Cross Oak Inns plc - The Tax Shelter Report

Cross Oak Inns plc - The Tax Shelter Report

Cross Oak Inns plc - The Tax Shelter Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

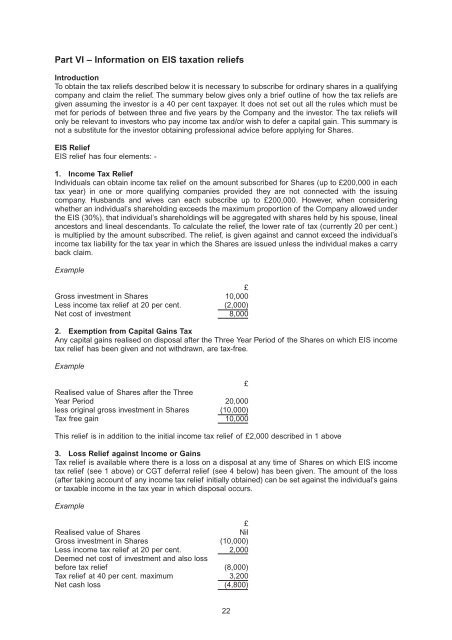

Part VI – Information on EIS taxation reliefs<br />

Introduction<br />

To obtain the tax reliefs described below it is necessary to subscribe for ordinary shares in a qualifying<br />

company and claim the relief. <strong>The</strong> summary below gives only a brief outline of how the tax reliefs are<br />

given assuming the investor is a 40 per cent taxpayer. It does not set out all the rules which must be<br />

met for periods of between three and five years by the Company and the investor. <strong>The</strong> tax reliefs will<br />

only be relevant to investors who pay income tax and/or wish to defer a capital gain. This summary is<br />

not a substitute for the investor obtaining professional advice before applying for Shares.<br />

EIS Relief<br />

EIS relief has four elements: -<br />

1. Income <strong>Tax</strong> Relief<br />

Individuals can obtain income tax relief on the amount subscribed for Shares (up to £200,000 in each<br />

tax year) in one or more qualifying companies provided they are not connected with the issuing<br />

company. Husbands and wives can each subscribe up to £200,000. However, when considering<br />

whether an individual’s shareholding exceeds the maximum proportion of the Company allowed under<br />

the EIS (30%), that individual’s shareholdings will be aggregated with shares held by his spouse, lineal<br />

ancestors and lineal descendants. To calculate the relief, the lower rate of tax (currently 20 per cent.)<br />

is multiplied by the amount subscribed. <strong>The</strong> relief, is given against and cannot exceed the individual’s<br />

income tax liability for the tax year in which the Shares are issued unless the individual makes a carry<br />

back claim.<br />

Example<br />

£<br />

Gross investment in Shares 10,000<br />

Less income tax relief at 20 per cent. (2,000)<br />

Net cost of investment 8,000<br />

2. Exemption from Capital Gains <strong>Tax</strong><br />

Any capital gains realised on disposal after the Three Year Period of the Shares on which EIS income<br />

tax relief has been given and not withdrawn, are tax-free.<br />

Example<br />

£<br />

Realised value of Shares after the Three<br />

Year Period 20,000<br />

less original gross investment in Shares (10,000)<br />

<strong>Tax</strong> free gain 10,000<br />

This relief is in addition to the initial income tax relief of £2,000 described in 1 above<br />

3. Loss Relief against Income or Gains<br />

<strong>Tax</strong> relief is available where there is a loss on a disposal at any time of Shares on which EIS income<br />

tax relief (see 1 above) or CGT deferral relief (see 4 below) has been given. <strong>The</strong> amount of the loss<br />

(after taking account of any income tax relief initially obtained) can be set against the individual’s gains<br />

or taxable income in the tax year in which disposal occurs.<br />

Example<br />

£<br />

Realised value of Shares<br />

Nil<br />

Gross investment in Shares (10,000)<br />

Less income tax relief at 20 per cent. 2,000<br />

Deemed net cost of investment and also loss<br />

before tax relief (8,000)<br />

<strong>Tax</strong> relief at 40 per cent. maximum 3,200<br />

Net cash loss (4,800)<br />

22