Retd,) - Independent Director<br />

Shri Krishna Mohan Sahni (IAS Retd.) - Independent Director<br />

Dr. Sidharth Sinha - Independent Director<br />

Shri G. N. Nair - Director<br />

Shri Kevin D’sa - Director<br />

Shri Rajinder Mahajan - Director<br />

Shri Prem Nath Tiwari - Nominee Director FMC<br />

Shri Anil Kumar Mishra - Managing Director & CEO<br />

Chief Financial Officer & COO<br />

Shri Shyam Sundar Vyas<br />

Company Secretary<br />

Shri Anil Maloo<br />

Statutory Auditors<br />

Haribhakti & Co.<br />

Chartered Accountants,<br />

Ahmedabad<br />

Bankers<br />

HDFC Bank Limited<br />

Punjab National Bank<br />

Indusind Bank<br />

Registered Office<br />

th<br />

Office No.- 4, 4 Floor, H K House,<br />

Ashram Road, Ahmedabad - 380 009.<br />

Phone: 079-4008 6000 / 39<br />

Fax: 079-4008 6041<br />

Website: www.nmce.<strong>com</strong><br />

NMCE Senior Management Team<br />

Vice President - Market Watch & Surveillance<br />

Dinesh Shukla<br />

Vice President - Business Development<br />

Narayan Rai<br />

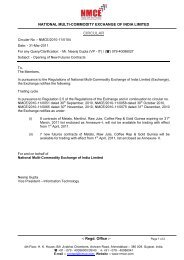

Vice President - Information Technology<br />

Neeraj Gupta<br />

AVP - Clearing & Settlement<br />

Rajendrasinh Chudasama<br />

AVP - Finance & Accounts<br />

Sarita Baxi<br />

Vice President - Business Development (North)<br />

Mahendrakumar Khattar<br />

General Manager - Logistics (South)<br />

Wilfred Noronha<br />

2

Trade with the Pioneer<br />

Board of Directors<br />

Shri B. B.Pattanaik<br />

(Chairman)<br />

Shri Shyamal Ghosh<br />

(Independent Director)<br />

Shri K R Nair<br />

(Independent Director)<br />

Shri K. M. Sahni<br />

(Independent Director)<br />

Dr. Sidharth Sinha<br />

(Independent Director)<br />

Shri G N. Nair<br />

(Director)<br />

Shri Kevin D’sa<br />

(Director)<br />

Shri Rajinder Mahajan<br />

(Director)<br />

Shri Prem Nath Tiwari<br />

(Nominee Director FMC)<br />

Shri Anilkumar Mishra<br />

(Managing Director & CEO)<br />

3

NATIONAL MULTI-COMMODITY EXCHANGE<br />

Our Vision<br />

National Multi-Commodity Exchange of India Limited is <strong>com</strong>mitted to provide world class services of<br />

on-line screen based Futures Trading of permitted <strong>com</strong>modities and efficient Clearing and guaranteed<br />

settlement, while <strong>com</strong>plying with Statutory/Regulatory requirements. We shall strive to ensure<br />

continual improvement of customer services and remain best service provider leader amongst all<br />

<strong>com</strong>modity exchanges.<br />

Our Mission<br />

<br />

Improving efficiency in <strong>com</strong>modity supply chain through on-line trading.<br />

<br />

Minimization of settlement risks.<br />

<br />

Improving efficiency of operations by providing best infrastructure and latest technology.<br />

<br />

Rationalizing the transaction fees to optimum level.<br />

<br />

Implementing best quality standards of warehousing, grading and testing in tune with trade<br />

practices.<br />

<br />

Improving facilities for structured finance.<br />

<br />

Improving quality of services rendered to suppliers and users of <strong>com</strong>modities<br />

<br />

Promoting awareness about the benefit of on-line trading futures trading services of NMCE to all<br />

the stake holders pan India.<br />

4

Trade with the Pioneer<br />

NATIONAL MULTI-COMMODITY EXCHANGE OF INDIA LIMITED<br />

NOTICE<br />

Notice is hereby given that the Ninth Annual General Meeting of the Members of the Company will be<br />

th<br />

held on Friday, September 30, 20<strong>11</strong> at <strong>11</strong> a.m. at the registered office of the Company at Office No. 4, 4<br />

Floor, H. K. House, Ashram Road, Ahmedabad – 380 009 to transact the following business:<br />

Ordinary Business:<br />

st<br />

1. To receive, consider and adopt the Audited Balance Sheet as at 31 March, 20<strong>11</strong> and the<br />

Profit and Loss Account for the year ended on that date together with the reports of Directors<br />

and Auditors thereon.<br />

2. To re-appoint Shri B B Pattanaik, who retires by rotation and being eligible offers himself for<br />

re-appointment.<br />

3. To re-appoint Dr. Sidharth Sinha, who retires by rotation and being eligible offers himself for<br />

re-appointment.<br />

4. To re-appoint Shri Shyamal Ghosh, IAS (Retired), who retires by rotation and being eligible<br />

offers himself for re-appointment.<br />

5. To appoint Statutory Auditors of the Company and to fix their remuneration and in this regard<br />

to consider and, if thought fit, to pass with or without modification(s), the following resolution<br />

as an Ordinary Resolution:<br />

“RESOLVED THAT M/s. Haribhakti & Co., Chartered Accountants, Ahmedabad<br />

(Registration No.: 103523W), be and are hereby appointed as Statutory Auditors of the<br />

Company, to hold office from the conclusion of this Annual General Meeting until the<br />

conclusion of the next Annual General Meeting of the Company on such remuneration as<br />

shall be fixed by the Board of Directors of the Company.”<br />

Special Business:<br />

6. To consider and if thought fit, to pass with or without modification the following resolution as an<br />

Ordinary Resolution:<br />

“RESOLVED THAT Shri Kevin D'sa, who was appointed as an additional Director of the<br />

Company with effect from November 30, <strong>2010</strong> pursuant to Section 260 of the Companies Act,<br />

1956 and holds office up to the ensuing Annual General Meeting of the Company and in<br />

respect of whom the Company is in receipt of a notice under Section 257 of the Companies<br />

Act, 1956 proposing his candidature for the directorship of the Company, be and is hereby<br />

appointed as a director of the Company, whose period of office shall be liable to determination<br />

of retirement of directors by rotation.”<br />

7. To consider and if thought fit, to pass with or without modification the following resolution as an<br />

Ordinary Resolution<br />

“RESOLVED THAT Shri Krishna Mohan Sahni, IAS (Retired), who was appointed as an<br />

additional Director of the Company with effect from May 23, 20<strong>11</strong> pursuant to Section 260 of<br />

the Companies Act, 1956 and holds office up to the ensuing Annual General Meeting of the<br />

Company and in respect of whom the Company is in receipt of a notice under Section 257 of<br />

the Companies Act, 1956 proposing his candidature for the directorship of the Company, be<br />

5

NATIONAL MULTI-COMMODITY EXCHANGE<br />

and is hereby appointed as a director of the Company, whose period of office shall be liable to<br />

determination of retirement of directors by rotation.”<br />

8. To consider and if thought fit, to pass with or without modification the following resolution as an<br />

Ordinary Resolution<br />

“RESOLVED THAT Shri Premnath Tiwari, Director, Forward Markets Commission, who was<br />

appointed as an additional Director of the Company with effect from August 20, 20<strong>11</strong> pursuant<br />

to Section 260 of the Companies Act, 1956 and holds office up to the ensuing Annual General<br />

Meeting of the Company and in respect of whom the Company is in receipt of a notice under<br />

Section 257 of the Companies Act, 1956 proposing his candidature for the directorship of the<br />

Company, be and is hereby appointed as a director of the Company, whose period of office<br />

shall be liable to determination of retirement of directors by rotation.”<br />

Place: New Delhi<br />

By order of the Board of Directors<br />

Date: September 7, 20<strong>11</strong> Anil Maloo<br />

AVP (Legal) & Company Secretary<br />

Notes:<br />

1. A MEMBER ENTITLED TO ATTEND AND VOTE AT THE MEETING IS ENTITLED TO<br />

APPOINT A PROXY TO ATTEND AND VOTE INSTEAD OF HIMSELF AND A PROXY NEED<br />

NOT BE A MEMBER OF THE COMPANY.<br />

2. Proxies, in order to be effective, must be received by the Company not later than 48 hours<br />

before the <strong>com</strong>mencement of the meeting.<br />

3. The related Explanatory Statement pursuant to Section 173(2) of the Companies Act, 1956<br />

setting out all material facts concerning items 6 to 8 is annexed.<br />

Item No.6<br />

Explanatory Statement pursuant to Section 173(2) of the Companies Act, 1956<br />

Shri Kevin D'sa was appointed as an additional director of the Company with effect from November 30,<br />

<strong>2010</strong> pursuant to Section 260 of the Companies Act, 1956 and read with Article 120 of the Articles of<br />

Association of the Company.<br />

In terms of Section 260 of the Act, Shri Kevin D'sa would hold office up to the date of ensuring Annual<br />

General Meeting of the Company.<br />

Mr. Kevin D'Sa is presently President (Finance) & Chief Finance Officer of Bajaj Auto Ltd. He is also the<br />

Chief Finance Officer and President (Business Development) of Bajaj Finserv Limited and Chief<br />

Finance Officer of Bajaj Holdings & Investment Limited. He is also serving on the boards of some of the<br />

Bajaj Group <strong>com</strong>panies. A brief profile of Shri Kevin D'sa is given in the Corporate Governance Report.<br />

The Company is in receipt of a notice under Section 257 of the Companies Act, 1956 proposing his<br />

candidature for the directorship of the Company, along with a security deposit of ` 500/-.<br />

The Board re<strong>com</strong>mends passing of the resolution set out at item no. 6 of the ac<strong>com</strong>panying notice.<br />

6

Trade with the Pioneer<br />

None of the directors, except Shri Kevin D'sa, the appointee himself, may be deemed to be concerned<br />

or interested in the proposed resolution.<br />

Item No.7<br />

Shri Krishna Mohan Sahni, IAS (Retired), was appointed as an additional director of the Company with<br />

effect from May 23, 20<strong>11</strong> pursuant to Section 260 of the Companies Act, 1956 and read with Article 120<br />

of the Articles of Association of the Company.<br />

In terms of Section 260 of the Act, Shri Krishna Mohan Sahni, IAS (Retired), would hold office up to the<br />

date of ensuring Annual General Meeting of the Company.<br />

Shri Krishna Mohan Sahni is a Retired I.A.S. A brief profile of Shri Krishna Mohan Sahni, IAS (Retired),<br />

is given in the Corporate Governance Report.<br />

The Company is in receipt of a notice under Section 257 of the Companies Act, 1956 proposing his<br />

candidature for the directorship of the Company, along with a security deposit of ` 500/-.<br />

The Board re<strong>com</strong>mends passing of the resolution set out at item no. 7 of the ac<strong>com</strong>panying notice.<br />

None of the directors, except Shri Krishna Mohan Sahni, the appointee himself, may be deemed to be<br />

concerned or interested in the proposed resolution.<br />

Item No.8<br />

Shri Premnath Tiwari, Director, Forward Markets Commission was appointed as an additional director<br />

of the Company with effect from August 20, 20<strong>11</strong> pursuant to Section 260 of the Companies Act, 1956<br />

and read with Article 120 of the Articles of Association of the Company.<br />

In terms of Section 260 of the Act, Shri Premnath Tiwari, would hold office up to the date of ensuring<br />

Annual General Meeting of the Company.<br />

Shri Premnath Tiwari is presently a Director of the Forward Markets Commission. A brief profile of Shri<br />

Premnath Tiwari is given in the Corporate Governance Report.<br />

The Company is in receipt of a notice under Section 257 of the Companies Act, 1956 proposing his<br />

candidature for the directorship of the Company, along with a security deposit of ` 500/-.<br />

The Board re<strong>com</strong>mends passing of the resolution set out at item no. 8 of the ac<strong>com</strong>panying notice.<br />

None of the directors, except Shri Premnath Tiwari, the appointee himself, may be deemed to be<br />

concerned or interested in the proposed resolution.<br />

Place: New Delhi<br />

By order of the Board of Directors<br />

Date: September 7, 20<strong>11</strong> Anil Maloo<br />

AVP (Legal) & Company Secretary<br />

7

NATIONAL MULTI-COMMODITY EXCHANGE<br />

To,<br />

The Members,<br />

DIRECTORS' <strong>REPORT</strong><br />

Your Directors are pleased to present the Ninth Annual Report of the Company together with the<br />

Audited Accounts for the Financial Year <strong>2010</strong>-<strong>11</strong>:<br />

Financial Results: (` In Lacs)<br />

Particulars <strong>2010</strong>-<strong>11</strong> 2009-<strong>2010</strong><br />

In<strong>com</strong>e<br />

From Operations 1687.<strong>11</strong> 1625.08<br />

Other In<strong>com</strong>e 314.05 157.58<br />

Total In<strong>com</strong>e<br />

Expenditure<br />

Operating and Other Expenses 910.22<br />

423.65<br />

Depreciation 541.78<br />

202.98<br />

Profit before tax 549.16<br />

<strong>11</strong>56.03<br />

Deferred Tax Liability / (Asset)<br />

Profit after tax<br />

Appropriations :<br />

Dividend<br />

Dividend Distribution Tax<br />

Transfer to Trade Guarantee Fund<br />

Balance available<br />

Balance brought forward from Previous year<br />

Balance carried to Balance Sheet<br />

2001.16 1782.66<br />

Prior Period Adjustments 107.48 0<br />

Provision for Taxation (Including Wealth Tax) 129.40 196.47<br />

291.86 128.28<br />

20.42 831.28<br />

0 208.33<br />

0 35.41<br />

<strong>11</strong>.42 9.72<br />

General Reserve 0 21.00<br />

9.00 556.82<br />

877.44 320.62<br />

886.44 877.44<br />

Operations:<br />

This year the trade volume has seen a drop of 4.17% over last year. It was ` 4,36,822 Crores as<br />

<strong>com</strong>pared to ` 4,55, 803 Crores (two-way) during the year 2009-10.<br />

There was significant improvement in participation and turn over in Rubber. The turnover increased<br />

from <strong>11</strong>,61,532 MT to 23,56,568 MT almost 103% growth, but since rubber price also had seen<br />

significant rise in value terms it grew from ` 14,246 Crores to ` 47,693 Crores which was the growth of<br />

about 235%. There has been increased participation from all the stakeholders, producers, traders,<br />

investors and industry. We conducted various awareness programmes and interaction meets to<br />

remove the myths about the futures market. The deliveries were also quite high.<br />

8

Trade with the Pioneer<br />

NMCE Rubber Futures (MT) 02-<strong>11</strong><br />

2500000<br />

2356568<br />

2000000<br />

1500000<br />

1532214<br />

<strong>11</strong>15810<br />

1083578<br />

<strong>11</strong>61532<br />

1000000<br />

796992<br />

500000<br />

361774<br />

221946<br />

188926<br />

0<br />

678<br />

FY 2002-03 FY 2003-04 FY 2004-05 FY 2005-06 FY 2006-07 FY 2007-08 FY 2008-09 FY 2009-10 FY <strong>2010</strong>-<strong>11</strong> FY 20<strong>11</strong>-12<br />

Your Company has a prudent delivery mechanism making it more suitable for the participants in<br />

physical <strong>com</strong>modity markets.<br />

During the year under review, the in<strong>com</strong>e from operation of the Company has increased from<br />

` 1625.08 Lacs in the previous year to `1687.<strong>11</strong> Lacs in the year under review. The other In<strong>com</strong>e during<br />

the year under review also increased and was ` 314.05 Lacs as <strong>com</strong>pared to ` 157.58 Lacs during the<br />

previous year. After providing for operating and other expenses amounting to ` 910.22 lacs and<br />

depreciation of ` 541.78 Lacs, your Company has earned a profit before taxation of ` 549.16 Lacs as<br />

<strong>com</strong>pared to ` <strong>11</strong>56.03 Lacs in the previous year. The Company after making provision of ` 129.40<br />

Lacs for taxation (including wealth tax) and ` 291.86 Lacs for deferred tax liability, has earned a net<br />

profit of ` 20.42 Lacs as <strong>com</strong>pared to ` 831.28 Lacs in the previous year. Thus, ` 886.44 Lacs has been<br />

carried forward to the Balance Sheet.<br />

Guidelines Issued by Department of Consumer Affairs, Government of India on Capital<br />

Structure of Existing Nationwide Exchanges after five years of operations:<br />

The Department of Consumer Affairs, Ministry of Consumer Affairs, Food and Public Distribution,<br />

Government of India, New Delhi had vide its letter No.12/1/2007-IT dated July 29, 2009 <strong>com</strong>e out with<br />

Equity Structure of Nationwide multi Commodity Exchanges after five years of operations. The<br />

Guidelines, inter alia, specify the minimum paid up equity share capital, inter se holding of<br />

shareholders, net worth requirements, eligibility criteria for prospective investors of <strong>com</strong>modity<br />

exchanges, etc.<br />

As per Guidelines, all National Commodity Exchanges should have paid up equity capital of at-least<br />

` 50 Crores and Net-worth of at-least ` 100 Crores. The Exchange is required to adhere to these<br />

guidelines on or before September 30, 20<strong>11</strong>. The Exchange has sought an extension of time from<br />

Forward Markets Commission up to March 31 2012, to <strong>com</strong>ply with the Guidelines.<br />

9

NATIONAL MULTI-COMMODITY EXCHANGE<br />

Dividend for the year <strong>2010</strong>-<strong>11</strong>:<br />

.<br />

In view of the Guidelines of Government of India / Forward Markets Commission, the Exchange has to<br />

raise the net-worth to ` 100 Crores. Hence, your directors do not re<strong>com</strong>mend any dividend for the year<br />

<strong>2010</strong>-<strong>11</strong> on the equity shares of the Company.<br />

Preferential Allotment of Equity Shares of the Company<br />

In order to increase the paid-up share capital and net worth, the Company had issued and allotted<br />

24,50,000 Equity Shares of ` 10/- each at a price of ` 102/- per share (including premium) to Bajaj<br />

Holdings and Investment Limited aggregating to ` 24,99,00,000/- on preferential allotment basis.<br />

Transfer of Equity Shares of the Company<br />

To <strong>com</strong>ply with the above mentioned Guidelines, during the year, Central Warehousing Corporation<br />

and Neptune Overseas Limited had acquired 17,78,347 and 17,09,949 Equity Shares of the Company<br />

of ` 10/- each respectively from Shri Anil Singhania. This has reduced the shareholding of Shri Anil<br />

Singhania to less than 1% of the paid up capital of the Company.<br />

Reliance Capital Limited had acquired 16, 66,667 Equity Shares of the Company of ` 10/- each from<br />

Reliance Money Infrastructure Limited. The updated Shareholding Pattern of the Company as at<br />

March 31, 20<strong>11</strong> is given in the Corporate Governance Report.<br />

Global Commodity Markets – Price Volatility and Financialisation<br />

A significant increase in the level and volatility of many <strong>com</strong>modity prices over the past decade has led<br />

to a debate about what has driven these developments. A particular focus has been on the extent to<br />

which they have been driven by increased financial investment in <strong>com</strong>modity derivatives markets. The<br />

available evidence suggests that while financial investors can affect the short-run price dynamics for<br />

some <strong>com</strong>modities, the level and volatility of <strong>com</strong>modity prices appear to be primarily determined by<br />

fundamental factors.<br />

The substantial increase in <strong>com</strong>modity prices over the past decade has been supported by a number of<br />

fundamental drivers. One of the most significant has been the shift in the <strong>com</strong>position of global growth<br />

over this period, as emerging market economies – like China , Brazil, Russia and India – have <strong>com</strong>e to<br />

prominence as the engines of world growth. Since these emerging market economies are generally at<br />

a relatively <strong>com</strong>modity-intensive stage of development, there has been a corresponding shift in global<br />

demand towards <strong>com</strong>modities as these countries industrialise and expand their infrastructure . Food<br />

prices have also been affected by economic development, with the <strong>com</strong>position and volume of food<br />

intake changing as per capita in<strong>com</strong>e in these economies rises, generally resulting in a shift away from<br />

grains towards higher protein foods such as pulses, livestock and dairy, which have high resource<br />

footprints.These trends are likely to continue for some years.<br />

There is Slowing growth in developed nations and high inflationary expectations in emerging markets<br />

due to increased demand for <strong>com</strong>modities . This has also benefited producers of <strong>com</strong>modities.<br />

Investors have found a 'store of value' in <strong>com</strong>modities. The intrinsic value of <strong>com</strong>modities in<br />

<strong>com</strong>parison with other asset classes is very high. There is a secular bull run in the <strong>com</strong>plex since the<br />

10

Trade with the Pioneer<br />

past decade. However, the year 2008 was an exception. Despite the drop in crude oil prices, the<br />

biggest worries for Asia continue to be rising food prices, weather concerns, depleting carry forward<br />

stocks and growing demand, making a perfect case of a bull run in agro <strong>com</strong>modities.<br />

Growth potential of Indian Commodity Bourses :<br />

Though it is still at a nascent stage, the volumes in the Indian <strong>com</strong>modities futures market have been<br />

growing incessantly. From ` 27,480 Crores, in 2003 the volumes have reached ` <strong>11</strong>,85,260 Crores<br />

in FY10-<strong>11</strong>. This kind of a spurt in volumes is despite the absence of options, index trading and<br />

institutional participation. Currently, there are five National Multi Commodity Exchanges and several<br />

regional exchanges in India. The growth in trading volumes has been primarily propelled by non Agri<br />

<strong>com</strong>modities which draw their liquidity from the international exchanges and are bench marked against<br />

them. They also have higher daily price limit.<br />

The future growth would <strong>com</strong>e from Agri Commodities. There is however fear that price rise in Agri<br />

<strong>com</strong>modities might be blamed to futures market and Agri <strong>com</strong>modity Futures trading may be banned<br />

as a measure to control inflation. The broker members therefore are not encouraged to significantly<br />

push the Agri <strong>com</strong>modity. With introduction of WDRA and later GST , there could be more opportunity<br />

for opening more delivery centres for agri <strong>com</strong>modities and thus increased participation.<br />

In international exchanges there is increasing awareness about <strong>com</strong>modities among people and more<br />

and more people can be seen parking their money in agricultural <strong>com</strong>modities like soybean, coffee,<br />

cocoa and corn, thus adding to the volumes on the exchange.<br />

Opportunity: There is huge opportunity in future growth of <strong>com</strong>modity exchange business. There is a<br />

long awaited amendment in the Forward Commission Regulation Act 1952 (FCRA), which will<br />

strengthen the regulator, Forward Markets Commission and enable it to introduce new products like<br />

Options, index trading and open up the market for new participants, which will help achieve the next<br />

phase of growth. Globally, <strong>com</strong>modity derivatives volumes are 35x-40x of the physical market but in<br />

India it is just 4x. As the number of participants is increasing by the day and the overall interest in<br />

<strong>com</strong>modity futures market among traders and investors is increasing rapidly, the growth potential of<br />

this market is immense.<br />

Foreign institutional investors, domestic institutions, banks and insurance <strong>com</strong>panies are not allowed<br />

to trade on the Indian <strong>com</strong>modity bourses and a majority of volumes <strong>com</strong>e from jobbers, arbitrageurs,<br />

retail traders and small scale enterprises and corporates (for hedging). Even portfolio management<br />

services are not permitted. Once all the above stakeholders are allowed to participate the business<br />

growth would be significant.<br />

Interaction with Automotive Tyre Manufacturer Association :<br />

The tyre manufacturers consume about 60% of rubber. More and more tyre <strong>com</strong>panies are setting up<br />

their manufacturing base in India. Their participation is very important. After various interactions with<br />

them we have seen good participation <strong>com</strong>ing from them. We continue to engage with them and<br />

explain various opportunities available to them to reduce the cost of Rubber procurement.<br />

Interaction with All India Rubber Manufacturer Association :<br />

The non tyre manufacturers consume about 40% of rubber. Their association represents small and<br />

medium enterprises. They have been badly affected by rising price of rubber and need to hedge their<br />

price risk. We conducted training programme for their members along with FMC and also<br />

independently in Mumbai, Delhi and Jallandhar. Some of our member brokers have registered their<br />

members as client.<br />

Early delivery system in Rubber:<br />

The increased participation by industry required either to increase the open interest limit or increase<br />

the delivery period. With FMC we were able to get approval for early delivery system in Rubber. This<br />

st<br />

has gained popularity. Now the delivery can be taken from 1 of every month. This has reduced the<br />

burden of squeeze in short window of delivery and producers are also getting paid early and industry as<br />

<strong>11</strong>

NATIONAL MULTI-COMMODITY EXCHANGE<br />

well as the exporters are able to get early delivery to meet their requirements. The exchange does the<br />

matching on first cum first serve basis and the delivery offers are shown on the trading screen.<br />

Training programme for the Commercial Tax Officials:<br />

We conducted training programme for the <strong>com</strong>mercial tax officials. Many of them were not aware about<br />

actual functioning of <strong>com</strong>modity futures and used to tax the participants. This was organised with the<br />

help of FMC and was very well appreciated.<br />

Interaction with Parliamentary standing Committee:<br />

We interacted with parliamentary standing <strong>com</strong>mittee members who visited Ahmedabad to<br />

understand about the working of <strong>com</strong>modity futures market. They had lots of apprehensions and myths<br />

which we tried to remove along with senior members of FMC including the chairman. This was required<br />

for the passage of FCRA Amendment Bill.<br />

Price Dissemination Project:<br />

Your Exchange has been at the fore front of price dissemination project being run by the FMC and all<br />

the national exchanges. The price ticker board provides the price information for both spot and futures<br />

to the farmers in local language for the <strong>com</strong>modities produced in their areas. Your exchange is handling<br />

the states of Gujarat, Karnataka, Tamilnadu and Kerala. The state governments have to play key role in<br />

this and we coordinate with APMCs to install and run this project.<br />

Awareness Programmes: We conducted 71 awareness programmes, 4 exclusively for farmers, 42<br />

for the members and traders, 13 for students and 12 for others like media, investors, government<br />

officials etc.<br />

Deposits:<br />

The Company has not accepted deposits from public under the provisions of Section 58A of the<br />

Companies Act, 1956 and rules made there under.<br />

Directors' Responsibility Statement<br />

As required u/s. 217A (2AA) of the Companies Act, 1956, your directors confirm that:-<br />

In the preparation of Annual Accounts, the applicable Accounting Standards have been<br />

followed and that no material departures have been made from the same.<br />

They have selected such accounting policies and applied them consistently and made<br />

judgments and estimates that are reasonable and prudent so as to give a true and fair view<br />

of the state of affairs of the Company at the end of the Financial Year and of the Profit of the<br />

Company for that period.<br />

They have taken proper and sufficient care for the maintenance of adequate accounting<br />

records in accordance with the provisions of the Companies Act, 1956, for safeguarding the<br />

assets of the Company and for preventing and detecting fraud and other irregularities.<br />

They have prepared the Annual Accounts on a Going Concern basis.<br />

Inquiry conducted by Forward Markets Commission in the affairs of the Exchange:<br />

Forward Markets Commission had initiated an inquiry into the affairs of the Exchange vide its letter<br />

reference no.FMC/COMP/VI /<strong>2010</strong>/12/14/00095 dated December 22, <strong>2010</strong>.<br />

The Forward Markets Commission vide its letter reference no.FMC/COMP/VI /<strong>2010</strong>/12/14(Part) dated<br />

July 25, 20<strong>11</strong> had forwarded to the Exchange a copy of its Final Order dated July 23, 20<strong>11</strong> for various<br />

irregularities <strong>com</strong>mitted by Shri Kailash R. Gupta, ex-Managing Director and Executive Vice Chairman<br />

of the Exchange. The Final Order is available on the website of the Commission www.fmc.gov.in .<br />

12

Trade with the Pioneer<br />

th<br />

The Exchange has been directed to take various steps in this regards. The Board of Directors at its 54<br />

meeting held on August 20, 20<strong>11</strong> authorized the Managing Director and other officials of the Company<br />

to implement the Final Order of the Commission. The Company is in the process of taking effective<br />

steps to implement the Order of the Commission.<br />

The Financial impact of the directions given by the Commission has been properly disclosed in the<br />

Notes to the Accounts forming part of the Financial Statements for the year ended March 31, 20<strong>11</strong>.<br />

Remarks of Statutory Auditors and Management Clarification<br />

The Statutory Auditors have made their observations and qualified their report to that extent. The<br />

Management's explanation to the reservation, qualification or adverse remark contained in Auditors'<br />

Report are dealt with in the Notes to the Accounts. The Auditor's Report read with the Notes to the<br />

Accounts give adequate disclosures with regards to the impact of various directions of the Commission<br />

on the Financial Statements of the Company. Thus, the Management <strong>com</strong>ments given in the Notes to<br />

the Accounts may be considered as <strong>com</strong>pliance of the provisions of Section 217 (3) of the Companies<br />

Act, 1956.<br />

The qualifications in the Auditors' Report referred in Para 3 are self explanatory, However, the Board<br />

has decided to take following steps:-<br />

(a) Regarding physical verification of fixed assets of the Company and internal control for<br />

purchase of the same, the Board has devised Fixed Assets verification plan, which will cover<br />

physical verification of all the assets of the Company in phased manner over a staggered<br />

period of 2 years and has also framed the policy regarding purchases of fixed assets.<br />

(b) Regarding amounts debited to parties covered u/s 297 and u/s 299 of the Companies<br />

Act, 1956 all the parties are related to only one director who has ceased to be so with effect<br />

from August 20, 20<strong>11</strong>, and to avoid any failure in future the Board has decided to take fresh<br />

declarations from all the directors.<br />

The qualifications in para no. 4 and 5 of the Auditors' Report are self explanatory. The Board has<br />

decided to follow the order of Forward Markets Commission referred to in note no. 4 of the Schedule “L”<br />

to the notes forming part of the accounts after ascertaining the amounts and its implications on the<br />

carrying value of the assets. Regarding applicability of AS 28 – “Impairment of Assets”, in view of the<br />

above stated order of the Commission, the Board has decided to ascertain the impairment loss to the<br />

intangible assets after obtaining opinion of experts for determining the carrying amount of those<br />

intangible assets.<br />

Statutory Auditors:<br />

M/s. Shah & Dalal, Chartered Accountants, had resigned during the year as Statutory Auditors of the<br />

Company.<br />

M/s. Haribhakti & Co., Chartered Accountants were appointed as Statutory Auditors of the Company<br />

for the year <strong>2010</strong>-<strong>11</strong> after taking necessary approval of the members at the Extra-Ordinary General<br />

Meeting held on July 2, 20<strong>11</strong>.<br />

M/s. Haribhakti & Co., Chartered Accountants shall hold office until the conclusion of the ensuing<br />

Annual General Meeting and being eligible, offer themselves for re-appointment. The Company has<br />

received a certificate from the Statutory Auditors to the effect that their reappointment, if made, would<br />

13

NATIONAL MULTI-COMMODITY EXCHANGE<br />

be in accordance with the ceiling laid down under Section 224 (1B) of the Companies Act, 1956.<br />

Change in Registered Office of the Company<br />

With effect from March 12, 20<strong>11</strong>, the Registered Office of the Company has been shifted to its own<br />

th<br />

premises at Office No.4, 4 Floor, H. K. House, Ashram Road, Ahmedabad.<br />

Intrusion in the Premises of the Company<br />

On February 21/22, 20<strong>11</strong>, there was unfortunate incidence of Intrusion in the Information Technology<br />

Department of the Company, aimed to sabotage the systems of the Exchange, but due to robust<br />

protection system nothing happened. Necessary actions are being taken against the suspects/<br />

culprits. Penetration Test and System Audit were conducted by the Company with the help of outside<br />

expert agency who verified that due to robust system installed in the IT department, there was no loss<br />

to the system and the data stored therein were intact and it was fully secured from any future intrusion<br />

as well.<br />

Creation of NMCE Employees' Group Gratuity Trust<br />

The Company has approached the Life Insurance Corporation of India for providing Gratuity benefits to<br />

the employees of the Company in the name of NMCE Employees' Group Gratuity Scheme to take<br />

effect from April 1, 20<strong>11</strong>.<br />

Directors:<br />

During the year, Shri Shyamal Ghosh, IAS (Retired) and Shri K. Rajendran Nair, IAS (Retired) were<br />

appointed as Independent Directors with effect from May 26, <strong>2010</strong> after obtaining prior approval of<br />

Forward Markets Commission, Government of India.<br />

Shri Joy Cheenath, IAS (Retired) was appointed as a Director in place of Shri Anil Singhania at the<br />

Eighth Annual General Meeting of the Company held on September 30, <strong>2010</strong>.<br />

Shri Kevin D'sa, Chief Financial Officer of the Bajaj Holdings and Investments Limited was appointed<br />

as an additional director by the Board, with effect from November 30, <strong>2010</strong>.<br />

Shri Krishna Mohan Sahni, IAS (Retired) was appointed as an Independent Director by the Board on<br />

May 23, 20<strong>11</strong> after obtaining prior approval of Forward Markets Commission, Government of India.<br />

Shri Premnath Tiwari, Director, Forward Markets Commission who was nominated by the Forward<br />

Markets Commission in place of Shri D. K. Soni, was appointed as an Additional Director with effect<br />

from August 20, 20<strong>11</strong>.<br />

Shri Anil Kumar Mishra was re-designated as Managing Director of the Company with effect from May<br />

26, <strong>2010</strong>.<br />

th<br />

The Board of Directors at its 54 meeting held on August 20, 20<strong>11</strong> noted the cessation of directorship of<br />

Shri Kailash R Gupta from the Board of Directors of the Company pursuant to the Final Order of<br />

Forward Markets Commission, Government of India dated July 23, 20<strong>11</strong>.<br />

The Board places on record its appreciation for the valuable services, advice and contribution made by<br />

Shri Anil Singhania and Shri Dinesh Kumar Soni, as Directors of the Company.<br />

14

Trade with the Pioneer<br />

Shri B B Pattanaik, Dr. Sidharth Sinha and Shri Shyamal Ghosh, IAS (Retired) retire by rotation at the<br />

ensuing Ninth Annual General meeting, and being eligible, offer themselves for re-appointment. The<br />

Board of Directors re<strong>com</strong>mend their re-appointment.<br />

Corporate Governance:<br />

Being an unlisted Company, the Exchange does not fall into the preview of Clause 49 of the Standard<br />

Listing Agreement. However, as a measure of good Corporate Governance, the Exchange has<br />

voluntarily adopted most of the Corporate Governance Practices as enumerated in aforesaid Clause<br />

49. A Report on Corporate Governance as at March 31, 20<strong>11</strong> is forming part of Annual Report.<br />

Conservation Of Energy, Technology Absorption and Foreign Exchange Earnings and Outgo:<br />

In view of the nature of activities which are being carried-out by the Company, Section 217(1) (e) of the<br />

Companies Act, 1956 read with Rules 2A and 2B of the Companies (Disclosures of Particulars in the<br />

Report of Board of Directors) Rules, 1988, concerning conservation of energy and technology<br />

absorption, respectively, are not applicable to the Company.<br />

During the year, the Company has expended ` 4,54,989/- on travelling of its executives, in foreign<br />

currency. The Company has not earned any foreign exchange during the year under review.<br />

Statement under Section 217 (2A) of The Companies Act, 1956 read with the Companies<br />

(Particulars of Employees) Rules, 1975:<br />

During the period under review, there was no employee, who was in receipt of remuneration exceeding<br />

the ceilings laid down in the Rules specified under Section 217(2A) of the Companies Act, 1956.<br />

Particulars under Section 9(2) of Forward Contracts (Regulation) Act, 1952 read with Rule 12 of<br />

the Forward Contracts (Regulation) Rules, 1954:<br />

In terms of provisions of Section 9(2) of Forward Contracts (Regulation) Act, 1952 read with Rule 12 of<br />

the Forward Contracts (Regulation) Rules, 1954, exchanges are required to include certain particulars<br />

in their annual reports. These particulars are enclosed as Annexure to this Annual Report.<br />

Acknowledgement<br />

The Board appreciates the cooperation and advice received from the Forward Markets Commission,<br />

Ministry of Consumer Affairs, and other ministries of the Government of India and State Governments.<br />

The directors gratefully acknowledge the support received from its members, vendors, shareholders,<br />

bankers, depository participant, print and electronic media and all other service providers, the<br />

Exchange has been working with. The Board also expresses its gratitude to all the employees, for their<br />

dedication and sincere efforts in the growth of the Exchange.<br />

Place: New Delhi<br />

For and on behalf of Board of Directors<br />

Date: September 7, 20<strong>11</strong> B B Pattanaik<br />

Chairman<br />

15

NATIONAL MULTI-COMMODITY EXCHANGE<br />

<strong>REPORT</strong> ON CORPORATE GOVERNANCE<br />

National Multi-Commodity Exchange of India Limited (NMCE) is an Unlisted Public Limited Company,<br />

therefore, Clause 49 of the Standard Listing Agreement dealing with Corporate Governance Practices<br />

is not applicable to NMCE. However, in continuation of its pursuit to adhere to good Corporate<br />

st<br />

Governance practices, NMCE is voluntarily furnishing this Report for the financial year ended on 31<br />

March, 20<strong>11</strong> for the information of all its stake holders.<br />

1. Company's Philosophy on Corporate Governance<br />

Corporate Governance is based on principles of integrity, fairness, equity, transparency,<br />

accountability and <strong>com</strong>mitment to values. Good governance practices stem from the culture and<br />

mind set of the organization. It is therefore not merely set of rules but it is way of life, about<br />

enacting regulations and procedures but also about establishing an environment of trust and<br />

confidence among various stakeholders. It is about maintaining highest level of transparency,<br />

accountability and equity in all facets of a Company's operations, and in all its interactions with its<br />

stakeholders including shareholders, employees, trading and clearing members, warehousing<br />

agencies and the regulators.<br />

NMCE is the De-mutualised Electronic Multi-Commodity Exchange of India and is operational<br />

th<br />

since 26 November 2002. It is <strong>com</strong>mitted to provide world class services of on-line screen based<br />

Futures Trading in permitted <strong>com</strong>modities with best international risk management practices.<br />

The unique strength of NMCE is its settlement via a Delivery Backed System, an imperative in the<br />

<strong>com</strong>modity trading business. These deliveries are executed through a sound and reliable<br />

warehouse receipt system, leading to guaranteed clearing and settlement. NMCE facilitates<br />

Electronic Derivative Trading Robust and Tested Trading Platform through Derivative Trading<br />

Settlement System (DTSS).<br />

Corporate governance is the practice for constantly improving sustainable value, trust and<br />

confidence of the Stakeholders as well as fulfillment of Company's <strong>com</strong>mitments. Your Company<br />

has formulated a Code of Conduct which is applicable to the Directors and members of the Senior<br />

management (i.e. upto designation of Vice President) of the Company, which delineate their<br />

roles, responsibilities and authorities for conducting the business on a highly ethical and efficient<br />

manner.<br />

16

Trade with the Pioneer<br />

2. Board of Directors<br />

Presently, the Board of Directors consists of <strong>11</strong> Directors, out of which five directors are<br />

Independent Directors, 1 Managing Director and rest of thedirectors are shareholders' directors.<br />

The detailed <strong>com</strong>position of the Board and other related information is given in the table below:<br />

Name of the Director Designation No. of Board Attendance<br />

meetings at the last<br />

attended during Annual<br />

the year General<br />

<strong>2010</strong>-20<strong>11</strong> Meeting<br />

Shri B. B. Pattanaik Chairman 7 Yes<br />

Shri Shyamal Ghosh, IAS (Retd.) Independent<br />

(Appointed w.e.f. May 26.<strong>2010</strong>)<br />

Director<br />

7 Yes<br />

Shri K. Rajendran Nair, IAS (Retd.)<br />

(Appointed w.e.f. May 26, <strong>2010</strong>)<br />

Independent<br />

6<br />

Director<br />

Independent<br />

Dr. Sidharth Sinha<br />

7<br />

Director<br />

Yes<br />

Yes<br />

Shri Krishna Mohan Sahni,<br />

IAS (Retd.)<br />

(Appointed w.e.f. May 23, 20<strong>11</strong>)<br />

Independent<br />

Director<br />

Not Applicable<br />

Not Applicable<br />

Shri D. K. Soni Nominee<br />

5 NO<br />

(Ceased w.e.f. August 20, 20<strong>11</strong>)<br />

Director (FMC)<br />

Shri Kailash R. Gupta<br />

(Ceased w.e.f. August 20, 20<strong>11</strong>)<br />

Director<br />

7 YES<br />

Dr. Joy Cheenath, IAS (Retd.)<br />

(Appointed w.e.f. September 30, <strong>2010</strong>)<br />

Director 4 NO<br />

Shri G. N. Nair Director 6 NO<br />

Shri Anil Singhania<br />

(Ceased w.e.f. September 30, <strong>2010</strong>)<br />

Shri Kevin D'sa<br />

(Appointed w.e.f. November 30, <strong>2010</strong>)<br />

Director<br />

2 NO<br />

Director<br />

2 NO<br />

Shri Rajinder Mahajan Director 7 NO<br />

Shri Premnath Tiwari Nominee<br />

Not Applicable Not Applicable<br />

(Appointed w.e.f. August 20, 20<strong>11</strong>) Director (FMC)<br />

Shri Anil Kumar Mishra Managing Director 7 YES<br />

17

NATIONAL MULTI-COMMODITY EXCHANGE<br />

During the year, seven Board meetings were held, details of which are given in the<br />

table below:<br />

Serial Meeting Date of meeting No. of total No. of<br />

No. No. Directors on the Directors<br />

date of meeting attended<br />

1.<br />

th<br />

45 May 26, <strong>2010</strong><br />

10 8<br />

th<br />

2. 46 September 7, <strong>2010</strong><br />

10 10<br />

th<br />

3. 47 September 30, <strong>2010</strong><br />

10 7<br />

th<br />

4. 48 November 19, <strong>2010</strong><br />

10 10<br />

th<br />

5. 49 January 19, 20<strong>11</strong><br />

<strong>11</strong> 10<br />

th<br />

6. 50 February 26, 20<strong>11</strong><br />

<strong>11</strong> <strong>11</strong><br />

st<br />

7. 51 March 12, 20<strong>11</strong><br />

<strong>11</strong> <strong>11</strong><br />

The time gap between any two meetings was less than four months.<br />

3. Director's Profile<br />

Brief resume of the Directors and nature of their expertise in specific areas are provided below:<br />

Shri B.B. Pattanaik – Chairman<br />

Shri B. B. Pattanaik, is the Chairman of the Board of Directors of the Company and is the Managing<br />

Director of Central Warehousing Corporation, New Delhi. (CWC)<br />

Shri Pattanaik is M.Sc. (Ag.) in Entomology and Agril Zoology (Gold Medalist) (BHU) and also P G<br />

Diploma in Marketing and Sales Management (Bhartiya Vidya Bhavan, Mumbai) and P G Diploma<br />

in Human Resource Development (IGNOU). He Joined Central Warehousing Corporation in the<br />

year 1979 and handled various key positions in CWC and is Managing Director of CWC since<br />

July 1, 2008. He was Chairman cum Managing Director of National Seeds Corporation Limited<br />

during September, 2004 to June, 2008. He is also a Director on the Board of Central Rail Side<br />

Warehouse Co. Ltd., New Delhi and Food Corporation of India, New Delhi. Shri Pattanaik has<br />

experience of over 32 years.<br />

st<br />

Shri Pattanaik does not hold any shares in the Company as on 31 March, 20<strong>11</strong>.<br />

Shri Shyamal Ghosh, IAS (Retired) – Independent Director<br />

Shri Shyamal Ghosh, IAS of 1965 batch, is Bachelor of Arts, Degree in Economic from Scottish<br />

Church College, Kolkata and Masters Degree in Economics from Kolkata University and also<br />

receipient of Parvin Fellowship by Princeton University, USA for the M.P.A. program of Woodrow<br />

Wilson School (Princeton University).<br />

Shri Ghosh has held various senior positions in both the State Government of Gujarat and<br />

Government of India.<br />

18

Trade with the Pioneer<br />

He was the Chairman of Tele<strong>com</strong> Commission and Secretary, Department of Tele<strong>com</strong>munications,<br />

th<br />

st<br />

Government of India from 7 February, 2000 to 31 May, 2002 when he retired from Civil Service.<br />

He was Administrator, Universal Service Obligation Fund, Department of Tele<strong>com</strong>munications<br />

during May 2002 to May 2005. Shri Ghosh is on the Board of Span Diagnostics Ltd., Burn Standard<br />

Co. Ltd., Spentex Industries Ltd., Quippo Tele<strong>com</strong> Infrastructure Ltd., IDBI Intech Ltd., Data<br />

Security Council of India (DSCI), Indo-German Social Service Organization, IPTV Forum and<br />

Sesame Street Trust India.<br />

st<br />

Shri Shyamal Ghosh does not hold any shares in the Company as on 31 March, 20<strong>11</strong>.<br />

Shri K Rajendran Nair, IAS (Retired) - Independent Director<br />

Shri. K. Rajendran. Nair, IAS of 1967 batch, is Bachelor of Veterinary Science, from Kerala<br />

University and Masters Degree in Management with Specialisation in Financial Planning & Control<br />

from Leeds University, U.K. (1982).<br />

Shri K. Rajendran Nair is presently SEBI appointed public interest director on the Board of<br />

Inter-Connected Stock Exchange of India Limited and is Chairman of the Board.<br />

He is also associated with IILM as Advisor for training programs for IAS and IPS Officers sponsored<br />

by Govt. of India.<br />

Shri Nair has held various senior positions in both the State Government of Punjab and<br />

Government of India. He was Secretary, in the Ministry of Textile, Government of India.<br />

st<br />

Shri K.Rajendran Nair does not hold any shares in the Company as on 31 March, 20<strong>11</strong>.<br />

Shri Krishna Mohan Sahni – Independent Director<br />

Shri Krishna Mohan Sahni, IAS of 1969 batch of UT cadre, is Bachelor of Arts (Hons.), English<br />

Literature, Masters of Arts, History from St. Stephens College, New Delhi and M.Sc. (Economics)<br />

from London School of Economics.<br />

Shri Sahni has held various senior positions in the Government of India. Since year 2004, he held<br />

the position of the Secretary to Government of India, Ministry of Labour & Employment, New Delhi.<br />

In the above capacity he was India's official delegate on the Governing Body of the International<br />

Labour organization (ILO), Geneva. Mr. Sahni was superannuated on December 31, 2006. Since,<br />

January 2007, he was re-appointed by the Government of India in the rank and pay of Secretary to<br />

Government of India for three years as Member Secretary, National Wage Boards for Journalists<br />

and other Newspaper Employees, Ministry of Labour & Employment, New Delhi.<br />

Shri Krishna Mohan Sahni was appointed as Director on the Board of the Company with effect from<br />

May 23, 20<strong>11</strong>.<br />

st<br />

Shri Krishna Mohan Sahni does not hold any shares in the Company as on 31 March, 20<strong>11</strong><br />

19

NATIONAL MULTI-COMMODITY EXCHANGE<br />

Dr. Sidharth Sinha – Independent Director<br />

Dr. Sidharth Sinha is a Professor in Indian Institute of Management, Ahmedabad since 1992. From<br />

1987 to 1992, he was in employment with School of Management, University of Massachusetts,<br />

Amherst, USA. From 1978 to 1982, he was associated with Foundation to Aid Industrial Recovery,<br />

New Delhi as Project Manager.<br />

Dr. Sidharth Sinha is a Graduate from School of Business Administration, University of California,<br />

Berkeley, USA and took Ph.D in Finance in the year 1987. He has <strong>com</strong>pleted Post Graduate<br />

Diploma in Management from Indian Institute of Management, Ahmedabad. He is on the Board of<br />

NMCE since March, 2003.<br />

Dr. Sinha is an expert on <strong>com</strong>modity futures and was member of the expert <strong>com</strong>mittee under<br />

Chairmanship of Professor Abhijit Sen to study the Impact of Futures Trading on Agriculture<br />

Commodity Prices, appointed by Government of India.<br />

st<br />

Dr. Sidharth Sinha does not hold any shares in the Company as on 31 March, 20<strong>11</strong><br />

Shri G.N. Nair<br />

Shri G.N. Nair, who is a Fellow Member of the Institute of Chartered Accountants of India and L.LB.<br />

from Kerala University, is having around 31 years of Industry experience. He is presently Director<br />

(Finance) of Central Warehousing Corporation (CWC).<br />

He was also CEO for sometime of Hindustan Latex Family Planning Promotion Trust (a non<br />

Government Organization) doing social services all over India. He had worked in several<br />

organizations. Some of the important organizations are Hindustan Latex Ltd., Keltron, Trivandrum<br />

Rubber Works and Kerala State Detergents & Chemicals. He has had the experience of managing<br />

Public Procurement and Human Resource Management in Companies. He had training in<br />

e procurement and Procurement Management in Public Sector from International Training Centre<br />

of International Labour Organisation, Turin, Italy. He is a faculty member of Institute of Chartered<br />

Accountants of India, Institute of Management in Govt. of Kerala and M/s. Suliaman Associates,<br />

Kochi. He is past Chairman of Trivandrum Chapter of ICAI, past Secretary of Rotary Club of<br />

Trivandrum Central, Member of Trivandrum Management Association, Member of Trivandrum<br />

Chapter of NIPM and Member of Central Chinmaya Mission, Trivandrum, Delhi and Noida. He has<br />

visited France, Bangaladesh and Dubai also.<br />

He was adjudged Best CFO for the year 2009 amongst Public Sector Undertakings by ICAI. He is<br />

on the Board of Punjab State Warehousing Corporation, Maharastra State Warehousing<br />

Corporation and Kerala State Warehousing Corporation. He is Managing Director of Central<br />

Railside Warehouse Company Limited.<br />

st<br />

Shri G.N. Nair does not hold any shares in the Company as on 31 March 20<strong>11</strong>.<br />

20 1

Trade with the Pioneer<br />

Dr. Joy Cheenath, IAS (Retired)<br />

Dr. Joy Cheenath joined the IAS in 1979. He did his Bachelor's and Master's Degrees in Economics<br />

from Loyola College, Chennai. During 1995-2000, he was at the University of Southern California,<br />

USA as a Joint Japan-World Bank Research Scholar and was awarded a Master's Degree in<br />

Political Economy and Public Policy and a Ph.D in Political Economy and Public Policy. He has a<br />

PG Diploma in Economic and Social Development from University of Manchester, U.K.<br />

He worked in senior positions in the Government of India and the State Government of Gujarat for<br />

over 30 years in sectors such as Food, Agriculture, Industry, Agro-industry, Power and Health. He<br />

was Managing Director of Gujarat Agro Industries Corporation, Managing Director of Gujarat<br />

Power Corporation Ltd., CMD of Uttar Gujarat Vij Company Ltd. and was Director on Boards of<br />

several other Companies.<br />

st<br />

Dr. Joy Cheenath does not hold any shares in the Company as on 31 March, 20<strong>11</strong>.<br />

Shri Kevin D'sa<br />

Shri Kevin D'Sa is a Commerce Graduate, a Chartered Accountant and a Cost Accountant. He<br />

began his career with Bajaj Auto Ltd. in September 1978 and is presently its President (Finance) &<br />

CFO.<br />

He is also the CFO and President (Business Development) of Bajaj Finserv Limited and CFO of<br />

Bajaj Holdings & Investment Limited.<br />

He is also serving on the Boards of some of the Bajaj Group <strong>com</strong>panies, which includes Bajaj Auto<br />

Holdings Limited, Bajaj Financial Solutions Limited, PT. Bajaj Auto Indonesia and Bajaj Financial<br />

Securities Limited.<br />

st<br />

Shri Kevin D'sa does not hold any shares in the Company as on 31 March, 20<strong>11</strong>.<br />

Shri Rajinder Mahajan<br />

Shri Rajinder Mahajan is General Manager (Credit) at Head Office of Punjab National Bank. He is<br />

M.Com. Gold Medalist and also CAIIB. He has 33 years of banking experience in various important<br />

capacities at centres like Delhi, Amritsar, Patiala, Ludhiana, Mumbai and also have international<br />

work experience of Shanghai (China).<br />

st<br />

Shri Rajinder Mahajan does not hold any shares in the Company as on 31 March, 20<strong>11</strong>.<br />

Shri Premnath Tiwari<br />

Shri Premnath Tiwari, a Nominee Director of Forward Markets Commission on the Board of the<br />

Company, was appointed on August 20, 20<strong>11</strong>. Shri Premnath Tiwari belongs to the 1991 batch of<br />

21

NATIONAL MULTI-COMMODITY EXCHANGE<br />

the Indian Revenue Services (Customs & Central Excise). He has done B.Tech (Electronics ) from<br />

IT BHU Varanasi and MBA from Punjab University. He has extensive experience of over 20 years<br />

in indirect taxation (Customs, Central Excise, Service Tax) and has handled assessment, audit,<br />

investigation, systems and administration.<br />

Shri Premnath Tiwari is working as Director, Forward Markets Commission, since May <strong>2010</strong> and<br />

handling administration, Market Surveillance, Audit, Enforcement and Investigation,<br />

implementation of various Plan Schemes - Price Dissemination Project, Awareness and Capacity<br />

Building Programs.<br />

st<br />

Shri Premnath Tiwari does not hold any shares in the Company as on 31 March, 20<strong>11</strong>.<br />

Shri Anil Kumar Mishra – Managing Director<br />

Shri Anil Kumar Mishra, has about 31 years of <strong>com</strong>modity trading supply chain management<br />

experience both in National and International Markets and has worked towards strengthening<br />

NMCE's relationships and brand image with customers, regulators, key investors and other<br />

business partners.<br />

Prior to joining NMCE he started and led the Indian Operations of Swiss MNC E<strong>com</strong> Agro Industrial<br />

Corporation's E<strong>com</strong> Gill Coffee Trading Pvt. Ltd. as the Country Manager. He was also Country<br />

Head for Cargill Coffee (a Coffee division of American MNC Cargill Inc). He was in-charge of Agri<br />

Exports in Grasim Industries Ltd. In National Market, he worked for Indo Gulf Fertilizers and<br />

Shriram Fertilizers (DCM Group). He was also a recipient of Bhartiya Udyog Ratna award in 2003<br />

and Best Coffee Exporter Award in the year 2006.<br />

st<br />

Shri Anil Kumar Mishra does not hold any shares in the Company as on 31 March 20<strong>11</strong>.<br />

4. Board Committees<br />

( I)<br />

Audit and Finance Committee of Directors:<br />

The following are the terms of reference:<br />

1) To create an open avenue for <strong>com</strong>munication between the Board of Directors, internal auditors<br />

and the statutory auditors.<br />

2) To re<strong>com</strong>mend the appointment and removal of statutory and internal auditors, fix audit fees<br />

and approve payment for other services.<br />

3) To provide directions and oversee the operation of the total audit function in the Company<br />

(internal as well as external).<br />

4) To monitor the adequacy of the internal control environment including <strong>com</strong>puterized<br />

information control system, security and management information system.<br />

5) To interact with the external auditors before finalizing the annual or half yearly/ quarterly<br />

financial statements.<br />

6) To review the annual financial statements and analysis of the performance of the Company.<br />

7) To scrutinize the reasons for default, if any, in payments.<br />

8) To review functioning of the whistle blower mechanism, if the same is existing.<br />

22

Trade with the Pioneer<br />

9) To review all related party transactions.<br />

10) To investigate the terms with <strong>com</strong>plete access to all records, information and personnel of the<br />

Company, and<br />

<strong>11</strong>) To re<strong>com</strong>mend appointment of Merchant Bankers, Lead Merchant Bankers, Book Running<br />

Lead Manager, Syndicate members, Underwriter to the Issue, Bankers to the Issue, etc. for<br />

raising of Resources of the Company.<br />

The <strong>com</strong>position of the Audit and Finance Committee is as under:<br />

Name of the Director Category Remarks<br />

Dr. Sidharth Sinha Independent Director Chairman<br />

Shri Shyamal Ghosh (IAS Retd.) Independent Director Member<br />

Shri G. N. Nair Director Member<br />

Shri Kevin D'sa, Director and Shri Anil Kumar Mishra, Managing Director and CEO, are special invitees.<br />

During the year, five meetings of the Committee were held as per the following details:<br />

Date of the<br />

meeting<br />

Meetings attended by<br />

Dr. Sidharth Shri Shyamal Shri G. N. Nair<br />

Sinha<br />

Ghosh<br />

May 26, <strong>2010</strong> Yes NA Yes<br />

September 7, <strong>2010</strong> Yes Yes Yes<br />

November 19, <strong>2010</strong> Yes Yes Yes<br />

January 19, 20<strong>11</strong> Yes Yes Yes<br />

March 12, 20<strong>11</strong> Yes Yes Yes<br />

(ii)<br />

Business Development Committee of Directors<br />

th<br />

The Committee was constituted by the Board of Directors of the Company at its 48 meeting held<br />

on November 19, <strong>2010</strong> at Kochi.<br />

The following are the terms of reference:<br />

1. To review detailed Business Plan along with Budget.<br />

2. To approve the detailed Business Plan and the Budget<br />

The detailed business plan to include:<br />

(a) Review Market Development such as product designing and delivery related<br />

issues<br />

(b) Change in Contract Specification<br />

(c) Margin Related Issues<br />

(d) Enrollment of new members<br />

(e) Transaction Charges<br />

(f) Review of New Membership enrolment<br />

(g) Screening for admission of Members<br />

(h) Discussions concerning operation plans and budgets for in<strong>com</strong>e and<br />

expenditure.<br />

23

NATIONAL MULTI-COMMODITY EXCHANGE<br />

At present, the <strong>com</strong>position of the Business Development Committee of Directors is as under:<br />

Name of the Director Category Remarks<br />

Shri Shyamal Ghosh (IAS Retd.) Independent Director Chairman<br />

Shri K. R. Nair (IAS Retd.) Independent Director Member<br />

Dr. Sidharth Sinha Independent Director Member<br />

Shri G.N. Nair Director Member<br />

Shri Rajinder Mahajan Director Member<br />

Shri Kevin D'sa Director Member<br />

During the year, two meetings of the Committee were held as per the following details:<br />

Date of the<br />

meeting<br />

Shri<br />

Shyamal<br />

Ghosh<br />

Shri<br />

Kailash<br />

Gupta<br />

Meetings attended by<br />

Dr.<br />

Sidharth<br />

Sinha<br />

Shri<br />

K. R.<br />

Nair<br />

Shri<br />

G. N.<br />

Nair<br />

Shri<br />

Rajinder<br />

Mahajan<br />

Shri<br />

Kevin<br />

D'sa<br />

December<strong>11</strong>, <strong>2010</strong><br />

Yes<br />

Yes<br />

Yes<br />

Yes<br />

Yes<br />

Yes<br />

NA<br />

March 12, 20<strong>11</strong><br />

Yes<br />

Yes<br />

Yes<br />

Yes<br />

Yes<br />

Yes<br />

Yes<br />

th<br />

Shri Kevin D’sa was inducted as member of the <strong>com</strong>mittee at 50 Board meeting held on<br />

February 26,20<strong>11</strong>. Shri Kailash R. Gupta ceased to be a Director with effect from August<br />

20,20<strong>11</strong>.<br />

(iii)<br />

Remuneration and Human Resources Committee of Directors<br />

th<br />

The Board of Directors in its 46 meeting held on May 26, <strong>2010</strong> re–constituted the Committee.<br />

The following are the terms of reference:<br />

To re<strong>com</strong>mend a suitable remuneration package for Managing Director, Chief Financial Officer,<br />

Chief Executive Officer, Chief Operating Officer and other executives of the Company.<br />

To re<strong>com</strong>mend on Employee Stock Option Plan entitlement<br />

To re<strong>com</strong>mend on payment of remuneration to the persons holding office or place of profit in the<br />

Company under section 314 of the Companies Act, 1956<br />

To review and re<strong>com</strong>mend on HR policies relating to recruitment, selection, placement, training,<br />

appraisal, promotions, leaves, remuneration grades, leave encashment, retirement, resignations,<br />

dismissals of employees of the Company.<br />

24

Trade with the Pioneer<br />

The <strong>com</strong>position of the Committee is as under<br />

Name of the Director Category Remarks<br />

Shri K. R. Nair (IAS Retd.) Independent Director Chairman<br />

Shri Shyamal Ghosh (IAS Retd.) Independent Director Member<br />

Dr. Sidharth Sinha Independent Director Member<br />

Shri Krishna Mohan Sahni (IAS Retd.) Independent Director Member<br />

Shri Krishan Mohan Sahni, (IAS Retd.) was inducted as member of the Committee with effect<br />

from August 20, 20<strong>11</strong><br />

During the year, two meetings of the Committee were held as per the following details:<br />

Date of the<br />

meeting<br />

Jan 19, 20<strong>11</strong><br />

Feb 26, 20<strong>11</strong><br />

Meetings attended by<br />

Shri K. R. Nair Shri Shyamal Ghosh Dr. Sidharth Sinha<br />

Yes Yes Yes<br />

Yes Yes Yes<br />

In addition to the above, the Exchange also has three other Committees of Directors, namely;<br />

(a)<br />

(b)<br />

(c)<br />

Disciplinary Committee of Directors<br />

Due Date Rates Committee<br />

New Products Committee<br />

5. The Shareholding Pattern of the Company:<br />

The Shareholding Pattern of the Company as on March 31, 20<strong>11</strong> was as under:<br />

Name of Share Holders No. of Equity % Holding<br />

Shares held<br />

Neptune Overseas Limited (*) 57,68,464 30.18<br />

Central Warehousing Corporation 56,78,347 29.70<br />

Bajaj Holdings and Investment Limited 24,50,000 12.82<br />

Reliance Capital Limited 16,66,667 8.72<br />

Punjab National Bank 15,52,265 8.12<br />

Gujarat Agro Industries Corporation Ltd. 10,45,100 5.47<br />

National Agriculture Co-operative<br />

Marketing Federation of India Limited<br />

7,50,000 3.92<br />

Shri Anil Singhania 1,66,667 0.87<br />

Shri Kailash. R. Gupta 38,807 0.20<br />

Shri Shankarlal Guru 150 0.00<br />

Gujarat State Agricultural Marketing Board 100 0.00<br />

National Institute of Agriculture Marketing 100 0.00<br />

Total 1,91,16,667 100.00<br />

25

NATIONAL MULTI-COMMODITY EXCHANGE<br />

(*) Pursuant to the letter reference no.FMC/LAD-ENF/VI/20<strong>11</strong>-12/02/2572 dated June 24, 20<strong>11</strong> of<br />

the Forward Markets Commission, 29,32,680 Equity Shares held by Neptune Overseas Limited do<br />

not have Voting Rights, which constitutes 15.34% of paid up equity capital of the Company.<br />

6. Share Capital history of the Company:<br />

th<br />

The History of allotment of equity share capital since the incorporation (i.e. 20 February, 2002) of<br />

the Company to March 31, 20<strong>11</strong> is as under:<br />

Sr Date of Reason of Allotment No. of Shares<br />

No. Allotment (Allloted)<br />

1 20-Feb-02 Subscription to MoA 51,600<br />

2 10-Apr-02 Allotment for cash 4,99,900<br />

3 23-May-02 Allotment for cash 2,50,000<br />

4 29-Mar-03 Allotment for cash 2,50,000<br />

5 17-Jul-03 Allotment for cash 25,74,000<br />

6 19-Jan-04 Allotment for cash 19,74,900<br />

7 29-Mar-04 Allotment for cash 10,00,000<br />

8 21-Jan-06 Allotment for cash 10,45,000<br />

9 24-Mar-06 Allotment for cash 23,54,600<br />

10 14-Oct-06 Rights issue for cash 44,77,350<br />

<strong>11</strong> 30-Dec-06 Rights issue (placement) 5,22,650<br />

12 20-Dec-08 Reliance Money Infrastructure Limited (*) 16,66,667<br />

13 30-Oct-10 Bajaj Holdings and Investment Limited (*) 24,50,000<br />

(*) preferential allotment<br />

7. General Body Meetings<br />

TOTAL 1,91,16,667<br />

The time and venue of the last three Annual General Meetings are as under:<br />

AGM Date Time Venue No. of<br />

special<br />

resolutions<br />

approved<br />

th<br />

6 September 27, 2008 12:00 noon Registered Office Nil<br />

th<br />

7 September 26, 2009 04.00 p.m. Registered Office Nil<br />

th<br />

8 September 30, <strong>2010</strong> 12:00 noon Registered Office 1<br />

26

Trade with the Pioneer<br />

Details of Extra Ordinary General Meetings (EGM) held during the financial year are as under:<br />

Date Time Venue No. of<br />

special resolutions<br />

approved<br />

October 30, <strong>2010</strong> 12:00 noon Registered Office 1<br />

December 27, <strong>2010</strong> 12:00 noon Registered Office 1<br />

8. Dividend declared for the past three years<br />

Sr. Financial Year Dividend Declaration Date Dividend<br />

No per Share (In `)<br />

1 2008-09 27/03/2009 0.50<br />

2 2009-10 31/03/<strong>2010</strong> 1.25<br />

3 <strong>2010</strong>-<strong>11</strong> -- --<br />

9. Share Transfer system<br />

The Company has appointed M/s. Sharepro Services (India) Private Limited as Registrar and Transfer<br />

Agent for physical and de-mat shares of the Company. The address of the same is as under:<br />

Sharepro Services (India) Private Limited<br />

Unit: National Multi- Commodity Exchange of India Limited.<br />

th<br />

416, 4 Floor, Dev Nandan Mall<br />

Opp. Sanyas Ashram, Ellisbridge<br />

Ahmedabad - 380 006<br />

Ph. 079-26582381-84<br />

In view of the above, the <strong>com</strong>plete work for transfer of securities is now being carried out at<br />

the above address. The Company has entered into an agreement with National Securities Depository<br />

Limited (NSDL) whereby the shareholders have an option to dematerialize their shares with the<br />

depository.<br />

ISIN Number for NSDL is INE988H01013.<br />

10. Address for Correspondence<br />

National Multi-Commodity Exchange of India Limited<br />

th<br />

Office No.4, 4 Floor, H.K. House,<br />

Ashram Road, Ahmedabad – 380009.<br />

Tel : +91 79 4008 6039/6040<br />

Fax: +91 79 4008 6041<br />

E-mail : legal@nmce.<strong>com</strong><br />

Website : www.nmce.<strong>com</strong><br />

27

NATIONAL MULTI-COMMODITY EXCHANGE<br />

OVERVIEW<br />

Management Discussion and Analysis<br />

GDP growth:<br />

GDP growth figures for Q4, <strong>2010</strong>-<strong>11</strong>, highlight an unmistakable downward trend. While in Q1, <strong>2010</strong>-<strong>11</strong>,<br />

GDP grew by 9.3 percent, in Q4, <strong>2010</strong>-<strong>11</strong>, GDP growth came down to 7.8 percent. Sectors like<br />

manufacturing and mining & quarrying have seen considerable erosion of growth momentum over the<br />

last one year. While consumption demand is still holding, a sharp decline in growth of investments is<br />

seen. Growth in Gross Fixed Capital Formation [GFCF] has dipped from 17.4 percent in Q1, <strong>2010</strong>-<strong>11</strong> to<br />

0.4 percent in Q4, <strong>2010</strong>-<strong>11</strong>. Given the evolving situation, growth in 20<strong>11</strong>-12 is likely to be close to the 8<br />

percent mark.<br />

Inflation:<br />

The inflation situation in the economy continues to be a cause for concern. Despite large scale<br />

tightening of the monetary policy by the RBI and other steps taken by the government, inflation<br />

continues to remain close to the double digit mark. In May 20<strong>11</strong>, WPI based headline inflation stood at<br />

9.1 percent. This is higher than 8.7 percent inflation recorded in April 20<strong>11</strong>. Core inflation too has<br />

moved up from 8 percent in April 20<strong>11</strong> to 8.6 percent in May 20<strong>11</strong>. Near term outlook for inflation is not<br />

too encouraging and there are chances that we may see inflation jump to the double digit territory on a<br />

few occasions. High international oil prices, likely decontrol of diesel prices, high global food prices<br />

and hike in Minimum Support Prices for the up<strong>com</strong>ing agriculture season are some of the factors that<br />

constitute the upside risks to inflation.<br />

There is always lurking fear among the stakeholders that Commodity futures market might<br />

unnecessarily be targeted and bans might be imposed in few <strong>com</strong>modities in case of high inflation.<br />

Rising <strong>com</strong>modity prices also put financial strain on the ability of participants to actively participate and<br />

they need more funds to pay for the margin money and MTM to retain their position.<br />

Agriculture:<br />

In case of the agriculture and allied activities sector, we find that the revised estimates have pegged<br />

growth in <strong>2010</strong>-<strong>11</strong> at 6.6 percent, which is much higher <strong>com</strong>pared to the advance estimates that had<br />

put growth at 5.4 percent.<br />

In this context it is important to note that the third advance estimates of crop production released by the<br />

Ministry of Agriculture have shown a significant upward revision as <strong>com</strong>pared to second advance<br />

estimates in the production of wheat [84.27 million tonnes from 81.47 million tonnes], pulses [17.29<br />

million tonnes from 16.51 million tonnes], oilseeds [302.51 lakh tonnes from 278.48 lakh tonnes] and<br />

sugarcane [340.54 million tonnes from 336.70 million tonnes]. These revisions are responsible for<br />