Features: - Tanker Operator

Features: - Tanker Operator

Features: - Tanker Operator

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TANKER<strong>Operator</strong><br />

JUNE 2008<br />

www.tankeroperator.com<br />

<strong>Features</strong>:<br />

<br />

<br />

<br />

<br />

<br />

<br />

Greeks command respect<br />

Posidonia- biggest ever<br />

Innovative product tanker<br />

Special survey for special VLCC<br />

Emissions - hot air?<br />

Salvage concerns expressed

At EMS Ship Management<br />

- we provide complete lifecycle services for your ships...<br />

· EMS New Building & Projects provides plan approval,<br />

design approval, new building supervision and commissioning<br />

services.<br />

· EMS Ship Management provides technical and<br />

commercial management services.<br />

· EMS Crew Management provides crew management<br />

and training services.<br />

· EMS Shipping Agencies provide agency, grab leasing<br />

and stevedoring services.<br />

<br />

12 different countries. Our team of more than 250 people<br />

ashore and a dedicated pool of more than 6000 seafarers<br />

work towards maximizingyour earning potential by taking<br />

care ofyour assets as our own.<br />

At EMS Ship Management we believe in ship management<br />

with a ship owner’s approach and through dedication and<br />

innovation we will make a difference.<br />

Please logon to:<br />

www.ems-shipmanagement.com for further information<br />

EMS Ship Management<br />

“Ship Management with a ship owner’s approach”<br />

Eitzen Maritime Services ASA<br />

www.ems-asa.com

TANKER<strong>Operator</strong><br />

Vol 7 No 7<br />

<strong>Tanker</strong> <strong>Operator</strong><br />

Magazine Ltd<br />

213 Marsh Wall<br />

London E14 9FJ, UK<br />

www.tankeroperator.com<br />

PUBLISHER/EVENTS/<br />

SUBSCRIPTIONS<br />

Karl Jeffery<br />

Tel: +44 (0)20 7510 4935<br />

jeffery@thedigitalship.com<br />

Contents<br />

04<br />

05<br />

Markets<br />

Supply or demand?<br />

News<br />

Industry news<br />

EDITOR<br />

Ian Cochran<br />

Tel: +44 (0)20 7510 4933<br />

cochran@tankeroperator.com<br />

ADVERTISING SALES<br />

David Jeffries<br />

Only Media Ltd<br />

Tel: +44 (0)20 8674 9444<br />

djeffries@onlymedia.co.uk<br />

PRODUCTION<br />

Vivian Chee<br />

Tel: +44 (0)20 8995 5540<br />

chee@btconnect.com<br />

SUBSCRIPTION<br />

6 months (4 issues)<br />

$142 /Eur110 /£75<br />

1 year (8 issues)<br />

$237/Eur185 /£125<br />

2 years (16 issues)<br />

$398/Eur310 /£210<br />

Subscription hotline:<br />

Tel: +44 (0)20 7510 4935<br />

Fax: +44 (0)20 7510 2344<br />

Email:<br />

jeffery@thedigitalship.com<br />

13<br />

Greek Shipping Review<br />

A changing profile<br />

Continuous improvement<br />

Looking to the future<br />

Directory<br />

Posidonia Preview<br />

37<br />

Technology<br />

37 Ship description<br />

Innovative product tanker<br />

delivered<br />

Marinvest profile<br />

Brodosplit faces uncertain<br />

future<br />

50 Shiprepair & Maintenance<br />

VLCC goes through survey<br />

UMC expands empire<br />

59 Emissions<br />

Intertanko's view<br />

ICS view<br />

62 Emergency Response<br />

ISU sets its stall out<br />

Printed by FISCHER Poligrafia<br />

ul. Dabrówki 10<br />

40-081 Katowice<br />

Poland<br />

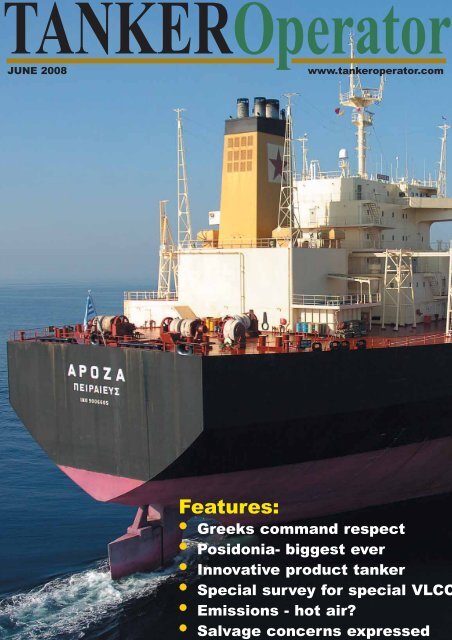

Front cover photo<br />

Neda Maritime's VLCC<br />

Arosa recently went through<br />

her third special survey. Her<br />

claim to fame is that she<br />

was the world's first double<br />

hull VLCC when delivered<br />

in 1993 (see page 50). Photo credit -<br />

Neda Maritime/LR.<br />

TANK CLEANING<br />

IMO-approved Chemicals<br />

in accordance with<br />

MEPC.1 / Circ.590<br />

We assist <strong>Tanker</strong> <strong>Operator</strong>s with:<br />

Chemical Tank Cleaning during cargo changeover from DPP to various CPP, CPP to<br />

Water White Standard, removal of MTBE residues, Inert Gas Soot, Dye, Veg. Oil etc.<br />

Preparation and assessment of the required tank cleaning<br />

Tank Cleaning Advice and Recommended Tank Cleaning Procedure<br />

Delivery of newly IMO-approved Marine Tank Cleaners from stocks world wide<br />

Delivery of chemical injection and special spraying equipment<br />

Supercargo and Supervision during the cleaning at sea by experienced experts<br />

NAVADAN · Hojvangen 13 · P.O.Box 35 · DK-3060 Espergaerde · Denmark · www.navadan.com<br />

Tel. +45-4917 0357 · Fax +45-4917 0657 · E-mail: navadan@navadan.com<br />

June 2008 TANKER<strong>Operator</strong> 01

COMMENT<br />

Greeks in for the Marathon haul<br />

We called our Greek Shipping Review - 'The Winds<br />

of Change'. This particular wind has been building<br />

up for a few years and has almost reached<br />

hurricane proportions.<br />

Although Greek shipping entrepreneurs were around well before the<br />

Second World War, it was not until the likes of Niarchos and Onassis<br />

got hold of surplus US 'Liberty' ships and 'T2' type tankers given to the<br />

Greeks as War reparations in the late 1940s and early 1950s, did we see<br />

Greek shipping really take off.<br />

Niarchos and Onassis vied with each other to build ever larger<br />

tankers in the mid 1950s, when a 47,000 dwt vessel was considered to<br />

be the largest in the world. Of course, these were soon surpassed by<br />

Ludwig's 85,000 dwt 'monsters' and again by the Japanese who<br />

introduced the first VLCC - 'Idemitsu Maru' in 1966.<br />

By the 1970s, everybody in the tanker business was into ULCCs and<br />

there was even a million tonne deadweight design on the drawing<br />

board. Then along came the shipping recession and the Iraq/Iran war.<br />

Many tankers found solace in Norwegian fjords and several were<br />

sold for scrap only being around 10 years of age. There were even<br />

unconfirmed rumours of tankers leaving a newbuilding yard and sailing<br />

directly into the scrapyard.<br />

What the dark 1970s and 1980s achieved was to weed out some of<br />

the weaker owners and operators with large fleets, such as Colocotronis<br />

and later Adriatic <strong>Tanker</strong>s. However, most of the independents<br />

soldiered on and managed to survive, but in the process gained a<br />

certain reputation for cutting corners, thus saving money.<br />

In the meantime, some of the leading Greeks, such as Livanos,<br />

Niarchos, Onassis and others have since passed away, but their empires<br />

remained and are still active to this day.<br />

The original entrepreneurs were joined by several retiring sea<br />

captains, who managed to negotiate loans from banks to buy a bulk<br />

carrier and/or tanker and so start the next generation, or Greek shipping<br />

dynasty - Nikos Vafias being an example.<br />

Vafias started Brave Maritime in the mid 1980s with just one bulk<br />

carrier and today the group manages bulk carriers, tankers and gas<br />

carriers under the Brave Maritime, Stealth Maritime and StealthGas<br />

banners. There are many more.<br />

Today, these 1980s-1990s Greek entrepreneurs are in their late 60s<br />

and 70s and by and large are still going strong. However, unlike their<br />

predecessors whose offspring opted for the jet setting lifestyle, the<br />

newer breed sent their children to business schools, universities and<br />

academies.<br />

If they were destined to follow in father's footsteps, they were often<br />

seconded to overseas broking houses and shipping companies to learn<br />

the business at the sharp end, once they had completed their education.<br />

Now in their late 20s and 30s, these highly educated younger shipping<br />

executives have bought new ideas to the table. They have embraced the<br />

world of stock exchange listings, futures markets without losing the<br />

Greek mantra - 'buy when the market is low-and sell when it is high'.<br />

Today, senior Greeks hold leading positions in most of the worldwide<br />

major shipping organisations and they have totally embraced the quality<br />

and safety regime that has been building up at international level since<br />

the Erika and Prestige sinkings. Greece is now a member of the EU, so<br />

its shipping fraternity has had to adhere to a new set of rules and<br />

regulations.<br />

They also control the world's largest percentage of shipping, either<br />

directly or indirectly, not necessarily from Greece, but also from the UK<br />

and the US, although due to current tax and economic reasons, we could<br />

see Greeks returning to their homeland.<br />

For many years, when visiting Greek shipowners, one only had to<br />

walk the length of Akti Miaouli along the Piraeus waterfront to see the<br />

majority of Greek shipping concerns. However, today they are spread<br />

out all over Athens and its surrounds and many are housed in swish new<br />

offices in the suburbs.<br />

Since about 2002, shipping has proved to be a lucrative industry in<br />

which to be involved and, at the time of writing, with large bulkers<br />

fetching $200,000 per day and tankers $150,000 per pay plus, the<br />

Greeks do not appear to have stopped their massive ordering spree.<br />

As of February this year, the Greek controlled fleet stood at nearly<br />

4,200 vessels of 261 mill dwt. A further 1,050 vessels of 86 mill dwt<br />

were under construction, or on order (see page 14). The age of the fleet<br />

has become progressively younger and with almost 25% of the current<br />

fleet on order, this progression is set to continue.<br />

There are obviously a few blips on the horizon, such as the banking<br />

crisis, high orderbook and perhaps an over reliance on the future of the<br />

BRIC countries (Brazil, Russia, India and China). But the Greeks have<br />

seen all this before and in the main survived to come back even stronger<br />

than ever.<br />

This year's Posidonia event will give the world an idea of where the<br />

shipping barometer sits today - almost full?<br />

TO<br />

TANKER<strong>Operator</strong><br />

The Latest News is now available on TANKER<strong>Operator</strong>’s website at<br />

www.tankeroperator.com and is updated weekly<br />

For access to the News just register by entering your<br />

e-mail address in the box provided.<br />

You can also request to receive free e-mail copies<br />

of TANKER<strong>Operator</strong> by filling in the form displayed<br />

on the website.<br />

Free trial copies of the printed version are also<br />

available from the website. These are limited to<br />

tanker company executives and are distributed at<br />

the publisher's discretion.<br />

02<br />

TANKER<strong>Operator</strong> June 2008

INDUSTRY - MARKETS<br />

Supply driving demand<br />

At any given time there are a<br />

considerable number of factors<br />

impacting the market behaviour<br />

pattern. Most can be attributed to<br />

either the supply or demand side of the<br />

equation.<br />

Historically, tanker supply and demand<br />

interaction has shown a high correlation to the<br />

freight rates in the clean and dirty sectors.<br />

Therefore, using historical trends as a<br />

guideline, we can identify certain market<br />

elements that, conspired together, effect<br />

today's marketplace, said leading US<br />

consultancy McQuilling.<br />

Currently, crude and dirty product spot<br />

earnings are unusually high for this time of<br />

year - that is the second quarter. When<br />

assessing the market, McQuilling formed the<br />

opinion that this was down to the supply side<br />

of the equation, rather than the demand side.<br />

Even though instincts will dictate that the<br />

reason for market spikes lies in increased<br />

demand, this may not be always the case. In<br />

<strong>Tanker</strong> market behaviour is<br />

an interaction between<br />

supply and demand<br />

fundamentals.<br />

fact, McQuilling said that it believed that oil<br />

demand may be down by 500,000 barrels per<br />

day from the consultant's January<br />

expectations.<br />

Bunker costs<br />

Conspiring together, multiple supply factors<br />

have placed the supply side in deficit<br />

compared with the demand figures. Recent<br />

high oil prices have caused the cost of bunkers<br />

to increase. For example, the April average<br />

bunker prices were as high as $528 per tonne,<br />

prompting slower steaming whenever possible<br />

to reduce fuel consumption.<br />

McQuilling's deployment models show that<br />

one knot of speed reduction in the VLCC fleet<br />

absorbs between 10 and 20 vessels in the<br />

supply side. Therefore, at the present time, the<br />

consultant believed that the fleet slowdown<br />

was one of the factors contributing to the<br />

recent tightness in tonnage supply, which put<br />

upward pressure on rates.<br />

Furthermore, reported increased delays in<br />

vessel loading and discharging activities also<br />

absorbed additional tonnage. The model<br />

showed that one incremental delay across the<br />

fleet resulted in the removal of tonnage supply<br />

equivalent to 10 VLCCs, 11 Suezmaxes, 23<br />

Aframaxes and seven Panamaxes.<br />

Delays caused by insufficient storage space<br />

on shore, port and terminal strikes, or cargo<br />

timing issues, plus other reasons, all add up to<br />

be another element constraining tanker supply.<br />

Another factor is the record number of<br />

conversion projects which are expected to be<br />

firmed up this year. McQuilling estimated that<br />

by the middle of May, 15 VLCCs had left the<br />

fleet for various conversion projects since the<br />

beginning of the year, while another three<br />

Dalian<br />

Ft. Lauderdale<br />

Hamburg<br />

Hong Kong<br />

London<br />

Mumbai<br />

New York<br />

Piraeus<br />

Roosendaal<br />

Seoul<br />

Shanghai<br />

Singapore<br />

Tokyo<br />

Washington, DC/Reston<br />

Zurich<br />

service & quality are within your reach<br />

INTERNATIONAL REGISTRIES, INC.<br />

The Marshall Islands Maritime and Corporate Administrator<br />

Piraeus<br />

Tel: +30 210 4293 223 | Fax: +30 210 4293 228 | piraeus@register-iri.com<br />

We Look Forward to Seeing You at<br />

Posidonia 2008<br />

Visit Us at Booth #513<br />

www.register-iri.com<br />

04<br />

TANKER<strong>Operator</strong> June 2008

First Class tankers: a new perspective<br />

TAKING<br />

TANKERS<br />

SERIOUSLY<br />

<strong>Tanker</strong>s are like a work of art – the more quality they offer, the more valuable<br />

they are. Welcome to GL, your First Class partner in improving the operational<br />

safety and profitability of your tankers!<br />

Germanischer Lloyd Aktiengesellschaft<br />

Vorsetzen 35 · 20459 Hamburg, Germany<br />

Phone +49 40 36149-0 · Fax +49 40 36149-200<br />

headoffice@gl-group.com · www.gl-group.com

INDUSTRY - MARKETS<br />

NITC has taken several<br />

VLCCs out of the market<br />

for storage purposes.<br />

were sold for scrap. The number of vessels<br />

leaving a sector obviously puts constraints on<br />

supply and as a result put upward pressure<br />

on rates.<br />

Storage<br />

The Iranians have also been using large<br />

tankers for crude oil storage in the Persian<br />

Gulf. Again, McQuilling estimated that around<br />

15 vessels of between one million and two<br />

million barrel capacity will be used for storage<br />

purposes with as much as 25 mill barrels on<br />

board. This also reduces supply in the short<br />

term, much the same as port delays as these<br />

were trading vessels.<br />

The Hebei Spirit incident also impacted the<br />

market as the deployment of single hull tanker<br />

became more difficult overnight. In addition<br />

to certain charterers that will not touch single<br />

hull vessels, others will opt for double hulls if<br />

the rates are favourable.<br />

Coupled with trading restrictions, the<br />

deployment of VLCCs is increasingly<br />

inefficient, McQuilling said. As in general a<br />

more compartmentalised trading scheme is<br />

less efficient and requires more tonnage to<br />

accomplish than the case where every tanker<br />

can trade to every port required. This also<br />

adds to tonnage constraints.<br />

While it is recognised that tonnage demand<br />

plays a major role in the rate behaviour pattern,<br />

McQuilling said that it didn't think that demand<br />

was driving the present market levels. The<br />

consultant said that the various factors listed on<br />

the supply side were conspiring together to<br />

cause a significant reduction in the availability<br />

of tonnage in the world's loading regions. They<br />

were the reasons for the historically high rates<br />

seen recently.<br />

<br />

06<br />

TANKER<strong>Operator</strong> June 2008

Concordia concludes P-MAX<br />

timecharter contracts<br />

Concordia Maritime recently<br />

signed timecharter contracts for<br />

three P-MAX newbuildings.<br />

The three year timecharter agreement was<br />

with ST Shipping and Transport, a subsidiary<br />

of Glencore and will kick in once the vessels<br />

are delivered from Brodosplit shipyard.<br />

In total, Concordia´s P-MAX fleet will<br />

consist of 10 vessels, of which six have been<br />

delivered and the four remaining will be<br />

handed over in 2009 and 2010.<br />

With the conclusion of the latest three<br />

contracts the entire fleet will be committed to<br />

timecharter contracts. ST Shipping and<br />

Transport is the shipping arm of Glencore, one<br />

of the world´s largest oil and other commodity<br />

traders.<br />

"We are very pleased to have concluded this<br />

transaction with ST Shipping and Transport.<br />

They have a large shipping operation and we<br />

view them as being an innovative and solid<br />

provider of oil transportation - a good and<br />

interesting customer for long term business"<br />

said Concordia Maritime president Hans<br />

Norén.<br />

"Since the sale of the V-MAX vessels in<br />

2004, we have had a solid and strong financial<br />

INDUSTRY - NEWS<br />

position, which is further strengthened by this<br />

transaction. The purpose of securing the<br />

vessels in our new building programme on<br />

long term charters is twofold. Steady and solid<br />

cash flows of course but it also helps us in our<br />

efforts to develop a deeper customer<br />

relationship, such as with ST Shipping.<br />

Another example is the oil- and energy major<br />

TOTAL which has four of our P-MAX on<br />

long term contracts" said financial manager<br />

Göran Hermansson.<br />

"These contracts mean that Concordia<br />

Maritime will have yet more stability and<br />

ability.<br />

Stability in terms of a really good solid<br />

financial base with steady cash flows and a<br />

strong balance sheet and ability to react and<br />

act swiftly when it comes to business<br />

opportunities and the further growth and<br />

development of the company. This is<br />

particularly relevant for the next couple of<br />

years when we believe the market will be<br />

weak", concluded Norén.<br />

The company said that the latest transaction<br />

would not affect the 2008 results, as out of the<br />

three vessels, one will be delivered in 2009<br />

and the other two in 2010.<br />

<br />

The Stena P-MAX Stena Primorsk seen leaving Stockholm following her naming<br />

ceremony in 2006.<br />

June 2008 TANKER<strong>Operator</strong> 07

INDUSTRY - NEWS<br />

Frontline reveals all<br />

Reflecting a stronger spot market<br />

Frontline has announced that net<br />

income for the 1Q08 was $221<br />

mill, equivalent to earnings per<br />

share of $2.95.<br />

Operating income for the quarter was $235.4<br />

mill including a gain on sale of assets of $15.5<br />

mill. This gain included $17.1 mill relating to<br />

the termination of the lease for the Front Maple.<br />

The average daily time charter equivalents<br />

(TCEs) earned in the spot and period market<br />

in the first quarter by the company's VLCCs,<br />

Suezmax tankers and Suezmax OBO carriers<br />

were $82,400, $51,600 and $43,200 per day<br />

respectively, compared with $45,700, $33,100<br />

and $42,400 per day respectively in the fourth<br />

quarter of 2007.<br />

These results also showed a continued<br />

differential in earnings between single and<br />

double hull tonnage. For example, the spot<br />

earnings for the double hull VLCCs and<br />

Suezmaxes were $104,700 and $53,700 per<br />

day in the first quarter, compared to $43,600<br />

and $37,500 per day in 4Q07.<br />

A profit share expense of $33.7 mill was<br />

recorded in the first quarter as a result of the<br />

profit sharing agreement with Ship Finance<br />

International compared to $16.1 mill in the<br />

fourth quarter. No profit share expenses were<br />

recorded in the first quarter of 2007 since Ship<br />

Finance was consolidated in that quarter.<br />

Charterhire expenses increased by $19.5<br />

mill in the first quarter compared with the<br />

4Q07 mainly as a consequence of chartering<br />

in six vessels from Nordic American <strong>Tanker</strong>s<br />

under a floating rate timecharter agreement.<br />

These six vessels are also included in the<br />

results on a timecharter basis with $19.8 mill<br />

on about 450 trading days.<br />

Interest income was $10.9 mill in the first<br />

quarter, of which $7.5 mill related to restricted<br />

deposits held by subsidiaries reported in<br />

Independent <strong>Tanker</strong>s Corp (ITCL). Interest<br />

expense, net of capitalised interest, was $47.9<br />

mill in the first quarter of which $13.6 mill<br />

relates to ITCL.<br />

Other financial items in the first quarter include<br />

an $18 mill gain on the spin-off of 17.53% of the<br />

company's shareholding in ITCL and a $3.5 mill<br />

gain on the forward contract to purchase shares in<br />

Overseas Shipholding Group (OSG).<br />

As of 31st March, 2008, Frontline had total<br />

cash and cash equivalents of $766.9 mill,<br />

which included $638.2 mill of restricted cash.<br />

Restricted cash included $414.6 mill relating<br />

to deposits in ITCL and $223.6 mill in<br />

Frontline Shipping and Frontline Shipping II,<br />

which were restricted under the charter<br />

agreements with Ship Finance.<br />

As of May 2008, the company had average<br />

total cash cost breakeven rates on a TCE basis<br />

for VLCCs and Suezmaxes of approximately<br />

$31,500 and $23,500 per day respectively.<br />

Fleet development<br />

In line with the strategy to reduce exposure to<br />

single hull tonnage, in the 1Q08 Frontline<br />

agreed with Ship Finance to terminate the long<br />

term charterparty between the companies for<br />

the single hull VLCC Front Sabang. Ship<br />

Finance simultaneously leased the vessel to an<br />

unrelated party. Frontline has received a<br />

compensation payment of approximately $24.6<br />

mill in the second quarter of 2008 for the early<br />

termination of the charterparty, which will be<br />

reported in the second quarter results.<br />

The single hull Suezmax Front Maple was<br />

sold in January 2008 by Ship Finance and the<br />

charter with Frontline terminated. Frontline<br />

gained around $17.1 mill related to the<br />

termination of the charter.<br />

The vessels Front Granite and Front Marble<br />

were delivered to Dockwise for conversion in<br />

February and March 2008, respectively. The third<br />

heavy lift vessel, Front Comor, converted by<br />

COSCO, was redelivered to Dockwise in May.<br />

In April, Frontline entered into a contract<br />

with Zhoushan Jinhaiwan Shipyard (Jinhaiwan)<br />

in China for the delivery of four 320,000 dwt<br />

VLCC newbuildings at a contract price of $135<br />

mill each and with attractive payment terms.<br />

The vessels are expected to be delivered in the<br />

second half of 2011. Frontline also announced<br />

that it had declared options for a further two<br />

similar VLCC newbuildings at a fixed price for<br />

delivery in the first half of 2012.<br />

Other Matters<br />

In February, Frontline spun off 17.53% of its<br />

holding in ITCL to Frontline shareholders,<br />

recording a gain of $18 mill in the first quarter<br />

as a result.<br />

The same month, Frontline agreed to invest<br />

$20 mill in NAVIG8 LIMITED (Navig8)<br />

against the issue of new share capital<br />

representing a 15.8% stake in the company.<br />

Navig8 controls about 30 tankers representing<br />

approximately 1.4 mill dwt, including<br />

newbuildings on order. Navig8 actively trades a<br />

timecharter fleet, owns and invests in tonnage,<br />

commercially and technically manages vessels<br />

for third parties and trades in the freightderivatives<br />

market. The investment should be<br />

considered as purely financial, but at the same<br />

time gave Frontline a foothold in the clean<br />

petroleum product market.<br />

In March, it was announced that Frontline<br />

and companies indirectly controlled by<br />

chairman and principal shareholder John<br />

Fredriksen, together held an aggregate of<br />

1,628,300 shares in OSG, or 5.3% of the total<br />

outstanding shares. In addition, Frontline also<br />

entered into a forward contract for another<br />

1,366,600 OSG shares, or an additional 4.4%<br />

of the total outstanding shares.<br />

On 20th May the company filed a Schedule<br />

13 D with the US Securities and Exchange<br />

Commission reporting that companies<br />

indirectly controlled by Fredriksen had<br />

reduced their holding in OSG to 244,900<br />

shares and that they together held an<br />

aggregate of 1,794,900 shares in OSG,<br />

corresponding to 5.2% ownership.<br />

In April, Frontline Management ceo Bjørn<br />

Sjaastad, informed the board of his<br />

resignation and he left the Company in the<br />

following month. The board has since started<br />

the recruitment process in order to find a new<br />

ceo for Frontline Management and expects<br />

that conclusion will be made at the end<br />

of August.<br />

<br />

BP Shipcare<br />

The Professional Lay-up Option<br />

Email: bpshipcare@bp.com<br />

Tel: +44 1932 771571 Fax: +44 1932 771690<br />

Your answer to<br />

a low freightrate<br />

environment and<br />

standdown<br />

periods<br />

Website: www.bpshipcare.com<br />

Tel: +60 87 415277 Fax: +60 87 415330<br />

clean seas safe ships commercial success<br />

08<br />

TANKER<strong>Operator</strong> June 2008

Hellespont has strengthened its<br />

management team by promoting<br />

Spyros Vlassopoulos to director<br />

responsible for chartering and<br />

sale & purchase.<br />

Formerly managing director of Hellespont<br />

Hammonia, Vlassopoulos will now be located<br />

at Hellespont's Piraeus-based chartering<br />

division.<br />

Taking over as managing director of the<br />

Hamburg-based fleet and safety division is<br />

Captain Matthias Imrecke<br />

Captain Imrecke has long experience in<br />

shipping both at sea and ashore with a number<br />

of managerial positions held in Germany,<br />

Switzerland, Greece, Malta and the UAE.<br />

Christian von Oldershausen, group ceo,<br />

said, "Spyros has done a great job building up<br />

our management here in Hamburg. Now that<br />

we have grown to 14 tankers in operation,<br />

with a further 15 to come, we need to beef up<br />

our commercial management in Greece.<br />

Spyros will do that, while Matthias will bring<br />

solid management experience in to meet the<br />

constantly increasing challenge of taking<br />

delivery of and running our modern fleet."<br />

Today, Hellespont operates 14 new crude,<br />

LR product and chemical tankers and has a<br />

INDUSTRY - NEWS<br />

Hellespont strengthens management<br />

team in Germany and Greece<br />

Captain Matthias Imrecke<br />

further 15 vessels under construction - the<br />

Hellespont Credo, a 13,000 dwt IMO<br />

chemical tanker to be delivered at the end of<br />

May, six platform supply vessels and eight<br />

17,000 dwt chemical carriers with delivery<br />

dates through 2010.<br />

<br />

Braemar business divisions rebranded<br />

Braemar Shipping Services has<br />

renamed three companies within<br />

its group.<br />

The service company said that this move was<br />

meant to create greater awareness of the<br />

breadth of its maritime services.<br />

The following concerns were rebranded:<br />

Environmental division - DV Howells -<br />

became Braemar Howells.<br />

Specialist loss adjusting arm Steege<br />

Kingston is now known as Braemar Steege.<br />

Falconer Bryan, the group's technical<br />

survey and marine consultancy services<br />

business, changed to Braemar Falconer.<br />

Quentin Soanes, executive director of<br />

Braemar Shipping Services, said: "….(the)<br />

rebranding will further demonstrate the<br />

breadth of the Braemar Shipping Services<br />

Group. It's an important harmonisation, which<br />

highlights the range of services our companies<br />

are able to supply to the maritime industry."<br />

Nigel Carpenter, ceo of Braemar's newest<br />

acquisition, which becomes Braemar Steege,<br />

said: "For us this new name places us clearly<br />

within the Braemar group of companies,<br />

enabling us to benefit from the associations<br />

and resources available within it while still<br />

maintaining our own individuality."<br />

Simon Rickaby, managing director of Braemar<br />

Howells said: "Braemar Shipping Services is an<br />

around the clock around the globe leading<br />

maritime services group of which Braemar<br />

Howells with 60 years counter pollution<br />

experience proudly contributes its own unique<br />

specialities as a class leader while remaining a<br />

client's natural choice of solution provider."<br />

John Falconer, executive director of Braemar<br />

Falconer welcomed the change mentioning:<br />

"We are the preferred survey service providers<br />

in the Far East for the marine and offshore<br />

industry. This change of name consolidates our<br />

position within the Braemar group of<br />

companies and gives us the strength to expand<br />

in other areas of the world."<br />

The name changes have already become<br />

effective while further rebranding of websites<br />

and corporate literature is scheduled to take<br />

place over the coming months.<br />

<br />

June 2008 TANKER<strong>Operator</strong> 09

INDUSTRY - NEWS<br />

All change at Wilhelmsen<br />

Tor Øiseth, president of<br />

Wilhelmsen Ships Equipment, has<br />

been appointed president of<br />

Wilhelmsen Marine Engineering,<br />

succeeding Lars Marcusson.<br />

In turn, Peter Stockley, managing director of<br />

Wilhelmsen Marine Systems, has been<br />

appointed president of Wilhelmsen Ships<br />

Equipment, succeeding Øiseth.<br />

Wilhelmsen Marine Engineering was<br />

formed following Wilhelmsen Maritime<br />

Services' recent acquisition of the Callenberg<br />

Group.<br />

"Tor Øiseth and Peter Stockley have solid<br />

experience and track records within this part<br />

of the industry and have been working closely<br />

together for years.<br />

"Their combined experience gives us a very<br />

good opportunity to create synergies between<br />

the two business areas. The market is<br />

Securewest appoints vice president<br />

Leading global maritime security<br />

services provider, Securewest<br />

International, has appointed<br />

Stuart Flynn to the post of vice<br />

president business development.<br />

Managing departments in the UK, US and<br />

Singapore, Flynn will be responsible for<br />

identifying new markets, as well as<br />

introducing and developing bespoke solutions<br />

and services to existing clients.<br />

He replaces former vice president Paul<br />

Singer who left Securewest at the end of April<br />

to take up a new position in the technology<br />

solutions sector.<br />

"These are exciting times for Securewest<br />

booming, capacity is stretched and order<br />

books are increasing by the day," said Dag<br />

Schjerven, president and ceo of Wilhelmsen<br />

Maritime Services.<br />

Marcusson has headed the Callenberg<br />

Group for the last 12 years and expressed a<br />

wish to step down, but continue as a member<br />

of the Wilhelmsen Marine Engineering<br />

management team, focusing on business<br />

development.<br />

Wilhelmsen Marine Engineering and<br />

Wilhelmsen Ships Equipment supply systems<br />

and turnkey solutions to the newbuilding,<br />

retrofit and offshore markets.<br />

Wilhelmsen Maritime Services is a whollyowned<br />

subsidiary of Wilh Wilhelmsen and<br />

operates through four business areas -<br />

Wilhelmsen Ships Service, Wilhelmsen Ship<br />

Management, Wilhelmsen Ships Equipment,<br />

and Wilhelmsen Marine Engineering. <br />

International," explained Flynn. "The<br />

company is now monitoring over 16 mill<br />

tonnes of shipping for clients worldwide, and<br />

in many respects I will be the 'face' of the<br />

business as regards its existing international<br />

clients and potential new customers."<br />

The appointment comes on the back of the<br />

opening of new international offices and a<br />

growing portfolio of services, including new,<br />

flexible security training delivery options.<br />

Flynn comes to Securewest with 21 years<br />

experience, specialising in security, IT and<br />

telecommunication applications within the<br />

governmental and private sectors, both<br />

nationally and internationally. <br />

Castrol extends<br />

global port coverage<br />

Castrol Marine has added 80<br />

ports to its global supply network<br />

worldwide and upgraded delivery<br />

capacity at a number of others.<br />

The marine lubricant supplier has expanded its<br />

service in 26 countries across Asia, Europe<br />

and in the Americas, with immediate effect.<br />

Highlights included the launch of barge<br />

deliveries at three ports along China's lower<br />

Yangtze River - Nanjing, Jiangyin, and Taicang.<br />

Until now, vessels had to rely on marine<br />

lubricant deliveries by drum. As well as cost<br />

savings and loading and efficiency benefits,<br />

bulk supply improves overall safety levels<br />

with less storage of drums required on board<br />

vessels. Six other Chinese ports have also<br />

been added to the supply network.<br />

Albert Chan, global offer director, Castrol<br />

Marine, said: "The roll-out of bulk supply<br />

along the Yangtze underlines our ongoing<br />

commitment to China. It means Castrol<br />

Marine customers can now benefit from<br />

speedier and more cost-effective lubricant<br />

product deliveries."<br />

The service upgrade continued a series of<br />

improvements by Castrol Marine at various<br />

Chinese ports in recent years, including<br />

Shanghai, the world's largest port, in response<br />

to the country's expanded role in international<br />

maritime trade.<br />

Elsewhere, barge supply has been<br />

introduced at nine locations in Japan, while in<br />

Europe, Castrol Marine has added 10 new<br />

ports to its UK network, and nearly 20 new<br />

ports across Scandinavia.<br />

"At a time when many others are reducing<br />

the number of ports they supply, Castrol<br />

Marine has expanded its global port coverage<br />

by approximately 10%," said Chan. <br />

Confused?<br />

You needn’t be!<br />

Contact MetWorks for all your<br />

weather solutions.<br />

Weather Routeing by the professionals<br />

Tel: 01344 411116 Email: ops@metworksltd.com Website: www.metworksltd.com<br />

10<br />

TANKER<strong>Operator</strong> June 2008

ISS expands shipping services<br />

worldwide<br />

Inchcape Shipping Services (ISS)<br />

has opened up in Nigeria offering<br />

full agency services.<br />

As from 15th May, the new offices, located in<br />

Lagos and Port Harcourt, are managed by<br />

Captain Reidar Roed, formerly ISS general<br />

manager in Saudi Arabia.<br />

ISS ceo Claus Hyldager said: "Nigeria is<br />

home to Africa's largest population - around<br />

120 mill - as well as being the world's sixth<br />

biggest oil exporter. The economy is buoyant<br />

and we see good potential for our core port<br />

agency business and for several of our other<br />

activities as well.<br />

"The IMF has influence in the country<br />

now," added Hyldager, "and as a result, the<br />

economy is being further opened up to<br />

encourage foreign investment."<br />

The new company is a joint venture<br />

between ISS and Union Maritime, a UKregistered<br />

shipowner with a well established<br />

operating base in Nigeria.<br />

Allan Vermaak, ISS' regional director,<br />

Africa said: "By joining forces with Union<br />

Maritime we benefit from their 20 years<br />

experience of operating in Nigeria and from<br />

their strong relationships with both local<br />

authorities and with local customers.<br />

"ISS will share waterfront office space<br />

with Union Maritime in Apapa/Lagos and<br />

we have taken on some of their key<br />

personnel who are now undergoing further<br />

training to ensure we service our<br />

customers to our global quality standards,"<br />

Vermaak continued.<br />

ISS Nigeria will service all ports and<br />

terminals across the country through a<br />

head office in Lagos and a branch office in<br />

Port Harcourt. The company has been<br />

launched with an initial staff of 17 in Lagos<br />

and 10 in Port Harcourt. The senior<br />

management positions have been filled by<br />

experienced expatriates and to reflect the<br />

strong focus on service delivery the<br />

business is headed up by Roed, a<br />

Norwegian master mariner.<br />

"For our charterer principals we have<br />

focused on establishing clearly defined<br />

operational, communication and financial<br />

processes in line with our global ISO 9002<br />

accreditation and quality management<br />

system," said Vermaak. "Our Nigerian<br />

operations will be audited as a priority so they<br />

quickly become part of this global<br />

accreditation."<br />

Captain Roed added: "In a location such<br />

INDUSTRY - NEWS<br />

as Nigeria one of our key functions as an<br />

agent is to ensure timely and accurate<br />

updates to our principals. Nigeria remains<br />

one of the few locations where the principal<br />

relies absolutely on the agent for accurate<br />

reliable information and ISS, through its<br />

structured approach to the communication<br />

process, is well placed to introduce a new<br />

standard to the Nigerian market.<br />

"For owners' matters ISS Nigeria is<br />

providing full custody control for both crew<br />

and spares movement within the country," he<br />

continued. "From a crew perspective all landbased<br />

transfers will be using ISS' own<br />

vehicles and staff, and for transfer offshore<br />

this will be carried out via ISS' own launch<br />

from our private jetty in Apapa.<br />

"Similarly for spare parts deliveries, we<br />

have established an in-house clearance and<br />

delivery team with bonded warehousing in<br />

Tin Can Port and additional secure<br />

warehousing in an ISS marshalling yard next<br />

to our jetty in Apapa from where we will<br />

transfer spares offshore using the ISS<br />

launch," said Roed.<br />

Another area in the latest succession of<br />

new office launches is the fast developing<br />

market of Mexico.<br />

ISS regional managing director for<br />

North and Central America, Lars<br />

Westerberg, commented: "We see Mexico as<br />

a country with great potential and vast<br />

opportunities, which is of strategic<br />

importance to our region.<br />

"We have started up a greenfield operation<br />

with Octavio Armas as our country manager<br />

based in Mexico City. Octavio brings with<br />

him a strong track record of experience within<br />

the maritime industry in Mexico and will be<br />

responsible for establishing ISS offices in the<br />

country's principal ports."<br />

Elsewhere, effective 1st June, ISS has<br />

joined with leading New Zealand agency,<br />

McKay Shipping, to form ISS-McKay.<br />

The announcement follows hard on the<br />

heels of the ISS acquisition a couple of<br />

months ago of Adsteam Agencies Tauranga<br />

(AATL) and Ports and Shipping Services<br />

(PASS).<br />

"We have pooled our businesses and ISS-<br />

McKay will perform all the operations of ISS<br />

in New Zealand as well as all the vessel<br />

operations of McKay Shipping, including<br />

tankers, and its associated companies,"<br />

explained ISS regional managing director for<br />

Australasia, Royce Brain.<br />

<br />

June 2008 TANKER<strong>Operator</strong> 11

INDUSTRY - GREEK SHIPPING REVIEW<br />

The winds of change<br />

A huge orderbook, younger executives and an eye for a business deal help<br />

to keep the Greeks in the forefront of world shipping.<br />

At the beginning of this year, Greek<br />

controlled companies accounted<br />

for 21% of the world's tanker<br />

tonnage, including the number of<br />

vessels under construction, or on order.<br />

In the growing chemical and product carrier<br />

sector, the percentage controlled by Greek<br />

managers and operators grew to 14%.<br />

Although difficult to quantify as the total<br />

changes almost daily, at the beginning of<br />

2008, Greeks were believed to control around<br />

1,270 tankers, of which 400 were<br />

newbuildings (see facts and figures section).<br />

During the past decade, the image of the<br />

Greek fleet has been drastically overhauled,<br />

whereas before it consisted of many elderly<br />

vessels, today the average age of the fleet is<br />

below 10 years.<br />

This has been due to the phenomenal<br />

newbuilding contracting and younger tonnage<br />

acquired on the sale & purchase market. We<br />

are also seeing a step change in the typical<br />

Greek entrepreneur. Gone are the days of the<br />

sea captain coming ashore, getting a bank loan<br />

and buying a secondhand ship. Nowadays, the<br />

senior executive is more likely to be a young<br />

Harvard, or similar, business school educated<br />

person, who would probably have had some<br />

experience in a worldwide broking house, or<br />

shipowner's commercial department in which<br />

to hone his or her skills.<br />

On the back of several years of a boom<br />

market, new players have emerged in virtually<br />

all sectors, even the LNGC market. Several<br />

have floated in the US and the UK and they<br />

all have readily embraced the IMO and EU<br />

rules and regulations, together with OCIMF's<br />

TMSA, without so much as a whimper, unlike<br />

in the old days.<br />

There has always been a certain amount of<br />

respect for a Greek shipowner, going back to<br />

the Niarchos and Onassis days and this has<br />

grown today as several of the key jobs in<br />

shipping - IMO secretary general, chairman of<br />

the International Chamber of<br />

Shipping/International Shipping Federation,<br />

Intertanko, Bimco and Intercargo chairmenare<br />

held by Greek nationals, as is the senior<br />

shipping position within the Royal Bank of<br />

Scotland, to name but a few.<br />

In recent times, several owners have<br />

embraced both codes, either by adding dry<br />

hulls to wet or the other way around in the<br />

wake of the burgeoning drybulk markets.<br />

However, not all roads to Athens are paved<br />

with gold. The Greek government is acutely<br />

aware of not having an active shipping<br />

element in the local stock exchange, due to<br />

restrictive regulations. However, a meeting<br />

was due to be held involving all interested<br />

parties on 26th May to try to resolve the<br />

problem.<br />

Most of the Greek public shipping<br />

companies are listed on the New York Stock<br />

Exchange or NASDAQ with just a handful<br />

joining London's Alternative Investment<br />

Market (AIM). However, all is not rosy across<br />

Spyros Polemis, chairman of the<br />

International Chamber of Shipping and the<br />

International Shipping Federation<br />

June 2008 TANKER<strong>Operator</strong> 13

INDUSTRY - GREEK SHIPPING REVIEW<br />

the pond and a few prospective IPOs have<br />

been pulled.<br />

In addition, the UK Government looked to<br />

have alienated foreign shipping concerns as in<br />

April, it was announced that overseas people<br />

living in the UK and considered as nondomicile<br />

for tax purposes -non-doms - will<br />

lose their exemption status.<br />

UK Finance Minister Alistair Darling has<br />

since announced a working group to advise<br />

Facts and Figures<br />

Last February, the Greek Shipping<br />

Co-operation Committee (GSCC)<br />

published its annual report, which<br />

contained facts and figures about<br />

the current state of Greek<br />

controlled shipping*.<br />

This survey concerns Greek controlled vessels<br />

of over 1,000 gt, flying both the domestic flag<br />

as well as other flags. As of 18th February this<br />

year, the fleet both domestic and overseas<br />

registered had increased significantly both in<br />

terms of deadweight tonnage and gross tonnes<br />

compared with the same date in 2007.<br />

the government on 'long-term challenges' to<br />

the UK tax system. Multinational companies<br />

have been invited to join the group, but it is<br />

unclear if shipping interests will be<br />

represented.<br />

Baltic chairman Michael Drayton has held<br />

talks with the UK Chamber of Shipping and<br />

they had agreed that their common goal was<br />

to make sure that someone with authority and<br />

with a broad view on all the cluster's shipping<br />

For example, Greek interests controlled<br />

4,173 vessels of 261 mill dwt, including 1,054<br />

on order of 50 mill gt, an increase of 474<br />

vessels of 43 mill dwt. Those flying the Greek<br />

flag also registered an increase and comprised<br />

1,197 vessels, including 422 on order,<br />

compared with 969 in 2007.<br />

The numbers of vessels entering the Greek<br />

register are expected to increase due to the<br />

measures taken to make the domestic flag<br />

more competitive. Out of the 1,054 vessels<br />

on order, some 422 are earmarked for the<br />

Greek registry.<br />

interests sits on the Treasury working group.<br />

Recent known high-profile Greek<br />

defections from the UK have included some<br />

of the Goulandris and Fafalios shipping<br />

families.<br />

Any more would play into the hands of the<br />

Greek Registry and boost attempts to<br />

persuade shipping companies to join the<br />

Athens Stock Exchange, once it becomes<br />

business friendly, in favour of London.<br />

TO<br />

Greek interests now control about 8.7% of<br />

the world's fleet in service or on order by<br />

number, 16.4% by deadweight tonnes and<br />

14.1% expressed in gt terms. In terms of<br />

vessels on order, these percentages are 11%,<br />

16.8% and 14.6% respectively.<br />

A comparison of flag used by Greek<br />

interests showed that there were no significant<br />

losses to any of the registries last year. Apart<br />

from the significant gains registered by Greek<br />

interests, there were also increases noted by<br />

Liberia and the Marshall Islands.<br />

In total, Greeks controlled 592 oil tankers,<br />

Greek parent companies ship types and age analysis. Ships of over 1,000 gt in service and currently on order.<br />

TYPE TO TAL O RDER BOOK (0-4) (5-9) (10 -14) (15 -19) (20 -24) 25 & ABOVE<br />

CARGO NO 524 49 83 40 31 41 72 257<br />

GT 7,976,749 2,087,663 3,208,183 874,119 262,414 445,193 748,220 2,438,620<br />

DW T 5,059,869 733,086 1,156,970 269,804 203,315 305,610 700,368 2,423,802<br />

CH EM ICAL & PRODUCTS NO 681 273 421 52 17 39 71 81<br />

G T 13,687,136 5,472,788 9,343,257 1,500,559 340,272 543,640 1,242,655 716,753<br />

D W T 22,951,384 9,130,638 15,701,192 2,476,519 539,579 927,715 2,129,877 1,176,502<br />

COM BINATION CARRIERS NO 7 1 3 3<br />

G T 302,839 63,709 114,969 124,161<br />

D W T 500,784 103,203 186,955 210,626<br />

LIQUID G AS N O 121 38 53 11 19 7 6 25<br />

GT 2,871,691 1,042,054 2,038,758 158,117 80,141 29,402 63,584 501,689<br />

DW T 2,985,117 1,146,044 2,035,509 186,165 84,307 28,525 64,575 586,036<br />

OIL TANKERS NO 592 125 257 104 48 103 55 25<br />

G T 44,804,635 10,809,221 20,923,065 9,022,842 3,884,354 7,518,629 2,435,103 1,020,642<br />

D W T 83,874,607 20,799,586 39,854,874 17,069,428 7,183,687 13,640,521 4,312,149 1,813,948<br />

ORE & BULK NO 1,793 487 670 217 214 97 244 351<br />

G T 70,846,171 25,445,688 33,686,136 9,198,852 7,459,436 3,802,548 7,401,420 9,297,779<br />

D W T 131,454,902 48,646,877 64,104,995 17,178,428 13,713,506 7,058,361 13,166,768 16,232,844<br />

OTHERS NO 64 13 22 5 7 6 6 18<br />

G T 529,665 157,872 183,187 18,705 64,162 50,029 54,828 158,754<br />

D W T 526,184 47,741 69,085 19,500 80,617 43,380 52,985 260,617<br />

PASSEN G ER N O 128 6 9 28 12 16 6 57<br />

GT 1,656,767 84,266 99,564 517,009 112,833 195,931 95,610 635,820<br />

D W T 355,144 8,586 12,336 100,738 27,350 45,392 24,436 144,892<br />

PURE CONTAINER NO 263 63 85 15 18 36 39 70<br />

G T 11,923,621 4,808,260 6,232,120 911,166 555,039 1,196,979 1,342,269 1,686,048<br />

D W T 13,221,230 5,178,430 6,754,238 1,041,493 649,539 1,405,292 1,506,626 1,864,042<br />

TOTAL NO 4,173 1,054 1,600 472 366 346 502 887<br />

G T 154,599,274 49,907,812 75,714,270 22,201,369 12,758,651 13,846,060 13,498,658 16,580,266<br />

D W T 260,929,221 85,690,988 129,689,199 38,342,075 22,481,900 23,557,999 22,144,739 24,713,309<br />

Source: GSCC/LR-Fairplay.<br />

14<br />

TANKER<strong>Operator</strong> June 2008

“Blueland Centre” 6-8 Agisilaou str., 151 23 Marousi, Athens Greece

INDUSTRY - GREEK SHIPPING REVIEW<br />

Flag analysis of vessels owned by Greek parent companies<br />

FLAG SH IPS DEADW EIGHT GROSS<br />

ANTIGUA & BARBUDA 2 3,891 2,840<br />

BA H A M A S 292 16,147,423 11,293,149<br />

BA RBA D O S 12 412,259 254,229<br />

BELGIU M 3 172,605 145,430<br />

BELIZE 1 2,909 1,982<br />

BERM U D A 2 151,940 137,342<br />

BRAZIL 2 49,680 31,212<br />

CAYM AN ISLAN D S 20 1,131,373 639,986<br />

CHINA,PEOPLE'SREPUBLICOF 2 6,106 6,281<br />

COM OROS 7 90,381 53,972<br />

CY PRU S 345 20,245,145 12,578,148<br />

DENM ARK (DIS) 4 50,235 38,238<br />

DOM INICA 9 1,033,525 549,636<br />

EGY PT 7 487,994 274,639<br />

GEORGIA 2 14,825 8,587<br />

G ERM A N Y 4 212,000 124,000<br />

GIBRA LTAR 7 155,229 109,910<br />

GREECE 1,197 93,870,095 55,560,010<br />

HONDURAS 3 2,236 15,198<br />

HONG KONG,CHIN A 29 1,625,288 944,121<br />

INDIA 1 13,022 8,562<br />

ISLE OF MAN 73 7,160,996 3,928,594<br />

ITALY 15 712,436 566,467<br />

JA M A ICA 7 171,547 100,875<br />

K ENY A 1 341 1,502<br />

KOREA,NORTH 1 20,005 12,180<br />

K O REA ,SO U TH 2 360,000 180,000<br />

LEBANON 2 34,381 22,268<br />

LIBERIA 472 30,897,835 17,514,023<br />

M A LTA 505 27,558,555 15,614,120<br />

M ARSHALL ISLAN D S 388 22,695,503 12,934,381<br />

NORW AY 1 2,203 2,028<br />

NORW AY (NIS) 3 446,130 250,847<br />

PA N A M A 575 29,525,466 17,378,641<br />

PH ILIPPIN ES 4 229,130 127,420<br />

PORTUGAL (M A R) 4 17,903 49,962<br />

RUSSIA 1 4,392 3,835<br />

SAO TOM E & PRINCIPE 1 6,910 4,154<br />

SAUDIARABIA 12 3,928 47,424<br />

SIN G A PO RE 21 762,147 438,305<br />

SLOVAKIA 3 14,286 10,376<br />

ST KITTS & NEVIS 1 12,450 9,992<br />

ST VINCENT &THE GRENADINES 75 1,913,489 1,148,375<br />

UNITED ARAB EM IRA TES 3 10,839 7,000<br />

UNITED KINGDOM 11 118,966 94,334<br />

UNKNOW N 32 2,240,378 1,280,705<br />

URUGUAY 1 3,390 2,521<br />

VANUATU 5 34,472 36,977<br />

VENEZUELA 3 92,982 54,496<br />

G rand Total 4,173 260,929,221 154,599,274<br />

Source: GSCC/LR-Fairplay.<br />

681 chemical and product tankers, 121 liquid gas carriers and seven<br />

combination carriers. Last year, the oil tanker total went down by just<br />

three vessels, mainly due to the single hull phase out, while the<br />

chemical and product tanker sectors showed an increase of 90 vessels<br />

of 2.5 mill dwt. Liquefied gas carriers also increased by 12 of 190,000<br />

dwt in total, while the combination carrier fleet lost two members.<br />

Out of the 1,054 vessels on order, 125 were oil tankers, 273 chemical<br />

and product tankers and 38 liquefied gas carriers.<br />

The average age of the overall Greek controlled fleet dropped to 12.5<br />

years, compared with 14.3 years in February 2007 and 15.3 years the<br />

year before. As for the Greek flag, the average age fell to just nine<br />

years, against 11.1 years in 2007 and 11.7 in 2006.<br />

Six major IACS member class societies share the majority of the<br />

Greek controlled fleet. These included:-<br />

Lloyd's Register = 878 vessels (825 in 2007)<br />

American Bureau of Shipping = 766 (612)<br />

Det Norske Veritas = 598 (569)<br />

ClassNK = 492 (446)<br />

Bureau Veritas = 462 (447)<br />

Germanischer Lloyd = 216 (208)<br />

Plus the Hellenic Register, which accounted for a further 126 vessels. <br />

*Figures were supplied to the Greek Shipping<br />

Co-operation Committee by LR-Fairplay.<br />

16<br />

TANKER<strong>Operator</strong> June 2008

INDUSTRY - GREEK SHIPPING REVIEW<br />

A commitment to<br />

continuous improvement<br />

During April's Intertanko Istanbul event, several leading Greek shipping personalities<br />

endorsed the idea of the Poseidon Challenge.<br />

Among them was Captain D<br />

Kastanias, senior HSSQE and<br />

training officer with relative<br />

newcomer Kyla Shipping. This<br />

company was established in 2006 and<br />

currently manages seven small coastal<br />

chemical/product tankers, which mainly trade<br />

in the Mediterranean region. The company<br />

also manages four bulkers trading worldwide.<br />

The tankers are classed with Lloyd's<br />

Register and have an average age of only<br />

three years. Since joining the European Union,<br />

Greece has been faced with the single hull<br />

phase out of its large fleet of coastal tankers,<br />

both trading locally and serving as bunker<br />

vessels.<br />

Encapsulating the new breed of Greek<br />

shipowner/manager/operator, the company's<br />

mantra is - 'Commitment to continuous<br />

improvement through innovation'.<br />

Captain Kastanias explained that Kyla's aim<br />

was to raise the HSSQE standards and culture<br />

in the very demanding world of coastal<br />

shipping.<br />

He said that safety was a way of life and<br />

was the top priority in all of Kyla's operations.<br />

He believed in encouraging initiatives that<br />

went beyond the committee room. "Be<br />

creative," he urged.<br />

He saw one of his roles as inspiring and<br />

motivating people to enhance the safety and<br />

environment culture and by adopting this, they<br />

would inspire others. "We need to raise the<br />

bar by talking to seafarers' hearts and minds,"<br />

he explained.<br />

Managing is based on the principles of<br />

continuous improvement and people<br />

empowerment and in practice continuous<br />

improvement meant that a company had to -<br />

Establish plans and develop effective<br />

working practices.<br />

Analyse, measure record and monitor<br />

performance and results.<br />

Identify improvement opportunities.<br />

Praise and correct.<br />

He explained that people empowerment meant<br />

providing people with the ability to perform,<br />

have no blame culture in the company and<br />

trust people to perform a task. This could be<br />

achieved by leadership as the leaders would<br />

be the ones who demonstrated commitment,<br />

desired attitudes and behaviour through their<br />

own example.<br />

They would also be accessible involving<br />

people in communications processes and would<br />

share the common vision, values and goals.<br />

People should be encouraged to be creative<br />

and be provided with the required resources<br />

and effective tools.<br />

He then described how a shipping company<br />

should be motivated. Top management should<br />

be committed and make frequent visits on<br />

board their ships as should the superintendents<br />

for inspections and audits. There should be<br />

reward schemes established for the best<br />

suggestions and initiatives. A spirit of<br />

emulation should be developed among the<br />

personnel for safety and environment<br />

excellence and that this culture should be<br />

enhanced both on board and ashore.<br />

"Make people proud to be a part of the vital<br />

role towards the achievement of these goals,"<br />

he urged.<br />

He claimed that Kyla's staff came from the<br />

first Greek ship operator to be accredited with<br />

an ISO 14001 certificate. An exhaustive risk<br />

assessment was undertaken on any new<br />

project. All the environmental sensitivities<br />

would be considered, operating procedures<br />

reviewed and, if necessary, revised to<br />

minimise local environmental impact.<br />

Energy audits have been carried out to<br />

identify and implement any savings potential<br />

both in the office and on board ship. "Through<br />

energy management initiatives, we can<br />

incorporate energy efficiency improvements<br />

into routine operations," Captain Kastanias said.<br />

Environmental improvements have been<br />

factored into newbuilding designs and<br />

shipboard operating practices.<br />

Kyla Shipping manages<br />

seven small<br />

Mediterranean trading<br />

coastal chemical/product<br />

tankers.<br />

June 2008 TANKER<strong>Operator</strong> 17

INDUSTRY - GREEK SHIPPING REVIEW<br />

Kyla also strives for a 'nobody gets hurt'<br />

policy. "We know that there are potential<br />

risks, but these can be substantially reduced if<br />

managed properly. We need to spend time,<br />

effort and money on recognising and<br />

eliminating hazards," he said.<br />

The company has found that crews' safety<br />

and environmental awareness in coastal<br />

vessel trades was unsatisfactory. He repeated<br />

that the key was in talking to seafarers' hearts<br />

and minds.<br />

A family culture was created and a spirit of<br />

advanced teamwork nurtured. The decision<br />

making was based on brainstorming sessions.<br />

Co-operation with local environmental and<br />

community groups was also vital in coastal<br />

trades to keep the ecological balance intact in<br />

an area served.<br />

Last year, Kyla put more emphasis on<br />

behaviour-based safety by adopting what it<br />

called the 'Take 5' initiative whereby the crew<br />

asked themselves five basic questions before<br />

starting a task. This helped remind people of<br />

the main points for maintaining continuous<br />

situation awareness. The award scheme<br />

allowed the supervisors to instantly recognise<br />

and reward employees and contractors. Open<br />

forums and workshops also led to an<br />

improved safety culture.<br />

Captain Kastanias said that the plan for this<br />

year focused on team safety targets,<br />

supervisory leadership and safety leadership<br />

training. "We have focused our efforts on<br />

employing efficient and well trained<br />

personnel," he explained. The company had<br />

recently introduced a computer-based<br />

selection, induction and ongoing assessment,<br />

psychometric tools and personalised training<br />

procedures.<br />

Kyla had established a realistic and dynamic<br />

training plan both on board and ashore, based<br />

upon the needs identified by KPIs, appraisals,<br />

drills, audits and other tools. Frequent on board<br />

and onshore training is given, both by in-house<br />

and by external trainers. Workshops and open<br />

forums are also held.<br />

Benchmarking performance was a very<br />

important tool. To be effective it must be<br />

ongoing, an integral part of the improvement<br />

process and should keep abreast of ever<br />

improving best practice.<br />

Captain Katsanias said that by and large, the<br />

shipping industry was reluctant to<br />

communicate results so he had proposed that<br />

Intertanko be the 'reference point' where all<br />

companies could submit their results. "TMSA<br />

and LTI's were not enough", he said.<br />

Kyla goes so far as to have forums for<br />

suppliers and sub-contractors on<br />

environmental and safety topics. For example,<br />

a fully certificated garbage contractor was<br />

appointed. "In this way, we overcame the<br />

bureaucratic obstacles surrounding garbage<br />

reception facilities ashore," he explained.<br />

Waste reduction has also been achieved by<br />

buying in bulk, thus reducing the volume of<br />

packaging needed.<br />

The company is also fully committed to<br />

social responsibility and offers scholarships<br />

and pays for summer camps for seafarers'<br />

offspring. Company personnel are encouraged<br />

to take higher education to better themselves<br />

and the company. Kyla is also an active<br />

member of Helmepa.<br />

However, the real problem today is the<br />

image of shipping in society. "A lot has been<br />

done, but little has been communicated to the<br />

outside world," Captain Kastanias said. "It<br />

should be improved", he stressed.<br />

Returning to Kyla, he said; "The framework<br />

of mutual understanding has paid dividends." TO<br />

18<br />

TANKER<strong>Operator</strong> June 2008

INDUSTRY - GREEK SHIPPING REVIEW<br />

Greeks look to the<br />

Future<br />

A seminar was held in Athens last month in an attempt to persuade the Greek shipping<br />

community to participate in the Forward Freight Agreements (FFAs) markets.<br />

Headed by SSY Futures senior<br />

director Ben Goggin, who also<br />

holds the post of chairman of the<br />

Forward Freight Agreement<br />

Brokers' Association (FFABA), co-ordinated<br />

by London's Baltic Exchange, the seminar<br />

attempted to address some of the most<br />

frequently asked questions, such as - who is<br />

participating, how does it work, do I want to<br />

be involved, can I lock in going forward and<br />

how can I avoid volatility in the future?<br />

It focused both on the dry and wet sectors in<br />

different sessions as although the drybulk FFA<br />

market is quite mature as it has been in existence<br />

longer, there is now a lot of interest in the tanker<br />

market, especially as the physical earnings were<br />

very high at present, which is most unusual as<br />

we approach the summer months.<br />

Goggin explained that it was easier to get<br />

audience participation with just one company<br />

at the helm, as those attending could take<br />

advantage of 'one to ones' discreetly, which<br />

might not be possible in a more publicly<br />

organised event. He explained that SSY holds<br />

seminars annually in Athens, Geneva and<br />

Copenhagen and is looking to organise an<br />

event in Houston in the near future.<br />

He thought that the new breed of younger<br />

Greeks coming to the fore in shipping were<br />

highly educated, both in shipping and<br />

commercial terms, open to new ideas and were<br />

more than capable of turning some of the new<br />

ideas into practice within their companies. Years<br />

ago, traditional Greek shipowners tended to be<br />

retired sea captains who did everything<br />

themselves, but were averse to change.<br />

SSY's philosophy is to link the physical<br />

market to the FFAs by giving a lecture on the<br />

current situation in drybulk and tanker<br />

chartering to set the picture. Indeed, SSY's FFA<br />

brokers tend to sit near the physical brokers in<br />

order the glean information on the latest fixtures<br />

and also liaise with the research department.<br />

Goggin explained that the ideal FFA<br />

department would consist of specialist futures<br />

brokers mixed with those having experience<br />

with the physical day-to-day chartering. In the<br />

tanker sector, SSY Futures employs six<br />

brokers in London and another four in<br />

Singapore, reflecting the island state's fast<br />

increasing commercial tanker operations<br />

sector at present.<br />

In Singapore, Vitol, Glencore, Trafigura and<br />

others were now strong players in the market<br />

and in recent years, tanker companies, brokers<br />

and traders had moved in-house 'heavyweights'<br />

to the island to beef up their operations. Goggin<br />

explained that by 07.30 London time,<br />

Singapore was already trading and no longer<br />

waited for the London market to open as had<br />

happened in the past. Channelled through the<br />

Southeast Asian powerhouse were customers<br />

located in Japan, Taiwan and China.<br />

Goggin had found that US interest was<br />

growing "a little bit slower" than other parts<br />

of the world. He explained that SSY has an<br />

office in Connecticut and is planning a<br />

seminar in Houston soon.<br />

On the dry side, the company has 17 futures<br />

brokers in London and another three in Hong<br />

Kong. When added together with the tanker<br />

desks, this makes SSY probably the largest<br />

futures broking house, Goggin thought.<br />

To his knowledge there was only one other<br />

fully integrated broking house having both<br />

futures and physical desks under one roof and<br />

that was Clarkson. However, tanker specialist<br />

ACM was also involved in a joint venture<br />

with GFI. ICAP was also believed to be<br />

moving into FFAs and currently owns London<br />

broking house JE Hyde. The company also<br />

recently took over Capital Shipbrokers.<br />

Goggin said that his role as chairman of the<br />

FFABA was to impartially promote the<br />

concept of FFAs, organise seminars and<br />

general get togethers and to speak with one<br />

authoritative voice. The Baltic Exchange is<br />

responsible for printing the number of lots<br />

traded and for selecting and monitoring the<br />

indices on which the trades are based. The<br />

figures are reported on a quarterly basis.<br />

Today tankers are regularly traded into 2009<br />

and even 2010 and Goggin thought with the new<br />

Timecharter Equivalent (TCE) index, which is<br />

quoted in US dollars rather than Worldscale, this<br />

would boost interest still further.<br />

Goggin is half way through a three year<br />

plan at SSY, which hinges on making the<br />

tanker futures desk more active in terms of<br />

lots traded to emulate the drycargo desk,<br />

which is a more mature market mainly<br />

because drycargo indices have been traded for<br />

a longer period of time.<br />

The most liquid trade at present is route<br />

TD3, which is the Persian Gulf/Japan VLCC<br />

spot voyage, which at the time of writing was<br />

trading on the physical market at near W200<br />

(roughly $160,000 per day), which has given<br />

the market food for thought.<br />

Volumes increased<br />

Meanwhile, last year was the first full year of<br />

formal reporting of trade volumes by brokers in<br />

the drybulk FFA market. The Baltic Exchange<br />

said that drybulk volumes were estimated to<br />

have increased by 34% year on year, while<br />

tanker trade volumes were estimated to have<br />

increased by 14% year on year.<br />

In the tanker market, FFA volumes were<br />

estimated to be 374,870,440 tonnes traded (a<br />

lot represents a day's hire or 1,000 tonnes),<br />

which was a 14% increase over the 2006<br />

figure of 329,434,250 tonnes. In the tanker<br />

market cleared business is thought to represent<br />

about 46% of volume.<br />

Commenting on the figures earlier this year,<br />

Jeremy Penn, Baltic Exchange ceo said;<br />

"This data will serve to show newcomers to<br />

the market just how much liquidity is now on<br />

offer and how successful this market has<br />

become. With the high rates achieved,<br />

especially in dry in the latter part of the year<br />

(2007), the dollar value of contracts will no<br />

doubt have increased at an even greater rate. It<br />

is noteworthy that the overall cleared figure<br />

for the year in dry business underplays the<br />

transition which has taken place. In the latter<br />

part of 2007 each week more than 50% of<br />

business was cleared and in some weeks it<br />

was 70%. The development of the tanker<br />

market is particularly pleasing recognising<br />

that overall the physical market had a quiet<br />

year with lower volatility than usual. This<br />

bodes well for the future."<br />

TO<br />

20<br />

TANKER<strong>Operator</strong> June 2008

INDUSTRY - GREEK SHIPPING REVIEW<br />

Greek controlled management companies<br />

Listed below are the major Greek<br />

controlled management and<br />

operating concerns. This list<br />

reflects companies that manage<br />

or operate chemical, product and<br />

crude oil tankers of over 30,000<br />

dwt.<br />

We have not included gas carriers, or<br />

managers/operators with only smaller vessels<br />

on their books. This list, which includes the<br />

known newbuildings, has been compiled from<br />

information taken from various public<br />

sources.<br />

It should only be used as a rough guide to<br />

Greek activity in shipping, as due to the fast<br />

moving nature of this sector, it has proved to<br />

be very difficult to gain an accurate snapshot<br />

of Greek shipping.<br />

The list has been compiled in alphabetical<br />

order of owner/manager/operator followed by<br />

the types of vessels managed and a<br />

newbuilding roundup.<br />

A.K. Shipping & Trading<br />

Chemical/product tankers, product tankers,<br />

crude carriers<br />

Aegean Shipping Management<br />

Chemical/product tankers, crude carriers<br />

Athenian Sea Carriers<br />

Product tankers<br />

Newbuildings - Four VLCCs<br />

Atlas Maritime<br />

Crude carriers<br />

Newbuildings - One Aframax<br />

Avin International<br />

Chemical/product tankers, product tankers,<br />

crude carriers<br />