Oxford Gateway Fund No.3 (for web).pub - The Tax Shelter Report

Oxford Gateway Fund No.3 (for web).pub - The Tax Shelter Report

Oxford Gateway Fund No.3 (for web).pub - The Tax Shelter Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

An EIS Portfolio <strong>Fund</strong><br />

A tax efficient portfolio<br />

Potential High Returns<br />

A valuable asset class<br />

<strong>Ox<strong>for</strong>d</strong> Capital Partners (OCP) is an established<br />

private equity investment manager focused on<br />

investing in high growth science and technology<br />

businesses. OCP manages the <strong>Ox<strong>for</strong>d</strong> <strong>Gateway</strong><br />

<strong>Fund</strong>s and has demonstrated superior investment<br />

returns.<br />

<strong>The</strong> <strong>Ox<strong>for</strong>d</strong> <strong>Gateway</strong> <strong>Fund</strong> No. 3 is a discretionary<br />

investment EIS portfolio fund which invests in<br />

emerging science and technology businesses in the<br />

UK. It offers serious investors an alternative asset<br />

investment programme focused on an absolutereturn<br />

strategy and provides access to wealth<br />

creation in businesses with high growth potential.<br />

Through a diversified portfolio of investments, the<br />

<strong>Fund</strong> offers risk reduction and enhanced returns<br />

with EIS tax advantages.<br />

Returns from traditional asset classes (cash,<br />

bonds, equities, properties) in the next five years<br />

are <strong>for</strong>ecast to be lower than those generated<br />

over the past decade. Long-term investors are<br />

increasingly recognising that venture capital can<br />

provide attractive investment opportunities to<br />

realise significant growth.<br />

We believe that returns on private equity, in<br />

particular on venture capital, will be significantly<br />

higher than on conventional asset classes.<br />

An allocation to private equity through a<br />

subscription to an EIS fund can enhance overall<br />

portfolio returns and reduce risk.<br />

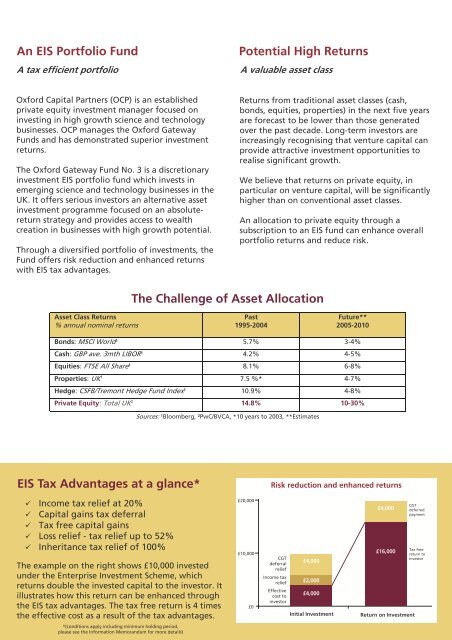

<strong>The</strong> Challenge of Asset Allocation<br />

Asset Class Returns<br />

% annual nominal returns<br />

Past<br />

1995-2004<br />

Future**<br />

2005-2010<br />

Bonds: MSCI World¹ 5.7% 3-4%<br />

Cash: GBP ave. 3mth LIBOR¹ 4.2% 4-5%<br />

Equities: FTSE All Share¹ 8.1% 6-8%<br />

Properties: UK 1 7.5 %* 4-7%<br />

Hedge: CSFB/Tremont Hedge <strong>Fund</strong> Index¹ 10.9% 4-8%<br />

Private Equity: Total UK 2 14.8% 10-30%<br />

Sources: ¹Bloomberg, ²PwC/BVCA, *10 years to 2003, **Estimates<br />

EIS <strong>Tax</strong> Advantages at a glance*<br />

Risk reduction and enhanced returns<br />

Income tax relief at 20%<br />

Capital gains tax deferral<br />

<strong>Tax</strong> free capital gains<br />

Loss relief - tax relief up to 52%<br />

Inheritance tax relief of 100%<br />

<strong>The</strong> example on the right shows £10,000 invested<br />

under the Enterprise Investment Scheme, which<br />

returns double the invested capital to the investor. It<br />

illustrates how this return can be enhanced through<br />

the EIS tax advantages. <strong>The</strong> tax free return is 4 times<br />

the effective cost as a result of the tax advantages.<br />

£20,000<br />

£10,000<br />

£0<br />

CGT<br />

deferral<br />

relief<br />

Income tax<br />

relief<br />

Effective<br />

cost to<br />

investor<br />

£4,000<br />

£2,000<br />

£4,000<br />

Initial Investment<br />

£4,000<br />

£16,000<br />

Return on Investment<br />

CGT<br />

deferred<br />

payment<br />

<strong>Tax</strong> free<br />

return to<br />

investor<br />

*(conditions apply including minimum holding period,<br />

please see the In<strong>for</strong>mation Memorandum <strong>for</strong> more details)