Print Program - TD Waterhouse

Print Program - TD Waterhouse

Print Program - TD Waterhouse

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

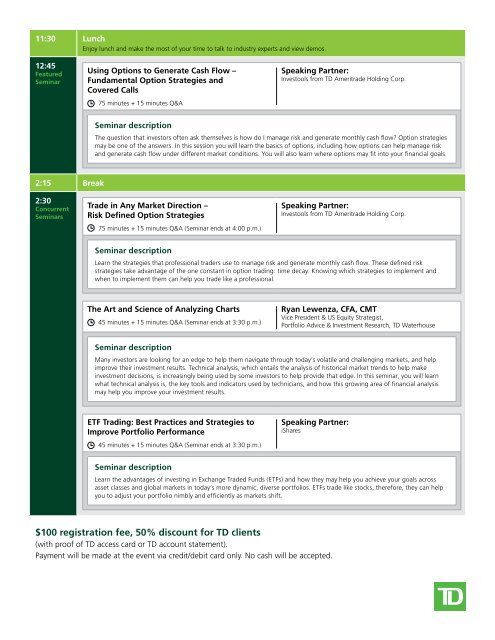

11:30 Lunch<br />

Enjoy lunch and make the most of your time to talk to industry experts and view demos.<br />

12:45<br />

Featured<br />

Seminar<br />

Using Options to Generate Cash Flow –<br />

Fundamental Option Strategies and<br />

Covered Calls<br />

75 minutes + 15 minutes Q&A<br />

Speaking Partner:<br />

Investools from <strong>TD</strong> Ameritrade Holding Corp.<br />

Seminar description<br />

The question that investors often ask themselves is how do I manage risk and generate monthly cash flow? Option strategies<br />

may be one of the answers. In this session you will learn the basics of options, including how options can help manage risk<br />

and generate cash flow under different market conditions. You will also learn where options may fit into your financial goals.<br />

2:15 Break<br />

2:30<br />

Concurrent<br />

Seminars<br />

Trade in Any Market Direction –<br />

Risk Defined Option Strategies<br />

75 minutes + 15 minutes Q&A (Seminar ends at 4:00 p.m.)<br />

Speaking Partner:<br />

Investools from <strong>TD</strong> Ameritrade Holding Corp.<br />

Seminar description<br />

Learn the strategies that professional traders use to manage risk and generate monthly cash flow. These defined risk<br />

strategies take advantage of the one constant in option trading: time decay. Knowing which strategies to implement and<br />

when to implement them can help you trade like a professional.<br />

The Art and Science of Analyzing Charts<br />

45 minutes + 15 minutes Q&A (Seminar ends at 3:30 p.m.)<br />

Ryan Lewenza, CFA, CMT<br />

Vice President & US Equity Strategist,<br />

Portfolio Advice & Investment Research, <strong>TD</strong> <strong>Waterhouse</strong><br />

Seminar description<br />

Many investors are looking for an edge to help them navigate through today’s volatile and challenging markets, and help<br />

improve their investment results. Technical analysis, which entails the analysis of historical market trends to help make<br />

investment decisions, is increasingly being used by some investors to help provide that edge. In this seminar, you will learn<br />

what technical analysis is, the key tools and indicators used by technicians, and how this growing area of financial analysis<br />

may help you improve your investment results.<br />

ETF Trading: Best Practices and Strategies to<br />

Improve Portfolio Performance<br />

45 minutes + 15 minutes Q&A (Seminar ends at 3:30 p.m.)<br />

Speaking Partner:<br />

iShares<br />

Seminar description<br />

Learn the advantages of investing in Exchange Traded Funds (ETFs) and how they may help you achieve your goals across<br />

asset classes and global markets in today’s more dynamic, diverse portfolios. ETFs trade like stocks, therefore, they can help<br />

you to adjust your portfolio nimbly and efficiently as markets shift.<br />

$100 registration fee, 50% discount for <strong>TD</strong> clients<br />

(with proof of <strong>TD</strong> access card or <strong>TD</strong> account statement).<br />

Payment will be made at the event via credit/debit card only. No cash will be accepted.