parti: objectives and features of the new reporting system 159 - TARA

parti: objectives and features of the new reporting system 159 - TARA

parti: objectives and features of the new reporting system 159 - TARA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

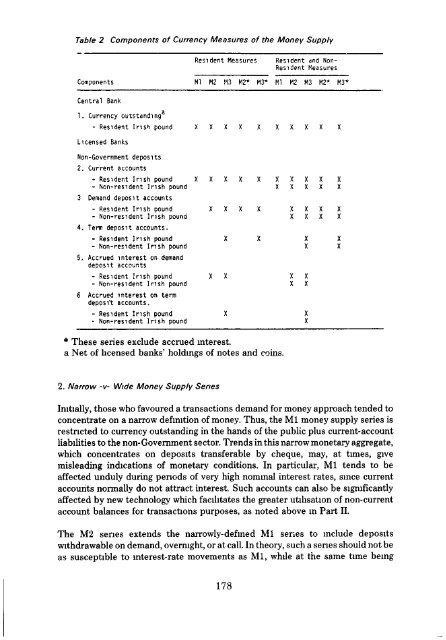

Table 2 Components <strong>of</strong> Currency Measures <strong>of</strong> <strong>the</strong> Money Supply<br />

Resident Measures<br />

Resident <strong>and</strong> Non-<br />

Resident Measures<br />

Components Ml M2 M3 M2* M3* Ml M2 M3 M2* M3*<br />

Central Bank<br />

1. Currency outst<strong>and</strong>ing<br />

- Resident Irish pound<br />

Licensed Banks<br />

Non-Government deposits<br />

2. Current accounts<br />

- Resident Irish pound<br />

- Non-resident Irish pound<br />

3 Dem<strong>and</strong> deposit accounts<br />

- Resident Irish pound<br />

- Non-resident Irish pound<br />

4. Term deposit accounts.<br />

- Resident Irish pound<br />

- Non-resident Irish pound<br />

5. Accrued interest on dem<strong>and</strong><br />

deposit accounts<br />

- Resident Irish pound<br />

- Non-resident Irish pound<br />

6 Accrued interest on term<br />

deposft accounts.<br />

- Resident Irish pound<br />

- Non-resident Irish pound<br />

* These series exclude accrued interest.<br />

a Net <strong>of</strong> licensed banks' holdings <strong>of</strong> notes <strong>and</strong> coins.<br />

2. Narrow -v- Wide Money Supply Series<br />

Initially, those who favoured a transactions dem<strong>and</strong> for money approach tended to<br />

concentrate on a narrow definition <strong>of</strong> money. Thus, <strong>the</strong> Ml money supply series is<br />

restricted to currency outst<strong>and</strong>ing in <strong>the</strong> h<strong>and</strong>s <strong>of</strong> <strong>the</strong> public plus current-account<br />

liabilities to <strong>the</strong> non-Government sector. Trends in this narrow monetary aggregate,<br />

which concentrates on deposits transferable by cheque, may, at times, give<br />

misleading indications <strong>of</strong> monetary conditions. In <strong>parti</strong>cular, Ml tends to be<br />

affected unduly during periods <strong>of</strong> very high nominal interest rates, since current<br />

accounts normally do not attract interest. Such accounts can also be significantly<br />

affected by <strong>new</strong> technology which facilitates <strong>the</strong> greater utilisation <strong>of</strong> non-current<br />

account balances for transactions purposes, as noted above in Part II.<br />

The M2 series extends <strong>the</strong> narrowly-defined Ml series to include deposits<br />

withdrawable on dem<strong>and</strong>, overnight, or at call. In <strong>the</strong>ory, such a series should not be<br />

as susceptible to interest-rate movements as Ml, while at <strong>the</strong> same time being<br />

178