Agricultural Godowns / Cold Storage Purpose ... - Efresh India

Agricultural Godowns / Cold Storage Purpose ... - Efresh India

Agricultural Godowns / Cold Storage Purpose ... - Efresh India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

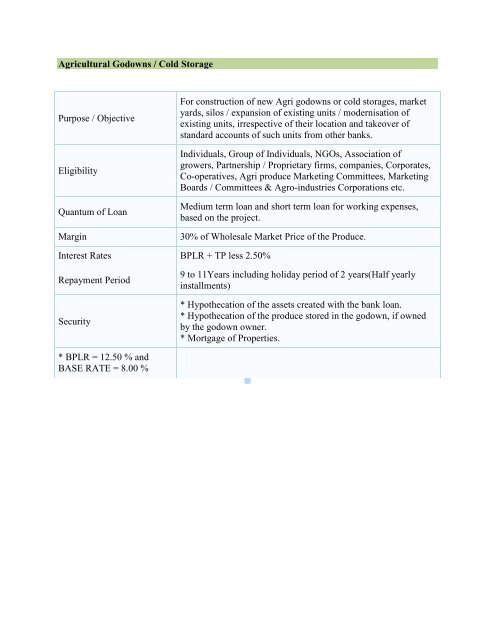

<strong>Agricultural</strong> <strong>Godowns</strong> / <strong>Cold</strong> <strong>Storage</strong><br />

<strong>Purpose</strong> / Objective<br />

Eligibility<br />

Quantum of Loan<br />

Margin<br />

For construction of new Agri godowns or cold storages, market<br />

yards, silos / expansion of existing units / modernisation of<br />

existing units, irrespective of their location and takeover of<br />

standard accounts of such units from other banks.<br />

Individuals, Group of Individuals, NGOs, Association of<br />

growers, Partnership / Proprietary firms, companies, Corporates,<br />

Co-operatives, Agri produce Marketing Committees, Marketing<br />

Boards / Committees & Agro-industries Corporations etc.<br />

Medium term loan and short term loan for working expenses,<br />

based on the project.<br />

30% of Wholesale Market Price of the Produce.<br />

Interest Rates BPLR + TP less 2.50%<br />

Repayment Period<br />

Security<br />

9 to 11Years including holiday period of 2 years(Half yearly<br />

installments)<br />

* Hypothecation of the assets created with the bank loan.<br />

* Hypothecation of the produce stored in the godown, if owned<br />

by the godown owner.<br />

* Mortgage of Properties.<br />

* BPLR = 12.50 % and<br />

BASE RATE = 8.00 %

Kisan Credit Card<br />

<strong>Purpose</strong> / Objective<br />

Eligibility<br />

Quantum of Loan<br />

Interest Rates<br />

Repayment Period<br />

Security<br />

To meet the short term credit requirements for cultivation of<br />

seasonal, annual, perennial crops.<br />

All farmers.<br />

KCC limit will be arrived based on scale of finance besides the<br />

following:-<br />

(a) Post harvest/house hold requirements of the farmer at 10% of<br />

the limit fixed subject to the max of RS.25,000/- per farmer.<br />

(b) 10% towards maintenance of farm assets subject to a<br />

maximum of Rs.25,000/- per farmer.<br />

(c) Provision for escalation in the cost of cultivation at 20%<br />

towards increase in the scale of finance of 10% per year.<br />

(d) Limit in the form of revolving credit.<br />

(e) Valid for 3 years.<br />

Amount Slab(Rs. in Lakhs) Interest Rate<br />

Upto 3.00 7%<br />

>3.00 to 5.00 BPLR + 0.50%<br />

>5.00 BPLR + 1.00%<br />

Two months from date of harvest.<br />

Hypothecation of crops/ additional security / third party<br />

guarantee.<br />

* BPLR = 12.50 % and<br />

BASE RATE = 8.00 %

Agri Clinic and Agri Business Centres<br />

<strong>Purpose</strong> / Objective<br />

Eligibility<br />

Quantum of Loan<br />

Margin<br />

* To supplement existing extension network to accelerate the<br />

process of technology transfer to agriculture.<br />

* To provide gainful employment to graduates in agriculture and<br />

allied activies.<br />

Graduates in Agriculture and Allied subjects like horticulture,<br />

animal husbandry, forestry, dairy, veterinary, poultry farming,<br />

pisciculture and other allied activities etc.<br />

* The project can be taken up whether individually or on Joint /<br />

Group basis.<br />

* The ceiling for the project cost by individual Rs.10 lakhs and<br />

for the group at Rs.50 lakhs [@ Rs.10 lakhs per member of the<br />

groups].<br />

* Upto Rs.5.00lakhs – No margin.<br />

* above Rs.5.00lakhs - 15% of the project outlay.<br />

TL-Repayment : 36 months and above :<br />

Interest Rates<br />

Repayment Period<br />

Security<br />

Subsidy<br />

Amount Slab(Rs. in Lakhs)<br />

Interest Rate<br />

0.50 to 2.00 BPLR + TP less 0.50%<br />

>2.00 to 5.00 BPLR + TP + 0.50%<br />

>5.00 BPLR + TP + 1%<br />

Loan period between 5 to 10 years including grace period of a<br />

maximum of 2 years depending on the activity. [Repayment<br />

programme will take into account of income generation,<br />

economic life of the asset etc.]<br />

* Limits upto Rs.5 lakhs - Assets created out of Bank loan.<br />

* Limits above Rs.5.00 lakhs - Assets created out of Bank loan,<br />

Third Party Guarantee, Mortgage of properties covering atleast<br />

100% of the loan exceeding Rs.2.00 lakhs.<br />

CAPITAL SUBSIDY<br />

* 25% of the Capital Cost of the project (Others).<br />

* 33.33% of the Capital Cost of the project (Borrowers belonging<br />

to SC / ST, Women / Other Disadvantaged sections / North East<br />

Region / Hill States).<br />

INTEREST SUBSIDY<br />

* For the First 2 Years, interest subsidy is available for the units

* BPLR = 12.50 % and<br />

BASE RATE = 8.00 %<br />

which are physically / financially / operationally progressing<br />

well.

Kisan Credit Card Plus<br />

<strong>Purpose</strong> / Objective<br />

Eligibility<br />

Quantum of Loan<br />

To enable the farmer to purchase farm assets based on his<br />

requirements including agri / allied activities.<br />

All farmers.<br />

20% of the maximum permissible limit (MPL) as a term loan<br />

subject to,<br />

(i)A maximum of RS.50000 where activities do not generate any<br />

direct additional income (OR)<br />

(ii)maximum of Rs.2.00 lakhs where activities generate direct<br />

additional income.<br />

For Crop Loans :<br />

Amount Slab(Rs. in Lakhs) Interest Rate<br />

Upto 3.00 7%<br />

>3.00 to 5.00 BPLR + 0.50%<br />

>5.00 BPLR + 1.00%<br />

Interest Rates<br />

For Term Loans :<br />

Amount Slab(in Lakhs) Interest Rate<br />

Upto 0.50 BPLR + TP less 1.75%<br />

>0.50 to 2.00 BPLR + TP less 0.50%<br />

>2.00 to 5.00 BPLR + TP + 0.50%<br />

>5.00 BPLR + TP + 1%<br />

Repayment Period<br />

Security<br />

3-5 years.<br />

Hypothecation of crops / additional security / third party<br />

guarantee.<br />

* BPLR = 12.50 % and<br />

BASE RATE = 8.00 %

<strong>Agricultural</strong> Jewel Loan Scheme<br />

<strong>Purpose</strong> / Objective<br />

Eligibility<br />

Quantum of Loan<br />

To meet the short term credit requirements for purchase of inputs<br />

like fertilizers, pesticides, seeds etc for carrying out e seasonal<br />

agri operations.<br />

All farmers.<br />

* Crop Loan: 60% of the value of the estimated produce or<br />

Rs.20,000/- per acre whichever is lower.<br />

* Term Loan: Maximum or Rs.15,000/- per acre. Ceiling of Rs.1<br />

lakh per acre for taking up various developmental activities like<br />

deepening of well etc.<br />

* Based on the scale of finance fixed for individual crops subject<br />

to the maximum advance value based on the net weight of jewel<br />

ornament which is now pegged at Rs.750 per gram or 70% of<br />

market value of the jewels to be pledged whichever is lower.<br />

Interest Rates<br />

Repayment Period<br />

Security<br />

Amount Slab(Rs. in<br />

Lakhs)<br />

Upto 3.00<br />

>3.00 to 5.00 BPLR + 0.50%<br />

>5.00 BPLR + 1.00%<br />

Interest Rate<br />

7%(under interest subvention scheme<br />

of GOI)<br />

Loan amount to be adjusted within 2 months from the date of<br />

harvest of the crop.<br />

Pledging of jewels.<br />

* BPLR = 12.50 % and<br />

BASE RATE = 8.00 %

<strong>Agricultural</strong> Produce Marketing Loan<br />

<strong>Purpose</strong> / Objective<br />

Eligibility<br />

Quantum of Loan<br />

Margin<br />

Repayment Period<br />

Security<br />

Other Requirements/Details<br />

* To provide finance against pledge of Warehouse receipts,<br />

godowns/cold storage receipts etc.<br />

* To avoid distress sale of agricultural produce by the farmers<br />

and enable them to get a remunerative price.<br />

All farmers who stored their produce in CWC/SWC or any<br />

authorized or approved private godowns.<br />

70% of the wholesale market price of the produce stored<br />

maximum of Rs.10.00 lakhs.<br />

30% of wholesale market prices of the produce.<br />

To be repaid within 12 months.<br />

<strong>Storage</strong> receipt issued by gown owner duly adopted by the<br />

pledge.<br />

Amount Slab(Rs. in Lakhs)<br />

Interest Rate<br />

0.50 to 2.00 BPLR less 0.50%<br />

>2.00 to 5.00 BPLR + 0.50%<br />

>5.00 BPLR + 1.00%<br />

* BPLR = 12.50 % and<br />

BASE RATE = 8.00 %

Financing Agriculturists for Purchase of Tractors<br />

<strong>Purpose</strong> / Objective<br />

Eligibility<br />

Quantum of Loan<br />

Margin<br />

Interest Rates<br />

Repayment Period<br />

Security<br />

* For mechanizing the farming activities so as to improve<br />

agricultural production / productivity.<br />

* To purchase tractors / power tiller together with necessary<br />

equipments like cultivator, tiller, mould board plough, disc<br />

harrow, cage wheel, trailer, threshers, harvesters etc.<br />

Farmer having minimum of 4 acres of irrigated land or 8 acres of<br />

dry land.<br />

Based on the quotation / invoice submitted for the vehicles and<br />

implements.<br />

a) 10%<br />

b) Can be reduced to 5% if value of collateral security is at least<br />

equal to loan amount.<br />

Amount Slab(Rs. in Lakhs)<br />

Interest Rate<br />

0.50 to 2.00 BPLR + TP less 0.75%<br />

>2.00 to 5.00 BPLR + TP less 0.50%<br />

>5.00 BPLR + TP + 0.25%<br />

Maximum 9 years, in half yearly / yearly installments depending<br />

upon the crop cultivated.<br />

* Hypothecation of tractor and other implements purchased with<br />

the Bank loan.<br />

* Third party guarantee mortgage of properties.<br />

* BPLR = 12.50 % and<br />

BASE RATE = 8.00 %

Purchase of second hand (pre-used) Tractors by Agriculturists<br />

<strong>Purpose</strong> / Objective<br />

Eligibility<br />

Quantum of Loan<br />

Margin<br />

Repayment Period<br />

Security<br />

Other Requirements/Details<br />

To meet out of the needs of farmers who cannot afford to buy a<br />

new tractor.<br />

Farmer having minimum of 4acres of irrigated land or 8acres of<br />

dry land.<br />

Maximum of Rs.1,50,000/- only.<br />

a) 5% for tractor age less than 3years.<br />

b) 10% for tractors of age more than 3years but less than 7years.<br />

In 5years with quarterly / half yearly / annual installments,<br />

depending upon the crop cultivated.<br />

* Hypothecation Of tractor purchased with the bank loan.<br />

* Mortgage of properties and Third party guarantee.<br />

Amount Slab(Rs. in Lakhs)<br />

Interest Rate<br />

0.50 to 2.00 BPLR + TP less 0.75%<br />

* BPLR = 12.50 % and<br />

BASE RATE = 8.00 %

Kisan Bike<br />

<strong>Purpose</strong> / Objective<br />

Eligibility<br />

Quantum of Loan<br />

Margin<br />

Repayment Period<br />

Security<br />

To enable farmers in purchasing motor cycle for transportation of<br />

small quantities of agricultural inputs.<br />

* Age: 18-55 years, Possesses driving license, Should own landed<br />

properties.<br />

* 2 acre irrigated / 4 acre dry land or 1 acre of agril land and<br />

income not less than Rs2500/PM(for loan upto Rs.25,000).<br />

* 3 acres of irrigated / 6 acres dry land or 1 acre of agril land and<br />

income not less than Rs5000/PM ( for loan Rs.25000/- to<br />

Rs.50000).<br />

As per quotations from authorized dealers with Maximum loan of<br />

Rs 50000/-<br />

5% (new vehicle) 25% (Old vehicle) old vehicle not more than 3<br />

years.<br />

To be repaid within 5-7 years half yearly or Annual installments.<br />

Hypothecation Of vehicles purchased.<br />

Other Requirements/Details BPLR + TP less 1.75%<br />

* BPLR = 12.50 % and<br />

BASE RATE = 8.00 %