1996 - National Treasury

1996 - National Treasury

1996 - National Treasury

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

-1.5-<br />

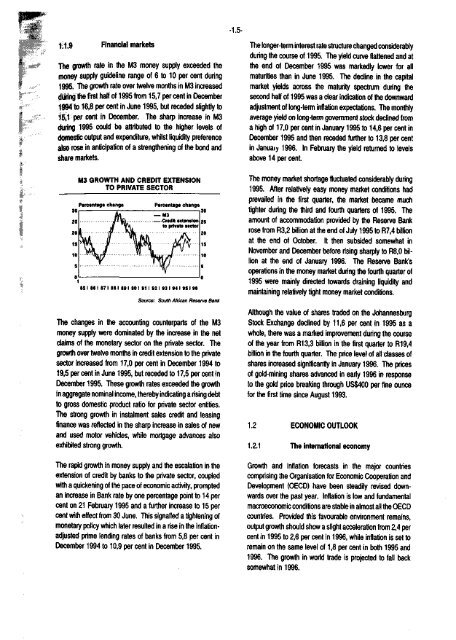

1.1.9 Financial markets<br />

The growth rate in the M3 money supply exceeded the<br />

money supply guideline range of 6 to 10 per cent during<br />

1995. The growth rate over twelve months in M3 increased<br />

during the first half of 1995 from 15,7 per cent in December<br />

1994 to 16,8 per cent in June 1995, but receded slightly to<br />

15,1 per cent in December. The sharp increase in M3<br />

during 1995 could be attributed to the higher levels of<br />

domestic output and expenditure, whilst liquidity preference<br />

also rose in anticipation of a strengthening of the bond and<br />

share markets.<br />

M3 GROWTH AND CREDIT EXTENSION<br />

TO PRIVATE SECTOR<br />

Percentage change<br />

Percentage change<br />

15 I 86 I »7 I 88 I 89 I 90 I 91 I 92 I 93 I 94 I 951 98<br />

Source: South African Reserve Bank<br />

The changes in the accounting counterparts of the M3<br />

money supply were dominated by the increase in the net<br />

claims of the monetary sector on the private sector. The<br />

growth over twelve months in credit extension to the private<br />

sector increased from 17,0 per cent in December 1994 to<br />

19,5 per cent in June 1995, but receded to 17,5 per cent in<br />

December 1995. These growth rates exceeded the growth<br />

in aggregate nominal income, thereby indicating a rising debt<br />

to gross domestic product ratio for private sector entities.<br />

The strong growth in instalment sales credit and leasing<br />

finance was reflected in the sharp increase in sales of new<br />

and used motor vehicles, while mortgage advances also<br />

exhibited strong growth.<br />

The rapid growth in money supply and the escalation in the<br />

extension of credit by banks to the private sector, coupled<br />

with a quickening of the pace of economic activity, prompted<br />

an increase in Bank rate by one percentage point to 14 per<br />

cent on 21 February 1995 and a further increase to 15 per<br />

cent with effect from 30 June. This signalled a tightening of<br />

monetary policy which later resulted in a rise in the inflationadjusted<br />

prime lending rates of banks from 5,8 per cent in<br />

December 1994 to 10,9 per cent in December 1995.<br />

The longer-term interest rate structure changed considerably<br />

during the course of 1995. The yield curve flattened and at<br />

the end of December 1995 was markedly lower for all<br />

maturities than in June 1995. The decline in the capital<br />

market yields across the maturity spectrum during the<br />

second half of 1995 was a clear indication of the downward<br />

adjustment of long-term inflation expectations. The monthly<br />

average yield on long-term government stock declined from<br />

a high of 17,0 per cent in January 1995 to 14,6 per cent in<br />

December 1995 and then receded further to 13,8 per cent<br />

in January <strong>1996</strong>. In February the yield returned to levels<br />

above 14 per cent.<br />

The money market shortage fluctuated considerably during<br />

1995. After relatively easy money market conditions had<br />

prevailed in the first quarter, the market became much<br />

tighter during the third and fourth quarters of 1995. The<br />

amount of accommodation provided by the Reserve Bank<br />

rose from R3,2 billion at the end of July 1995 to R7,4 billion<br />

at the end of October. It then subsided somewhat in<br />

November and December before rising sharply to R8,0 billion<br />

at the end of January <strong>1996</strong>. The Reserve Bank's<br />

operations in the money market during the fourth quarter of<br />

1995 were mainly directed towards draining liquidity and<br />

maintaining relatively tight money market conditions.<br />

Although the value of shares traded on the Johannesburg<br />

Stock Exchange declined by 11,6 per cent in 1995 as a<br />

whole, there was a marked improvement during the course<br />

of the year from R13.3 billion in the first quarter to R19.4<br />

billion in the fourth quarter. The price level of all classes of<br />

shares increased significantly in January <strong>1996</strong>. The prices<br />

of gold-mining shares advanced in early <strong>1996</strong> in response<br />

to the gold price breaking through US$400 per fine ounce<br />

for the first time since August 1993.<br />

1.2 ECONOMIC OUTLOOK<br />

1.2.1 The international economy<br />

Growth and inflation forecasts in the major countries<br />

comprising the Organisation for Economic Cooperation and<br />

Development (OECD) have been steadily revised downwards<br />

over the past year. Inflation is low and fundamental<br />

macroeconomic conditions are stable in almost all the OECD<br />

countries. Provided this favourable environment remains,<br />

output growth should show a slight acceleration from 2,4 per<br />

cent in 1995 to 2,6 per cent in <strong>1996</strong>, while inflation is set to<br />

remain on the same level of 1,8 per cent in both 1995 and<br />

<strong>1996</strong>. The growth in world trade is projected to fall back<br />

somewhat in <strong>1996</strong>.