Oxford Gateway Fund No.3 (for web).pub - The Tax Shelter Report

Oxford Gateway Fund No.3 (for web).pub - The Tax Shelter Report

Oxford Gateway Fund No.3 (for web).pub - The Tax Shelter Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

A Proven Process<br />

A strong investment strategy<br />

An Experienced Team<br />

A broad set of skills<br />

OCP uses rigorous processes <strong>for</strong> investing in early<br />

stage and development businesses with high<br />

growth potential and <strong>for</strong> constructing a<br />

diversified portfolio.<br />

Clear investment strategy<br />

Sophisticated portfolio construction<br />

Strong risk management<br />

Professional team with relevant experience<br />

Supported by leading specialist advisors<br />

Active involvement with companies<br />

Transparent and in<strong>for</strong>mative reporting<br />

Track record of superior investment per<strong>for</strong>mance<br />

Ted Mott - CEO, has 25 years experience in<br />

technology businesses and investment<br />

banking in the US, Europe and Asia. A<br />

successful investor and entrepreneur, he<br />

founded OCP in 1992. He is a Cambridge<br />

University economist and an Insead MBA.<br />

Robin Hill FCA - Finance Director, has over<br />

30 years’ experience of managing and<br />

advising businesses. He has been CEO and<br />

CFO of high tech and services businesses in<br />

the US and Europe.<br />

David Mott - Investment Manager, has<br />

several years’ experience of managing and<br />

advising venture capital investments.<br />

Previously at Result Ventures and PwC.<br />

Chris Mallows FSI - Investor Advisor, trained<br />

as a stockbroker with Cazenove and later<br />

with SG Warburg. He is the <strong>for</strong>mer CEO of<br />

Standard Chartered Securities.<br />

Adrian Goodall -Investment Manager,<br />

previously strategy director at THUS plc and<br />

was in the top-rated telecoms teams at<br />

Goldman Sachs and SBC Warburg.<br />

Victor Christou PhD - Investment Manager,<br />

has 15 years tech experience and was the<br />

Royal Society Chemistry Entrepreneur of the<br />

Year. Graduate of Stan<strong>for</strong>d Business School.<br />

Lucy Dighton -Investment Analyst, is a life<br />

science graduate of <strong>Ox<strong>for</strong>d</strong> University.<br />

Previously gained technology experience<br />

with Synaptics UK in Cambridge.<br />

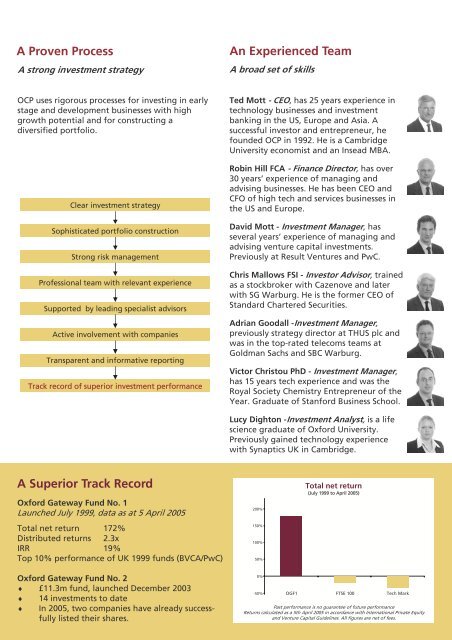

A Superior Track Record<br />

<strong>Ox<strong>for</strong>d</strong> <strong>Gateway</strong> <strong>Fund</strong> No. 1<br />

Launched July 1999, data as at 5 April 2005<br />

Total net return 172%<br />

Distributed returns 2.3x<br />

IRR 19%<br />

Top 10% per<strong>for</strong>mance of UK 1999 funds (BVCA/PwC)<br />

200%<br />

150%<br />

100%<br />

50%<br />

Total net return<br />

(July 1999 to April 2005)<br />

<strong>Ox<strong>for</strong>d</strong> <strong>Gateway</strong> <strong>Fund</strong> No. 2<br />

♦ £11.3m fund, launched December 2003<br />

♦ 14 investments to date<br />

♦ In 2005, two companies have already successfully<br />

listed their shares.<br />

0%<br />

-50%<br />

OGF1 FTSE 100 Tech Mark<br />

Past per<strong>for</strong>mance is no guarantee of future per<strong>for</strong>mance<br />

Returns calculated as a 5th April 2005 in accordance with International Private Equity<br />

and Venture Capital Guidelines. All figures are net of fees.