A. Kisan Credit Card Canara Bank is the pioneer in ... - Efresh India

A. Kisan Credit Card Canara Bank is the pioneer in ... - Efresh India

A. Kisan Credit Card Canara Bank is the pioneer in ... - Efresh India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

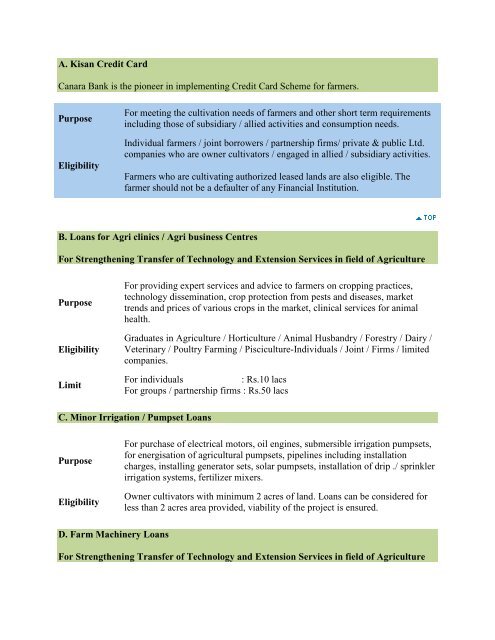

A. <strong>K<strong>is</strong>an</strong> <strong>Credit</strong> <strong>Card</strong><br />

<strong>Canara</strong> <strong>Bank</strong> <strong>is</strong> <strong>the</strong> <strong>pioneer</strong> <strong>in</strong> implement<strong>in</strong>g <strong>Credit</strong> <strong>Card</strong> Scheme for farmers.<br />

Purpose<br />

Eligibility<br />

For meet<strong>in</strong>g <strong>the</strong> cultivation needs of farmers and o<strong>the</strong>r short term requirements<br />

<strong>in</strong>clud<strong>in</strong>g those of subsidiary / allied activities and consumption needs.<br />

Individual farmers / jo<strong>in</strong>t borrowers / partnership firms/ private & public Ltd.<br />

companies who are owner cultivators / engaged <strong>in</strong> allied / subsidiary activities.<br />

Farmers who are cultivat<strong>in</strong>g authorized leased lands are also eligible. The<br />

farmer should not be a defaulter of any F<strong>in</strong>ancial Institution.<br />

B. Loans for Agri cl<strong>in</strong>ics / Agri bus<strong>in</strong>ess Centres<br />

For Streng<strong>the</strong>n<strong>in</strong>g Transfer of Technology and Extension Services <strong>in</strong> field of Agriculture<br />

Purpose<br />

Eligibility<br />

Limit<br />

For provid<strong>in</strong>g expert services and advice to farmers on cropp<strong>in</strong>g practices,<br />

technology d<strong>is</strong>sem<strong>in</strong>ation, crop protection from pests and d<strong>is</strong>eases, market<br />

trends and prices of various crops <strong>in</strong> <strong>the</strong> market, cl<strong>in</strong>ical services for animal<br />

health.<br />

Graduates <strong>in</strong> Agriculture / Horticulture / Animal Husbandry / Forestry / Dairy /<br />

Veter<strong>in</strong>ary / Poultry Farm<strong>in</strong>g / P<strong>is</strong>ciculture-Individuals / Jo<strong>in</strong>t / Firms / limited<br />

companies.<br />

For <strong>in</strong>dividuals<br />

: Rs.10 lacs<br />

For groups / partnership firms : Rs.50 lacs<br />

C. M<strong>in</strong>or Irrigation / Pumpset Loans<br />

Purpose<br />

Eligibility<br />

For purchase of electrical motors, oil eng<strong>in</strong>es, submersible irrigation pumpsets,<br />

for energ<strong>is</strong>ation of agricultural pumpsets, pipel<strong>in</strong>es <strong>in</strong>clud<strong>in</strong>g <strong>in</strong>stallation<br />

charges, <strong>in</strong>stall<strong>in</strong>g generator sets, solar pumpsets, <strong>in</strong>stallation of drip ./ spr<strong>in</strong>kler<br />

irrigation systems, fertilizer mixers.<br />

Owner cultivators with m<strong>in</strong>imum 2 acres of land. Loans can be considered for<br />

less than 2 acres area provided, viability of <strong>the</strong> project <strong>is</strong> ensured.<br />

D. Farm Mach<strong>in</strong>ery Loans<br />

For Streng<strong>the</strong>n<strong>in</strong>g Transfer of Technology and Extension Services <strong>in</strong> field of Agriculture

Purpose<br />

Eligibility<br />

For purchase of tractors, power tillers, trailers, comb<strong>in</strong>e harvester, gra<strong>in</strong><br />

threshers, sprayers, dusters, ploughs, drills, mechanical weeders or any o<strong>the</strong>r<br />

modern agricultural mach<strong>in</strong>ery.<br />

Farmers who sat<strong>is</strong>fy <strong>the</strong> <strong>Bank</strong>'s norms.<br />

E. Farm Development Loans<br />

Purpose<br />

Eligibility<br />

For digg<strong>in</strong>g / deepen<strong>in</strong>g of wells, construction of tanks, ponds, drill<strong>in</strong>g of bore<br />

wells, soil and water conservation watershed development bundl<strong>in</strong>g land<br />

reclamation, level<strong>in</strong>g of land, terrac<strong>in</strong>g, conversion of dry land <strong>in</strong>to wet,<br />

irrigable lands, fenc<strong>in</strong>g, construction of farm houses and o<strong>the</strong>r allied activities.<br />

Farmer should be owner of <strong>the</strong> land<br />

F. Vehicle Loan for Agricultur<strong>is</strong>ts<br />

Purpose<br />

Eligibility<br />

For purchase of brand new vehicles such as bicycles, mopeds, two wheeler /<br />

three wheeler carriages, jeeps, vans and o<strong>the</strong>r light motor vehicles for<br />

superv<strong>is</strong><strong>in</strong>g agricultural operation / management of farm / estate and for<br />

transportation of agricultural produce / <strong>in</strong>puts, vehicles may also be considered.<br />

Purchase of heavy vehicles such as lorries for big farmers own<strong>in</strong>g at least 15<br />

acres of perennially irrigated land.<br />

Agriculur<strong>is</strong>t cultivat<strong>in</strong>g h<strong>is</strong> own land or engaged <strong>in</strong> allied activities such as<br />

dairy, poultry, sericulture, f<strong>is</strong>h farm<strong>in</strong>g, etc.<br />

G. Loan for Plantation Crops<br />

Purpose<br />

Eligibility<br />

For establ<strong>is</strong>hment of estates, clear<strong>in</strong>g of jungle, conversion of barren land <strong>in</strong>to<br />

cultivable land, purchase of plant<strong>in</strong>g material, rejuvenation / replant<strong>in</strong>g.<br />

Owners of <strong>the</strong> land who have experience / knowledge <strong>in</strong> <strong>the</strong> proposed activity.<br />

H. Loan for Mar<strong>in</strong>e F<strong>is</strong>heries<br />

Mar<strong>in</strong>e F<strong>is</strong>heries<br />

Inland F<strong>is</strong>heries<br />

Purchase / construction of mechanized f<strong>is</strong>h<strong>in</strong>g vessels, f<strong>is</strong>h<strong>in</strong>g equipments,<br />

work<strong>in</strong>g capital requirement for voyages<br />

Construction / deepen<strong>in</strong>g / widen<strong>in</strong>g / desilt<strong>in</strong>g of ponds, purchase of

f<strong>in</strong>gerl<strong>in</strong>gs, equipments, manures, feeds and labour <strong>in</strong>puts.<br />

Eligibility<br />

Well experienced f<strong>is</strong>h farmers with suitable land, professional f<strong>is</strong>hermen<br />

I. Loan for Sericulture<br />

Purpose<br />

Eligibility<br />

Marg<strong>in</strong><br />

For cultivation of mulberry, rear<strong>in</strong>g of silk worms, construction of rear<strong>in</strong>g<br />

house, purchase of rear<strong>in</strong>g equipments / wire mesh / d<strong>is</strong>ease free lay<strong>in</strong>gs (DFL).<br />

License / perm<strong>is</strong>sion from Sericulture Department for rear<strong>in</strong>g silkworms <strong>in</strong> <strong>the</strong><br />

area, wherever required.<br />

Technical ass<strong>is</strong>tance from Sericulture Department or any o<strong>the</strong>r organization<br />

deal<strong>in</strong>g with sericulture development should be available on cont<strong>in</strong>uous bas<strong>is</strong>.<br />

For limits upto Rs.50,000/- : Nil<br />

For limits above Rs.50,000/- : 15-25%<br />

J. Loans for Poultry and Duck rear<strong>in</strong>g<br />

Purpose<br />

Eligibility<br />

For establ<strong>is</strong>h<strong>in</strong>g / improv<strong>in</strong>g layer / broiler farms and hatcheries <strong>in</strong>clud<strong>in</strong>g<br />

purchase of chicks, feeds, medic<strong>in</strong>es, equipments, feed mix<strong>in</strong>g plants,<br />

construction of poultry sheds, also for rear<strong>in</strong>g Ducks / Turkeys / Qual<strong>is</strong>.<br />

Person hav<strong>in</strong>g experience / knowledge <strong>in</strong> poultry.<br />

K. Produce Loan<br />

Purpose<br />

Eligibility<br />

Maximum<br />

Limit<br />

Repayment<br />

To keep <strong>the</strong> produce <strong>in</strong> an approved godown or warehouse or <strong>in</strong> farmers’<br />

residence enabl<strong>in</strong>g <strong>the</strong>m to sell <strong>the</strong> produce for a better price of a later date.<br />

1. Farmers who have availed Crop Loan /KCC.<br />

2. Farmers who have not availed Crop Loan /KCC.<br />

Rs.10 lacs per party<br />

With<strong>in</strong> 12 months from <strong>the</strong> date of grant<br />

L. Loan for Cold Storage and Rural Godown<br />

Purpose<br />

1. For creation of scientific storage capacity with allied facilities to store farm<br />

produce, processed farm produce and agricultural <strong>in</strong>puts.

2. Promotion of grad<strong>in</strong>g, standardization and quality control of agricultural<br />

produce prevention of d<strong>is</strong>tress sale, streng<strong>the</strong>n agriculture market<strong>in</strong>g<br />

<strong>in</strong>frastructure.<br />

Eligibility<br />

Individuals / farmers, group of farmers / growers, partnership / proprietary<br />

firms, NGO’s SHG’s, Companies, Corporations, Co-operatives, Agro-<br />

Process<strong>in</strong>g Co-operative Societies., Agricultural Produce Market<strong>in</strong>g<br />

Committees, Market<strong>in</strong>g Board and Agro Process<strong>in</strong>g Corporations, Grower’s<br />

Associations.<br />

M. Drip / Spr<strong>in</strong>kler Irrigation Loans<br />

Purpose<br />

Eligibility<br />

For purchase of drippers, pressure regulators, filters, pipes, accessories,<br />

fertilizer mixers and pumpsets. Construction of overhead tanks and<br />

<strong>in</strong>stallation of spr<strong>in</strong>kler irrigation units. Purchase of water sav<strong>in</strong>g devices /<br />

modern irrigation equipments.<br />

Owners of land. Tenant cultivators can also be considered.<br />

N. Dairy Loan and Ra<strong>is</strong><strong>in</strong>g Crossbreed Heirs<br />

Purpose<br />

Eligibility<br />

1. For construction of cattle shed, purchase of high yield<strong>in</strong>g milch<br />

cattle, dairy equipments, cattle feed, cultivation of green fodder,<br />

transportation of animal, sett<strong>in</strong>g of on-farm process<strong>in</strong>g and<br />

pasteurization plants.<br />

2. Purchase / rear<strong>in</strong>g of cross breed heifers.<br />

1. Farmer should have experience / knowledge <strong>in</strong> ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g dairy<br />

animals<br />

Eligibility<br />

2. Veter<strong>in</strong>ary facilities readily and easily available.<br />

3. Should be cultivat<strong>in</strong>g or hav<strong>in</strong>g arrangements for supply of green<br />

fodder.<br />

4. Availability of technical ass<strong>is</strong>tance / guidance artificial <strong>in</strong>sem<strong>in</strong>ation<br />

facilities.

O. Loans for Construction of Farm Structures<br />

Purpose<br />

Eligibility<br />

Construction of farm structures <strong>in</strong>clud<strong>in</strong>g storage rooms / godowns / sheds<br />

for livestock and farm mach<strong>in</strong>ery.<br />

Farmer shall be <strong>the</strong> owner of <strong>the</strong> land. Should be economic land hold<strong>in</strong>gs<br />

hav<strong>in</strong>g sufficient surplus <strong>in</strong>come from agriculture to repay <strong>the</strong> loan.<br />

P. <strong>K<strong>is</strong>an</strong> Suvidha<br />

Purpose<br />

Eligibility<br />

• For meet<strong>in</strong>g <strong>the</strong> comprehensive credit needs of farmers.<br />

• Work<strong>in</strong>g capital requirements: for crop cultivation expenses,<br />

work<strong>in</strong>g capital requirements for allied activities, ma<strong>in</strong>tenance of<br />

farm mach<strong>in</strong>ery/ equipments, non-farm sector activities and<br />

consumption needs.<br />

• Term loans requirements like purchase of agricultural implements,<br />

land development, purchase of bullocks and carts, purchase of farm<br />

mach<strong>in</strong>ery, m<strong>in</strong>or irrigation.<br />

Agricultur<strong>is</strong>ts can avail f<strong>in</strong>ance for work<strong>in</strong>g capital requirements ei<strong>the</strong>r<br />

under KCCS (<strong>K<strong>is</strong>an</strong> credit <strong>Card</strong> Scheme) or under <strong>K<strong>is</strong>an</strong> Suvidha scheme<br />

and not under both <strong>the</strong> schemes.<br />

Q. <strong>Canara</strong> <strong>K<strong>is</strong>an</strong> OD<br />

Purpose<br />

Eligibility<br />

To provide a hassle-free overdraft facility for work<strong>in</strong>g capital expenses of<br />

agricultur<strong>is</strong>ts to be <strong>in</strong>curred for allied activities, repairs and replacements of<br />

farm mach<strong>in</strong>ery, work<strong>in</strong>g capital requirements or/and for non-farm sector<br />

activities and consumption needs, subject to ceil<strong>in</strong>g for each type of<br />

expense.<br />

The account can also be operated by ATM card (if facility <strong>is</strong> available <strong>in</strong> <strong>the</strong><br />

branch) or cheque leaves.<br />

Agricultur<strong>is</strong>ts hav<strong>in</strong>g sat<strong>is</strong>factory repayment record for <strong>the</strong> past 1 year.<br />

The Scheme <strong>is</strong> operational only <strong>in</strong> select branches of <strong>the</strong> <strong>Bank</strong>.<br />

R. General <strong>Credit</strong> <strong>Card</strong> Scheme (GCCS)<br />

Objective<br />

• General <strong>Credit</strong> <strong>Card</strong> Scheme has been <strong>in</strong>troduced as an important<br />

measure <strong>in</strong> <strong>the</strong> area of F<strong>in</strong>ancial Inclusion.<br />

• To provide hassle free credit to Rural and Semi-urban households

without <strong>in</strong>s<strong>is</strong>tence on security, purpose or end use of <strong>the</strong> credit.<br />

Purpose<br />

Eligibility Norms<br />

Loan Quantum<br />

Marg<strong>in</strong><br />

Tenability<br />

Security<br />

• Loan can be sanctioned for any general purpose <strong>in</strong>clud<strong>in</strong>g that of<br />

consumption.<br />

• All Rural / Semi-urban households are eligible irrespective of <strong>the</strong>ir<br />

activity, whe<strong>the</strong>r agricultural or non agricultural and <strong>in</strong>come level.<br />

• Loan quantum shall be 50 % of <strong>the</strong> net annual <strong>in</strong>come of <strong>the</strong> entire<br />

household.<br />

• Maximum of Rs. 25000/-.<br />

• No marg<strong>in</strong> shall be <strong>in</strong>s<strong>is</strong>ted<br />

Limit extended <strong>is</strong> of overdraft nature tenable for three years<br />

No security <strong>is</strong> <strong>in</strong>s<strong>is</strong>ted. No co-obligation / third party guarantee<br />

S. Kr<strong>is</strong>hi Mitra <strong>Card</strong> Scheme<br />

Objective<br />

Purpose<br />

Loan Quantum<br />

Tenability<br />

Security<br />

• To provide easy credit to Individual Tenant Farmers, Oral Lessees,<br />

Share Croppers and farmers cultivat<strong>in</strong>g lands without proper records.<br />

• Cultivation of Crops<br />

• Ma<strong>in</strong>tenance of animals and farm mach<strong>in</strong>ery<br />

• Repairs and replacements of mach<strong>in</strong>eries<br />

• Replacement of animals<br />

• Maximum of Rs. 50,000/- subject to Scale of F<strong>in</strong>ance and a<br />

maximum of 50% of <strong>the</strong> value of <strong>the</strong> produce.<br />

Extended ei<strong>the</strong>r as an operative limit with a tenability of 3 years (subject to<br />

annual review) or as a s<strong>in</strong>gle transaction limit, repayable <strong>in</strong> 5 years <strong>in</strong><br />

quarterly / half yearly / yearly <strong>in</strong>stallments.<br />

Hypo<strong>the</strong>cation of Crops.<br />

T. F<strong>in</strong>anc<strong>in</strong>g Jo<strong>in</strong>t Liability Groups of Tenant Farmers<br />

Objective<br />

Purpose<br />

Loan Quantum<br />

General <strong>Credit</strong> <strong>Card</strong> Scheme has been <strong>in</strong>troduced as an important measure<br />

<strong>in</strong> <strong>the</strong> area of F<strong>in</strong>ancial Inclusion.<br />

Cultivation of Crops based on <strong>the</strong> details of <strong>the</strong> crops ra<strong>is</strong>ed by <strong>the</strong> JLG<br />

members<br />

Maximum of Rs. 50,000/- per farmer and Rs. 5,00,000/- per group.

Repayment<br />

L<strong>in</strong>ked to market<strong>in</strong>g of crops - not to exceed 12 months for short duration<br />

crops and 18 months for long duration crops.<br />

U. <strong>K<strong>is</strong>an</strong> Tatkal (only <strong>in</strong> select states)<br />

Objective<br />

Purpose<br />

Loan Quantum<br />

Repayment<br />

Security<br />

To provide credit for meet<strong>in</strong>g <strong>the</strong> post harvest expenses of <strong>the</strong> farmers who<br />

have availed KCCS Loans<br />

To meet <strong>the</strong> expenditure towards stor<strong>in</strong>g, process<strong>in</strong>g, treatment of food<br />

gra<strong>in</strong>s, godown charges, etc<br />

• M<strong>in</strong>imum of Rs. 1,000/-<br />

• Maximum of Rs. 50,000/- but not to exceed 50% of KCCS Limit /<br />

25% of annual <strong>in</strong>come<br />

In 3-5 years <strong>in</strong> half yearly / annual <strong>in</strong>stallments.<br />

Collateral of Securities extended to KCCS Loans.<br />

V. Scheme for Redemption of Debts of Farmers from Non-Institutional Sources<br />

Objective<br />

To provide relief to farmers and remove <strong>the</strong> debt burden from non<strong>in</strong>stitutional<br />

sources.<br />

Purpose To prepay <strong>the</strong> debts availed by <strong>the</strong> farmer from non <strong>in</strong>stitutional sources<br />

Loan Quantum Maximum of Rs. 50,000/- subject to 150% of <strong>the</strong> Gross Annual Income<br />

Repayment With<strong>in</strong> 5 years – <strong>in</strong> quarterly / half yearly / yearly <strong>in</strong>stallments.<br />

Security Mortgage of Property, if <strong>the</strong> cumulative loans exceed Rs. 1,00,000/-<br />

W. Gold Loans for Agricultural Purposes<br />

Objective<br />

Purpose<br />

Loan Quantum<br />

Repayment<br />

Security<br />

To provide loans to farmers for various agricultural purposes aga<strong>in</strong>st <strong>the</strong><br />

pledge of gold Jewelleries<br />

To meet all farm requirement of <strong>the</strong> farmers<br />

Maximum of Rs. 3,00,000/- subject to 80% of <strong>the</strong> appra<strong>is</strong>ed value or per<br />

gram limit specified from time to time.<br />

With<strong>in</strong> 12 months<br />

Pledge fo gold Jewelleries

Our O<strong>the</strong>r Loan Products:<br />

The schemes mentioned above are only illustrative and not exhaustive. We have o<strong>the</strong>r loan<br />

products also to supplement <strong>the</strong> farmers' <strong>in</strong>come. The important ones are:<br />

T<strong>is</strong>sue Culture<br />

Floriculture<br />

Mushroom Cultivation<br />

Aquaculture<br />

Export oriented<br />

agriculture<br />

Seed production and<br />

process<strong>in</strong>g<br />

Lift Irrigation Projects<br />

Piggery, Rabbit Rear<strong>in</strong>g, Bee Keep<strong>in</strong>g, Bullock Cart Loans, Sheep,<br />

Goat Rear<strong>in</strong>g<br />

Bio Gas plants<br />

Dealers of d<strong>is</strong>tribution of fertilizers, pesticides, seeds etc.<br />

Custom service units for ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g fleet of tractors, Bulldozers,<br />

well bor<strong>in</strong>g equipments.<br />

Loans for Farm Forestry, Bio-diesel Plants, Tree Borne Oil Seeds,<br />

etc.<br />

General <strong>in</strong>formation(Not Exhaustive)<br />

1. Proposed activity should be technically feasible and economically viable.<br />

2. The quantum of loan depends on scale of f<strong>in</strong>ance / accepted project cost.<br />

3. Rate of <strong>in</strong>terest as applicable from time to time will be charged.<br />

4. Marg<strong>in</strong> money of 15-25% has to be brought by <strong>the</strong> applicant depend<strong>in</strong>g on <strong>the</strong> quantum of<br />

loan.<br />

5. Wherever subsidy <strong>is</strong> available it will be treated as marg<strong>in</strong>.<br />

6. Generally for loans above Rs. 1,00,000, mortgage of landed property <strong>is</strong> to be provided as<br />

security, subject to certa<strong>in</strong> deviations as permitted under bank policy.<br />

7. Notified crops will be covered under Rashtriya Kr<strong>is</strong>hi Bima Yojana Scheme.<br />

8. Insurance <strong>in</strong> respect of assets created to be obta<strong>in</strong>ed as per norms of bank.<br />

9. Lien should be noted at RTO/Port authorities / MPEDA wherever applicable.<br />

10. Loan Applications will be d<strong>is</strong>posed of as per time norms of <strong>the</strong> bank.

Documents to be produced by <strong>the</strong> applicant:<br />

1. Certified copies of records <strong>in</strong> respect of lands owned / leased.<br />

2. NOC / No Due Certificate from o<strong>the</strong>r f<strong>in</strong>ancial <strong>in</strong>stitutions wherever applicable.<br />

3. Two passport size photographs.<br />

4. Documents of title and o<strong>the</strong>r relevant documents, wherever landed properties are taken as<br />

security.<br />

5. Plan and estimate <strong>in</strong> respect of construction / drill<strong>in</strong>g / deepen<strong>in</strong>g of wells, proforma<br />

<strong>in</strong>voice / quotations <strong>in</strong> case of mach<strong>in</strong>es, vehicle, etc.<br />

6. Valuation certificate of <strong>the</strong> land from a competent authority / panel valuer wherever<br />

applicable.<br />

7. O<strong>the</strong>r documents related to specific schemes.<br />

For all <strong>the</strong> Above Schemes Conditions Apply.<br />

The <strong>in</strong>formation provided above are only illustrative and not exhaustive. For more details, please<br />

contact your nearest <strong>Canara</strong> <strong>Bank</strong> Branch or mail to pcw<strong>in</strong>g@canbank.co.<strong>in</strong>