2011 - Tower Federal Credit Union

2011 - Tower Federal Credit Union

2011 - Tower Federal Credit Union

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Mid-year, we lowered our mortgage rates still further, to the lowest they’ve been in our history. This<br />

stimulated an upswing in refinancing, and the year ended with its strongest quarter ($130 million) in<br />

real estate lending.<br />

The number of closings by <strong>Tower</strong> Title Services declined about a quarter in <strong>2011</strong>, mimicking the drop<br />

in real estate lending. But the total dollar amount of the real estate it handled actually increased by<br />

2.9% to $96.8 million. Members are still taking advantage of the good value, one-stop convenience, and<br />

simplified closings that are building a solid reputation for <strong>Tower</strong> Title Services.<br />

Prime Share, Club, and Checking balances climb.<br />

As the <strong>Tower</strong> community grows in number, members are keeping more of their money right here,<br />

strengthening the credit union for everyone. This strong deposit growth allows us to respond to your<br />

financial needs at each stage of life, at the best possible rates.<br />

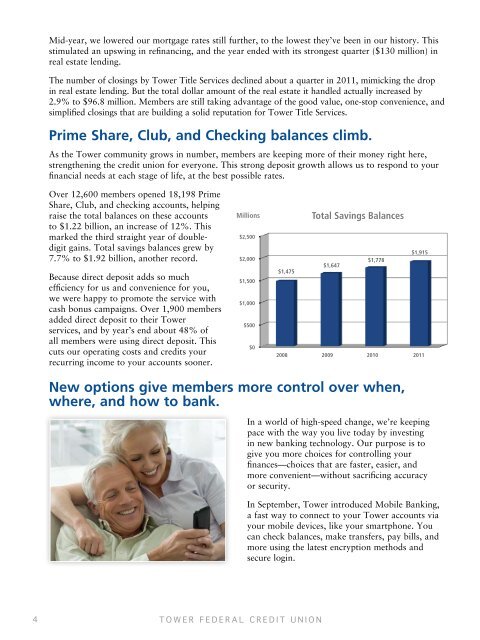

Over 12,600 members opened 18,198 Prime<br />

Share, Club, and checking accounts, helping<br />

raise the total balances on these accounts<br />

to $1.22 billion, an increase of 12%. This<br />

marked the third straight year of doubledigit<br />

gains. Total savings balances grew by<br />

7.7% to $1.92 billion, another record.<br />

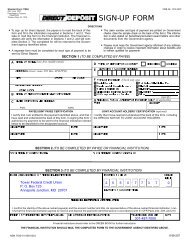

Because direct deposit adds so much<br />

efficiency for us and convenience for you,<br />

we were happy to promote the service with<br />

cash bonus campaigns. Over 1,900 members<br />

added direct deposit to their <strong>Tower</strong><br />

services, and by year’s end about 48% of<br />

all members were using direct deposit. This<br />

cuts our operating costs and credits your<br />

recurring income to your accounts sooner.<br />

Millions<br />

$2,500<br />

$2,000<br />

$1,500<br />

$1,000<br />

$500<br />

$0<br />

Total Savings Balances<br />

$1,915<br />

$1,778<br />

$1,647<br />

$1,475<br />

2008 2009 2010 <strong>2011</strong><br />

New options give members more control over when,<br />

where, and how to bank.<br />

In a world of high-speed change, we’re keeping<br />

pace with the way you live today by investing<br />

in new banking technology. Our purpose is to<br />

give you more choices for controlling your<br />

finances—choices that are faster, easier, and<br />

more convenient—without sacrificing accuracy<br />

or security.<br />

In September, <strong>Tower</strong> introduced Mobile Banking,<br />

a fast way to connect to your <strong>Tower</strong> accounts via<br />

your mobile devices, like your smartphone. You<br />

can check balances, make transfers, pay bills, and<br />

more using the latest encryption methods and<br />

secure login.<br />

4<br />

TOWER FEDERAL CREDIT UNION