A Comparison of Capital Budgeting Techniques Capital budgeting ...

A Comparison of Capital Budgeting Techniques Capital budgeting ...

A Comparison of Capital Budgeting Techniques Capital budgeting ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Capital</strong> <strong>Budgeting</strong> <strong>Techniques</strong><br />

A collection <strong>of</strong> methods allowing the manager to choose among a variety <strong>of</strong> investment projects.<br />

Methods:<br />

• Average Accounting Return<br />

• Payback<br />

• Discounted payback<br />

• Internal Rate <strong>of</strong> Return<br />

• Modified Internal Rate <strong>of</strong> Return<br />

• Net Present Value<br />

• Pr<strong>of</strong>itability Index<br />

Average Accounting Return (AAR)<br />

AAR is the ratio <strong>of</strong> the Average Net Income to the Average Book Value.<br />

Decision rule: Take the project if AAR is greater than some target ratio set by accountants.<br />

Disadvantages: It has too many flaws, don't ever use it.<br />

Payback period<br />

Payback is the time it takes to recover the initial cost <strong>of</strong> the investment. Payback is usually measured in<br />

years.<br />

Decision rule: Take the project with the shortest payback period<br />

Disadvantages<br />

It ignores time value <strong>of</strong> money<br />

It ignores risk<br />

It ignores cash inflows beyond the cut<strong>of</strong>f point<br />

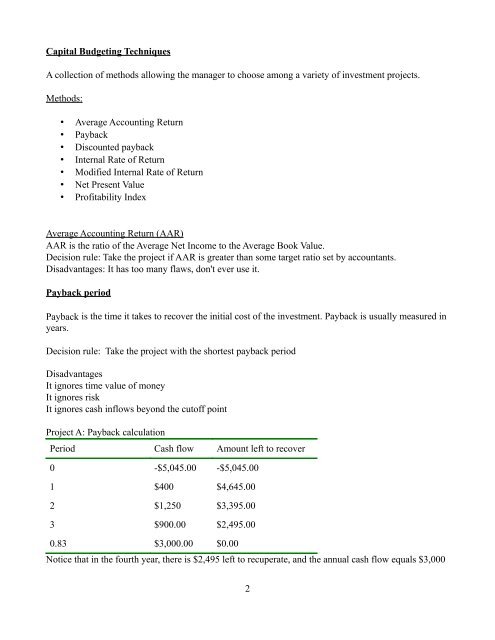

Project A: Payback calculation<br />

Period Cash flow Amount left to recover<br />

0 -$5,045.00 -$5,045.00<br />

1 $400 $4,645.00<br />

2 $1,250 $3,395.00<br />

3 $900.00 $2,495.00<br />

0.83 $3,000.00 $0.00<br />

Notice that in the fourth year, there is $2,495 left to recuperate, and the annual cash flow equals $3,000<br />

2