Print-Friendly - Singapore Customs

Print-Friendly - Singapore Customs

Print-Friendly - Singapore Customs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Budget Day Inspection<br />

It was announced in Budget 2013 that the tax rates of non-cigarette tobacco products would be<br />

increased, to harmonise the rates with that of cigarettes.<br />

On the afternoon of Budget Day on 25 February, about 100 <strong>Singapore</strong> <strong>Customs</strong> officers were mobilised to conduct<br />

inspections on goods affected by the change and ensure that the correct amount of duties and Goods and<br />

Services Tax (GST) was applied to them.<br />

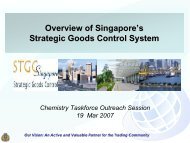

Advancing Trade through Supply<br />

Chain Security<br />

The excise duties for Beedies, Ang Hoon and smokeless tobacco were increased by 25%, from $239 per<br />

kilogramme to $299 per kilogramme. For unmanufactured tobacco, the excise duties were increased by 1.5%, from<br />

$347 per kilogramme to $352 per kilogramme.<br />

All Set for AED<br />

How Infineon Technologies Prepares<br />

for AED<br />

Nab that Illegal Cigarette Peddler!<br />

In Pursuit of Excellence<br />

Budget Day Inspection<br />

Duo Fined $1.02M Each for Under-<br />

Declaring Values and Furnishing Money<br />

for the Purchase of 34 Imported Cars<br />

Facilitating FTA Goods in Transit<br />

Sharing <strong>Customs</strong> Expertise with<br />

ASEAN Counterparts<br />

Innovating for <strong>Customs</strong> Progress<br />

<strong>Singapore</strong> <strong>Customs</strong> at Safety & Security<br />

Asia 2013<br />

Training Calendar<br />

Officers verified the stock balance of affected non-cigarette tobacco goods such as loose tobacco leaves or Ang<br />

Hoon (left), and Beedies, a type of Indian cigarettes (right), held in the licensed warehouses against <strong>Singapore</strong><br />

<strong>Customs</strong>' records.<br />

The checks ensured that duty-paid non-cigarette tobacco goods were accounted for and have been removed from<br />

the licensed area of the licensed warehouses. If the affected goods are still stored in the licensed areas, the<br />

revised duty rates will be applied to these goods.<br />

A Licensed Warehouse is a designated area approved and licensed by <strong>Singapore</strong> <strong>Customs</strong> for storing imported<br />

dutiable goods, namely liquors, tobacco products, motor vehicles and petroleum, with the duty and GST payable<br />

suspended.<br />

About 100 <strong>Singapore</strong> <strong>Customs</strong> officers went to 27 selected licensed warehouses to conduct checks. In total, 200<br />

officers were on alert on Budget Day, ready to be deployed for inspection.<br />

For full details on the tariff changes, refer to Circular 02/2013 on the <strong>Singapore</strong> <strong>Customs</strong> website. To find out<br />

more about this year's Budget, visit www.singaporebudget.gov.sg

Share this article <strong>Print</strong>-<strong>Friendly</strong> Previous Article | Home | Next Article