Doing business in New Zealand - Grant Thornton

Doing business in New Zealand - Grant Thornton

Doing business in New Zealand - Grant Thornton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Individuals<br />

Individuals are taxed <strong>in</strong> accordance<br />

with the general pr<strong>in</strong>ciples outl<strong>in</strong>ed (see<br />

calculation of taxable <strong>in</strong>come, p18). The<br />

most significant exception to the general<br />

position arises for employees, who<br />

are not permitted any tax deductions<br />

and are assessed <strong>in</strong> respect of any<br />

allowances, <strong>in</strong>clud<strong>in</strong>g accommodation,<br />

provided <strong>in</strong> relation to employment.<br />

However, employers may reimburse<br />

employees tax-free for work-related<br />

expenditure that would otherwise meet<br />

general deductibility tests.<br />

Residence criteria: <strong>in</strong>dividuals<br />

An <strong>in</strong>dividual is tax resident <strong>in</strong> <strong>New</strong><br />

<strong>Zealand</strong> if:<br />

• their permanent place of abode is <strong>in</strong><br />

<strong>New</strong> <strong>Zealand</strong>, irrespective of whether<br />

the taxpayer has a permanent place of<br />

abode outside <strong>New</strong> <strong>Zealand</strong><br />

• they are personally present <strong>in</strong> <strong>New</strong><br />

<strong>Zealand</strong> for more than 183 days <strong>in</strong><br />

total <strong>in</strong> any 12 month period.<br />

A taxpayer who is resident may only<br />

subsequently become a non-resident if<br />

they:<br />

• are absent for more than 325 days <strong>in</strong><br />

any 12 month period<br />

• do not ma<strong>in</strong>ta<strong>in</strong> a permanent place of<br />

abode <strong>in</strong> <strong>New</strong> <strong>Zealand</strong>.<br />

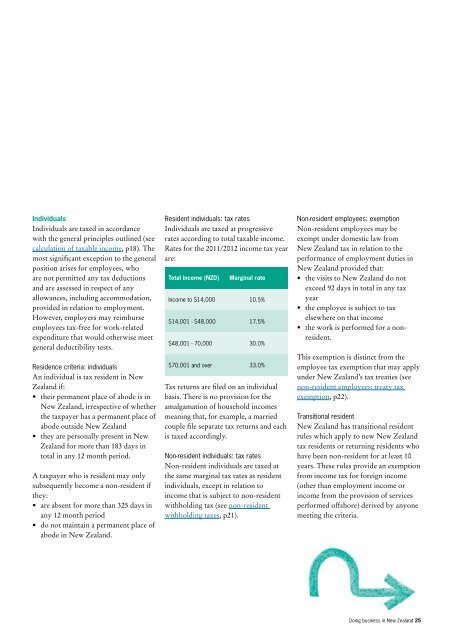

Resident <strong>in</strong>dividuals: tax rates<br />

Individuals are taxed at progressive<br />

rates accord<strong>in</strong>g to total taxable <strong>in</strong>come.<br />

Rates for the 2011/2012 <strong>in</strong>come tax year<br />

are:<br />

Total <strong>in</strong>come (NZD)<br />

Marg<strong>in</strong>al rate<br />

Income to $14,000 10.5%<br />

$14,001 - $48,000 17.5%<br />

$48,001 - 70,000 30.0%<br />

$70,001 and over 33.0%<br />

Tax returns are filed on an <strong>in</strong>dividual<br />

basis. There is no provision for the<br />

amalgamation of household <strong>in</strong>comes<br />

mean<strong>in</strong>g that, for example, a married<br />

couple file separate tax returns and each<br />

is taxed accord<strong>in</strong>gly.<br />

Non-resident <strong>in</strong>dividuals: tax rates<br />

Non-resident <strong>in</strong>dividuals are taxed at<br />

the same marg<strong>in</strong>al tax rates as resident<br />

<strong>in</strong>dividuals, except <strong>in</strong> relation to<br />

<strong>in</strong>come that is subject to non-resident<br />

withhold<strong>in</strong>g tax (see non-resident<br />

withhold<strong>in</strong>g taxes, p21).<br />

Non-resident employees: exemption<br />

Non-resident employees may be<br />

exempt under domestic law from<br />

<strong>New</strong> <strong>Zealand</strong> tax <strong>in</strong> relation to the<br />

performance of employment duties <strong>in</strong><br />

<strong>New</strong> <strong>Zealand</strong> provided that:<br />

• the visits to <strong>New</strong> <strong>Zealand</strong> do not<br />

exceed 92 days <strong>in</strong> total <strong>in</strong> any tax<br />

year<br />

• the employee is subject to tax<br />

elsewhere on that <strong>in</strong>come<br />

• the work is performed for a nonresident.<br />

This exemption is dist<strong>in</strong>ct from the<br />

employee tax exemption that may apply<br />

under <strong>New</strong> <strong>Zealand</strong>’s tax treaties (see<br />

non-resident employees: treaty tax<br />

exemption, p22).<br />

Transitional resident<br />

<strong>New</strong> <strong>Zealand</strong> has transitional resident<br />

rules which apply to new <strong>New</strong> <strong>Zealand</strong><br />

tax residents or return<strong>in</strong>g residents who<br />

have been non-resident for at least 10<br />

years. These rules provide an exemption<br />

from <strong>in</strong>come tax for foreign <strong>in</strong>come<br />

(other than employment <strong>in</strong>come or<br />

<strong>in</strong>come from the provision of services<br />

performed offshore) derived by anyone<br />

meet<strong>in</strong>g the criteria.<br />

<strong>Do<strong>in</strong>g</strong> <strong>bus<strong>in</strong>ess</strong> <strong>in</strong> <strong>New</strong> <strong>Zealand</strong> 25