Although 2009 is certainly a year to forget - Unquote

Although 2009 is certainly a year to forget - Unquote

Although 2009 is certainly a year to forget - Unquote

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

unquote<br />

France<br />

LA RÉFÉRENCE PAR EXCELLENCE DU PRIVATE EQUITY EN FRANCE<br />

Issue 114 AUGUST/SEPTEMBER 2010<br />

Early-stage and expansion deals: less <strong>is</strong> more<br />

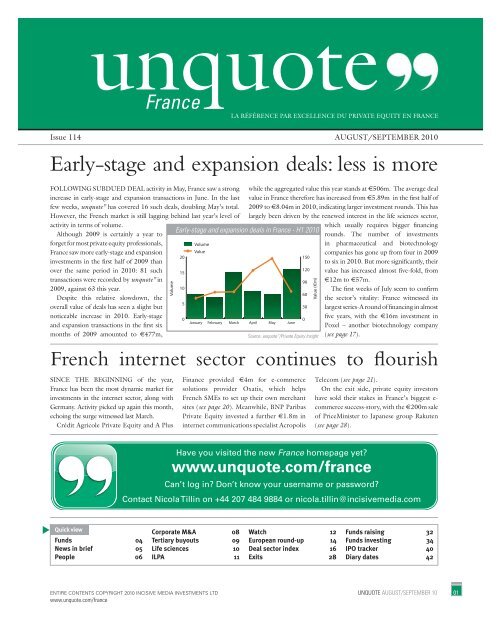

FOLLOWING SUBDUED DEAL activity in May, France saw a strong<br />

increase in early-stage and expansion transactions in June. In the last<br />

few weeks, unquote” has covered 16 such deals, doubling May’s <strong>to</strong>tal.<br />

However, the French market <strong>is</strong> still lagging behind last <strong>year</strong>’s level of<br />

activity in terms of volume.<br />

<strong>Although</strong> <strong>2009</strong> <strong>is</strong> <strong>certainly</strong> a <strong>year</strong> <strong>to</strong><br />

<strong>forget</strong> for most private equity professionals,<br />

Volume<br />

France saw more early-stage and expansion<br />

Value<br />

20<br />

investments in the first half of <strong>2009</strong> than<br />

over the same period in 2010: 81 such 15<br />

transactions were recorded by unquote” in<br />

<strong>2009</strong>, against 63 th<strong>is</strong> <strong>year</strong>.<br />

10<br />

Despite th<strong>is</strong> relative slowdown, the<br />

5<br />

overall value of deals has seen a slight but<br />

noticeable increase in 2010. Early-stage<br />

0<br />

January February March<br />

and expansion transactions in the first six<br />

months of <strong>2009</strong> amounted <strong>to</strong> 477m,<br />

Volume<br />

SINCE THE BEGINNING of the <strong>year</strong>,<br />

France has been the most dynamic market for<br />

investments in the internet sec<strong>to</strong>r, along with<br />

Germany. Activity picked up again th<strong>is</strong> month,<br />

echoing the surge witnessed last March.<br />

Crédit Agricole Private Equity and A Plus<br />

Finance provided 4m for e-commerce<br />

solutions provider Oxat<strong>is</strong>, which helps<br />

French SMEs <strong>to</strong> set up their own merchant<br />

sites (see page 20). Meanwhile, BNP Paribas<br />

Private Equity invested a further 1.8m in<br />

internet communications special<strong>is</strong>t Acropol<strong>is</strong><br />

while the aggregated value th<strong>is</strong> <strong>year</strong> stands at 506m. The average deal<br />

value in France therefore has increased from 5.89m in the first half of<br />

<strong>2009</strong> <strong>to</strong> 8.04m in 2010, indicating larger investment rounds. Th<strong>is</strong> has<br />

largely been driven by the renewed interest in the life sciences sec<strong>to</strong>r,<br />

which usually requires bigger financing<br />

rounds. The number of investments<br />

in pharmaceutical and biotechnology<br />

companies has gone up from four in <strong>2009</strong><br />

150<br />

120<br />

90<br />

<strong>to</strong> six in 2010. But more significantly, their<br />

value has increased almost five-fold, from<br />

12m <strong>to</strong> 57m.<br />

The first weeks of July seem <strong>to</strong> confirm<br />

60<br />

30<br />

the sec<strong>to</strong>r’s vitality: France witnessed its<br />

largest series-A round of financing in almost<br />

five <strong>year</strong>s, with the 16m investment in<br />

0<br />

April May June<br />

Poxel – another biotechnology company<br />

Source: unquote”/Private Equity Insight (see page 17).<br />

Early-stage and expansion deals in France - H1 2010<br />

French internet sec<strong>to</strong>r continues <strong>to</strong> flour<strong>is</strong>h<br />

Value (m)<br />

Telecom (see page 21).<br />

On the exit side, private equity inves<strong>to</strong>rs<br />

have sold their stakes in France’s biggest e-<br />

commerce success-s<strong>to</strong>ry, with the 200m sale<br />

of PriceMin<strong>is</strong>ter <strong>to</strong> Japanese group Rakuten<br />

(see page 28).<br />

Have you v<strong>is</strong>ited the new France homepage yet?<br />

www.unquote.com/france<br />

Can’t log in? Don’t know your username or password?<br />

Contact Nicola Tillin on +44 207 484 9884 or nicola.tillin@inc<strong>is</strong>ivemedia.com<br />

Quick view<br />

Funds 04<br />

News in brief 05<br />

People 06<br />

Corporate M&A 08<br />

Tertiary buyouts 09<br />

Life sciences 10<br />

ILPA 11<br />

Watch 12<br />

European round-up 14<br />

Deal sec<strong>to</strong>r index 16<br />

Exits 28<br />

Funds ra<strong>is</strong>ing 32<br />

Funds investing 34<br />

IPO tracker 40<br />

Diary dates 42<br />

ENTIRE CONTENTS COPYRIGHT 2010 INCISIVE MEDIA INVESTMENTS LTD UNQUOTE AUGUST/SEPTEMBER 10 01<br />

www.unquote.com/france

In <br />

uncertain times, there are still some<br />

investments <br />

that will pay dividends. IE<br />

Consulting <br />

can help you understand<br />

how <br />

current and future developments<br />

will <br />

impact your reputation and your<br />

ability <br />

<strong>to</strong> do business. And we can<br />

tell <br />

you how your competition will be<br />

affected, <br />

<strong>to</strong>o. We can also help you ra<strong>is</strong>e<br />

capital, <br />

source and execute deals and<br />

safeguard <br />

and create value.<br />

<br />

<br />

<br />

<br />

<br />

<br />

supporting <br />

private equity

unquote<br />

contents<br />

04<br />

08<br />

News<br />

Funds 04<br />

News in brief 05<br />

People 06<br />

Analys<strong>is</strong><br />

Corporate M&A 08<br />

Tertiary buyouts 09<br />

Life sciences 10<br />

ILPA 11<br />

Watch 12<br />

European round-up 14<br />

Deals<br />

Deal sec<strong>to</strong>r index 16<br />

Early-stage 17<br />

Poxel 17<br />

McPhy Energy 17<br />

EyeTechCare 18<br />

Expansion 19<br />

Groupe Chr<strong>is</strong>tian Bernard 19<br />

Redman Promotion 19<br />

Oxat<strong>is</strong> 20<br />

Nuxeo 20<br />

Acropol<strong>is</strong> Telecom 21<br />

Novapost 22<br />

Devederm 22<br />

Comu<strong>to</strong> (Covoiturage.fr) 23<br />

FInteractive 24<br />

Intégral Système 24<br />

Kall<strong>is</strong>ta Energy 25<br />

Buyouts 26<br />

Thermocoax 26<br />

Hyper Embal/Valeurd<strong>is</strong> 27<br />

Groupe ACR 27<br />

Exits<br />

PriceMin<strong>is</strong>ter 28<br />

Carmat SAS 29<br />

Groupe Keria 30<br />

Trecobat 30<br />

Funds ra<strong>is</strong>ing 32<br />

Funds investing 34<br />

IPO tracker 40<br />

Diary dates 42<br />

16<br />

28<br />

We aim <strong>to</strong> validate fully all<br />

investment, divestment and fundra<strong>is</strong>ing<br />

data via direct contact with the<br />

investment professionals themselves.<br />

Th<strong>is</strong> policy, combined with the scale of<br />

our edi<strong>to</strong>rial and research operation,<br />

enables Inc<strong>is</strong>ive Financial Publ<strong>is</strong>hing<br />

journals <strong>to</strong> offer the prov<strong>is</strong>ion of broad,<br />

detailed and accurate data.<br />

Follow us on Twitter for<br />

breaking French private<br />

equity news:<br />

twitter.com/Franceunquote<br />

ISSN – 1467-0062<br />

Volume 2010/8<br />

Annual Subscription (Standard Plus):<br />

£1,500/2,250/$2,700<br />

Publ<strong>is</strong>hed by<br />

Inc<strong>is</strong>ive Financial Publ<strong>is</strong>hing ltd<br />

Haymarket House<br />

28-29 Haymarket<br />

London<br />

SW1Y 4RX<br />

UK<br />

Tel: +44 20 7484 9700<br />

Fax: +44 20 7004 7548<br />

All rights reserved. No part of th<strong>is</strong> publication<br />

may be reproduced or s<strong>to</strong>red in a database or<br />

electronic retrieval system, transmitted in any<br />

form or by any means, electronic, mechanical,<br />

pho<strong>to</strong>copied, recorded or otherw<strong>is</strong>e, without<br />

prior written perm<strong>is</strong>sion from the publ<strong>is</strong>hers. No<br />

statement in th<strong>is</strong> journal <strong>is</strong> <strong>to</strong> be construed as a<br />

recommendation <strong>to</strong> buy or sell securities.<br />

Acting Edi<strong>to</strong>r-in-Chief &<br />

Head of Research<br />

Emanuel Eftimiu<br />

emanuel.eftimiu@inc<strong>is</strong>ivemedia.com<br />

Edi<strong>to</strong>r-in-Chief<br />

Kimberly Romaine<br />

kimberly.romaine@inc<strong>is</strong>ivemedia.com<br />

Reporters<br />

Gregoire Gille – gregoire.gille@inc<strong>is</strong>ivemedia.com<br />

Vik<strong>to</strong>r Lundvall – vik<strong>to</strong>r.lundvall@inc<strong>is</strong>ivemedia.com<br />

Gail Mwamba – gail.mwamba@inc<strong>is</strong>ivemedia.com<br />

Online Edi<strong>to</strong>r<br />

John Bakie<br />

john.bakie@inc<strong>is</strong>ivemedia.com<br />

Publ<strong>is</strong>hing Direc<strong>to</strong>r<br />

Catherine Lew<strong>is</strong><br />

catherine.lew<strong>is</strong>@inc<strong>is</strong>ivemedia.com<br />

Advert<strong>is</strong>ing & Sponsorship Manager<br />

Stephen O’Sullivan<br />

stephen.osullivan@inc<strong>is</strong>ivemedia.com<br />

Production Edi<strong>to</strong>r<br />

Tim Kimber<br />

tim.kimber@inc<strong>is</strong>ivemedia.com<br />

Sub-edi<strong>to</strong>r<br />

Eleanor Stanley<br />

eleanor.stanley@inc<strong>is</strong>ivemedia.com<br />

Marketing<br />

Helen Longhurst<br />

helen.longhurst@inc<strong>is</strong>ivemedia.com<br />

Subscription Sales<br />

Nicola Tillin<br />

nicola.tillin@inc<strong>is</strong>ivemedia.com<br />

ENTIRE CONTENTS COPYRIGHT 2010 INCISIVE MEDIA INVESTMENTS LTD UNQUOTE AUGUST/SEPTEMBER 10 03<br />

www.unquote.com/france

funds<br />

Name<br />

Gilde Buyout Fund IV<br />

Closed on<br />

800m (June 2010)<br />

Focus<br />

Buyouts, mid-market, Europe<br />

Contact<br />

Koos Teule<br />

Gilde Buy Out Partners BV<br />

New<strong>to</strong>nlaan 91<br />

PO Box 85067<br />

3508 AB Utrecht<br />

Netherlands<br />

Tel : +31 30 219 2508<br />

Adv<strong>is</strong>ers<br />

MV<strong>is</strong>ion (Placement agent); SJ<br />

Berwin (Legal)<br />

unquote<br />

Gilde’s latest fund reaches 800m hard-cap<br />

Fund<br />

Gilde Buyout Partners has closed its Gilde Buyout Fund IV on 800m. Launched in March <strong>2009</strong>,<br />

the vehicle has a 10-<strong>year</strong> lifespan, with the potential <strong>to</strong> extend by two one-<strong>year</strong> periods. Based in the<br />

Netherlands, the fund was oversubscribed and reached its hard-cap following strong inves<strong>to</strong>r interest.<br />

Management fees have been set at 1.65%, while the hurdle and carry follow the industry standard of<br />

8% and 20% respectively. Carried interest will be paid on the fund as a whole. MV<strong>is</strong>ion acted as global<br />

placing agent and SJ Berwin was mandated as legal adv<strong>is</strong>er. Gilde’s previous buyout fund, Gilde Buyout<br />

Fund III, reached its 600m target in September 2006. To date, it has completed nine investments.<br />

Inves<strong>to</strong>rs<br />

The fund has attracted 45 contribu<strong>to</strong>rs, with several previous Gilde inves<strong>to</strong>rs returning. 50% of<br />

commitments came from Europe, 35% from the US and 15% from the Asia Pacific. Pension plans and<br />

sovereign wealth funds account for the majority of the inves<strong>to</strong>r base.<br />

Investments<br />

Gilde aims <strong>to</strong> make equity investments of 25-200m in mid-market companies across a wide range of<br />

industries, with a core focus on the Benelux, German-speaking and French economies. The fund expects<br />

<strong>to</strong> perform around 15 investments over its lifetime, several of which are said <strong>to</strong> be already in the pipeline.<br />

People<br />

The fund <strong>is</strong> managed by the Gilde buyout team, led by Boudewijn Molenaar.<br />

Name<br />

Argos Expansion<br />

Closed on<br />

45m (July 2010)<br />

Target<br />

120m<br />

Focus<br />

Expansion, SMEs, France<br />

Contact<br />

Constance Jay<br />

Argos Soditic<br />

14, rue de Bassano<br />

75783 Par<strong>is</strong> Cedex 16<br />

France<br />

Tel: +33 1 53 67 20 50<br />

Adv<strong>is</strong>ers<br />

Proskauer Rose (Legal)<br />

Latest Argos fund holds 45m first close<br />

Fund<br />

Argos Soditic has closed its Argos Expansion fund on 45m. The vehicle will make its first investments while<br />

continuing <strong>to</strong> ra<strong>is</strong>e funds from LPs, with a final target of 120m. The fund has a 10-<strong>year</strong> lifespan with a five<strong>year</strong><br />

investment period. Officially launched in January 2008, it started receiving commitments in <strong>2009</strong>.<br />

Based in France, Argos Expansion <strong>is</strong> an FCPR benefiting from simplified author<strong>is</strong>ation procedures.<br />

Management fees have been set at 2%, hurdle at 7% and carry at 20%. While no placing agent was<br />

mandated, Proskauer Rose acts as legal adv<strong>is</strong>er <strong>to</strong> the fund.<br />

Inves<strong>to</strong>rs<br />

Argos Expansion has received commitments from 14 inves<strong>to</strong>rs so far. The EIF and CDC Entrepr<strong>is</strong>es,<br />

acting on behalf of the French Strategic Investment Fund (FSI), have contributed along with the three<br />

fund managers. The vehicle <strong>is</strong> looking <strong>to</strong> attract commitments from France and the rest of Europe.<br />

Investments<br />

The fund will provide development and acqu<strong>is</strong>ition financing for small and medium-sized French<br />

enterpr<strong>is</strong>es (SMEs) already held or being acquired by their management teams. It will typically invest<br />

between 2-12m in junior capital (sponsorless mezzanine) and minority equity. The fund should<br />

perform between 10-15 investments in businesses with enterpr<strong>is</strong>e values ranging from 10-100m.<br />

People<br />

An independent management team cons<strong>is</strong>ting of three partners – Olivier Bossan, Lou<strong>is</strong> de Lestanville<br />

and Jean de Sampigny – will manage the fund’s operations and investments.<br />

04 UNQUOTE AUGUST/SEPTEMBER 10 ENTIRE CONTENTS COPYRIGHT 2010 INCISIVE MEDIA INVESTMENTS LTD<br />

www.unquote.com/france

unquote<br />

Carlyle set <strong>to</strong> exit O<strong>to</strong>r<br />

CARLYLE HAS entered in<strong>to</strong> exclusive d<strong>is</strong>cussions with<br />

packaging and office supplies wholesaler DS Smith, regarding<br />

the acqu<strong>is</strong>ition of Carlyle’s stake in l<strong>is</strong>ted company O<strong>to</strong>r.<br />

The transaction would involve the sale of 94.75% of O<strong>to</strong>r’s share<br />

capital, which Carlyle acquired in 2005. In addition, shares<br />

retained by O<strong>to</strong>r’s chairman would also be sold <strong>to</strong> DS Smith,<br />

which would then control more than 95% of the company.<br />

DS Smith has offered 8.97 per O<strong>to</strong>r share, which would value<br />

the company at 247m, including a 47m debt. Following<br />

completion of the transaction by the end of 2010, DS Smith<br />

intends <strong>to</strong> launch an offer for the remaining l<strong>is</strong>ted shares. O<strong>to</strong>r <strong>is</strong> a<br />

French corrugated cardboard packaging manufacturer, operating<br />

six box plants, three specialty sheet plants, two paper mills and<br />

one packaging machine unit. Floated on NYSE Alternext Par<strong>is</strong> in<br />

1998, it posted revenues of 315m in <strong>2009</strong>.<br />

news in brief<br />

Avenir et al. back Société<br />

Hôtelière Côte Rôtie<br />

AVENIR ENTREPRISES, Sofival, BNP Paribas<br />

Développement, Garibaldi Participations and R<strong>is</strong>que &<br />

Sérénité have funded the buyout of eight hotels on behalf of<br />

Société Hôtelière Côte Rôtie (SHCR).<br />

The eight hotels, located in the Rhône-Alpes region of France,<br />

were acquired from Groupe Accor for an und<strong>is</strong>closed amount.<br />

Sofival, a local real estate developer, contributed 39% of the<br />

funds. The remainder was provided by private equity houses<br />

Avenir Entrepr<strong>is</strong>es (21%), BNP Paribas Développement (17%),<br />

Garibaldi Participations (7%) and R<strong>is</strong>que & Sérénité (5%).<br />

SHCR was created <strong>to</strong> operate hotels and aims <strong>to</strong> take<br />

advantage of the region’s <strong>to</strong>ur<strong>is</strong>t potential, especially for<br />

skiing holidays.<br />

AIFM vote put back <strong>to</strong> autumn<br />

A CRUCIAL VOTE on the AIFM<br />

Directive has been delayed until<br />

September.<br />

Issues regarding third country rules,<br />

which would limit the capabilities of<br />

non-EU domiciled hedge, private<br />

equity and venture capital funds, led<br />

<strong>to</strong> the collapse of talks between the<br />

European parliament and country<br />

representatives.<br />

The European comm<strong>is</strong>sion had set<br />

an ambitious target of agreeing the<br />

regulations by the end of th<strong>is</strong> month.<br />

However, the Span<strong>is</strong>h EU presidency<br />

says it will not be possible <strong>to</strong> reach an<br />

agreement in June, and the vote has<br />

now been delayed until the second<br />

parliamentary session in September<br />

th<strong>is</strong> <strong>year</strong>.<br />

A delay in holding the vote gives<br />

lobby<strong>is</strong>ts crucial extra time <strong>to</strong> push<br />

for changes in the draft leg<strong>is</strong>lation,<br />

which could negatively impact private<br />

equity and venture capital investment<br />

in Europe.<br />

Seventure leads Nutrionix investment<br />

PREVIOUS INVESTORS Seventure Partners have worked with seven business<br />

angels <strong>to</strong> provided additional funding for French-based Nutrionix, a company that<br />

special<strong>is</strong>es in the reduction of sodium in food.<br />

The first round of funding from Seventure of 900,000 completed in spring<br />

<strong>2009</strong> enabled Nutrionix <strong>to</strong> launch its first commercial product, K-Salt, and<br />

accelerate product development. Th<strong>is</strong> second round of funding was arranged<br />

<strong>to</strong> take advantage of increasingly receptive market conditions and the need <strong>to</strong><br />

accelerate development.<br />

Lloyds sells UK<br />

portfolio <strong>to</strong><br />

Coller Capital<br />

LLOYDS BANKING GROUP has<br />

become the latest bank <strong>to</strong> cut its private<br />

equity exposure, selling its £480m<br />

portfolio of UK private equity stakes <strong>to</strong><br />

a newly created joint venture, Cavend<strong>is</strong>h<br />

Square Partners.<br />

Lloyds will jointly own the venture with<br />

Coller Capital, which has agreed <strong>to</strong> pay<br />

£332m for 70% of the venture, while the<br />

bank maintains a 30% stake.<br />

The deal will see a transfer of 40 UK<br />

trading companies <strong>to</strong> the new vehicle,<br />

currently managed by Bank of Scotland<br />

Integrated Finance (BOSIF). Coller<br />

won the deal through an auction<br />

process, with the agreement subject <strong>to</strong><br />

regula<strong>to</strong>ry approval.<br />

Lloyds expects <strong>to</strong> complete the transfer<br />

of the assets and ex<strong>is</strong>ting BOSIF<br />

management team <strong>to</strong> the new vehicle by<br />

the third quarter of 2010.<br />

ENTIRE CONTENTS COPYRIGHT 2010 INCISIVE MEDIA INVESTMENTS LTD UNQUOTE AUGUST/SEPTEMBER 10 05<br />

www.unquote.com/france

news in brief<br />

LBO France plans<br />

Medi-Partenaires exit<br />

LBO FRANCE <strong>is</strong> working on plans <strong>to</strong> exit its stake in French<br />

healthcare provider Medi-Partenaires SA, according <strong>to</strong> media<br />

reports. Rothschild has reportedly been hired <strong>to</strong> handle the<br />

sale, which <strong>is</strong> estimated <strong>to</strong> be valued at about 1bn.<br />

LBO France led the 600m secondary buyout of the company<br />

in 2007, investing alongside Barclays Private Equity, Crédit<br />

Agricole and Intermediate Capital.<br />

unquote<br />

AlpInvest sale rumoured<br />

THE OWNERS OF private equity heavyweight AlpInvest could<br />

be looking for a sale, according <strong>to</strong> reports. AlpInvest <strong>is</strong> owned<br />

by Dutch pension funds ABP and PGGM. ABP, AlpInvest and<br />

Crédit Su<strong>is</strong>se, which <strong>is</strong> rumoured <strong>to</strong> have been mandated for<br />

the sale, have all declined <strong>to</strong> comment.<br />

Founded in 1999, AlpInvest <strong>is</strong> one of the largest European<br />

private equity firms. With more than 40bn under management,<br />

it special<strong>is</strong>es in fund investments, secondary investments, coinvestments<br />

and mezzanine transactions.<br />

AXA Private Equity buys Phönix/Strack Group<br />

AXA PRIVATE EQUITY has acquired<br />

a majority stake in Phönix/Strack<br />

Group, a special valves supplier <strong>to</strong> the<br />

chemicals industry.<br />

No financial details for the transaction have<br />

been d<strong>is</strong>closed, but the inves<strong>to</strong>r <strong>is</strong> looking<br />

<strong>to</strong> grow the company internationally<br />

through add-on acqu<strong>is</strong>itions, as well as by<br />

exploiting ex<strong>is</strong>ting market opportunities.<br />

Founded in 1910, Phönix/Strack<br />

manufactures special valves for<br />

international blue-chip companies in<br />

the fields of energy, petrochemicals and<br />

chemicals. The group generated revenues<br />

of approximately 40m in <strong>2009</strong> and<br />

employs a workforce of 250 at its plants<br />

in Volkmarsen and Magdeburg, as well<br />

as through its sales entities in France and<br />

the US.<br />

people moves<br />

Edmond de<br />

Rothschild CP<br />

strengthens team<br />

Edmond de Rothschild Capital Partners<br />

has recruited a new investment direc<strong>to</strong>r<br />

and analyst. It has also promoted one of<br />

its analysts <strong>to</strong> asset manager.<br />

Aymeric Marraud des Grottes has been<br />

appointed as investment direc<strong>to</strong>r. He<br />

previously worked as an analyst and later<br />

associate for JP Morgan, which he joined<br />

in 2001.<br />

Marie Londero <strong>is</strong> joining the firm as an<br />

analyst, having recently graduated from<br />

the ESCP-EAP school.<br />

BNP Paribas Private Equity<br />

appoints Rivet-Fusil as FoF head<br />

BNP Paribas Private Equity has appointed Jean-Marc Rivet-Fusil <strong>to</strong> head its fundsof-funds<br />

team. He has been charged with defining and implementing the firm’s<br />

fund-of-funds strategy, which includes defining and supporting the d<strong>is</strong>tribution<br />

of tailored offerings.<br />

Rivet-Fusil will form part of the two-person investment committee, working alongside<br />

Stéphanie Egoian, who has been promoted <strong>to</strong> chief investment officer. Egoian will be<br />

in charge of coordinating the fund’s investment strategy <strong>to</strong> define its funds selection<br />

and investment processes.<br />

Rivet-Fusil joined BNP Paribas in 2007 as chief investment officer, coming<br />

from Amundi. He has also held previous roles at Access Capital Partners, Banexi<br />

Ventures Partners and Banexi Participations, covering funds selection, venture<br />

capital, buyouts and mezzanine financing. Egoian joined as investment direc<strong>to</strong>r<br />

in 1999 and has also worked as chief financial officer of the company’s Europe<br />

Telecom & Media Fund.<br />

06 UNQUOTE AUGUST/SEPTEMBER 10 ENTIRE CONTENTS COPYRIGHT 2010 INCISIVE MEDIA INVESTMENTS LTD<br />

www.unquote.com/france

EUROPEAN<br />

FUNDRAISING<br />

REVIEW 2010<br />

LOOKING TO RAISE FUNDS IN<br />

EUROPE IN 2010 AND BEYOND?<br />

The ninth edition of the European Fundra<strong>is</strong>ing Review <strong>is</strong> out now.<br />

Th<strong>is</strong> essential guide provides you with an in-depth analys<strong>is</strong> of<br />

private equity and venture capital fundra<strong>is</strong>ing activity for each major<br />

European region.<br />

Order your copy now by calling+44 (0)20 7968 4506<br />

and quoting ref: FPA<br />

In association with:<br />

unquote.com

corporate M&A<br />

unquote<br />

Corporates trump private equity<br />

in European M&A<br />

Private equity continues <strong>to</strong> lag behind corporate buyers in size of merger and<br />

acqu<strong>is</strong>ition (M&A) deals executed in Europe, as cash-rich corporate players flex<br />

their muscles <strong>to</strong> offer both capital and synergies in the space.<br />

Gail Mwamba reports<br />

The first half of th<strong>is</strong> <strong>year</strong> has seen a significant pick-up in<br />

M&A activity, with deal-making in Europe estimated <strong>to</strong> have<br />

reached about $230bn in the first half of 2010. A significant<br />

number of these deals have been executed by corporates<br />

making acqu<strong>is</strong>itions, which includes the purchase of Cogn<strong>is</strong><br />

by BASF for an estimated enterpr<strong>is</strong>e value of 3.1bn.<br />

According <strong>to</strong> Edward<br />

Boyce, Nomura’s Londonbased<br />

managing direc<strong>to</strong>r of<br />

investment banking, the <strong>to</strong>p<br />

20 largest deals seen in Europe,<br />

the Middle East and Africa<br />

(EMEA) th<strong>is</strong> <strong>year</strong> have been<br />

executed by corporates.<br />

“The <strong>to</strong>p deals we have seen<br />

th<strong>is</strong> <strong>year</strong> in EMEA, in terms<br />

of size, have been corporates<br />

buying corporates,” says Boyce.<br />

“They are situations where a trade buyer <strong>is</strong> a better solution,<br />

and a private equity inves<strong>to</strong>r cannot compete because it <strong>is</strong><br />

not able <strong>to</strong> provide the same synergies.”<br />

According <strong>to</strong> Boyce, corporate players are able <strong>to</strong> sometimes<br />

win over vendors because they generally offer a longer<br />

holding period, while private equity inves<strong>to</strong>rs tend <strong>to</strong> seek<br />

<strong>to</strong> exit within three <strong>to</strong> five <strong>year</strong>s.<br />

Corporates are also able <strong>to</strong> reign in situations where the target<br />

company will require constant streams of cash <strong>to</strong> survive,<br />

which may be a d<strong>is</strong>advantage for private equity players who<br />

are generally geared <strong>to</strong> finance acqu<strong>is</strong>itions. In recent times,<br />

corporates have increasingly been able <strong>to</strong> provide th<strong>is</strong> kind<br />

of support, as many are sitting on large pots of money, some<br />

of which has been gained through retained earnings.<br />

“Securing funding <strong>is</strong> not<br />

an <strong>is</strong>sue for us, as we have<br />

cashflows that have been<br />

generated organically,”<br />

says Swag Mukerji, chief<br />

financial officer at Londonbased<br />

washing machine<br />

producer SafetyKleen.<br />

“Fortunately, we have been<br />

resilient <strong>to</strong> the recession.”<br />

However, the availability<br />

for corporates of sustained<br />

cashflow and the potential for synergies with their targets has<br />

not been enough <strong>to</strong> purchase significant assets from private<br />

equity players.<br />

According <strong>to</strong> unquote” data, although exiting via trade sales<br />

constituted about 44% of deal volume in the first half of 2010,<br />

th<strong>is</strong> only amounted <strong>to</strong> 17% of <strong>to</strong>tal value. Th<strong>is</strong> <strong>is</strong> compared<br />

<strong>to</strong> secondary buyouts, where 28% of volume equated <strong>to</strong> 44%<br />

in deal value. It remains <strong>to</strong> be seen if corporates will extend<br />

their reign <strong>to</strong> th<strong>is</strong> space as well. <br />

08 UNQUOTE AUGUST/SEPTEMBER 10 ENTIRE CONTENTS COPYRIGHT 2010 INCISIVE MEDIA INVESTMENTS LTD<br />

www.unquote.com/france

unquote<br />

tertiary buyouts<br />

Tertiary buyouts:<br />

passing it on<br />

As deal-making fever returns <strong>to</strong> the market, tertiary sales appear <strong>to</strong> be<br />

back in vogue for a number of private equity inves<strong>to</strong>rs looking <strong>to</strong> put<br />

their secondary assets on the block. Gail Mwamba reports<br />

French pharmaceutical firm Cerba European Lab was recently<br />

sold by IK Investment Partners <strong>to</strong> PAI partners in an estimated<br />

500m tertiary buyout. PAI backed the 2006 secondary buyout<br />

from As<strong>to</strong>rg Partners. However, the company’s private equity<br />

investment h<strong>is</strong><strong>to</strong>ry stretches back even further, having been backed<br />

by Initiative & Finance and Natex<strong>is</strong> in a previous funding round.<br />

Barclays Private Equity also chose <strong>to</strong> go with a private equity<br />

player in its sale of UK luggage brand Antler in May, <strong>to</strong> Lloyds<br />

Development Capital – the third time the firm had been backed<br />

by a private equity inves<strong>to</strong>r. BPE bought the company from<br />

Royal Bank Equity Finance in 2004, with the vendor having<br />

backed its first buyout in 1999.<br />

Some tertiary deals have been spurred by inves<strong>to</strong>rs looking for<br />

more experienced buyers able <strong>to</strong> offer speed of execution as well<br />

as an attractive deal price. Th<strong>is</strong> was the case for Change Capital<br />

Partners, which th<strong>is</strong> month sold UK fashion retailer Republic in<br />

a tertiary deal <strong>to</strong> TPG Capital for an estimated £300m. Change<br />

Capital backed the company in a 2005 SBO from 3i.<br />

“There was a lot of private equity and trade interest in the<br />

business, and we made the dec<strong>is</strong>ion <strong>to</strong> pursue the option of<br />

a financial buyer based on both price and timing,” says Steve<br />

Petrow, managing direc<strong>to</strong>r at Change Capital Partner in<br />

London. “Trade players had a lot of interest, but the time frame<br />

that we were working within was quite difficult.”<br />

However, for Herkules, which recently sold Nordic healthcare<br />

equipment manufacturer Handicare <strong>to</strong> Nordic Capital, financial<br />

backers were specifically sought as Handicare was in need of<br />

fresh capital. Herkules, which had bought the company from<br />

AAC Capital Partners in 2005, ran out of capital in its first fund<br />

and was not able <strong>to</strong> finance further growth.<br />

“We invited only financial parties, and we had strong interest<br />

from Nordic and European funds, as well as US funds with<br />

offices in Europe,” says Patrik Egeland, partner at Herkules in<br />

Oslo. “We felt the company would benefit from having more<br />

capital <strong>to</strong> grow.”<br />

According <strong>to</strong> Petrow, the industry <strong>is</strong> expecting <strong>to</strong> see more<br />

tertiary deals in the future. Th<strong>is</strong> may well be the case, with recent<br />

reports of private equity buyers reportedly having joined the race<br />

<strong>to</strong> buy Bain Capital’s Italian software company, TeamSystem<br />

SpA, for an estimated 600m. Bain bought the company in a<br />

secondary buyout from Palamon Capital Partners in 2004.<br />

The spurt in tertiary activity may reflect difficult conditions<br />

in other exit markets, as the world economy remains weak.<br />

However, with some sellers specifically targeting other private<br />

equity buyers, believing they can bring something more <strong>to</strong> the<br />

business, it could indicate inves<strong>to</strong>rs are adopting a longer-term<br />

view, hoping their portfolio companies will continue <strong>to</strong> thrive<br />

long after inves<strong>to</strong>r and company part ways. <br />

ENTIRE CONTENTS COPYRIGHT 2010 INCISIVE MEDIA INVESTMENTS LTD UNQUOTE AUGUST/SEPTEMBER 10 09<br />

www.unquote.com/france

life sciences<br />

unquote<br />

Life sciences:<br />

testing times ahead?<br />

Pharmaceuticals and biotechnology have fared marginally better than other sec<strong>to</strong>rs<br />

during the global recession, but the last two <strong>year</strong>s have still been lacklustre for<br />

private equity investments in life sciences. However, with a healthy number of deals<br />

already th<strong>is</strong> <strong>year</strong>, what <strong>is</strong> on the cards for the rest of 2010? Greg Gille reports<br />

As in many sec<strong>to</strong>rs, the <strong>to</strong>p end of the life sciences market<br />

struggled the most in both 2008 and <strong>2009</strong>. Buyouts more than<br />

halved; unquote” only recorded four each <strong>year</strong>, down from a 10<br />

per <strong>year</strong> average between 2005 and 2007. Expansion deals were<br />

also scarce, with 16 in 2008 and 18 in <strong>2009</strong>, compared <strong>to</strong> an<br />

average 35 per <strong>year</strong> recorded between 2005 and 2007.<br />

However, early-stage investments remained in line with<br />

pre-2007 levels. <strong>2009</strong> saw 54 venture capital investments, a<br />

marginal improvement on the<br />

46 per <strong>year</strong> average recorded<br />

between 2004 and 2006.<br />

Venture capital<strong>is</strong>ts remained<br />

active throughout the cr<strong>is</strong><strong>is</strong>,<br />

betting strategic investments<br />

in innovative businesses would<br />

prove fruitful in the coming<br />

<strong>year</strong>s. Michiel de Haan,<br />

partner at venture firm Aescap,<br />

explains: “We are interested<br />

in companies that are very<br />

ambitious and we therefore aim<br />

for the long term. If you want<br />

<strong>to</strong> be a successful venture firm in life sciences, you cannot look<br />

for exits on the short term.”<br />

So far th<strong>is</strong> <strong>year</strong>, there have been five buyouts in the sec<strong>to</strong>r,<br />

already <strong>to</strong>pping both 2008 and <strong>2009</strong>. The <strong>year</strong> started with<br />

a bang from Charterhouse Capital, which bought Deb Group<br />

from Barclays for a generous £325m. Other notable deals<br />

include AAC Capital’s £100m acqu<strong>is</strong>ition of Martindale<br />

Pharmaceuticals, as well as the £400m Cerba Lab buyout by<br />

PAI partners.<br />

As far as venture investments are concerned, the 27 earlystage<br />

and 14 expansion deals recorded in the first half of 2010<br />

point <strong>to</strong> a return <strong>to</strong> pre-cr<strong>is</strong><strong>is</strong> levels of activity, in both volume<br />

and value. De Haan highlights the strengths of Europe for the<br />

near future: “Life sciences has a very favourable outlook, with<br />

an ageing population and a growing need for better medicine<br />

and healthcare; emerging countries also offer opportunities<br />

for European life sciences firms. Technology has always been<br />

better in Europe than in the US; what has been lacking for the<br />

last 20 <strong>year</strong>s and now reversed<br />

<strong>is</strong> the human capital.”<br />

That <strong>is</strong>, of course, if inves<strong>to</strong>rs<br />

stay on track, for a looming<br />

hurdle might test their resolve<br />

<strong>to</strong> support innovation through<br />

the economic slowdown. The<br />

AIFM Directive <strong>is</strong> <strong>certainly</strong> a<br />

cause for concern for venture<br />

firms; portfolio d<strong>is</strong>closure in<br />

particular <strong>is</strong> seen as a major<br />

competitive d<strong>is</strong>advantage for<br />

innovative companies, left open<br />

<strong>to</strong> the prying eyes of competi<strong>to</strong>rs.<br />

The EVCA <strong>is</strong> vocally opposing the directive and warns that<br />

many firms could s<strong>to</strong>p investing al<strong>to</strong>gether. “Small startups<br />

are hit the hardest by regulation, which <strong>is</strong> aimed at big<br />

banks and large private equity houses. It <strong>is</strong> alarming how<br />

governments urge us <strong>to</strong> promote innovation, but make it very<br />

difficult for investment companies,” de Haan adds. However,<br />

he leaves the door open <strong>to</strong> optim<strong>is</strong>m: “It hurts, but obviously<br />

we have <strong>to</strong> get over it.” <br />

10 UNQUOTE AUGUST/SEPTEMBER 10 ENTIRE CONTENTS COPYRIGHT 2010 INCISIVE MEDIA INVESTMENTS LTD<br />

www.unquote.com/france

unquote<br />

ILPA<br />

Broad-brush solution<br />

<strong>to</strong> a complex <strong>is</strong>sue?<br />

In a buyer’s market it <strong>is</strong> hardly surpr<strong>is</strong>ing that there has been a real focus on realigning<br />

various terms & conditions of private equity funds <strong>to</strong> favour LP inves<strong>to</strong>rs.<br />

But are attempts <strong>to</strong> drive and perhaps formal<strong>is</strong>e th<strong>is</strong> process wide of the mark?<br />

Julian Longhurst investigates<br />

It’s a sign of the times: the inves<strong>to</strong>r relations partner of a well<br />

respected European mid-cap inves<strong>to</strong>r <strong>is</strong> nervous of h<strong>is</strong> group’s<br />

upcoming fundra<strong>is</strong>ing programme. Despite having multiple<br />

previous funds under its belt and an innate confidence in the firm’s<br />

tried and tested investment strategy, the current conditions make<br />

it hard <strong>to</strong> predict how the fundra<strong>is</strong>ing process will pan out.<br />

Of course, while there may have been a short window of<br />

fundra<strong>is</strong>ing activity in the first four or five months of the <strong>year</strong>,<br />

macroeconomic demons have<br />

once again made the situation<br />

worse for any GPs doing the<br />

fundra<strong>is</strong>ing rounds. But there are<br />

other <strong>is</strong>sues making the process<br />

more onerous: the significantly<br />

more thorough LP due diligence<br />

process <strong>is</strong> one thing, along with<br />

a strong push from the buy-side<br />

<strong>to</strong> secure more LP-friendly terms<br />

and conditions.<br />

In th<strong>is</strong> regard, LPs have had some<br />

help from the Institutional Limited<br />

Partner Association (ILPA), a US organ<strong>is</strong>ation with some 220<br />

members in 10 countries. ILPA has built a set of principles aimed<br />

at serving as “a bas<strong>is</strong> for continued d<strong>is</strong>cussion between the general<br />

partner and limited partner”. The principles have <strong>certainly</strong> lent<br />

some weight <strong>to</strong> LPs’ calls for changes in areas such as management<br />

fees, transaction fees, GP fund contributions, key-man and nofault<br />

clauses, and transparency, especially in carry d<strong>is</strong>tribution.<br />

While the general shift in power has <strong>certainly</strong> precipitated some<br />

notable concessions in Ts&Cs (note Apollo and Blacks<strong>to</strong>ne as<br />

cases in point), there are those that suggest the principles are a<br />

knee jerk reaction <strong>to</strong> <strong>is</strong>sues endemic at the <strong>to</strong>p end of the scale and<br />

represent <strong>to</strong>o simpl<strong>is</strong>tic a solution for the industry as a whole.<br />

A good example of th<strong>is</strong>, according <strong>to</strong> one mid-market special<strong>is</strong>t,<br />

<strong>is</strong> the practice of GPs taking a large slice of the transaction fees<br />

they earn, rather than passing it all <strong>to</strong> the fund: “Larger funds<br />

will never get away with th<strong>is</strong> again – it <strong>is</strong> such a conflict of<br />

interests. But, the <strong>is</strong>sue <strong>is</strong> nowhere near as clear for much smaller<br />

funds, whose operational<br />

costs are d<strong>is</strong>proportionately<br />

high in compar<strong>is</strong>on <strong>to</strong> their<br />

management fee income.<br />

For them, the ability <strong>to</strong><br />

supplement income via<br />

transaction fees can be<br />

important in some cases.”<br />

It <strong>is</strong> not just GPs who think it<br />

so, and research suggests only<br />

one in eight LPs will ins<strong>is</strong>t on<br />

the full implementation of the<br />

principles, suggesting that the<br />

“one size fits all” approach really doesn’t work.<br />

Whatever the rights or wrongs of ILPA’s principles, between<br />

now and the end of 2012 virtually every private equity group<br />

that currently invests from an external fund will have gone out<br />

<strong>to</strong> market <strong>to</strong> ra<strong>is</strong>e new money, so we could be some way from<br />

knowing exactly how far the pendulum will swing <strong>to</strong>wards LPs. <br />

A more detailed look at the fundra<strong>is</strong>ing environment will be covered<br />

in the August/September <strong>is</strong>sue of Private Equity Europe.<br />

ENTIRE CONTENTS COPYRIGHT 2010 INCISIVE MEDIA INVESTMENTS LTD UNQUOTE AUGUST/SEPTEMBER 10 11<br />

www.unquote.com/france

France watch period <strong>to</strong> end June 2010<br />

unquote<br />

PERIOD TO END<br />

JUNE 2010<br />

Figures are based on all expansion/early-stage transactions in France that were confirmed as having an<br />

institutional private equity or mezzanine inves<strong>to</strong>r as a lead or syndicate partner.<br />

For further information on Inc<strong>is</strong>ive Media’s data and research please call Emanuel Eftimiu on:<br />

+44 20 7004 7464.<br />

Volume<br />

15<br />

12<br />

9<br />

6<br />

3<br />

YTD 2010 Volume 13<br />

YTD 2010 Value<br />

€89.7m<br />

0<br />

0<br />

Q2 2005 Q4 2005 Q2 2006 Q4 2006 Q2 2007 Q4 2007 Q2 2008 Q4 2008 Q2 <strong>2009</strong> Q4 <strong>2009</strong> Q2 2010<br />

Q2 2005<br />

Q4 2005<br />

Q2 2006<br />

Q4 2006<br />

Q2 2007<br />

Q4 2007<br />

Q2 2008<br />

Q4 2008<br />

Source: unquote”<br />

Number and <strong>to</strong>tal value in m of French early-stage deals per quarter.<br />

Q2 <strong>2009</strong><br />

Q4 <strong>2009</strong><br />

Early-stage<br />

Q2 2010<br />

100<br />

80<br />

60<br />

40<br />

20<br />

Value (€m)<br />

Volume<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

YTD 2010 Volume 48<br />

YTD 2010 Value<br />

388.2m<br />

0<br />

0<br />

Q2 2005 Q4 2005 Q2 2006 Q4 2006 Q2 2007 Q4 2007 Q2 2008 Q4 2008 Q2 <strong>2009</strong> Q4 <strong>2009</strong> Q2 2010<br />

Q2 2005<br />

Q4 2005<br />

Q2 2006<br />

Q4 2006<br />

Q2 2007<br />

Q4 2007<br />

Q2 2008<br />

Q4 2008<br />

Q2 <strong>2009</strong><br />

Q4 <strong>2009</strong><br />

Expansion<br />

Q2 2010<br />

Source: unquote”<br />

Number and <strong>to</strong>tal value in m of French expansion deals per quarter.<br />

* Does not include PIPE deals like Cinven’s 1.518bn investment in Eutelsat in Q4 2004, nor any<br />

refinancings like the SigmaKalon 1.6bn deal in Q3 2005<br />

500<br />

400<br />

300<br />

200<br />

100<br />

Value (m)<br />

Figures are based on all buyouts in France with a recorded or estimated value of 10m+ that were confirmed as having an<br />

institutional private equity or mezzanine inves<strong>to</strong>r as a lead or syndicate partner.<br />

Volume<br />

YTD 2010 Volume 15<br />

YTD 2010 Value 3.1bn<br />

60<br />

15<br />

50<br />

12<br />

40<br />

9<br />

30<br />

6<br />

20<br />

10<br />

3<br />

0<br />

0<br />

Q2 2005 Q4 2005 Q2 2006 Q4 2006 Q2 2007 Q4 2007 Q2 2008 Q4 2008 Q2 <strong>2009</strong> Q4 <strong>2009</strong> Q2 2010<br />

Q2 2005<br />

Q4 2005<br />

Q2 2006<br />

Q4 2006<br />

Q2 2007<br />

Q4 2007<br />

Q2 2008<br />

Q4 2008<br />

Q2 <strong>2009</strong><br />

Q4 <strong>2009</strong><br />

Q2 2010<br />

Buyouts<br />

Value (bn)<br />

Volume<br />

European buyouts<br />

YTD 2010 Volume 121<br />

YTD 2010 Value 19bn<br />

250<br />

80<br />

70<br />

200<br />

60<br />

150<br />

50<br />

40<br />

100<br />

30<br />

20<br />

50<br />

10<br />

0<br />

0<br />

Q2 2005 Q4 2005 Q2 2006 Q4 2006 Q2 2007 Q4 2007 Q2 2008 Q4 2008 Q2 <strong>2009</strong> Q4 <strong>2009</strong> Q2 2010<br />

Q2 2005<br />

Q4 2005<br />

Q2 2006<br />

Q4 2006<br />

Q2 2007<br />

Q4 2007<br />

Q2 2008<br />

Q4 2008<br />

Q2 <strong>2009</strong><br />

Q4 <strong>2009</strong><br />

Q2 2010<br />

Value (bn)<br />

Source: unquote”<br />

Number and <strong>to</strong>tal value of 10m+ French buyouts per quarter.<br />

Source: unquote”<br />

Number and <strong>to</strong>tal value of European 10m+ buyouts per quarter<br />

12 UNQUOTE AUGUST/SEPTEMBER 10 ENTIRE CONTENTS COPYRIGHT 2010 INCISIVE MEDIA INVESTMENTS LTD<br />

www.unquote.com/france

Financial<br />

3/25/09 5:53:18 PM<br />

<br />

<br />

<br />

<br />

fxweek.com<br />

countries”.<br />

<br />

<br />

<br />

Sales head quits BarCap 2<br />

Athanasopoulos resigns<br />

FX bonuses down 60% 3<br />

Napier Sco t releases latest<br />

remuneration report<br />

Rabobank reshuffle 4<br />

Changes in structured products<br />

Cognotec tackles liquidity 6<br />

New liquidity management<br />

module launched<br />

Saxo Bank results 9<br />

Forex b osts income<br />

StreamBase 6.3 a rives 11<br />

Improved FX o fering from new<br />

CEP software<br />

<br />

<br />

<br />

May 2 09<br />

start of April.<br />

WWW.FINANCIALDIRECTOR.CO.UK<br />

declaration said.<br />

9<br />

8<br />

3/4/09 18:51:03<br />

Struggling <strong>to</strong><br />

keep up with<br />

the news?<br />

Look no further.<br />

With over 100 magazines, newsletters, journals and websites covering every<br />

Inc<strong>is</strong>ive Media provides you with the<br />

intelligence <strong>to</strong>olkit you need <strong>to</strong> succeed in <strong>to</strong>day’s changing markets.<br />

Inc<strong>is</strong>ive Media creates tailor-made packages <strong>to</strong> give you the edge.<br />

Call our information team and find out how a bespoke package will make your business work smarter<br />

LONDON<br />

Nicky on +44 (0)20 7968 4569<br />

or email him at<br />

nicky.hudson@inc<strong>is</strong>ivemedia.com<br />

watersonline.com<br />

APRIL <strong>2009</strong><br />

APRIL <strong>2009</strong> BUY VS. BUILD | FIX FOR FX | EXCEL RISK | ALGO TRADING | WATERS DEBATE<br />

Drastic<br />

Cutbacks<br />

Severely slashed IT budgets and headcounts<br />

force a shift in the buy-vs.-build argument.<br />

WATERS DEBATE<br />

Hire American?<br />

FIX for FX<br />

Tackling Excel R<strong>is</strong>k<br />

Technology<br />

Inte ligence<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

FX Week<br />

The global business o foreign exchange April 6 <strong>2009</strong> v.20 n.14<br />

G-20 plans global systemic r<strong>is</strong>k regime<br />

<br />

<br />

LONDON – A declaration by the Group of of the financial sec<strong>to</strong>r. They wi l also submi<br />

<strong>to</strong> regula<strong>to</strong>ry peer reviews. No details large hedge funds, which wi l be required<br />

impact on systemic r<strong>is</strong>k. Th<strong>is</strong> includes<br />

20 leading economies (G-20) fleshed out<br />

plans for a global regime of systemic r<strong>is</strong>k have emerged on when the FSB wi l be <strong>to</strong> reg<strong>is</strong>ter and supply information <strong>to</strong><br />

regulation, “covering regulated banks, establ<strong>is</strong>hed, what its exact responsibilities national regula<strong>to</strong>rs on questions such as<br />

shadow banks and private pools of capital<br />

the amount of leverage they employ. Any<br />

<strong>to</strong> limit the build-up of systemic r<strong>is</strong>k”.<br />

counterparties <strong>to</strong> trades with hedge funds<br />

A communiqué i sued after the group’s<br />

wi l be required <strong>to</strong> have e fective r<strong>is</strong>k management,<br />

se ting limits for single counter-<br />

London summit on April 2 said the plans<br />

would establ<strong>is</strong>h “much greater cons<strong>is</strong>tency<br />

and systemi co-operation betw en<br />

moni<strong>to</strong>r the leverage of the funds.<br />

party exposures and using mechan<strong>is</strong>ms <strong>to</strong><br />

To prevent regula<strong>to</strong>ry arbitrage, the FSB<br />

At the centre of the proposals lay plans<br />

wi l draw up guidelines <strong>to</strong> help national<br />

<strong>to</strong> increase the role of the Financial Stability<br />

Forum, which would be given<br />

stitutes a systemica ly-important financial<br />

authorities determine exactly what con-<br />

greater powers and renamed the Financial<br />

institution, market or instrument. “These<br />

Stability Board (FSB). Participating are and who it senior sta f wi l be. guidelines should focus on what institutions<br />

do rather than their legal form,” the<br />

countries – compr<strong>is</strong>ing the FSB’s cu rent Participating countries agr ed <strong>to</strong> amend<br />

members, plus Spain – wi l commit <strong>to</strong> thei regula<strong>to</strong>ry systems <strong>to</strong> encompass a l<br />

maintaining financial stability, and regulated banks, shadow banks and private<br />

pools of capital that might have an for co-operation between<br />

The FSB wi l also develop mechan<strong>is</strong>ms<br />

enhancing the openne s and transparency<br />

national<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

SEOUL – The International rates su fered significant<br />

Swaps and Derivatives A sociation<br />

(Isda) has a tacked tri lion won ($1.2 bi lion),<br />

losses, estimated <strong>to</strong> reach 1.7<br />

South Korean court rulings prompting them <strong>to</strong> sue the<br />

on FX ba rier options, for banks <strong>to</strong> have the contracts<br />

undermining the contractual cance led, also a cusing them<br />

commitments of the over-thecounter<br />

derivatives market. won has dropped 24% since<br />

of unfairness and fraud. The<br />

The cases involve FX knockin/knock-out<br />

(Kiko) options against the US do lar at the<br />

September 15 <strong>to</strong> reach 1,379<br />

contracts that Korean inves<strong>to</strong>rs<br />

bought between 2007 Dec<strong>is</strong>ions have been made in<br />

cus<strong>to</strong>mers <strong>to</strong> s<strong>to</strong>p-lo s.<br />

and last <strong>year</strong>, <strong>to</strong> protect them 11 cases, including four cases<br />

against won appreciation, where the Seoul Central D<strong>is</strong>trict<br />

Court ruled in favour of<br />

with many opting for the<br />

cheaper ba rier options. However,<br />

when the US do lar made a preliminary injunction due<br />

the companies, granting them<br />

a turnaround last <strong>year</strong>, corpo-<br />

<strong>to</strong> “changed circumstances”. the favourable dec<strong>is</strong>ion.<br />

In reviewing the cases, the<br />

courts considered whether the<br />

banks had fu ly d<strong>is</strong>closed the<br />

r<strong>is</strong>ks <strong>to</strong> cus<strong>to</strong>mers, the suitability<br />

of the products, the<br />

magnitude of losses incurred<br />

– relative <strong>to</strong> the financial<br />

strength of the company – and<br />

whether the banks had performed<br />

their duties <strong>to</strong> adv<strong>is</strong>e<br />

Citibank and Woori Bank<br />

have won the cases brought<br />

against them over advice <strong>to</strong><br />

clients about s<strong>to</strong>p lo ses, but<br />

Isda last Wednesday (April 1)<br />

attacked the reasoning behind<br />

NEW YORK<br />

Ceci on +1 212 457 7860 or email<br />

ceci.recalde@inc<strong>is</strong>ivemedia.com<br />

Inside<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

The G-20 countries agreed<br />

<strong>to</strong> amend thei regula<strong>to</strong>ry<br />

systems <strong>to</strong> encompass a l<br />

regulated banks, shadow<br />

banks and private pools of<br />

capital that might have an<br />

impact on systemic r<strong>is</strong>k<br />

<br />

Isda pans Korean courts over options rulings<br />

CCE S: FTSE-1 0 FDs AND THEIR INSTITUTES GR EN SHOOTS? OR PUSHING UP DAISIES? STOCK PRICES UP, RETAIL PRICES DOWN THANK YOU, DARLING<br />

FINANCIALDIRECTOR<br />

CREATIVE ACCOUNTANTS<br />

HOW TO SEE THE PICTURE<br />

BEHIND THE NUMBERS<br />

HONG KONG<br />

Roopam +852 3411 4837 or email<br />

Roopam@inc<strong>is</strong>ivemedia.com<br />

inc<strong>is</strong>ivemedia.com<br />

inc<strong>is</strong>ive-events.com

European round-up<br />

unquote<br />

Benelux unquote”<br />

June may have been rather sedate, but the Benelux region could soon witness its biggest deal in <strong>year</strong>s. TPG and Goldman Sachs’<br />

private equity wing are closing in on a 1.2bn deal <strong>to</strong> buy Belgian nappy maker Ontex from Candover. The bid originally<br />

stumbled when Goldman Sachs’ initial partner withdrew from the sale. However, TPG’s involvement put it back on track and the<br />

sale should be completed in the coming weeks.<br />

News was otherw<strong>is</strong>e scarce on the buyout front; Apax Partners agreed <strong>to</strong> acquire BNP Paribas’s Belgian personal finance arm for<br />

an und<strong>is</strong>closed amount. Meanwhile, Barclays Private Equity bought MPS Meat Processing Systems in a secondary buyout from<br />

Steadfast Capital.<br />

In the Netherlands, Gilde Buyout Partners closed its Gilde Buyout Fund IV on 800m. Launched in March <strong>2009</strong>, the vehicle<br />

will make equity investments of 25-200m in mid-market companies across a wide range of industries, with a core focus on the<br />

Benelux, German-speaking and French economies.<br />

Last but not least, all eyes could turn <strong>to</strong> Amsterdam if reports of an AlpInvest sale were <strong>to</strong> material<strong>is</strong>e. Owned by Dutch pension<br />

funds ABP and PGGM, AlpInvest <strong>is</strong> one of the largest European private equity firms. With more than 40bn under management,<br />

it special<strong>is</strong>es in fund investments, secondary investments, co-investments and mezzanine transactions.<br />

Deutsche unquote”<br />

The DACH region has seen a steady increase in activity across the board. Fundra<strong>is</strong>ing has seen its first recorded activity in a<br />

few months with Sw<strong>is</strong>s-based SAM Private Equity holding a first close on its cleantech fund-of-funds. Buyout activity has been<br />

reasonably prevalent, with a number of deals being closed in the last few weeks. HgCapital’s acqu<strong>is</strong>ition of Teufel Speakers from<br />

Riverside <strong>is</strong> a recent significant transaction.<br />

Another secondary buyout, Nordic Capital’s acqu<strong>is</strong>ition of German company SiC Processing, was one of the more prominent<br />

investments for the region. The value of the deal was not d<strong>is</strong>closed, but the acqu<strong>is</strong>ition gave exiting inves<strong>to</strong>r Frog Capital a 3x<br />

return on investment. Other deals of note include NORD Holding’s MBO of Uhlig Rohrbogen GmbH and Chequers Capital’s<br />

66m acqu<strong>is</strong>ition of Versatel Kabel.<br />

Early-stage and expansion deals in the DACH region have been highly active, with Earlybird accounting for three investments,<br />

in CrowdPark, B2X Care Solutions and ubitricity. Additionally, WHEB Ventures provided 4.4m in expansion funding for<br />

VIA Optronics.<br />

The exit window, which seems <strong>to</strong> have opened lately, has seen a few more deals close. Apart from the two exits included in the<br />

secondary buyouts already mentioned, Permira, Goldman Sachs Capital Partners and SV Life Sciences exited Cogn<strong>is</strong> in a trade<br />

sale <strong>to</strong> BASF. The exit gave a reported 3x return on investment for Permira.<br />

Nordic unquote”<br />

The Nordic market has once again proven <strong>to</strong> be a strong source for private equity activity. The number of deals has continuously<br />

grown in the first half of the <strong>year</strong>, as the Nordic region prepares for the summer holidays. There have been two fund closures in<br />

the last few weeks, with CapMan Buyout IX and the secondaries fund Cubera V reaching final close. Both funds will focus on the<br />

Nordic region.<br />

Chalmers Innovation led the increase in early-stage and expansion investments recorded by unquote”. A <strong>to</strong>tal of five investments<br />

have been reported by the inves<strong>to</strong>r in recent month. Other early-stage deals include Vækstfonden’s investment in biotech company<br />

En<strong>to</strong>moPharm and Norinnova’s backing of VIV<strong>is</strong>ion Roller. The largest expansion deal was for NOK 52m in resort opera<strong>to</strong>r<br />

14 UNQUOTE AUGUST/SEPTEMBER 10 ENTIRE CONTENTS COPYRIGHT 2010 INCISIVE MEDIA INVESTMENTS LTD<br />

www.unquote.com/france

unquote<br />

European round-up<br />

Målselv Utvikling. Other deals of note included two investments by Fouriertransform and Almi’s backing of Videofy.me.<br />

Buyout activity in the Nordic region has seen a large increase over the last few weeks. A <strong>to</strong>tal of eight buyouts were recorded,<br />

including Tri<strong>to</strong>n’s SEK 1.3bn MCS acqu<strong>is</strong>ition and Ra<strong>to</strong>s’ DKK 1.09bn S<strong>to</strong>fa buyout. CapMan’s acqu<strong>is</strong>ition of INR and Aspen<br />

was another high profile buyout.<br />

Exits have also seen an increase, with five having been recorded. One IPO has taken place, with CapMan’s partial exit of MQ.<br />

However, with the cancellation of EPiServer’s IPO, things haven’t been entirely rosy for the IPO market. It will be interesting <strong>to</strong><br />

see if the increasing activity will be maintained after summer.<br />

Southern Europe unquote”<br />

The number of deal completions in the Southern European buyout segment remains subdued, but there are signs that the debt<br />

market <strong>is</strong> open for business: although not yet a done deal, reports early in July suggested that the multi-billion-euro package<br />

of debt needed <strong>to</strong> support CVC’s buyout bid for Span<strong>is</strong>h infrastructure business Albert<strong>is</strong> had been approved. If the deal goes<br />

through it will value Albert<strong>is</strong> at around 25bn. Only two other buyouts – both smaller mid-cap acqu<strong>is</strong>itions – are known <strong>to</strong> have<br />

been completed since early June.<br />

In further bad news for buyout inves<strong>to</strong>rs in the region, the large banking syndicate holding debt in Span<strong>is</strong>h bakery business<br />

Panrico reached an agreement over a debt-for-equity swap, which sees backer Apax Partners losing the majority of its holding in<br />

the business.<br />

Outside of the buyout area, dealflow has also been scarce with just a handful of expansion and early-stage transactions being<br />

confirmed across the region. The most significant transaction came in the form of Ambienta’s 30m expansion capital investment<br />

in the Italian industrial cooling systems producer Spig SpA.<br />

Despite the gloomy deal conditions there <strong>is</strong> clearly some cause for optim<strong>is</strong>m as Madrid-based law firm Gómez-Acebo & Pombo<br />

recently announced its intention <strong>to</strong> create a new stand-alone private equity practice. The new group will provide a multid<strong>is</strong>ciplinary<br />

offering, encompassing M&A, tax, f<strong>is</strong>cal, fund structuring and regula<strong>to</strong>ry advice.<br />

UK & Ireland unquote”<br />

<strong>Although</strong> activity in the UK continued <strong>to</strong> be concentrated around the lower- <strong>to</strong> mid-market region, the market saw at least one<br />

deal exceed the £250m mark. The largest of the 14 deals in the buyout segment was TPG Capital’s £300m purchase of UK<br />

fashion retailer Republic from Change Capital Partners. Th<strong>is</strong> marked the third time the company had been backed by a private<br />

equity group, as inves<strong>to</strong>rs continue <strong>to</strong> view the fashion segment with high-growth expectations.<br />

Indeed fashion and entertainment seemed <strong>to</strong> be the flavour of the month, with Gala Coral finally completing its restructuring, as<br />

Apollo Management, Cerberus, Park Square and York Capital Management <strong>to</strong>ok over as equity inves<strong>to</strong>rs – replacing Candover,<br />

Cinven and Permira. The previous inves<strong>to</strong>rs are estimated <strong>to</strong> have lost about £670m on their original investment in the gaming<br />

company, after the mezzanine inves<strong>to</strong>rs swapped £558m of debt for equity, and injected £200m in new cash.<br />

The entertainment sec<strong>to</strong>r also saw CVC take a 28% stake in Merlin, boosting the expansion segment, which saw about 12 deals.<br />

Fashion was also en vogue in expansion, with Balder<strong>to</strong>n Capital investing $9m in UK online fashion retailer my-wardrobe.com;<br />

Advent Venture Partners investing $4.5m in online fashion company farfetch.com; and Key Capital Partners backing UK fashion<br />

company Fly53 with a £1m investment.<br />

Venture deal-making remained relatively subdued, seeing only two deals. The larger of the two was Finance Wales’s investment<br />

in software and computer services company, Altech Software. The company received funding <strong>to</strong> market its newly developed food<br />

processing software.<br />

ENTIRE CONTENTS COPYRIGHT 2010 INCISIVE MEDIA INVESTMENTS LTD UNQUOTE AUGUST/SEPTEMBER 10 15<br />

www.unquote.com/france

deal sec<strong>to</strong>r index<br />

unquote<br />

DEALS<br />

VALUE<br />

(M)<br />

TYPE NAME LEAD BACKERS REGION PAGE<br />

AUTO PARTS n/d MBO Groupe ACR EQUITY: Nextstage<br />

DEBT: LCL, SocGen<br />

Gennevilliers 27<br />

BIOTECHNOLOGY 16m Early-stage Poxel EQUITY: EdRIP Lyon 17<br />

BUILDING<br />

MATERIALS AND<br />

FIXTURES<br />

CLOTHING<br />

ACCESSORIES<br />

CONTAINERS AND<br />

PACKAGING<br />

FINANCIAL<br />

ADMINISTRATION<br />

INDUSTRIAL<br />

SUPPLIERS<br />

unquote<br />

early-stage<br />

Early-stage transactions include start-up/seed and early-stage equity investments. Start-up/seed financing <strong>is</strong> provided <strong>to</strong> companies for use<br />

in product development and initial marketing. Companies may be in the process of being set up or may have been in business for a short<br />

time, but have not sold their product commercially. Early-stage financing allows companies which have completed the product development<br />

stage and require further funds <strong>to</strong> initiate commercial manufacturing and sales. They may not yet be generating any revenues.<br />

EdRIP et al. invest 16m in Poxel<br />

Transaction<br />

Edmond de Rothschild Investment Partners (EdRIP), CDC Entrepr<strong>is</strong>es and Crédit Agricole Private<br />

Equity have provided drugs developer Poxel with a 16m series-A round of financing.<br />

EdRIP contributed 8m <strong>to</strong> the round via its Biod<strong>is</strong>covery 3 FCPR, Partenariat & Innovation 2 FCPI<br />

and Partenariat & Innovation 3 FCPI funds. CDC invested 5m via the InnoBio fund, a vehicle it <strong>is</strong><br />

managing on behalf of the state-backed Fonds Stratégique d’Invest<strong>is</strong>sement.<br />

EARLY-STAGE<br />

Poxel<br />

16m<br />

Location Lyon<br />

Sec<strong>to</strong>r Biotechnology<br />

Founded <strong>2009</strong><br />

Staff 7<br />

The remaining 3m was provided by Crédit Agricole PE. Th<strong>is</strong> transaction <strong>is</strong> the largest French series-A<br />

round of funding since 2005.<br />

Poxel will use the new funds <strong>to</strong> accelerate the development and clinical testing of its most advanced<br />

product, Imeglimine, designed <strong>to</strong> treat type-2 diabetes.<br />

Company<br />

Poxel span out from Merck Serono in <strong>2009</strong>. It develops anti-diabetic molecules, focusing particularly on<br />

treatment for type-2 diabetes. Poxel’s pipeline cons<strong>is</strong>ts of innovative products with original mechan<strong>is</strong>m<br />

of action, with an improved safety profile compared <strong>to</strong> currently available therapies. Based in Lyon,<br />

Poxel currently employs seven people.<br />

People<br />

Raphael W<strong>is</strong>niewski led the deal for EdRIP. CDC was represented by Thibaut Roulon. Bruno Montanari<br />

handled the transaction for Crédit Agricole. W<strong>is</strong>niewski and Montanari will join Poxel’s board, along<br />

with Olivier Martinez from the InnoBio fund. Thomas Kuhn <strong>is</strong> CEO of Poxel.<br />

Adv<strong>is</strong>ers<br />

Equity – Orsay, Frédéric Lerner, Lou<strong>is</strong> d’Urzo (Legal); HBC Avocats, Jonathan Burnham (Legal);<br />

Adwelsen, Florent Béliard (Financial due diligence); Régimbeau, Isabelle Mendelsohn (Intellectual<br />

property due diligence).<br />

Company – Bignon Lebray, Guy de Foresta (Legal); Bionest (Other due diligence).<br />

Sofinnova et al. back McPhy with 13.7m<br />

Transaction<br />

Sofinnova Partners, Gimv and Amundi Private Equity have backed McPhy Energy with a 13.7m<br />

second round of funding, alongside h<strong>is</strong><strong>to</strong>ric inves<strong>to</strong>rs.<br />

The company had already ra<strong>is</strong>ed a 1.6m first round of financing in January <strong>2009</strong> from Emertec and<br />

Areva. The new funds will be used for the global expansion of McPhy and the further industrial<strong>is</strong>ation<br />

and commercial<strong>is</strong>ation of its products. Already present in Spain and Italy, the company also plans <strong>to</strong><br />

expand in<strong>to</strong> Germany, northern Europe, the Middle East and Japan.<br />

EARLY-STAGE<br />

McPhy Energy<br />

13.7m<br />

Location La Motte-Fanjas<br />

Sec<strong>to</strong>r Renewable<br />

energy<br />

equipment<br />

Founded 2008<br />

ENTIRE CONTENTS COPYRIGHT 2010 INCISIVE MEDIA INVESTMENTS LTD UNQUOTE AUGUST/SEPTEMBER 10 17<br />

www.unquote.com/france

early-stage<br />

unquote<br />

McPhy’s cleantech focus was a major attraction for the inves<strong>to</strong>rs. The deal marks Sofinnova’s fourth<br />

investment in th<strong>is</strong> sec<strong>to</strong>r, following its funding of DNP Green, Revolt Technology and Neosens.<br />

All contribu<strong>to</strong>rs <strong>to</strong> th<strong>is</strong> round believe solid state hydrogen s<strong>to</strong>rage will address the crucial <strong>is</strong>sue of<br />

sustainable energy s<strong>to</strong>rage.<br />

Company<br />

McPhy <strong>is</strong> a French company founded in January 2008 <strong>to</strong> industrial<strong>is</strong>e and commercial<strong>is</strong>e a new<br />

technology for the solid s<strong>to</strong>rage of hydrogen, in the form of magnesium hydride. The technology<br />

addresses the merchant hydrogen and renewable energy markets.<br />

McPhy owns exclusive rights on a portfolio of unique patents, which results from more than eight <strong>year</strong>s<br />

of research at the CNRS and CEA, in partnership with Joseph Fourier University.<br />

People<br />

Alessio Beverina led the deal for Sofinnova. Bart Diels handled the transaction for Gimv. Florent<br />

Thomann represented Amundi PEF. Pascal Mauberger <strong>is</strong> CEO of McPhy.<br />

Adv<strong>is</strong>ers<br />

Company – Clipper<strong>to</strong>n Finance, Nicolas von Bulow, Thomas Neveux (M&A).<br />

EARLY-STAGE<br />

EyeTechCare<br />

7.5m<br />

Location<br />

Sec<strong>to</strong>r<br />

Founded 2008<br />

Staff 7<br />

Rillieux-la-Pape<br />

Medical<br />

equipment<br />

Crédit Agricole et al. in 7.5m EyeTechCare deal<br />

Transaction<br />

Crédit Agricole Private Equity and insurance company SHAM have provided medical devices developer<br />

EyeTechCare with a 7.5m round of funding.<br />

Crédit Agricole led the round with 4.5m, while SHAM invested 3m. EyeTechCare had already<br />

ra<strong>is</strong>ed 1.2m in 2008 from Crédit Agricole and CEA-Invest<strong>is</strong>sement. The new funds will be used <strong>to</strong><br />

complete the initial clinical trials on humans, as well as <strong>to</strong> establ<strong>is</strong>h the manufacturing facilities and sales<br />

and marketing force required for the company’s first product.<br />

The inves<strong>to</strong>rs believe EyeTechCare’s solution will respond <strong>to</strong> unmet needs in the treatment of glaucoma.<br />

Crédit Agricole, which has been following the company since its inception, was particularly impressed<br />

with the management team’s progress over the last two <strong>year</strong>s.<br />

Company<br />

EyeTechCare was founded in 2008 and <strong>is</strong> based in Rillieux-la-Pape, near Lyon. With a staff of seven<br />

researchers, it special<strong>is</strong>es in non-invasive therapeutic medical devices using ultrasound technology. The<br />

company <strong>is</strong> currently developing an ultrasound-based medical device for the treatment of glaucoma; its<br />

market launch <strong>is</strong> scheduled for early 2011.<br />

People<br />

Alexia Perouse handled the transaction for Crédit Agricole. Olivier Szymkowiak represented SHAM.<br />

Fabrice Romano <strong>is</strong> the chairman of EyeTechCare.<br />

Adv<strong>is</strong>ers<br />

Equity – Morgan Lew<strong>is</strong> Bockius (Legal).<br />

Company – MAGS (Legal); Aelios Finance (Corporate finance).<br />

18 UNQUOTE AUGUST/SEPTEMBER 10 ENTIRE CONTENTS COPYRIGHT 2010 INCISIVE MEDIA INVESTMENTS LTD<br />

www.unquote.com/france

unquote<br />

expansion<br />

Expansion capital <strong>is</strong> provided <strong>to</strong> support the growth and expansion of an establ<strong>is</strong>hed company and must include an element of equity financing.<br />

Funds may be used <strong>to</strong> enable increased production capacity, market or product development and/or <strong>to</strong> provide additional working capital.<br />

Acqu<strong>is</strong>ition finance provided <strong>to</strong> a new or ex<strong>is</strong>ting investee company <strong>to</strong> support its acqu<strong>is</strong>ition of a target or targets <strong>is</strong> also included in th<strong>is</strong> section.<br />

Butler invests 15m in Chr<strong>is</strong>tian Bernard<br />

Transaction<br />

Butler Capital has invested 15m in French jeweller Groupe Chr<strong>is</strong>tian Bernard, acquiring slightly less<br />

than 50% of the company.<br />