July 2013 - Tower Federal Credit Union

July 2013 - Tower Federal Credit Union

July 2013 - Tower Federal Credit Union

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INSIDE: FREE checking p.3 | A timeline of <strong>Tower</strong>’s history p.4-5 | Scholarship winners p.7<br />

<strong>Tower</strong> <strong>Federal</strong> <strong>Credit</strong> <strong>Union</strong> • <strong>July</strong> <strong>2013</strong><br />

60 th<br />

th<br />

ANNIVERSARY<br />

<strong>Tower</strong>LineISSUE<br />

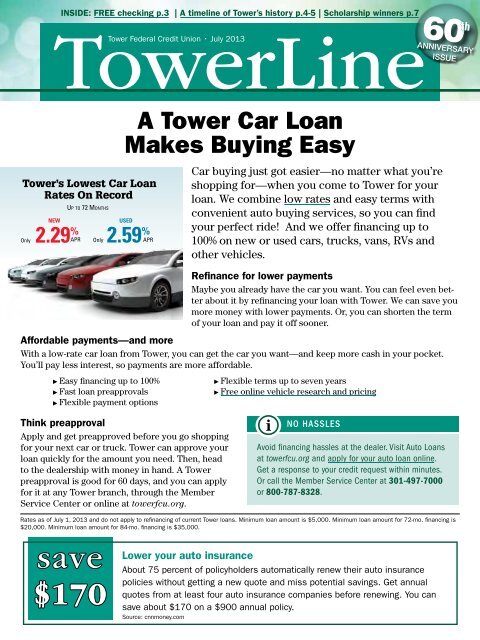

<strong>Tower</strong>’s Lowest Car Loan<br />

Rates On Record<br />

Only<br />

NEW<br />

2.29 % APR<br />

Up to 72 MonthsUSED<br />

Only<br />

A <strong>Tower</strong> Car Loan<br />

Makes Buying Easy<br />

Car buying just got easier—no matter what you’re<br />

shopping for—when you come to <strong>Tower</strong> for your<br />

loan. We combine low rates and easy terms with<br />

convenient auto buying services, so you can find<br />

your perfect ride! And we offer financing up to<br />

100% on new or used cars, trucks, vans, RVs and<br />

other vehicles.<br />

Refinance for lower payments<br />

Maybe you already have the car you want. You can feel even better<br />

about it by refinancing your loan with <strong>Tower</strong>. We can save you<br />

more money with lower payments. Or, you can shorten the term<br />

of your loan and pay it off sooner.<br />

Affordable payments—and more<br />

With a low-rate car loan from <strong>Tower</strong>, you can get the car you want—and keep more cash in your pocket.<br />

You’ll pay less interest, so payments are more affordable.<br />

Easy financing up to 100%<br />

Fast loan preapprovals<br />

Flexible payment options<br />

Think preapproval<br />

Apply and get preapproved before you go shopping<br />

for your next car or truck. <strong>Tower</strong> can approve your<br />

loan quickly for the amount you need. Then, head<br />

to the dealership with money in hand. A <strong>Tower</strong><br />

preapproval is good for 60 days, and you can apply<br />

for it at any <strong>Tower</strong> branch, through the Member<br />

Service Center or online at towerfcu.org.<br />

Flexible terms up to seven years<br />

Free online vehicle research and pricing<br />

Avoid financing hassles at the dealer. Visit Auto Loans<br />

at towerfcu.org and apply for your auto loan online.<br />

Get a response to your credit request within minutes.<br />

Or call the Member Service Center at 301-497-7000<br />

or 800-787-8328.<br />

Rates as of <strong>July</strong> 1, <strong>2013</strong> and do not apply to refinancing of current <strong>Tower</strong> loans. Minimum loan amount is $5,000. Minimum loan amount for 72-mo. financing is<br />

$20,000. Minimum loan amount for 84-mo. financing is $35,000.<br />

save<br />

$170<br />

USED<br />

2.59 % APR<br />

i<br />

NO HASSLES<br />

Lower your auto insurance<br />

About 75 percent of policyholders automatically renew their auto insurance<br />

policies without getting a new quote and miss potential savings. Get annual<br />

quotes from at least four auto insurance companies before renewing. You can<br />

save about $170 on a $900 annual policy.<br />

Source: cnnmoney.com

Message from Your Chairman<br />

T<br />

his year <strong>Tower</strong> celebrates its 60th Anniversary. In this special issue, you will find<br />

historical notes and milestones—and comments from a few long-time members—<br />

about our founding and continuous growth to become a nationally recognized leader in<br />

the credit union industry. Here’s a brief look at each decade.<br />

George M. Cumberledge<br />

Member, 1971<br />

We started small with a mission to serve the financial needs of<br />

employees of the newly formed National Security Agency. By the end<br />

of 1953, a group of seven turned $35 into assets of $34,200, granted 183<br />

loans, and built a membership of 978.<br />

By 1963, <strong>Tower</strong> celebrated its first decade with $1.5 million in assets<br />

(ranked in the top 7% of credit unions), almost the same amount in loans,<br />

and nearly 6,000 members. New offerings that year included the College<br />

Tuition Program and transactions by mail for deposits and payments.<br />

A decade later, the Board of Directors authorized special loan promotions,<br />

“to make membership aware of the convenience and advantages<br />

of borrowing from your <strong>Credit</strong> <strong>Union</strong>”. Membership tripled to 19,500<br />

with almost $25 million in loans and $31 million in assets. Another first<br />

in 1973 was “hiding” account numbers in the newsletter with $5 to winners.<br />

In honor of our 60th Anniversary, look for your hidden account<br />

number for $60 to each winner.<br />

By the end of <strong>Tower</strong>’s third decade, we had moved to our own twostory<br />

Headquarters Building, opened three other offices, introduced<br />

MasterCards ® and our first ATM— giving members greater access to<br />

their accounts— and improved the efficiency of teller services with the<br />

installation of modular terminals. In 1983, the credit union experienced<br />

one of its strongest asset growths in 30 years, and a big growth in its<br />

loan portfolio as well. Total assets were $184 million, loans $116 million<br />

and membership just over 56,200.<br />

Ten years later, <strong>Tower</strong> introduced many new products in response<br />

to member needs: New 4- and 5-year Mini-Jumbo and Bump-Up Share<br />

Certificates and IRAs gave members increased investing versatility;<br />

reduced rates and enhanced terms for auto loans; a convertible adjustable-rate<br />

mortgage made it easier for members to finance their homes;<br />

and home equity loans boosted borrowing power. <strong>Tower</strong> ended 1993<br />

with 89,400 members, $614 million in assets and $430 million in loans.<br />

The year 2003 marked <strong>Tower</strong>’s 50th Anniversary, and it was our<br />

most successful year since we were established. <strong>Tower</strong> grew in membership,<br />

broke records in loan volume, delivered new products and<br />

services online— almost one-third of the membership were active<br />

Home Banking users— and expanded the branch network. In the 10<br />

years prior, <strong>Tower</strong> had become a $1 billion financial institution, with<br />

over 100,000 members, added a debit card, launched a Web site and<br />

joined a nationwide network of ATMs.<br />

Over the last 10 years, <strong>Tower</strong> has doubled in assets to over $2.6 billion<br />

with 131,000 members worldwide, and a branch network throughout<br />

central Maryland. <strong>Tower</strong> is recognized as a leader for its real estate<br />

leading program, use of technology in Mobile Banking, financial education<br />

offerings, and public advocacy on credit union regional and national<br />

issues. Thank you for being part of the journey.<br />

2 <strong>Tower</strong>Line | july <strong>2013</strong> | towerfcu.org

Save on <strong>Credit</strong> Card Interest<br />

4.99% APR Balance Transfer Special<br />

Every week your mailbox is stuffed with “teaser<br />

rate” credit card offers that appear to be great. Be<br />

careful. People are tricked every day. They transfer<br />

a balance to take advantage of a super low introductory<br />

rate, but miss the fine print and are stuck with<br />

high interest rates after a few short months, plus<br />

fees for everything.<br />

A full year to pay at 4.99%<br />

If you carry a balance on one or more credit cards<br />

with other companies, <strong>Tower</strong> has a special deal that<br />

is great. Move those balances to a <strong>Tower</strong> Master-<br />

Card ® for our special 4.99% APR balance transfer<br />

rate. This special rate is good for 12 months from<br />

the date the transfer posts to your <strong>Tower</strong> Master-<br />

Card, giving you breathing room to pay down your<br />

balance and save money.<br />

Bonus! Along with a low 4.99% APR balance<br />

transfer rate, <strong>Tower</strong> has no transfer fee when you<br />

move balances to a <strong>Tower</strong> MasterCard. Other credit<br />

card issuers charge a 3% to 5% fee on the amount<br />

you transfer. Think about it—that’s a $30 to $50 fee<br />

for every $1,000 you transfer!<br />

Earn cash rewards with a Gold Card<br />

When you switch to a <strong>Tower</strong> Gold Card, you’ll<br />

receive a 1% rebate on every purchase you make, automatically<br />

credited each month to your credit card<br />

account balance. That’s cash back on everything you<br />

buy. There are no annual or nuisance fees. No limits.<br />

No restrictions. Just cash rewards every month.<br />

i<br />

LOWER YOUR RATE<br />

Apply now for a <strong>Tower</strong> MasterCard and transfer your<br />

high-rate balances at towerfcu.org. If you already have<br />

a <strong>Tower</strong> credit card, go online to Forms and select<br />

<strong>Credit</strong> Card Balance Transfer.<br />

Switch to <strong>Tower</strong> FREE Checking<br />

Free since 1977, still pays dividends<br />

Of the 50 largest credit unions in the nation, <strong>Tower</strong><br />

is one of only 36 that still offers FREE checking, according<br />

to a recent survey by Bankrate.com. <strong>Tower</strong><br />

has offered FREE checking since 1977. There is no<br />

monthly fee or service charge, no additional requirements<br />

or hoops to jump through.<br />

Among the top 50 credit unions, the average<br />

minimum to open a checking account is $22. <strong>Tower</strong><br />

FREE checking requires only a $10 minimum<br />

deposit. There is no minimum balance requirement<br />

after your initial deposit.<br />

And, just as we have for over three decades, <strong>Tower</strong><br />

still pays dividends on every dollar. In fact, of the 50<br />

credit unions in the Bankrate survey, <strong>Tower</strong> is one of<br />

only 18 that still pays dividends on FREE checking.<br />

Make the smart switch<br />

FREE MasterCard ® debit card that earns you cash<br />

back with Debit Rewards<br />

FREE overdraft protection †<br />

FREE Mobile App and Mobile Deposit *<br />

FREE transactions at over 40,000 surcharge-free<br />

ATMs nationwide §<br />

FREE Home Banking and online statements<br />

FREE online Bill Payment when you pay three or<br />

more bills per month<br />

FREE checks with FREE direct deposit<br />

It’s easy to get started<br />

Just go to towerfcu.org and click Switch Kit. The kit<br />

has everything you need to open your new <strong>Tower</strong><br />

FREE checking account, close your old one, set up direct<br />

deposit and change your automatic withdrawals.<br />

For help making the switch, visit a branch or call<br />

the Member Service Center at 301-497-7000 or<br />

800-787-8328.<br />

†<br />

<strong>Federal</strong> regulations limit the total number of electronic transfers from any<br />

non-transactional account—Prime Share (savings), Clubs, or Money Market—<br />

to six (6) per account per month. This includes overdraft transfers, online<br />

Cross Member Transfers and Funds Transfer, and cleared checks from a<br />

Money Market account. You can make an unlimited number of transfers and<br />

withdrawals through the mail, at an ATM, and in person at a branch. Transfers<br />

made to a <strong>Tower</strong> loan account are not included in the limitation of six per<br />

account per month.<br />

*<br />

Your carrier’s message and data rates may apply. Members must be 18 years<br />

of age to qualify to make mobile deposits. Other mobile deposit restrictions<br />

may apply.<br />

§<br />

<strong>Tower</strong>-owned ATMs are totally free. At surcharge-free ATMs, your first four<br />

transactions each month are free. Each additional transaction is only $1.<br />

towerfcu.org | july <strong>2013</strong> | <strong>Tower</strong>Line 3

1953<br />

<strong>2013</strong><br />

to<br />

O<br />

Happy An<br />

<strong>Tower</strong> <strong>Federal</strong><br />

n February 3, 1953, seven National Security Agency employees with<br />

vision and hope contributed $5 each to found Arlington Hall <strong>Federal</strong> <strong>Credit</strong><br />

<strong>Union</strong>—now called <strong>Tower</strong> <strong>Federal</strong> <strong>Credit</strong> <strong>Union</strong>. As word caught on, <strong>Tower</strong>’s membership grew to<br />

978 by year’s end. Today, <strong>Tower</strong> serves over 131,000 members worldwide. From beginning assets<br />

of $35, <strong>Tower</strong> is now a $2.6 billion financial institution, the largest federal credit union in Maryland.<br />

From a one, small office operation, <strong>Tower</strong> now has 18 branches throughout Anne Arundel, Baltimore,<br />

Howard and Prince George’s counties.<br />

Looking back, we have grown because of the trust and faith our members—both past and present—<br />

have placed in us. Here is a glimpse of some of <strong>Tower</strong>’s major milestones over the past six decades,<br />

along with remembrances from some of our long-time members and the year they joined.<br />

“Starting <strong>Tower</strong> was difficult. We met in the cafeteria. The biggest problem was we had more [members]<br />

who wanted loans, than those who deposited [money]…The Office of Personnel showed us how to manage.<br />

This enabled us to hire the first manager. We took off from there….<strong>Tower</strong> enabled me to buy my first car,<br />

and also to purchase the first car for my son.” Everard Hughes, Founding Member<br />

<strong>Tower</strong> grew from one part-time employee in 1953 to over 460 today. Our expansion and growth meant relocation—from<br />

a small office at newly-formed NSA at Ft. Meade in Md. to a new two-story Headquarters Building<br />

by 1975 (later named Judith A. Burgin Memorial Building, after a former <strong>Tower</strong> Manager)—to our current<br />

<strong>Tower</strong> Headquarters in nearby Laurel in 1990.<br />

“In the summer of 1957, I was a G.I. at Arlington Hall Station, Va. I wanted to get married and move off post<br />

with my wife. A co-worker suggested I [join] the credit union and borrow $200 for expenses. So, I have been<br />

a <strong>Tower</strong> member as long as I’ve been married—54 years.” Lawrence Kroger, 1957<br />

As our sponsoring agency personnel grew, so did <strong>Tower</strong>’s membership, reaching 50,000 by 1982, and <strong>Tower</strong><br />

branches to five. Growing family members raised the need for community branches. The Millersville branch<br />

opened in summer of 1989, followed by 12 others. Now, 24 years later, we have 18 branches and members<br />

number over 131,000 worldwide.<br />

“[<strong>Tower</strong>] helped pay for my honeymoon trip in 1953. I was able to buy several cars through <strong>Tower</strong>. <strong>Tower</strong><br />

has always been there when I needed a loan. In 1985, <strong>Tower</strong> helped with my daughter’s wedding expenses…<br />

Thank you <strong>Tower</strong>.” Anthony Grabenstein, 1958<br />

1953<br />

Arlington Hall<br />

<strong>Federal</strong> <strong>Credit</strong><br />

<strong>Union</strong> founded<br />

1962<br />

First $1M in assets<br />

5,300 members<br />

1970<br />

Monthly statements<br />

introduced<br />

1978<br />

$100M in assets<br />

37,900 members<br />

1983<br />

First ATM installed<br />

1955<br />

First newsletter<br />

<strong>Credit</strong> <strong>Union</strong><br />

News Flash<br />

4 <strong>Tower</strong>Line | july <strong>2013</strong> | towerfcu.org<br />

1966<br />

Name changed<br />

to <strong>Tower</strong> <strong>Federal</strong><br />

<strong>Credit</strong> <strong>Union</strong><br />

1977<br />

Offers free<br />

Checking<br />

1982<br />

50,000 th<br />

member joins<br />

1985<br />

<strong>Tower</strong> Talk 24<br />

begins

niversary<br />

<strong>Credit</strong> <strong>Union</strong><br />

60 th<br />

<strong>Tower</strong> changed by-laws in 1970 to reflect “once a member, always a member” lifetime membership. Efforts<br />

to expand led <strong>Tower</strong> employees to rally in 1998 on Capital Hill in support of the <strong>Credit</strong> <strong>Union</strong> Membership<br />

Access Act, allowing credit unions to extend membership to groups beyond their single sponsor.<br />

We introduced free checking accounts in 1977, the convenience of direct deposit and the investing power<br />

of Share Certificates a year later, and Money Market accounts by the end of the decade. Home equity loans<br />

were helping members by the mid 70s and <strong>Tower</strong> was an early credit union leader with a 30-year mortgage<br />

program by the mid 80s. MasterCard® credit cards premiered in 1983, and Gold Card rebate savings began<br />

10 years later.<br />

We installed an “online real-time”computer system in 1970 and converted to our own in-house data processing<br />

center in 1980. The first <strong>Tower</strong> ATM was put into service in 1983 and <strong>Tower</strong> Talk 24 phone automation<br />

two years later. With the technology boom of the 90s, we launched towerfcu.org in 1997 and quickly<br />

advanced our online offerings of eServices—Home Banking, eStatements, Bill Payment, Funds Transfer,<br />

online applications and forms, Mobile Banking and Mobile Deposit—in only 15 years.<br />

th<br />

ANNIVERSARY<br />

ISSUE<br />

“When I decided I wanted to buy my own car and went down to <strong>Tower</strong> to borrow<br />

money, I had some feminist fire in my eye and was all set to resist any suggestions that my husband<br />

co-sign or any other such requirements. The <strong>Tower</strong> loan officer left me marooned on my dudgeon by not<br />

asking any such questions and immediately granted the loan.” Betty (Mavis) Fletcher, 1955<br />

“I came to work at Arlington Hall in May 1957. I joined <strong>Tower</strong> almost immediately and have profited from<br />

its services ever since. <strong>Tower</strong> has been the source of auto loans [and] mortgage loans over the years as<br />

well as a good place to save money and bank. Good rates and friendly service.” Edwin (Sandy) Jordan, 1958<br />

“In 1988, I moved 2,000 miles to Utah...all my banking needs were completely taken care of by <strong>Tower</strong>. I<br />

now live in Virginia, about 100 miles from <strong>Tower</strong> and my wife and several children have <strong>Tower</strong> accounts.<br />

Anything we have need of, including transferring money....is taken care of by a telephone call to either<br />

<strong>Tower</strong> Talk 24 or the Member Service Center.” William Bonin Moore, 1957<br />

“<strong>Tower</strong> has helped [us] with the purchase of three homes and college education of two children…I am<br />

thankful for the dedicated foresighted leaders who have made the credit union successful. I no doubt have<br />

saved thousands in fees and interest.” Brice Turner, 1958<br />

1987<br />

Becomes largest<br />

federal credit<br />

union in Md.<br />

1997<br />

towerfcu.org<br />

goes live<br />

2001<br />

Home Banking<br />

begins<br />

2005<br />

Remote Teller<br />

Stations installed<br />

<strong>2013</strong><br />

Merger with USCG<br />

Community <strong>Credit</strong> <strong>Union</strong><br />

$2.6B in assets<br />

131,000 members<br />

1996<br />

Member Service<br />

Center created<br />

1998<br />

100,000 th<br />

member joins<br />

2002<br />

$1B in assets<br />

110,000 members<br />

2009<br />

One of the 50 largest<br />

credit unions in U.S.

WebNotes<br />

towerfcu.org<br />

Stronger online protection<br />

<strong>Tower</strong> is increasing SafeLog security in Home<br />

Banking to make it safer for you to monitor<br />

and manage your money online. SafeLog helps<br />

prevent unauthorized persons from unauthorized<br />

computers from gaining access to your<br />

accounts.<br />

With the emergence of social media, personal<br />

information has become one zero eight seven seven seven readily available. Therefore, to<br />

make SafeLog stronger and more secure, <strong>Tower</strong> will be removing challenge questions as a<br />

sign-in option.<br />

SafeLog now uses a one-time access code, which you must register for in advance to receive.<br />

<strong>Tower</strong> will send you an access code in the future only if we need to confirm your identity when<br />

you login to Home Banking from a new computer or a computer you do not normally use.<br />

We recommend you include in your SafeLog contact information at least two current phone<br />

numbers, in addition to your current e-mail address. If your information is already current,<br />

you will not need to take any action. To update or add to your contact information, visit<br />

towerfcu.org, login to Home Banking, go to User Options and select SafeLog.<br />

Online bill paying made simple<br />

When it comes to paying bills online, you can spend time signing up at each of your biller’s<br />

Web sites. Or you can save time by paying all of your bills at one place with <strong>Tower</strong>’s convenient,<br />

secure Bill Payment.<br />

<strong>Tower</strong>’s Bill Payment gives you an easy way to keep<br />

track of your payments—no jumping from site to<br />

site and remembering one six three six nine seven<br />

several user names and passwords. It makes paying<br />

bills hassle-free and saves you money.<br />

There are no stamps to buy, checks to write or envelopes<br />

to lick, so you can spend less time paying bills<br />

and more time for you. Plus, Bill Payment is FREE<br />

when you pay three or more bills each month.<br />

Bill Payment is ready whenever you are, 24 hours a<br />

day, seven days a week. Another way to save time is<br />

by scheduling payments up to 12 months in advance<br />

so your bills are paid even when you’re away on<br />

vacation or business.<br />

To sign up for <strong>Tower</strong>’s FREE Bill Payment today, visit<br />

towerfcu.org, login to Home Banking and go to Payment<br />

Manager.<br />

Planning & Investing<br />

Travel Tips<br />

<strong>Tower</strong> in the News<br />

ATMs/Branches<br />

Home<br />

Refinance Loan<br />

6 <strong>Tower</strong>Line | july <strong>2013</strong> | towerfcu.org

Welcome to <strong>Tower</strong>!<br />

The merger with the U.S. Coast Guard<br />

Community <strong>Credit</strong> <strong>Union</strong> is complete.<br />

We welcome to <strong>Tower</strong>’s family the over<br />

4,000 former USCGCCU members who<br />

automatically became <strong>Tower</strong> members<br />

as a result of the successful merger.<br />

Along with a boost in membership, the<br />

merger expanded <strong>Tower</strong>’s branch locations.<br />

We look forward to meeting the<br />

financial needs of our new Coast Guard<br />

members, both today and in the years<br />

to come.<br />

FREE Seminar for Caregivers<br />

Are you caring for an elderly parent or<br />

family member, or think that you may<br />

in the near future? Join us for a FREE<br />

seminar, Role Reversal: Your Aging<br />

Parents and You, presented by a Certified<br />

Financial Planner professional<br />

from <strong>Tower</strong> Financial Services.<br />

Hear an overview of critical factors you<br />

may need to consider when faced with<br />

the difficult challenge of caring for an<br />

aging parent or family member. Learn<br />

how to initiate dialogue with parents<br />

and devise a legacy plan. Discuss legal<br />

issues including living wills, medical directives,<br />

estate plans, taxes, and power<br />

of attorney. Learn about housing and<br />

healthcare options and costs.<br />

The seminar will take place on Thursday,<br />

<strong>July</strong> 18 at 6:30 p.m. at <strong>Tower</strong>’s<br />

Arundel Mills branch. Refreshments<br />

will be served.<br />

Space is limited. To reserve a seat, call<br />

<strong>Tower</strong> Financial Services at 301-497-<br />

7062 or 800-787-8328, ext. 7062 or<br />

register online at towerfcu.org. Go to<br />

Planning & Investing, FREE Financial<br />

Seminars.<br />

Securities and Financial Planning offered<br />

through LPL Financial, a Registered Investment<br />

Advisor, Member FINRA/SIPC. Insurance<br />

products offered through LPL Financial or its<br />

licensed affiliates. <strong>Tower</strong> <strong>Federal</strong> <strong>Credit</strong> <strong>Union</strong><br />

and <strong>Tower</strong> Financial Services are not registered<br />

broker dealers nor affiliated with LPL Financial.<br />

Not NCUA Insured No <strong>Credit</strong> <strong>Union</strong> Guarantee May Lose Value<br />

<strong>Tower</strong> Members Winners Again<br />

Each year, young college-bound<br />

credit union members from Maryland<br />

and Washington, D.C. enter to win a<br />

$1,000 scholarship in an essay and<br />

video competition sponsored by the<br />

two one seven seven six zero <strong>Credit</strong><br />

<strong>Union</strong> Foundation of MD & D.C. We<br />

are delighted that two of the 11 winners<br />

of this year’s competition are <strong>Tower</strong><br />

members.<br />

Congratulations to Kathleen Hupfeld<br />

and Connor Gilbert! Of the 319 entries,<br />

40 <strong>Tower</strong> members submitted essays—<br />

the highest number of member participation<br />

from one credit union.<br />

Get Cash on the Go<br />

When you’re traveling this summer,<br />

get cash fast and easy at over 40,000<br />

surcharge-free ATMs nationwide. Just<br />

look for the CO-OP Network, CU24 CU<br />

HERE, or MoneyPass logo displayed on<br />

the ATM (see logos on back page). Get<br />

cash, check your account balance, or<br />

transfer money between your <strong>Tower</strong><br />

accounts…all on the go.<br />

Fee-free ATMs are conveniently located<br />

at participating credit unions, as well<br />

as in many shopping centers, grocery<br />

stores, airports, five seven eight one<br />

two movie theaters, gas stations, and<br />

at most 7-Eleven stores and Costco<br />

warehouses. Your first four transactions<br />

each month are free. Each additional<br />

transaction is only $1.<br />

To find a surcharge-free ATM at or<br />

near your travel destination, visit<br />

towerfcu.org on your PC or mobile<br />

device and select ATMs/Branches. Or,<br />

select Locations using <strong>Tower</strong>’s Mobile<br />

App on your smartphone or tablet. Get<br />

fast and easy access to ATM addresses,<br />

maps and driving directions.<br />

Mobile ATM locator services and Mobile App are<br />

free to all <strong>Tower</strong> members. Your mobile carrier’s<br />

Internet access rates may apply.<br />

Summer Food Drive<br />

Help those less fortunate in our community<br />

this summer. Now through<br />

the end of August, <strong>Tower</strong> is collecting<br />

non-perishable food items for Elizabeth<br />

House, a local soup kitchen. Drop your<br />

donations off at any <strong>Tower</strong> branch.<br />

For branch locations and hours, visit<br />

towerfcu.org and select ATMs/Branches.<br />

Win $60 !<br />

Do you see your account number hidden<br />

in this issue of <strong>Tower</strong>Line? If so,<br />

contact us! In honor of <strong>Tower</strong>’s 60th<br />

anniversary, we will deposit $60 to your<br />

Prime Share account. Good luck!<br />

January 2001<br />

<strong>Tower</strong> introduces<br />

Home Banking<br />

60,639<br />

<strong>Tower</strong> members using<br />

Home Banking today<br />

<strong>July</strong> 2001<br />

<strong>Tower</strong> introduces<br />

online Bill Payment<br />

23,050<br />

<strong>Tower</strong> members signed up<br />

for Bill Payment today<br />

towerfcu.org | july <strong>2013</strong> | <strong>Tower</strong>Line 7

Calendar of Events<br />

JULY<br />

1<br />

JULY<br />

<strong>2013</strong><br />

JULY<br />

4<br />

JULY<br />

18<br />

USCG Community <strong>Credit</strong> <strong>Union</strong><br />

Merger Complete<br />

Elizabeth House Food Drive<br />

<strong>July</strong> 1 – August 31<br />

Holiday Closing<br />

Independence Day<br />

Free Financial Seminar<br />

Role Reversal: Your Aging Parents & You<br />

6:30 p.m.<br />

Arundel Mills Branch<br />

cyberSafety<br />

Cyber crooks seem to come up with new online<br />

scams daily. It’s hard to keep up with all of the<br />

schemes and malware, especially since some of the<br />

e-mails can look like the real deal. However, there<br />

are some common signs to look out for that can<br />

help you recognize fraudulent e-mails. For instance,<br />

be wary of e-mails with hundreds of addresses in<br />

the recipient field, especially if the message text<br />

seems to be directed toward only one person.<br />

Be especially careful about links within an e-mail,<br />

especially if the link is the only content in the body<br />

of the e-mail, or the links are shortened and don’t<br />

show the actual URL address. Another red flag is<br />

e-mail text in ALL CAPS, or if the content states an<br />

urgent or emergency need. If an e-mail claims it’s<br />

a matter of life or death, the sender wouldn’t be<br />

targeting a stranger for help. Be wary of e-mails<br />

from unrecognizable addresses or senders, ones<br />

with no subject line, and e-mails full of grammatical<br />

errors and typos.<br />

Contact Information<br />

7901 Sandy Spring Road, Laurel, MD 20707-3589<br />

301-497-7000 | 800-787-8328<br />

<strong>Tower</strong> Talk 24 301-498-TT24 | 800-787-TT24<br />

towerfcu.org<br />

Community Branches<br />

Annapolis<br />

2525 Riva Rd., Annapolis<br />

Arundel Mills<br />

7065 Arundel Mills Circle, Hanover<br />

Clarksville<br />

6030 Daybreak Circle, Clarksville<br />

Columbia<br />

9021 Snowden Square Dr., Columbia<br />

Curtis Bay<br />

2415 Hawkins Point Rd., Baltimore<br />

Ellicott City<br />

9150-12 Baltimore National Pike, Ellicott City<br />

Gambrills<br />

1077 Route 3 North, Gambrills<br />

Laurel (<strong>Tower</strong> Headquarters)<br />

7901 Sandy Spring Rd., Laurel<br />

Millersville<br />

699 Old Mill Rd., Millersville<br />

National Business Park (NBP)<br />

300 Sentinel Dr., Annapolis Junction<br />

Owings Mills<br />

9207 Lakeside Blvd., Owings Mills<br />

Pasadena<br />

8146 Ritchie Hwy., Pasadena<br />

8585 Fort Smallwood Rd., Pasadena<br />

Over 40,000 Surcharge-Free ATMs<br />

Look for these logos<br />

Did You Know<br />

?<br />

<strong>Tower</strong>’s branches in Ellicott City, Gambrills<br />

and Pasadena were among the first financial<br />

institutions in Maryland to use Remote<br />

Teller Stations. In 2005, WMAR-TV News in<br />

Baltimore even did a feature story on <strong>Tower</strong>’s<br />

new state-of-the-art teller technology.<br />

Find ATM locations and driving directions at towerfcu.org<br />

#07TCU090000 (07/13)