Evaluation Template 3.26.xlsx - Texas Solar Power Company

Evaluation Template 3.26.xlsx - Texas Solar Power Company

Evaluation Template 3.26.xlsx - Texas Solar Power Company

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Independent <strong>Solar</strong> Financial <strong>Evaluation</strong><br />

Commissioned by: <strong>Texas</strong> <strong>Solar</strong> <strong>Power</strong><br />

Property: Mueller<br />

Exclusively for: Mueller Customer<br />

Utility: Austin Energy<br />

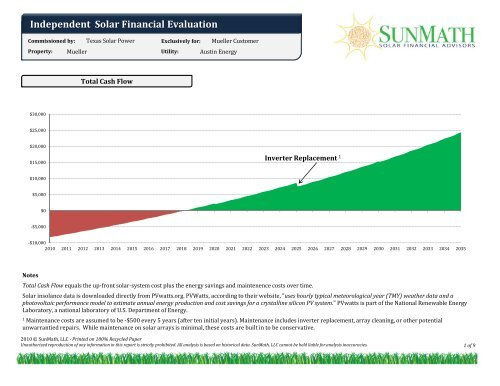

Total Cash Flow<br />

$30,000<br />

$25,000<br />

$20,000<br />

$15,000<br />

Inverter Replacement 1<br />

$10,000<br />

$5,000<br />

$0<br />

‐$5,000<br />

‐$10,000<br />

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035<br />

Notes<br />

Total Cash Flow equals the up‐front solar‐system cost plus the energy savings and maintenence costs over time.<br />

<strong>Solar</strong> insolance data is downloaded directly from PVwatts.org. PVWatts, according to their website, "uses hourly typical meteorological year (TMY) weather data and a<br />

photovoltaic performance model to estimate annual energy production and cost savings for a crystalline silicon PV system." PVwatts is part of the National Renewable Energy<br />

Laboratory, a national laboratory of U.S. Department of Energy.<br />

1<br />

Maintenance costs are assumed to be ‐$500 every 5 years (after ten initial years). Maintenance includes inverter replacement, array cleaning, or other potential<br />

unwarrantied repairs. While maintenance on solar arrays is minimal, these costs are built in to be conservative.<br />

2010 © SunMath, LLC · Printed on 100% Recycled Paper<br />

Unauthorized reproduction of any information in this report is strictly prohibited. All analysis is based on historical data. SunMath, LLC cannot be held liable for analysis inaccuracies.<br />

1 of 9

Lifetime Energy Cost: No <strong>Solar</strong> System vs. Proposed <strong>Solar</strong> System<br />

Most people who consider purchasing a solar array only have one alternative: Continuing to purchase power from<br />

their local utility. The below graph shows how much money you would save if you choose to invest in a solar system.<br />

While solar systems have a large up‐front cost, they typically result in lower total power costs over their lifetime;<br />

Meaning, in this case, purchasing a solar system makes financial sense.<br />

BreakEven Payback<br />

Years 8.2<br />

$90,000<br />

$80,000<br />

$70,000<br />

$60,000<br />

Lifetime Savings from <strong>Solar</strong><br />

$24,360<br />

4<br />

$50,000<br />

$40,000<br />

$30,000<br />

$20,000<br />

Up‐front <strong>Solar</strong> System<br />

Expense 2<br />

Break‐Even Payback 3<br />

$10,000<br />

$0<br />

2010 2012 2014 2016 2018 2020 2022 2024 2026 2028 2030 2032 2034<br />

Without <strong>Solar</strong> System<br />

With <strong>Solar</strong> System<br />

Notes<br />

2<br />

The "With <strong>Solar</strong> System" Scenario starts out above zero because there is an up‐front cost to install a solar system.<br />

3<br />

The break‐even is the point at which you would have spent the same amount of money whether you had bought a solar system or if you had not. After this point, your<br />

solar system will have paid for itself and would continue to offset your energy consumption for free.<br />

4<br />

"Lifetime Savings from <strong>Solar</strong>" equals the total amount of money you would save over the lifetime of the solar system vs. not having a solar system<br />

2010 © SunMath, LLC · Printed on 100% Recycled Paper<br />

Unauthorized reproduction of any information in this report is strictly prohibited. All analysis is based on historical data. SunMath, LLC cannot be held liable for analysis inaccuracies.<br />

2 of 9<br />

2 of 15

Investment Statistics<br />

Net Out‐of<br />

Pocket<br />

$8,199<br />

31%<br />

Sources of System Payment<br />

Return Statistics<br />

5<br />

Net Present Value (NPV) of Array $10,081<br />

Internal Rate of Return (IRR) 6 13.4%<br />

Approximate "taxable bond‐equivalent" Yield 7 18.6%<br />

Tax Credits<br />

$3,514<br />

13%<br />

Rebates<br />

$14,652<br />

56%<br />

Total Production<br />

Energy Production (kWh)<br />

184,292<br />

Energy Savings ($) $34,158<br />

BreakEven Payback<br />

Years 8.2<br />

Notes<br />

5<br />

Net Present Value (NPV) is: the difference between the present value of cash inflows and the present value of cash outflows. NPV is used in capital budgeting to analyze the<br />

profitability of an investment or project.<br />

6<br />

Internal Rate or Return (IRR or RoR) is: the discount rate used in capital budgeting that makes the net present value of all cash flows from a project equal to zero. Generally<br />

speaking, the higher a project's internal rate of return, the more desirable it is to undertake the project.<br />

7<br />

The "taxable bond‐equivalent" Yield allows a customer to compare a solar installation to a normal taxable bond. Simply comparing the IRR is not fair because individuals<br />

do not pay taxes on money they save, only on money they earn (in the case of a corporate bond).<br />

Salvage Value is assumed to be $0. In reality, the entire solar array will likely still be producing electricity, and would therefore have some value. To be conservative, we<br />

assume they are useless.<br />

2010 © SunMath, LLC · Printed on 100% Recycled Paper<br />

Unauthorized reproduction of any information in this report is strictly prohibited. All analysis is based on historical data. SunMath, LLC cannot be held liable for analysis inaccuracies.<br />

3 of 9

Electricity Bill Savings in First Year<br />

Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Annual<br />

kWh Usage 1,211 1,161 1,070 985 925 1,002 1,315 1,870 2,226 2,320 2,225 1,690 18,000<br />

kWh Produced 574 527 580 592 715 680 692 709 756 756 697 709 7,988<br />

Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Annual<br />

Old Utility Bill<br />

8<br />

$112 $107 $98 $90 $84 $92 $141 $211 $256 $269 $257 $168 $1,885<br />

Energy Savings $60 $55 $60 $59 $67 $67 $86 $88 $94 $95 $87 $76 $894<br />

New Utility Bill $53 $53 $38 $31 $17 $25 $55 $122 $162 $174 $170 $92 $992<br />

% of Usage Offset 53% 51% 61% 66% 80% 72% 61% 42% 37% 35% 34% 45% 47%<br />

$300<br />

$250<br />

$200<br />

$150<br />

$100<br />

$50<br />

$60 $55 $60 $59<br />

$67 $67<br />

$86 $88<br />

$94 $95<br />

$87<br />

$76<br />

$0<br />

Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct<br />

Old Utility Bill New Utility Bill Monthly Savings<br />

Notes<br />

8<br />

"Old Utility Bill" estimated based on information submitted to SunMath. Additional utility costs including gas consumption, and other fees are not included for the<br />

purpose of this analysis. If we estimated your electricity consumption and were off by >25%, please email us at support@sunmath.com with your correct usage and we'll<br />

resend your evaluation.<br />

2010 © SunMath, LLC · Printed on 100% Recycled Paper<br />

Unauthorized reproduction of any information in this report is strictly prohibited. All analysis is based on historical data. SunMath, LLC cannot be held liable for analysis inaccuracies.<br />

4 of 9

Annual Cash Flow Summary (Years 112)<br />

Year 0 1 2 3 4 5 6 7 8 9 10 11 12<br />

System Cost ‐$26,365 ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐<br />

Loan ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐<br />

Total Rebates $14,652 ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐<br />

Total Tax Credits $3,514 ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐<br />

Total Cost $8,199 <br />

Other Incentives<br />

Feed‐In Tariffs ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐<br />

9<br />

Ren. Energy Credits ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐<br />

Energy Savings ‐ $894 $924 $955 $987 $1,020 $1,054 $1,090 $1,126 $1,164 $1,203 $1,244 $1,285<br />

Total Other Incentives $894 $924 $955 $987 $1,020 $1,054 $1,090 $1,126 $1,164 $1,203 $1,244 $1,285<br />

Costs<br />

Loan Service ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐<br />

Maintenance ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐$200 ‐<br />

Total Costs ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐$200 ‐<br />

Total Cash Flows $8,199 $894 $924 $955 $987 $1,020 $1,054 $1,090 $1,126 $1,164 $1,203 $1,044 $1,285<br />

Annual Rate of Return<br />

10<br />

11% 11% 12% 12% 12% 13% 13% 14% 14% 15% 13% 16%<br />

Notes<br />

9<br />

All solar arrays are eligible for Renewable Energy Credits (RECs), however, many utilities require that all RECs be transferred in exchange for any incentive offered.<br />

Check the fine print of your agreement to determine if you own your RECs.<br />

10<br />

"Annual Rate of Return" divides the nominal annual cash flow in each respective year by the net cost of the system .<br />

2010 © SunMath, LLC · Printed on 100% Recycled Paper<br />

Unauthorized reproduction of any information in this report is strictly prohibited. All analysis is based on historical data. SunMath, LLC cannot be held liable for analysis inaccuracies.<br />

5 of 9

Alternative Investment Analysis 11<br />

Considering other uses for the money needed for a solar installation is<br />

important and often enlightening. Below, you will see the value of your solar<br />

array cost ($8,199) after 25 years if you chose to invest in a<br />

financial asset instead of solar.<br />

If you install a solar array and then invest your energy savings in financial<br />

assets over the next 25 years, you will have the below amounts of money.<br />

Additionally, you will have reduced your total risk by getting<br />

the large portion of your return from energy savings, instead of a financial asset.<br />

Certificate of Deposit<br />

$19,808<br />

Certificate of Deposit<br />

$51,426<br />

RISK<br />

Corporate Bonds<br />

$31,140<br />

<strong>Solar</strong> Array<br />

Cost<br />

z<br />

Corporate Bonds<br />

$66,424<br />

$8,199<br />

Stocks<br />

$48,956<br />

Stocks<br />

$86,960<br />

Notes<br />

11<br />

Approximate expected returns for different financial assetsbased on historical returns. Return assumptions are on page nine.<br />

= $10,000<br />

= $5,000<br />

2010 © SunMath, LLC · Printed on 100% Recycled Paper<br />

Unauthorized reproduction of any information in this report is strictly prohibited. All analysis is based on historical data. SunMath, LLC cannot be held liable for analysis inaccuracies.<br />

6 of 9

Property Value Increase<br />

<strong>Solar</strong> panels add value to structures by reducing monthly carrying costs (reducing energy costs). Everyone quotes an Appraiser's Journal Article: Evidence<br />

of Rational Market Valuations for Home Energy Efficiency that says: "the selling price of homes increases by $20.73 for every $1 decrease in annual fuel<br />

bills". Rather than multiplying your expected annual energy savings times 20.73, we have supplied you with a real‐world example of how much more a<br />

Home without <strong>Solar</strong> Panels<br />

Home with <strong>Solar</strong> Panels<br />

The Smith family has decided<br />

to buy a house. They believe<br />

they can afford to spend<br />

$1,800 a month.<br />

After deducting all fixed and<br />

variable costs, the Smith's<br />

know how large a mortgage<br />

payment they can afford.<br />

Monthly Budget $1,800 Monthly Budget $1,800<br />

‐ Cable, HOA, Security, Etc. ‐$300 ‐ Cable, HOA, Security, Etc. ‐$300<br />

Average Monthly Energy Costs $157 Average Monthly Energy Costs $83<br />

12<br />

= Available for Mortgage Payment $1,343 = Available for Mortgage Payment $1,417<br />

The Smith's are willing to<br />

spend $13,875 more for a<br />

house with your size solar<br />

array.<br />

If the Smith's have $1,343 a month,<br />

they can afford to spend $250,156<br />

on a house.<br />

If the Smith's have $1,417 a month,<br />

they can afford to spend $264,031<br />

on a house.<br />

The Average Monthly Energy Costs above have been estimated based on your current energy consumption, as well as the size array the contractor has proposed for you.<br />

Therefore, the home value increase calculated above is how much more your house should be worth. If you have a more or less valuable house, it will not affect the<br />

property value difference, i.e. If you own a $100,000 or $1,000,000 house, the value of your house should still increase by $13,875.<br />

Notes<br />

12<br />

The mortgage for both houses is assumed to be a 30 year fixed mortgage at today's prevailing rates (4.50%)<br />

2010 © SunMath, LLC · Printed on 100% Recycled Paper<br />

Unauthorized reproduction of any information in this report is strictly prohibited. All analysis is based on historical data. SunMath, LLC cannot be held liable for analysis inaccuracies.<br />

7 of 9

CO2 Reduction Snapshot 13<br />

In addition to reducing your energy bills, a solar array reduces your carbon footprint.<br />

Below are various actions with equal CO 2 emission reductions.<br />

kWh Produced per Year<br />

Trees Planted<br />

6.1 kW Array<br />

kWh Produced per Year<br />

kWh Produced per Year by<br />

kWh Produced per Year<br />

of CO 2 Offset Annually<br />

kWh Produced per Year<br />

Cars Taken off the Road for One Year<br />

Notes<br />

13<br />

Average of 1.5 pounds of carbon emissions per kilowatt‐hour for US ,based on Department of Energy, for Canada, the Ontario Ministry for Energy; for the UK, UK<br />

Environment Watch and for Australia, various state government environmental departments (averaged)<br />

2010 © SunMath, LLC · Printed on 100% Recycled Paper<br />

Unauthorized reproduction of any information in this report is strictly prohibited. All analysis is based on historical data. SunMath, LLC cannot be held liable for analysis inaccuracies.<br />

8 of 9

Inputs & Assumptions<br />

System Specs<br />

Total Cost<br />

$26,365<br />

Cost / Watt $4.32<br />

Total Watts 6,105<br />

Orientation South (180)<br />

System Life<br />

25 Years<br />

Installation Date<br />

Oct‐2010<br />

Expected Investment Returns<br />

Certificate of Deposit<br />

4%<br />

Corporate Bonds 6%<br />

Stocks 8%<br />

Other Statistics<br />

Panel Efficiency in 25 years<br />

14<br />

85%<br />

Discount Rate 4.5%<br />

Annual Energy Increase 4.0%<br />

Tax Rate 28%<br />

15<br />

Average Electricty Cost (kWh) $0.0940<br />

Notes<br />

14<br />

Photovoltaic panels decline in efficiency due to UV exposure. Sandia National Laboratories published a paper titled: Photovoltaic Module Performance and Durability<br />

Following LongTerm Field Exposure, that states the annual photovoltaic output decline is 0.4% annually.<br />

15<br />

Electricity Cost is estimated based on bills submitted or regional average. Includes applicable taxes.<br />

2010 © SunMath, LLC · Printed on 100% Recycled Paper<br />

Unauthorized reproduction of any information in this report is strictly prohibited. All analysis is based on historical data. SunMath, LLC cannot be held liable for analysis inaccuracies.<br />

9 of 9