schedule of us treasury securities slgs time deposit - TreasuryDirect

schedule of us treasury securities slgs time deposit - TreasuryDirect

schedule of us treasury securities slgs time deposit - TreasuryDirect

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

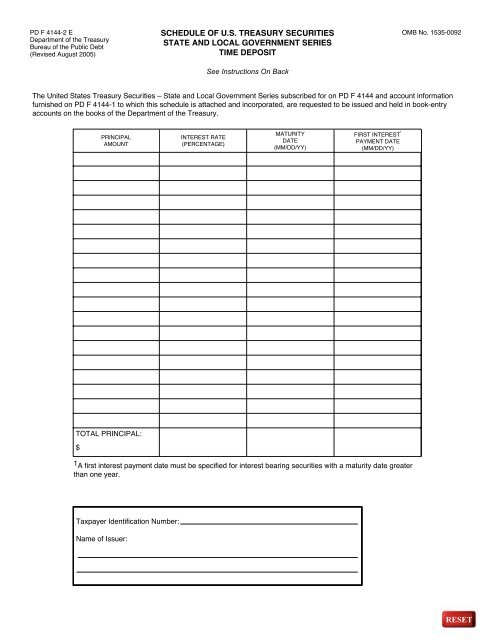

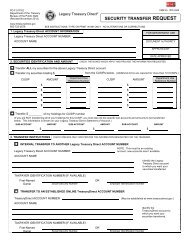

PD F 4144-2 E<br />

Department <strong>of</strong> the Treasury<br />

Bureau <strong>of</strong> the Public Debt<br />

(Revised Aug<strong>us</strong>t 2005)<br />

SCHEDULE OF U.S. TREASURY SECURITIES<br />

STATE AND LOCAL GOVERNMENT SERIES<br />

TIME DEPOSIT<br />

See Instructions On Back<br />

OMB No. 1535-0092<br />

The United States Treasury Securities – State and Local Government Series subscribed for on PD F 4144 and account information<br />

furnished on PD F 4144-1 to which this <strong>schedule</strong> is attached and incorporated, are requested to be issued and held in book-entry<br />

accounts on the books <strong>of</strong> the Department <strong>of</strong> the Treasury.<br />

PRINCIPAL<br />

AMOUNT<br />

INTEREST RATE<br />

(PERCENTAGE)<br />

MATURITY<br />

DATE<br />

(MM/DD/YY)<br />

FIRST INTEREST 1<br />

PAYMENT DATE<br />

(MM/DD/YY)<br />

TOTAL PRINCIPAL:<br />

$<br />

1 A first interest payment date m<strong>us</strong>t be specified for interest bearing <strong>securities</strong> with a maturity date greater<br />

than one year.<br />

Taxpayer Identification Number:<br />

Name <strong>of</strong> Issuer:

U.S. TREASURY SECURITIES<br />

STATE AND LOCAL GOVERNMENT SERIES<br />

TIME DEPOSIT<br />

Instructions<br />

Bureau <strong>of</strong> the Public Debt Telephone Number: (304) 480-5299<br />

Special Investments Branch Fax Number: (304) 480-5277<br />

200 Third Street Internet Address: http://www.<strong>slgs</strong>.gov<br />

PO Box 396<br />

E-Mail Address: opda-sib@bpd.treas.gov<br />

Parkersburg, WV 26106-0396 Governing Regulations: 31 CFR Part 344<br />

Principal Amount: The amount for each security m<strong>us</strong>t be at least $1,000 and in increments <strong>of</strong> $1.<br />

Interest Rate: The rate <strong>of</strong> interest on each security may not exceed the maximum interest rate for Treasury Securities <strong>of</strong> comparable<br />

terms <strong>of</strong> maturity, as shown on the Treasury Rate Table applicable to this issuance. The applicable Treasury Rate Table for this<br />

issuance is determined by the date the initial subscription is faxed, postmarked, or carrier date stamped. The Treasury Rate Table is<br />

available on our website listed above.<br />

Maturity Date:<br />

• Certificate <strong>of</strong> Indebtedness (Non-interest bearing): The maturity date specified m<strong>us</strong>t be at least<br />

fifteen days, but not greater than one year, from the date <strong>of</strong> issue.<br />

• Certificate <strong>of</strong> Indebtedness (Interest bearing): The maturity date specified m<strong>us</strong>t be at least thirty<br />

days, but not greater than one year, from the date <strong>of</strong> issue.<br />

• Note: The maturity date specified m<strong>us</strong>t be at least one year and one day, but not greater than ten<br />

years, from the date <strong>of</strong> issue.<br />

• Bond: The maturity date specified m<strong>us</strong>t be at least ten years and one day, but not greater than forty<br />

years, from the date <strong>of</strong> issue.<br />

First Interest Payment Date: The Issuer specifies the first interest payment date for all interest bearing notes and bonds. The first<br />

interest payment date m<strong>us</strong>t occur any <strong>time</strong> between thirty days and one year <strong>of</strong> the date <strong>of</strong> issue. The final interest payment date m<strong>us</strong>t<br />

coincide with the maturity date <strong>of</strong> the security.<br />

Interest Computation: Interest on a certificate <strong>of</strong> indebtedness is computed on an annual basis and is paid at maturity with the<br />

principal. Interest on a note or bond is paid semi-annually. Interest for other than a full semi-annual interest period is computed on<br />

the basis <strong>of</strong> a 365-day or 366-day year (for certificates <strong>of</strong> indebtedness) and on the basis <strong>of</strong> the exact number <strong>of</strong> days in the half-year.<br />

(for notes and bonds). See the appendix to subpart E <strong>of</strong> Part 306 <strong>of</strong> the Code <strong>of</strong> Federal Regulations for rules regarding computation<br />

<strong>of</strong> interest.<br />

NOTICE UNDER PAPERWORK REDUCTION ACT<br />

We estimate it will take you about 30 minutes to complete this form. However, you are not required to provide information requested<br />

unless a valid OMB control number is displayed on the form. Any comments or suggestions regarding this form should be sent to the<br />

Bureau <strong>of</strong> the Public Debt, Forms Management Officer, Parkersburg, WV 26106-1328.