EDGE_G_4 12-59-34_Layout 1 - The Tax Shelter Report

EDGE_G_4 12-59-34_Layout 1 - The Tax Shelter Report

EDGE_G_4 12-59-34_Layout 1 - The Tax Shelter Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Edge Performance VCT plc<br />

5<br />

• Non-qualifying Investments<br />

Initially, the net proceeds of the Offer will be invested in various fixed income securities, cash and cash equivalent<br />

assets, offering a high degree of capital preservation. Whilst a suitable level of return will be sought, the Company<br />

also regards capital preservation as an important consideration. Subsequently, up to 30% of the investment funds<br />

will be maintained in such investments whilst the balance is reinvested in Qualifying Investments.<br />

• Dividends and share buy-backs<br />

<strong>The</strong> Board intends to distribute most of the Company’s available net income through dividends, and to make share<br />

buy-backs at a discount of no more than 10% to net asset value, subject to liquidity constraints and regulatory<br />

requirements.<br />

Summary of Investment Policy<br />

• Edge Performance offers the opportunity to invest in the entertainment industry, and seeks to allow investors to<br />

take advantage of VCT tax reliefs whilst combining:<br />

• high targeted returns;<br />

• downside risk protection; and<br />

• liquidity.<br />

• Up to 30% of each of the C, D, E, F and G Share Funds will remain in a range of fixed income securities and cash<br />

and cash equivalent assets. Of the remainder, the Company will balance investments with a high level of capital<br />

protection with other investments where the potential for significantly higher returns justifies a lower level of capital<br />

protection.<br />

• <strong>The</strong> intention is that the Investor’s risk is thereby minimised, underpinning the return of the Investor’s effective cost<br />

of investment of 70p per Share (assuming income tax relief at 30%).<br />

XV:1.1<br />

VCT tax benefits<br />

VCT status currently confers the following benefits on Shareholders:<br />

Income tax relief at 30% – Qualifying Investors will receive tax relief of up to 30% of the amount subscribed for G Shares,<br />

provided the G Shares are held for at least five years.<br />

For every £10,000 invested, up to £3,000 can be reclaimed from HM Revenue & Customs, so an investment of £10,000<br />

could effectively cost only £7,000. <strong>The</strong>refore, after the initial costs of the Offer (5.5%), that £7,000 could be worth<br />

£9,450, an increase of 35%, before the Company even makes its first investment.<br />

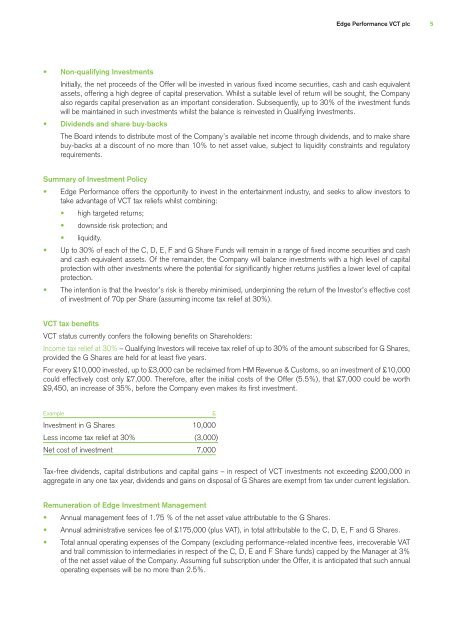

Example £<br />

Investment in G Shares 10,000<br />

Less income tax relief at 30% (3,000)<br />

Net cost of investment 7,000<br />

<strong>Tax</strong>-free dividends, capital distributions and capital gains – in respect of VCT investments not exceeding £200,000 in<br />

aggregate in any one tax year, dividends and gains on disposal of G Shares are exempt from tax under current legislation.<br />

Remuneration of Edge Investment Management<br />

• Annual management fees of 1.75 % of the net asset value attributable to the G Shares.<br />

• Annual administrative services fee of £175,000 (plus VAT), in total attributable to the C, D, E, F and G Shares.<br />

• Total annual operating expenses of the Company (excluding performance-related incentive fees, irrecoverable VAT<br />

and trail commission to intermediaries in respect of the C, D, E and F Share funds) capped by the Manager at 3%<br />

of the net asset value of the Company. Assuming full subscription under the Offer, it is anticipated that such annual<br />

operating expenses will be no more than 2.5%.