- Page 1: HUMAN TRAFFICKING IN THE REPUBLIC O

- Page 4 and 5: HUMAN TRAFFICKING IN THE REPUBLIC O

- Page 6 and 7: TABLE OF CONTENTS LIST OF ABBREVIAT

- Page 8 and 9: III.2.2.4.4. Users of Commercial Se

- Page 10 and 11: III.5.1. Legal Analysis . . . . . .

- Page 12 and 13: LIST OF ABBREVIATIONS AND ACRONYMS

- Page 14 and 15: PREFACE You have before you a Repor

- Page 16 and 17: GENERAL INFORMATION ABOUT SERBIA I.

- Page 18 and 19: POLITICAL, ECONOMIC AND SOCIAL SITU

- Page 20 and 21: HUMAN RIGHTS IN SERBIA § 14. Altho

- Page 22 and 23: WOMEN IN SERBIA institution of ombu

- Page 24 and 25: WOMEN IN SERBIA women, although thi

- Page 26 and 27: WOMEN IN SERBIA women won around 11

- Page 28 and 29: WOMEN IN SERBIA participatory proce

- Page 30 and 31: CHILDREN IN SERBIA § 53. Although

- Page 32 and 33: CHILDREN IN SERBIA whereby this fig

- Page 34 and 35: CHILDREN IN SERBIA school. Although

- Page 36 and 37: PERSONS WITH DISABILITIES IN SERBIA

- Page 38 and 39: PERSONS WITH DISABILITIES IN SERBIA

- Page 40 and 41: PERSONS WITH DISABILITIES IN SERBIA

- Page 42 and 43: NATIONAL MINORITIES IN SERBIA I.7.

- Page 44 and 45: NATIONAL MINORITIES IN SERBIA care,

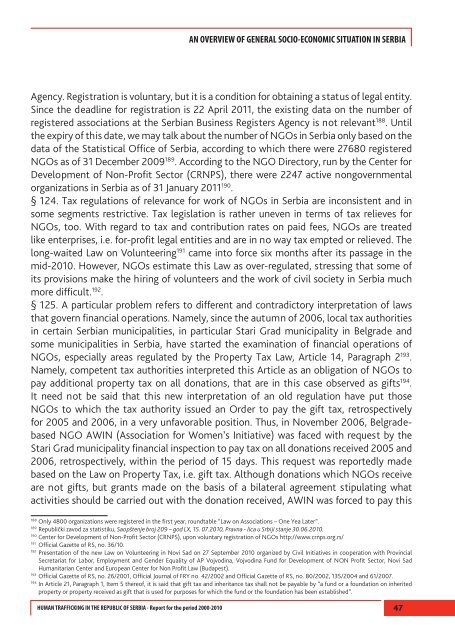

- Page 46 and 47: NONGOVERNMENTAL ORGANIZATIONS IN SE

- Page 50 and 51: NONGOVERNMENTAL ORGANIZATIONS IN SE

- Page 52 and 53: HUMAN TRAFFICKING AS A GLOBAL PHENO

- Page 54 and 55: TRAFFICKING IN HUMAN BEINGS IN SERB

- Page 56 and 57: TRAFFICKING IN HUMAN BEINGS IN SERB

- Page 58 and 59: ANTI-TRAFFICKING ACTIVITIES AND MEC

- Page 60 and 61: ANTI-TRAFFICKING ACTIVITIES AND MEC

- Page 62 and 63: HOW TO DEAL WITH TRAFFICKING: INTER

- Page 64 and 65: HOW TO DEAL WITH TRAFFICKING: INTER

- Page 66 and 67: HOW TO DEAL WITH TRAFFICKING: INTER

- Page 68 and 69: HOW TO DEAL WITH TRAFFICKING: INTER

- Page 70 and 71: HOW TO DEAL WITH TRAFFICKING: INTER

- Page 72 and 73: ARTICLES 1-5 III.2. Protocol to Pre

- Page 74 and 75: ARTICLES 1-5 Article 5 Criminalizat

- Page 76 and 77: ARTICLES 1-5 2. Each Party shall en

- Page 78 and 79: ARTICLES 1-5 2. Each Party may, at

- Page 80 and 81: ARTICLES 1-5 • Criminal offences

- Page 82 and 83: ARTICLES 1-5 § 217. It is signific

- Page 84 and 85: ARTICLES 1-5 ACTION Palermo Protoco

- Page 86 and 87: ARTICLES 1-5 PURPOSE Palermo Protoc

- Page 88 and 89: ARTICLES 1-5 III.2.1.1.5 The Crimin

- Page 90 and 91: ARTICLES 1-5 III.2.1.2.1 Criminaliz

- Page 92 and 93: ARTICLES 1-5 three months to five y

- Page 94 and 95: ARTICLES 1-5 § 262. If, in the cou

- Page 96 and 97: ARTICLES 1-5 § 274. If there are c

- Page 98 and 99:

ARTICLES 1-5 • if the accused has

- Page 100 and 101:

ARTICLES 1-5 § 294. This Law defin

- Page 102 and 103:

ARTICLES 1-5 § 305. As to the proc

- Page 104 and 105:

ARTICLES 1-5 investigative teams; t

- Page 106 and 107:

ARTICLES 1-5 III.2.1.2.15 Protectio

- Page 108 and 109:

ARTICLES 1-5 cooperation let us men

- Page 110 and 111:

ARTICLES 1-5 and forcing a juvenile

- Page 112 and 113:

ARTICLES 1-5 III.2.2. Practice Anal

- Page 114 and 115:

ARTICLES 1-5 3. Who has left the pl

- Page 116 and 117:

ARTICLES 1-5 been avoided being dep

- Page 118 and 119:

ARTICLES 1-5 of Foreigners Act, i.e

- Page 120 and 121:

ARTICLES 1-5 rejected the notion th

- Page 122 and 123:

ARTICLES 1-5 were condemning and st

- Page 124 and 125:

ARTICLES 1-5 III.2.2.4.4. Users of

- Page 126 and 127:

ARTICLES 1-5 agencies which were, a

- Page 128 and 129:

ARTICLES 1-5 § 393. Soon, advertis

- Page 130 and 131:

ARTICLES 1-5 human trafficking and

- Page 132 and 133:

ARTICLES 1-5 III.2.2.6. Human Traff

- Page 134 and 135:

ARTICLES 1-5 inspired by a specific

- Page 136 and 137:

ARTICLES 1-5 while novelty in the p

- Page 138 and 139:

ARTICLES 1-5 existing provisions on

- Page 140 and 141:

ARTICLES 1-5 sentenced for human tr

- Page 142 and 143:

ARTICLES 1-5 21 Year Imprisonment f

- Page 144 and 145:

ARTICLES 1-5 the fact that it did n

- Page 146 and 147:

ARTICLES 1-5 Aleksandar Putnik, wit

- Page 148 and 149:

ARTICLES 1-5 some of the victims ar

- Page 150 and 151:

ARTICLES 1-5 helpers, the Tomić br

- Page 152 and 153:

ARTICLES 1-5 BELGRADE - In Blace ne

- Page 154 and 155:

ARTICLES 1-5 you convict them to lo

- Page 156 and 157:

ARTICLES 1-5 III.2.2.11. Setting Up

- Page 158 and 159:

ARTICLES 1-5 than one month in the

- Page 160 and 161:

ARTICLES 1-5 The Novi Sad District

- Page 162 and 163:

ARTICLES 1-5 technical assistance a

- Page 164 and 165:

ARTICLES 1-5 judge of the Šabac Di

- Page 166 and 167:

ARTICLES 1-5 the respondents said t

- Page 168 and 169:

ARTICLE 6 Janković sent the report

- Page 170 and 171:

ARTICLE 6 CoE Article 10 Identifica

- Page 172 and 173:

ARTICLE 6 CoE Article 15 Compensati

- Page 174 and 175:

ARTICLE 6 § 468. For the purpose o

- Page 176 and 177:

ARTICLE 6 that the trial is closed,

- Page 178 and 179:

ARTICLE 6 arrest and charge in a la

- Page 180 and 181:

ARTICLE 6 without permanent or temp

- Page 182 and 183:

ARTICLE 6 could have access to the

- Page 184 and 185:

ARTICLE 6 at jobs detrimental to th

- Page 186 and 187:

ARTICLE 6 the first hearing of the

- Page 188 and 189:

ARTICLE 6 III.3.1.4.6. Ensuring a S

- Page 190 and 191:

ARTICLE 6 III.3.2.Practice Analysis

- Page 192 and 193:

ARTICLE 6 § 549. Still, positive e

- Page 194 and 195:

ARTICLE 6 Institute for Social Prot

- Page 196 and 197:

ARTICLE 6 Participating in the Crim

- Page 198 and 199:

ARTICLE 6 However, in spite of all

- Page 200 and 201:

ARTICLE 6 Pending criminal trial be

- Page 202 and 203:

ARTICLE 6 In 2005, a few months aft

- Page 204 and 205:

ARTICLE 6 § 575. The term “re-in

- Page 206 and 207:

ARTICLE 6 III. 3.2.3.1. Evolution o

- Page 208 and 209:

ARTICLE 6 Belgrade. The Mobile Team

- Page 210 and 211:

ARTICLE 6 order to adjust preventio

- Page 212 and 213:

ARTICLE 6 in direct work with traff

- Page 214 and 215:

ARTICLE 6 for every presumed traffi

- Page 216 and 217:

ARTICLE 6 instead of coordination,

- Page 218 and 219:

ARTICLE 6 including the doubt wheth

- Page 220 and 221:

ARTICLE 6 at identification and lat

- Page 222 and 223:

ARTICLE 6 advice from legal special

- Page 224 and 225:

ARTICLE 6 In November 2004, a 12-ye

- Page 226 and 227:

ARTICLE 6 In the end, IOM covered t

- Page 228 and 229:

ARTICLE 6 professional psychologica

- Page 230 and 231:

ARTICLE 6 At the beginning of Febru

- Page 232 and 233:

ARTICLE 6 list of problems is much

- Page 234 and 235:

ARTICLE 6 rejected and useless, he

- Page 236 and 237:

ARTICLE 6 current condition, they r

- Page 238 and 239:

ARTICLE 6 • Child trafficking for

- Page 240 and 241:

ARTICLE 6 § 678. It should certain

- Page 242 and 243:

ARTICLE 6 of the shelter in which t

- Page 244 and 245:

ARTICLE 6 III.3.2.4.2. Special Need

- Page 246 and 247:

ARTICLE 6 perform all procedural ac

- Page 248 and 249:

ARTICLE 6 § 967. At meetings, both

- Page 250 and 251:

ARTICLE 6 to come home because she

- Page 252 and 253:

ARTICLE 6 social welfare center reg

- Page 254 and 255:

ARTICLE 6 their families. 414 Child

- Page 256 and 257:

ARTICLE 6 representatives of the Mo

- Page 258 and 259:

ARTICLE 6 In September 2003, a citi

- Page 260 and 261:

ARTICLE 6 seizure and confiscation

- Page 262 and 263:

ARTICLE 6 damage and litigation cos

- Page 264 and 265:

ARTICLE 7 III.4. Protocol to Preven

- Page 266 and 267:

ARTICLE 7 purpose intended {Article

- Page 268 and 269:

ARTICLE 7 III.4.2. Practice Analysi

- Page 270 and 271:

ARTICLE 7 § 752. Moreover, “if t

- Page 272 and 273:

ARTICLE 8 III.5. Protocol to Preven

- Page 274 and 275:

ARTICLE 8 • Officials are require

- Page 276 and 277:

ARTICLE 8 shall be obliged to act i

- Page 278 and 279:

ARTICLE 8 are to see if in the near

- Page 280 and 281:

ARTICLE 8 further communication bet

- Page 282 and 283:

ARTICLE 8 § 785. The general absen

- Page 284 and 285:

ARTICLE 8 am punished after everyth

- Page 286 and 287:

ARTICLE 9 III.6. Protocol to Preven

- Page 288 and 289:

ARTICLE 9 countries of origin, tran

- Page 290 and 291:

ARTICLE 9 sub-objectives defined wi

- Page 292 and 293:

ARTICLE 9 governmental and internat

- Page 294 and 295:

ARTICLE 9 director of the Institute

- Page 296 and 297:

ARTICLE 9 envisages different preve

- Page 298 and 299:

ARTICLE 9 § 836. In December 2006,

- Page 300 and 301:

ARTICLE 9 young people as one rathe

- Page 302 and 303:

ARTICLE 9 Although not directly and

- Page 304 and 305:

ARTICLE 9 significant progress and

- Page 306 and 307:

ARTICLE 9 and NGOs exists 492 . How

- Page 308 and 309:

ARTICLE 9 of poverty in 2008 and 20

- Page 310 and 311:

ARTICLE 9 Chart III.6.1.9.1. Previo

- Page 312 and 313:

ARTICLE 9 310 YEAR NO. OF ISSUED PE

- Page 314 and 315:

ARTICLE 9 persons whom we identifie

- Page 316 and 317:

ARTICLE 10 § 906. As far as Serbia

- Page 318 and 319:

ARTICLE 10 CoE Article 29 Specialis

- Page 320 and 321:

ARTICLE 10 Strategy to Combat Traff

- Page 322 and 323:

ARTICLE 10 Special attention was pa

- Page 324 and 325:

ARTICLE 10 § 924. Between 28 May a

- Page 326 and 327:

ARTICLE 10 § 930. Police cooperati

- Page 328 and 329:

ARTICLE 10 In 2005, proceedings for

- Page 330 and 331:

ARTICLE 10 strengthen further coope

- Page 332 and 333:

ARTICLE 10 section for Criminal Law

- Page 334 and 335:

ARTICLE 10 § 954. One objection th

- Page 336 and 337:

ARTICLE 11 all three differ by thei

- Page 338 and 339:

ARTICLE 11 3. Where appropriate, an

- Page 340 and 341:

ARTICLE 11 to disembark to a harbor

- Page 342 and 343:

ARTICLE 11 do not need visa for sta

- Page 344 and 345:

ARTICLE 11 intend to illegally cros

- Page 346 and 347:

ARTICLE 11 Declaration on the Borde

- Page 348 and 349:

ARTICLES 12 AND 13 acting today? Gr

- Page 350 and 351:

ARTICLES 12 AND 13 CoE Article 9 Le

- Page 352 and 353:

ARTICLES 12 AND 13 New Serbian Pass

- Page 354 and 355:

ARTICLES 12 AND 13 Since June 2010,

- Page 356 and 357:

ARTICLE 14 (2) travel documents, an

- Page 358 and 359:

ARTICLE 14 (2) of non-discriminatio

- Page 360 and 361:

ARTICLE 14 (2) legislative or judic

- Page 362 and 363:

ARTICLE 14 (2) notorious lie. It ha

- Page 364 and 365:

ARTICLES 36 AND 37 III.11. CoE Conv

- Page 366 and 367:

Recommendations for the Harmonizati

- Page 368 and 369:

• Article 231 of the Criminal Pro

- Page 370 and 371:

Protection of Trafficking Victims

- Page 372 and 373:

ASTRA SOS HOTLINE AND DIRECT VICTIM

- Page 374 and 375:

ASTRA SOS HOTLINE AND DIRECT VICTIM

- Page 376 and 377:

ASTRA SOS HOTLINE AND DIRECT VICTIM

- Page 378 and 379:

ASTRA SOS HOTLINE AND DIRECT VICTIM

- Page 380 and 381:

ASTRA SOS HOTLINE AND DIRECT VICTIM

- Page 382 and 383:

ASTRA SOS HOTLINE AND DIRECT VICTIM

- Page 384 and 385:

ASTRA SOS HOTLINE AND DIRECT VICTIM

- Page 386 and 387:

ASTRA SOS HOTLINE AND DIRECT VICTIM

- Page 388 and 389:

ASTRA SOS HOTLINE AND DIRECT VICTIM

- Page 390 and 391:

ASTRA SOS HOTLINE AND DIRECT VICTIM

- Page 392 and 393:

ASTRA SOS HOTLINE AND DIRECT VICTIM

- Page 394 and 395:

ASTRA SOS HOTLINE AND DIRECT VICTIM

- Page 396 and 397:

ASTRA SOS HOTLINE AND DIRECT VICTIM

- Page 398 and 399:

ASTRA SOS HOTLINE AND DIRECT VICTIM

- Page 400 and 401:

ASTRA SOS HOTLINE AND DIRECT VICTIM

- Page 402 and 403:

ASTRA SOS HOTLINE AND DIRECT VICTIM

- Page 404 and 405:

ASTRA SOS HOTLINE AND DIRECT VICTIM

- Page 406 and 407:

MAPS The Consular Offices of the Re

- Page 408 and 409:

MAPS II - Map of Routes Across Serb

- Page 410 and 411:

PERCEPTION AND UNDERSTANDING OF THE

- Page 412 and 413:

PERCEPTION AND UNDERSTANDING OF THE

- Page 414 and 415:

PERCEPTION AND UNDERSTANDING OF THE

- Page 416 and 417:

PERCEPTION AND UNDERSTANDING OF THE

- Page 418 and 419:

THE CASE OF LABOR EXPLOITATION OF T

- Page 420 and 421:

THE CASE OF LABOR EXPLOITATION OF T

- Page 422 and 423:

THE CASE OF LABOR EXPLOITATION OF T

- Page 424 and 425:

THE CASE OF LABOR EXPLOITATION OF T

- Page 426 and 427:

THE CASE OF LABOR EXPLOITATION OF T

- Page 428 and 429:

THE CASE OF LABOR EXPLOITATION OF T

- Page 430 and 431:

THE CASE OF LABOR EXPLOITATION OF T

- Page 432 and 433:

THE CASE OF LABOR EXPLOITATION OF T

- Page 434 and 435:

THE CASE OF LABOR EXPLOITATION OF T

- Page 436 and 437:

THE CASE OF LABOR EXPLOITATION OF T

- Page 438 and 439:

THE CASE OF LABOR EXPLOITATION OF T

- Page 440 and 441:

THE CASE OF LABOR EXPLOITATION OF T

- Page 442 and 443:

THE CASE OF LABOR EXPLOITATION OF T

- Page 444 and 445:

THE CASE OF LABOR EXPLOITATION OF T

- Page 446 and 447:

THE CASE OF LABOR EXPLOITATION OF T

- Page 448 and 449:

THE CASE OF LABOR EXPLOITATION OF T

- Page 450 and 451:

DISCOVERED CASES OF TRAFFICKING AND

- Page 452 and 453:

DISCOVERED CASES OF TRAFFICKING AND

- Page 454 and 455:

DISCOVERED CASES OF TRAFFICKING AND

- Page 456 and 457:

DISCOVERED CASES OF TRAFFICKING AND

- Page 458 and 459:

DISCOVERED CASES OF TRAFFICKING AND

- Page 460 and 461:

ACTIVE ANTI-TRAFFICKING ACTORS IN T

- Page 462 and 463:

ACTIVE ANTI-TRAFFICKING ACTORS IN T

- Page 464 and 465:

ACTIVE ANTI-TRAFFICKING ACTORS IN T

- Page 466 and 467:

ACTIVE ANTI-TRAFFICKING ACTORS IN T

- Page 468 and 469:

ACTIVE ANTI-TRAFFICKING ACTORS IN T

- Page 470 and 471:

ACTIVE ANTI-TRAFFICKING ACTORS IN T

- Page 472 and 473:

ACTIVE ANTI-TRAFFICKING ACTORS IN T

- Page 474 and 475:

ACTIVE ANTI-TRAFFICKING ACTORS IN T

- Page 476 and 477:

Organizing workshops, seminars, for

- Page 478 and 479:

Towards the Schengen White List rep

- Page 480 and 481:

A global alliance agaist forced lab

- Page 482:

Aleksić I., Lukić M., Serbia - Co