Firstly, Lion Capital acquired eyewear retailer Alain Afflelou - Unquote

Firstly, Lion Capital acquired eyewear retailer Alain Afflelou - Unquote

Firstly, Lion Capital acquired eyewear retailer Alain Afflelou - Unquote

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4<br />

france<br />

unquote.com/france<br />

A tale of two buyouts<br />

Sizeable French LBOs resembled the<br />

proverbial buses in May: you wait for one for<br />

an eternity, and then two appear at once.<br />

<strong>Firstly</strong>, <strong>Lion</strong> <strong>Capital</strong> <strong>acquired</strong> <strong>eyewear</strong> <strong>retailer</strong><br />

<strong>Alain</strong> <strong>Afflelou</strong> from Bridgepoint, Apax France<br />

and Altamir Amboise in a deal believed to be<br />

valued at nearly €800m (see page 8). The target<br />

could have slipped from private equity’s grasp<br />

had it not been for last year’s tumultuous public<br />

markets: <strong>Alain</strong> <strong>Afflelou</strong>, whose stores are a<br />

familiar sight in France’s high street, was rearing<br />

for an IPO for the best part of 2011.<br />

UK-based <strong>Lion</strong> <strong>Capital</strong> scored France’s<br />

largest buyout in 2010 when it <strong>acquired</strong> Picard<br />

Surgelés for €1.5bn – it is ahead of the pack<br />

in 2012 as well since transactions are so far<br />

struggling to break the €500m mark. As the<br />

<strong>Alain</strong> <strong>Afflelou</strong> deal shows, foreign investors<br />

still have an edge when it comes to large-cap<br />

buyouts – this was also clear last year as the<br />

three largest French deals came courtesy of<br />

cross-border deal-doers. Debt on the <strong>Afflelou</strong><br />

deal was again provided by global players,<br />

namely Citi, UniCredit and Alcentra.<br />

By comparison, Sagard Private Equity’s<br />

acquisition of discount wholesaler Stokomani<br />

from Advent International for around €200m<br />

(see page 8) feels home-grown: proof that local<br />

players hold their own when it comes to the<br />

more intimate lower mid-cap segment. Sagard<br />

initially approached Advent with a pre-emptive<br />

offer a year ago, but the vendor declined,<br />

organising an auction process which attracted<br />

mostly French mid-cap players. Leverage on<br />

the Stokomani transaction was also provided<br />

by France’s usual suspects: BNP Paribas, Société<br />

Générale, LCL and AXA Mezzanine.<br />

Tough road ahead<br />

These two transactions were followed by the<br />

€124m Sepur and €150-200m Armatis<br />

buyouts at the end of May. But local GPs are<br />

still lamenting the lack of visibility on macroeconomic<br />

trends and company performances,<br />

and accessing financing for all but the best<br />

deals remains problematic.<br />

Issue 5 – June 2012<br />

“From what we see in the market,<br />

opportunities are still there. Vendors are still<br />

willing to divest, especially those that have<br />

delayed processes for several months now,”<br />

Argos Soditic partner Karel Kroupa told<br />

your correspondent. “That said, everything<br />

is more complex: due diligence, financing,<br />

negotiations... One has to be really motivated<br />

to see a deal through to completion. Processes<br />

therefore tend to last longer for all but the very<br />

best assets.”<br />

Cinven could help ascertain whether May’s<br />

mid-cap uptick was just a flash in the pan: the<br />

Deaflow in France stays slow<br />

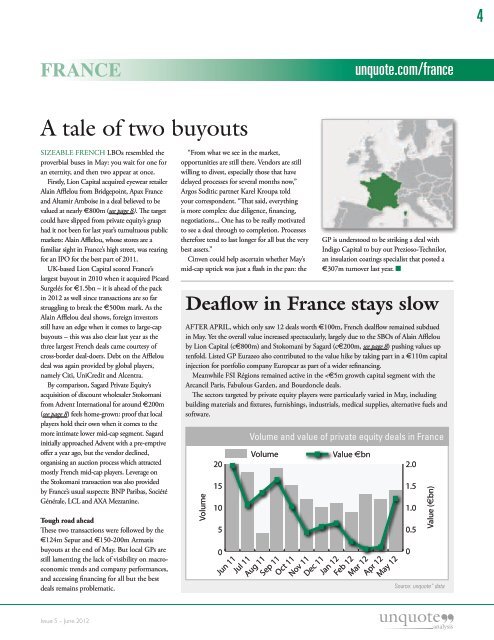

After April, which only saw 12 deals worth €100m, French dealflow remained subdued<br />

in May. Yet the overall value increased spectacularly, largely due to the SBOs of <strong>Alain</strong> <strong>Afflelou</strong><br />

by <strong>Lion</strong> <strong>Capital</strong> (c€800m) and Stokomani by Sagard (c€200m, see page 8) pushing values up<br />

tenfold. Listed GP Eurazeo also contributed to the value hike by taking part in a €110m capital<br />

injection for portfolio company Europcar as part of a wider refinancing.<br />

Meanwhile FSI Régions remained active in the